Stablecoin Upheaval: From the U.S. to Hong Kong, a Global Regulatory Landscape

TechFlow Selected TechFlow Selected

Stablecoin Upheaval: From the U.S. to Hong Kong, a Global Regulatory Landscape

Stablecoins are stepping out of the gray zone and moving toward regulated financial mainstream, as the window of currency-level benefits gradually opens.

Author: imToken

Stablecoins, the form of crypto finance closest to RWA, are undergoing an unprecedented regulatory transformation.

In the early hours of June 18, 2025, the U.S. Senate passed the GENIUS Act (Giving Every Nation a United Stablecoin) with 68 votes in favor and 30 opposed—a landmark in crypto payment legislation. This marks the first time the United States has established a clear compliance pathway for stablecoins at the federal level, signaling a pivotal shift for digital assets from technical experimentation toward institutionalization.

Meanwhile, Hong Kong has proactively advanced its regulatory framework through the new Stablecoin Ordinance and upcoming licensing applications, with formal acceptance of stablecoin issuer licenses set to begin on August 1. This positions Hong Kong as the world’s first financial hub to implement a localized stablecoin licensing regime.

As discussed in "Institutional Adoption Landscape: Holdings, Stablecoins, and Legislation Advance Together—Are Giants Reshaping Web3?", this new era of compliance led by jurisdictions like the U.S. and Hong Kong may profoundly reshape the role of stablecoins within the global financial system. The underlying forces behind these changes are rapidly moving into the spotlight.

01 United States: Firing the First Shot in Stablecoin Compliance

Over the past five years, which has been the most successful crypto financial product globally?

The answer is not hard to guess—and it's neither DeFi innovations like Uniswap that ignited the DeFi Summer, nor NFTs such as CryptoPunks that sparked the digital art craze. Instead, it’s something everyone now takes for granted: stablecoins.

Indeed, beyond niche applications in DeFi and NFTs, stablecoins aimed at everyday users have become one of the most widely accepted use cases across both crypto and non-crypto audiences. They are increasingly serving as critical bridges for on-chain payments, cross-border settlements, financial transactions, and even Web2 scenarios, significantly expanding and deepening the user base of the crypto economy.

Objectively speaking, however, their widespread adoption has long operated in a gray area—lacking unified regulation, transparent reserve mechanisms, and clear legal definitions—creating key barriers to institutional participation and mainstream adoption.

As a bellwether for global financial regulation, the passage of the U.S. GENIUS Act carries milestone significance. For the first time at the federal level, the bill comprehensively defines stablecoins, sets issuance qualifications, outlines reserve requirements, and protects user rights. Key provisions include mandatory 1:1 reserve backing: all issuers must hold fiat reserves equal in value to their issued stablecoins, allowing users to redeem 1:1 at any time.

Issuance rights will be limited to banks, licensed non-bank financial institutions, and audited compliant enterprises. The scope covers various types of stablecoins—including enterprise settlement and consumer payment variants—meaning that stablecoin operations previously existing in regulatory limbo will now enter a framework of “clear laws and regulations.” This shift will have profound implications for companies like Circle, PayPal, and JPMorgan actively advancing stablecoin initiatives.

Accordingly, Circle—the only publicly listed stablecoin issuer in the U.S.—has seen its stock surge since its IPO on June 5, rising from an initial price of $31 to a peak of $263.45, an increase of over 100%, placing it alongside major players like Coinbase and Robinhood.

Notably, Circle’s market capitalization briefly approached $60 billion—nearly matching the total circulating supply of its USDC stablecoin—signaling that the market is beginning to revalue the compliance-driven stablecoin model.

This demonstrates that the potential of “compliant stablecoins” is no longer confined to Web3 narratives but is now being integrated into mainstream financial discourse. Regardless of future developments, this moment represents a turning point for digital assets gaining broader visibility and legitimacy within regulated financial frameworks.

02 Hong Kong: Leading the Way with Licensing and Rapid Implementation

Since issuing the "Policy Statement on the Development of Virtual Assets in Hong Kong" on October 31, 2022, Hong Kong has remained at the forefront of crypto regulation among major global jurisdictions.

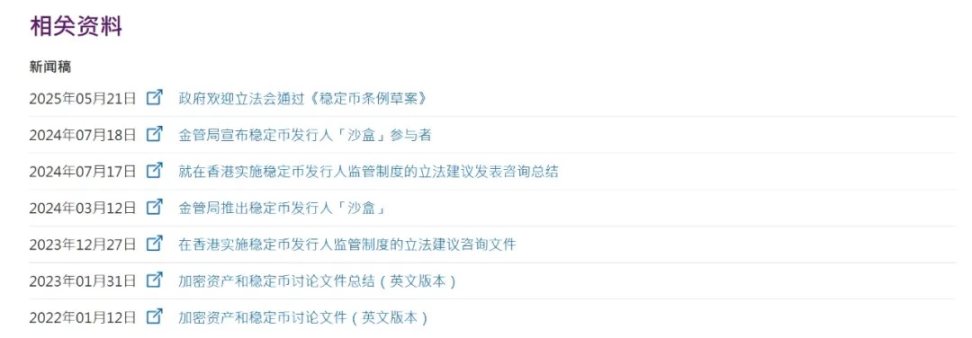

As early as January 2022, the Hong Kong Monetary Authority (HKMA) released a discussion paper on crypto assets and stablecoins, inviting stakeholder feedback. At the start of last year, it launched a “sandbox” for stablecoin issuers to understand the business models of institutions planning to issue fiat-backed stablecoins in Hong Kong.

The latest Hong Kong Stablecoin Ordinance will take effect on August 1, when the HKMA will begin accepting license applications. The authority has already initiated market consultations on detailed implementation guidelines.

Source: Hong Kong Monetary Authority

Based on current disclosures, the regulatory framework adheres to the principle of “same activity, same risk, same regulation.” Key requirements include obtaining a stablecoin issuance license from the HKMA, establishing a locally registered entity, fully backing issued tokens with reserves, and holding highly liquid assets such as fiat currencies or short-term government bonds.

The structure closely resembles the U.S. regulatory approach. Notably, the Hong Kong regime applies to stablecoins pegged to major currencies like USD and HKD. Its core goal is to provide a stable settlement medium for Web3 finance while attracting more institutions to launch stablecoin operations in the city.

As a leading international financial center, Hong Kong has long pursued paths of financial innovation. In many ways, the stablecoin market aligns perfectly with Hong Kong’s strengths—offering diverse financial services backed by years of experience, mature risk management systems, robust trading infrastructure, and a large customer base.

This enables Hong Kong to emphasize flexible implementation and international alignment, encouraging institutions to use the city as a gateway to explore stablecoin issuance and clearing routes across Asia. Local leaders such as HashKey and OSL are reportedly preparing license applications, making them key indicators of how Hong Kong integrates crypto compliance with traditional financial infrastructure.

03 Europe, South Korea, and Other Emerging Hubs

Beyond the U.S. and Hong Kong, the European Union’s MiCA Regulation (Markets in Crypto-Assets), effective since 2024, provides comprehensive oversight of crypto assets, including detailed classification of stablecoins into two main categories: EMTs (Electronic Money Tokens) and ARTs (Asset-Referenced Tokens).

EMTs refer to stablecoins pegged to a single fiat currency—such as EURC issued by Circle—while ARTs are linked to baskets of assets, similar to the failed Libra project. EMT issuers must obtain authorization as electronic money institutions under EU law, submit to central bank supervision, disclose reserve composition and operational mechanisms, and guarantee user redemption rights. Circle’s EURC is among the first products to benefit from MiCA compliance.

South Korea, another influential player in the crypto space, has also taken steps forward. The ruling party of newly elected President Lee Jae-myung has proposed the Digital Asset Basic Act, which would allow Korean companies with at least 500 million KRW (~$370,000) in equity and sufficient reserve-backed refund guarantees to issue stablecoins.

Source: Cointelegraph

According to data from the Bank of Korea, stablecoin trading volume in South Korea surged, reaching 57 trillion KRW (~$42 billion) in Q1 across five major domestic exchanges: Upbit, Bithumb, Korbit, Coinone, and Gopax.

Recently, senior deputy governor Ryu Sang-don stated that the introduction of won-denominated stablecoins should proceed gradually—starting with the most strictly regulated commercial banks before eventually extending access to non-bank institutions.

Additionally, several other major financial centers have previously introduced local stablecoin frameworks or pilot programs:

-

The Monetary Authority of Singapore (MAS) proposed a stablecoin regulatory draft in 2023 emphasizing 1:1 reserves, transparent disclosure, and local operational presence;

-

Abu Dhabi Global Market (ADGM) launched a stablecoin settlement pilot, attracting cross-border operations from PayPal and USDC;

-

Japan enacted new legislation permitting banks and trust companies to issue stablecoins;

Overall, European regulators focus on protecting user rights and financial stability, while South Korea leans toward collaboration with domestic financial and tech giants. These moves collectively indicate that global stablecoin regulation is converging toward standardized frameworks. Stablecoins are no longer operating in legal gray zones but are increasingly recognized as formal components of financial innovation. Regulatory sandboxes are becoming strategic tools to attract Web3 projects and investment.

Dialectically speaking, starting in 2025—whether regarding crypto asset ETFs or stablecoins—a new regulatory cycle has clearly emerged as a watershed moment for Web3 and the broader crypto industry. As compliance becomes the dominant theme in the next phase of stablecoin development, national-level institutional experiments are not only reshaping market dynamics but also fundamentally shaping the future infrastructure of Web3 finance.

In sum, globally, stablecoins are undergoing a dramatic transition—from “wild expansion” to “institution-led governance.” With regulations rolling out worldwide, this structural transformation is now unfolding in full force.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News