Q2 net profit of $386 million, Robinhood made a killing this time from "crypto trading"

TechFlow Selected TechFlow Selected

Q2 net profit of $386 million, Robinhood made a killing this time from "crypto trading"

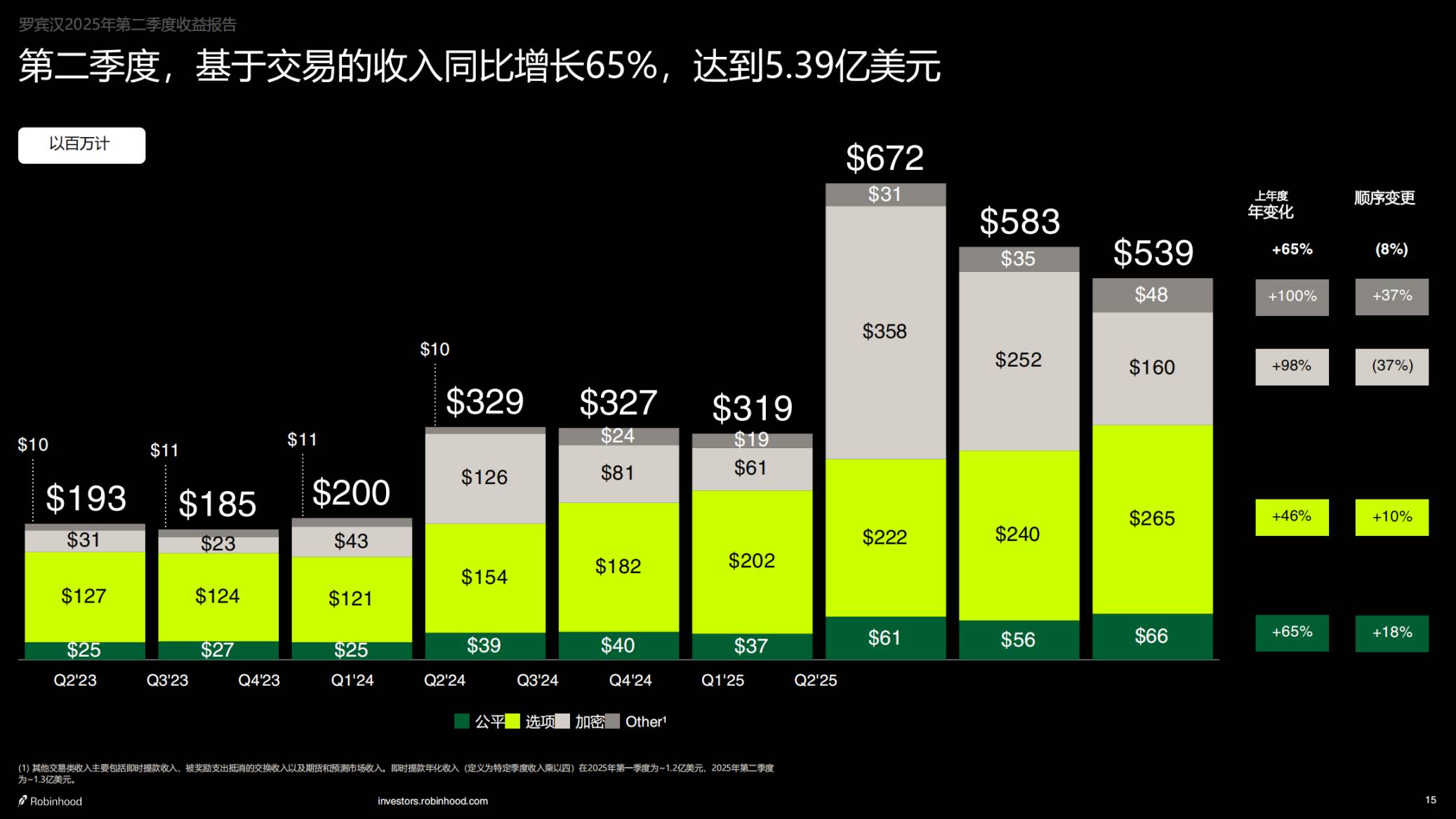

Revenue from crypto-related transactions nearly doubled, accounting for about 30% of the transaction segment.

Author: ChandlerZ, Foresight News

On July 30, U.S. fintech platform Robinhood released its second-quarter 2025 earnings report, maintaining strong overall growth momentum, with particularly notable expansion in the cryptocurrency sector.

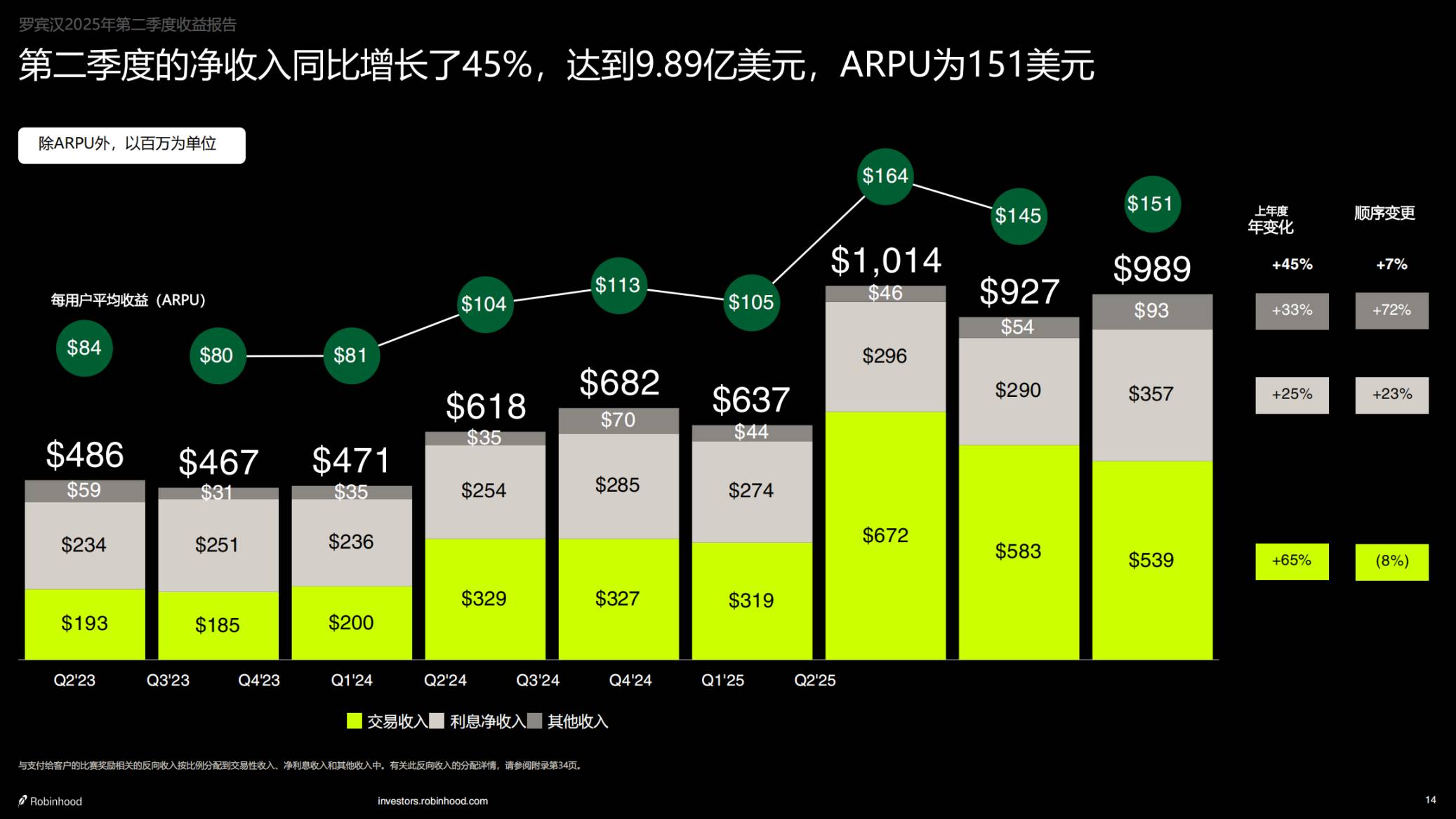

Total net revenue reached $989 million, a 45% year-over-year increase, while net income amounted to $386 million, up 105% compared to the same period last year. Diluted earnings per share rose from $0.21 a year ago to $0.42, doubling year-on-year. This quarter, Robinhood delivered solid results across revenue, profit, and user growth metrics.

Strong Quarterly Financial Performance, Platform Activity Continues to Rise

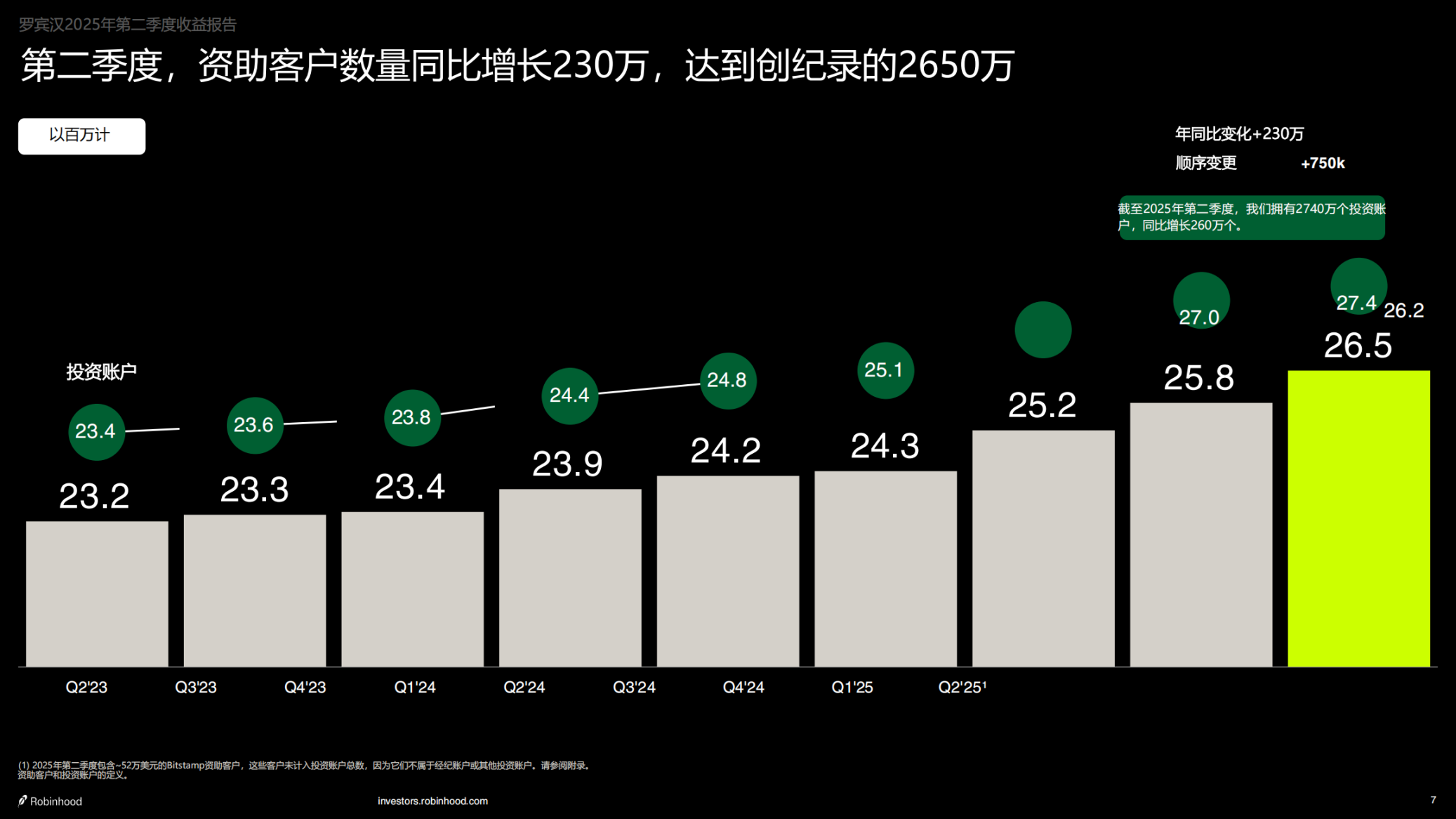

The number of active funded accounts reached 26.5 million, an increase of 2.3 million year-over-year, with a total of 27.4 million investment accounts. Accompanying the rise in user numbers was a significant expansion in platform assets. As of June 30, 2025, total assets under custody on the Robinhood platform reached $279 billion, nearly doubling year-over-year. This growth was driven primarily by sustained customer net deposits and a recovery in overall market valuations.

User engagement also showed positive trends. Average revenue per user (ARPU) stood at $151, a 34% increase year-over-year. Net deposits for the quarter were $13.8 billion, totaling $57.9 billion over the past twelve months, up 41% year-over-year. These figures reflect stronger customer stickiness and improved capital retention. The number of Robinhood Gold subscription service users reached 3.5 million, marking a 76% annual growth rate. The Gold service operates on a membership model priced at $5 per month, generating an annualized subscription revenue of $176 million, serving as a stable cash flow source.

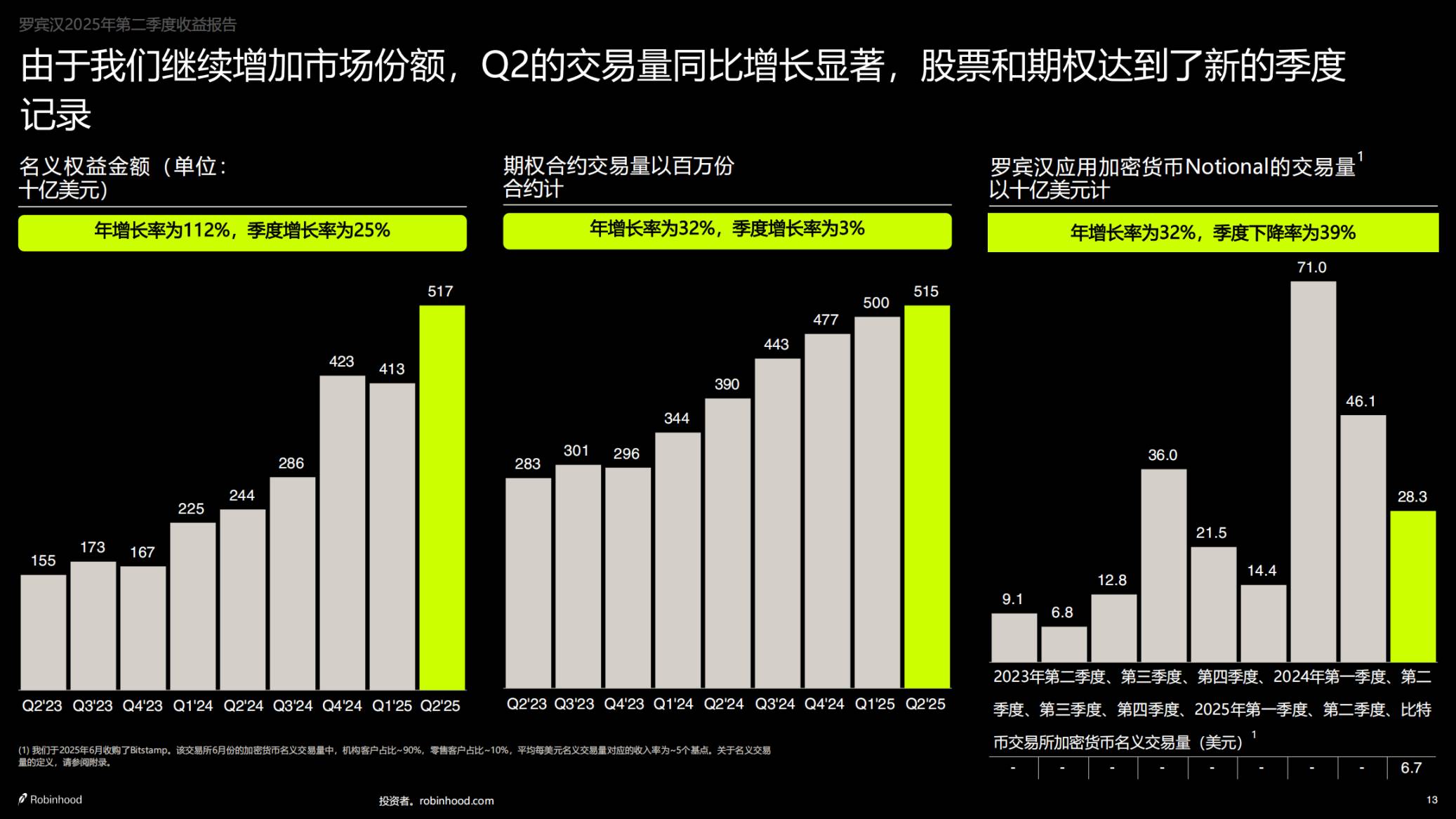

In terms of trading activity, options contracts traded reached 515 million, and nominal stock trading volume hit $517 billion, both record highs. Robinhood continues to enhance support for active traders through product updates such as charting tools, simulated performance displays, and options analytics modules, further attracting high-frequency trading users.

Rapid Growth in Crypto Business, Bitstamp Consolidation Adds Incremental Value

The most watched segment this quarter was Robinhood’s crypto asset business. The company disclosed that cryptocurrency trading revenue reached $160 million, a 98% increase year-over-year. Nominal cryptocurrency trading volume within the Robinhood app amounted to $28 billion, up 32% year-over-year. Additionally, Bitstamp, acquired in June, contributed $7 billion in trading volume, included in the financial statements for the first time. Based on this, Robinhood’s total quarterly crypto trading volume reached $35 billion, making it the fastest-growing segment within its trading operations.

The consolidation of Bitstamp not only expanded trading scale but more importantly provided Robinhood with institutional trading channels and global regulatory licenses. Bitstamp holds over 50 global crypto licenses, with 90% of its trading volume coming from institutional users and an average fee of five basis points per trade, becoming a key component of Robinhood’s emerging revenue streams.

Besides Bitstamp, Robinhood plans to complete the acquisition of Canadian platform WonderFi, expected to close in the second half of 2025. Through this deal, the company will expand its digital asset services in Canada and further enter markets beyond North America.

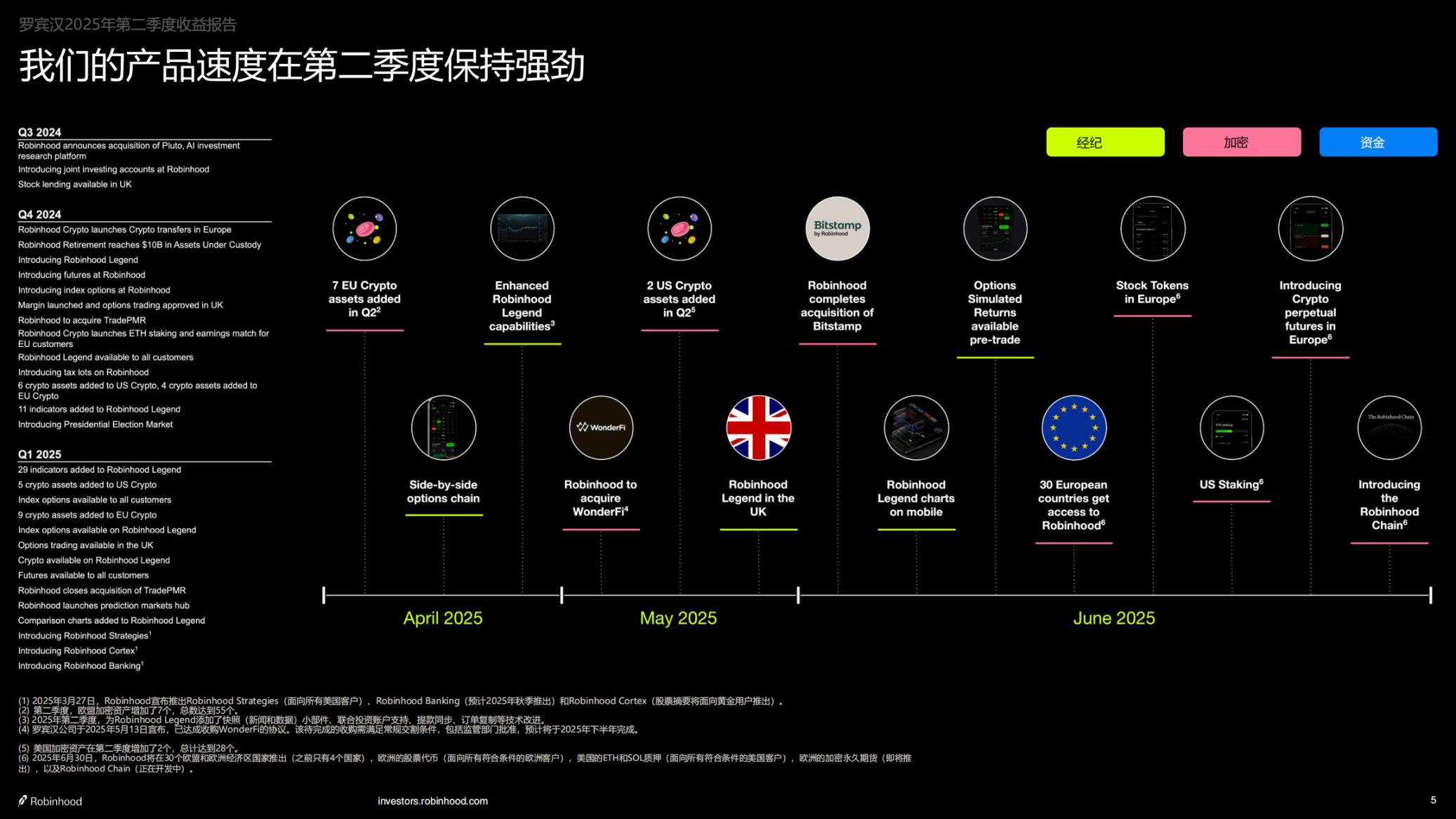

On the product front, Robinhood continues iterating in the crypto space. In Q2 2025, the company expanded its services to 30 European countries, far exceeding four countries a year earlier. Robinhood also launched "stock tokens," enabling users in Europe to trade tokenized versions of more than 200 U.S. stocks and ETFs. In the U.S. market, the company has launched staking services for ETH and SOL and plans to introduce crypto perpetual contracts.

The company is also developing Robinhood Chain, an underlying technology platform designed to support future on-chain trading and asset management. These initiatives not only expand Robinhood’s technical capabilities in digital assets but also strengthen its compliance coverage and product diversity across multiple regions.

Expanding Business Boundaries, Financial Services Offerings Growing More Diverse

Beyond trading and crypto, Robinhood is gradually building a product ecosystem centered on account management and wealth tools. In Q2 2025, assets in Robinhood Retirement accounts reached $19 billion, a 118% year-over-year increase. The growth of these long-term funds enhances platform asset stability and increases customer lifetime value.

Robinhood Strategies, launched earlier this year, is beginning to scale. This digital asset allocation service now manages over $500 million in assets and serves more than 100,000 users, establishing an initial pool of passively managed customer assets. The company is also progressively rolling out the Robinhood Gold Card credit card, which has been activated by 300,000 customers this quarter, linking trading accounts with spending scenarios to increase user capital concentration on the platform.

In terms of revenue structure, total operating expenses for the quarter were $550 million, up 12% year-over-year. Adjusted operating expenses were $444 million, with growth contained within 9%. In the earnings report, the company updated its full-year operating expense outlook, factoring in the Bitstamp acquisition, projecting adjusted operating expenses and share-based compensation costs between $21.5 billion and $22.5 billion for the year, slightly above initial targets.

As of quarter-end, Robinhood held $4.2 billion in cash and equivalents, providing a solid financial foundation for future business expansion and buyback programs. Regarding shareholder returns, the company has repurchased $703 million in common stock over the past 12 months and stated it will continue executing the remaining authorization, with buyback timing adjustable based on market conditions.

Future Roadmap

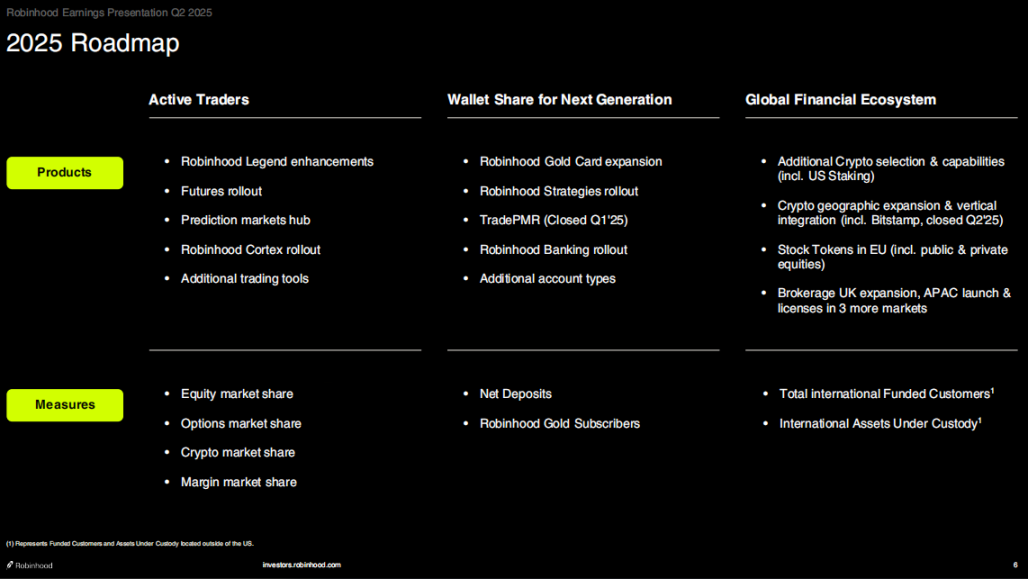

In its earnings report, Robinhood outlined its future development strategy across three core areas: deepening trading tools, expanding customer assets, and international expansion.

On the trading tools front, Robinhood will continue enhancing features for active traders. Robinhood Legend will add new functionalities including prediction markets, simulated earnings tools, and cross-asset chart analysis, strengthening technical support for high-frequency users. The Cortex intelligent analytics system will also be rolled out in more use cases, assisting users in making more granular investment decisions.

In terms of account systems and asset coverage, Robinhood plans to launch Robinhood Banking in fall 2025, integrating checking, savings, and wealth management into a closed-loop asset custody and payment platform. The company will also expand issuance of the Robinhood Gold Card and link it with its trading rewards system to reinforce user engagement.

International operations are a key expansion focus for 2025. Robinhood has fully entered 30 European countries and launched localized trading services in the UK. The company plans to enter the Asia-Pacific market in the coming quarters and has already initiated financial licensing applications in multiple regions.

In the crypto ecosystem, the company will continue expanding its product scope, launching crypto perpetual contracts in Europe and advancing development of Robinhood Chain to build an on-chain infrastructure tailored to its own services. Once integration of the Bitstamp and WonderFi exchanges is complete, the company will possess both institutional and retail crypto capabilities in North America and Europe, laying the foundation for a global business model.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News