500 Million USD Sold in 12 Minutes—Who Is Really Playing the PUMP Presale Game?

TechFlow Selected TechFlow Selected

500 Million USD Sold in 12 Minutes—Who Is Really Playing the PUMP Presale Game?

Perhaps a carnival for the few.

By TechFlow

The biggest story recently has been the token pre-sale of meme launch platform Pump.fun.

After much anticipation, PUMP began its pre-sale on July 12, selling $500 million worth of tokens in just 12 minutes. This shows it's not that the market lacks capital—rather, money tends to wait and then pour into major projects.

As Bitcoin hits new highs, the PUMP pre-sale appears at a pivotal moment when the market may be shifting from bearish to bullish, and sentiment is turning from pessimism to optimism. More people are starting to FOMO, and whales continue opening large long positions on Hyperliquid.

In contrast, others feel disappointed for failing to secure PUMP tokens through centralized exchanges (CEXs).

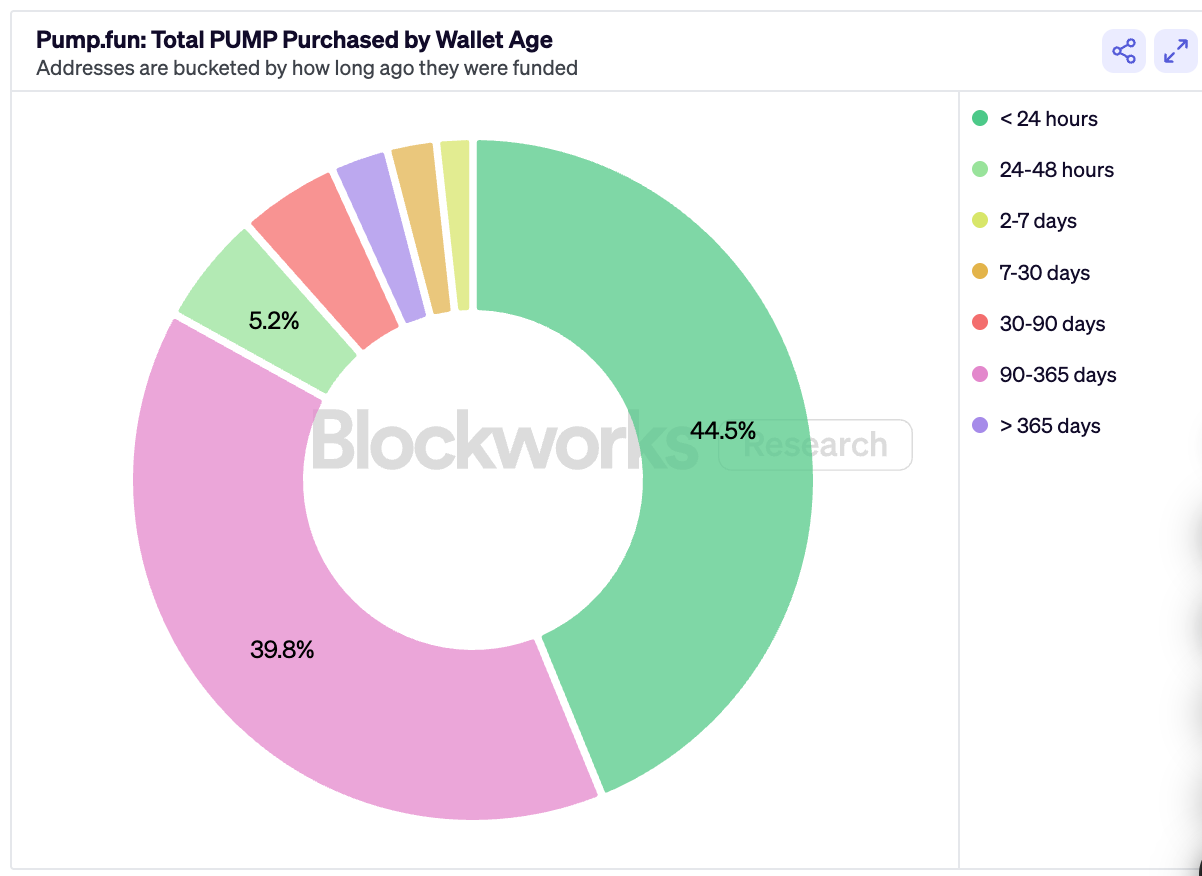

Data from Pump.fun’s official website reveals that several CEXs previously announced as pre-sale partners show zero participation in the successful allocation channels. Meanwhile, platforms like Kraken, Kucoin, and Gate that did have allocations account for only about 10% of the total PUMP pre-sale volume.

If you tried to participate via a CEX, you likely came away empty-handed.

But don’t be too discouraged—here's some data that might offer perspective, pointing toward a clearer conclusion: The PUMP pre-sale may have been a party for only a few.

Kraken: A Two-Person Party

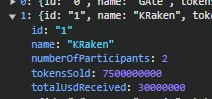

Pump.fun initially partnered with six CEXs for the pre-sale. Regardless of the reasons behind it, three of them recorded zero participation. This naturally shifts attention to the other three that did manage allocations.

Kraken secured the largest share among CEXs, accounting for $30 million in allocations.

You might assume many users obtained PUMP through Kraken—but in reality, only two individuals may have done so.

According to data monitored by Twitter user @splinter0n from the pre-sale interface, the "number of participants" field for Kraken showed just 2, meaning only two independent addresses participated, collectively securing $30 million.

(Image source: @splinter0n, original post here)

In the comments, users speculated about who these two might be, but social media generally believes they were well-resourced whales. Regular retail investors simply can't access such large amounts, especially when CEX systems fail during high-demand events.

The blogger also shared further data: only 15 participants secured $5 million via Gate; 120 participants secured nearly $16.5 million via Kucoin.

In total, fewer than 140 individuals participated across these three exchanges. Considering one person could control multiple addresses, the actual number of unique participants may be even lower.

Notably, the blogger’s monitoring data—including total participants and total investment—aligns closely with figures reported by Pump.fun, suggesting high credibility.

While Pump.fun hasn’t officially confirmed participant counts per exchange, we can reasonably assume these numbers reflect reality.

In short, participating via CEX was a privilege for a select few, leaving most others disappointed.

Most People Only Bought $500

If CEX users missed out due to technical issues, did retail investors who bought directly via the official site strike gold?

Let’s look at the data.

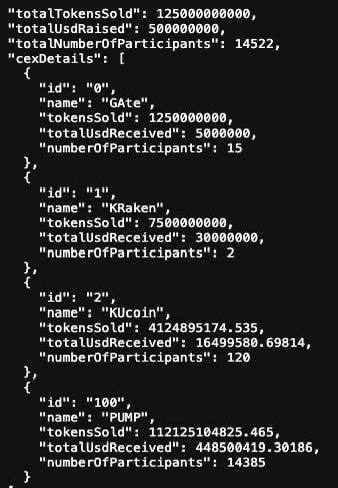

Blockworks, a leading international media and analytics platform, recently launched a dashboard providing clear insights into the PUMP pre-sale.

A total of 10,000 unique addresses participated. The most common purchase range was $100–$1,000, with the median purchase amount around $540.

Note this is the median, not the average—this method avoids distortion caused by a few ultra-large purchases inflating the mean.

In other words, most buyers invested around $500. Yet on Twitter, you’ll see countless posts expressing regret or FOMO, as if they’d missed out on tens of thousands—or even hundreds of thousands—of dollars.

There’s often a vast gap between real data and social media sentiment. Emotions can be amplified, but wallet balances remain limited.

On the other hand, 202 wallets purchased over $1 million worth of PUMP, and 138 wallets bought over $500,000.

Other interesting data points are also worth noting.

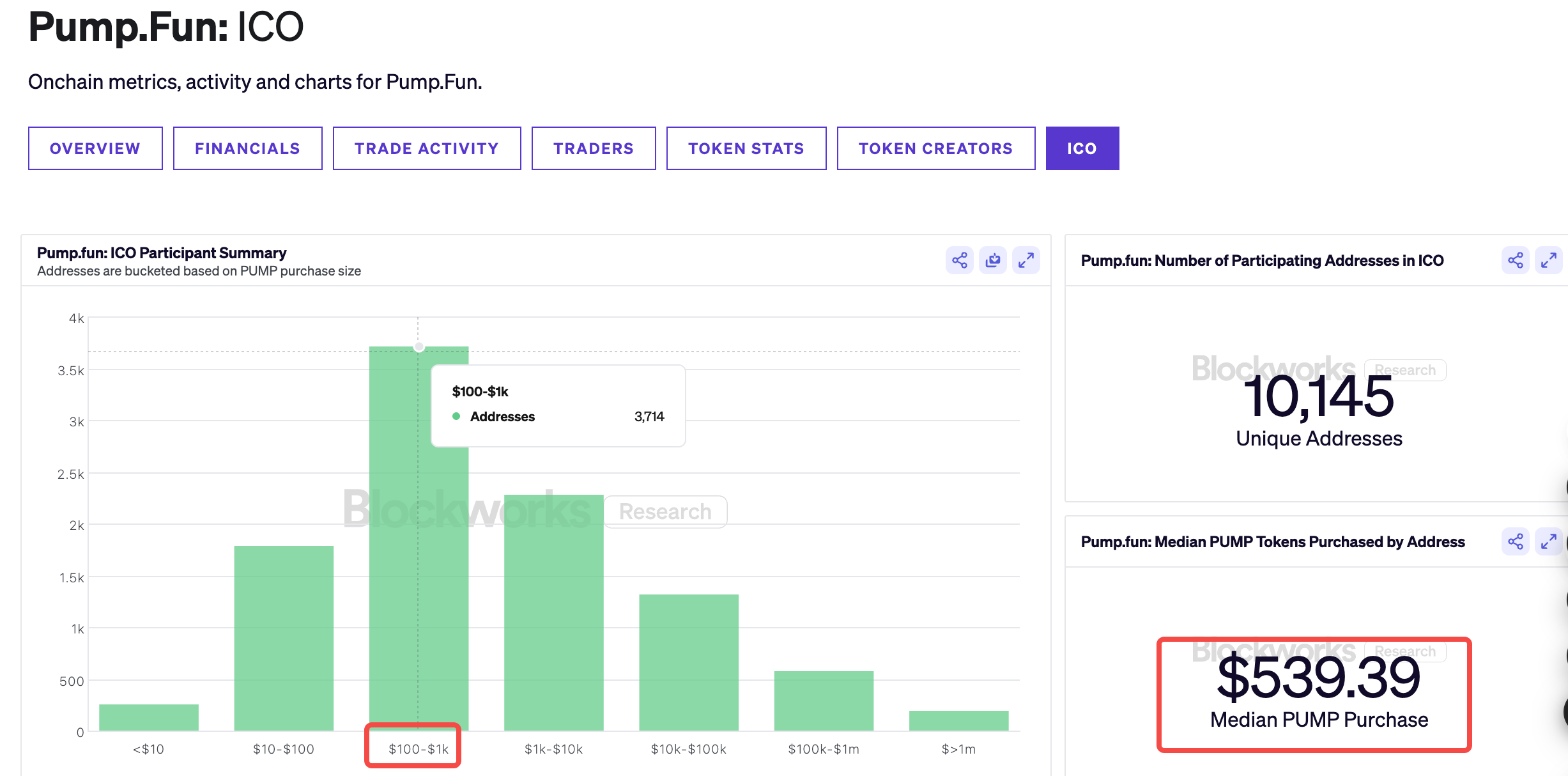

Nearly 45% of participating wallets were newly created within the last 24 hours.

If there’s a per-wallet purchase cap, large players and institutions can bypass it by generating numerous new addresses, maximizing their total allocation.

By contrast, wallets older than one year accounted for less than 5% of participants. This supports a community theory: pre-sales favor big players, while long-term holders ("old degens") may end up providing exit liquidity.

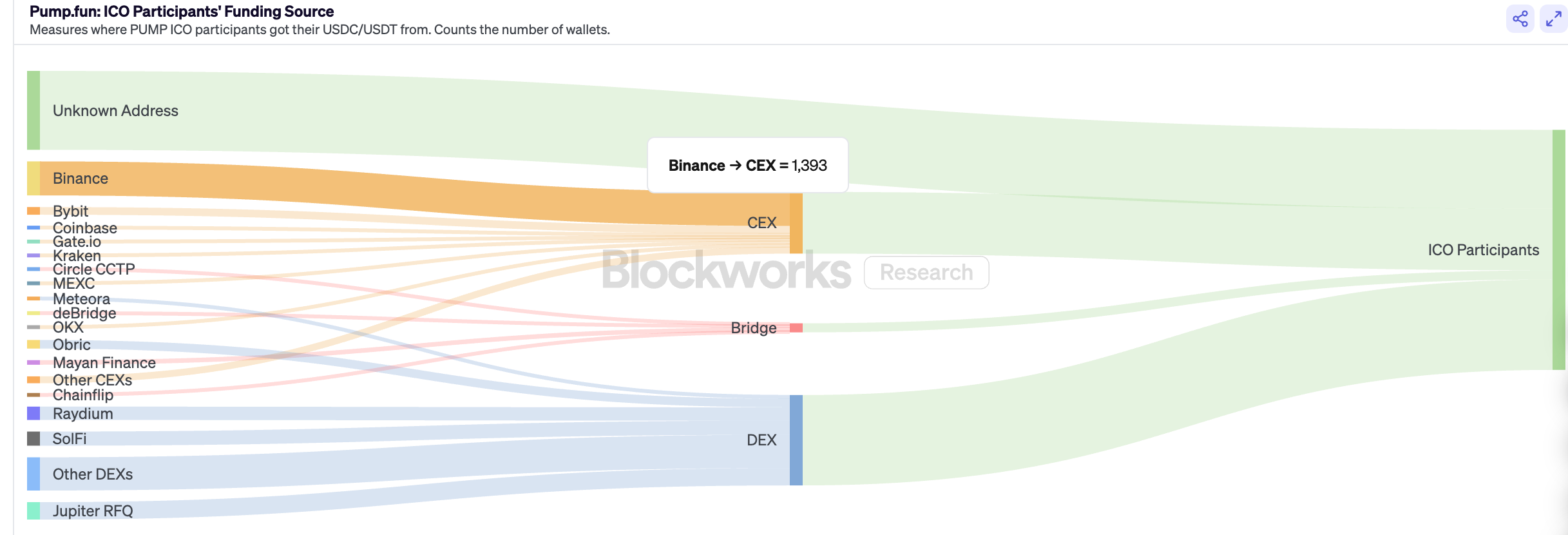

Finally, examining the funding sources for those who participated directly on Pump.fun’s site reveals an important trend: aside from self-hosted wallets, the majority of off-chain funds actually originated from Binance withdrawals—exceeding the combined withdrawal addresses from all other CEXs.

On-chain, DeFi protocols in the Solana ecosystem—such as Raydium, SolFi, and Jupiter—also contributed significant capital. Combined, self-hosted wallets and DEX sources accounted for over 60% of the more than 10,000 participating addresses, while CEX-sourced funds accounted for less than 30%.

This once again highlights the importance of access channels.

For most crypto projects, the shorter the participation path, the better. People prefer convenience. If users must withdraw from a CEX to a personal wallet before joining a pre-sale, their willingness to participate naturally decreases.

Hence, it makes perfect sense that major CEXs are now embedding on-chain launch features and building native on-chain wallets directly into their apps.

Edge Walkers

Looking at all the PUMP pre-sale data together, what appears to be an open, decentralized event increasingly shows signs of centralization in practice.

Low-cost creation of new wallets, pre-market long/short battles on Hyperliquid, CEX channel failures—all these factors make the PUMP pre-sale resemble an elite game, carefully orchestrated rather than community-driven.

And this isn’t the first time we’ve seen FOMO and criticism around a token amplified on social media. Retail investors keep chasing the illusion of the “next 100x gem,” only to discover, upon seeing the data, that they were merely marginal participants.

As we continue watching from the sidelines in disappointment, the market becomes ever more dependent on capital movements from a small few.

At this moment of Bitcoin’s new all-time high, those on the edge still feel the chill of the altitude.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News