The story behind xStocks: Rome wasn't built in a day

TechFlow Selected TechFlow Selected

The story behind xStocks: Rome wasn't built in a day

From the perspective of finance and compliance, let's review their story.

Author: Web3 Finance Explained

The Story Behind xStocks – Rome Wasn't Built in a Day

The public only saw xStocks launch in the first half of 2025, but the team behind it had been preparing for at least four years. There must have been many stories throughout this journey. This article attempts to review their story from financial and compliance perspectives, aiming to establish a methodology for future projects with similar compliance challenges.

1. Tax Planning and Compliance in Company Registration

The founding team identified the trend and vast potential of stablecoins and RWA as early as 2021, aspiring to build a bridge between equity and blockchain. With vision in place, the next step was execution.

First came company registration.

The most critical aspect of company registration is choosing the right jurisdiction. The team behind xStocks initially chose Switzerland.

Why Switzerland? Similar to Silicon Valley in the U.S., the city of Zug in Switzerland is famously known as Crypto Valley. The renowned Ethereum Foundation was established here. Switzerland has long been a key financial center, not only open to the blockchain industry but also a global leader in regulatory and legislative development. As early as 2021, it expanded its securities laws by formally introducing legislation related to DLT (Distributed Ledger Technology), with partial enforcement beginning on February 1, 2021, and full enforcement effective August 1, 2021.

The timing of the issuer's company registration closely followed the rollout of this law.

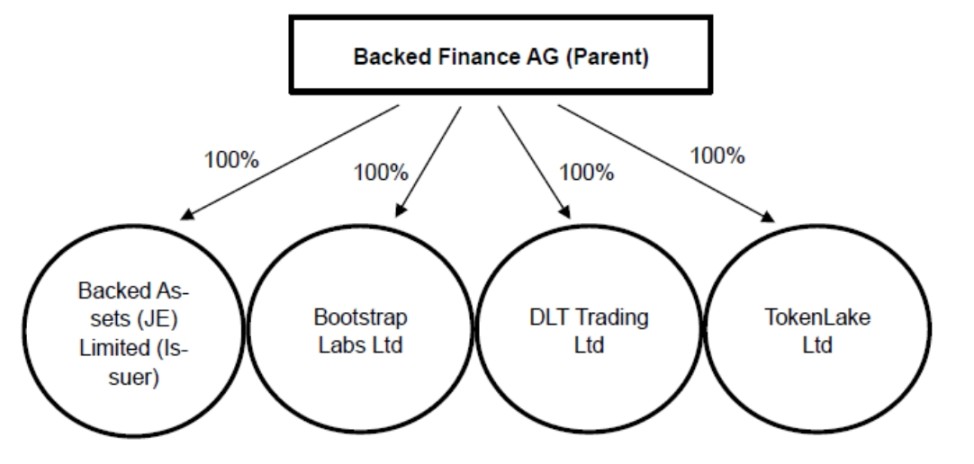

Three companies are primarily involved in xStocks' operations:

-

Backed Finance AG, the parent company of the issuer, registered in Zug and founded in early 2021. On February 1, 2021, parts of Switzerland’s DLT law came into effect. These two dates are no coincidence—the founding team demonstrated professionalism, sharp insight, and decisive action.

-

Backed Assets (JE) Limited, a private limited company incorporated in Jersey on January 19, 2024. It serves as the issuer of xStocks.

-

Backed Assets GmbH, established in Switzerland on April 20, 2021. This entity merged with the issuer on February 23, 2024, with Backed Assets (JE) Limited surviving the merger and assuming all assets and liabilities of the former Backed Assets GmbH.

Now the question arises: Why establish Backed Assets (JE) Limited? Why assign the role of issuer to this specific entity rather than having the parent company, Backed Finance AG, serve directly as issuer?

Answer: For functional specialization. By delegating issuance to a dedicated subsidiary, the parent company Backed Finance AG can focus on its core tokenization technology and services, while the issuer concentrates on product issuance—a common corporate governance and risk management strategy.

Then why not simply incorporate the issuer in Switzerland instead of establishing a new company in Jersey? What makes Jersey so attractive?

Where is Jersey? Jersey is an island located between Britain and France (only 8 km by 14.5 km). It maintains its own independent legal system, courts, and government, and is internationally recognized as a separate jurisdiction. (Source: Government of Jersey)

For the founding team, tax considerations were paramount. The issuer earns revenue by charging up to a 5% fee on product issuance and redemption prices. As the business scales, this could become substantial income—tax planning was essential from day one, ideally aiming for zero taxation. The team explored options and ultimately selected Jersey after reviewing the Jersey Income Tax Law, which reveals three tax rates:

-

0%: General case

-

10%: Financial services companies

-

20%: Utility companies, cannabis industry, land-related income, profits from hydrocarbon oil import and supply trade.

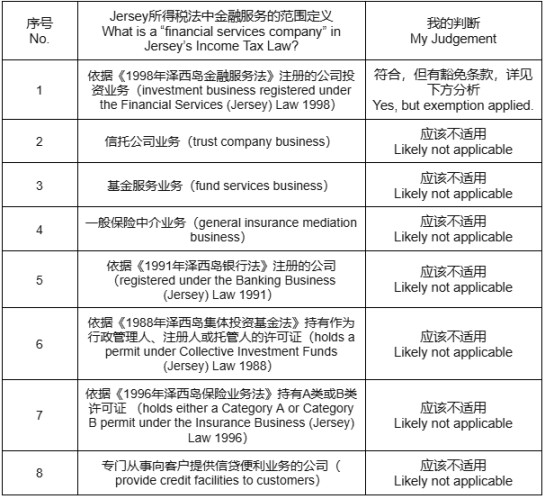

The team likely considered that their business might be classified as financial services. So how could they qualify for the 0% rate? The table below summarizes the definition of financial services companies under this tax law, supplemented with my own analysis (likely aligned with the founders’ reasoning).

Detailed analysis: How to avoid being classified as a financial services company subject to the 10% tax rate required deep research by the team—this is actually the core of the entire business architecture design. Let's examine it closely.

According to the Financial Services (Jersey) Law 1998, the definition of "Investment Business" specifically includes:

-

Buying/selling investments: purchasing, selling, subscribing, or underwriting investments as principal or agent.

-

Arranging transactions: arranging for others (as principal or agent) the purchase, sale, subscription, underwriting, or conversion of investments.

Given that the issuer’s primary business model involves charging fees (commissions) during buying and selling processes, it superficially fits the definition of "Investment Business," suggesting a 10% tax rate would apply.

However, the team did not stop there. They discovered another regulation: the Financial Services (Investment Business (Special Purpose Investment Business – Exemption)) (Jersey) Order 2001. Clause 4(1) of this law provides an exemption for special purpose entities (SPVs). In other words, if certain conditions are met, the entity does not fall under the definition of a company registered under the Financial Services (Jersey) Law 1998, and thus the 10% tax rate under the Jersey Income Tax Law does not apply.

The exemption conditions are as follows:

-

It is a special purpose company and has obtained relevant approvals

-

Its sole or main activity consists of participation in:

-

Lending, providing guarantees, engaging in derivatives trading

-

Issuing securities

-

Asset securitization, acquisition, or asset re-packaging

-

Capital markets transactions

-

Or any other transaction approved by the Committee

-

Or any transaction related to any of the above

Seeing these conditions, the team began strategizing how to align their business with the exemption criteria. Naturally, setting up a company in Jersey solely for “issuing securities” might qualify for exemption. Even if not straightforward, a special approval route could be pursued. The path forward became clear—establish a Special Purpose Vehicle (SPV) in Jersey.

This explains why, after the issuer Backed Assets (JE) Limited was formed on January 19, 2024, the merger with Backed Assets GmbH occurred just one month later on February 23—remarkably swift. Moreover, such a special purpose company also satisfies the earlier-mentioned requirement for functional separation.

Another consideration in placing the issuer in Jersey relates to licensing. Typically, securities issuance requires a license. From the founders’ perspective, Jersey—functioning as a self-governing “small village”—does not require formal licensing for issuance; only local government approval is needed, making the process much simpler. While obtaining a license in Switzerland may also be feasible, considering both licensing difficulty and tax optimization, Jersey clearly emerged as the superior choice.

-----------------------------------------------------------------------------------------------------------------------------

Lesson for future teams: Tax laws reflect national authority and intent. To protect national interests, primary tax statutes usually aim for comprehensive coverage. When tax incentives aren’t visible in the main text, don’t give up—explore supplementary laws and special clauses; surprises often await. Two directions are worth exploring: explicit preferential provisions, and opportunities for special approvals—i.e., whether the government has intentionally left flexible loopholes.

-----------------------------------------------------------------------------------------------------------------------------

2. The Compliance Story of Custody

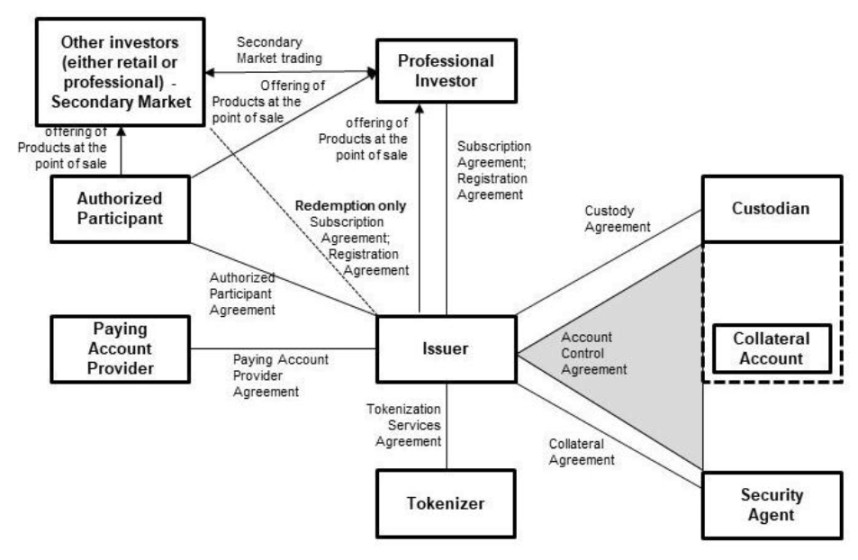

Source: Company's Securities Notes

The logic of xStocks is simple: investors first transfer funds to the issuer, who uses the funds to purchase corresponding real stocks and issues equivalent xTokens to the investor’s wallet. To prevent misappropriation or loss of these real stock assets, a secure approach is entrusting them to a trusted third party—the custodian.

Custody isn't only about asset security; it plays a vital role in anti-money laundering (AML) and Know Your Customer (KYC) procedures. Thus, countries have specific regulations, such as the U.S. Investment Advisers Act of 1940 and the UK's CASS rules.

On xStocks’ product page, three different custodians are listed. Why?

Typically, using multiple custodians is driven by several factors:

-

Risk diversification: Ensures that even if one custodian fails (e.g., asset loss or system failure), others maintain asset safety.

-

Compliance with diverse regulatory requirements: xStocks targets global markets (except the U.S.), where different jurisdictions impose varying rules.

-

Improved operational flexibility and efficiency: Some custodians specialize in certain asset types (e.g., stocks or ETFs) or have better technical integration with specific blockchains (e.g., Solana or Ethereum). Partnering with multiple custodians allows xStocks to optimize asset management and settlement efficiency.

-

Scalability: As the business grows, multiple custodians share the workload, ensuring efficient operations and laying the groundwork for expansion into additional asset classes (e.g., bonds or other RWAs).

Below are details on the three custodians. Notably, some comply with U.S. regulations, while others meet EU standards.

-

Alpaca Securities LLC (Wilmington, North Carolina, USA): A broker-dealer registered with the U.S. SEC and a FINRA member. Its securities account control agreement dates to June 20–23, 2025, governed by New York State law.

-

Maerki Baumann & Co. AG (Zurich, Switzerland): A Swiss bank licensed by FINMA, serving as the Swiss custodian. The issuer signed a custody agreement (framework) with them on November 23–24, 2022, governed by Swiss law.

-

InCore Bank AG (Zurich, Switzerland): Maerki Baumann & Co. AG has outsourced its securities trading to InCore Bank AG.

-

Alpaca Crypto LLC (San Mateo, California, USA): A money services business registered with FinCEN, serving as the U.S. custodian. The issuer signed a cryptocurrency services agreement with them on March 28, 2025, governed by California state law.

Another question arises: If the business cannot operate in the U.S., why involve a U.S. custodian?

This highlights a key innovation by the team: an alternative collateral structure. Simply put, this is a new way of holding and managing collateral introduced by the issuer to enhance the scalability of xStocks and further reduce settlement risks.

Since many popular underlying assets (e.g., U.S. stocks) are primarily traded in U.S. markets, using U.S.-based custodians and brokers enables more direct and efficient handling of purchases, holdings, and sales of these assets—optimizing settlement and reducing cross-jurisdictional complexity and potential delays. The innovation lies in mimicking real-world logistics: setting up warehouses at the origin of goods to enable faster, more efficient inventory management regardless of the end customer’s location.

Lesson for future teams: Custody is mandatory. Teams should consider involving multiple custodians based on the locations of underlying assets.

3. The Journey from Professional to Retail Investors

Under Jersey regulations, products can only be issued to two categories of individuals:

-

Professional Investors: Individuals whose regular activities involve acquiring, holding, managing, or disposing of investments (as principal or agent) for business purposes.

-

Individuals who have received and confirmed the "SPB Order Investment Warning": This notice states that the product is suitable only for those with a "substantial asset base" sufficient to bear potential losses and "sufficient financial expertise" to understand investment risks. Additionally, the issuance of the product and activities of any involved parties are not fully governed by all provisions of the 1998 Financial Services (Jersey) Law. Investors must confirm they belong to one of these categories before issuance.

In short, products can only be issued to professional and financially resilient investors. We can infer that issuing to anyone outside these two groups would violate the conditions approved by the Jersey government for the issuer’s operations—potentially resulting in loss of the 0% tax rate or even termination of business.

So how do retail investors gain access to xStocks?

Based on my analysis, this is achieved through leveraging the tiered structure of financial markets, the openness of blockchain technology, and ecosystem partnerships between Backed Finance and regulated exchanges and DeFi platforms.

Taking exchanges as an example, the key is ensuring retail investors do not participate directly in the initial issuance. Currently, all exchange partners of the issuer are regulated and have robust KYC procedures. While xStocks are indeed initially issued to the two qualified investor types mentioned above, once tokenized and on-chain, retail investors can freely trade them. At that point, even if the Jersey government wanted to intervene, it would be beyond reach.

Extending this idea further, retail investors could also participate via DeFi platforms, or qualified professional investors could repack xStocks into other financial products and resell them to retail investors after initial issuance.

Lesson for retail investors: This workaround around initial issuance rules effectively shifts risk onto retail investors. Retail participants must recognize their informational and cognitive limitations. Before investing in such products, thoroughly read the risk disclosures in the offering documents and ensure you truly understand what you are investing in.

4. The Team Story

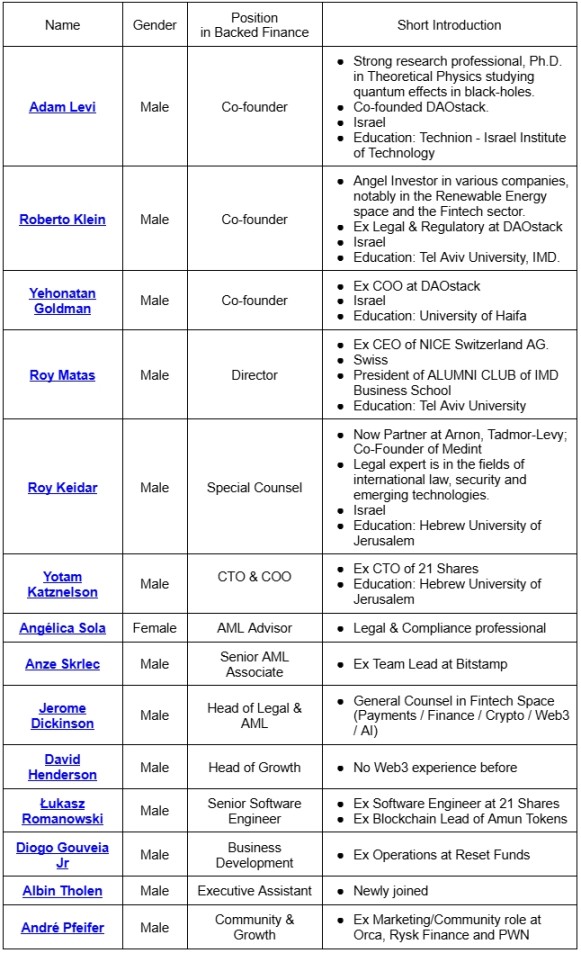

From the table above, we can observe:

-

The core team is from Israel, most likely Jewish.

-

The founding team possesses high-level insight, shared backgrounds, and aligned philosophies—many are alumni or former colleagues from the same prior company.

-

Strong emphasis on compliance. In addition to legal experts, three team members are dedicated to anti-money laundering (AML).

Conclusion:

Over the past four-plus years since 2021, the journey of an innovative financial product—from concept to market—has involved far greater challenges than most can imagine. These three stories offer only a glimpse, yet already reveal that success requires alignment of timing (the macro trend toward tokenization), location (favorable jurisdiction for incorporation), and people (talented team and strong ecosystem partners).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News