Two Paradigms of Stock Tokenization: xStocks' Open Approach vs. Robinhood's Walled Garden

TechFlow Selected TechFlow Selected

Two Paradigms of Stock Tokenization: xStocks' Open Approach vs. Robinhood's Walled Garden

How do these platforms strike a balance among stringent financial regulations, complex technical implementation, and significant market opportunities?

Author: Aiying Research

Real-World Asset (RWA) tokenization is no longer a futuristic narrative confined to blockchain enthusiasts—it has become a financial reality. Stock tokenization, in particular, has entered a new phase as major fintech players like Kraken and Robinhood enter the space. This blockchain-driven structural transformation is now underway. For the first time, global investors can trade "digital stocks" of companies such as Apple and Tesla with near-zero friction, 24/7. Yet beneath the market noise lie deeper questions that demand answers. Following our previous report, *From Retail Playground to Financial Disruptor: A Deep Dive into Robinhood’s Business Landscape and Future Strategy*, this Aiying (Aiying) research aims to cut through the surface hype and deliver an in-depth analysis of mainstream stock tokenization products. We move beyond the "what" to focus on the "how" and the "risks," offering clients, investors, developers, and regulators a reference map combining depth and practical insights.

Aiying will conduct a comparative deep dive into two representative cases—the open DeFi pathway via xStocks (issued by Backed Finance and traded on exchanges like Kraken) and the regulated "walled garden" model of Robinhood—while incorporating insights from key industry participants such as Hashnote and Securitize to explore one central question:

How do these platforms balance stringent financial regulation, complex technical implementation, and massive market opportunities? What distinct paths have they chosen, and how do their underlying logic and compliance designs fundamentally differ? This report aims to uncover precisely that.

I. Core Analysis (1): The Compliance "Headache" and "Shield"—Underlying Logic of Two Mainstream Models

The primary challenge of stock tokenization isn’t technological—it’s regulatory. Any attempt to bring traditional securities onto the blockchain must navigate a complex web of global financial regulations. In this ongoing negotiation with regulators, two divergent compliance models have emerged: 1:1 asset-backed security tokens and derivative-based tokens. These models differ fundamentally in legal structure and operational logic, shaping product design, user rights, and risk profiles. Let's unpack each.

Model 1: xStocks—The Open DeFi Pathway

Core Definition: Tokens held by users (e.g., TSLAX for Tesla stock) legally represent direct or indirect ownership or entitlement to real shares (TSLA). This is a "true" on-chain representation of equities, emphasizing authenticity and transparency.

Legal Architecture & Market Performance

Aiying believes xStocks’ compliance design is elegant—leveraging layered legal entities and clear regulatory frameworks to embrace blockchain openness while minimizing legal exposure.

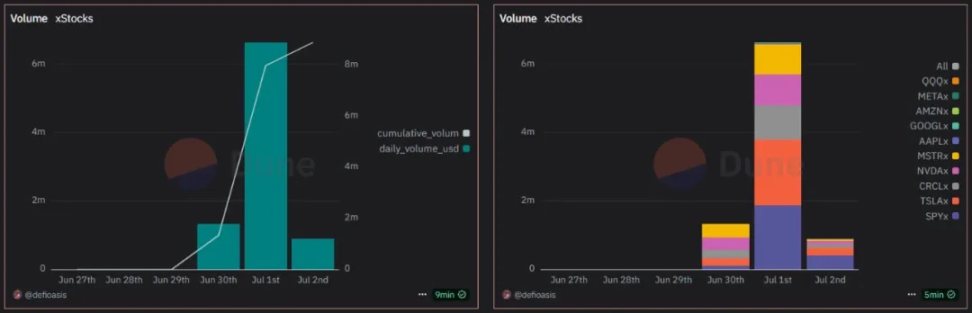

Currently, xStocks supports 61 stocks and ETFs, with 10 already seeing on-chain trading activity, indicating early market vitality. After being listed on Bybit and Kraken, trading volume surged—reaching $6.641 million in daily volume by July 1, with over 6,500 traders executing more than 17,800 transactions.

Issuance Entity & Regulatory Framework:

xStocks are issued by Swiss company Backed Finance, operating under Switzerland’s DLT (Distributed Ledger Technology) Act. Switzerland was chosen due to its relatively clear and innovation-friendly digital asset regulatory environment.

Special Purpose Vehicle (SPV):

This is the foundation of the entire architecture. Backed Finance established an SPV in Liechtenstein—a jurisdiction known for stable legal and tax conditions. This SPV acts as an “asset vault,” holding only real equities. Its sole function is asset custody, enabling critical risk isolation: even if trading platforms (like Kraken or Bybit) or the issuer face operational issues, the underlying assets held in the SPV remain secure and independent.

Asset Backing & Liquidity Strategy

To ensure on-chain token value and credibility, xStocks employs a transparent asset backing mechanism and dual-track liquidity system.

1:1 Pegging (1 Token = 1 Share):

Each circulating xStock token corresponds exactly to one real share held in third-party custody. This 1:1 peg is central to its value proposition. Token supply for NVIDIA, Circle, and Tesla shares has already exceeded 10,000 units.

Issuance Process:

Qualified institutional investors apply for a Backed Account and purchase shares via Backed. Acting as a primary investor, Backed buys shares through brokers, which are then held in custody by a third party. xStocks mints an equivalent number of tokens and returns them to the investor. These primary investors can mint and redeem tokens at any time.

Proof of Reserve (PoR):

Transparency builds trust. xStocks integrates Chainlink’s Proof of Reserve (PoR) oracle network. Anyone can independently verify, in real time on-chain, that Backed Finance holds sufficient real shares to back all issued tokens.

Dual-Track Liquidity Strategy:

- Centralized Exchange (CEX) Market Makers: On major exchanges like Kraken and Bybit, professional market makers provide liquidity, allowing users to trade xStocks as easily as other cryptocurrencies.

- DeFi Protocols: xStocks tokens are open and composable. Users can deposit them into Solana-based DeFi protocols (lending platforms, DEX liquidity pools) to earn yield. xStocks has partnered with Jupiter (DEX aggregator) and Kamino (lending protocol), leveraging DeFi composability to unlock additional value. For example, the most-traded SP500 (SPY) token has achieved $1 million in USDC-denominated liquidity on-chain.

xStocks' ecosystem is co-built by issuer Backed, exchanges Bybit and Kraken, and underlying blockchain Solana

Model 2: Robinhood—The Compliant "Walled Garden"

Core Definition: Unlike xStocks, tokens purchased on Robinhood are not legal equity. They represent financial derivative contracts between the user and Robinhood Europe, tracking the price of specific stocks. Legally, they are OTC derivatives; the on-chain token is merely a digital receipt for this contractual right.

1. Legal Architecture & Technical Implementation

Aiying finds Robinhood’s approach a pragmatic form of “regulatory arbitrage”—packaging the product as an existing, well-defined financial instrument to enable rapid, low-cost deployment.

Issuance Entity & Regulatory Framework:

Tokens are issued by Robinhood Europe UAB, a Lithuanian-registered investment firm regulated by the Bank of Lithuania. It operates under the EU’s MiFID II (Markets in Financial Instruments Directive II), classifying these tokens as derivatives—thus sidestepping stricter securities issuance rules.

Low-Cost, Rapid Deployment:

Robinhood deployed 213 stock tokens on Arbitrum for just $5.35 in gas fees, demonstrating high efficiency via Layer 2 technology. Metadata has been set for 79 tokens, preparing them for trading.

Pioneering Move:

Robinhood boldly ventured into tokenizing private company shares, launching tokens for OpenAI and SpaceX to gain early traction in the high-value private equity space. As of now, 2,309 OpenAI (o) tokens have been minted. (OpenAI tokens will indirectly expose investors to OpenAI via Robinhood’s SPV ownership, with token prices linked to the SPV’s stake valuation.)

2. "Walled Garden" Technical & Compliance Design

Robinhood’s tech stack closely aligns with its compliance strategy, forming a closed but compliant ecosystem.

On-Chain KYC & Whitelisting:

Reverse engineering of Robinhood’s smart contract revealed embedded permission controls. Every token transfer triggers a check verifying whether the recipient address is on Robinhood’s approved wallet registry. Only EU users who passed Robinhood’s KYC/AML process can hold or trade these tokens—creating a true “walled garden.”

Limited DeFi Composability:

This model inherently restricts interaction with permissionless DeFi protocols. The on-chain value of these tokens remains locked within Robinhood’s ecosystem.

Future Plan (Robinhood Chain):

To better serve its RWA ambitions, Robinhood plans to build its own Layer 2—Robinhood Chain—on top of Arbitrum’s tech stack, signaling its intent to control core infrastructure.

Despite finding a compliant path under EU rules, Robinhood’s model has sparked controversy and potential risks.

"Fake Equity" Controversy:

The launch of OpenAI and SpaceX tokens drew sharp criticism. OpenAI officially denied any partnership and clarified that the tokens confer no equity. This incident highlights significant risks around disclosure and user perception in the derivative model.

Centralization Risk:

User funds and trade execution depend entirely on Robinhood Europe’s operations and creditworthiness. Platform failure would expose users to counterparty risk.

3. Summary Comparison of Two Models

The fundamental differences are now clear. xStocks embodies the open, composable spirit of Crypto Native and DeFi. Robinhood represents a “shortcut” within existing regulatory frameworks.

Key Takeaways

xStocks follows an “asset-on-chain” path, aiming to transparently and authentically map real-world asset value onto the blockchain, embracing open finance. Robinhood follows a “business-on-chain” path—using blockchain as a tool to package and deliver its traditional derivative business. Aiying views this as essentially a CeFi (Centralized Finance) upgrade powered by blockchain.

II. Core Analysis (2): The "Song of Ice and Fire" in Tech Architecture—Open DeFi vs. Walled Garden

Beneath compliance lies the technological skeleton that enables product vision. Aiying believes the contrasting tech choices and component designs of xStocks and Robinhood reflect their opposing philosophies: open versus closed.

1. Base Blockchain Selection: The Triad of Performance, Ecosystem, and Security

Choosing the base chain—the “soil” for asset issuance—is a strategic decision involving performance, cost, security, and ecosystem.

xStocks Chooses Solana:

The driving force is peak performance. Solana is renowned for high throughput (theoretical TPS in tens of thousands), ultra-low fees (typically under $0.01), and sub-second finality—critical for high-frequency trading and real-time interaction with complex DeFi protocols. However, historical network outages highlight stability concerns—an inherent trade-off.

Robinhood Chooses Arbitrum:

Arbitrum, an Ethereum Layer 2 solution, offers a “stand on the shoulders of giants” strategy. By adopting Arbitrum, Robinhood gains higher performance and lower costs than Ethereum mainnet, while inheriting Ethereum’s unmatched security, vast developer community, and mature infrastructure. Moreover, Robinhood plans to migrate to a custom Layer 2 built on Arbitrum tech, optimized specifically for RWA—revealing long-term ambition.

Analysis: This isn't about which is “better,” but about strategic direction. Solana pursues integrated high performance as a monolithic chain; Arbitrum embraces modularity and inherited security. The former is bold, the latter conservative.

2. Key Technical Components Breakdown

Beyond the base layer, several components form the core of stock tokenization systems.

Smart Contract Design:

- xStocks (SPL Token): As a standard Solana SPL token, its smart contract allows free transfers—similar to ERC-20 on Ethereum. This open design enables seamless integration with DeFi protocols (e.g., using xStocks as collateral on Kamino).

- Robinhood (Permissioned Token): As discussed, its contract embeds transfer restrictions. Every transaction checks against an internal whitelist—the technical core of its “walled garden” and the reason it cannot interact with open DeFi.

The Critical Role of Oracles (e.g., Chainlink):

- Price Feeds: Stock token values must track real-world prices. Oracles (like Chainlink Price Feeds) act as data bridges, securely and decentralizedly feeding stock prices from multiple sources into smart contracts—vital for pricing, trading, and liquidations.

- Proof of Reserve (PoR): Essential for 1:1 backed tokens like xStocks. Chainlink PoR allows smart contracts to automatically prove off-chain reserve adequacy. This code-level trust is timelier and more convincing than traditional audits.

Cross-Chain Interoperability (e.g., Chainlink CCIP):

- Value: In a multi-chain world, cross-chain capability is crucial. Protocols like CCIP allow assets like xStocks to move securely across blockchains (e.g., from Solana to Ethereum). This breaks silos, expands liquidity pools, and unlocks new use cases—key to achieving the vision of “one token, universal access.” Backed Finance has indicated using Chainlink CCIP for cross-chain bridging.

3. Asset Onboarding & SPV Operations Explained

For asset-backed tokens, the SPV is the vital link between real-world assets and the blockchain. Its operation is rigorous and tightly coordinated.

- Asset Isolation: The issuer (e.g., Backed Finance) purchases real shares on regulated markets (e.g., NYSE). These shares are not held on the issuer’s balance sheet but deposited into a regulated, independent SPV and safeguarded by a licensed third-party custodian (e.g., a bank).

- Token Minting: Upon confirmation of asset deposit by the SPV and custodian, a verified instruction is sent to the on-chain smart contract to mint an equal number of tokens on the target blockchain (e.g., 100 TSLA shares → 100 TSLAX tokens).

- Token Distribution: Newly minted tokens are distributed via compliant exchanges (e.g., Kraken) or directly to KYC/AML-verified qualified investors.

- Lifecycle Management: During the token’s life, the issuer uses smart contracts and oracles to handle corporate actions. When Tesla pays dividends, the SPV receives cash and triggers the smart contract to distribute equivalent stablecoins or tokens to holders. For stock splits, the contract auto-adjusts token balances.

- Redemption & Burning: When an investor redeems, they send tokens to a designated burn address. The smart contract verifies and notifies the SPV. The SPV sells the corresponding real shares in the traditional market and returns cash to the investor. Simultaneously, the on-chain tokens are permanently destroyed, maintaining the 1:1 peg between on-chain supply and off-chain reserves.

III. Core Analysis (3): Business Models & Risk Assessment—Navigating the Hidden Reefs

Beneath complex compliance and tech lies clear business logic. Stock tokenization platforms create unprecedented value for users while opening new revenue streams for themselves. Yet, opportunity and risk go hand in hand.

1. Business Models & Revenue Streams

While both offer stock token trading, revenue models differ.

Robinhood’s Revenue Sources:

- Explicit Revenue: As per official disclosure, Robinhood charges non-Eurozone users a 0.1% FX conversion fee when using euros to buy USD-denominated tokens.

- Potential Revenue: Though currently “zero-commission” to attract users, the model is expandable. Future options include Payment for Order Flow (PFOF)—though restricted in the EU—premium subscription services for active traders, or yield from underlying assets.

- Private Equity Expansion: By tokenizing OpenAI and SpaceX shares, Robinhood taps into high-value assets. This is not just a powerful user acquisition tactic but could lead to future monetization via information services or transaction facilitation.

xStocks (Kraken & Backed Finance) Revenue Sources:

- Trading Fees: Kraken, as a core exchange, charges taker/maker fees on xStocks trades—the most traditional exchange revenue model.

- Minting/Redeeming Fees: Backed Finance, serving institutional clients, may charge service fees on large-scale minting and redemption operations to cover costs of purchasing, custody, and managing underlying assets.

- B2B Services: Backed Finance’s core business is providing end-to-end tokenization-as-a-service solutions to financial institutions. xStocks serves both as a product and a showcase of its technical capabilities.

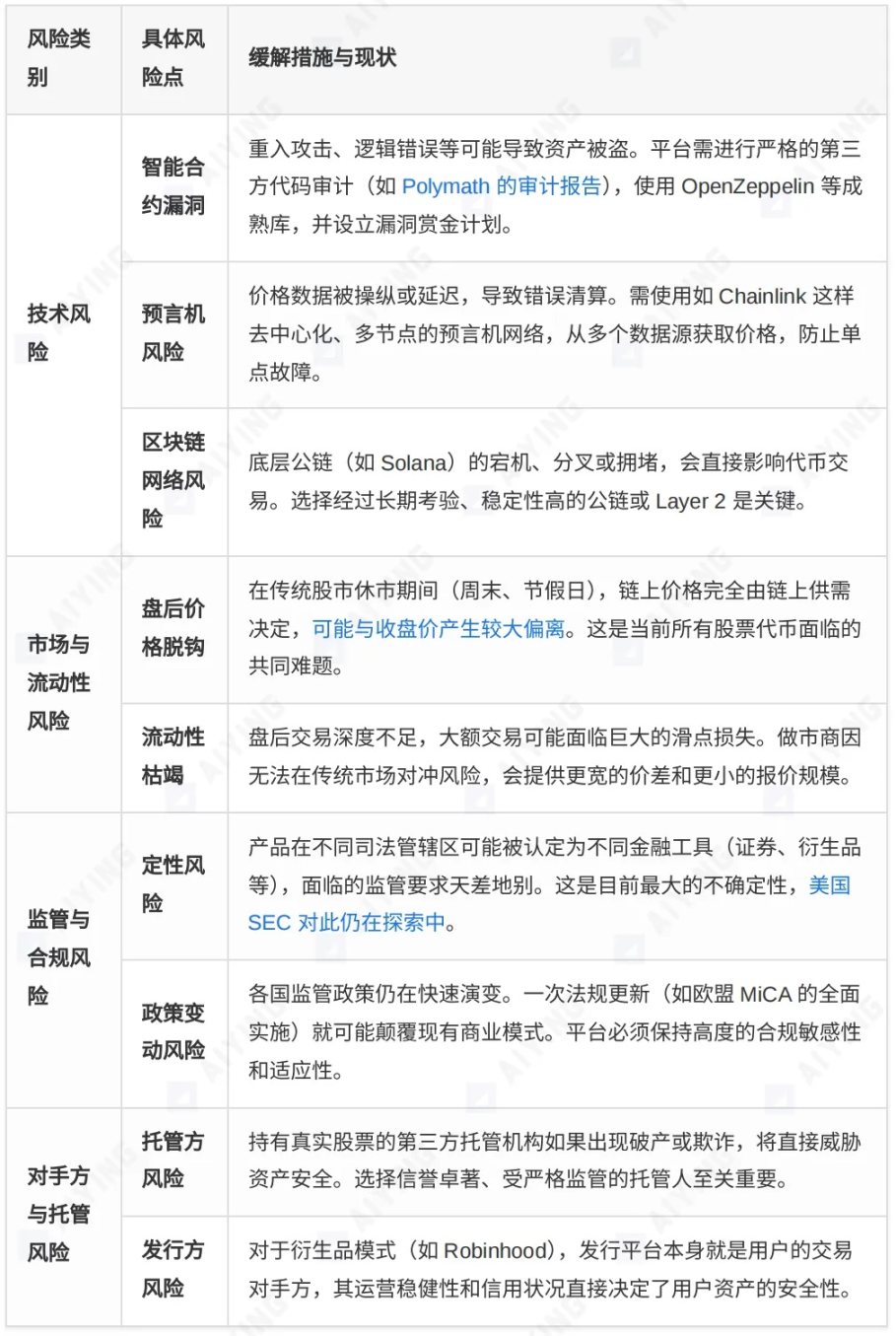

2. Comprehensive Risk Assessment Matrix

While enjoying the convenience of stock tokenization, investors must be fully aware of the underlying risks.

IV. Market Landscape & Future Outlook: Who Will Dominate the Next-Gen Financial Markets?

Players in the RWA space are vying for dominance with distinct strategies. Understanding their differences helps us anticipate industry evolution.

1. Major Player Matrix Comparison

The RWA tokenization landscape features fierce competition, with players forming unique strategic clusters. We categorize them into three camps for deep comparison.

2. Market Trends & Evolution Paths

Looking ahead, stock tokenization—and the broader RWA sector—is following several clear trends:

- From Isolation to Integration: Early tokenization efforts were siloed. Now, the trend is toward deep integration with mainstream financial institutions (e.g., BlackRock, Franklin Templeton) and the wider DeFi ecosystem. Tokenized assets are becoming bridges between TradFi and DeFi.

- Regulation Driving Innovation: Regulatory clarity is the strongest catalyst. EU’s MiCA, Switzerland’s DLT Act, and Singapore’s Project Guardian are providing clearer rules, which in turn fuel more compliant innovation. Regulatory competence is becoming a core competitive advantage.

- Institutional Adoption & Product Diversification: With BlackRock bringing trillions in money market funds on-chain via BUIDL, institutional participation will inject massive liquidity and credibility. Products will expand beyond stocks and bonds to structured products, private equity, and alternative assets.

- Private Equity Tokenization as the New Blue Ocean: Platforms like Robinhood are pioneering private company stock tokenization, opening doors to markets traditionally reserved for institutions and HNWIs. Despite challenges in valuation, disclosure, and legality, this is a highly promising frontier.

Final Thoughts & Outlook

The wave of stock tokenization is unstoppable—but the path ahead is not smooth. Several core questions will shape its ultimate form:

Open vs. Closed: Will the market be dominated by open, composable models like xStocks, or by compliant but closed “walled gardens” like Robinhood? More likely, both will coexist long-term, serving different user segments. Crypto-native users will favor open DeFi, while traditional investors may prefer regulated, familiar environments.

Race Between Tech & Law: Cross-chain tech (e.g., CCIP), Layer 2 solutions, and privacy-preserving computation (e.g., ZK-proofs) will continue evolving to overcome scalability, interoperability, and privacy bottlenecks. Meanwhile, the pace at which global legal frameworks adapt to technological innovation will determine the speed and ceiling of industry growth.

Stock tokenization is far more than simply moving financial assets onto a blockchain—it is fundamentally reshaping how assets are issued, traded, settled, and owned. It promises a more efficient, transparent, and inclusive global financial market. While the journey is fraught with technical, market, and regulatory “reefs,” the destination it points to is irreversible. For all market participants—investors, builders, and regulators alike—the imperative is to actively and prudently embrace this unfolding financial revolution, grounded in a deep understanding of its mechanics and risks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News