Staking Toncoin to get UAE visa—when residency rights also become tokenized

TechFlow Selected TechFlow Selected

Staking Toncoin to get UAE visa—when residency rights also become tokenized

This is not only an exploration of the feasibility of cryptocurrency going mainstream, but also a new opportunity to reshape global capital and talent flows.

Written by: TechFlow

You project teams are up to no good again—trying to trick me into staking once more?

But this time, things seem different.

On July 6, TON officially announced a partnership with the United Arab Emirates (UAE), launching a program offering successful TON token stakers a 10-year UAE Golden Visa. The application portal is already live on TON's official website, where applicants can register using their email address, full name, and TON wallet address.

Staking has long been a key way for crypto participants to engage with projects and earn rewards or governance rights.

However, in recent years, staking benefits have become increasingly intangible. After market education, users have grown more cautious—wary of opportunity costs from locked-up capital, and even more fearful of becoming exit liquidity for others.

Compared to abstract voting rights or APR that might erode native token value, gaining state-backed residency rights through tokens—effectively unlocking access to live, work, and invest in the UAE—feels far more tangible.

In many ways, this suggests that real-world "residency rights" can now be tokenized.

While tokenization has swept across asset classes like real estate, government bonds, and equities, residency rights have had no precedent—until now. And as "investment migration" emerges in a new, on-chain form, how feasible is it really?

$100,000 in Tokens, 10 Years of Visa Validity

Let’s examine the details outlined on TON’s official website regarding this Golden Visa initiative.

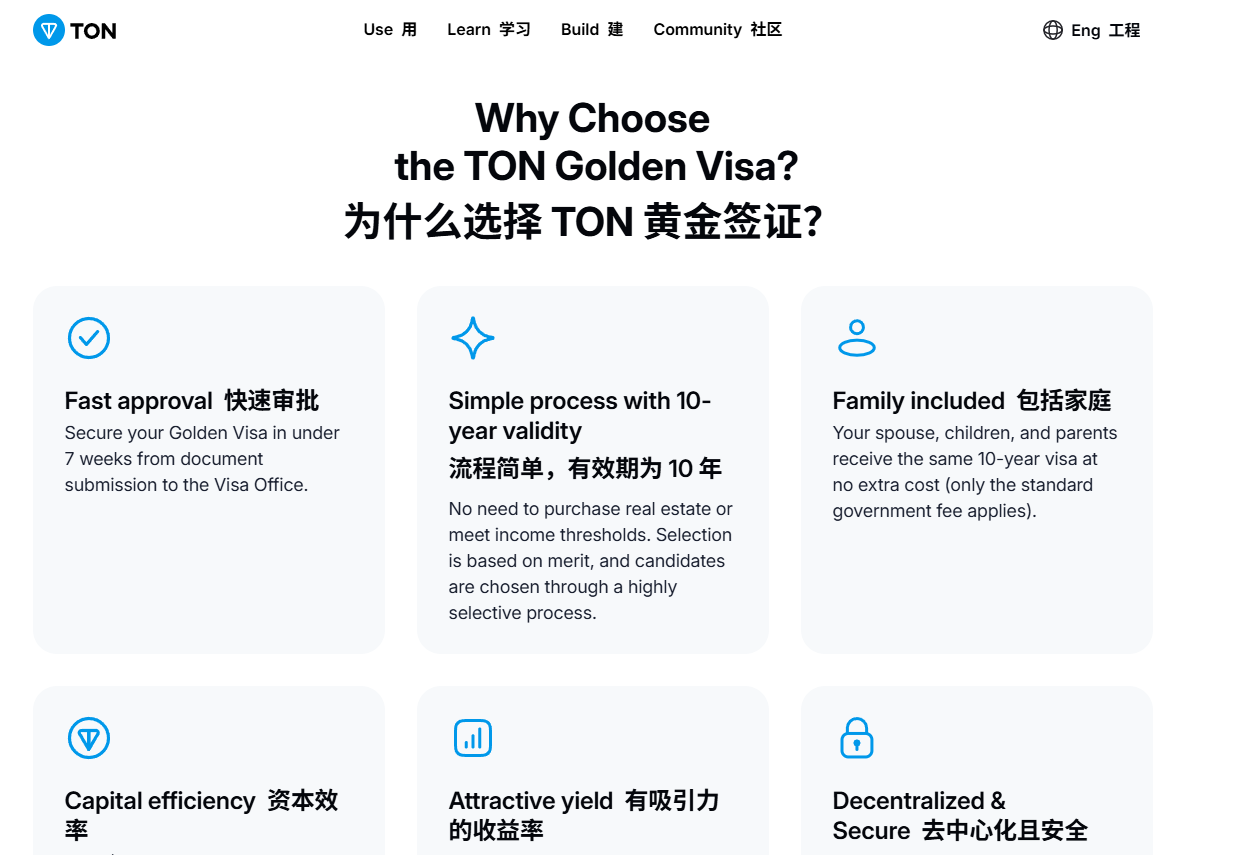

First, investors must stake TON tokens worth $100,000 (valued at market price at the time of staking) via smart contracts on the Toncoin network, locking them for three years (36 months), during which withdrawal is not allowed.

In addition, applicants must pay a one-time processing fee of $35,000, covering administrative and identity verification costs associated with the visa.

This means the total cost for investors amounts to $135,000, plus a three-year lock-up period.

The benefits, however, fall into roughly three categories:

-

Token Returns: During the staking period, investors earn an approximate annual yield of 3–4%, paid out in TON tokens.

-

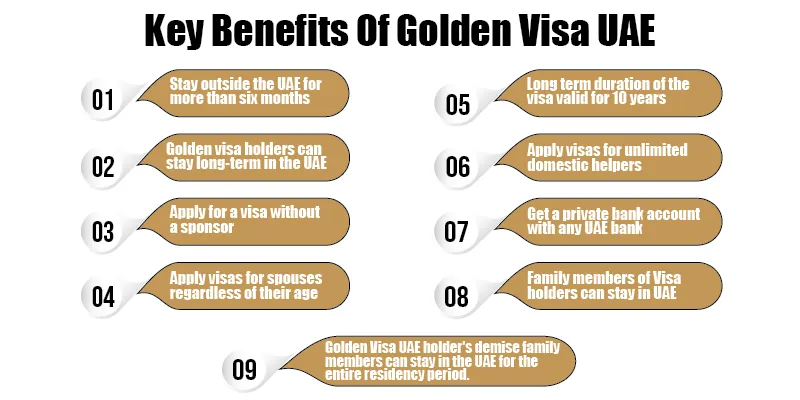

Residency Rights: The primary applicant receives a 10-year UAE Golden Visa.

-

Family Benefits: The visa extends beyond the main applicant to immediate family members. Spouses, children, and parents can all be included under the same family visa program, each receiving a 10-year Golden Visa.

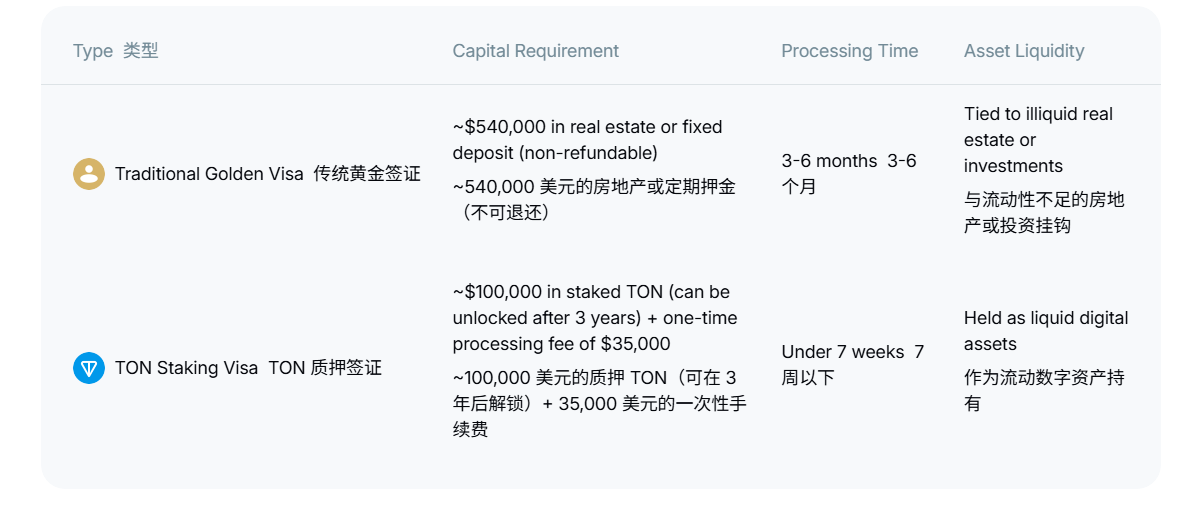

By comparison, obtaining the Golden Visa through traditional routes requires a minimum investment of $540,000 (2 million AED) in property or equivalent fixed deposits. These assets cannot be sold or withdrawn either during application or after approval—an extremely rigid requirement.

This structure aims to ensure applicants possess sufficient financial capacity to reside in the UAE and contribute long-term investment to the local economy.

For investors, though, this ties up capital—"locking" funds and sacrificing liquidity and investment flexibility. In contrast, the $100,000 staked in Toncoin unlocks after three years, preserving significantly higher asset liquidity—a major appeal of this program.

Additionally, traditional visa applications take at least 3–6 months; TON has compressed this timeline to under seven weeks. Compared side-by-side, the Toncoin staking pathway dramatically lowers both capital and time barriers.

What Are the Benefits of the Golden Visa?

Since its launch in 2019, the UAE Golden Visa has attracted global high-net-worth individuals thanks to its flexibility and high added value. Its advantages extend well beyond long-term residency, offering significant conveniences in lifestyle, business operations, and wealth management.

First, the Golden Visa offers a 10-year validity with renewal options, allowing holders to freely live, work, and study in the UAE. Starting in 2024, the previous requirement of residing in the country for six months per year was lifted—making it especially suitable for globally mobile digital nomads.

Second, the UAE imposes no personal income tax, capital gains tax, or VAT, and allows free movement of foreign exchange—providing an ideal environment for both traditional and crypto investors to manage wealth.

Geographically, the UAE sits at the crossroads of Asia, Africa, and Europe, with Dubai and Abu Dhabi serving as global hubs for commerce and finance. Holding a local visa facilitates easier business development.

Notably, Dubai’s free trade zones (such as DMCC) offer zero tariffs and 100% foreign ownership—ideal conditions for crypto enterprises and blockchain startups to establish operations.

For crypto natives and investors, the Golden Visa isn’t just about residency—it’s also a strategic asset allocation tool.

As mentioned earlier, compared to the traditional $540,000 investment in illiquid assets, the Toncoin program requires only $100,000 in staked digital assets, unlockable after three years. This preserves liquidity in digital holdings, enabling investors to enjoy UAE tax advantages and its thriving business ecosystem while retaining the ability to adjust portfolios when markets recover.

Possibly, the appeal of the Golden Visa lies not merely in material returns, but in opening a gateway for the crypto community to global markets.

That said, it’s important to note that according to TON’s current website description: "During visa processing, our issuing partners in the UAE will review your application details and provide guidance." This implies that the visa benefits offered by TON may not stem directly from an official UAE government collaboration, but rather are executed through intermediary partners.

From Abstract Staking to Tokenized Residency

In the crypto space, staking is typically tied to voting rights or minimal yields, often lacking real utility.

Many stakers gain little governance influence while losing liquidity due to lock-ups—and when VC-led token models collapse amid bear markets, they often end up as “bagholders.” This sense of “emptiness” around staking has led most users to question its purpose:

What you get in return for locking up funds is too often just hollow promises.

The Toncoin-UAE Golden Visa initiative transforms $100,000 worth of staked TON tokens into a 10-year residency pass.

TON, backed by Telegram’s massive user base and active in social use cases, hasn't seen strong token performance in this market cycle. But this innovative move clearly brings fresh attention.

If the process proves smooth and compliant with regulations, it’s easy to foresee interest from high-net-worth individuals and large on-chain holders within the crypto community—potentially increasing demand for Toncoin.

Setting aside the $100,000 threshold and complex legal frameworks, simply comparing this to other crypto projects shows how these additional two benefits elevate staking to an entirely new level.

Whether the staking makes financial sense depends on individual perspectives. But even if TON drops to zero in three years, you’d essentially have paid $100,000 for a 10-year UAE residency—something tangible. With other projects, if the token crashes, you’re left with nothing.

Beyond that, viewed more broadly, the UAE itself harbors ambitious goals in the crypto space.

Dubai’s “Blockchain Strategy 2020” has already drawn over 200 companies. In 2024, Abu Dhabi launched a crypto regulatory sandbox, further cementing its position in the digital economy.

The Golden Visa program could be an extension of this ambition—by attracting crypto capital, the UAE enhances its economic competitiveness and positions itself in the global governance of digital assets.

A region granting residency rights in exchange for token staking might have sounded science fiction a few years ago—but today, it’s reality.

This year alone, we’ve seen more corporations and governments adopting cryptocurrency reserve programs, signaling broader global acceptance of digital currencies. For individuals holding crypto, “geographic arbitrage” is becoming increasingly viable.

Imagine a future “digital nomad citizenship marketplace”? Investors bidding on residency rights on-chain—or even some forward-thinking nations tokenizing citizenship itself?

This isn’t just about crypto going mainstream—it’s about redefining the flow of global capital and talent.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News