From State-Owned Enterprise Director to Losing 3 Million, the Disillusioned Crypto Trader in Fengge's Lens

TechFlow Selected TechFlow Selected

From State-Owned Enterprise Director to Losing 3 Million, the Disillusioned Crypto Trader in Fengge's Lens

Being consumed by greed and illusion is often not a one-time all-in bet, but rather a process.

Written by: TechFlow

Open up crypto Twitter, and you'll always see those self-proclaimed gurus flaunting eight-figure portfolios or boasting about life-changing gains from a single contract trade.

Whether it's filtered hype or real skill, achieving big results in crypto isn't a stroke of luck accessible to every ordinary person.

Recently, well-known Bilibili content creator "Fengge the Fugitive" (Fengge) documented the story of a former deputy factory director at a state-owned enterprise in Handan, Hebei, who lost millions in cryptocurrency trading and now lives under 3 million RMB (~$414k) in debt—a life derailed.

As of publication, the video has already garnered 750,000 views, sparking widespread discussion across social media.

Peeling back the glossy illusion of overnight wealth, this is a true story of an average retail trader trapped by information asymmetry and consumed by greed.

From Factory Director to Ride-Hailing Driver with Debt

The subject’s real name wasn’t revealed in the original interview. However, since his Bilibili ID is “Zhe Li Chong Sheng” (“Rebirth”), we’ll refer to him as Brother Rebirth for the rest of this article.

Brother Rebirth once lived a life many would envy.

As he shared on camera, he was the deputy director of a state-owned coal washing plant in Handan, Hebei, earning 9,000 RMB (~$1,250) after tax per month. He owned a mortgage-free home, drove an Audi, managed a team of 20–30 people, and held the respected rank of deputy section-level official.

In 2018, he married and had a daughter, who is now five years old. His family life was happy and stable.

"We were comfortably middle-class... not rich, but certainly not struggling," he recalled, his voice tinged with distant warmth.

Back then, he took his daughter on trips to Shandong and Zhengzhou, living by the philosophy of raising a daughter with abundance. With both parents receiving pensions, there was no financial pressure at all. Life felt solid—unshakable. You’d be hard-pressed to spot any cracks.

Now, it’s all gone.

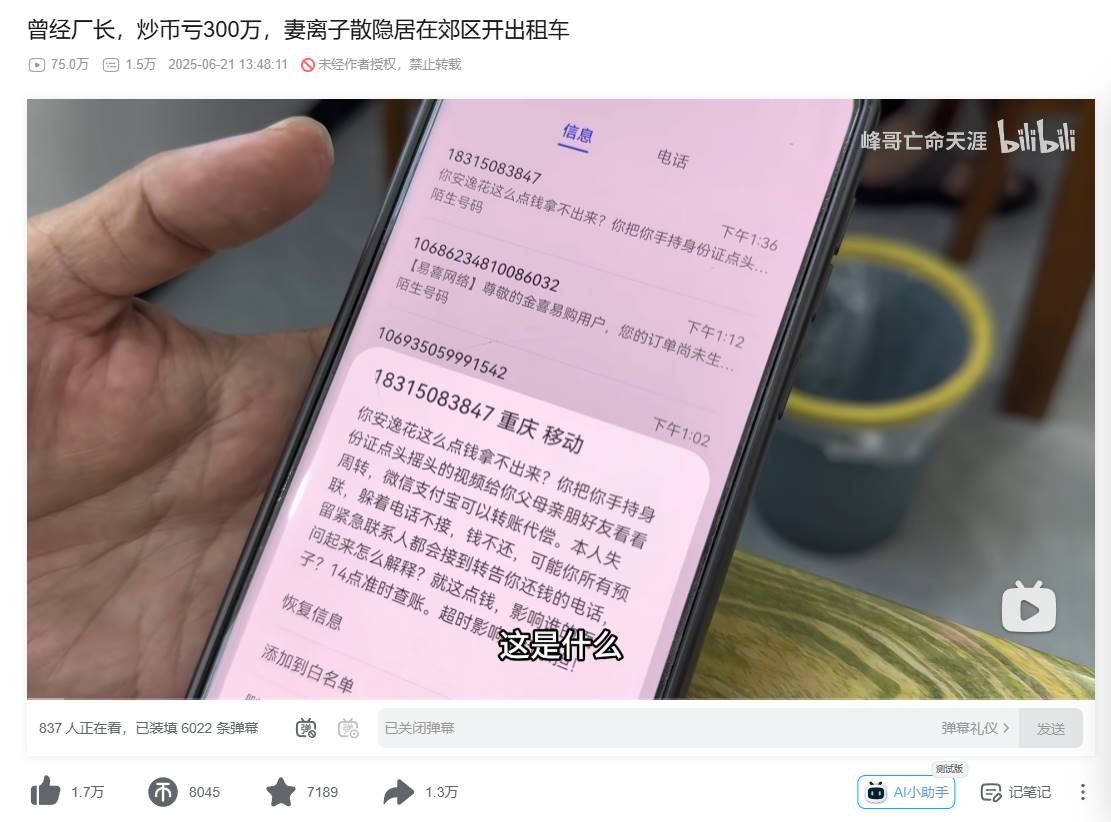

At the start of the video, Brother Rebirth shows Fengge the screens of various loan apps on his phone, revealing his debts—one app alone showing over 100,000 RMB owed. His total losses from crypto trading amount to 3 million RMB. Every day, he struggles just to keep up with mounting repayments.

He now drives a ride-hailing car for 13–14 hours daily, making around 300 RMB (~$41) in revenue. After paying vehicle rent and basic living expenses, only about 100 RMB remains. He rents a single room for 600 RMB/month—the private bathroom being the last shred of dignity he clings to.

The seven-figure debt follows him like a shadow. Annual interest amounts to 200,000–300,000 RMB (~$27,500–$41,250). Most loans are already in default, and collection calls never stop ringing.

When asked why he agreed to be interviewed and exposed publicly, Brother Rebirth said:

"The main reason I initially refused your interview was fear of losing my job. But now that I’ve decided I won’t go back—that door is closed—I have nothing left to lose. I might as well face things head-on, work hard outside, and earn money to pay off my debts."

In stark contrast to his courage in facing life and the camera, his family has completely fallen apart:

Two months ago, his wife filed for divorce due to the debt crisis and took their daughter. His parents have given up on him entirely. A text message from his father cuts especially deep: "This family no longer has you. Everything about you is finished."

His five-year-old daughter, too young to understand, only knows that "Dad went away for work."

From state-owned enterprise executive to indebted driver, Brother Rebirth’s downfall is truly heartbreaking. The rapid descent? Driven by the frenzy of high-leverage crypto trading and the obsessive desire to "turn things around."

Shitcoins, High Leverage, No Stop-Loss

His story may mirror countless ordinary crypto traders—devoured not by one reckless all-in bet, but by a slow, steady process fueled by greed and delusion.

On camera, Brother Rebirth openly recounted his journey into crypto: from initial wins to excessive leverage, the 3 million RMB loss wasn’t a single collapse, but the accumulation of repeated impulsive decisions.

His introduction to speculative trading began earlier, with online stamp and coin card investments. In the 2010s, these products—marketed as backed by postage stamps—lured in countless retail investors. Brother Rebirth dipped his toes in, made a small profit of 10,000–20,000 RMB, and narrowly escaped when the market crashed, gaining false confidence in "buy low, sell high" tactics.

He admits he was still cautious back then—but that early taste of success planted the seed of speculation.

In 2020, he entered the crypto world, starting with spot trading. At first, he was careful—but greed quickly took over.

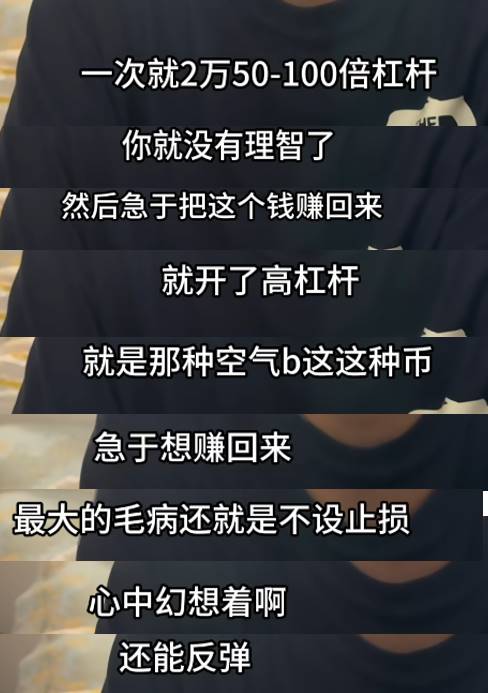

To chase higher returns, he began chasing altcoins and opened futures contracts. Contract trading allows users to borrow against their capital, enabling 10x, 50x, or even 100x leverage—amplifying both profits and risks exponentially.

As he described, starting with just a few hundred RMB, he could generate 40–50% returns. Encouraged, he kept increasing his stakes—both in principal and leverage.

He describes it as "death by a thousand cuts"—never going all-in at once, more like a frog slowly boiled alive. Lose 20,000 today? Borrow another 20,000 tomorrow and throw it back in.

In a darkly ironic moment during the original interview, Fengge remarks that this step-by-step approach seems relatively prudent. Brother Rebirth immediately corrects him:

"It wasn’t prudent at all. If I had 20,000 RMB today, I’d use very low leverage—nothing dangerous. Low-leverage altcoin contracts are usually fine… But back then, my mindset was twisted. I was desperate to win it all back. So at what I thought was the ‘right’ moment, I’d go all-in—10x, 50x, even 100x leverage."

Clearly, Brother Rebirth underestimated the volatility of altcoins—making liquidation inevitable. Another critical flaw? A complete lack of trading discipline.

He admits his biggest mistake was failing to set stop-losses. Even when he did set them, he’d often cancel them out of hope, clinging to the fantasy of a rebound.

This irrational gambling led to repeated liquidations and repeated borrowing. And as we now know, the final outcome was inevitable.

Four Times Borrowing, Never Recovered

In 2020, he burned through his 10,000 RMB savings and experienced his first margin call.

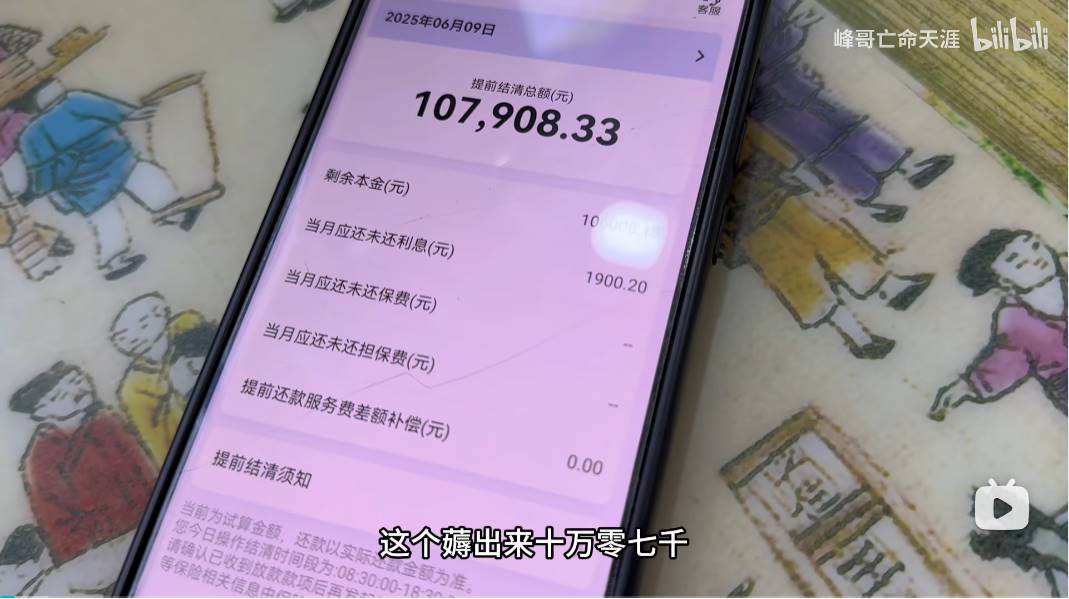

He borrowed 100,000 RMB via Alipay’s Huabei and Anyi Hua platforms, raised another 120,000 RMB from friends and family, and used his parents’ life savings to cover the 220,000 RMB deficit. He promised never to trade again—but less than six months later, seeing news of Bitcoin’s surge, he convinced himself "another chance had come."

The second time, he borrowed 150,000 RMB via online loans and another 150,000 RMB from relatives—totaling 300,000 RMB—for more high-leverage trades. After another blowup, he told himself "a few ten-thousand RMB I can handle slowly," burying a much larger time bomb.

By 2023, his debt had ballooned to over 600,000 RMB. Unable to secure enough through loans or family help, he sold his sister’s apartment—under 70 sqm—for 500,000 RMB, with relatives covering the remaining 100,000 RMB to clear the debt once again.

But this brief "debt freedom" brought no relief—only intensified psychological torment. Selling his sister’s dowry home weighed heavily on him. His parents were shocked, emotionally shattered. He confessed: "I felt extremely oppressed."

Crypto has cycles, and tales of rags-to-riches during bull markets continue to lure in the desperate—fueling the illusion that one more trade could reverse everything.

In 2024–2025, he mortgaged his own home, took out 700,000 RMB in high-interest loans (20–30% annual rate), plus another 300,000 RMB in online loans—bringing his total debt past one million RMB.

And of course, none of these leveraged bets ever paid off.

The cost of borrowing wasn’t just financial—it was the erosion of trust. To raise funds, he lied repeatedly, manipulating friends and family. As the saying goes: one lie requires another to cover it, draining relationships and credibility.

"In public I acted human; behind the scenes, I was a ghost. I lost even the basic底线of being a decent person..." Brother Rebirth said, before everything finally collapsed.

A friend exposed him to his wife, revealing the full scale of his debt. She broke down and filed for divorce. When his parents learned he had mortgaged the house, they gave up entirely, sending him this message:

"You’re possessed. You’ve mortgaged the house… This family no longer has you."

After the interview, Brother Rebirth created his own account, warning others never to borrow money to trade such products: "I destroyed my beautiful life with my own hands."

"Turning things around"—that phrase might refer to a subway station in Shenzhen, or symbolize the desperate dream of gamblers who’ve lost too much. But more often, it’s just a bottomless pit of compounding greed.

Lianger Steps In, Long Road Ahead

After Fengge’s video spread, Chinese-speaking crypto’s most famous contract trader, Lianger, posted online announcing he would donate 50,000 RMB to Brother Rebirth, plus an additional 60,000 RMB to cover monthly living expenses (5,000 RMB/month) for one year—specifically to prevent him from returning to contract trading.

Lianger understands Brother Rebirth deeply—they’ve both danced on the edge of contract trading, both tasted the bitterness of liquidation. His assistance feels less like charity and more like saving a version of his former self.

Yet even the kindest gestures must have boundaries.

Brother Rebirth’s addiction to speculative trading cannot be ignored. Fueled by the obsession to "turn things around" and the sunk-cost fallacy, he may easily fall back into the same trap—especially in a crypto culture where narratives of "borrowing to recover" are everywhere. And the person lending him money? None other than Lianger himself—the ultimate poster child of contract trading drama.

If a contract king gives you money and tells you to quit contracts, will you actually stop?

Don’t forget: in reality, Brother Rebirth still survives by driving a ride-hailing car. The grueling income he earns through physical labor moves far too slowly compared to the instant highs promised by leveraged trading.

With a million RMB in debt looming overhead, we don’t yet know which path he’ll choose—whether he’s chasing another shot at sudden riches, or striving simply to reclaim the dignity he once lost.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News