Bitcoin Mortgages: A New $6.6 Trillion Blue Ocean

TechFlow Selected TechFlow Selected

Bitcoin Mortgages: A New $6.6 Trillion Blue Ocean

Real estate tycoon Trump makes a time-limited comeback, aiming to inflate the next bubble with "Bitcoin mortgages."

Author: BUBBLE, BlockBeats

On May 27, Cantor Fitzgerald launched its $2 billion Bitcoin-backed lending program for institutional clients, with initial borrowers including crypto firms FalconX Ltd. and Maple Finance. As one of the official primary dealers of U.S. Treasury securities, the entry of this century-old Wall Street institution marked a highly symbolic breakthrough.

Bitcoin is evolving from a static store of value into a financial instrument capable of influencing the credit system.

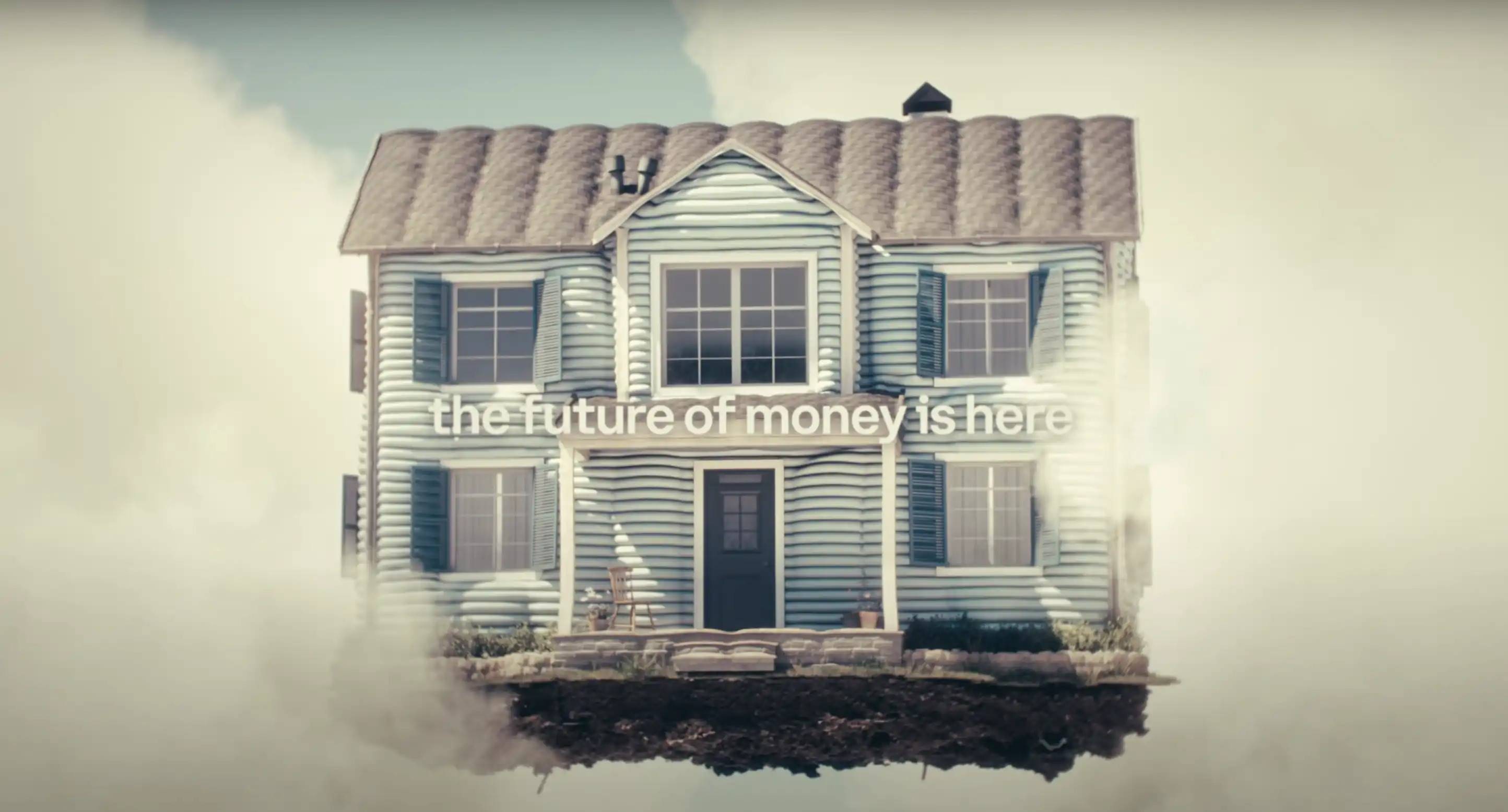

Just one month later, Bill Pulte, director of the Federal Housing Finance Agency (FHFA), sent another powerful signal. He directed Fannie Mae and Freddie Mac—two pillars of the U.S. housing finance system—to study the feasibility of incorporating cryptocurrencies like Bitcoin into their mortgage underwriting frameworks. This announcement triggered a strong market reaction, with Bitcoin surging nearly 2.87% within 24 hours, reclaiming the $108,000 level.

As posed in a Coinbase ad campaign: "In 2012 you needed 30,000 bitcoins to buy a house; today you need only 5. If home prices keep falling when priced in Bitcoin, why do they keep rising in dollar terms?" What impact might Bitcoin-backed mortgages have on the dollar-based financial system?

Does Bill Pulte’s Statement Carry Weight?

Bill Pulte publicly called on Fannie Mae (FNMA) and Freddie Mac (FHLMC) via Twitter to prepare for potential changes. These two government-sponsored enterprises (GSEs) do not directly issue home loans but play a central “market-making” role in the secondary mortgage market by purchasing privately originated mortgages, thereby ensuring liquidity and sustainability in the lending ecosystem.

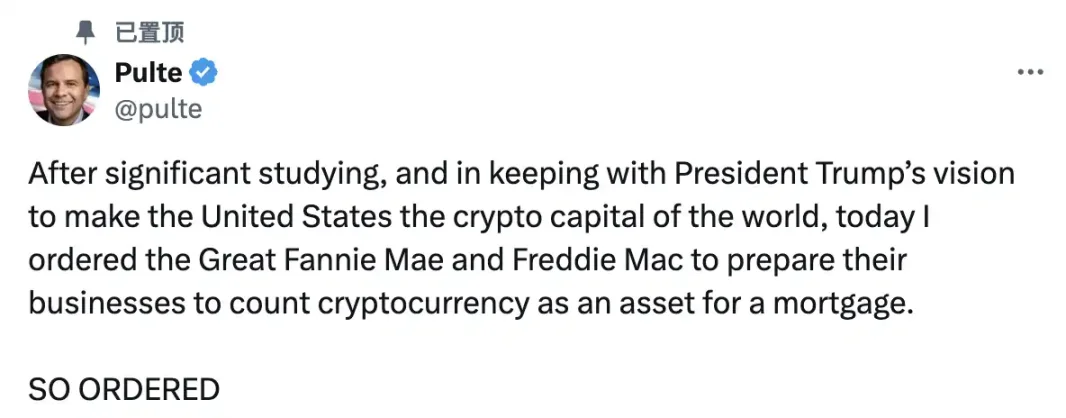

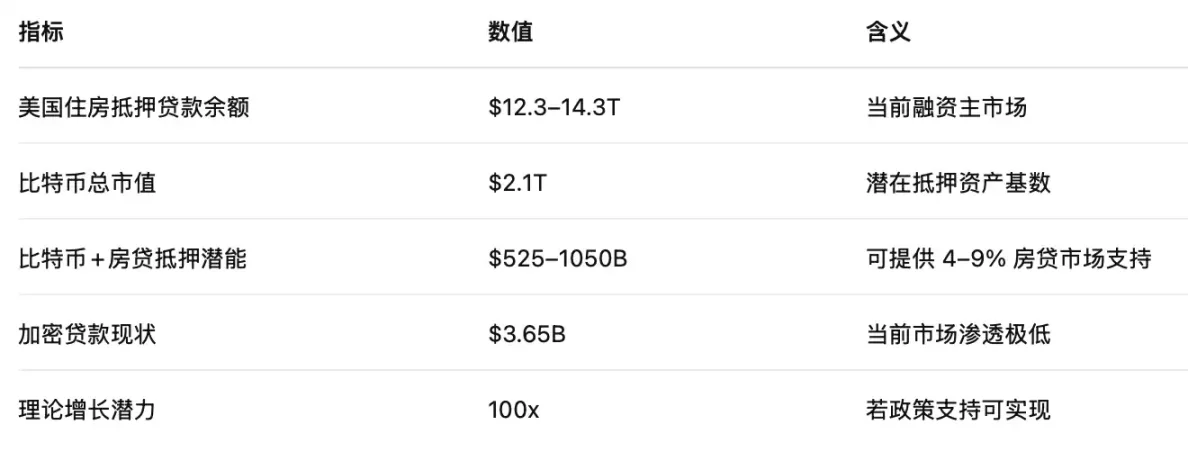

The FHFA, established after the 2008 subprime crisis, oversees both institutions. According to a JPMorgan research report, as of December 2024, Fannie Mae and Freddie Mac collectively guaranteed $6.6 trillion in agency mortgage-backed securities (MBS), representing 50% of all outstanding U.S. mortgage debt. Ginnie Mae, fully backed by the U.S. government and directly regulated by HUD, contributed an additional $25 billion in MBS, accounting for 20%.

Outstanding balances of agency MBS (Ginnie Mae, Fannie Mae, Freddie Mac) as of December 2024. Source: JPMorgan

During Trump’s first term, stakeholders discussed various reforms for GSEs, but no legislative progress was made. Pulte used a commanding tone in his tweet because, as FHFA director, he holds supervisory board positions at both companies. Since taking office in March 2025, he has carried out sweeping personnel and structural reforms—removing multiple directors from both entities, appointing himself board chair, and dismissing 14 executives including Freddie Mac’s CEO—significantly strengthening FHFA’s control over the GSEs. The agency is now consulting with the White House and Treasury Department on potential public listing plans based on “implicit guarantees,” giving Pulte’s policy moves profound implications for the financial system. Now, FHFA’s exploration of integrating crypto assets into mortgage underwriting signals a structural shift in regulatory attitudes toward digital assets.

Pulte’s personal background adds further complexity. As the third-generation leader of Pulte Homes, the third-largest homebuilder in the U.S., and like President Trump, a scion of a real estate dynasty, he is also among the earliest federal officials in Trump’s circle to openly support cryptocurrency. As early as 2019, he advocated for crypto philanthropy on social media and disclosed holding significant amounts of Bitcoin and Solana. His investments include high-volatility assets such as GameStop and Marathon Digital, aligning more closely with the “Degen” archetype than typical politicians. Given his crypto track record, his push to integrate digital assets into American homeownership appears far from impulsive.

Divisions Within Government

Yet, there are clear divisions within the government. In March, ProPublica revealed that the Department of Housing and Urban Development (HUD) is exploring the use of stablecoins and blockchain technology to track federal housing assistance funds. An HUD official said the initiative is championed by Irving Dennis, the agency’s new Chief Deputy Financial Officer, formerly a partner at global consultancy EY.

Unlike the semi-official GSEs overseen by FHFA, Ginnie Mae is a fully government-owned entity. Discussions here are therefore more cautious. The proposal has faced strong internal opposition, with critics warning it could lead to another 2008-style crisis. Some officials have even dismissed it as “handing out Monopoly money.” An internal memo noted that HUD already possesses robust auditing and fund-tracking capabilities, and introducing blockchain and crypto payments would add unnecessary complexity while risking asset volatility and compliance issues.

Currently, platforms like Milo Credit and Figure Technologies already offer Bitcoin-backed mortgage products. However, since they cannot securitize these loans for sale to Fannie Mae or Freddie Mac, their interest rates remain high and liquidity limited. If Bitcoin were integrated into the federal mortgage system, borrowing costs could drop significantly, allowing holders to leverage their holdings and transition from “HODLing” to building household wealth.

Naturally, risks remain. As former SEC official Corey Frayer warned, introducing volatile crypto assets into the FHA-guaranteed $1.3 trillion mortgage market could trigger systemic shocks during any major de-peg event. Legal scholar Hilary Allen went further, calling it dangerously reckless to use society’s most vulnerable populations as test subjects for technological experimentation.

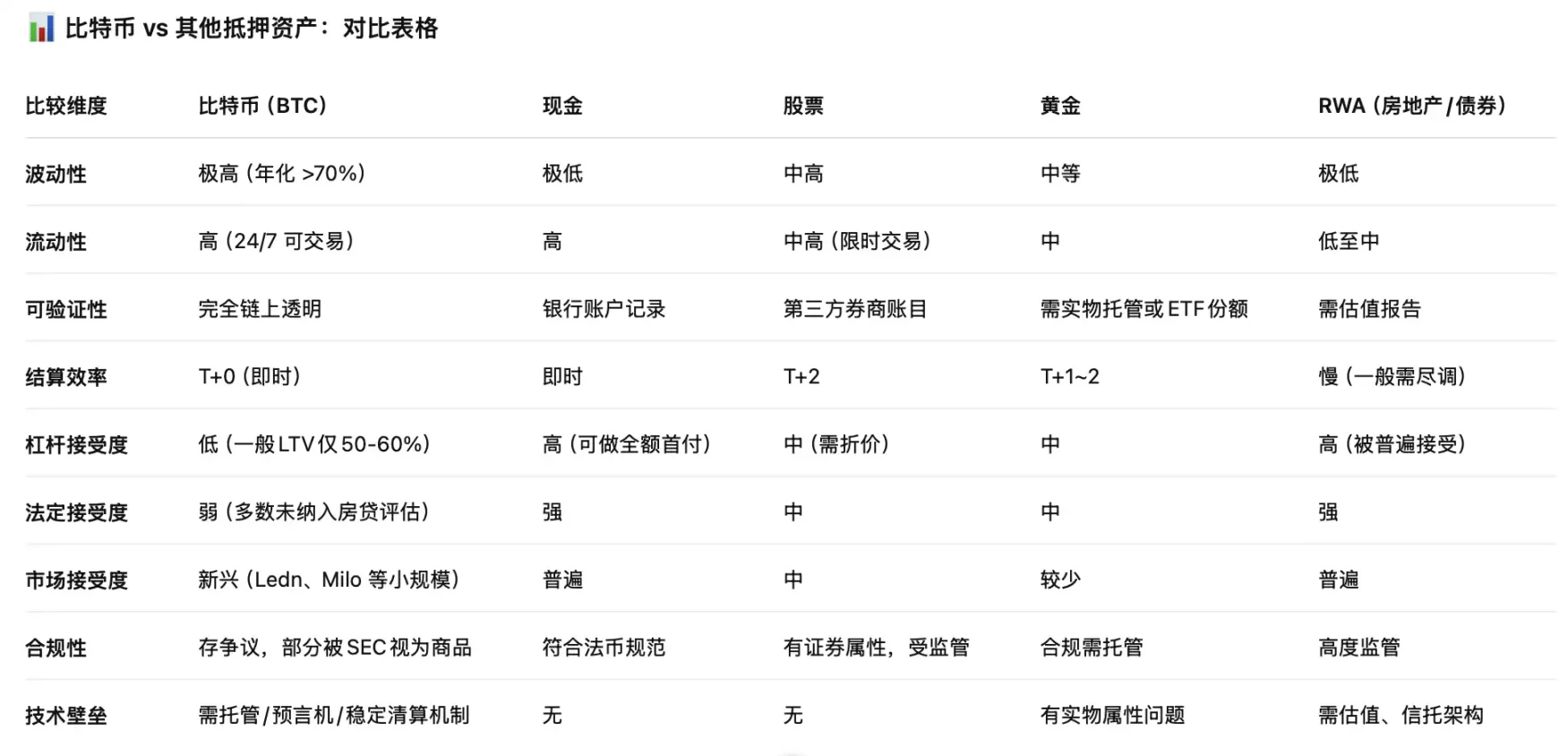

The core of this divide lies in whether the U.S. is ready to formally incorporate Bitcoin from an “alternative investment” into its public financial infrastructure. FHFA’s proposed direction—which would allow Bitcoin balances to directly satisfy down payment or reserve requirements—carries deep significance by granting decentralized assets a “housing leverage” effect for the first time. Yet, crypto’s inherent price volatility creates challenges in valuation and risk provisioning when treated as reserves. Whether such assets should be eligible during periods of extreme price swings involves complex questions around financial regulation, liquidity management, and systemic stability.

What does the new FHFA directive entail? And how have Americans previously used crypto for loans?

In the aftermath of the 2008 subprime crisis, current U.S. mortgage underwriting imposes strict compliance rules: even if borrowers own cryptocurrency, they must first convert it to USD and maintain it in a regulated U.S. bank account for 60 days before it qualifies as “seasoned funds” for loan assessment. Pulte’s proposal clearly aims to dismantle this procedural barrier.

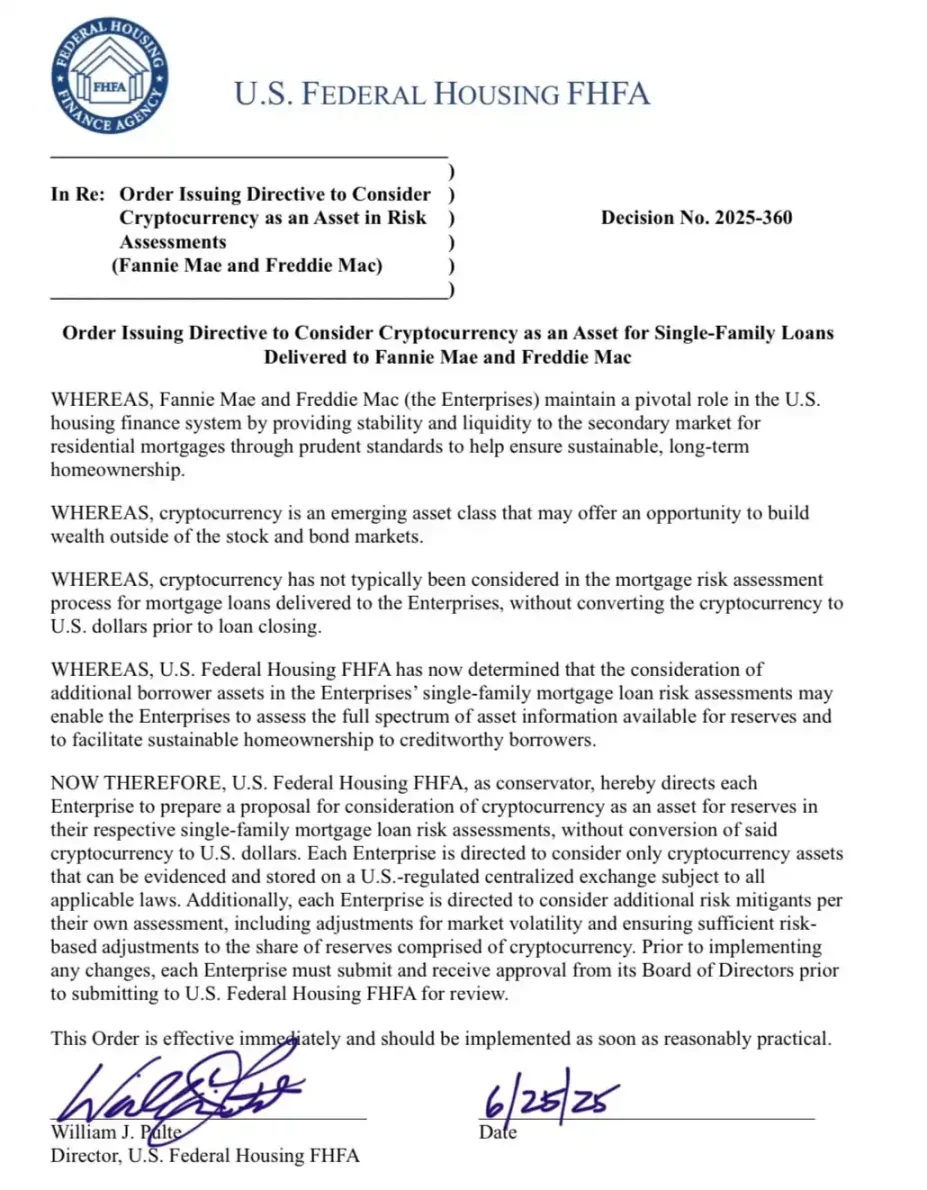

The official order, Decision No. 2025-360, instructs the two mortgage giants to treat cryptocurrency as a valid component of borrower wealth diversification. To date, crypto has been excluded from mortgage risk assessments because borrowers typically don’t liquidate their digital assets before loan maturity. The directive requires Fannie Mae and Freddie Mac to develop proposals for including crypto in borrower reserve evaluations for single-family mortgage risk models. It also mandates direct calculation of crypto holdings without requiring conversion to fiat.

FHFA has issued clear “guidelines” on which cryptocurrencies qualify. Only assets issued on U.S.-regulated centralized exchanges and fully compliant with applicable laws are eligible. Additionally, enterprises must implement risk mitigation measures, adjusting for known crypto market volatility and appropriately reducing risk exposure based on the proportion of crypto reserves held by borrowers.

Before any changes take effect, proposals must be submitted to and approved by each company’s board. After board approval, they will be forwarded to FHFA for review and final authorization. This decision aligns with broader federal efforts to recognize crypto in financial processes and echoes Pulte’s statement: “to fulfill President Trump’s vision of making America the global capital of cryptocurrency.” The directive reflects a commitment to position the U.S. as a leading jurisdiction for crypto innovation.

What Does This Actually Mean?

It’s widely understood that using a highly liquid asset as collateral to obtain a less liquid one is a sound financial principle. But BTC sits at the intersection of multiple interests. If it becomes officially recognized as qualifying collateral for U.S. mortgage lending, its impact could rival—or even surpass—the anticipated effect of Trump’s pre-presidency “Bitcoin Reserve Act.” And the consequences won’t be limited to a single group; American households, financial institutions, and government agencies alike will feel the ripple effects.

How Many Americans Would Use Bitcoin to Buy Homes—and How Much Could They Save?

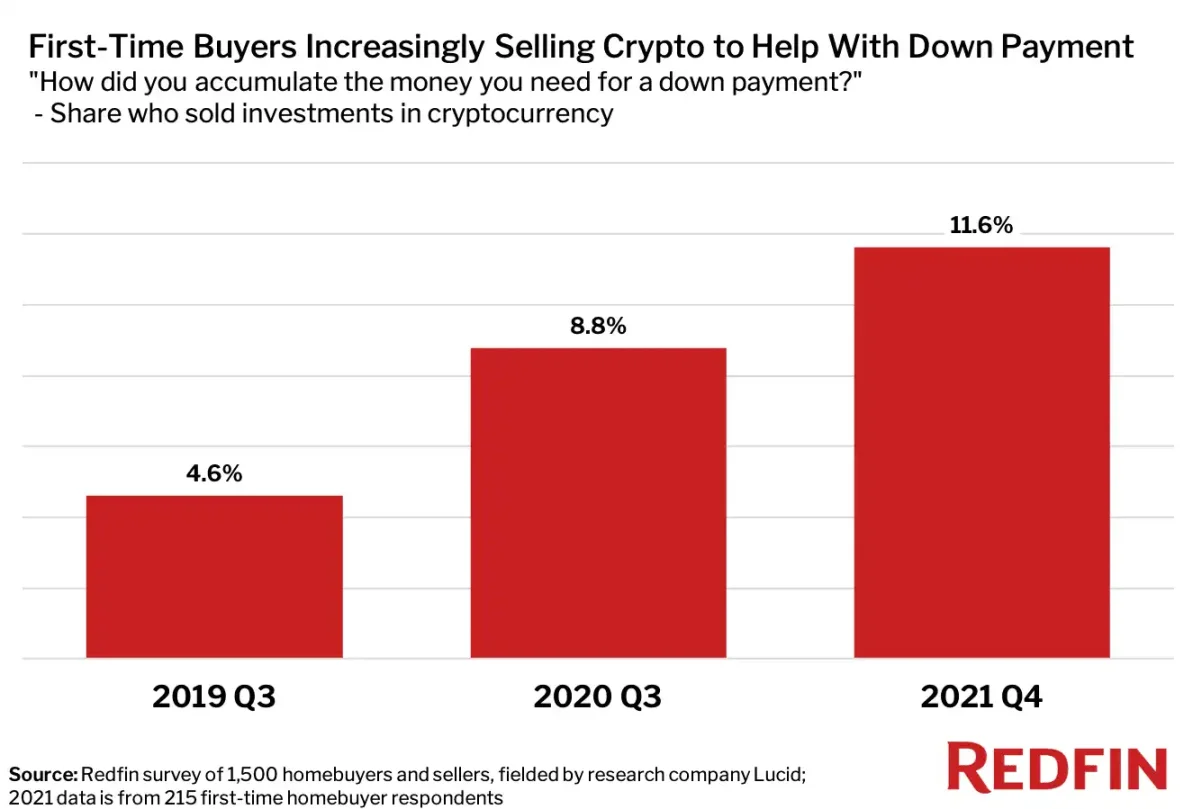

Daryl Fairweather, chief economist at U.S. real estate brokerage Redfin, noted: “With time on their hands and few exciting spending options during the pandemic, many people began trading crypto. While some investments failed, others accumulated substantial wealth—enough, at least, to cover a home down payment.”

According to Security.org’s 2025 Crypto Consumer Report, approximately 28% of American adults (about 65 million people) hold cryptocurrency, with Gen Z and Millennials showing particularly high adoption—over half have owned or currently own digital assets. As these younger generations gain greater share in the housing market, crypto as a home purchase method may grow increasingly popular.

In 2021, Redfin conducted a survey, commissioning research firm Lucid to sample 1,500 first-time homebuyers. When asked how they saved for down payments, the most common answer was “salary” (52%), followed by less common sources like “cash gifts from family” (12%) and “early withdrawals from retirement accounts” (10%). Notably, those who “sold crypto to buy homes” rose steadily from 2019 to 2021, reaching nearly 12% by year-end. Four years later, with increased crypto adoption, this figure has likely grown further.

As for savings, CJK, founder of People’s Reserve, shared a story during a June 25 Twitter Space with Emmy-nominated producer Terence Michael. In 2017, he sold 100 BTC to buy a house now worth $500,000—but the BTC he sold would today be worth tens of millions. That experience inspired him to create People’s Reserve, aiming to help others retain their Bitcoin through mortgage financing.

This leads to a hypothetical scenario: suppose you bought $50,000 worth of Bitcoin in 2017. By 2025, it’s worth $500,000. Instead of selling and paying $90,000 in capital gains tax, you partner with a crypto-backed lender, pledge $300,000 worth of BTC as collateral, and receive a $300,000 mortgage at 9.25% interest. The lender holds your Bitcoin in custody—you still own it—while you pay about $27,000 annually in interest (potentially lower in future), saving $90,000 in taxes. You also retain exposure to Bitcoin’s upside and inflation-hedging benefits—especially relevant amid the “Great Beauty Act” raising the U.S. debt ceiling to $5 trillion.

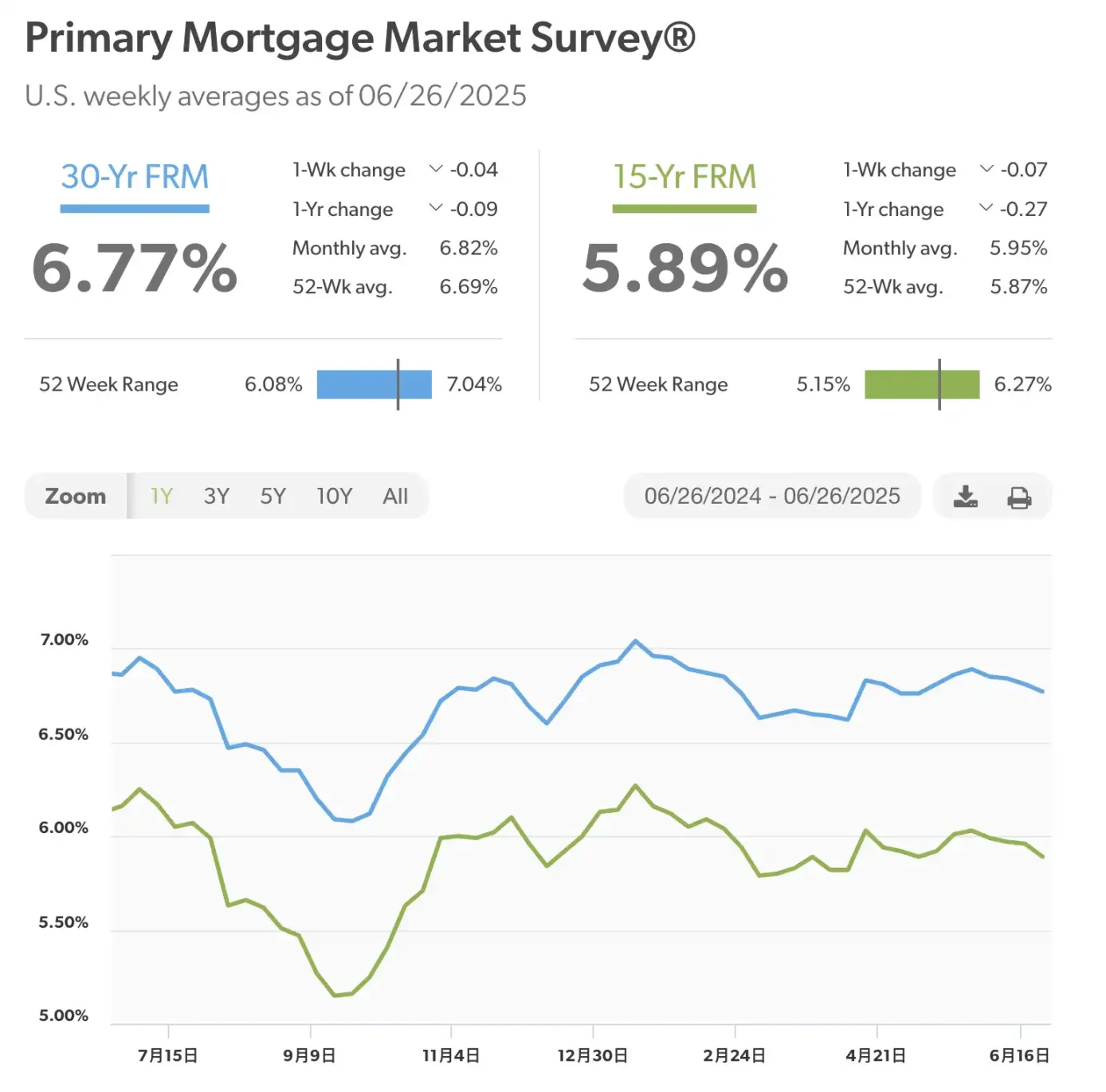

According to Freddie Mac data, current average U.S. 30-year mortgage rates hover around 7%, while 15-year rates are near 6%.

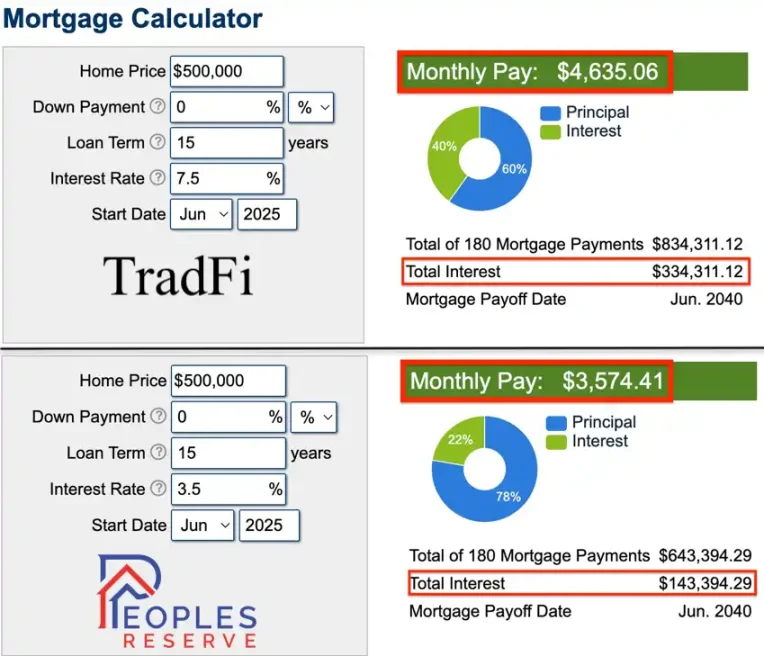

Private lenders like Milo Credit currently offer Bitcoin loans at LTV ~50% with annual rates of 9–10%. Native BTC ecosystem platforms like People’s Reserve aim to reduce rates to 3.5% (at LTV 33%). Under this model, a $500,000 15-year mortgage would save about $1,000 per month, totaling nearly $190,000 in interest savings over the loan term.

While not all institutions will offer such low rates, policy momentum suggests that major U.S. lenders may soon provide rates comparable to traditional assets, making Bitcoin-backed loans a smarter financial choice for Americans.

A Supporting Tool for GSE Privatization

Just one month before FHFA directed Fannie Mae and Freddie Mac to consider crypto in mortgage evaluations, President Trump posted on his social platform Truth: “I am moving forward with plans to take these great companies (Freddie and Fannie) public, but I want to make clear that the U.S. government will continue its implicit guarantee, and I will steadfastly regulate them as President.”

Opening the door to Bitcoin-backed mortgages provides an indirect yet crucial pathway supporting GSE privatization. It introduces diversified collateral types into the housing finance system and may, across dimensions of risk transfer, capital formation, regulatory restructuring, and political coordination, create space for Fannie Mae and Freddie Mac’s transition away from government backing.

First, in credit risk management, crypto-backed mortgages could alleviate pressure on GSEs’ role as “lenders of last resort.” Historically, Fannie and Freddie bear policy obligations to finance loans for non-traditional borrowers—those lacking sufficient credit history or income documentation. Allowing Bitcoin-backed lending opens a new channel for “credit-invisible but asset-visible” crypto-native investors, easing the GSEs’ unique burden in promoting housing inclusivity. Institutionalizing Bitcoin—a decentralized, verifiable, globally liquid asset—as collateral effectively creates an “off-system” alternative loan pool, leaving room for structural optimization in GSE portfolios post-privatization.

In capital structure, Bitcoin-backed lending may also support GSE privatization through native crypto asset securitization. A key obstacle to privatization is a regulatory capital shortfall of $180 billion—projected to take over seven years to close via retained earnings alone. If Bitcoin-backed mortgages scale into rated, packageable Mortgage-Backed Securities (Crypto-MBS), they could attract new classes of capital investors and serve as “off-market supplements” to existing GSE securities. Such assets would allow GSEs to achieve capital independence without relying on congressional appropriations or taxpayer funding, reducing systemic friction during government exit.

Simultaneously, this mechanism forces modernization of housing finance regulation. Traditional GSE evaluation relies on income verification, debt-to-income ratios, and FICO scores—cash flow models. Widespread use of crypto-backed lending shifts focus toward asset strength, on-chain history, and wallet net worth. This pivot from “income-based” to “asset-based” risk logic helps GSEs build more flexible, market-driven underwriting models after privatization and lays institutional groundwork for integrating future novel collateral types. Regulatory acceptance of crypto in underwriting could enable GSEs to expand into broader financial asset insurance, enhancing their competitive edge.

More importantly, politically, promoting Bitcoin-backed lending fosters a “technology substitution” narrative, creating rhetorical cushioning for Trump’s GSE privatization agenda. Privatization has long faced fierce resistance from Democrats, housing advocacy groups, and certain state governments, who fear reduced access to financing for low- and middle-income families. Legalizing crypto-backed mechanisms offers an alternative: even as the government withdraws explicit guarantees, markets can provide substitute financing through technology, assets, and shared-risk models. This logic not only balances public discourse but gives policymakers greater flexibility in negotiating between fiscal responsibility and financial stability.

Thus, while Bitcoin lending is not a direct tool for GSE privatization, its institutionalization is creating a critical “financial buffer zone.” It expands the collateral base in housing finance, relieves GSEs of policy burdens, offers capital alternatives, and strengthens market acceptance of decentralized financial reform. In a political cycle favoring “smaller government, stronger markets,” the credit function of crypto assets is becoming a key driver of structural reform in housing finance.

How Much Mortgage Pressure Can Bitcoin Relieve?

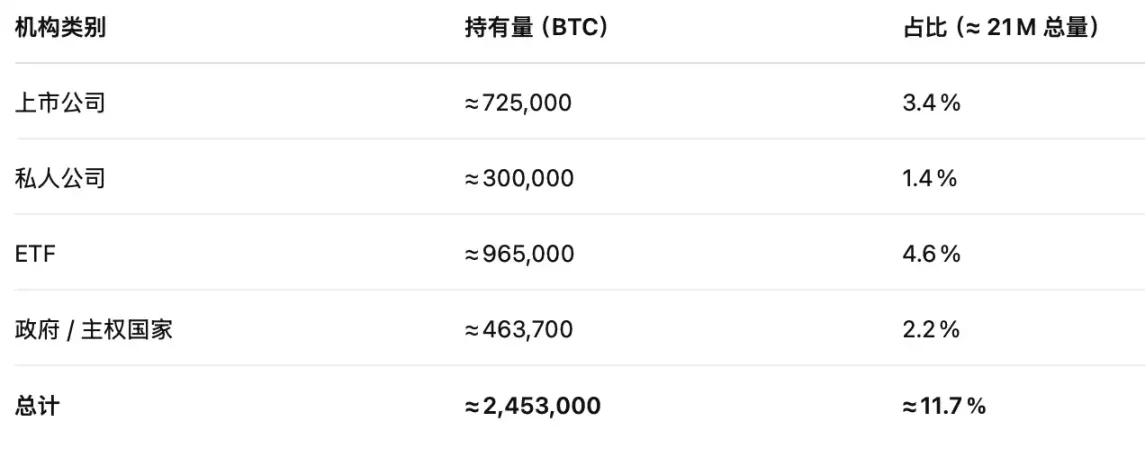

Bitcoin’s current market cap stands at approximately $2.1 trillion—about 17% of the U.S. mortgage market. If the entire BTC market cap were eligible for mortgage collateral, it could support $1.05 trillion in loans (at 50% LTV), roughly 8–9% of existing mortgage debt. Even assuming only 50% of BTC is usable as collateral, it could still back $525 billion in loans—4–5% of total mortgages. While portions held by ETFs, listed companies, or sovereigns may not easily participate, these represent only about 10% of total supply.

Therefore, institutionalizing Bitcoin mortgages would not only deeply impact the crypto community but unleash unprecedented asset transformation power into traditional finance—creating a virtuous cycle that unlocks Bitcoin’s purchasing power without dismantling existing systems. Should policies fully materialize, Bitcoin-backed lending could inject hundreds of billions in new financing into the housing market—over 100 times larger than today’s crypto mortgage market.

The Great Beauty Act

If Bill Pulte’s statements boost Bitcoin mortgage prospects, the formal enactment of the *Great Beauty Act* serves as a powerful policy stimulus for the U.S. real estate sector. Its centerpiece provision permanently increases the Qualified Business Income (QBI) deduction from 20% under the Tax Cuts and Jobs Act to 23%. This change directly benefits individuals and corporations investing in real estate via limited partnerships, S-corps, or REITs, lowering their effective marginal tax rate to around 28.49%.

For property businesses whose balance sheets rely on rental income, this improves after-tax cash flow and optimizes capital structure. It also indirectly lowers the entry cost for entities holding Bitcoin or other digital assets to acquire real estate through legal vehicles, providing a more solid compliance framework for bridging “on-chain assets” with “off-chain real estate.”

Additionally, the *Great Beauty Act* restores and extends 100% bonus depreciation and raises the Section 179 immediate expensing limit to $2.5 million, enabling faster tax write-offs of upfront capital expenditures in real estate projects. This encourages concentrated investment in new construction, warehouses, and productive assets, helping developers build more resilient cash flow profiles amid rising interest rate uncertainty. For investors or RWA projects leveraging Bitcoin via DAOs, LLCs, or SPVs to acquire property, the reinstated depreciation rules effectively hedge against delayed rental returns and long asset turnover cycles, facilitating the conversion of digital assets like BTC into more liquid underlying revenue rights within real estate ventures.

Bitcoin + Real Estate—Trump appears to be playing a grand strategic game.

Which Market-Led Projects Are Leading the Charge?

Lending Platforms

Milo Credit

Milo Credit, a fintech company based in Florida, launched one of the first U.S. housing loan products backed by cryptocurrency in 2022. Its model allows users to pledge Bitcoin, Ethereum, or USDC as collateral and obtain mortgage financing up to 100% of a property’s value—without a cash down payment. This structure avoids triggering capital gains taxes and lacks forced liquidation clauses, enabling borrowers to access home financing while retaining upside exposure to their crypto holdings.

Milo offers loans up to $5 million with terms extending to 30 years, currently charging annual interest rates between 9% and 10%, with no prepayment penalties. Collateral security is managed by third-party custodians such as Coinbase, Gemini, and BitGo. As of early 2025, Milo had facilitated over $65 million in crypto-backed home loans.

Notably, such loans previously did not meet U.S. federal mortgage standards and could not be securitized and sold to Fannie Mae or Freddie Mac, resulting in higher funding costs and elevated interest rates. If legislation passes, this system could see lower rates. Due to crypto’s price volatility, Milo still requires over-collateralization to ensure loan safety.

Ledn

Headquartered in Canada, Ledn is one of the first native crypto platforms to pioneer structured lending products using on-chain assets. Known for its “Bitcoin-Backed Loans,” Ledn enables users to borrow fiat (USD or USDC) against Bitcoin collateral, typically at 50% LTV, with instant disbursement and minimum loan durations as short as weekly interest periods. Unlike Milo, Ledn does not directly link to real estate transactions but serves as a short-term liquidity solution for users who want cash without selling Bitcoin. The platform also offers Bitcoin and USDC savings accounts with compounding interest. Emphasizing security and compliance, Ledn stores collateral with third-party custodians and undergoes regular audits, maintaining notable influence in Canada and Latin America.

Moon Mortgage

Moon Mortgage is a lending platform tailored for crypto-native users, focusing on Web3 founders, DAO members, and crypto investors lacking traditional credit histories. Its flagship product allows users to apply for conventional-style home loans using BTC or ETH as collateral, with the property serving as secondary collateral—addressing mismatches between asset ownership and income verification. By partnering with compliant U.S. lenders and custodians, Moon Mortgage offers interest rates and repayment structures similar to traditional mortgages. It replaces FICO scores with proprietary models assessing on-chain asset history and risk tolerance. Positioned as a niche player, Moon Mortgage champions the idea of “getting on the property ladder without selling your coins” and is one of the few U.S. mortgage projects openly targeting on-chain identity users.

People’s Reserve

Founded by CJK Konstantinos, People’s Reserve is a crypto-financial infrastructure project aiming to build a Bitcoin-centric mortgage and credit ecosystem. The platform is developing several “Bitcoin-powered” financial products, including self-repaying mortgages and Home Equity Bitcoin Lines of Credit (HEBLOC), which let homeowners exchange home equity for Bitcoin liquidity. Central to its design is preserving user ownership of Bitcoin—never rehypothecating pledged assets—and using multi-signature custody to prevent centralized control. People’s Reserve aims to match traditional mortgage interest rates, increasing mainstream adoption of crypto finance. Currently in development and not yet live, the platform has opened sign-ups for notifications and plans to launch its first test services on July 4.

Infrastructure Providers

Beeline Title

Beeline Title does not offer crypto loans but builds blockchain-based infrastructure for title registration and digital custody in crypto-backed mortgage transactions. Specializing in digitizing property registration and integrating it with crypto custody systems, Beeline enables fully on-chain, paperless real estate ownership and lien management. According to AInvest, Beeline will launch its national service in August 2025, facilitating the first wave of Bitcoin-collateralized real estate deals. Its emergence signals growing standardization and compliance in linking crypto assets with physical real estate, laying technical and institutional foundations for large-scale adoption.

MicroStrategy has also contributed to the infrastructure, having developed a BTC credit model that Pulte recently expressed interest in on social media X.

Can Bitcoin Change the Old Rules?

From百年-old Wall Street brokerages to federal housing regulators, from Trump’s public endorsements to the reshaping of real estate capital structures, a Bitcoin-centered financial order is permeating top-down. Bitcoin’s identity is shifting—from “digital cash” to “digital gold” and now toward becoming a “credit medium”—offering traditional finance a new model for capital organization. This fusion of “decentralized assets” with “federal-grade credit tools” is challenging the deepest design principles of mortgage lending.

In the future, when Fannie Mae and Freddie Mac truly integrate Bitcoin into their underwriting models, a new financial paradigm and ecosystem may emerge. Bitcoin will represent not just stored wealth, but a lever capable of moving housing, taxation, credit, and even governance itself.

And the institutionalization of Bitcoin mortgages may become the most symbolic “tool” of Trump’s *Great Beauty* era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News