PhD Student Delivering Food and the Crypto-Trading Youth: Who Is Stealing Young People's Compounded Future?

TechFlow Selected TechFlow Selected

PhD Student Delivering Food and the Crypto-Trading Youth: Who Is Stealing Young People's Compounded Future?

What countless young people lack most today is not a degree, nor capital, but a sense of direction.

By Daii

Two recent events prompted me to write about this topic today. They've been weighing on my mind, and I feel compelled to speak up.

-

One is about Chinese PhD graduates delivering food;

-

The other is about young South Koreans turning to cryptocurrency exchanges out of despair.

These two scenarios may seem unrelated, yet they act like mirrors reflecting the same group—young people—being torn between two extremes.

Let's first talk about China’s food-delivery youth.

There's nothing shameful about delivering food, but when someone with a PhD must rely on delivery gigs to make ends meet, it becomes an ironic commentary on our times. Ding Yuanzhao, widely reported in media, epitomizes this phenomenon. He holds a doctorate, has received advanced education, yet due to real-life hardships, he ultimately donned a delivery rider's uniform and joined the ranks of highly educated couriers crisscrossing urban streets.

He is not alone.

China now has over 7.45 million Meituan riders, tens of thousands of whom hold associate degrees or higher, including thousands with master’s degrees. According to data disclosed by Meituan in 2022, 29% of its riders possess大专-level education or above, and the company hires more than 5,000 fresh graduates annually to fill rider positions (source: Caixin Global).

Now let's look at young South Koreans who are enthusiastic about trading crypto.

In South Korea, there are over 16 million real-name registered cryptocurrency accounts—more than one-third of the country’s total population. In the first half of 2023, Bitcoin prices in South Korea were at one point 12% higher than the global average, creating what the industry calls the "Kimchi Premium."

As reported by Cointelegraph, this premium did not arise by market accident—it's a typical product of massive retail investor inflow driven by the desire to "get rich overnight." The so-called "enthusiasm" of South Korea’s younger generation for cryptocurrencies is, in fact, closer to desperation:

With traditional channels offering diminishing returns, young people increasingly turn to high-risk, high-volatility assets as their only viable outlet.

On the surface, young people in these two countries appear to have taken divergent paths—one riding scooters for deliveries, the other staring at screens trading coins—but fundamentally, they’re trapped by the same problem:

Resource misallocation, narrowing upward mobility, and mounting real-world pressures.

Let us examine more concretely the roots of this predicament.

1. The Reality Trap

At a macro level, the struggles of today’s youth are rarely due to personal laziness or lack of ability. Rather, they are caught in sweeping economic structural shifts. They grew up during an era of rapid growth, only to enter society just as that expansion hits a ceiling—not facing the question of “how to climb faster,” but rather “how not to be thrown off the train.”

This all begins with the slowdown in economic growth.

1.1 Economic Gear-Shifting and Stalling

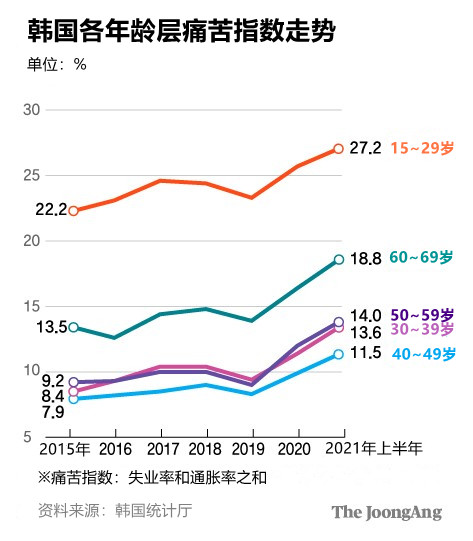

South Korea’s per capita GDP plateaued after reaching a historical peak in 2021. According to World Bank data, its growth rates in 2022 and 2023 fell below the global average for two consecutive years. Meanwhile, youth unemployment (ages 15–29) has remained around 6.6%, roughly double the national average, highlighting the structural challenges faced by young people.

China’s situation is even more severe. National Bureau of Statistics data show that in 2023, the unemployment rate among non-student youth aged 16–24 climbed to 21.3%. In 2024, this figure was temporarily suspended from publication, sparking widespread public concern. As of May 2025, it still stood at 14.9% (source: Reuters).

Unemployment itself isn’t the worst part—the true despair comes from being unable to find work matching one’s education and skills for extended periods. When there’s a huge gap between “available jobs” and “promised prospects,” young people easily fall into a state of “idling”: educated, yet directionless; hardworking, yet unrewarded.

1.2 Housing Costs Squeezing Lives

Housing, once a starting point in life, has become the ceiling crushing young people.

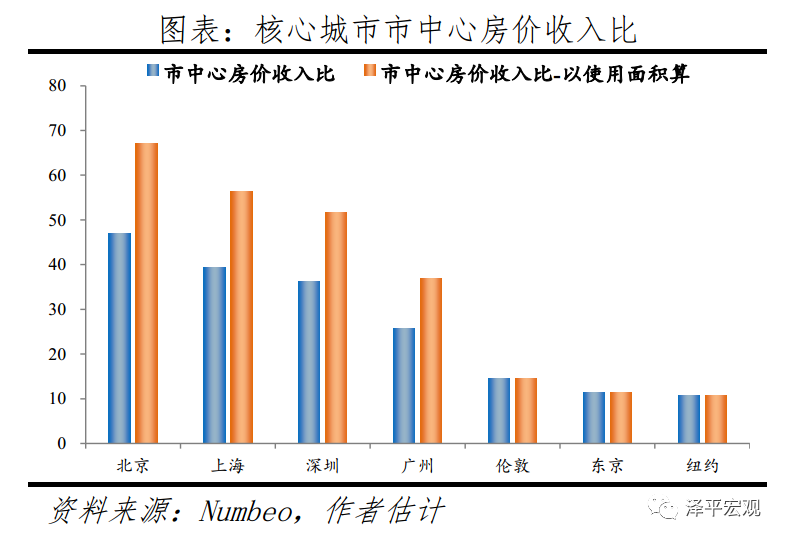

In South Korea, Seoul’s price-to-income ratio (PIR) stands at approximately 15—meaning a young person would need to work 15 years without spending a cent to afford a home (data source: Numbeo). In China, the ratio is far higher—PIRs in first-tier cities like Beijing and Shanghai exceed 34, placing them at extreme levels globally.

The OECD includes 38 member states representing the world’s most developed and representative market economies. Under its metrics, the average PIR typically ranges between 7 and 10. China’s megacities, with ratios exceeding 30, have strayed far beyond internationally acceptable affordability thresholds—indicating that housing barriers for youth are now abnormal.

The reality is harsh: amid towering cityscapes, young people increasingly feel like “outsiders” without ownership. They can’t buy, dare not commit to long-term rentals; they don’t belong, yet cannot escape.

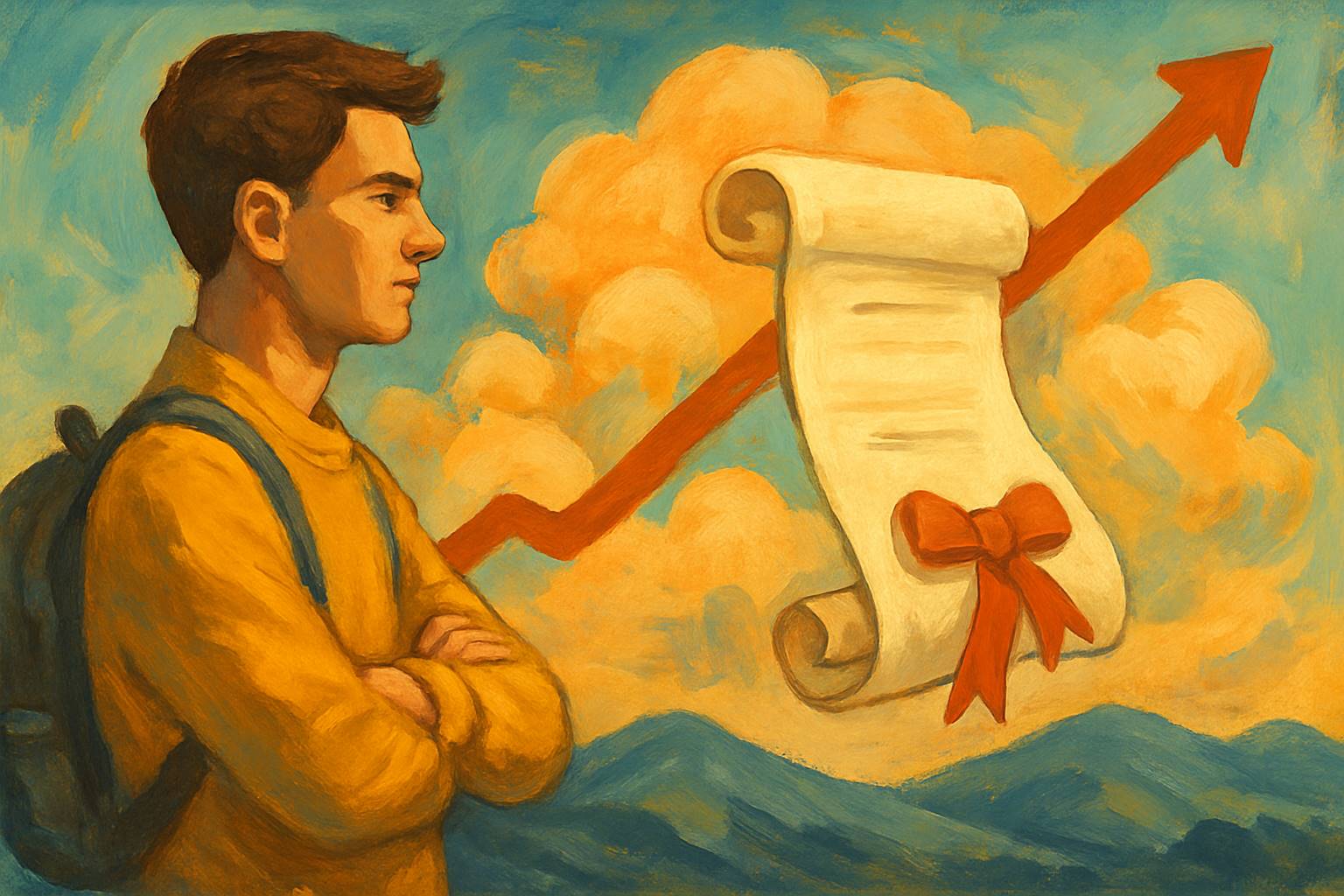

1.3 Declining Returns on Education

The belief that “knowledge changes destiny” is being repeatedly shattered by reality.

Over the past two decades, China’s university enrollment expansion brought higher education into the mainstream. In 2000, only 2.2 million students entered college nationwide; by 2025, that number had surpassed 10.5 million—an almost fivefold increase. Yet this explosive growth in educational scale has not translated into commensurate gains in return.

Data from the Ministry of Education show that median annual salaries for bachelor’s degree holders have stagnated between 60,000 and 80,000 RMB for several years. In first-tier cities, this doesn’t even cover basic rent and living expenses. For many majors, income fails to justify the opportunity cost of years spent studying.

More critically, the marginal value of degrees is declining. Research by Stanford economist Eric Hanushek shows that the income premium of a bachelor’s degree over a high school diploma has dropped from 15% in the late 20th century to just 8–10% today. This means the “social passport” function of diplomas is rapidly eroding. When degrees are no longer scarce, they lose their screening and empowering power, becoming mere labels.

To put it simply: for many young people, education is no longer a handrail to climb life’s ladder, but merely a default entry ticket to job platforms. Having it doesn’t guarantee transformation; lacking it means you can’t even get through the door.

2. Choices Born of Necessity

Young people aren't unwilling to work hard or avoid grounded efforts. They're trapped in a cruel paradox:

The harder they work, the deeper they sink into low-value repetitive labor; the more persistent they are, the harder it becomes to break through system-imposed boundaries.

2.1 At the End of “6 Yuan Per Order” Lies an Invisible Future

Across China’s streets and alleys, delivery riders have become the foundational “muscle tissue” of platform economies. They weave through urban cracks, measuring every 3-kilometer trip, exchanging time for 6 yuan per delivery. Their work is precisely sliced by algorithms into metrics such as “deliver within 20 minutes,” “customer satisfaction,” and “completion rate达标.” Every action is quantified, scored, ranked.

They complete orders, boost volume, chase performance—but gain no social capital, transferable skills, or career advancement path. No matter how fast they deliver, they can’t transition into platform operations or algorithm departments.

Their “effort” resets daily, never compounding into “compound interest.”

2.2 High-Leverage Bets Are Wagers on Fate, Not Markets

In South Korea, young people embrace cryptocurrency not out of technological faith, but deep economic despair. They know saving for a down payment on salary alone is fantasy; entrepreneurship requires resources; exams favor the elite. That leaves only one option: betting.

Crypto exchanges offer high-leverage products where a $1,000 position could become $10,000—or vanish—in a single day. Screenshots of “+$5,000 credited” or “up 50% today” flood Korean crypto communities and Telegram groups, acting like visual toxins glued to every disillusioned youth’s screen.

They don’t truly believe in blockchain—they just see no conventional path to “getting on board.” So they bet their fate on volatile assets, even if the odds of success are one in a thousand.

This isn’t speculation. It’s faith born of desperation.

They use capital, emotion, and trust to fill a structural void—a black hole created by missing upward pathways.

2.3 Young People Without Compound Interest

More dangerous than unemployment is losing the ability to generate compound interest. Both physical labor and high-risk gambling lack foundations for accumulation—they offer no positive feedback loops, no long-term curves.

Food delivery relies on physical stamina, crypto trading on emotional swings, returns on luck—all while risks are borne entirely by individuals. Platforms and exchanges appear neutral but use algorithms and rules as control tools, turning each participant into fuel for the machine—extracted, exploited, yet denied any share of value creation.

Delivery work is drained liquidity; crypto trading is ignited liquidity.

Though seemingly opposite, both are mirror images of the same mechanism:

Both contribute traffic and volatility at the system’s edge, yet neither gains eligibility to share in internal rewards.

It’s not that they aren’t good enough—it’s that systemic structures block their upward paths.

Are young people truly without options? Of course not. But the way out doesn’t lie between these two false choices. It requires stepping outside the entire misleading framework and finding genuinely sustainable paths of accumulation.

3. Breaking Free Starts with Cognitive Upgrade

Breaking free is possible—but it demands profound cognitive reconstruction.

In this algorithm-driven, structurally rigid era, escaping困境 means refusing to keep circling the paths systems have laid out for you.

3.1 Understand: A Degree Isn’t Sunk Cost—It’s a Base Asset with Embedded Options

A diploma may no longer be rare or directly valuable, but it remains the minimum threshold to access new platforms, industries, and markets. What determines its real worth isn’t its prestige, but whether you’re willing to actively exercise the embedded “option to relearn.”

The return on educational investment has shifted from “one-time payout” to “continuous conversion.” Only by constantly reshaping your knowledge and stepping outside comfort zones can a degree avoid rotting on your resume and instead transform into real opportunities.

3.2 Bet on Skills That Are “Compoundable × Transferable”

Stop expecting one exam, one job offer, one promotion to secure your future—that’s a path to illusion. The new reality demands: reinvent yourself every six months.

AI tool usage, data analysis, Web3 security, cross-border remote collaboration, video communication skills—these fields share three traits:

-

Short learning curve (can grasp basics in 3–6 months)

-

Skill portability (applicable across multiple platforms/industries)

-

Clear market premium (highly sought after by competitive roles)

In today’s world where “degree premium” has collapsed, compounded skill portfolios are the new social passport.

3.3 Start Building Cross-Cycle Asset Allocation Skills

You don’t need to become a financial expert, but you must develop basic defenses against economic cycles. After setting aside living expenses, consider making low-frequency dollar-cost averaging into long-term scarce assets—such as Bitcoin.

This serves as an inflation hedge and marks the beginning of breaking free from “living solely on wages.” It’s not gambling—it’s a defensive move to transcend local economic cycles and build personal financial independence.

I’ve detailed this strategy further in my article *Bitcoin: The Ultimate Risk Mitigation Tool for Long-Term Thinkers*. It represents a personal financial structure independent of platforms and market sentiment—a “backup plan” for your future.

3.4 Most Crucially—Stop Handing Your Life Over to Any Platform UI

Don’t let pop-ups like “Complete 30 Orders, Get 150 Yuan Bonus” dictate your time, nor notifications like “BTC Breaks $110K” control your emotions. These interfaces and alerts aren’t informing you—they’re training you.

True freedom means maintaining independent operation and judgment—even when platforms go down or markets freeze for 48 hours.

Life isn’t a race won by completing tasks or catching rallies. It’s a compoundable curve you can design yourself. And the starting point of that curve is cognitive awakening.

Conclusion: Not to Be Defined, But to Define

Chinese actor Wang Baoqiang rose from rural obscurity to the spotlight, from extra roles to director. His success never came from “being chosen,” but from consistently investing time in meaningful things. He took no shortcuts, only deliberate choices—he didn’t chase trending paths, but kept doing small, unglamorous things that compound over time. He didn’t have overnight fame, but he built a reusable trajectory.

This is precisely what today’s youth lack most:

Not degrees, not capital—but direction.

What is worth doing day after day? What skills quietly accumulate chips for you across cycles?

Your choices determine whether you’ll be consumed by the system;

Your persistence determines whether you can eventually break free.

American writer Vivian Greene once said:

Life isn't about waiting for the storm to pass; it's about learning to dance in the rain.

Simple words, yet deeply moving. It doesn’t preach idealism, nor comfort you with promises that storms will end. It simply reminds you:

The world won’t get better—but you can grow stronger.

Don’t wait for platform systems to design your fate, nor pin hopes on a sudden market surge or lucky break. Real power comes from whether you’re willing, in the fiercest winds and darkest days, to build something of your own.

Start today. Start with one conscious choice. Even if it’s just reading one more page, learning one new skill, or recording one observation.

Whatever you create—no matter how small—is your countermove against destiny.

Storms will come again. Even if the roof leaks and the ground turns to mud, build your own stage—

Then dance in the rain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News