72 Meme Coin ETF Applications: Creating Real Value or Speculation in Regulatory Clothing?

TechFlow Selected TechFlow Selected

72 Meme Coin ETF Applications: Creating Real Value or Speculation in Regulatory Clothing?

The altcoin ETF boom is reshaping the logic of crypto investing.

By Thejaswini MA

Translated by AididiaoJP, Foresight News

Does this create real value, or merely cloak speculation in regulatory legitimacy?

January 2024 feels like a lifetime ago. Though only 18 months have passed, it might as well be a century. For crypto, it has been nothing short of an epic journey.

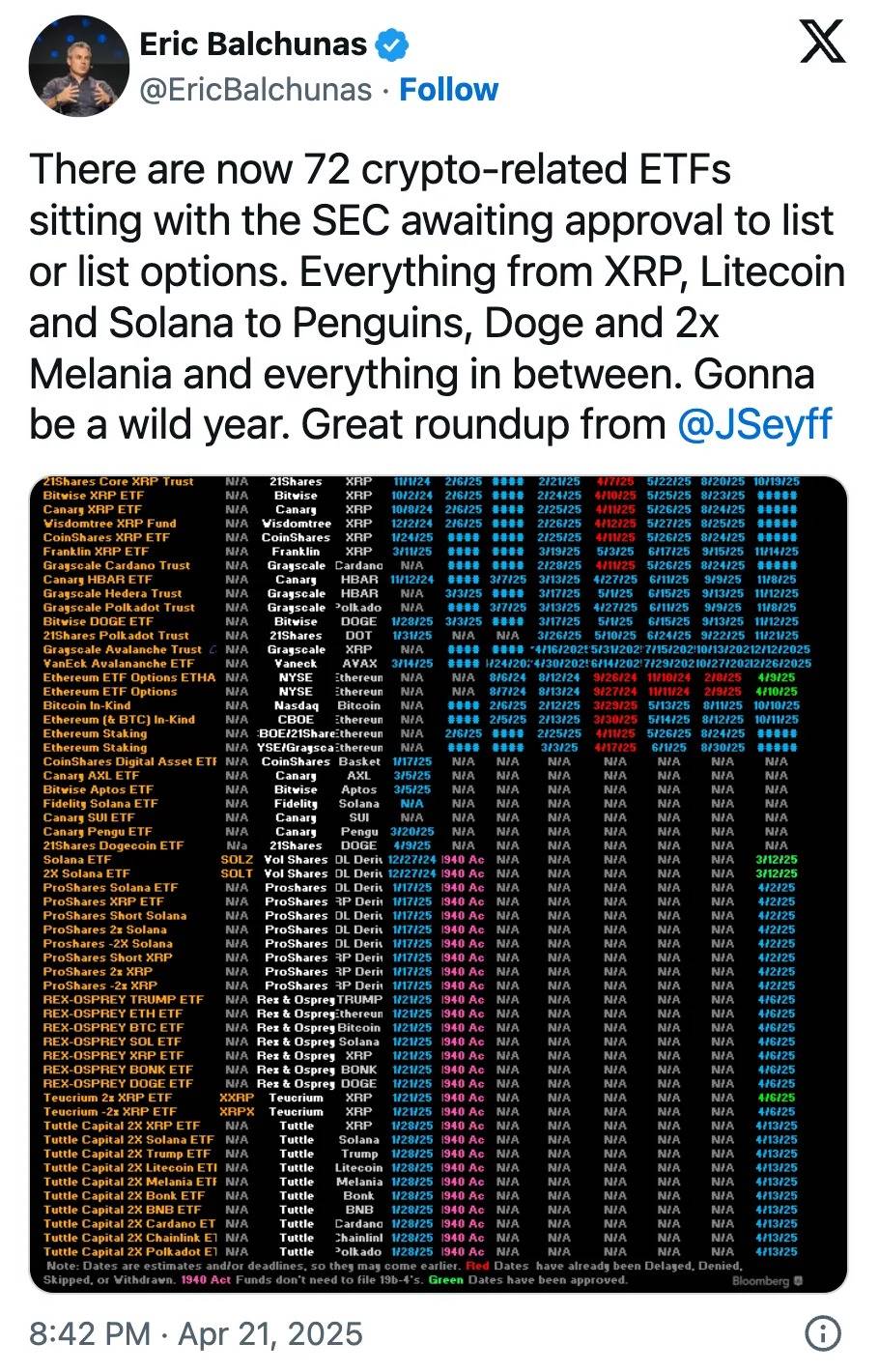

On January 11, 2024, spot Bitcoin ETFs landed on Wall Street. Roughly six months later, on July 23, Ethereum ETFs took the stage. Today, the U.S. Securities and Exchange Commission (SEC) is inundated with 72 pending crypto ETF applications—and that number keeps growing.

From Solana to Dogecoin, from XRP to Pudgy Penguins, asset managers are packaging every kind of digital asset into compliant financial products. Bloomberg analysts Eric Balchunas and James Seyffart have raised their approval probability estimate to "over 90%," signaling what may become the largest expansion in the history of crypto investment products.

If 2024 was a year of survival against the odds, then 2025 is the season of reaping rewards amid fierce competition.

The $107 Billion Bitcoin ETF Feast

To understand the significance of altcoin ETFs, we must first grasp how spot Bitcoin ETFs defied expectations and rewrote the rules of asset management.

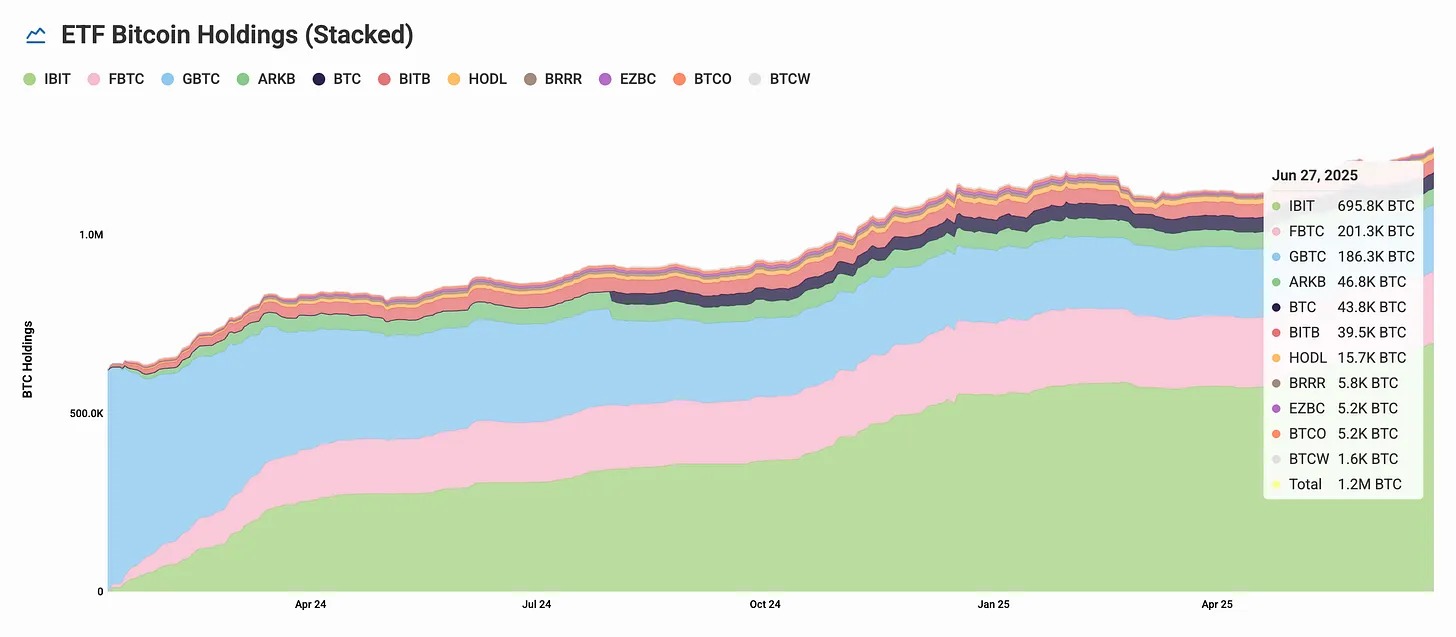

In just one year, Bitcoin ETFs attracted $107 billion in inflows—the most successful ETF launch in history. Eighteen months on, total assets under management (AUM) have reached $133 billion.

BlackRock’s IBIT alone holds 694,400 BTC, worth over $74 billion. All Bitcoin ETFs combined control 1.23 million BTC—approximately 6.2% of the circulating supply.

When BlackRock’s Bitcoin ETF became the fastest in history to surpass $70 billion in AUM, it proved that demand for crypto exposure through traditional investment vehicles is not only real and massive—but far from saturated. Institutions and retail investors alike are lining up to get in.

This success has created a virtuous cycle: ETF accumulation reduces exchange Bitcoin balances, institutional holdings grow rapidly, price stability improves, and the entire crypto market gains unprecedented legitimacy. Even during market volatility, institutional capital continues to flow in. These aren’t day traders or retail speculators—they’re pension funds, family offices, and sovereign wealth funds treating Bitcoin as a legitimate asset class.

It is precisely this success that has led to around 72 altcoin ETF applications piling up on the SEC’s desk by April.

What’s the Value of an ETF?

If you can buy altcoins directly on exchanges, what’s the point of an ETF? This is exactly where the logic of mainstream adoption comes in. ETFs are milestones for digital assets.

They grant digital assets the right to trade legally on traditional stock exchanges, allowing investors to access crypto through ordinary brokerage accounts. For the average investor unfamiliar with blockchain technology, this is a godsend. No need to set up wallets, manage private keys, or navigate technical complexities. Even if one overcomes the wallet hurdle, risks like hacking, lost keys, and exchange collapses remain ever-present. ETFs handle custody and security on behalf of investors, offering highly liquid assets tradable on mainstream platforms.

Altcoin Gold Rush

The application list reveals the diversity of soon-to-be-compliant crypto assets. Giants like VanEck, Grayscale, Bitwise, and Franklin Templeton have filed Solana ETF applications, with approval odds estimated at 90%. Nine firms—including newcomer Invesco Galaxy (ticker: QSOL)—are vying for a piece of the SOL pie.

XRP follows closely behind, with multiple filings targeting this payment-focused token. Cardano, Litecoin, and Avalanche ETFs are also under review.

Even meme coins aren’t spared. Major issuers have submitted applications for Dogecoin and PENGU ETFs. “No one’s applied for a Fartcoin ETF yet,” joked Bloomberg’s Eric Balchunas on X.

Why this sudden surge? It’s a confluence of factors. The pro-crypto stance of the Trump administration signals a regulatory shift. New SEC Chair Paul Atkins has overturned Gary Gensler’s “enforcement over regulation” approach, establishing a dedicated crypto task force to draft clear rules.

The thaw culminated in the SEC’s latest statement declaring that “protocol staking activities” do not constitute securities offerings—marking a complete reversal from previous crackdowns on staking services like Kraken and Coinbase.

With both Bitcoin and altcoins gaining institutional validation, corporate crypto treasuries on the rise, and Bitwise research showing 56% of financial advisors willing to allocate to crypto, demand is expanding beyond Bitcoin and Ethereum for diversified crypto exposure.

Demand Test

While Bitcoin ETFs have proven institutional demand is real, early analysis suggests altcoin ETFs will face a very different landscape.

Katalin Tischhauser, Research Head at Sygnum Bank, estimates total inflows into altcoin ETFs could reach only “hundreds of millions to $1 billion”—a fraction of Bitcoin’s $107 billion.

Even the most optimistic projections suggest altcoin ETFs combined won’t reach 1% of Bitcoin’s scale. Fundamentally, this gap makes sense.

The comparison with Ethereum is even starker. As the second-largest cryptocurrency, Ethereum ETFs attracted only about $4 billion in net inflows over 231 trading days—just 3% of Bitcoin’s $133.3 billion AUM. Despite recently adding $1 billion in new inflows over 15 sessions, Ethereum’s institutional appeal still lags far behind Bitcoin, foreshadowing an uphill battle for altcoin ETFs to capture investor attention.

Bitcoin won institutional favor due to first-mover advantage, regulatory clarity, and its simple “digital gold” narrative. Now, 72 applicants are fighting over a market that may only sustain a handful of winners.

Staking Changes the Game

A key factor that could differentiate altcoin ETFs from Bitcoin products is yield generation via staking. The SEC’s green light on staking opens new possibilities: ETFs can now stake holdings and distribute rewards to investors.

Current Ethereum staking yields offer ~2.5–2.7% annual returns. After fees and operating costs, investors could still earn a net 1.9–2.2%, modest by traditional fixed-income standards—but highly attractive when combined with potential price appreciation.

Solana staking offers similar opportunities. This creates a new revenue model for ETF issuers and new value for investors. Staking-enabled ETFs are no longer just price-exposure tools—they become income-generating assets.

Multiple Solana ETF filings explicitly include staking provisions, with plans to stake 50–70% of holdings while maintaining liquidity reserves. The Invesco Galaxy Solana ETF filing specifically mentions using “trusted staking providers” to generate additional yield.

But staking introduces operational complexity. ETF managers handling staked assets face multiple challenges: balancing sufficient unstaked reserves for redemptions while maximizing staked positions for yield; managing slashing risks—financial penalties when validators make errors or break rules; and running validator nodes requires technical expertise and robust infrastructure. Successfully operating a staking-based crypto ETF is like walking a tightrope—possible, but extremely difficult.

Prior approved Bitcoin and Ethereum ETFs lacked this feature, as the SEC under Gary Gensler viewed staking as violating securities laws by constituting unregistered securities offerings.

Fee Wars

With 72 applications, fee wars are inevitable. When numerous products compete for limited institutional capital, price becomes a critical differentiator. Traditional crypto ETF management fees range from 0.15% to 1.5%, but competition could drive them much lower.

Some issuers may even use staking yields to subsidize management fees, launching zero-fee or even negative-fee products to attract assets. In Canada, several newly launched Solana ETFs offered time-limited fee waivers.

Lower fees benefit investors but squeeze issuer margins. Only the largest, most efficient operators will survive. Expect consolidation, exits, and pivots—eventually, the market will crown its winners.

Viewpoint

The altcoin ETF boom is reshaping crypto investing.

Bitcoin ETFs were a resounding success. Ethereum ETFs provided a second option but drew lukewarm responses due to complexity and lackluster yields. Now, asset managers are betting that different cryptocurrencies serve different roles.

Solana touts speed, XRP focuses on payments, Cardano emphasizes “academic rigor,” and even Dogecoin tells a story of mainstream acceptance. There’s logic here. Cryptocurrencies are no longer a monolithic alternative asset class—they’ve fragmented into dozens of distinct investment vehicles with varying risk profiles and use cases.

As the largest crypto by market cap, Bitcoin has become an extension of traditional portfolios for many equity investors—offering diversification and a hedge against uncertainty. Ethereum, despite ranking second, hasn’t achieved the same level of integration; most retail and institutional investors don’t treat Ethereum ETFs as core holdings.

Altcoin ETFs must deliver differentiated value to avoid repeating Ethereum’s fate.

Yet this also reflects how far the industry has drifted from its original ideals. When meme coins get ETF applications, when 72 products compete fiercely, when fee wars resemble commodity markets—the space has become fully mainstream.

The question remains: Does this create real value, or merely dress up speculation in regulatory legitimacy? The answer may depend on perspective. Asset managers see new revenue streams in crowded markets; investors gain easy access to crypto through familiar products.

The market will ultimately decide.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News