TechFlow

TechFlow Selected TechFlow Selected

TechFlow

Will the soft RUG scandal affect enthusiasm for stock tokenization?

By: Bright, Foresight News

As Robinhood, Kraken, and Bybit successively announced their entry into tokenized U.S. equities, and major ecosystems such as Chainlink and Jupiter began supporting trading of tokenized stocks like Apple, Tesla, and NVIDIA, this "boundary-breaking" concept suddenly went viral in the crypto community. Among them, native crypto exchanges Kraken and Bybit chose to adopt xStocks' underlying Solana-based architecture for stock tokenization, while digital brokerage Robinhood opted for Arbitrum as its issuance chain.

Just as excitement was peaking across various ecosystems, a cold splash of news hit the market. According to LinkedIn profiles, the three co-founders of Israeli company Backed Finance—the entity behind the stock tokenization platform xStocks—Adam Levi Ph.D., Yehonatan Goldman, and Roberto Klein—have all been confirmed to have previously worked at DAOstack, which later went bankrupt.

Among them, Adam Levi Ph.D. served as co-founder and public face of DAOstack, Yehonatan Goldman was Chief Operating Officer, and Roberto Klein handled legal and regulatory affairs at DAOstack.

Data from ICO Drops shows that DAOstack raised approximately $30 million through multiple funding rounds between Q4 2017 and May 2018, but shut down by the end of 2022 due to fund exhaustion. The DAOstack team has since been accused of a "soft rug pull."

According to crypto KOL @cryptobraveHQ, DAOstack launched its token $GEN in 2019, which after experiencing the 2021 bull market, was simply left to freefall. "The team couldn't even be bothered to list it on a small exchange—after launching the token, they just let it go to zero."

How xStocks Works

That said, in terms of operational mechanics, xStocks does—at least for now—offer a functional framework.

xStocks is operated primarily by Backed Assets, an issuer based in Jersey, under a Swiss parent company. Backed Assets purchases U.S. stocks via IBKR Prime, a channel provided by Interactive Brokers, then transfers and holds these shares in segregated accounts at Clearstream, a custodian affiliated with Deutsche Börse.

Once the "buy-transfer-deposit" three-step process is complete, the issuer Backed Assets triggers a smart contract deployed on Solana to mint corresponding tokenized shares—one-to-one. For example, every 1,000 Tesla shares purchased and secured off-chain results in the minting of 1,000 TSLAx tokens on-chain. The control address of the token contract belongs solely to Backed, the issuing entity. Third-party exchanges such as Kraken, Bybit, and Jupiter can then directly list these tokens for spot or derivatives trading.

If investors or market makers hold one or more TSLAx tokens, they may apply to Backed to redeem them for actual Tesla shares held through the broker. Additionally, dividends are distributed automatically via token airdrops following on-chain snapshots.

During market closure, the price of stock tokens across the network is referenced using Chainlink's oracle. If prices significantly deviate from real-world U.S. equity values, arbitrageurs can profit by buying or selling tokens on platforms like xStocks, Kraken, or Bybit, thereby pushing prices back toward fair value.

Potential Concerns

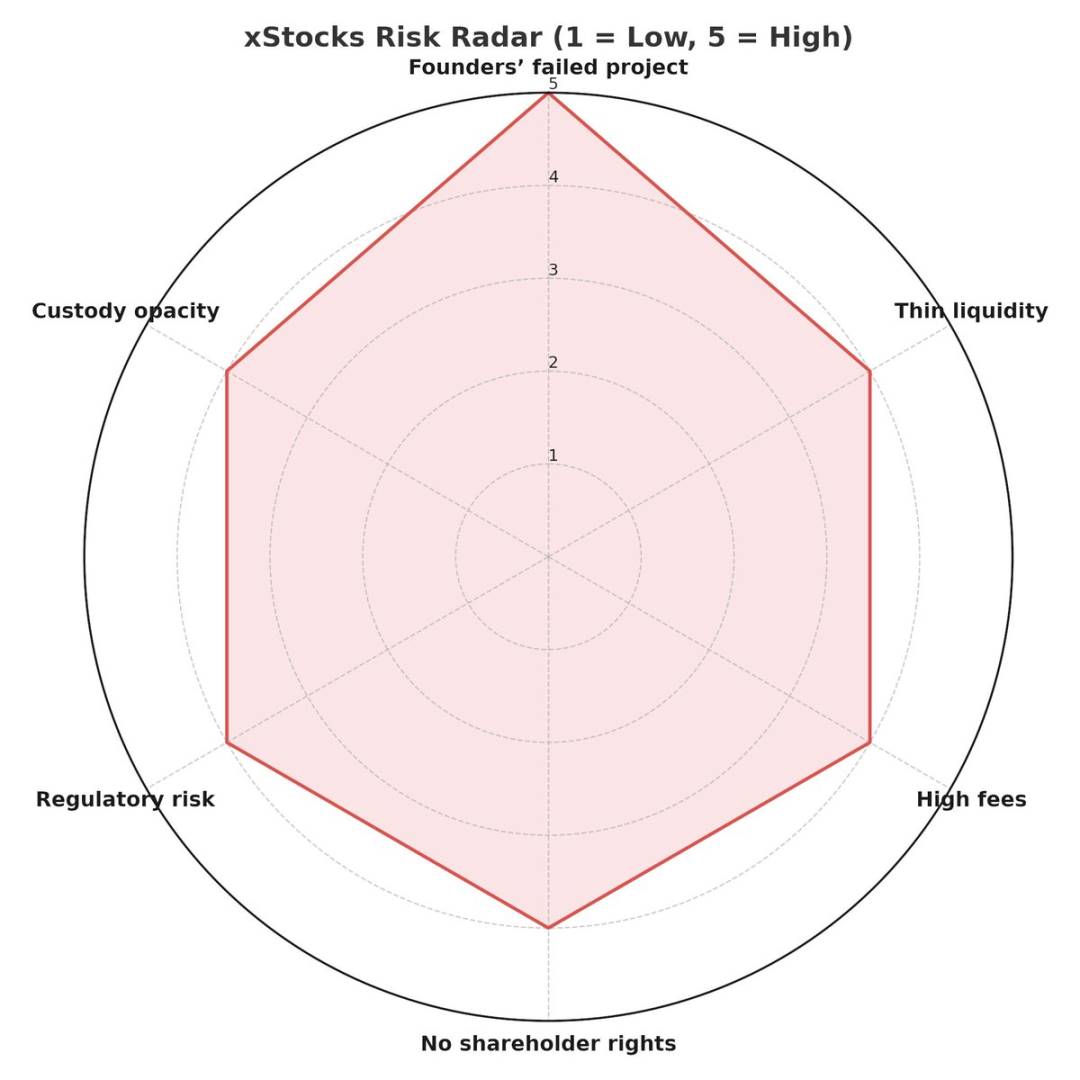

However, beyond the founders’ history of alleged "soft rug pulls," users continue to report numerous shortcomings with xStocks—some of which appear fundamentally unfixable. Some users have bluntly stated: "Tokenized stocks on-chain are merely castrated versions of real stocks designed for tax avoidance."

For instance, liquidity on xStocks is widely seen as extremely thin. Each listed stock currently offers only around 6,000 tokens, leading to significant price volatility on-chain that far exceeds actual movements in the underlying U.S. stock market.

Secondly, fees are excessively high. Tokenized stocks on xStocks incur a 0.50% burn fee plus an annual 0.25% management fee—making holding U.S. equities on-chain more expensive than owning physical shares.

In addition, some community members point out that because the underlying stocks are held off-chain by third-party custodians without regular public audits, there remains a risk of catastrophic failure. Moreover, these on-chain tokens do not confer shareholder voting rights; holders effectively own unsecured notes, raising serious concerns. Finally, the slow speed of purchasing and redemption processes has drawn unbearable criticism from users.

To quote the KOL who exposed the xStocks founders’ past: "Israeli Web3 projects combine the laid-back attitude of European ventures with American-style capital operations—but overall, they are completely irresponsible toward users from start to finish."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News