E Guard Breakout Battle: Can the Ethereum Community Foundation Become a New Engine to Ignite ETH Value?

TechFlow Selected TechFlow Selected

E Guard Breakout Battle: Can the Ethereum Community Foundation Become a New Engine to Ignite ETH Value?

Community awakening, or just a speculative gimmick?

Author: Hotcoin Research

1. Introduction: A Breakout Signal Amid ETH's Downturn?

Since 2024, ETH’s price growth has significantly lagged behind BTC and SOL, falling short of earlier market expectations. While Bitcoin has performed strongly in this cycle, Ethereum faces increasing competition from emerging Layer 1 networks like Solana and Sui, as well as established Layer 2 platforms such as Base and Arbitrum, all vying for market share. This has hindered ETH’s ability to rise in tandem with other major assets. Meanwhile, declining mainnet usage has led to shrinking revenue, weakening the ETH burn mechanism and further suppressing price performance. Additionally, lackluster performance of spot Ethereum ETFs and limited institutional adoption and reserves have contributed to the underperformance. In this environment of “BTC dominance and ETH weakness,” many believe traditional mechanisms are no longer sufficient to protect or grow Ethereum’s value. Dissatisfaction within the Ethereum community is growing. Some members attribute the price stagnation to strategic missteps and governance issues at the Ethereum Foundation (EF), citing "inaction, centralized control, low transparency, bureaucratic bloat, and lack of long-term vision." Although EF announced a strategic restructuring in June 2025, skepticism remains.

Against this backdrop, core Ethereum developer Zak Cole announced the formation of the Ethereum Community Foundation (ECF) at EthCC 8—the eighth annual Ethereum community conference held in Cannes, France—in July 2025—proclaiming, “ETH reaching $10,000 is not a joke, but a necessary goal!” He stated that ECF will “say what the Ethereum Foundation dares not say, and do what it refuses to do,” explicitly declaring its mission to support the Ethereum ecosystem in asset form and drive ETH to $10,000. This declaration reflects community disappointment with past governance models and has sparked widespread debate over whether ECF can catalyze a turnaround for Ethereum.

This article explores the context behind ECF’s founding, analyzes the fundamental reasons for ETH’s underperformance in this cycle, and provides an in-depth examination of ECF’s mission and strategy. It compares ECF with the Ethereum Foundation (EF), highlighting their differences and potential conflicts, and assesses the practical implications of ECF’s emergence for the Ethereum ecosystem and ETH’s price. Finally, it considers market reactions and future trajectories to offer insights into Ethereum’s developmental outlook.

2. Why Has ETH Lagged? — Five Key Factors Behind Price Stagnation

Source: https://www.tradingview.com/symbols/ETHBTC/

The ETH/BTC price ratio has been steadily declining this year, hitting a short-term low of 0.01867 on May 25. As of July 10, the latest data shows the ETH/BTC ratio at 0.02493—a 52.8% drop compared to the same period last year. ETH’s weak performance in this cycle stems from multiple interrelated factors, which can be summarized in five key areas:

1. Ethereum’s Economic Model and Upgrade Impact

Technically, the Dencun upgrade in March 2024 significantly altered Ethereum’s economic model. By introducing blob transactions, it drastically reduced fees for Layer-2 solutions, prompting users to migrate en masse to networks like Polygon and Optimism. This shift dispersed liquidity and transaction demand from the mainnet, causing Ethereum’s mainnet fee income to plummet nearly 99%. Lower fees also meant less ETH was burned, shifting the network from deflationary to inflationary—undermining long-term value support. Additionally, mainnet activity has trended downward, with some data showing post-Dencun transaction volumes falling to multi-year lows, fueling concerns about the upgrade’s effectiveness.

The upcoming Pectra upgrade in 2025 aims to improve staking efficiency, contract performance, and scalability. However, market expectations remain muted. The negative impacts following key upgrades—lower burns and higher supply—have outweighed benefits so far, exerting downward pressure on price.

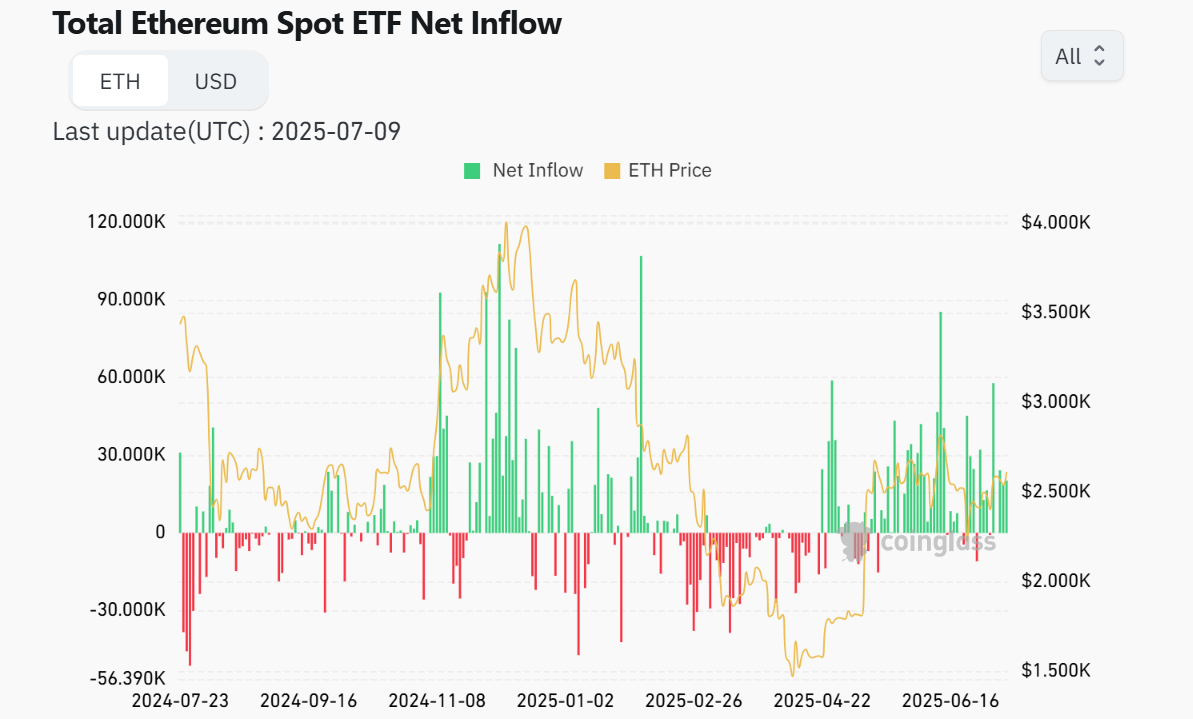

2. Market Risk Aversion and Spot ETF Fund Flows

Since late 2024, various macro events have triggered significant market volatility and global risk-off sentiment. Historical data shows that Ethereum typically experiences sharper declines than Bitcoin during bear markets. Grayscale reports that in recent downturns, ETH has fallen on average 1.2 times more than BTC—this cycle approaching 1.8 times.

While the launch of spot Ethereum ETFs initially attracted capital, enthusiasm began to wane at the start of 2025. Bitcoin continued to draw strong investor interest, while ETH remained flat. Though conditions improved slightly by late April, ETH still lags far behind BTC. As of July 10, 2025, U.S. spot Bitcoin ETFs hold approximately $137.5 billion in assets, compared to just $11.4 billion for Ethereum ETFs—a stark gap indicating weak institutional demand.

Source: https://www.coinglass.com/eth-etf

3. Intensifying Competition and Fragmented Market Attention

Market attention has become increasingly fragmented due to diversified trends. On one hand, news of the U.S. planning a Bitcoin strategic reserve and several states publicly endorsing BTC has drawn massive investor focus and capital inflows. On the other, competing blockchains like Solana (SOL) and Binance Chain (BNB) have rapidly expanded their ecosystems through meme-driven momentum, driving significant price gains. Furthermore, alternative blockchain networks such as Base, Sui, and Tron have briefly captured large speculative flows, temporarily diverting attention and capital from Ethereum.

In contrast, Ethereum has recently lacked breakout applications or innovative concepts capable of generating broad market consensus. Innovation in DeFi has notably slowed, marginalizing Ethereum in the race for attention. While the rapid rise of Layer-2 networks (e.g., Arbitrum, Optimism) has effectively addressed scalability, it has objectively diluted ecosystem resources and reduced mainnet transaction activity, further diminishing market visibility.

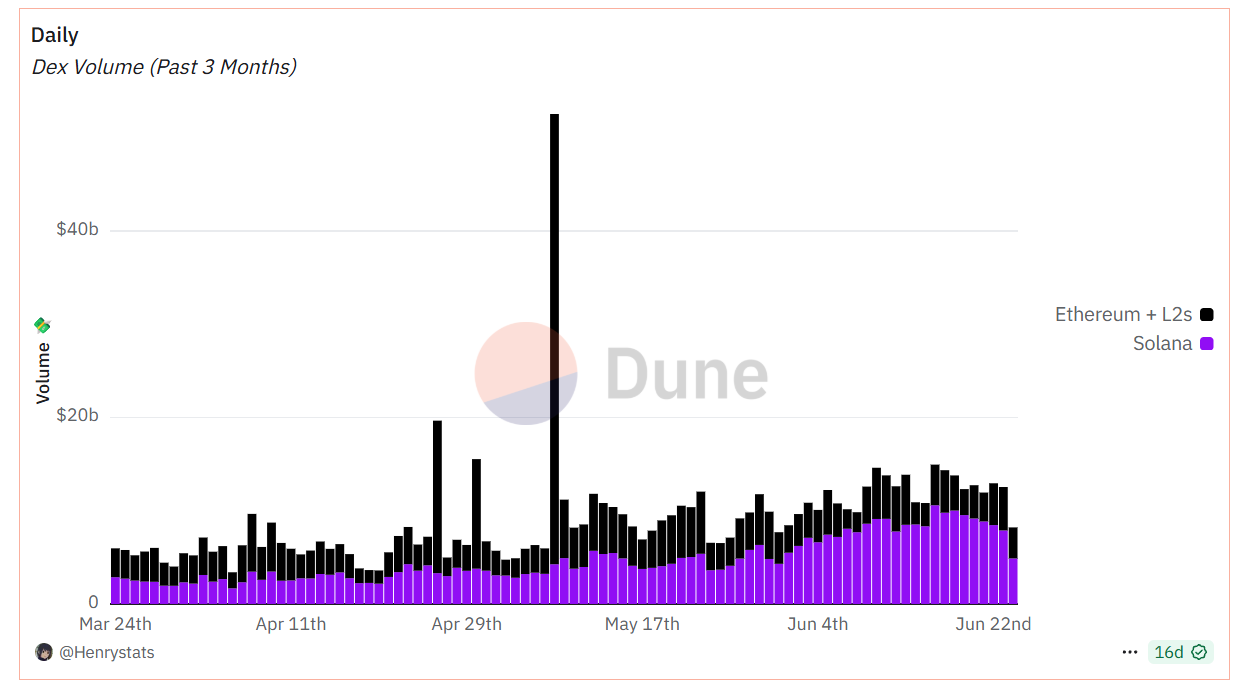

Source: https://dune.com/Henrystats/ethereum-vs-solana

4. Low Institutional Demand and Interest

Institutional capital remains heavily concentrated in Bitcoin, with significantly lower demand and attention toward Ethereum. Most national or institutional strategic reserves prioritize BTC, rarely including ETH in long-term asset allocations. Although in July 2025, New York-listed company Bit Digital announced a full pivot from Bitcoin to ETH—planning to become one of the world’s largest publicly traded ETH holders—such moves remain isolated cases. Additionally, legacy blockchain firms like BTCS and Sharplink Gaming have begun exploring Ethereum staking, but their relatively small scale limits broader market impact.

Clearly, large institutions, public companies, and government reserves hold far less ETH than BTC. This institutional preference constrains Ethereum’s valuation upside. In the current environment, ETH lacks sufficient institutional credibility and capital attraction.

5. Whale Selling and Liquidity Uncertainty

Recently, major ETH holders—including Jump Crypto, Paradigm, and Golem Network—have reduced their positions, collectively selling around $1.5 billion worth of ETH. Some of these assets were transferred to exchanges and sold, intensifying market sell-side pressure.

Meanwhile, fluctuations in Ethereum’s staking reward rate and active validator count suggest the circulating supply is undergoing dynamic adjustment. These supply-side uncertainties increase market volatility and add short-term downward pressure on price, negatively affecting market sentiment.

In summary, the confluence of changes in the technical-economic model, macroeconomic and leverage risks, competitive dynamics, institutional preferences, and liquidity structure has collectively resulted in Ethereum’s relative underperformance in this cycle.

3. ECF’s Mission and Its Contrast with EF

ECF enters with a “market-first” mindset, aiming to elevate ETH’s status as a core asset through financial and policy tools. The Ethereum Community Foundation (ECF) claims it will “serve ETH holders, say what EF won’t say, and do what EF won’t do.” It sets ETH’s “North Star” at a $10,000 price target, arguing that only when price and network security rise together can ETH’s long-term value be secured.

1. Mission and Positioning of the Ethereum Community Foundation (ECF)

ECF claims to have raised millions of dollars’ worth of ETH from anonymous holders and community donors. It will fund projects based on three principles: “promote burn, no token, immutable”—supporting initiatives that do not issue their own tokens, deploy directly on the Ethereum mainnet, and contribute to ETH burning. Disclosed ECF strategies include:

-

Driving high-burn applications: Funding high-volume on-chain projects (e.g., financial derivatives, RWA tokenization) to generate substantial gas fees, increase ETH burns, reduce circulating supply, and boost price.

-

Accelerating institutional adoption: Providing banks and enterprises with integrated Ethereum solutions, positioning Ethereum as a global settlement layer to attract traditional finance capital.

-

Empowering community governance: Establishing the Ethereum Validator Association (EVA) and introducing token-based voting to give PoS validators greater influence over protocol upgrades and funding allocation.

Transparent funding: All grant decisions made via community token voting, with 100% public disclosure of fund flows—aiming to avoid the “black box” criticism often directed at EF.

ECF emphasizes key focus areas including infrastructure development, ETH value enhancement, maximizing ETH burns, extreme transparency, institutional engagement, and government collaboration. Through improving network infrastructure and data availability, engaging regulators, and optimizing “blob space” pricing, ECF seeks to strengthen Ethereum’s base-layer economics and build an ecosystem model centered on ETH appreciation.

2. Key Differences Between ECF and the Ethereum Foundation (EF)

The differences between ECF and the existing Ethereum Foundation (EF) in vision and operations are significant:

-

Goal Orientation: ECF explicitly prioritizes raising ETH’s price, viewing “ETH value surge” as essential to validating network security. EF, by contrast, traditionally emphasizes long-term ecosystem and technological development (e.g., protocol upgrades, zero-knowledge research), without directly targeting price.

-

Funding Principles: ECF enforces strict criteria—“no token, promote burn, immutable”: approved projects must deploy on the Ethereum mainnet, must not issue new tokens, and must use immutable smart contracts to ensure all economic value flows back to ETH holders. In contrast, many EF-funded projects (e.g., Uniswap, ENS, Optimism) eventually issued their own tokens. ECF criticizes this “genesis project token issuance” as “economic feudalism,” whereas EF favors diverse ecosystem investment and does not strictly adhere to the “fat protocol” theory.

-

Governance Model: ECF champions 100% transparency—grant proposals and fund disbursements decided by community voting and fully disclosed. It aims to empower token holders to directly oversee fund usage, criticizing EF’s system as “centralized decision-making and opaque.” EF, as a traditional nonprofit, relies primarily on proceeds from past ETH sales, with internal decisions driven by core teams and committees—often criticized by the community for lacking real-time oversight and decentralization.

-

Philosophy: ECF openly represents “holder interests,” with its founders advocating a “ETH-centric capitalism.” EF, in contrast, promotes “credible neutrality” and public goods funding, focusing on protocol impartiality and long-term sustainability. For example, EF invests in community education, consensus and execution layer research, and generally avoids making price-related statements. ECF, however, unapologetically treats ETH as an asset class, using price targets to “calibrate” all decisions.

Overall, ECF’s emergence reflects both frustration with the traditional foundation model and a community-led exploration of balancing “ecosystem building” with “asset value.” Whether ECF can deliver on its ambitious goals—boosting ETH’s value and securing the network—while EF adapts its governance to address community concerns, will shape Ethereum’s future direction. The clash of ideologies and strategies may present new evolutionary opportunities for this decentralized network.

4. Analysis of ECF’s Impact on the Ethereum Network and ETH Price

The formation of ECF could have multifaceted effects on the Ethereum network and ETH’s price. If ECF operates as planned, its potential impact on the Ethereum ecosystem could be profound.

1. Impact on the Ethereum Ecosystem

-

Infrastructure and Technology: ECF-backed public goods projects—such as optimizing blob data pricing—could enhance mainnet performance and Layer-2 interoperability, strengthening Ethereum’s overall technical ecosystem.

-

On-chain Activity and ETH Burns: If ECF successfully drives high-volume applications like real-world asset tokenization, it will directly increase mainnet transactions and gas consumption, amplifying the EIP-1559 burn effect and enhancing ETH scarcity.

-

Validator Governance: The Ethereum Validator Association (EVA) funded by ECF could give stakers a stronger voice in protocol improvements, potentially reshaping Ethereum’s governance landscape and increasing validator influence over fee structures and proposal priorities.

-

Relationship with Layer 2: By incentivizing the use of Ethereum’s blob space over third-party data networks, ECF’s approach may anchor more Layer-2 activity at the Ethereum settlement layer, preventing the mainnet from being marginalized.

-

Long-term Ecosystem Impact: If ECF encourages developers to focus on tokenless public infrastructure, it may reshape the values of the Ethereum DApp ecosystem, prompting more projects to return to the mainnet with ETH as the primary value carrier—reinforcing Ethereum’s “credible neutrality” in the public chain competition.

2. Impact on ETH Price

-

Supply-Demand Fundamentals: Increased ETH burns and real-world utility driven by ECF could improve ETH’s supply-demand balance—deflationary pressure combined with rising demand may provide positive price support.

-

Market Confidence and Expectations: ECF’s bold "$10K ETH" target sets a new psychological benchmark for investors. Such a clear price-oriented narrative could attract renewed attention and restore market confidence in ETH.

-

Institutional Capital Inflows: ECF’s push to position Ethereum as a global financial settlement layer, if successful in forging partnerships with traditional institutions, could bring institutional capital into ETH via corporate blockchain adoption or spot ETFs—creating new sources of buying pressure.

-

Risks and Uncertainties: Overemphasizing price could attract regulatory scrutiny or market skepticism. If ECF fails to deliver tangible results in the short term, it may disappoint investors. Moreover, the concentration of ECF’s funding strategy raises concerns about undue influence by a small group, leading some to view it as a speculative gimmick. Additionally, ECF’s lead founder Zak Cole has been involved in previous projects whose post-airdrop or post-launch price performance fell short of expectations, potentially undermining trust.

In sum, ECF’s focus on public infrastructure, on-chain finance, and governance transparency could inject new vitality into the Ethereum network. If successfully executed, these measures may enhance economic efficiency and support ETH price appreciation. However, actual outcomes depend on real project deployment and sustained community participation. Even with ECF’s backing, the ultimate drivers of price will remain macroeconomic conditions, regulatory developments, and technological progress.

5. Conclusion and Outlook: Community Awakening or Speculative Hype?

The emergence of the Ethereum Community Foundation reflects both dissatisfaction with Ethereum’s current state and divergent interpretations of its future. It may represent a grassroots awakening—a community-driven challenge to centralization and a push for maximizing ETH value. Or it may simply be another speculative stunt—an “elegantly packaged wealth scheme.” ECF’s bold slogans and aggressive roadmap perfectly capture the community’s desire for price recovery, but their fulfillment requires long-term market validation.

Looking ahead, Ethereum’s trajectory and ETH’s price will be shaped by multiple forces. Key catalysts include continued institutional inflows, as some listed companies and large institutions begin dollar-cost averaging ETH as a long-term asset. The Pectra upgrade will further improve data transmission efficiency, paving the way for on-chain applications—especially in AI/Web3—potentially boosting network utilization and ETH burns. Moreover, if ECF’s initiatives in on-chain asset issuance and infrastructure investment gain traction, they could revitalize the ecosystem and support ETH’s value.

Regardless of the outcome, ECF’s arrival highlights a split within the Ethereum community: some seek rapid returns and price booms, while others prioritize protocol-level innovation and long-term progress. The critical question going forward is whether ECF can deliver substantive projects within its framework of “transparency, no token, promote burn” and withstand market scrutiny. If it succeeds, ECF could become a pivotal force reigniting ETH’s growth. Otherwise, it may fade into obscurity as little more than a loud but fleeting publicity campaign.

About Us

Hotcoin Research, the core investment and research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We have built a “triple-system” service model integrating “trend analysis, value discovery, and real-time tracking.” Through deep dives into industry trends, multidimensional assessments of high-potential projects, and round-the-clock market volatility monitoring—combined with our weekly《Hotcoin Premium Selection》strategy livestreams and daily《Blockchain Today》news briefings—we deliver precise market insights and actionable strategies for investors at all levels. Leveraging cutting-edge data analytics models and an extensive industry network, we continuously empower novice investors to build cognitive frameworks and help institutional players capture alpha, jointly seizing value-growth opportunities in the Web3 era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News