The essence of strategy is an arbitrage business.

TechFlow Selected TechFlow Selected

The essence of strategy is an arbitrage business.

Strategy is not in the leverage business, but in the arbitrage business.

Author: Dio Casares

Translation: TechFlow

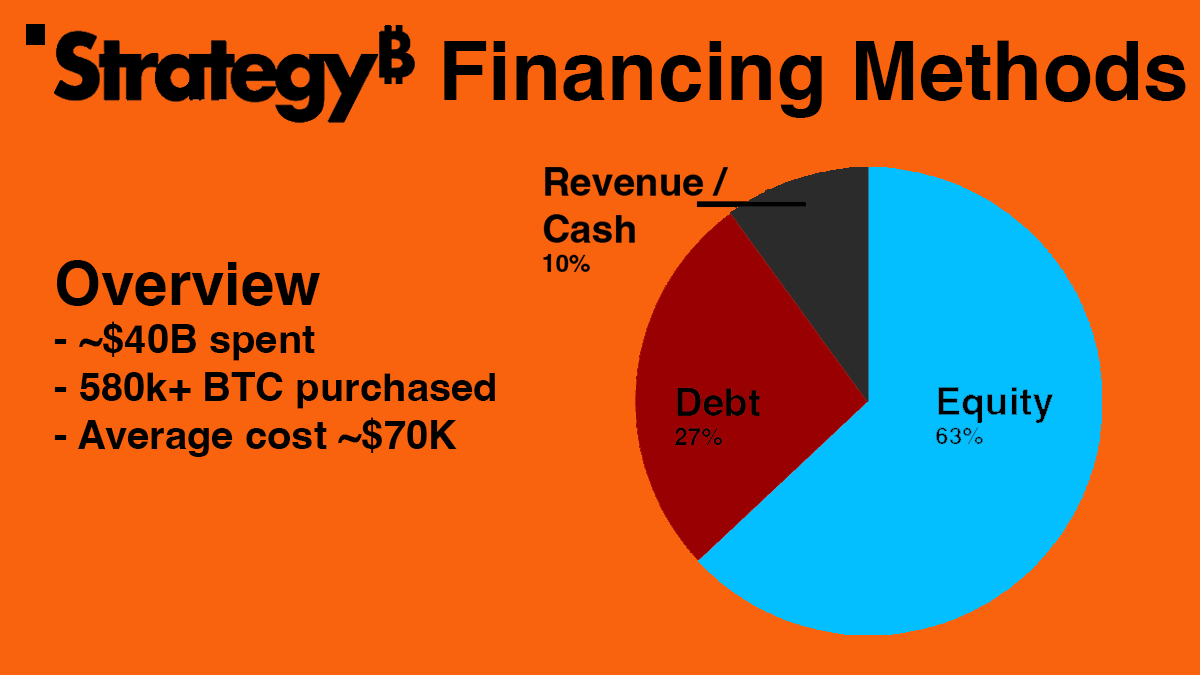

Over the past five years, Strategy has spent $40.8 billion—equivalent to Iceland's GDP—to acquire over 580,000 bitcoins. This represents 2.9% of the total bitcoin supply or nearly 10% of active bitcoins (1).

Strategy’s stock ticker $MSTR has risen by 1600% over the past three years, compared to Bitcoin’s increase of approximately 420% during the same period. This extraordinary growth has pushed Strategy’s valuation beyond $100 billion and earned it a place in the Nasdaq 100 Index.

This dramatic rise has also sparked skepticism. Some believe $MSTR could become a trillion-dollar company, while others sound alarm bells, questioning whether Strategy might be forced to sell its Bitcoin holdings, potentially triggering a massive selloff that could suppress Bitcoin’s price for years.

Yet, while these concerns are not entirely unfounded, most people lack a fundamental understanding of how Strategy operates. This article will delve into the mechanics of Strategy’s operations and examine whether it poses a major risk to Bitcoin accumulation or represents a revolutionary model.

How Does Strategy Acquire So Much Bitcoin?

Note: Data may differ from time of writing due to new financings, etc.

Broadly speaking, Strategy acquires funds to purchase Bitcoin through three main channels: revenue from its operating business, issuing shares/equity, and debt. Of these three, debt attracts the most attention. While debt is often scrutinized, the vast majority of capital Strategy uses to buy Bitcoin actually comes from equity issuance—selling shares to the public and using the proceeds to purchase Bitcoin.

This may seem counterintuitive—why would someone buy Strategy’s stock instead of Bitcoin directly? The answer is simple: it goes back to one of crypto’s favorite business models—arbitrage.

Why Do People Choose to Buy $MSTR Instead of $BTC Directly?

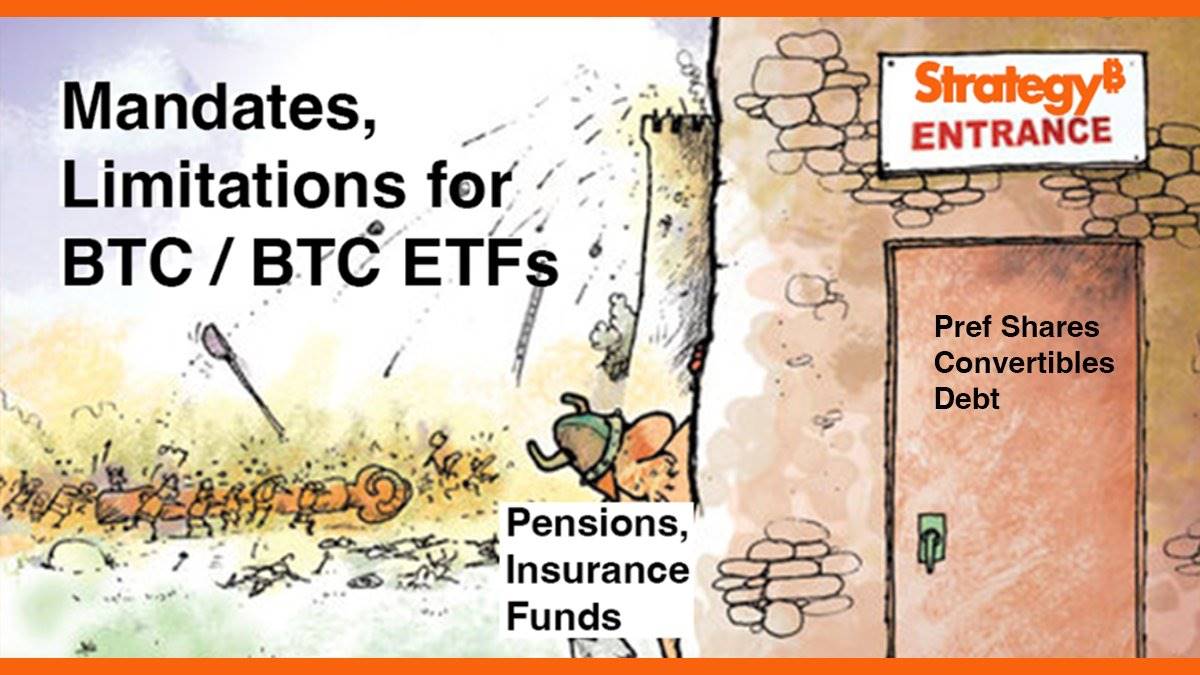

Many institutions, funds, and regulated entities operate under "investment mandates." These mandates define what assets a company can or cannot invest in. For example, credit funds can only buy credit instruments, equity funds can only buy stocks, and long-only funds can never short, and so on.

These mandates ensure investors that, for instance, an equity-only fund won’t invest in sovereign debt, and vice versa. They force portfolio managers and regulated entities—such as banks and insurers—to act more responsibly by limiting them to specific types of risk rather than allowing unrestricted exposure. After all, the risk profile of investing in Nvidia stock is vastly different from buying U.S. Treasuries or allocating capital to money markets.

Because these mandates tend to be highly conservative, significant pools of capital within funds and institutions remain “locked” and unable to access emerging industries or opportunities—including cryptocurrency, and especially direct exposure to Bitcoin—even if fund managers personally wish to gain some level of Bitcoin exposure.

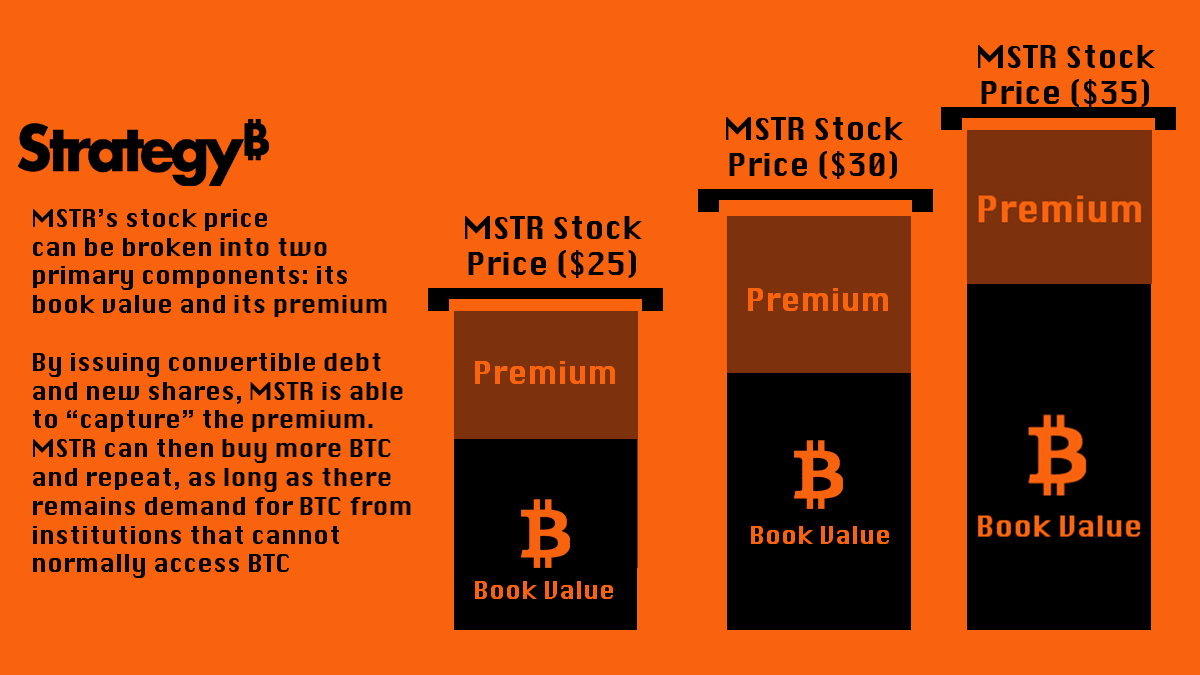

Michael Saylor, Strategy’s founder and Executive Chairman (@saylor), recognized this gap between institutional demand for asset exposure and their actual investment constraints—and capitalized on it. Before Bitcoin ETFs existed, $MSTR was one of the few reliable vehicles for stock-only entities to gain Bitcoin exposure. This meant Strategy’s shares frequently traded at a premium, as demand for $MSTR exceeded its available supply. Strategy has consistently leveraged this premium—the difference between the market value of $MSTR shares and the underlying Bitcoin value per share—to raise capital and buy more Bitcoin, while increasing Bitcoin ownership per share.

Over the past two years, holding $MSTR delivered a 134% "return" in Bitcoin-denominated terms—one of the highest returns among scalable Bitcoin investment strategies in the market. Strategy’s product directly serves entities that typically cannot access Bitcoin directly.

This is a textbook case of "mandate arbitrage." As noted earlier, prior to the launch of Bitcoin ETFs, many market participants were barred from investing in non-exchange-traded securities. However, as a publicly listed company, Strategy was permitted to hold and purchase Bitcoin ($BTC). Even now that Bitcoin ETFs have launched, it's completely incorrect to assume this strategy is obsolete—many funds remain prohibited from investing in ETFs, including the majority of mutual funds managing $25 trillion in assets.

A classic case study is Capital Group’s Capital International Investors Fund (CII), which manages $509 billion in assets but is restricted to equities—unable to directly hold commodities or ETFs (Bitcoin is largely classified as a commodity in the U.S.). Due to these restrictions, Strategy became one of the few tools CII could use to gain exposure to Bitcoin’s price movements. In fact, CII’s confidence in Strategy is so high that it holds around 12% of Strategy’s shares, making CII one of the largest non-insider shareholders.

Debt Terms: A Constraint for Others, an Advantage for Strategy

Beyond favorable supply dynamics, Strategy also enjoys advantages in the structure of its debt. Not all debt is created equal. Credit card debt, mortgage loans, margin loans—these are fundamentally different forms of borrowing.

Credit card debt is personal, unsecured, and based on income and repayment ability, often carrying interest rates above 20% annually. Margin loans are secured against existing assets (typically stocks), and if the value of those assets nears the loan amount, brokers or banks can liquidate your entire position. Mortgage loans, however, are considered the "holy grail" of debt because they allow you to finance an appreciating asset (like a house) while only paying periodic interest (mortgage payments).

While not entirely risk-free—especially in today’s rate environment, where interest can accumulate to unsustainable levels—mortgages remain the most flexible form of debt due to lower rates and the fact that lenders cannot seize the asset as long as monthly payments are made.

Typically, such mortgage-like structures apply only to real estate. But corporate loans can sometimes function similarly—requiring interest payments over a set term, with the principal (original loan amount) due only at maturity. Although loan terms vary widely, generally, as long as interest payments are met, debt holders have no right to seize corporate assets.

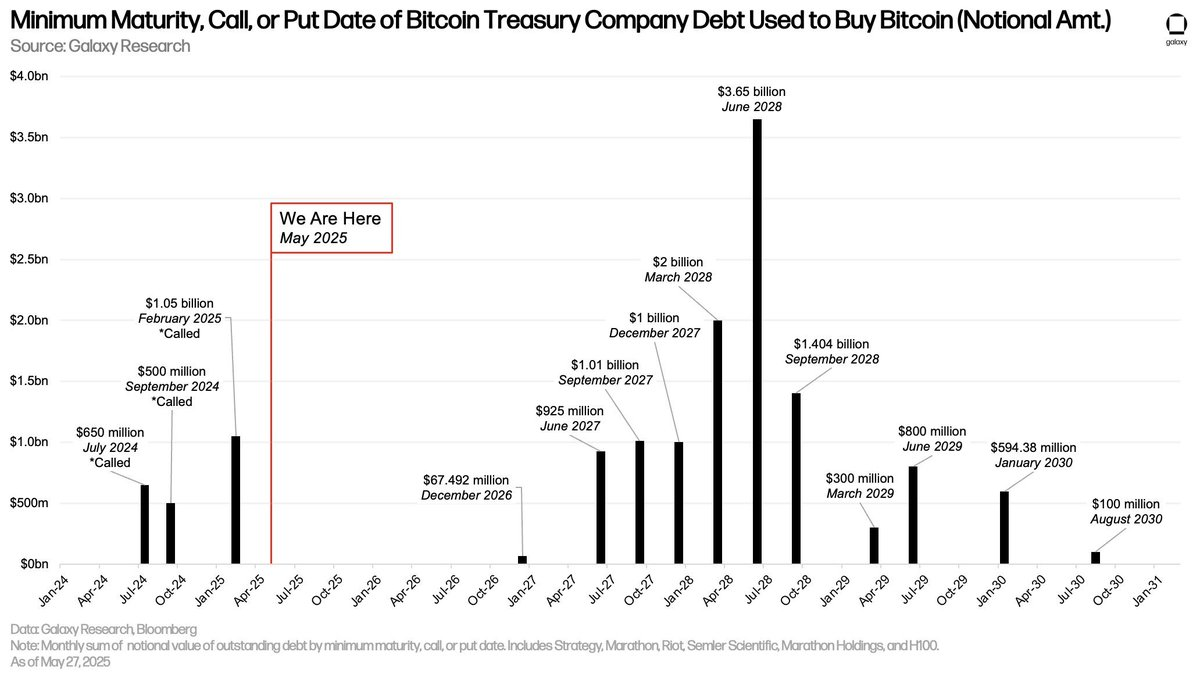

Chart source: @glxyresearch

This flexibility allows corporate borrowers like Strategy to better withstand market volatility, turning $MSTR into a vehicle for "harvesting" crypto market volatility. That said, it does not eliminate risk entirely.

Conclusion

Strategy is not in a leveraged business—it's in an arbitrage business.

Although it currently carries some debt, Bitcoin would need to fall to around $15,000 per coin over the next five years to pose a serious threat to Strategy. With the expansion of "treasury companies"—firms replicating Strategy’s Bitcoin accumulation model—including MetaPlanet, Nakamoto by @DavidFBailey, and others, this will become another focal point of discussion.

However, if these treasury companies, in competing with each other, stop charging premiums and begin taking on excessive debt, the entire landscape could shift—with potentially severe consequences.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News