Uncovering Bullish: Parent Company Bought the Bottom with 160,000 BTC, Earning Billions Over Six Years

TechFlow Selected TechFlow Selected

Uncovering Bullish: Parent Company Bought the Bottom with 160,000 BTC, Earning Billions Over Six Years

Although Bullish is not one of the most well-known cryptocurrency exchanges, its origins are exceptionally prestigious.

By Jaleel and Peggy, BlockBeats

Circle, the issuer of USDC, successfully listed on the U.S. stock market, surging 168% on its first day and raising $1.1 billion, becoming the first publicly traded stablecoin company. Gemini has also followed closely by submitting its IPO documents. Meanwhile, Bullish—a lesser-known exchange platform—has reportedly secretly filed for an IPO with the SEC.

In the highly profitable CEX sector of the crypto world, Bullish isn’t a household name, but in reality, its origins are exceptionally prestigious.

In 2018, EOS emerged out of nowhere, hailed as the "Ethereum killer." Its parent company, Block.one, rode this wave to conduct the longest and largest ICO (Initial Coin Offering) in history, raising a staggering $4.2 billion.

Years later, after the EOS hype faded, Block.one “started anew,” pivoting to launch Bullish—an exchange focused on compliance and targeting traditional financial markets—prompting backlash from the EOS community, which effectively expelled Block.one.

In July 2021, Bullish officially launched. Initial capital included: $100 million in cash, 164,000 Bitcoin (worth about $9.7 billion at the time), and 20 million EOS tokens contributed by Block.one; external investors added another $300 million, including PayPal co-founder Peter Thiel, hedge fund titan Alan Howard, and prominent crypto investor Mike Novogratz.

By these figures, Bullish’s total assets exceeded $10 billion at launch—an extraordinarily strong start.

Pro-Circle, Anti-Tether: Bullish Aims for Compliance

Bullish’s positioning has always been clear: scale matters less than compliance.

This is because Bullish's ultimate goal isn't just to profit within the crypto space—it aims to become a legitimate, publicly listed financial exchange.

Prior to full operations, Bullish reached an agreement with public company Far Peak to invest $840 million for a 9% stake, then merge in a $2.5 billion deal, achieving a backdoor listing and lowering traditional IPO barriers.

At that time, media reports valued Bullish at $9 billion.

Thomas, the former CEO of Far Peak, now serves as Bullish’s current CEO. He brings strong compliance credentials: previously COO and President of the New York Stock Exchange, where he excelled and built deep relationships with Wall Street giants, CEOs, and institutional investors. He holds extensive resources across regulatory and capital circles.

Notably, while Bullish’s outward investments and acquisitions have been limited, they include high-profile names in crypto: Babylon (Bitcoin staking protocol), ether.fi (restaking protocol), and blockchain media outlet CoinDesk.

In short, Bullish stands out as the crypto exchange most eager to transform into a “Wall Street正规军” (mainstream financial institution).

But ideals are lush, reality is harsh. Compliance proved far more difficult than expected.

With increasingly tough U.S. regulations, Bullish’s original merger-listing plan was terminated in 2022, ending an 18-month effort. Bullish had considered acquiring FTX for rapid expansion, but the deal fell through. The company was forced to seek new compliance pathways—such as shifting focus to Asia and Europe.

Bullish team at Hong Kong Consensus Conference

Earlier this year, Bullish obtained Type 1 (securities trading) and Type 7 (automated trading services) licenses from Hong Kong’s Securities and Futures Commission (SFC), along with a virtual asset exchange license. It also secured licensing from Germany’s Federal Financial Supervisory Authority (BaFin) for crypto trading and custody services.

Bullish currently employs around 260 people globally, with over half based in Hong Kong, and the rest distributed across Singapore, the U.S., and Gibraltar.

Another clear sign of Bullish’s commitment to compliance: being pro-Circle and anti-Tether.

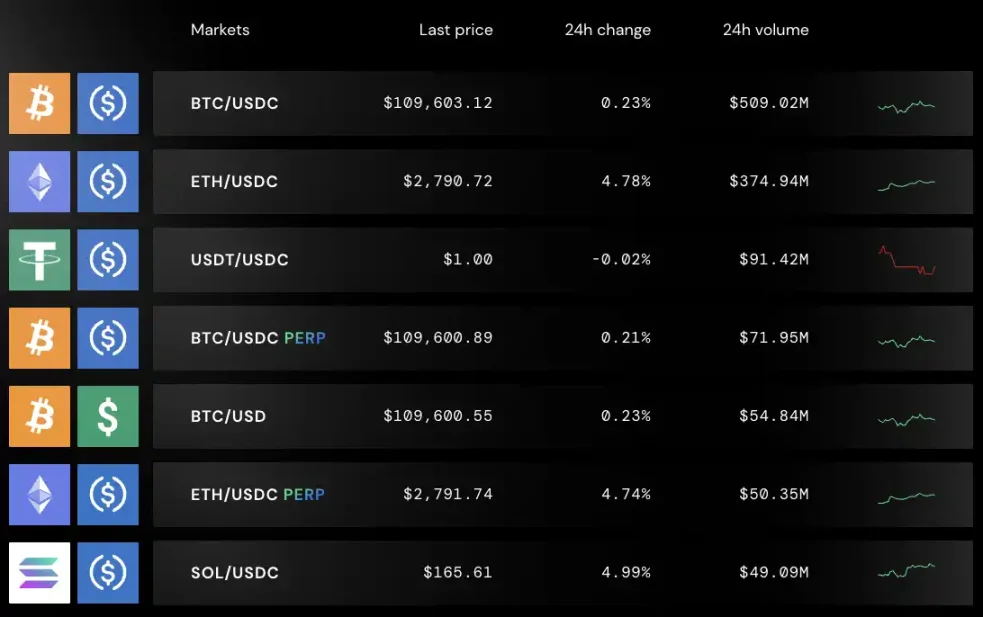

On the Bullish platform, the top stablecoin trading pairs are overwhelmingly dominated by USDC—not USDT, despite the latter’s larger circulation and longer history. This reflects Bullish’s clear stance on regulatory alignment.

In recent years, as USDT faces growing regulatory pressure from the U.S. SEC, its market dominance has begun to waver. In contrast, USDC—the stablecoin jointly developed by compliant firm Circle and Coinbase—not only successfully went public on the U.S. stock market as the “first stablecoin stock,” but has also gained favor from capital markets with strong stock performance. Thanks to its transparency and regulatory compatibility, USDC’s trading volume continues to surge.

According to a recent report by Kaiko, USDC’s trading volume on centralized exchanges (CEX) rose significantly in 2024, reaching $38 billion in March alone—far surpassing the monthly average of $8 billion in 2023. Among platforms, Bullish and Bybit lead in USDC trading volume, together capturing approximately 60% of the market share.

The Love-Hate Relationship Between Bullish and EOS

If one sentence could describe the relationship between Bullish and EOS, it would be: “the ex and the new flame.”

Although the price of A (formerly EOS) surged 17% following news of Bullish’s secret IPO filing, the truth is that relations between the EOS community and Bullish remain strained—because after abandoning EOS, Block.one immediately embraced Bullish.

Back in 2017, during the golden age of blockchain projects, Block.one released a whitepaper introducing EOS—a so-called superchain promising “one million TPS and zero fees”—which quickly attracted global investor enthusiasm. Within a year, EOS raised $4.2 billion via ICO, setting an industry record and fueling dreams of dethroning Ethereum.

But the dream collapsed as fast as it began. After the mainnet launch, users quickly discovered that the chain wasn’t nearly as “invincible” as advertised. While transactions didn’t require fees, they did require staking CPU and RAM—making the process complex and user-unfriendly. Node elections were far from the promised “democratic governance,” instead rapidly falling under control of whales and exchanges, leading to vote-buying and mutual vote-padding.

Yet what truly accelerated EOS’s decline wasn’t just technical flaws, but internal resource misallocation at Block.one.

Block.one had originally pledged $1 billion to support the EOS ecosystem, but in practice did the opposite: making large purchases of U.S. Treasury bonds, hoarding 160,000 BTC, investing in failed social product Voice, and spending funds on stock trading and domain acquisitions. Very little was actually used to support EOS developers.

Meanwhile, power within the company was highly centralized, with key executives almost entirely consisting of Block.one founder BB, his relatives, and close friends—forming a tight-knit “family-run business.” In 2020, BM announced his departure from the project, foreshadowing the complete split between Block.one and EOS.

What truly ignited fury among the EOS community was the emergence of Bullish.

BB, co-founder of Block.one

In 2021, Block.one announced the launch of Bullish, claiming to have already secured $10 billion in funding, backed by elite investors like PayPal co-founder Peter Thiel and Wall Street veteran Mike Novogratz. The new platform emphasized compliance and stability, aiming to serve as a bridge between crypto and institutional finance.

However, Bullish shares virtually no connection with EOS—neither technically nor brand-wise. It doesn’t use EOS technology, doesn’t accept EOS tokens, denies any association, and offered not even a basic thank-you.

To the EOS community, this felt like a public betrayal: Block.one used resources accumulated through EOS to build a “new love.” And EOS was left behind.

Thus began the community’s backlash.

At the end of 2021, the community launched a “fork rebellion” to cut off Block.one’s control. The EOS Foundation stepped forward as the community’s representative to negotiate with Block.one. But after a month of talks exploring multiple options, no agreement was reached. Ultimately, the EOS Foundation teamed up with 17 nodes to revoke Block.one’s authority and remove it from EOS’s management. In 2022, the EOS Network Foundation (ENF) filed a legal suit accusing Block.one of breaking its ecosystem commitments. In 2023, the community even considered a hard fork to completely isolate Block.one and Bullish’s assets.

After the split between EOS and Block.one, the community engaged in years-long litigation over ownership of the raised funds—but to date, Block.one still retains control and usage rights over the money.

So in the eyes of many in the EOS community, Bullish is not simply a “new project,” but rather a symbol of betrayal—a shiny yet shameful “new lover” built on their lost ideals.

In 2025, EOS rebranded to Vaulta, aiming to build Web3 banking services atop its blockchain, and renamed its token from EOS to A, seeking to move past its history.

Just How Rich Is Block.one?

We know that early on, Block.one raised $4.2 billion—the largest fundraising event in crypto history. In theory, this sum could have sustained long-term development of EOS, supported developers, driven innovation, and nurtured ecosystem growth. Yet when EOS developers pleaded for funding, Block.one handed out checks as small as $50,000—less than two months’ salary for a Silicon Valley programmer.

“Where did the $4.2 billion go?” the community asked.

On March 19, 2019, BM revealed part of the answer in an email to Block.one shareholders: as of February 2019, Block.one’s total holdings (cash and invested funds) amounted to $3 billion. Of this, about $2.2 billion was invested in U.S. government bonds.

So where did the $4.2 billion go? Largely into three buckets: $2.2 billion in U.S. Treasuries—low risk, steady returns, preserving wealth; 160,000 Bitcoin—now worth over $16 billion; and minor stock plays and acquisition attempts, such as the failed Silvergate investment and purchase of the Voice domain.

What many don’t realize is that Block.one, the parent company of EOS, is currently the private company holding the most Bitcoin—160,000 BTC, 40,000 more than stablecoin giant Tether.

Data source: bitcointreasuries

At the current price of $109,650, this 160,000 BTC stash is worth approximately $17.544 billion. That means just from Bitcoin appreciation, Block.one has made over $13 billion in paper profits—about 4.18 times its original ICO raise.

From a “cash is king” perspective, Block.one today is undeniably successful—even more “forward-thinking” than MicroStrategy—and ranks among the most profitable project teams in crypto history. But not because it “built a great blockchain,” rather because it mastered how to preserve principal, grow assets, and exit gracefully.

This is the ironic and real side of the crypto world: those who win in the end aren’t necessarily the ones with the best technology or the brightest ideals, but those who best understand compliance, timing, and how to hold onto their money.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News