The slumbering giant turns again: Why BIP-119 is the most important upgrade since Taproot?

TechFlow Selected TechFlow Selected

The slumbering giant turns again: Why BIP-119 is the most important upgrade since Taproot?

Exploring the potential and controversies of the Bitcoin technical proposal BIP-119 and its core feature "Covenants."

By Oliver, Mars Finance

In the crypto world, Ethereum and its ecosystem always resemble a mischievous teenager, constantly capturing market attention with novel DeFi Lego and NFT artworks. In contrast, Bitcoin is more like a silent, profound elder. It rarely changes, but every subtle move it makes sends deep tremors throughout the entire industry. After the major "Taproot" upgrade in 2021, this elder enjoyed several years of tranquility. Yet beneath the calm surface, an undercurrent about its future is stirring—and the catalyst for this ripple is a technical proposal numbered BIP-119.

The core of this proposal is an ancient yet powerful magic known as "covenants." It could potentially achieve consensus by year-end, but the debate surrounding it has long transcended code itself, evolving into a philosophical battle over Bitcoin's soul and future. This isn't merely a dispute over technical direction—it’s more like a collective introspection into Bitcoin’s identity: Should it remain an immutable digital gold, or evolve into a financial operating system capable of continuous adaptation?

A "Smart Will" from the Future

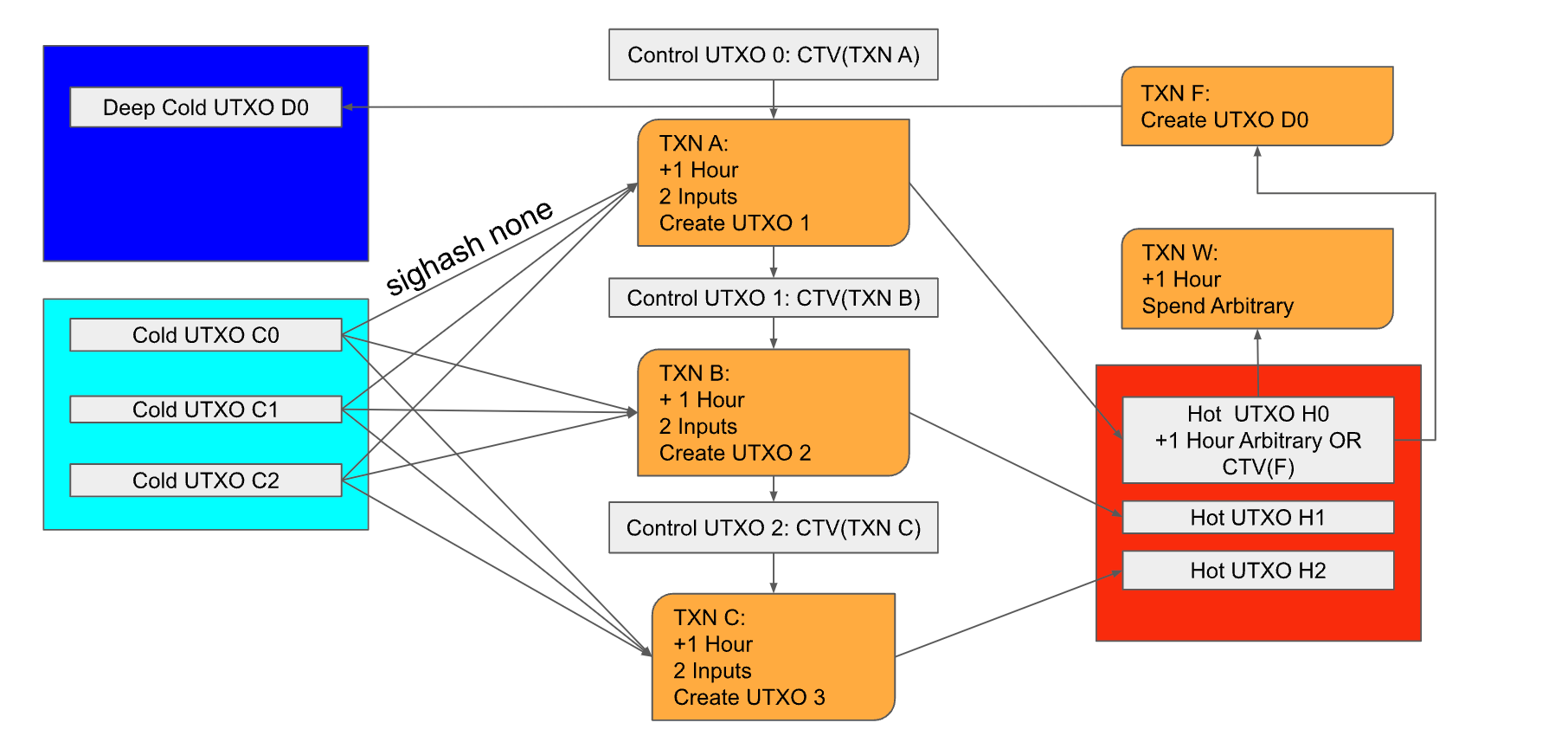

To understand the power of BIP-119, let’s imagine a scenario. Suppose you are a far-sighted Bitcoin whale who wants to pass your assets to your descendants, yet fears they might recklessly squander them. In today’s Bitcoin world, you’re powerless. Once private keys are handed over, control is fully transferred. But if BIP-119 were activated, you could create a "smart will" from the future for your Bitcoin UTXO (think of it as your "digital check").

The heart of this "will" is OP_CHECKTEMPLATEVERIFY (CTV). It allows you to define exactly how these funds can be spent in the future. For example, you could set a template stipulating: "These 1,000 BTC shall start being transferred annually beginning in 2040—only 10 BTC per year to my son’s designated address for living and education expenses." Any transaction attempt violating this "template" would be rejected by the entire Bitcoin network. It’s like placing your assets under a time lock and rule lock forged by global consensus—private keys are no longer the sole scepter of authority.

The most intuitive application of this feature is what’s known as "Smart Vaults"—personal digital vaults. Currently, if your private key is stolen, it’s catastrophic. But in a CTV-enabled world, even if hackers obtain your private key, they cannot drain your entire fortune at once. They’d be forced to act like well-behaved "good kids," slowly withdrawing funds according to your pre-set withdrawal schedule (e.g., 0.1 BTC per week), giving you precious time to detect the theft and take countermeasures. As Jameson Lopp, co-founder of security firm Casa and industry veteran, put it, such mechanisms will “greatly enhance the ability to build better, more secure custody methods.” For institutions and long-term holders who prioritize asset security above all, this is undoubtedly a blessing.

Building On-Ramps for the "Lightning Highway"

If Smart Vaults represent just the appetizer of CTV’s potential, its true game-changing impact lies in empowering Bitcoin Layer 2 ecosystems, particularly the Lightning Network. While the Lightning Network dramatically improves Bitcoin’s payment efficiency, it has always faced a bottleneck: entry. Every user must first open a transaction on the congested main road (Bitcoin’s base layer) to purchase a "ticket" (open a channel). When thousands try to board simultaneously, the main chain inevitably becomes gridlocked.

CTV elegantly solves this via a mechanism called "Channel Factories." It enables users to carpool. Multiple parties can pool funds and, through a single on-chain transaction, jointly create a shared UTXO, then use that foundation to open countless Lightning channels off-chain among themselves. According to its designer Jeremy Rubin, this could reduce users’ on-chain costs for joining the Lightning Network by an order of magnitude. Previously, everyone had to drive their own car onto the highway; now, they can ride a bus sharing one entrance ramp—the efficiency difference is immense. At its core, this enhances the scalability of Bitcoin’s property rights distribution, marking a critical step toward mass adoption.

Even more intriguingly, this mechanism enables "non-interactive" channel creation. Imagine Coinbase directly opening a Lightning Network channel for you and depositing some BTC, while you remain completely offline. The next time you log in, you’ll be pleasantly surprised to find yourself already on the "Lightning Highway." Such seamless user experience was previously unimaginable.

Risk of Opening Pandora’s Box?

This all sounds wonderful—so why has the activation path for BIP-119 been so rocky, even sparking a fierce civil war within the community in 2022? The opposition voices are equally loud, fearing that these "covenants" may become the key to unlocking Pandora’s box.

The loudest alarm concerns threats to Bitcoin’s core values—censorship resistance and fungibility. Critics paint a chilling picture: a heavily regulated centralized exchange might be compelled by governments to require all user withdrawals to go into a CTV "covenant address." Funds in such addresses could then only be sent to other KYC-compliant "whitelisted" addresses. In this way, the Bitcoin ecosystem would be invisibly split into "clean" and "tainted" parallel universes, undermining its foundation as a globally neutral currency. This "slippery slope" concern isn’t really about the technology per se, but rather reflects deeper anxiety about whether Bitcoin can resist future national-level infiltration.

Another faction of opponents consists of technical "perfectionists." They argue that while CTV is useful, it’s “not general enough.” They believe instead of activating a single-purpose "wrench" (CTV), more time should be spent developing a more flexible, powerful "Swiss Army knife"—such as another widely discussed proposal, OP_CAT. They fear that hastily deploying a "half-baked" solution today might result in obsolete "zombie code" tomorrow, burdening Bitcoin’s minimalist, elegant protocol with permanent technical debt. Underlying this is a profound divide in Bitcoin’s development philosophy between "incrementalism" and "holism."

Then there are the staunch "Bitcoin fundamentalists." To them, Bitcoin’s value lies precisely in its simplicity and immutability. As one community member put it: “What Bitcoin *cannot* do is more important than what it *can* do.” They view any increase in protocol complexity as heresy, believing it expands the attack surface. In 2022, when the proponent of BIP-119 attempted to push activation through a "speedy trial" mechanism, strong opposition emerged—including from Bitcoin advocate Andreas Antonopoulos. Antonopoulos made clear that his objection wasn’t to the technology itself, but to the arrogant process that disrespected community consensus.

A Political Game About Governance

The controversy ultimately ended in failure of the 2022 activation attempt—but it taught the community a valuable lesson: in Bitcoin, code quality matters, but the process of achieving consensus is what truly determines life or death.

Fast forward to 2025, the proponents of BIP-119 have clearly learned their lessons. They’ve returned, humbler and wiser. In June this year, an open letter signed by 66 prominent developers and institutional representatives—including Jameson Lopp mentioned earlier and custody giant Anchorage—called on the community to reevaluate BIP-119. This time, they aren’t acting alone—they’ve formed a "builders alliance." Even smarter, they’ve bundled BIP-119 with another less controversial, complementary proposal, BIP-348. This is undoubtedly a shrewd political maneuver, forcing opponents to weigh the trade-offs: rejecting BIP-119 might also mean sacrificing another beneficial upgrade.

No matter the final fate of BIP-119, the prolonged debate around it has immense value. It acts like a mirror, clearly reflecting the complexity, challenges, and evolution of Bitcoin’s decentralized governance. It compels every participant to ponder where that sacred balance point truly lies—between efficiency and security, evolution and stability, pragmatism and idealism.

In the end, Bitcoin’s future may not hinge on the activation of any single opcode, but on whether this global community of millions of invisible hands can, through repeated collisions and difficult compromises, find the right course toward the stars and the sea. This soul-searching inquiry into "covenants" continues—and each of us is a witness to this great social experiment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News