VISA Stablecoin Data Revealed: Average Spending $45, Small Transactions Account for 40% of Market

TechFlow Selected TechFlow Selected

VISA Stablecoin Data Revealed: Average Spending $45, Small Transactions Account for 40% of Market

Retail stablecoin payment volume accounts for only 0.6% of total transaction volume, but transaction counts make up half.

Author: Ethan Chan

Translation: TechFlow

Visa Network's Average Transaction Size is $45

Earlier this week, during a recent podcast with Visa Crypto team members Cuy (Head of Crypto) and Noah (Head of On-chain Data), we introduced a simple and elegant stablecoin data analysis methodology, leveraging a unique key data point from Visa:

The average transaction value across all Visa transactions over the past 12 months (through March) was $45. (Source)

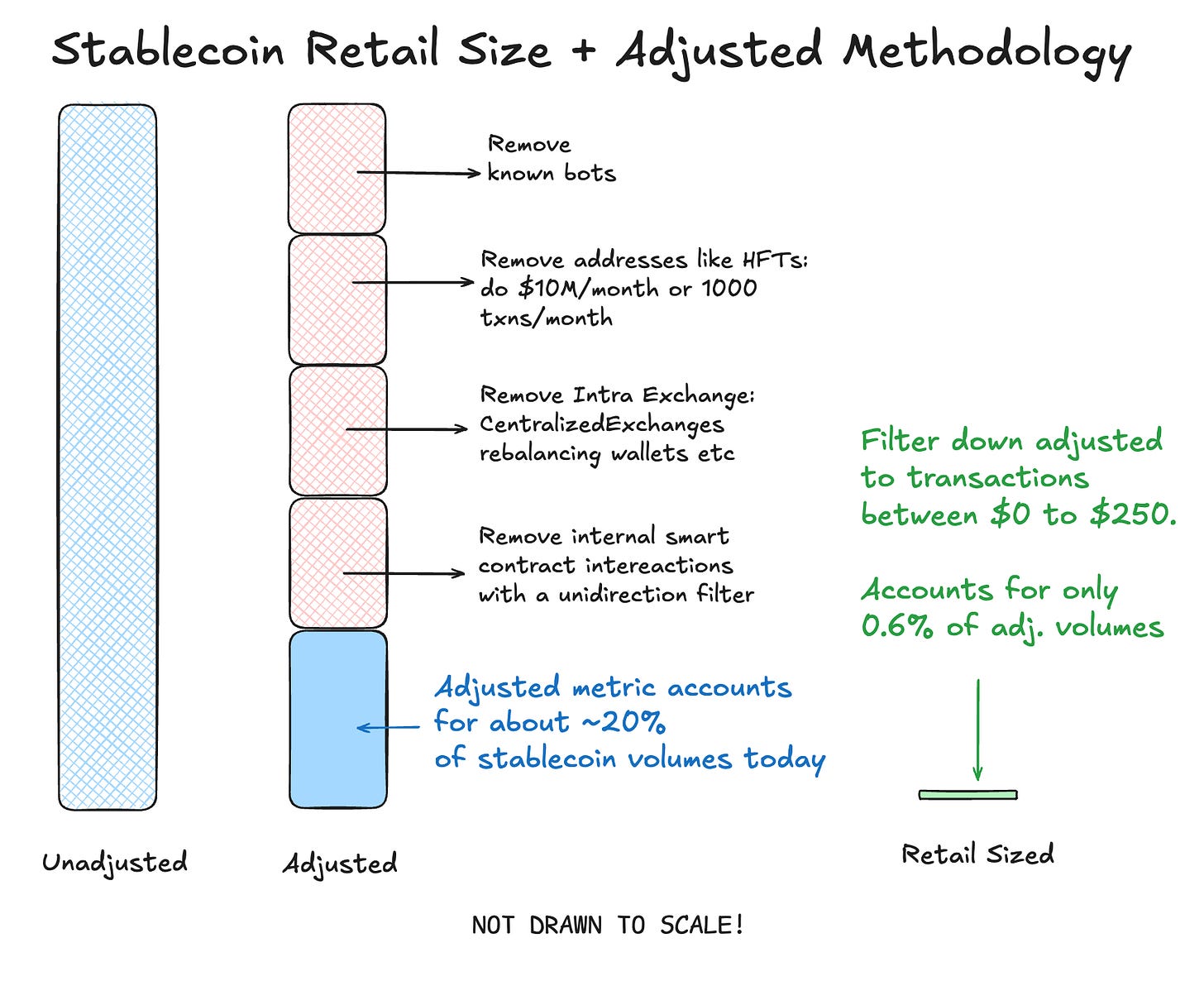

Unadjusted, Adjusted, and Retail-Scale Payments

Before diving into the data, here’s a quick recap of our methodology used in the Visa x Allium Stablecoin Analytics Dashboard.

We take the $45 average and assume most retail transactions fall between $0 and $250. That makes sense—how many daily retail purchases exceed $250? People buy coffee, clothes, etc., typically involving small amounts.

Motivation behind the methodology: If we use a Visa card to buy a $5 coffee, that $5 flows through two different banks—one on the buyer’s side and one on the seller’s (coffee shop) side—via intermediaries like credit card networks and processors. If all these activities were recorded on a blockchain, the transaction amount would be several times the $5. However, in our analysis, we focus only on the $5 payment for that cortado.

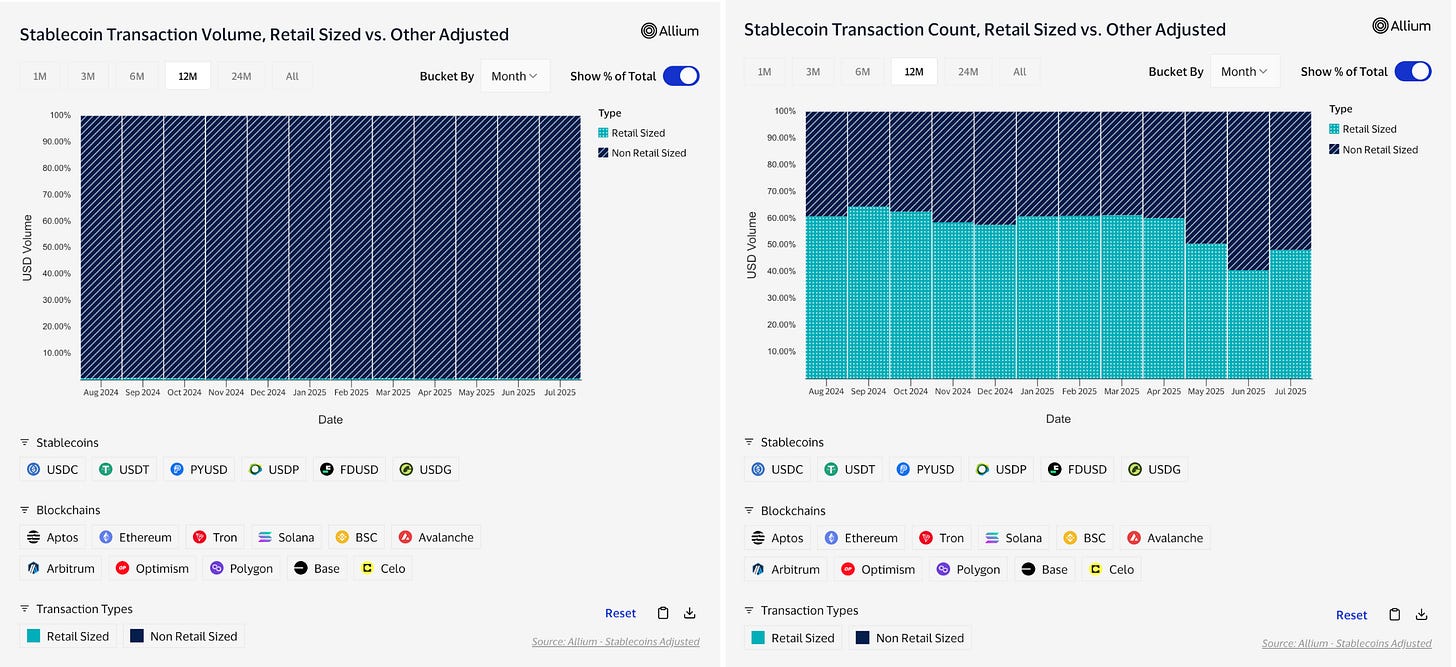

Although retail-scale stablecoin transfers account for only 0.6% of adjusted nominal transaction volume, they represent approximately 40% of all adjusted stablecoin transactions.

We can see that the turquoise "retail-scale" segment is almost invisible on the dashboard because it accounts for just 0.6% of adjusted stablecoin transaction volume.

Visa Onchain Analytics Transactions

This aligns well with what we’d expect from a retail payments environment—small, high-frequency transactions such as buying coffee, sending money to friends, or paying bills. While individual payments are small, they dominate in transaction count, much like traditional consumer spending.

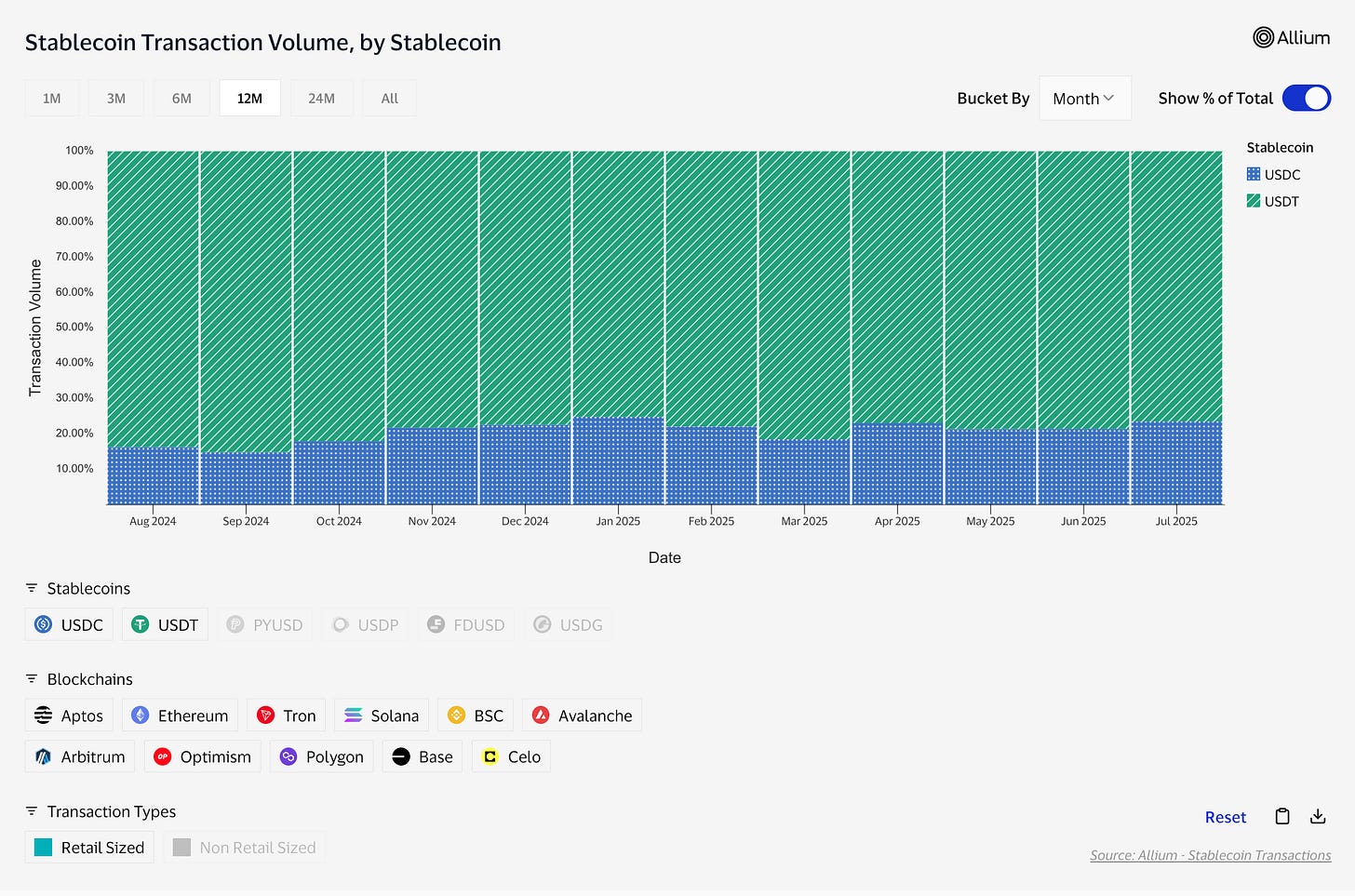

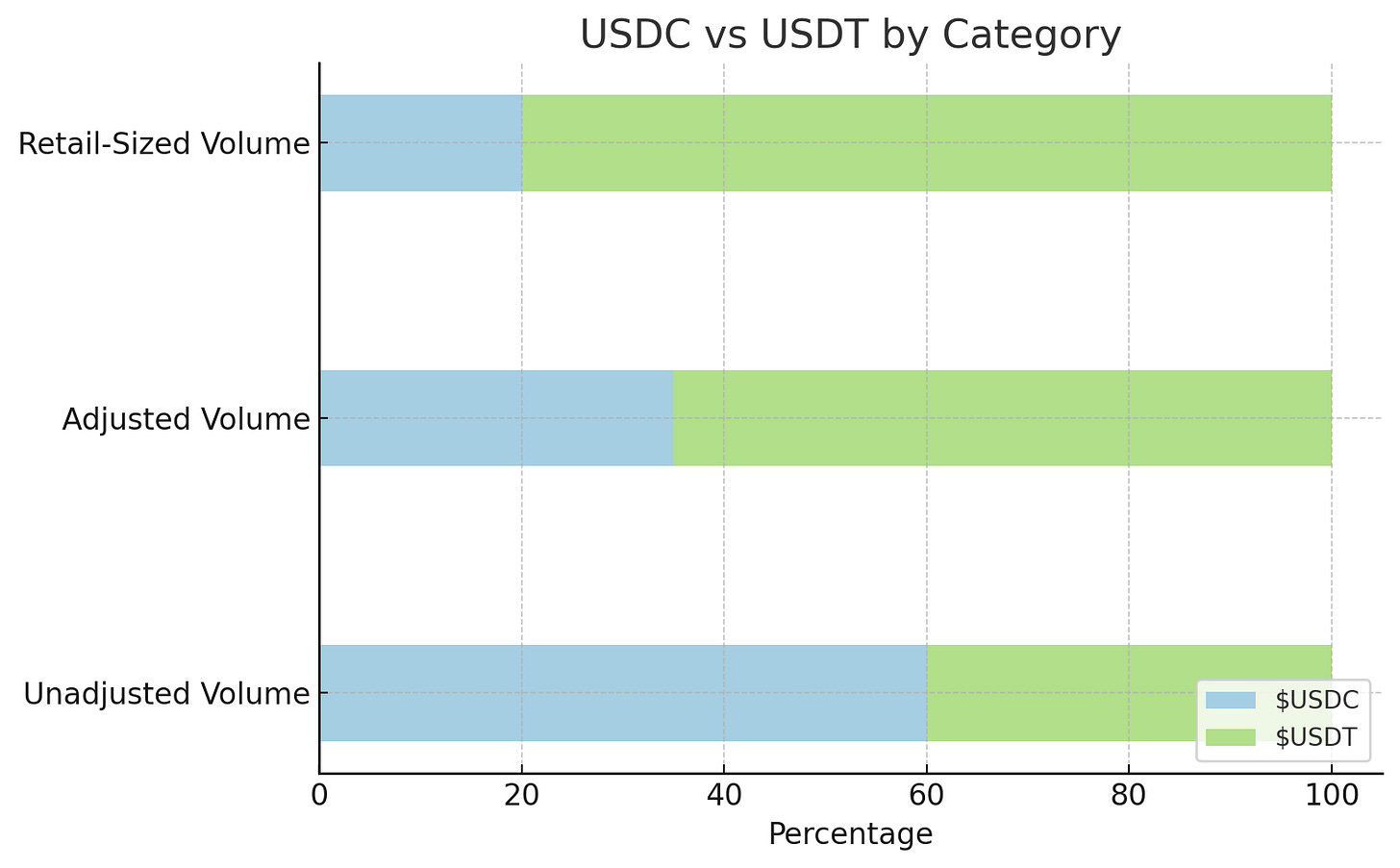

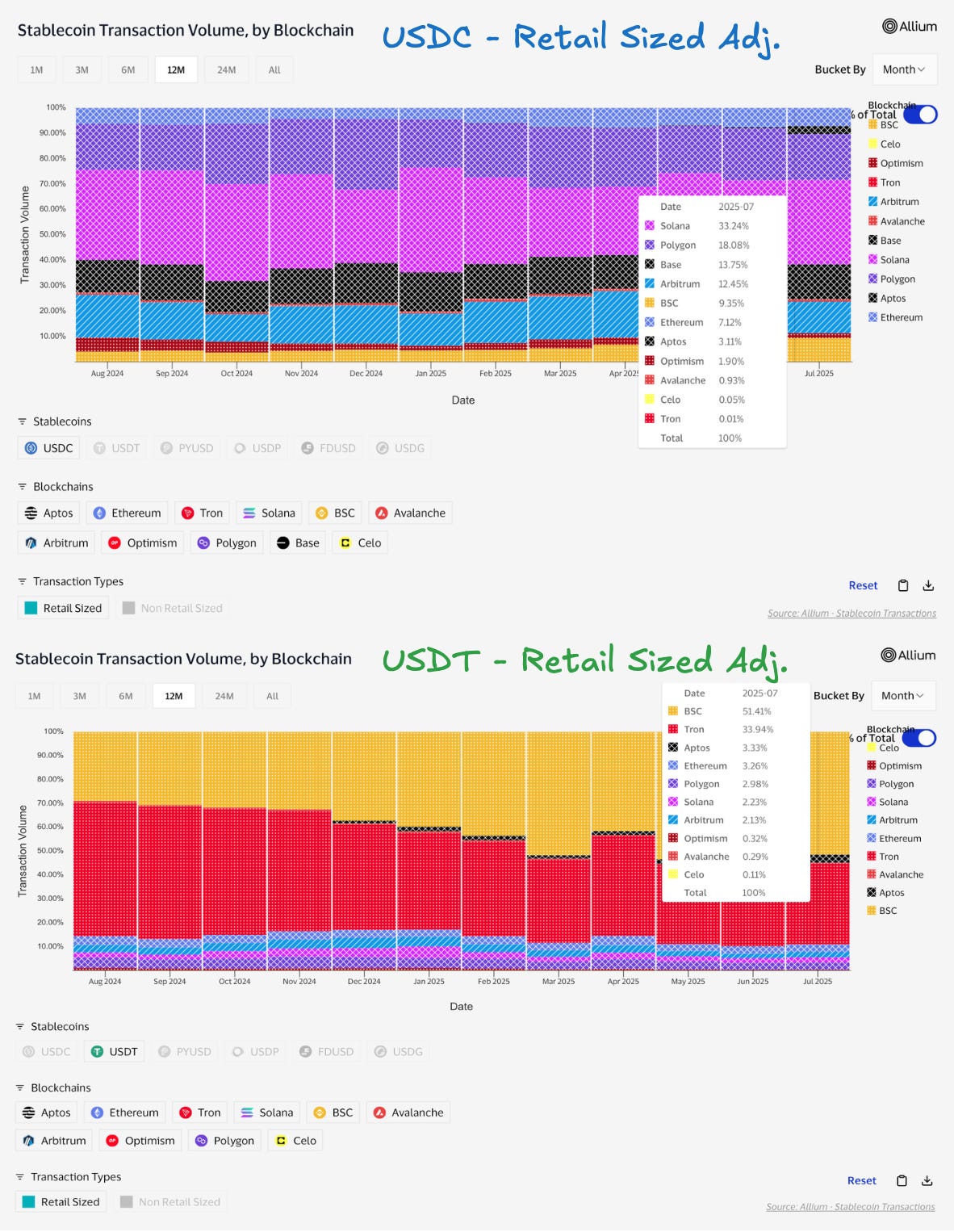

A Closer Look at USDC vs. USDT Retail-Scale Distribution

About 80% of retail-scale stablecoin transfers are settled in USDT: We know USDT is increasingly used in emerging markets, especially for everyday retail payments and cross-border remittances. This fits USDT’s role as a unit of account and store of value in markets with volatile local currencies or strict capital controls.

Note: Retail-scale transaction volume is a subset of adjusted transaction volume (0.6%)

About 65% of adjusted stablecoin transfer volume is settled in USDT, compared to only about 40% of all (unadjusted) stablecoin transfer volume: This suggests USDC has stronger penetration in enterprise use cases such as high-frequency trading, bulk settlements, and B2B payments.

Retail-Scale Transactions by Blockchain

Retail prefers low-cost + high-throughput chains: It's common for both USDT and USDC retail volumes to occur on high-throughput blockchains.

76% of adjusted retail-scale USDC transactions occur on Solana, Polygon, Base, and Arbitrum, while 85% of adjusted retail-scale USDT transactions occur on BSC and Tron: This reflects USDC’s preference among U.S.-based platforms, whereas USDT dominates in emerging markets such as Latin America and Southeast Asia, where BSC and Tron are most accessible and often integrated into local wallets, exchanges, and payment apps (Binance P2P, TronLink).

Retail-Scale Adjusted by Blockchain

We’re Still in the Early Stages!

With a simple $45 assumption and a retail-scale filter, we’ve been able to clearly break down the current landscape of “real-world” payments. Although these small transfers have low nominal value, they account for nearly half of adjusted transaction counts!

We’re still in the early stages of this journey. We look forward to continuously tracking these metrics as the industry evolves, and welcome your feedback as we collectively explore the path forward. If interested, we discussed some related data points on our podcast—check it out here:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News