Crypto revenue surged 98%, dissecting Robinhood's strong growth and global expansion behind its Q2 earnings

TechFlow Selected TechFlow Selected

Crypto revenue surged 98%, dissecting Robinhood's strong growth and global expansion behind its Q2 earnings

Robinhood's second-quarter earnings report gave the market a clear answer: it was absolutely the right decision for traditional brokers to embrace crypto.

By Umbrella, TechFlow

On July 30, Robinhood released its Q2 2025 earnings report, drawing significant market attention and discussion.

Beneath this financial report lies a critical glimpse into how Robinhood is reshaping the role of a brokerage amid the global embrace of Web3. As a platform transitioning from traditional finance to the forefront of Web3, its growth drivers and strategic positioning warrant deeper exploration.

Financial Data Analysis

According to official reports (source: Robinhood Q2 2025 Earnings Report), Robinhood's total revenue for the second quarter reached $989 million, a 45% year-on-year increase, with net income reaching $386 million and a profit margin of 39%, significantly higher than the same period last year. These figures strongly reflect its steady progress in the market, demonstrating its potential to solidify its position in the fiercely competitive brokerage industry.

In terms of revenue composition, transaction revenue (including options, equities, and cryptocurrency trading) amounted to $539 million, up 65% year-on-year, driven primarily by increased volumes in both cryptocurrency and stock trading. Its proactive Web3 transformation strategy, particularly the push in crypto-related businesses, has become a key new engine for transaction revenue growth.

Interest income reached $302 million, benefiting from the expansion of cash management products, while subscription services (mainly Robinhood Gold) contributed $114 million, a 76% year-on-year increase, with user numbers growing to 3.5 million. This highlights Robinhood's success in building high-stickiness revenue streams.

Compared to Q2 2024 (total revenue of $682 million, net income of $188 million), Robinhood’s revenue structure shows an increasingly diversified trend, significantly reducing reliance on any single revenue source.

Beneath these numbers, Robinhood demonstrates a balanced capability in user growth and cost management. The notable rise in net income indicates that the company has effectively controlled operating expenses while seizing market opportunities. Particularly under changing interest rate environments and shifting user behaviors, the growth in interest and subscription revenues has provided strong support for improved profitability.

However, revenue diversification also brings new considerations: while the rapid growth in transaction revenue is encouraging, continued reliance on PFOF (payment for order flow) may still face regulatory volatility; the expansion of subscription services requires ongoing enhancement of user experience to sustain growth momentum. These figures are not just a reflection of current performance but also offer clear guidance for future strategic adjustments, laying a crucial foundation for further Web3 transformation.

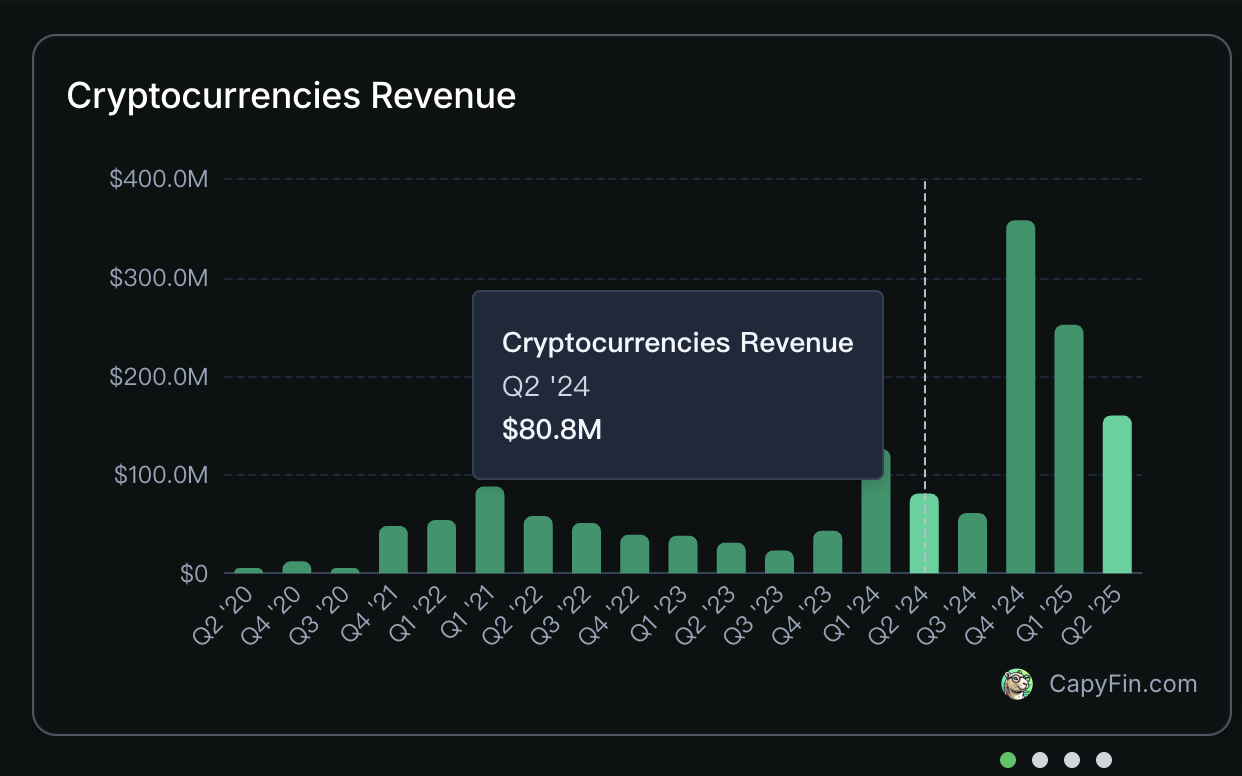

Crypto Business Revenue Grows 98%

The most significant innovation for Robinhood in the past quarter was its initiatives in the crypto space. According to the earnings report, Q2 cryptocurrency trading revenue reached $160 million, a year-on-year increase of 98% from $80.8 million.

This outstanding growth in the cryptocurrency sector stems largely from two major moves by Robinhood this year—its acquisition of Bitstamp and the launch of tokenized stock trading services.

On June 2, 2025, Robinhood officially completed its $200 million acquisition of Bitstamp, one of the longest-operating global cryptocurrency exchanges. This deal not only grants Robinhood access to a mature exchange network across Europe, the UK, and Asia, along with over 50 global regulatory licenses, but also importantly strengthens its institutional client base—an area where Robinhood had previously been labeled as merely a "retail paradise." This acquisition solidifies Robinhood's presence in both retail and institutional markets and equips it with the capacity to compete against major players like Binance and Coinbase.

The acquisition of Bitstamp provided substantial momentum for Robinhood’s expansion in crypto. Stock prices, often the most direct reflection of market sentiment, responded sharply: following the announcement of the Bitstamp acquisition, Robinhood’s shares surged 13% on June 4, reaching $74.42 in pre-market trading.

Beyond the numerical gains, the strategic significance of this acquisition may be even greater. It marks Robinhood’s transformation from a retail-focused trading platform into a global fintech player serving both retail and institutional clients, enhancing its competitiveness in the cryptocurrency arena.

In addition to the strategic acquisition of Bitstamp, Robinhood has made major technological innovations—launching tokenized stock trading services for the European market.

On June 30, 2025, during the “Robinhood Presents: To Catch a Token” event held in Cannes, France, Robinhood officially announced the launch of its tokenized U.S. stock products, which went live in the EU region starting July 1.

Robinhood now supports tokenized trading of over 200 popular U.S. stocks and ETFs, including major names like Apple and Nvidia, and even private pre-IPO companies such as OpenAI and SpaceX. Although the founders of these two companies have publicly expressed skepticism, there is no doubt that Robinhood has achieved its goal—capturing the attention of investors worldwide interested in U.S. stock trading.

Competitors

Robinhood’s strong Q2 performance has sparked comparisons between it and traditional brokers like Futu in the market.

As a traditional brokerage, Futu now faces an increasingly formidable "young rival," and users on X have begun sharing comparative analyses of the two platforms.

An X post by user @bruce_aiweb3 offers a detailed comparison across multiple dimensions. From a product background perspective, Robinhood was founded by Stanford developers specializing in high-frequency trading software rather than Wall Street veterans, giving it a tech-first DNA. Smooth user experience and gamified onboarding have earned Robinhood widespread popularity among younger retail investors.

In contrast, Futu benefits from its unique "Tencent" heritage, inheriting the tech giant’s sharp product vision and community-building strengths—featuring killer apps and a highly sticky social trading community. While this background brings proven methodologies and operational maturity, it also introduces geopolitical risks.

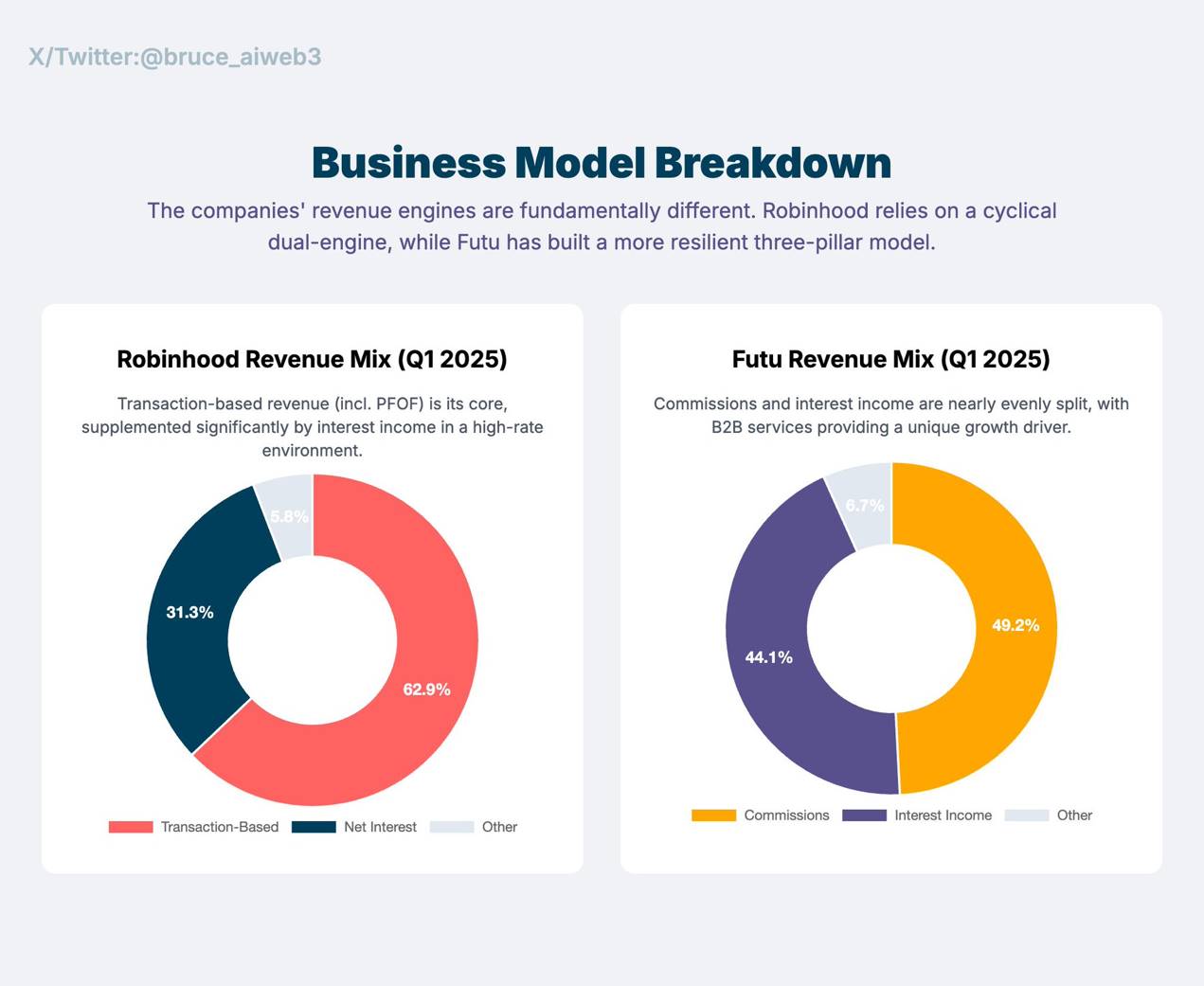

From a revenue model standpoint, Robinhood currently relies heavily on PFOF (payment for order flow) and interest income, which generate high revenue within economic cycles despite their cyclical nature. Futu, however, boasts a more diversified revenue mix, including commissions, interest, and high-margin B2B enterprise services (IPO distribution, investor relations, ESOP management), enhancing its resilience against market fluctuations.

Image source:@Bruce_aiweb3

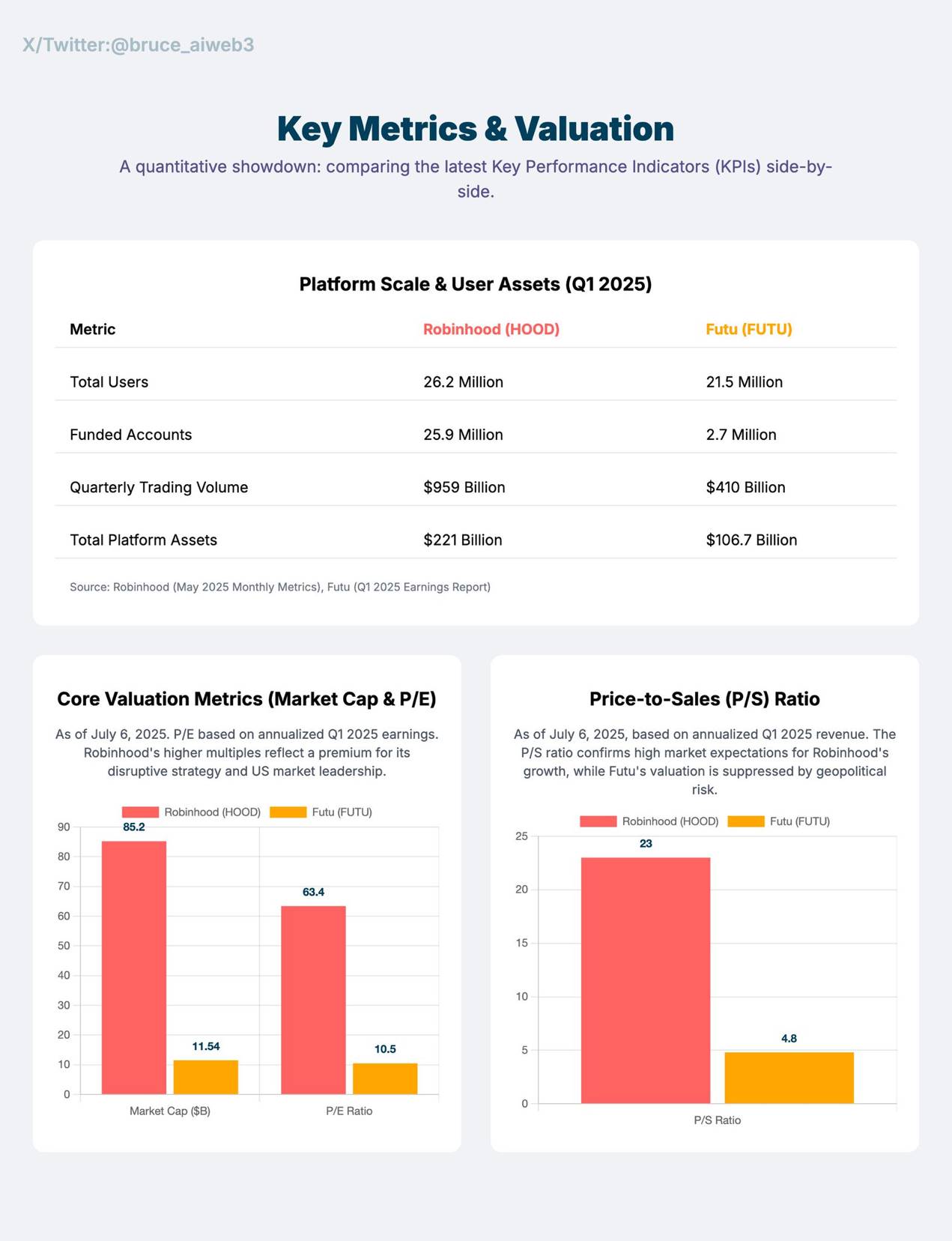

In valuation metrics, Robinhood trades at a P/E ratio of approximately 63x, far exceeding Futu’s 10.5x. Robinhood also has a much larger user base, with 25.9 million accounts—about ten times that of Futu—though Futu’s users have higher average assets.

Image source:@Bruce_aiweb3

Since Futu has not yet released its Q2 report, the article compares Q1 results: Robinhood is larger in scale ($927 million vs. $603 million), but has a lower profit margin (36.2% vs. 45.6%). This reflects that while Robinhood enjoys broader global reach and faster growth, it lacks the long-established profitability strength that Futu has cultivated over time.

This contrast is also evident in their fiscal year comparisons from 2024 to 2023: Robinhood grew revenue by 58.6%, achieving $1.41 billion in net profit and turning profitable after prior losses. Futu showed steady growth—revenue up 36.7%, net income up 28.3%, reaching $699 million.

Looking ahead, Robinhood is overcoming major regulatory hurdles amid the global Web3 wave, steadily advancing toward becoming a global brokerage giant. In contrast, Futu continues to face persistent geopolitical risks with no immediate resolution in sight.

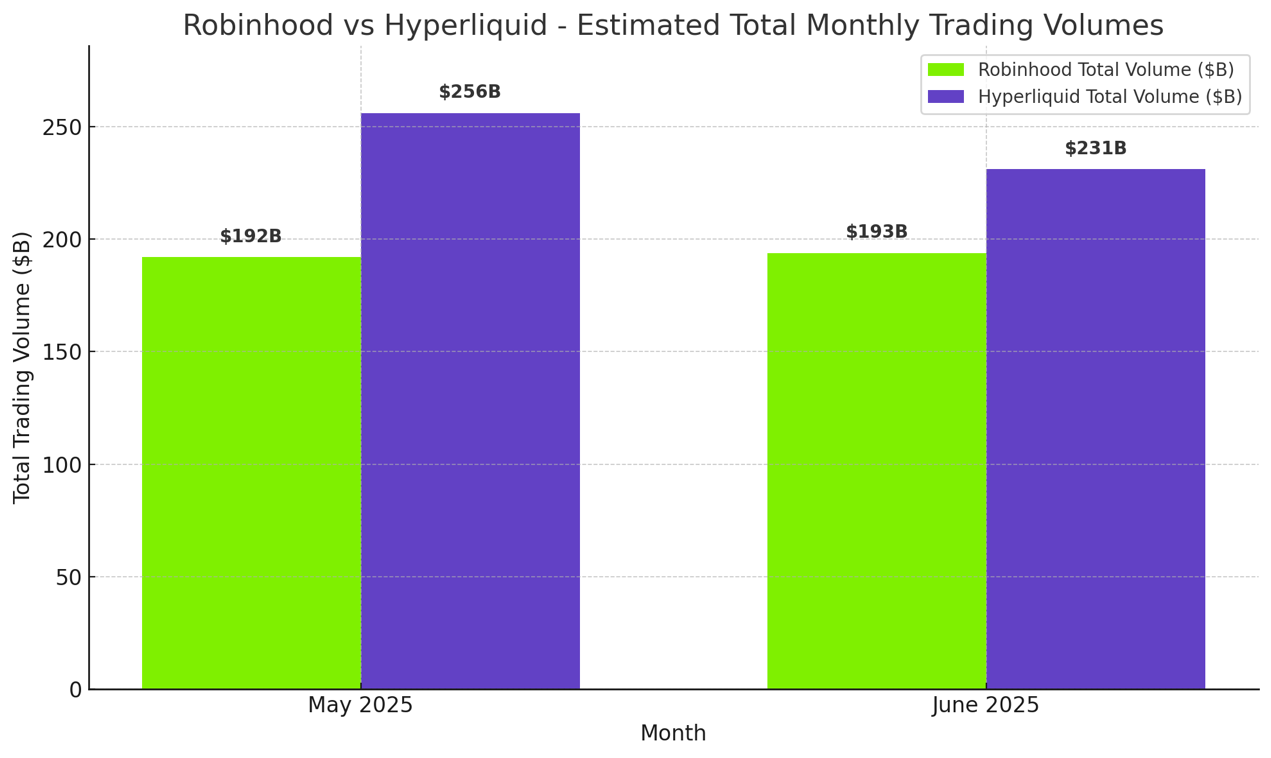

Robinhood, hailed as the "champion of retail investors" and a rising star in Web3, has also been compared to Hyperliquid, a recently emerged decentralized exchange.

In data comparisons from May and June, Hyperliquid’s trading metrics consistently surpassed those of Robinhood.

Image source:@jonbma

However, some users argue that Hyperliquid’s data is inflated due to perpetual contracts, making the comparison unfair.

Nonetheless, many users still believe Hyperliquid is severely undervalued. This indirectly underscores the massive demand in cryptocurrency trading and validates Robinhood’s strategic shift toward Web3. Moreover, Robinhood’s more diversified business model and broader global footprint give it a significantly deeper moat compared to Hyperliquid.

Whether compared to Futu or Hyperliquid, Robinhood holds distinct advantages and is currently navigating a multi-dimensional competitive landscape defined by stable profitability, explosive growth, and technological innovation in the Web3 era. Its solid Q2 performance has reinforced its market standing.

Entering the Second Half

Robinhood’s Q2 earnings report delivers a clear message to the market: embracing cryptocurrency is unequivocally the right move for traditional brokerages.

Amid rising global acceptance of Web3, Robinhood has clearly emerged as a leader riding this wave. In the second half of this year, Robinhood plans to roll out several crypto-related initiatives, including the acquisition of Canadian digital asset service provider WonderFi, launching cryptocurrency perpetual futures trading in Europe, and introducing additional crypto product offerings for clients.

We look forward to seeing this "Robin Hood," elevated by retail investors, continue driving the integration of crypto and traditional finance in the coming months and deliver an even stronger performance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News