Galaxy Digital Report: Hyperliquid's L1 Begins to Gain a Foothold

TechFlow Selected TechFlow Selected

Galaxy Digital Report: Hyperliquid's L1 Begins to Gain a Foothold

HyperEVM is transforming from an obscure supporting player into a financial behemoth, with its recent updates propelling it to become a bridge connecting perpetual contracts and the DeFi world.

Authors: Lucas Tcheyan & Will Owens

Translation: TechFlow

HyperEVM is Hyperliquid’s EVM-compatible general-purpose Layer 1 blockchain, and it is beginning to show early signs of development.

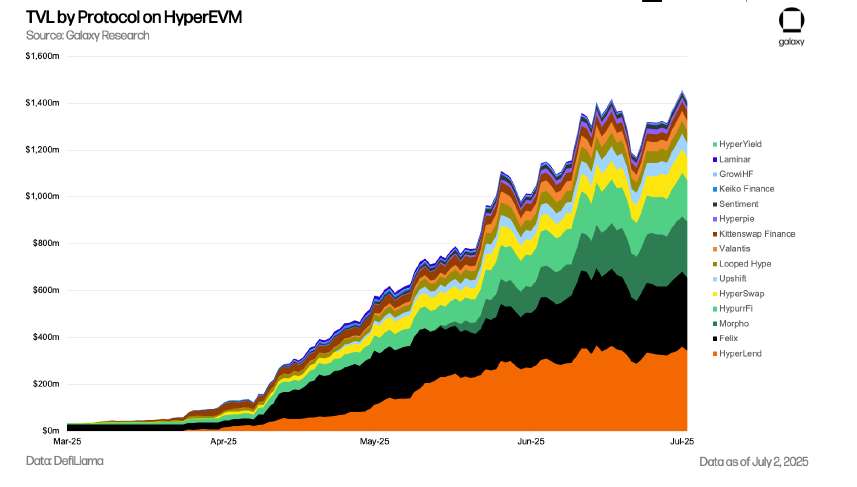

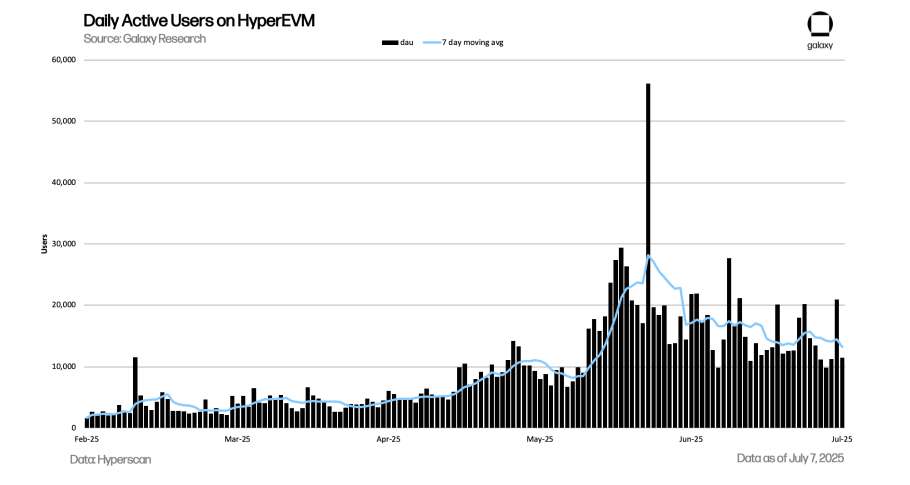

Although activity on HyperEVM remains modest compared to HyperCore (Hyperliquid's flagship perpetuals trading platform), the chain has seen steady growth in transaction volume, total value locked (TVL), and application development since its February launch. This progress has occurred despite a lack of robust tooling and direct incentive programs. Upgrades to core infrastructure, a maturing DeFi ecosystem, and growing speculation around potential airdrops are all contributing momentum to HyperEVM.

The recent release of CoreWriter marks a pivotal moment for the ecosystem. By enabling full write access to HyperCore, CoreWriter will unlock a new class of applications natively integrated across both layers, further blurring the line between the two platforms and transforming HyperEVM from a sidecar into a core driver of Hyperliquid’s expanding on-chain financial stack.

Key Takeaways

Development on HyperEVM is progressing iteratively and cautiously to ensure that its activities do not impact HyperCore. While this has created some friction for early builders, it hasn’t stopped a significant number of developers from launching applications—over 175 teams are now building on HyperEVM.

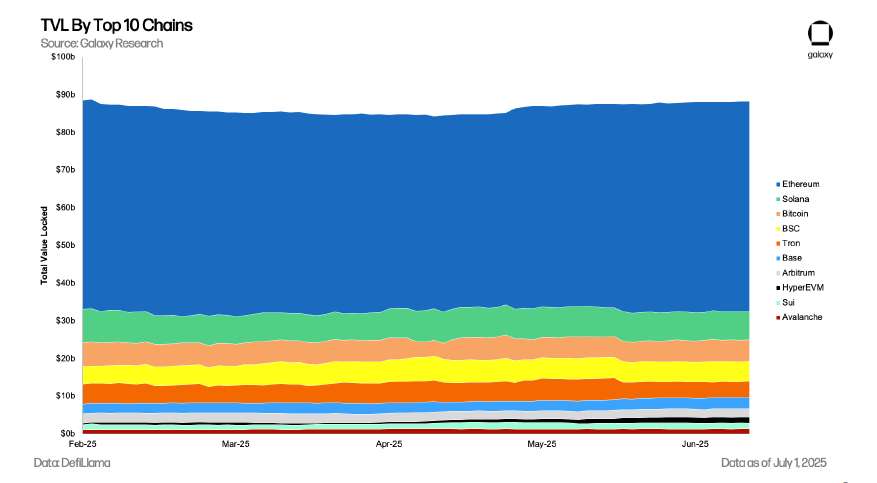

HyperEVM has already secured a top-10 position among L1 networks by TVL. Leading applications are primarily composed of DeFi products, especially lending, aligning with HyperEVM’s goal of unlocking DeFi composability for HyperCore.

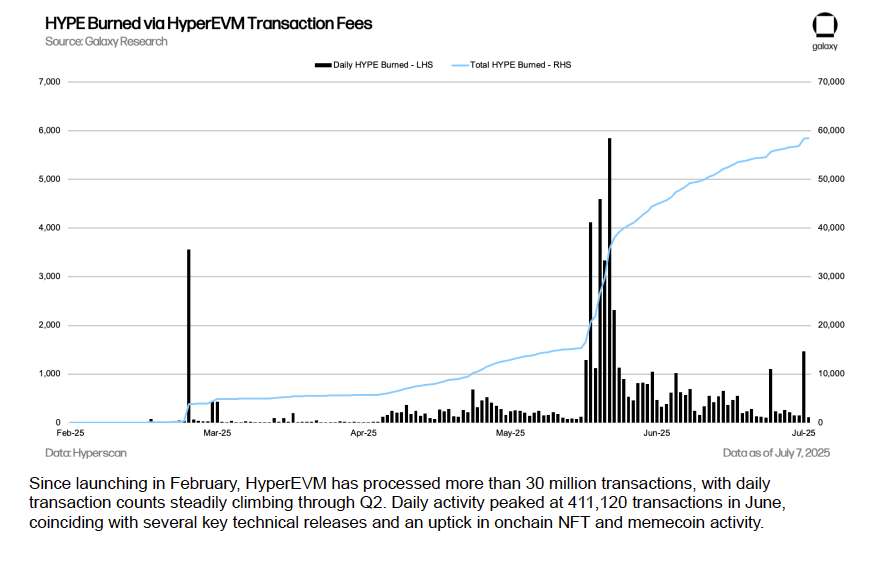

HYPE is HyperEVM’s native gas token, with base and priority fees burned on every transaction. Transaction fee burns have so far accounted for 0.006% of HYPE’s total supply. However, if on-chain transaction activity rebounds as expected over the coming months, burn volumes are likely to increase significantly.

User engagement still lags behind HyperCore adoption. As blockchain infrastructure and tools improve integration between HyperEVM and HyperCore, HyperCore adoption is expected to grow further in the next month.

The recent launch of CoreWriter enables smart contracts on HyperEVM to write directly to HyperCore—a major unlock for the HyperEVM application ecosystem—and is expected to drive a surge in app deployment and user activity in the coming months.

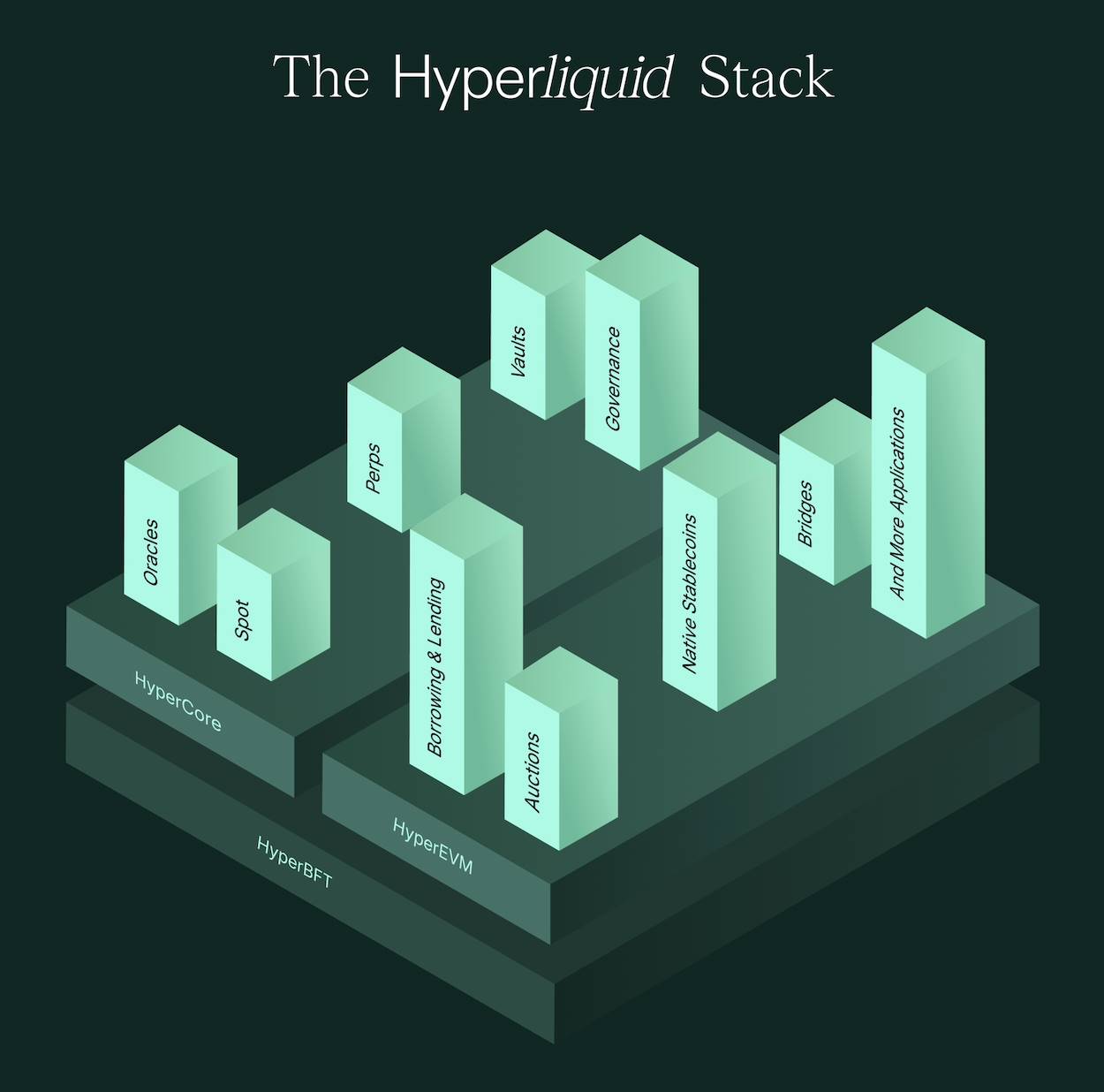

Hyperliquid’s broader vision positions HyperEVM as a complementary financial layer to HyperCore. The long-term goal is to create a vertically integrated DeFi stack where trading, lending, vaults, and staking coexist natively across both chains.

HyperEVM Architecture

Hyperliquid operates two interconnected yet distinct platforms: HyperEVM and HyperCore. HyperCore is better known—the perpetual futures trading platform featuring an on-chain order book, margin system, and matching engine. Since its 2023 launch, it has dominated the perpetuals market and begun competing with centralized exchange offerings. HyperEVM, launched on February 18, is Hyperliquid’s EVM-compatible general-purpose Layer 1, designed to unlock DeFi composability for HyperCore through integration with a general smart contract platform.

A key distinction is that HyperCore and HyperEVM are separate chains, but both are secured by the same HyperBFT consensus mechanism—a hybrid proof-of-stake and Byzantine fault tolerance system optimized for high throughput and low latency—and the same validator set. This allows applications built on HyperEVM to interact directly with HyperCore’s spot and perpetual order books.

(Source: Hyperliquid Docs)

Consensus & Execution

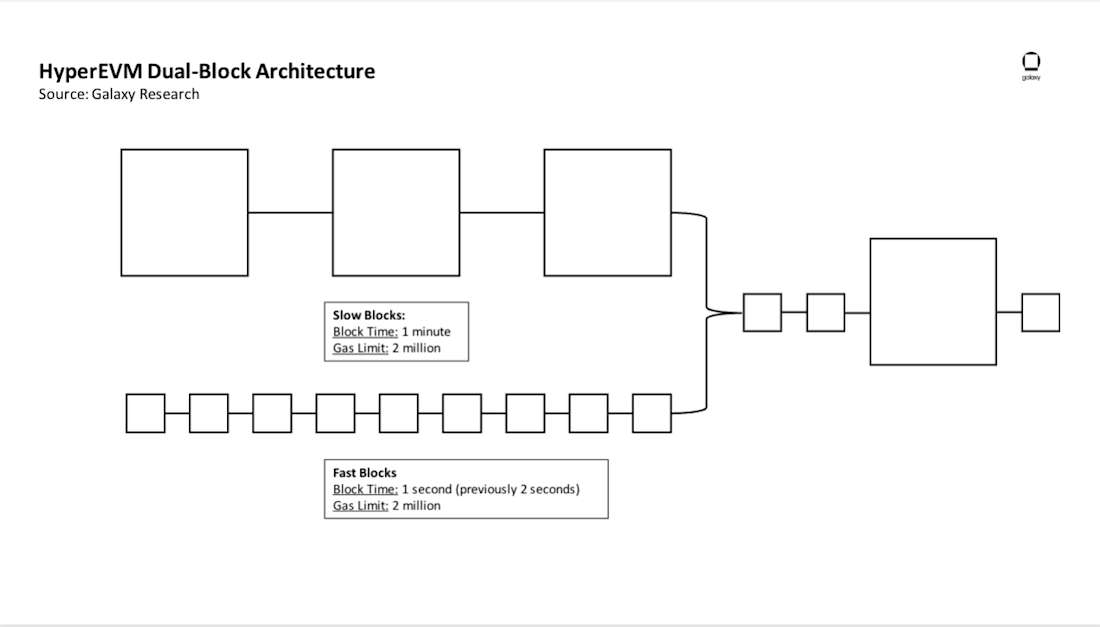

HyperEVM employs a “dual block architecture” to balance speed and capacity. It processes fast microblocks every second with a 2 million gas limit, enabling near-instantaneous regular transfers and transactions. Simultaneously, it processes larger blocks every minute with a 30 million gas limit, giving builders room to handle heavy tasks like deploying large smart contracts or minting large NFT batches. Block latency is under one second, supporting up to 200,000 orders per second.

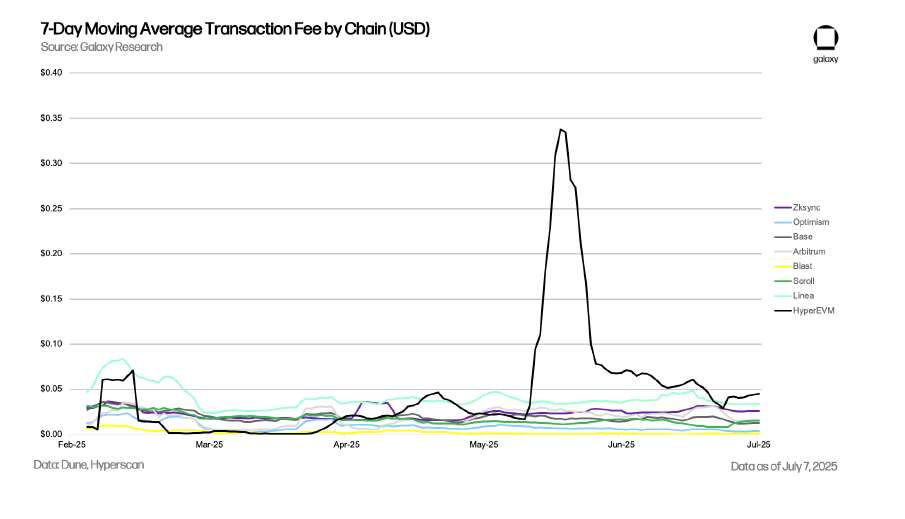

While HyperEVM offers high throughput and low latency, its transaction fees consistently exceed those of Ethereum L2 networks, especially during periods of congestion. The chart below compares median daily transaction fees on HyperEVM against seven L2 networks.

Notably, HyperEVM fees spike dramatically during peak activity (exceeding $0.30 per transaction).

HYPE is the gas token on HyperEVM, which uses a modified version of Ethereum’s EIP-1559 mechanism to burn both base and priority fees. The chain is EVM-compatible, allowing teams to easily redeploy EVM smart contracts on HyperEVM. Since launch, over 55,000 HYPE tokens have been burned—0.006% of total supply. In contrast, over 367,000 HYPE have already been burned on HyperCore due to spot trading fees. At the current market price of $39.12 per HYPE, this represents over $2.15 million in cumulative burns. On May 26, daily burn peaked at 5,849 HYPE (~$226,000), coinciding with a surge in contract deployments and user activity. As HyperEVM activity expands, its contribution to total HYPE consumption will shift from marginal to a material force driving long-term supply reduction.

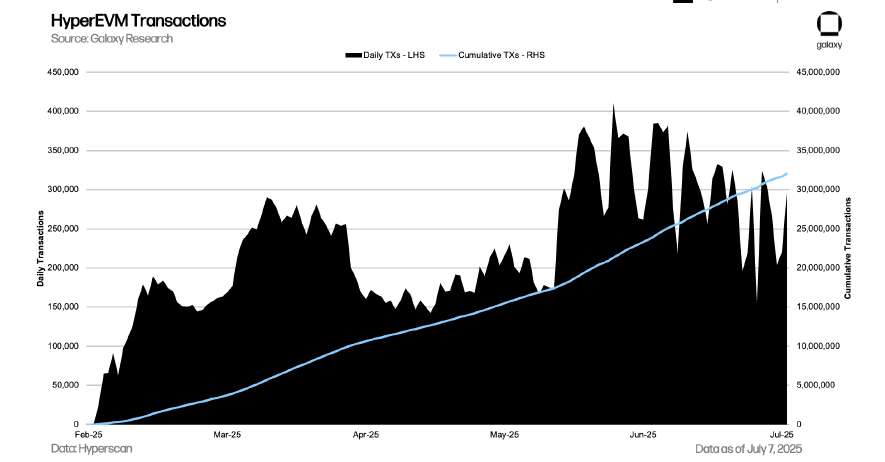

Since its February launch, HyperEVM has processed over 30 million transactions, with daily transaction volume steadily climbing through Q2. In June, daily volume peaked at 411,120 transactions, coinciding with the release of several key technologies and rising NFT and memecoin trading volumes on-chain.

Technical Upgrades

HyperEVM launched with only basic functionality: spot transfers of HYPE between HyperCore and HyperEVM, and wrapped HYPE contracts for DeFi apps. It was a barebones release, missing many key features expected of a general-purpose Layer 1, most notably integration with HyperCore.

In their announcement, the team explained that launching in such a primitive state ensured "equal access and a level playing field for everyone." The phased rollout also allowed them to upgrade the system more safely while incorporating real-time user feedback. According to HyperEVM developers, the lack of mature tooling did create friction, but it didn't halt development.

Since launch, the team has rolled out multiple technical upgrades to HyperEVM, including:

March 25: HyperCore and HyperEVM connected, enabling users to trade any token from one chain on the other.

April 30: Read precompiles launched, allowing HyperEVM smart contracts to read state from HyperCore.

May 26: Microblock duration halved to 1 second, increasing HyperEVM throughput. Improving throughput remains a top technical priority, with further reductions in block time expected.

June 26: HyperEVM blocks updated to sort cancel-only orders before others, improving integration with HyperCore.

July 5: HyperEVM updated with a new precompile called CoreWriter, enabling HyperEVM contracts to write directly to HyperCore—placing orders, transferring spot assets, managing vaults, staking HYPE, etc. This elevates HyperEVM from a chain that could only read HyperCore updates to one that can directly update HyperCore’s state—a significant leap forward for HyperEVM’s unique capabilities (discussed further below). The team announced CoreWriter’s first upgrade on July 2 and deployed it three days later (mainnet updates typically occur on Saturdays).

While CoreWriter represents a major step toward unifying HyperEVM and HyperCore, it has limitations. Most notably, writes via CoreWriter are not atomic (TechFlow note: in multithreaded programming, an operation that cannot be interrupted by thread scheduling; once started, it runs to completion), meaning smart contracts cannot confirm within a single transaction whether an order or state change succeeded on HyperCore. This asynchronous design is intentional, aimed at minimizing front-running, but poses challenges for more complex or precision-dependent trading strategies. Thus, while CoreWriter enables new application types, its early implementation favors use cases tolerant of asynchronous execution or high success rates—such as staking, vault deposits, and simpler programmatic interactions. Given the complexity of interactions between HyperEVM and HyperCore, the Hyperliquid team will continue iterating, gradually unlocking new features without compromising HyperCore’s functionality.

HyperEVM Application Ecosystem

Since launch, the HyperEVM ecosystem has grown rapidly, with over 175 projects publicly building on the chain and many more developing in stealth. Developers are central to any emerging ecosystem, and Hyperliquid has attracted a strong cohort thanks to its unique architecture and integration with HyperCore. HyperCore is one of the most liquid on-chain exchanges, with a large user base that can easily migrate to HyperEVM. We spoke with numerous teams who previously worked on other chains and are now building on HyperEVM—they repeatedly cited sustained user demand or the need for greater liquidity as key drivers. Unlike many other Layer 1 ecosystems, Hyperliquid has attracted developers without dedicated incentive or grant programs. The success of HYPE, combined with expectations around future airdrops (42% of remaining supply), has proven sufficient motivation.

HyperEVM’s total value locked (TVL) has steadily climbed the L1 rankings since launch, currently sitting in 10th place. TVL growth has been concentrated in a few key protocols (detailed below). Importantly, this growth occurred without liquidity mining or ecosystem incentives. While most of Hyperliquid’s users and trading activity remain on HyperCore, HyperEVM now positions itself as the DeFi settlement layer for the entire stack. With CoreWriter soon unlocking write access to HyperCore, TVL is expected to shift from passive capital (idle lending) to active capital—trading across live perpetual markets, vaults, and order books.

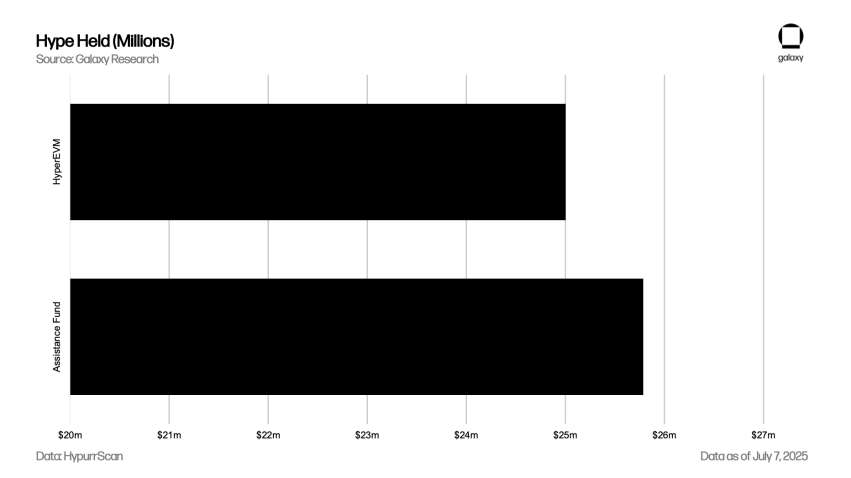

As shown below, the amount of HYPE held in the ecosystem’s support fund (25.79 million) still exceeds the total HYPE on the HyperEVM chain (~25 million). This imbalance indicates HyperEVM is still in early stages. As on-chain usage grows, we expect more idle funds to migrate into efficient DeFi use cases.

Although HyperEVM launched in February, meaningful smart contract deployment didn’t begin until mid-May. Several factors contributed to this delay. At launch, HyperEVM lacked ERC-20 support, a block explorer, or reliable indexers—imposing significant constraints on developers. Additionally, the Hyperliquid team gave little advance notice about the launch, causing many teams to only begin full-scale development and deployment after HyperEVM went live. With core infrastructure and tools—including cross-VM asset bridges, contract indexing, and verification tools—rolling out in March and April, contract deployment accelerated. With CoreWriter now released, we expect another surge as applications update their functionality and bring products to market.

Top TVL Protocols

HyperLend is the highest TVL project on HyperEVM, with $487 million, and serves as the chain’s primary lending protocol. It offers standard lending features such as core pools (enabling depositing or borrowing multiple tokens in a single pool), efficiency mode (allowing higher borrowing against correlated assets), and isolated pools (isolating risk to specific token pairs). On June 10, HyperLend announced a focus on HyperCore integration. This update enables position liquidations to occur directly on HyperEVM or via cross-chain execution on HyperCore—one of the first major integrations between the two chains and likely what Hyperliquid founders envisioned when launching HyperEVM. Through HyperCore integration, HyperLend now offers liquidators three distinct clearing methods. For a complete overview of HyperLend’s liquidation handling, see the team’s post here. The team also hinted at other products leveraging CoreWriter, though details remain undisclosed.

Felix, with $340 million TVL, ranks second and offers a suite of on-chain lending products. The app features two core primitives: a collateralized debt position (CDP) market and a “vanilla” lending market. Felix leverages Hyperliquid’s EVM compatibility as backend infrastructure, using Liquity’s v2 architecture for its CDP stablecoin feUSD and Morpho’s tech stack for its vanilla lending market. In April, Felix announced USDhl, a fiat-backed stablecoin developed in partnership with stablecoin platform M0. Public on-chain data shows Felix’s stablecoin products have contributed over $100 million in stablecoins to the HyperEVM ecosystem since launch, mostly from feUSD ($75 million). Felix plans to integrate clearing functionality on HyperCore following the CoreWriter release.

HypurrFi is the third-largest lending application on Hyperliquid, with $318 million TVL. It brands itself as Hyperliquid’s “debt infrastructure provider.” Beyond lending, HypurrFi offers an over-collateralized stablecoin USDXL, a built-in decentralized exchange (DEX), and yield vaults for asset deployment. After USDXL depegged in May, the team reduced its issuance cap to $5 million while working on a more robust peg mechanism.

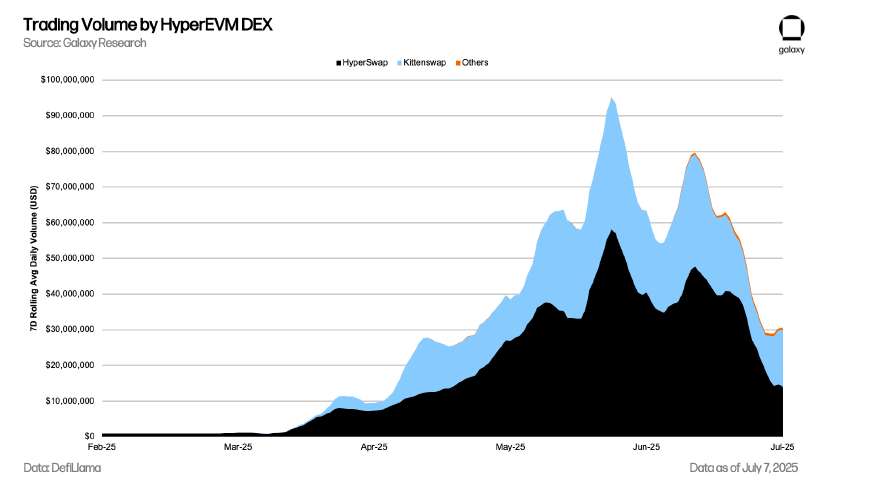

HyperSwap and KittenSwap are Hyperliquid’s primary AMM-based DEXes and rank fourth and fifth by TVL. They follow common EVM AMM designs, offering standard and concentrated liquidity positions similar to Uniswap. KittenSwap also adopts Curve’s ve(3,3) model. The CoreWriter release will significantly enhance their functionality, enabling integration with HyperCore’s order book so user orders can be routed through either the DEX or order book for optimal execution.

Unit Protocol serves as the asset tokenization layer for the Hyperliquid ecosystem, enabling cross-chain deposits and withdrawals of major cryptocurrencies like BTC, ETH, and SOL on both HyperCore and HyperEVM. Unit operates a decentralized guardian network that issues native spot assets via a “lock-and-mint” system, eliminating reliance on centralized custodians. As of July 1, Unit has deployed over $100 million in BTC and $13 million in ETH on HyperEVM.

Beyond these examples, many teams are building products dependent on CoreWriter integration. Below are a few:

Kinetiq is a liquid staking protocol on Hyperliquid operating across HyperCore and HyperEVM. It allows users to stake native HYPE tokens on HyperCore and receive kHYPE—a liquid staking derivative usable in DeFi apps on HyperEVM. Kinetiq uses an oracle-based autonomous validator selection system to dynamically delegate HYPE to the highest-performing validators, optimizing yield and securing the network. To streamline staking operations between HyperEVM and HyperCore, Kinetiq will leverage CoreWriter for seamless integration and liquidity. Just days after CoreWriter’s release, the team announced a planned product launch on July 15.

Sentiment is a decentralized lending protocol on HyperEVM enabling users to borrow and lend assets with customizable leverage. Users can pledge assets (like kHYPE from Kinetiq or other HyperEVM tokens) to borrow stablecoins such as USDC at competitive rates, facilitating strategies like leveraged yield farming. Sentiment’s smart contracts are preparing to interact with HyperCore via CoreWriter, enabling real-time access to Hyperliquid’s on-chain order book for collateral valuation and liquidation management.

HyperDrive and Hyperwave offer tokenized versions of HLP—a community-owned protocol vault executing market-making and liquidation strategies on HyperCore. The CoreWriter update will make it easier for these projects to integrate HLP into HyperEVM’s evolving DeFi ecosystem.

Liminal is a delta-neutral yield protocol built atop HyperCore. Liminal leverages Hyperliquid’s high-performance trading infrastructure to execute automated, market-neutral strategies and capture funding fees from perpetual futures markets. Its non-custodial design ensures user control over funds, while institutional accounts use Hyperliquid’s native proxy system for secure trade execution. The CoreWriter release will eventually allow the team to deploy HyperEVM contracts for users to manage positions on HyperCore.

Rysk is a decentralized options trading protocol on HyperEVM that turns covered calls (TechFlow note: "covered" refers to using held assets as collateral or guarantee) into liquid, tradable primitives. It allows users to earn upfront premiums while enabling advanced options trading within Hyperliquid’s DeFi ecosystem. Rysk uses HyperCore APIs to hedge buyer option flows in real time directly on-chain, but plans to upgrade its stack to integrate CoreWriter. This will reduce execution risk for covered calls and provide greater transparency. The team is also exploring options for users to build custom trading strategies combining options and perps using HyperEVM and CoreWriter.

Outlook

Nearly six months after launch, HyperEVM possesses all the ingredients to become a compelling general-purpose L1 platform that complements a successful perpetuals trading venue. While other emerging L1s require massive incentive programs and truly novel applications to attract users and developers, HyperEVM comes pre-equipped with access to both, allowing builders to focus on product development and innovation.

Jeff Yan, founder of Hyperliquid, recently said on a podcast: “(Hyper)EVM is to finance what AMMs were to trading.” While HyperCore remains the foundational building block of the Hyperliquid ecosystem, it alone cannot serve all use cases built atop a perps exchange. In the short term, HyperCore will likely remain the primary trading hub. However, we expect HyperEVM activity to accelerate over the next year as blockchain performance and tooling improve and applications mature. Through vertical integration, Hyperliquid aims to create a comprehensive financial ecosystem—offering users a one-stop solution while retaining sticky liquidity.

The recently launched CoreWriter is a critical catalyst that will accelerate HyperEVM’s development through full integration with HyperCore. It enables HyperEVM applications to write directly to HyperCore for the first time, creating seamless interaction between the two environments and unlocking more powerful, coordinated on-chain applications.

In short, CoreWriter marks a significant milestone for HyperEVM. Developers have expressed interest in leveraging this integration to build products that would be difficult to replicate elsewhere.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News