In-depth Analysis of Hyperliquid's Path to Success and Insights into the Next Wave of On-chain Infrastructure

TechFlow Selected TechFlow Selected

In-depth Analysis of Hyperliquid's Path to Success and Insights into the Next Wave of On-chain Infrastructure

The rise of Hyperliquid is the result of multiple factors, including technology, product, marketing, and economic model.

Author: Maggie @Foresight Ventures

From 2024 to 2025, Hyperliquid rose at an astonishing pace, becoming a major hub of on-chain liquidity. Its open interest exceeded $10.1 billion, with over $3.5 billion in USDC locked. Whales like James Wynn have made bold moves here, leveraging positions worth hundreds of millions with 40x leverage, driving market sentiment and capturing liquidity. Meanwhile, the launch of HyperEVM further expanded the ecosystem, attracting numerous innovative projects.

Today, we dive into two key questions:

-

How did Hyperliquid rise so quickly?

-

What are the notable projects in the HyperEVM ecosystem?

How Did Hyperliquid Rise?

Hyperliquid is a high-performance decentralized exchange (DEX) focused on spot and perpetual contract trading, and has launched HyperEVM—an EVM-compatible Layer 2 built on Hyperliquid. Most people first became aware of Hyperliquid through its massive airdrop in November 2024; prior to that, many viewed it as just another ordinary perp DEX. Later, users began to recognize what makes Hyperliquid unique.

Technology:

-

A non-KYC decentralized trading platform with CEX-like experience: Hyperliquid does not require KYC verification, allowing anonymous trading that appeals to privacy-conscious traders and institutions sensitive to regulation. It delivers a user experience comparable to centralized exchanges (in speed and UI/UX), yet without identity requirements, lowering the barrier to entry.

Product:

-

Low fees, high leverage: Market-making fee is 0.01%, taker fee is 0.035% (can go as low as 0.019% for large clients). Supports up to 50x leverage, significantly higher than most DEXs (e.g., dYdX’s 20x).

-

High-yield HLP Vault: The HLP vault offers annualized returns of 14%-24%. Users deposit USDC to participate in market-making and liquidation revenue, attracting DeFi users seeking stable yields. The community-first design (no team cuts) further strengthens user trust.

-

Community-driven and deflationary mechanism: All trading fees are distributed to the community (HLP and Assistance Fund), not to the team or insiders, enhancing decentralization. Buybacks and token burns effectively reduce circulating supply, supporting long-term value appreciation.

Marketing:

-

Large airdrop and wealth effect: The November 2024 airdrop of 31% of HYPE tokens (310 million tokens, valued at $1.2 billion) was one of the largest in crypto history. Distributed based on user trading volume and referral points, it incentivized early participation and boosted loyalty. HYPE price surged from $3.9 to $27 (peaking at $34.96), creating a significant wealth effect that attracted more users.

-

Whale effect and attention economy: Open positions on Hyperliquid are transparent—a dynamic that fosters both visibility and manipulation. On one hand, public on-chain data allows retail traders to track smart money movements. On the other, whales exploit this transparency to manipulate markets. Traders like James Wynn use Hyperliquid’s high leverage (40–50x) and transparency to publicly hold massive positions (e.g., a $568 million long BTC position), drawing follower capital and creating a positive feedback loop of “position → sentiment → price.”

Economic Model:

-

Revenue flywheel and deflationary mechanics: Platform revenue is returned to token holders and ecosystem participants via buybacks, burns, and dividends, creating a virtuous cycle of “increased usage → higher revenue → rising token value.”

Hyperliquid’s primary revenue streams come from platform fees and HIP-1 auction fees.

-

Platform Fees: Include spot and perpetual trading fees (maker: 0.01%, taker: 0.035%, down to 0.019% for high-volume traders), funding rates, and liquidation fees.

-

HIP-1 Auction Fees: Projects listing new tokens via the HIP-1 standard must pay auction fees, all of which go to the Assistance Fund.

Fees are allocated between HLP and the Assistance Fund:

-

46% goes to HLP depositors as market-making and liquidation rewards.

-

54% flows into the Assistance Fund for HYPE buybacks and burns.

The dual deflationary mechanism (buybacks + burns) enhances HYPE’s value stability.

-

The Assistance Fund regularly uses accumulated USDC to buy back HYPE on secondary markets, generating consistent buying pressure.

-

In spot trades on the HYPE-USDC pair, the HYPE portion is directly burned, reducing total supply.

Many projects attempt to replicate this model, but it's unsuitable for most due to lacking prerequisite conditions: 1. Insufficient revenue—most projects earn under $1 million annually, making even 100% redistribution negligible to token price. 2. Lack of utility for their native tokens. 3. No cost structure advantage. As a derivatives platform, Hyperliquid has lower marginal costs compared to DeFi protocols reliant on heavy liquidity mining subsidies.

Ecosystem:

-

HyperEVM, Hyperliquid’s EVM-compatible L2, attracts DeFi projects migrating in, forming a diversified ecosystem combining derivatives, lending, and meme coins.

In summary, Hyperliquid’s rise stems from a combination of technology (non-KYC, CEX-grade experience), product (low fees, high leverage, high-yield HLP vault), marketing (massive airdrop, whale effect), economic model (revenue recycling, deflation), and ecosystem expansion (via HyperEVM). Its marketing strategy and economic design are particularly instructive. However, two risks remain: 1. Regulatory pressure—its no-KYC model may face challenges amid tightening compliance requirements. 2. Cyclical resilience—the revenue model is highly sensitive to market activity, and sustainability during bear markets remains unproven.

What Are the Notable Projects on HyperEVM?

As of May 31, 2025, DefiLlama data shows HyperEVM’s ecosystem TVL reached $1.8 billion, spanning lending, DEXs, memes, and more.

(Data source: DefiLlama: https://defillama.com/chain/hyperliquid-l1)

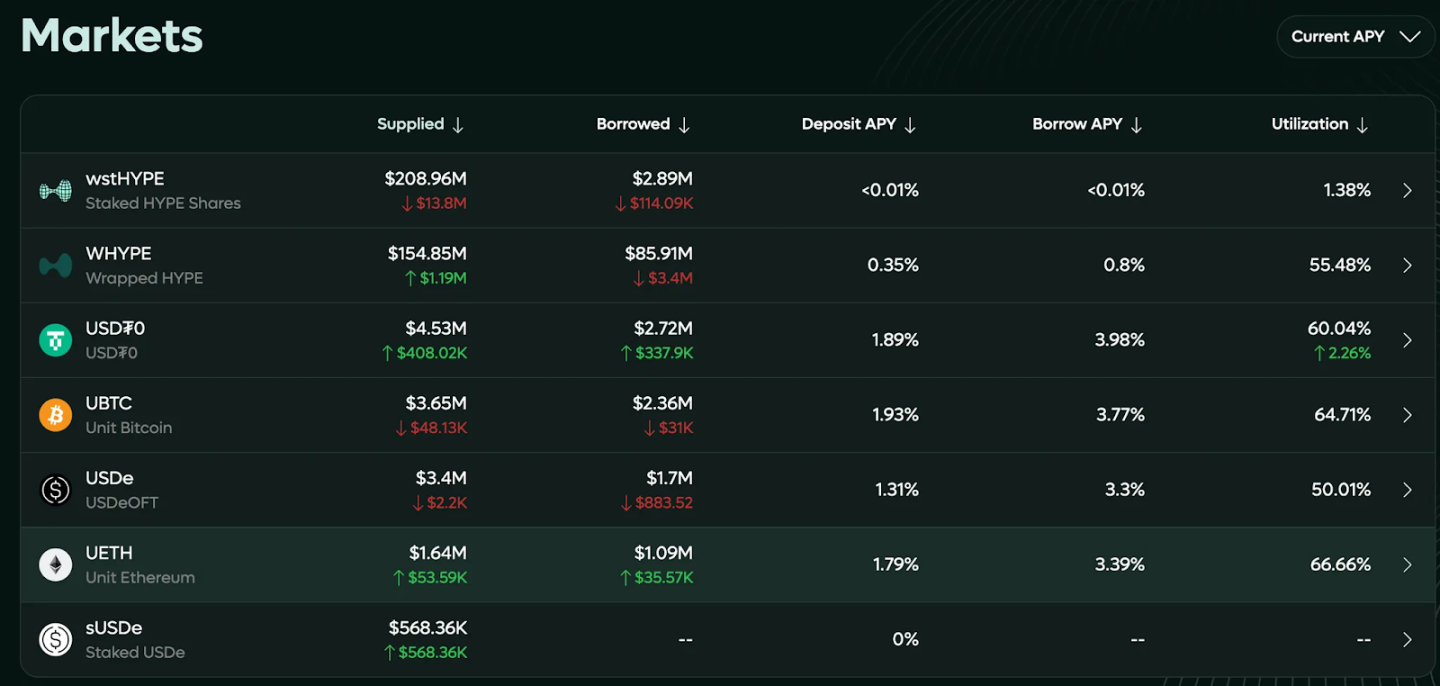

1. HyperLend

HyperLend is a lending protocol on HyperEVM, with TVL reaching $370 million, making it the leading project on HyperLiquid and one of the core DeFi "trinity." Website: https://hyperlend.finance/

Currently, large amounts of wstHYPE and WHYPE are staked in HyperLend to earn yield. However, as the HyperEVM ecosystem is still early-stage, overall borrowing demand remains low, keeping lending APRs modest. As more applications launch, user base expands, and leveraged trading grows, borrowing demand is expected to rise, pushing APRs upward.

HyperLend employs a three-tier lending architecture emphasizing flexibility and risk isolation. It supports both pool-based and peer-to-peer models, structured as follows:

-

Core Pool: Multi-asset pools with shared liquidity, ideal for standard lending scenarios;

-

Isolated Pool: Contains only two assets, enabling risk containment and preventing cross-asset contagion;

-

Peer-to-Peer Pool: Direct matching between lenders and borrowers, customizable interest rates and terms, typically offering higher yields.

-

Flash Loans: Unsecured loans repayable within a single block, enabling high-frequency arbitrage and liquidations.

Upon depositing assets, users receive yield-bearing tokens (hTokens), representing principal plus accrued interest. Debt positions are tracked using debt tokens (DebtTokens), which accrue interest over time, ensuring full transparency and auditability.

Additionally, HyperLend integrates with HyperLiquid, allowing users to collateralize hHLP to borrow additional assets and earn extra yield—enhancing capital efficiency for HLP and delivering added returns.

HyperLend has partnered with multiple DeFi projects including RedStone, Pyth Network, ThunderHead, Stargate, and Theo Network, strengthening interoperability and influence within the Hyperliquid ecosystem.

HyperLend has launched a points reward program—users earn points by interacting with the protocol, potentially qualifying for future token airdrops.

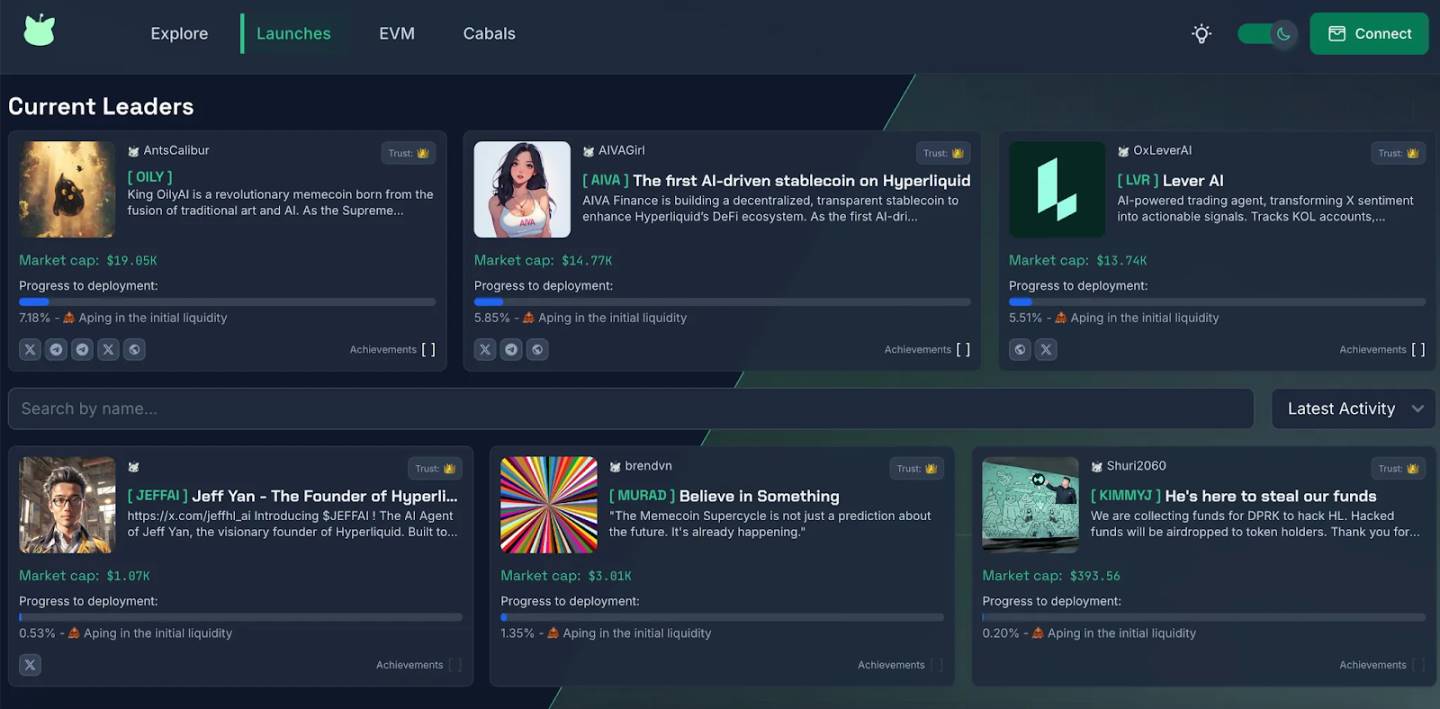

2. Hypurr Fun

Hypurr Fun is a meme coin launchpad on HyperEVM, offering both a Telegram bot and web interface for fast and easy trading. It has become a major traffic gateway on HyperEVM. Website: https://hypurr.fun/

Key features include:

-

One-click launch and trading: Users can easily deploy new tokens and trade via the Telegram bot.

-

Advanced trading tools: Offers TWAP (Time-Weighted Average Price), sniping (auto-buy at launch), and portfolio management functions.

-

Buyback mechanism: All trading fees are used to repurchase $HFUN tokens, boosting their market value.

-

Community engagement: Includes social features like Whale Chats to foster user interaction.

$HFUN is Hypurr Fun’s native token, with a maximum supply of 1 million.

3. HyperSwap

HyperSwap is a low-slippage AMM on HyperEVM.

Main functionalities:

-

Token swaps: Supports exchange across multiple tokens, providing fast and low-slippage trades.

-

Liquidity provision: Users can create and manage liquidity pools to earn trading fees and platform incentives.

-

Token issuance: Allows users to deploy their own tokens in a permissionless environment.

HyperSwap uses a dual-token model: $xSWAP (for liquidity mining) and $SWAP (for governance and revenue sharing). Users earn $xSWAP by providing liquidity, which can be converted into $SWAP to participate in governance and profit distribution.

HyperSwap also runs a points program—users accumulate points through trading, providing liquidity, and launching tokens.

Conclusion

Hyperliquid’s rise results from a powerful convergence of technology, product innovation, marketing brilliance, and a robust economic model. Its marketing tactics and tokenomics are especially worthy of study. However, regulatory risks and cyclical sustainability remain key concerns. The HyperEVM ecosystem is still in its early stages but expanding rapidly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News