Coinbase and Robinhood's Race in Blockchain Stock Investments

TechFlow Selected TechFlow Selected

Coinbase and Robinhood's Race in Blockchain Stock Investments

Robinhood simplifies crypto trading, while Coinbase focuses on institutional clients.

Written by: Brendan on Blockchain

Translated by: Baishihelian

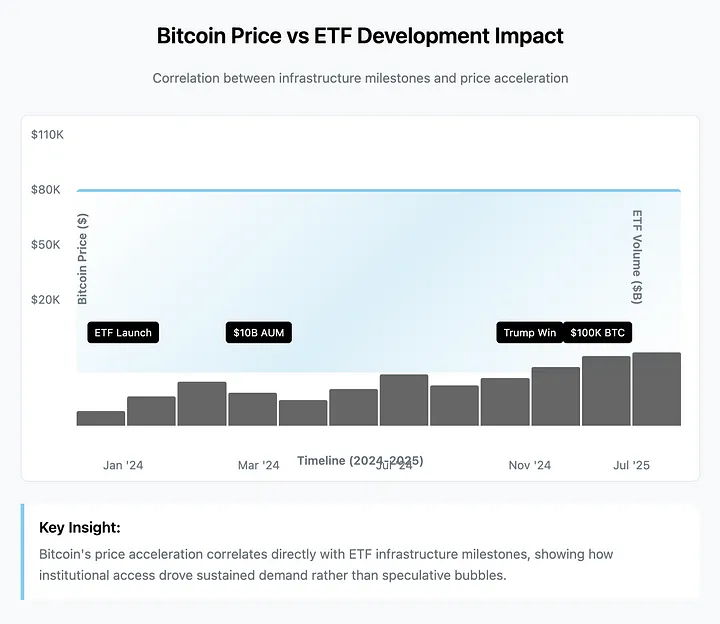

When Bitcoin broke $100,000 in December 2024, it wasn't just another price milestone—it was the climax of a much larger shift. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, fundamentally changing how institutional capital flows into crypto—and we're witnessing the results in real time.

What struck me most about this moment is that after years of regulatory resistance, the approval didn't just legitimize Bitcoin—it created an entirely new infrastructure layer through which traditional finance can now connect. The result? Bitcoin rapidly transformed from a digital curiosity into a portfolio necessity, faster than anyone anticipated.

The real intrigue lies in this infrastructure shift. These aren't conventional investment products. Spot Bitcoin ETFs hold actual Bitcoin, not contracts or derivatives. Think of them like gold ETFs that hold physical bullion—but here, the "vault" is digital, and custodians are crypto-native firms suddenly managing billions in institutional assets.

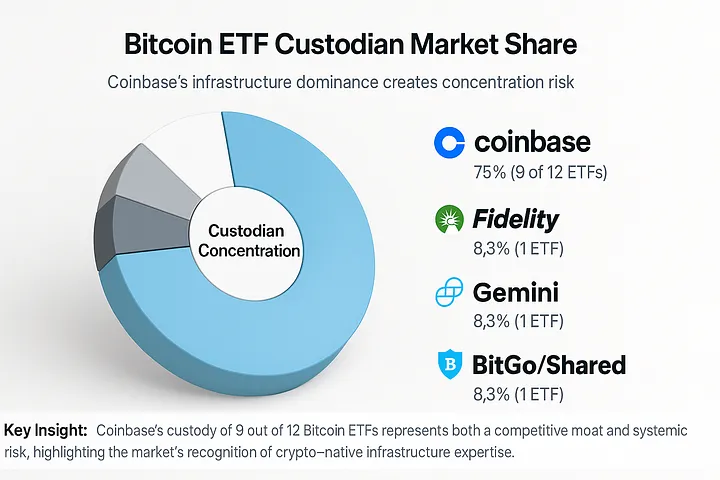

Of the 12 spot Bitcoin ETFs currently trading, 9 rely on Coinbase for custody.

Coinbase’s custody of 9 out of 12 Bitcoin ETFs brings both competitive advantage and concentration risk. This dominance in infrastructure generates stable revenue but raises questions about single points of failure within the crypto ecosystem.

This isn’t accidental—markets have realized that crypto infrastructure requires genuine crypto expertise. Traditional banks that spent years talking about "blockchain solutions" now find they need companies that truly understand how to secure digital assets at institutional scale.

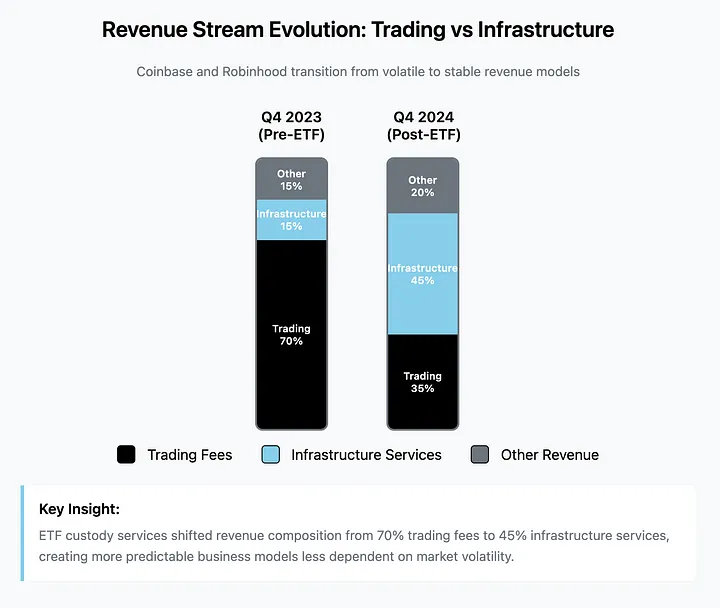

This concentration creates fascinating dynamics. Coinbase has evolved from a platform dependent on trading fees (booming in bull markets, starving in bear markets) into critical financial infrastructure. ETF custody generates predictable income regardless of market sentiment. It's like shifting from being a casino to becoming the bank that handles the casino’s money.

The data speaks volumes. Coinbase posted its best year ever in 2024, and analysts expect massive growth in 2025. The company has transitioned from riding the crypto wave to becoming the infrastructure against which institutional waves crash.

But such an infrastructure role naturally attracts competition, and Robinhood is catching up in its own way. While Coinbase focuses on institutional custody and compliance, Robinhood targets retail investors frustrated by crypto's complexity.

The ETF revolution has reshaped crypto platforms’ revenue models. Transaction fees dropped from 70% to 35%, while infrastructure services grew from 15% to 45%, creating a more predictable business model less reliant on market volatility.

Robinhood’s recent moves reflect this strategy: tokenized U.S. stocks in Europe, staking for major cryptocurrencies, perpetual futures trading, and a custom blockchain for real-world asset settlement. Robinhood is building entry points for mass adoption, while Coinbase manages the vaults.

Robinhood’s commission-free crypto trading and simplified user experience have captured market share, especially as regulatory clarity reduces friction. Record trading volumes and analyst optimism for 2025 suggest this retail-first approach complements, rather than competes directly with, institutional infrastructure.

Then there’s BTCS Inc., offering a completely different lesson. As the first cryptocurrency company listed on Nasdaq back in 2014, BTCS represents a pure-play crypto business model. The company pioneered “Bividends” (paying dividends to shareholders in Bitcoin instead of cash), operates blockchain analytics, and holds direct crypto assets.

BTCS currently holds 90 Bitcoin and has expanded via strategic financing to hold 12,500 Ethereum. The company demonstrates how a crypto-native business can adapt to institutional validation without abandoning its core principles. While giants battle for infrastructure dominance, niche players are carving out sustainable niches.

What makes this ecosystem shift so compelling is how quickly traditional finance has absorbed a technology designed to disrupt it.

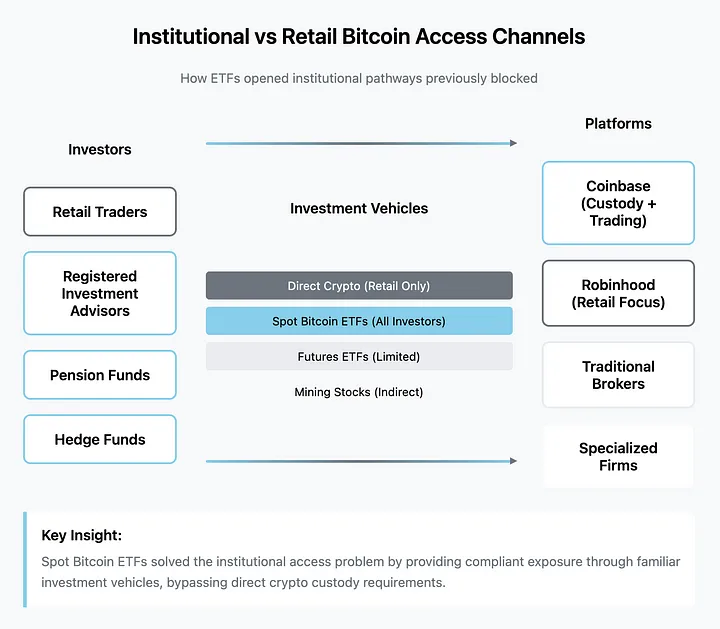

Spot Bitcoin ETFs solved institutional access by providing compliant investment vehicles. The chart below shows how different types of investors can gain exposure to Bitcoin without directly holding crypto assets.

ETFs offer institutions the regulatory wrapper they demand, transforming crypto from an alternative asset into a standard portfolio component.

The regulatory landscape suggests this acceptance is permanent. Political leaders openly support crypto as national strategic infrastructure, and the SEC’s continued evolution indicates the framework will expand, not contract. Ethereum ETFs, multi-crypto funds, and integration with traditional wealth management are logical next steps.

Institutional behavior confirms this maturity. Recent filings show that during the volatility of Q1 2025, some asset managers reduced their Bitcoin ETF positions while others made their first allocations. This isn't speculation—it's portfolio management. Institutions now treat crypto as an asset class requiring risk assessment and allocation decisions.

The infrastructure enabling this transformation continues to solidify. Custody solutions have evolved from exchange wallets to institutional-grade security. Trading infrastructure now handles billions in daily volume without the outages common in early crypto markets. Regulatory frameworks provide clarity for compliance officers wary of digital assets.

Market structure reflects this evolution. Price discovery happens on regulated platforms with institutional participation, not fragmented crypto-only venues. Liquidity comes from diverse sources, including algorithmic trading, institutional arbitrage, and retail participation through familiar brokers.

But what I find most striking is this: we’re witnessing the creation of a parallel financial infrastructure—not the replacement of existing systems. Cryptocurrency isn’t disrupting traditional finance; it’s forcing traditional finance to build systems compatible with crypto.

Coinbase acts as a bridge between the Bitcoin network and institutional custody needs. Robinhood builds crypto trading that feels like stock trading. ETF providers package crypto exposure into familiar investment tools. Each player addresses a specific friction point, rather than demanding full adoption of a new paradigm.

This infrastructure-first approach explains why the approval of Bitcoin ETFs triggered such dramatic price movements.

Bitcoin’s price acceleration correlates directly with milestones in ETF infrastructure—not speculative bubbles. The alignment between regulatory developments, ETF trading volume, and sustained price gains indicates institutional demand is driving the market.

Institutional capital wasn’t waiting for crypto to mature—it was waiting for compliant access. Once available, allocation decisions follow standard portfolio logic, not speculation.

The winners of this transformation may not be the platforms with the most users or highest trading volumes. They are the companies providing reliable infrastructure for an asset class institutions can no longer ignore.

Success metrics are shifting too. Revenue stability matters more than growth rate. Regulatory compliance becomes a competitive edge. Technical reliability determines institutional trust. These factors favor established players with the resources to build robust infrastructure over startups promising disruption.

Looking ahead, the infrastructure is already in place. Regulatory frameworks continue evolving in a supportive direction. Institutional adoption follows predictable patterns based on risk tolerance and allocation models. The speculation phase is ending—the infrastructure utilization phase is beginning.

The revolution isn’t about Bitcoin hitting six figures. It’s about the infrastructure that makes crypto a standard part of diversified portfolios. The companies building and maintaining this infrastructure will control the future of institutional crypto adoption.

That’s where real value creation and capture truly lie.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News