Bitcoin Underperforms Gold, but the Golden Age of the Crypto Economy Has Just Begun

TechFlow Selected TechFlow Selected

Bitcoin Underperforms Gold, but the Golden Age of the Crypto Economy Has Just Begun

No force is stronger than an idea whose time has come, and the crypto economy has never felt more unstoppable.

Author: Ryan Watkins

Translation: TechFlow

TechFlow Editorial: In 2026, the crypto economy is undergoing its most critical transformation in eight years. This article explores how the market has achieved a "soft landing" from the excessive expectations of 2021 and is gradually building a valuation framework grounded in cash flows and real-world use cases.

The author uses the Red Queen effect to explain the past four years of pain, pointing out that with relaxed U.S. regulation and an explosion of enterprise adoption, crypto assets are shifting from cyclical speculation to long-term secular growth.

Facing global trust crises and currency devaluation, this isn't just an industry recovery—it's the rise of a parallel financial system. For investors deeply rooted in Web3, this represents not only a cognitive reset but also an undervalued, cross-cycle opportunity to enter at a pivotal moment.

The full text follows:

Key Takeaways

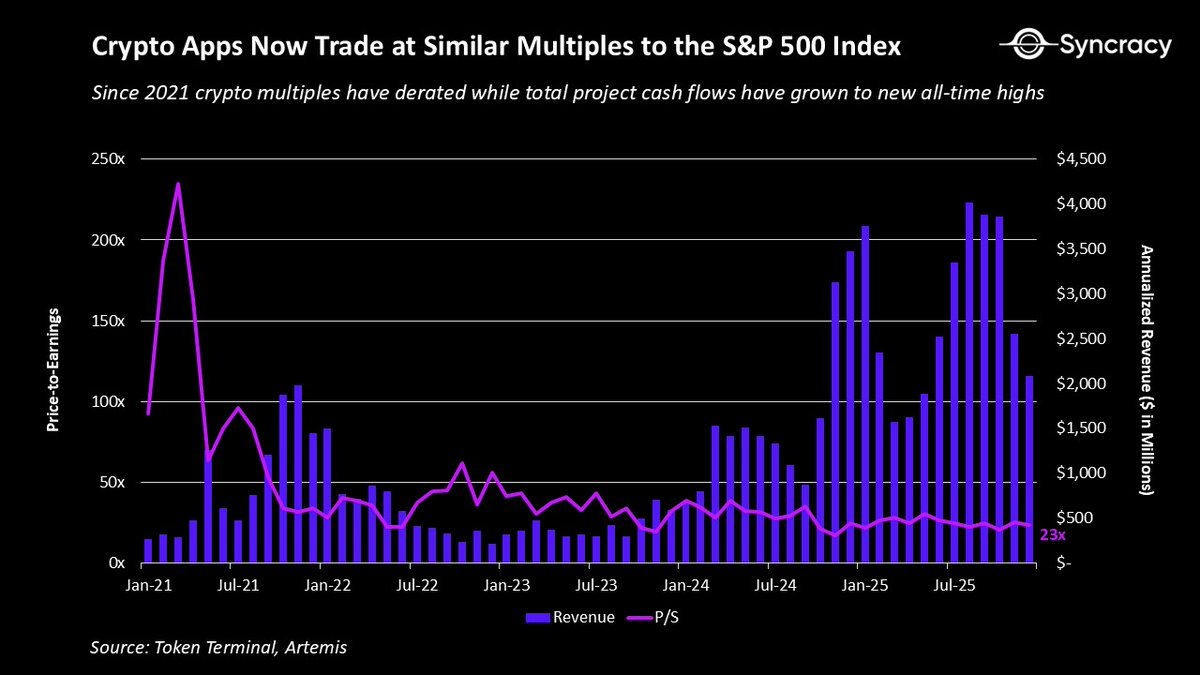

- This asset class prematurely priced in expectations in 2021; since then, valuations have undergone rational correction, and top-tier assets are now fairly valued.

- With improving U.S. regulatory clarity, alignment and value capture for tokens are finally turning positive, making them more attractive as investments.

- Growth in the crypto economy is shifting from cyclical to secular, and valuable use cases beyond Bitcoin have already emerged.

- Winning blockchains are solidifying their status as standards for startups and large enterprises alike, becoming hubs for some of the world’s fastest-growing businesses.

- After four years of bear market pain, sentiment around altcoins has hit rock bottom. Multi-year opportunities in top projects are mispriced by the market, and few analysts incorporate exponential growth into their models.

- While leading projects may thrive in the next era of crypto, increasing pressure to deliver and rising competition from enterprises will eliminate weaker participants.

- No force is stronger than an idea whose time has come—and crypto has never felt more inevitable.

In my eight years in this industry, the crypto economy is going through the biggest transformation I’ve ever witnessed. Institutions are accumulating positions while pioneering cypherpunks diversify their wealth. Enterprises are preparing for S-curve growth, while disillusioned native developers exit. Governments are steering global finance onto blockchain rails, while short-term traders still obsess over chart lines. Emerging markets celebrate financial democratization, while cynical Americans lament it as nothing more than a casino game.

There's been a lot of debate recently about which historical period today’s crypto economy most resembles. Optimists compare it to the post-dot-com bubble era, arguing that the speculative phase is over and long-term winners like Google and Amazon will now emerge and climb the S-curve. Pessimists liken it to emerging markets—such as certain ones in the 2010s—suggesting weak investor protections and chronic capital shortages could lead to poor asset performance despite strong underlying industry growth.

Both perspectives hold merit. After all, history is investors’ best guide aside from experience. Yet analogies can only take us so far. We must also understand crypto within its own macroeconomic and technological context. Markets aren’t monolithic—they consist of many actors and narratives, interconnected yet distinct.

Below is my best assessment of where we’ve been and where we’re headed.

The Red Queen’s Cycle

“Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

— Lewis Carroll

In many ways, expectations are the only thing that matters in financial markets. Beat expectations, prices go up; miss them, prices fall. Over time, expectations swing like a pendulum, and forward returns tend to be inversely correlated with them.

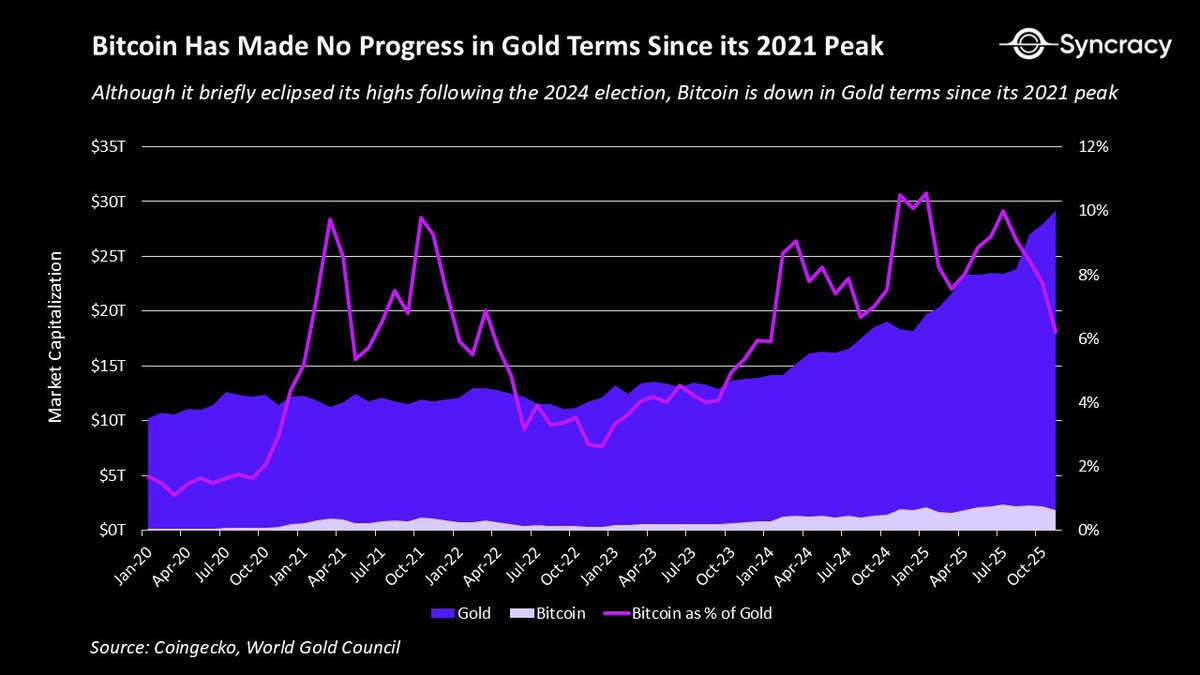

In 2021, the crypto economy front-loaded expectations to a degree far beyond most people’s understanding. In some ways, the overheating was obvious—DeFi blue chips trading at 500x price-to-sales multiples, or eight smart contract platforms each surpassing $100 billion in valuation. Not to mention the Metaverse and NFT madness. But perhaps the clearest cold-eyed indicator is the Bitcoin/Gold ratio.

Despite tremendous progress, Bitcoin’s price against gold has never reached new highs since 2021—and has actually declined. Who would have thought that in Trump’s declared “crypto capital of the world,” after the launch of history’s most successful ETF and amid systemic dollar devaluation, Bitcoin’s success as digital gold would be worse than four years ago?

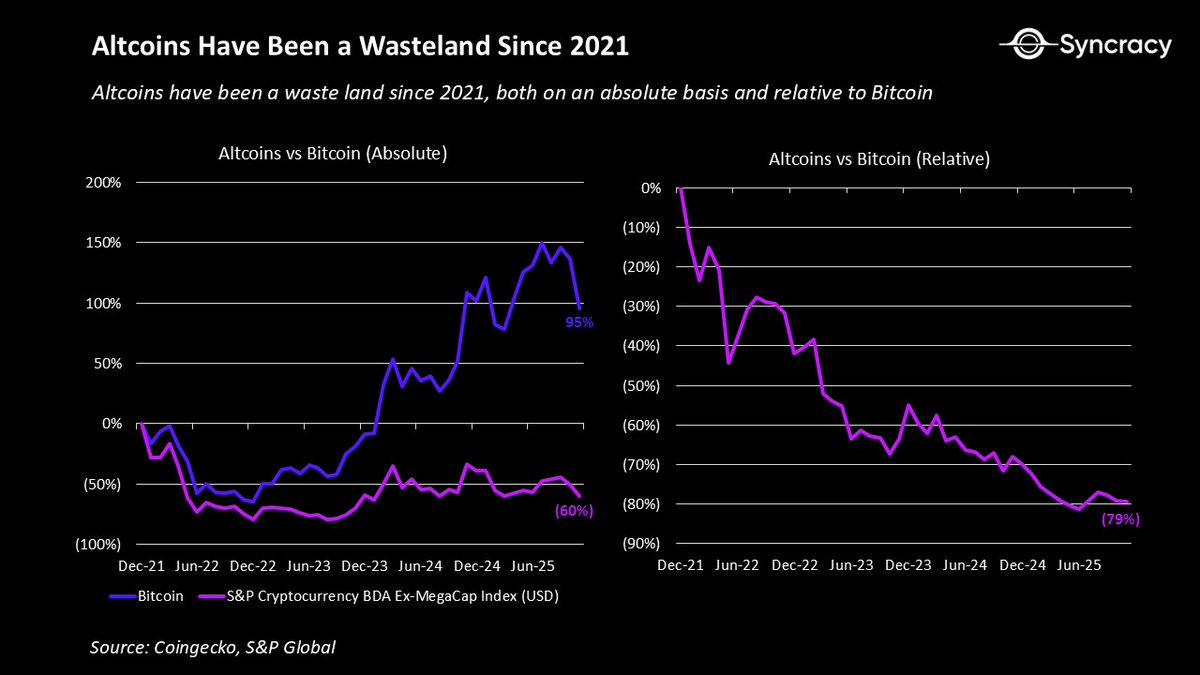

For other assets, the situation is even worse. Most projects entered this cycle with structural flaws that amplified the difficulty of meeting extreme expectations:

- Most projects have cyclical revenue streams, predicated on continuously rising asset prices;

- Regulatory uncertainty hindered institutional and corporate participation;

- Dual ownership structures created misalignment between equity insiders and public-market token investors; <4>Lack of disclosure norms led to information asymmetry between project teams and communities;

- No shared valuation framework, resulting in excessive volatility and no fundamental price floor.

The combination caused most tokens to bleed steadily, with only a handful approaching their 2021 peaks. This had a profound psychological impact—few things are more demoralizing than sustained effort without reward.

The disappointment was especially acute for speculators who saw crypto as the easiest path to wealth. Over time, this struggle triggered widespread burnout across the industry.

Of course, this is a healthy development. Mediocre efforts shouldn’t continue generating extraordinary outcomes as they did before. The era when vaporware created massive fortunes—pre-2022—was clearly unsustainable.

Yet there’s a silver lining: these problems are now widely understood, and prices reflect those realities. Today, outside of Bitcoin, few native crypto participants bother discussing long-term fundamentals. After four painful years, the asset class now has the necessary conditions to surprise the market again.

The Enlightened Crypto Economy

As outlined above, the crypto economy entered this cycle with multiple structural issues. Fortunately, awareness is now universal, and many of these problems are fading into history.

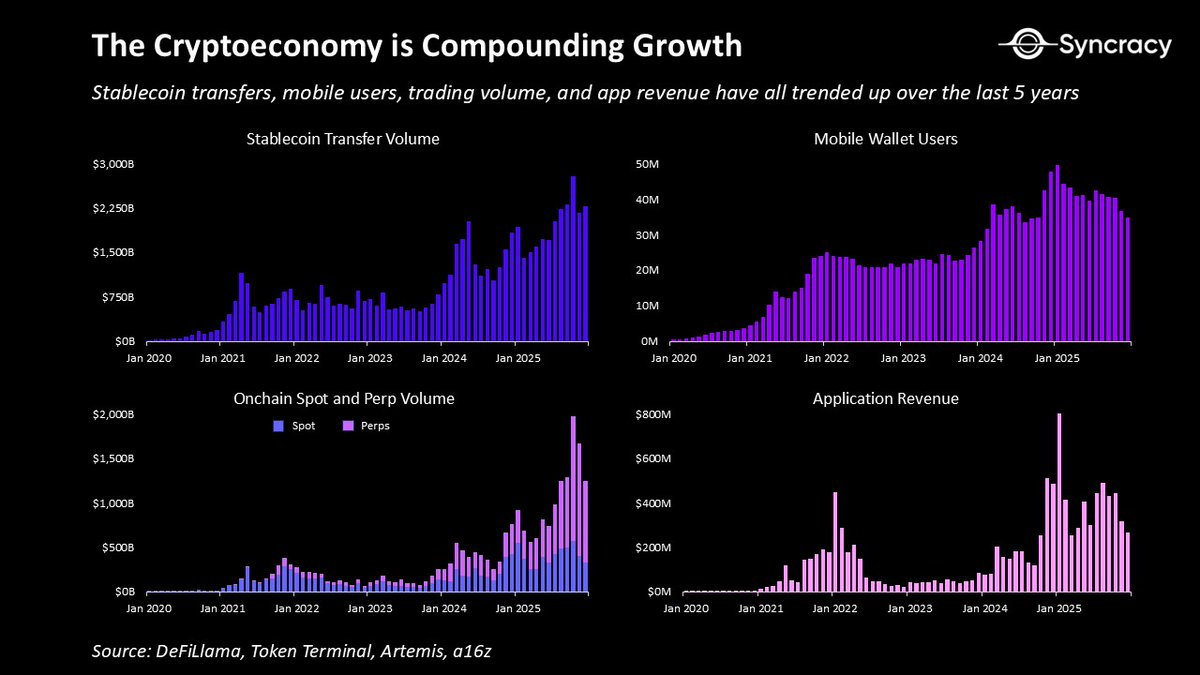

First, beyond digital gold, numerous use cases are now demonstrating compound growth, with many more transitioning toward sustainability. Over recent years, the crypto economy has delivered:

- Peer-to-peer internet platforms: enabling users to transact and enforce contractual relationships without government or corporate intermediaries.

- Digital dollars: storable and transferable anywhere on Earth with internet access, offering billions cheap, reliable money.

- Permissionless exchanges: allowing anyone, anywhere, to trade top global assets across categories 24/7 in transparent venues.

- Novel derivative instruments: such as event contracts and perpetual swaps, providing society with predictive insights and more efficient price discovery.

- Global collateral markets: enabling permissionless credit via transparent, automated infrastructure, significantly reducing counterparty risk.

- Democratized asset creation platforms: allowing individuals and institutions to issue publicly tradable assets at minimal cost.

- Open fundraising platforms: empowering anyone worldwide to raise capital for ventures, overcoming local economic constraints.

- Physical infrastructure networks (DePIN): distributing operations to independent operators via crowdsourced capital, creating more scalable and resilient infrastructure.

This isn’t an exhaustive list of all value propositions built so far. The key point is that many of these use cases now demonstrate real utility and are growing steadily regardless of crypto asset price movements.

Meanwhile, as regulatory pressure eases and founders recognize the cost of misalignment, dual equity-token models are being corrected. Many existing projects are consolidating assets and revenues into a single token, while others clearly separate on-chain revenues (for token holders) from off-chain revenues (for equity holders). Additionally, disclosure practices are improving thanks to maturing third-party data providers, reducing information asymmetry and enabling better analysis.

At the same time, there's growing consensus around a simple, time-tested principle: outside rare store-of-value assets like BTC and ETH, 99.9% of assets must generate cash flows. As more fundamental investors enter the space, these frameworks will strengthen further, increasing overall market rationality.

In fact, given enough time, the concept of “autonomous sovereign ownership of on-chain cash flows” may be seen as a paradigm unlock on par with “autonomous sovereign digital value storage.” After all, when else in history could you hold a digital bearer asset that autonomously pays you from anywhere on Earth every time it’s used?

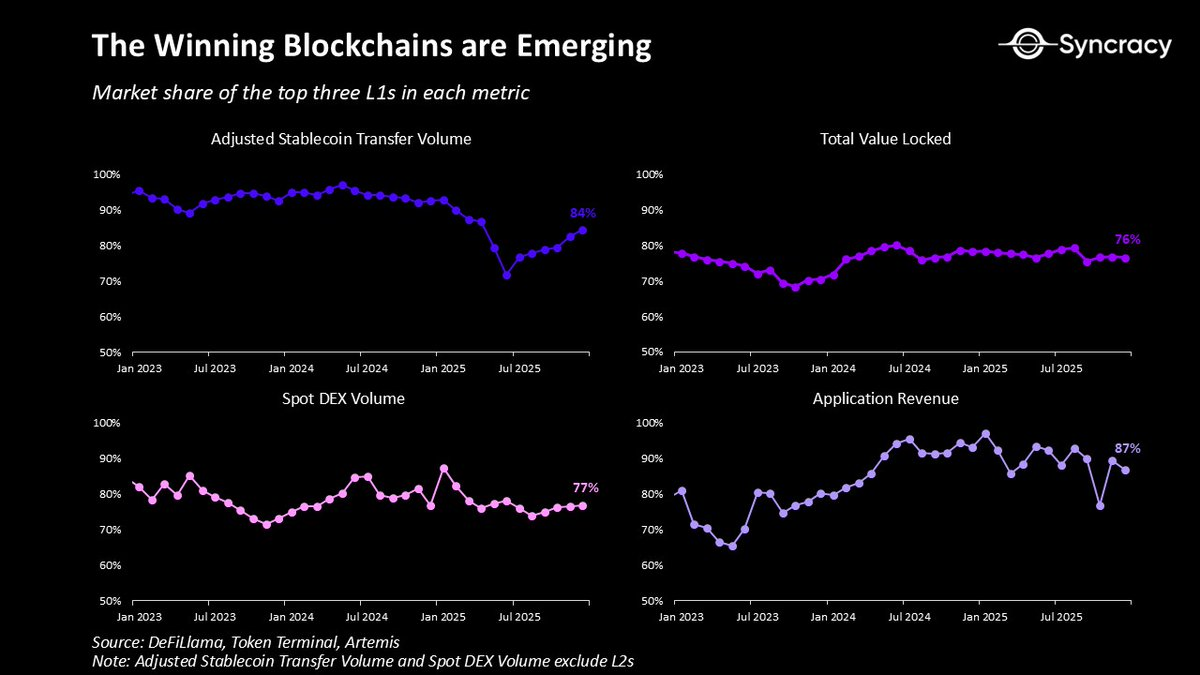

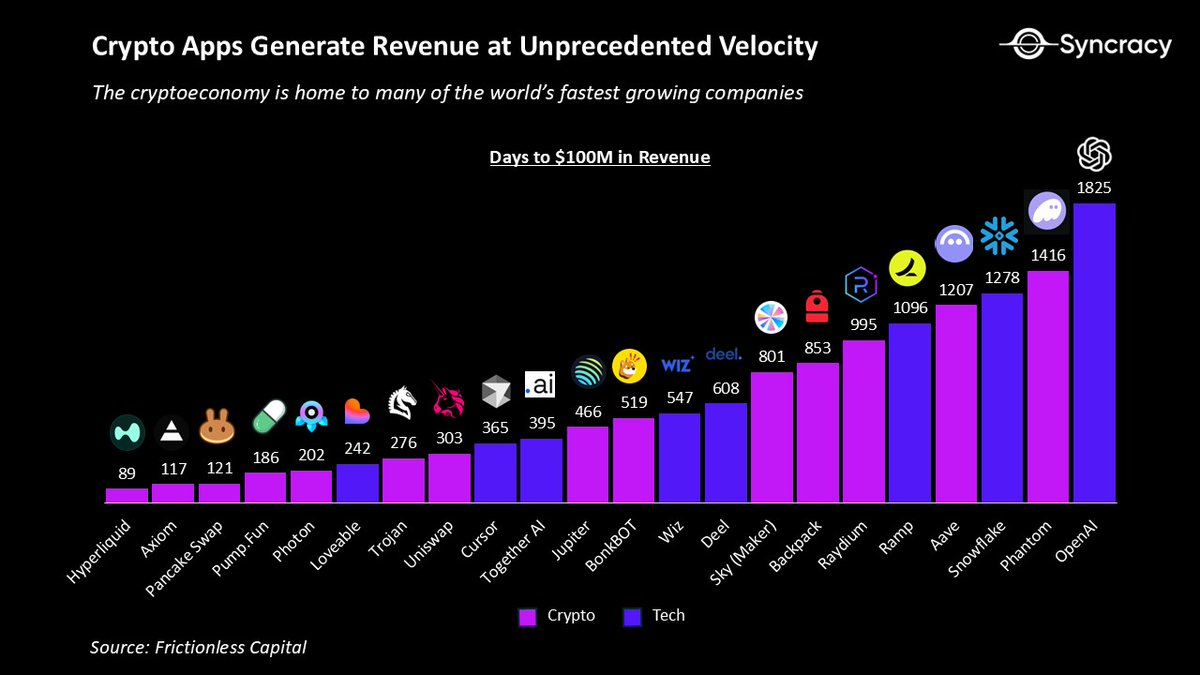

Against this backdrop, winning blockchains are increasingly emerging as the monetary and financial foundation of the internet. Over time, Ethereum, Solana, and Hyperliquid are strengthening their network effects through expanding ecosystems of assets, applications, businesses, and users. Their permissionless design and global distribution enable applications on these platforms to become some of the fastest-growing businesses in the world, with unmatched capital efficiency and revenue velocity. Long-term, these platforms are likely to underpin the total addressable market (TAM) for financial superapps—a space nearly every leading fintech company is now racing to capture.

Given this, it’s no surprise that Wall Street and Silicon Valley giants are accelerating their blockchain initiatives. Each week brings a wave of new product announcements—from tokenization to stablecoins and everything in between.

Critically, unlike earlier eras of crypto, these efforts aren’t experiments—they’re production-grade products, mostly built on public blockchains rather than isolated private systems.

As the lagging effects of regulatory changes continue permeating the system over the coming quarters, these activities will only accelerate. With greater clarity, corporations and institutions can finally shift focus from “Is this legal?” to how blockchains can expand revenue, reduce costs, and unlock new business models.

Perhaps one of the clearest signs of the current state is that few industry analysts model for exponential growth. Anecdotally, many of my sell-side and buy-side peers hesitate to assume annual growth rates above 20%, fearing they’ll appear overly optimistic.

After four years of pain and valuation resets, it’s worth asking: what if this really does grow exponentially? What if “daring to dream” starts paying off again?

The Twilight Hour

“To light a candle is to cast a shadow.”

— Ursula Le Guin

On a cool autumn day in 2018, before another exhausting day at investment banking, I visited an old professor’s office to discuss blockchain. After I sat down, he recounted a conversation with a skeptical equity hedge fund manager who claimed crypto was entering a nuclear winter—an “answer in search of a problem.”

After giving me a crash course on unsustainable sovereign debt burdens and crumbling institutional trust, he revealed how he responded: “In ten years, the world will thank us for building this parallel system.”

We’re not quite at ten years yet, but his prediction looks remarkably prescient, as crypto increasingly appears to be an idea whose time has come.

In that spirit—and central to this article’s thesis—the world still vastly underestimates what’s being built here. Most relevant for investors: multi-year opportunities in leading projects remain underpriced.

The last part is crucial, because while crypto may be unstoppable, your favorite token might still go to zero. The flip side of crypto becoming inevitable is intensified competition and unprecedented pressure to deliver. As I mentioned earlier, institutional and corporate entry will likely sweep away many weaker players. This doesn’t mean they’ll win everything or appropriate the technology, but only a few native players will emerge as dominant forces around which the world reorients.

This isn’t meant to be cynical. In every emerging tech field, 90% of startups fail. There will likely be more high-profile failures in coming years—but don’t let that distract from the bigger picture.

Perhaps no technology better embodies the zeitgeist of our times. Declining trust in institutions across developed societies, unsustainable fiscal spending in G7 nations, overt currency debasement by the world’s largest fiat issuer, deglobalization and fragmentation of international order, and rising demand for a fairer system than the old one. As software continues to eat the world, AI becomes the latest accelerant, and younger generations inherit wealth from aging baby boomers, there’s no better moment for crypto to step out of its niche bubble.

While many analysts frame this moment using classic models like the Gartner Hype Cycle or Carlota Perez’s “post-frenzy” phase—implying the best returns are behind us and what follows is a duller phase of tooling—the reality is far more interesting.

The crypto economy isn’t a single mature market but a collection of products and businesses at different stages of adoption curves. More importantly, when a technology enters its growth phase, speculation doesn’t disappear—it merely ebbs and flows with sentiment shifts and innovation cycles. Anyone claiming the speculative era is over is either tired—or ignorant of history.

Skepticism is warranted, but cynicism isn’t. We’re reimagining money, finance, and how our most important economic institutions are governed. It should be challenging—and equally fun and exciting.

Your task now is to figure out how best to navigate this emerging reality—not to write endless tweet threads arguing why it’s all doomed to fail.

Because beyond the fog of disillusionment and uncertainty lies a once-in-a-lifetime opportunity—for those willing to bet on a new dawn, rather than mourn the sunset of the old.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News