Everything You Need to Know About Binance Alpha and the Upcoming Skate Perpetual Contract Listing

TechFlow Selected TechFlow Selected

Everything You Need to Know About Binance Alpha and the Upcoming Skate Perpetual Contract Listing

Building an interchain composability application stack to create a stateless future across virtual machines.

Author: Black Mario

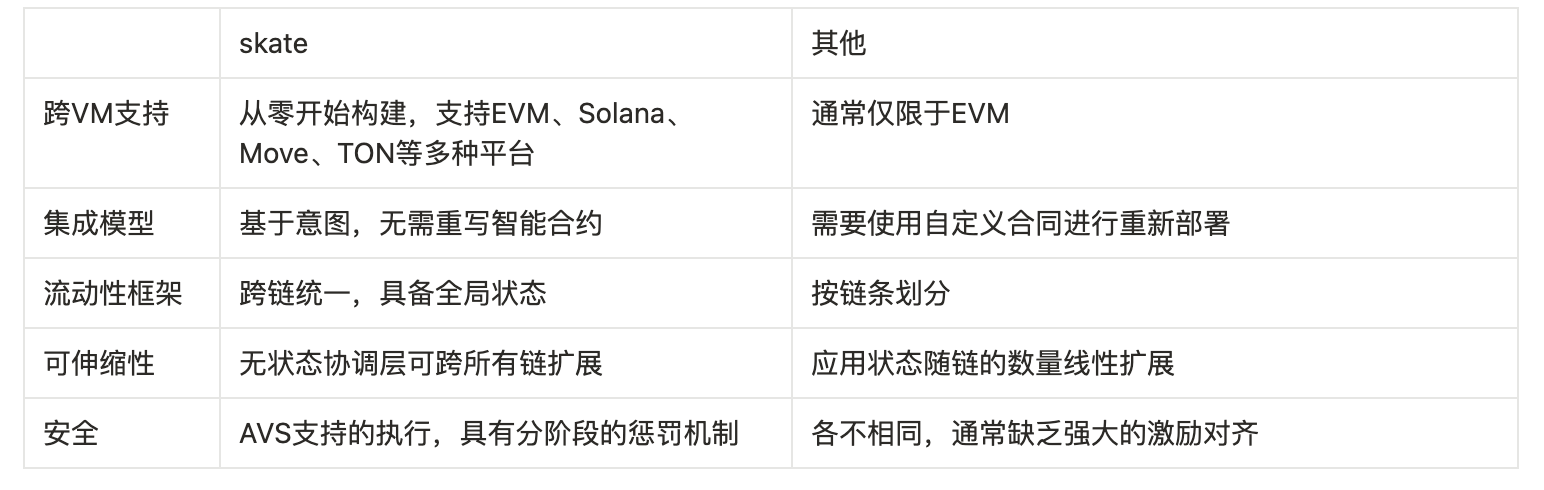

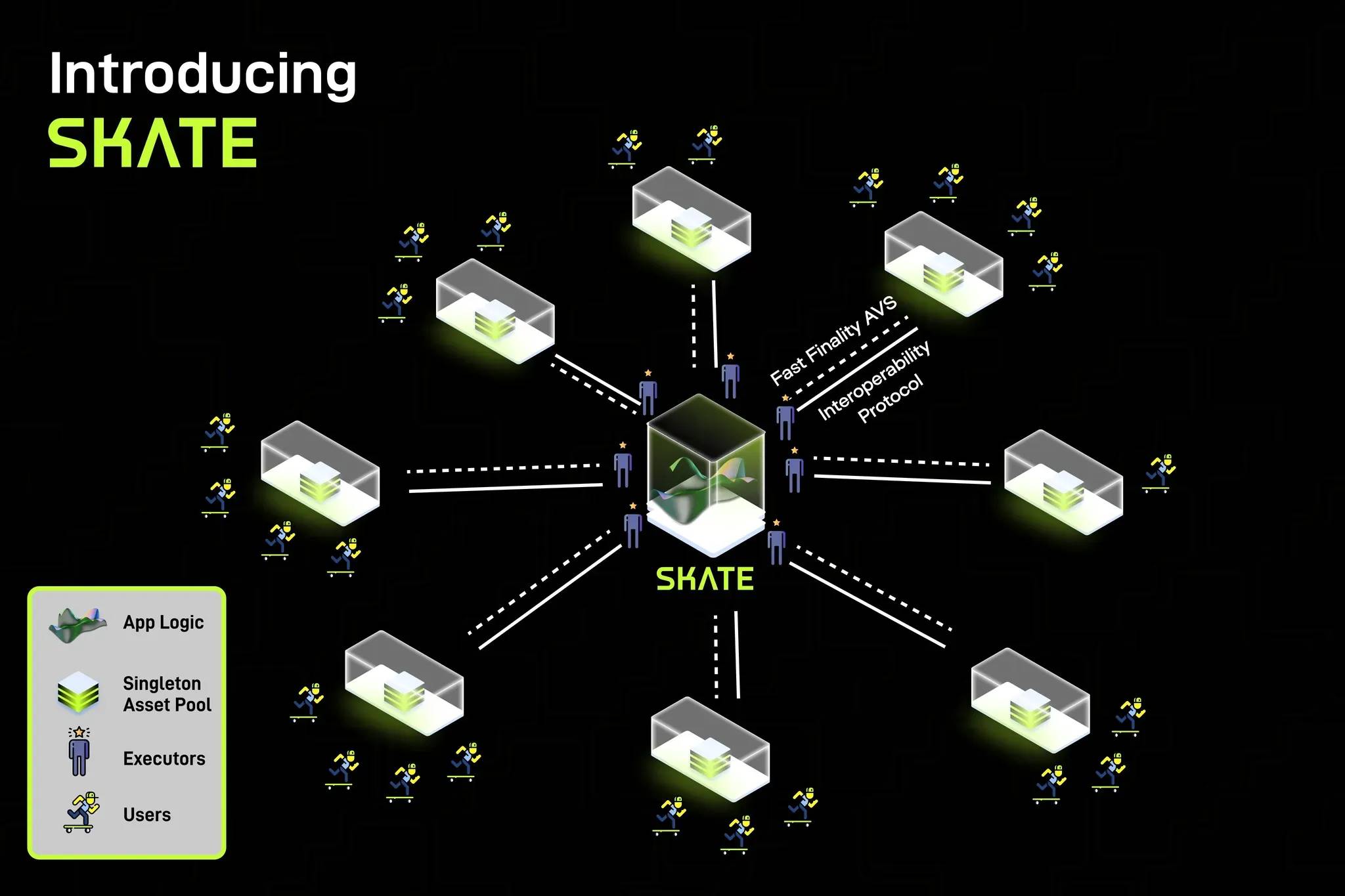

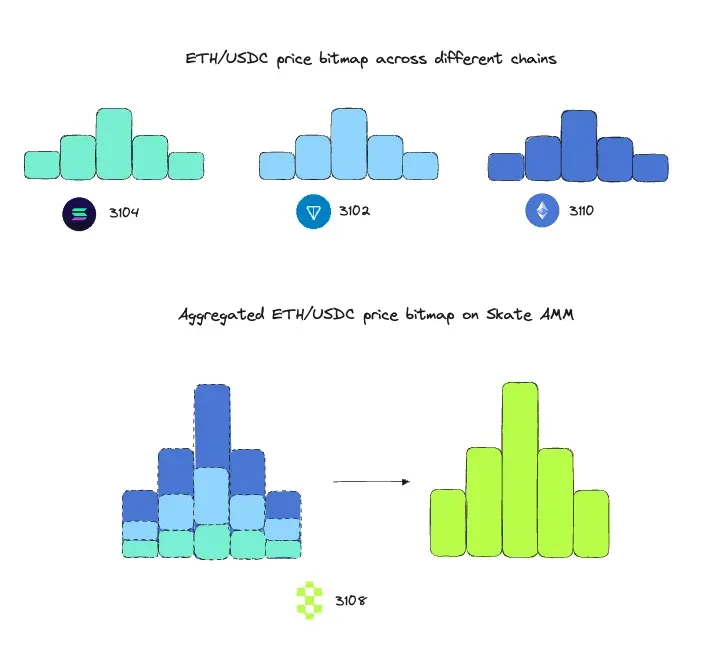

Skate is a stateless, cross-virtual-machine infrastructure layer dedicated to providing a unified application logic and liquidity framework for the multi-chain ecosystem. It enables developers to deploy applications once and achieve shared state and logic across multiple chains, significantly reducing development costs and improving cross-chain deployment efficiency.

In reality, current Web3 infrastructure commonly suffers from fragmentation—each chain has its own independent runtime environment and contract system, forcing developers to repeatedly write and deploy logic, while users frequently switch between multiple wallets and application interfaces. By establishing a universal execution environment, Skate synchronizes and coordinates logic, state, and liquidity, allowing cross-chain applications to interact seamlessly without migrating or duplicating state or relying on bridge operations.

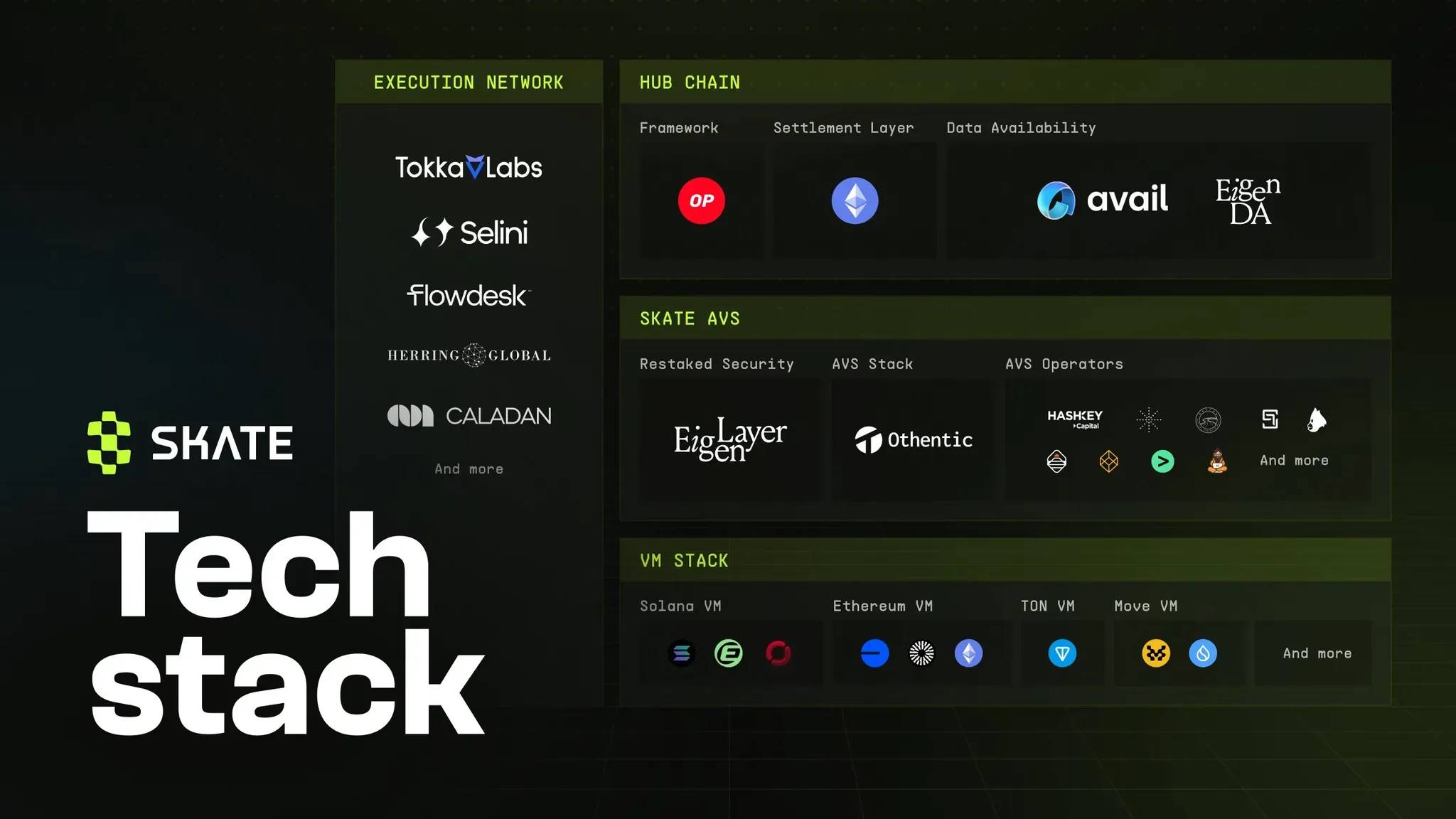

The core design goal of Skate is to provide a highly composable and scalable runtime framework for on-chain applications without asset custody or state replication. Its underlying architecture supports compatibility with multiple virtual machines including EVM, Solana, TON, and Move, natively enabling cross-VM coordination, and ensures security and verifiability in cross-chain processes through stateless execution and AVS validation mechanisms.

With this architecture, Skate provides foundational infrastructure for building unified multi-chain application logic and liquidity networks, advancing Web3 from "multi-chain deployment" toward "inter-chain integration," and laying the groundwork for next-generation cross-chain DeFi and asset protocols. As one of the key narrative directions aligned with current industry trends, the project is preparing to launch its TGE soon and is drawing significant market attention.

Architecture Design

Skate’s architectural design centers around the principle of “stateless coordination,” aiming to build a runtime system compatible with various virtual machine environments and capable of cross-chain coordination. Unlike traditional on-chain applications that require full logic and state deployment and maintenance on each target chain, Skate provides a lightweight coordination layer responsible only for synchronizing intents, orchestrating logic, and managing liquidity—while assets and state remain securely on their native chains.

Skate's execution model is intent-driven: users sign operation intents on their native chains, which are then executed by executors within the Skate network and validated via EigenLayer’s AVS for security and task scheduling. This approach eliminates the cumbersome manual process of cross-chain interactions, enabling true inter-chain abstraction and seamless user experiences.

Structurally, Skate adopts a modular hub-and-spoke design—centralizing the processing of application logic, state mapping, and message passing at the core layer, while allowing flexible integration of execution modules across individual chains. This design not only supports both EVM and non-EVM networks but also leaves room for future expansion into emerging chain architectures.

Furthermore, Skate introduces the concept of global application logic, hosting a shared cross-chain logic state and unifying on-chain invocation and state access interfaces—fundamentally resolving the burden of rebuilding applications on every new chain. This decentralized, stateless, cross-VM coordination model is positioning Skate as a critical middleware connecting multi-chain ecosystems, offering stable system support for composable finance, asset interoperability, and next-gen cross-chain infrastructure.

Skate AMM: Building the Next-Gen Liquidity Engine

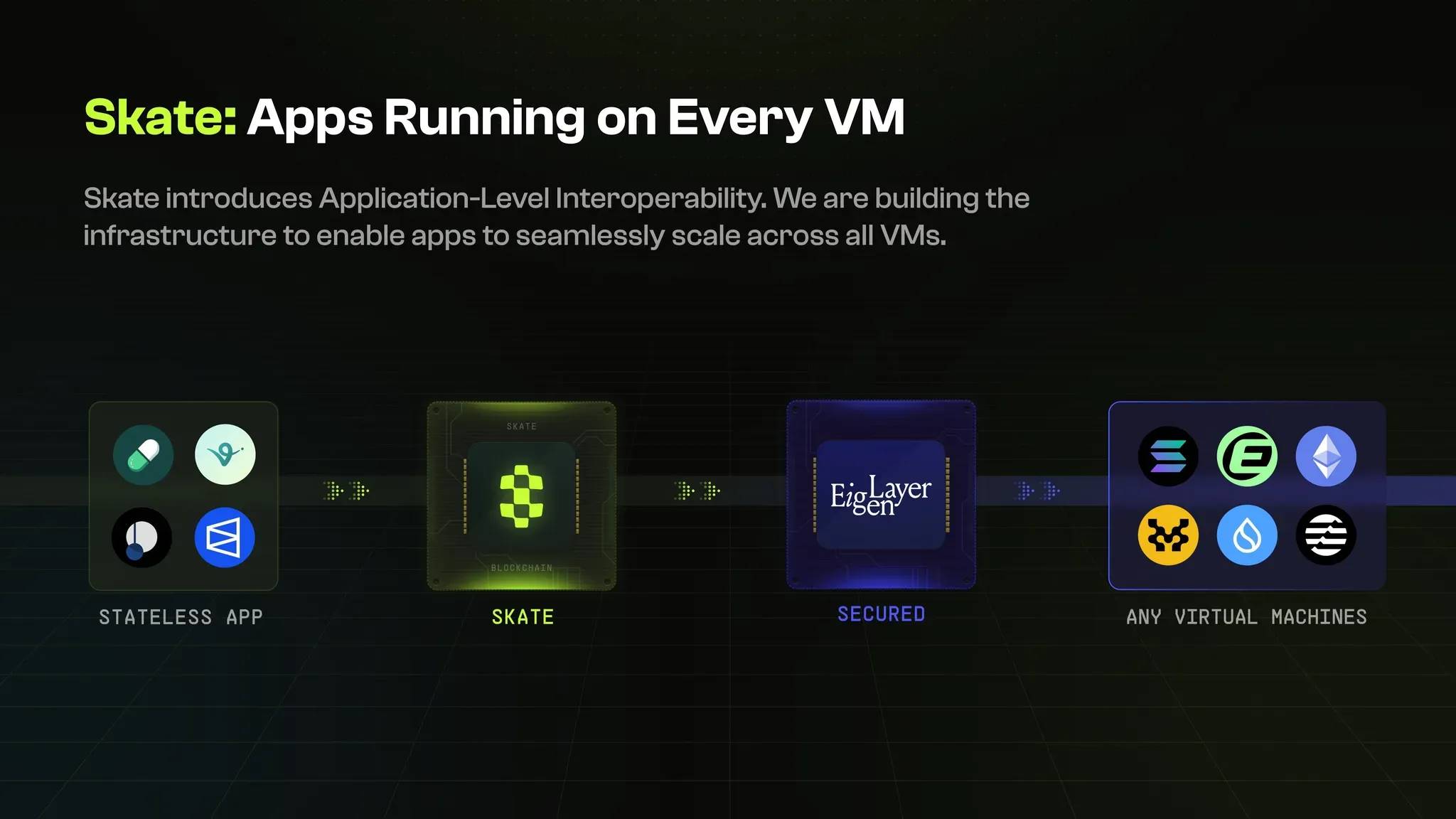

Skate AMM is the core product module within the Skate architecture—a unified liquidity engine designed to address structural issues such as fragmented liquidity, inefficient arbitrage, and inconsistent pricing in multi-chain environments. By creating a cross-VM shared price state system, it connects asset markets across different chains, enabling highly coordinated price discovery, arbitrage execution, and capital allocation.

In traditional cross-chain architectures, liquidity is siloed per chain, leading to price deviations and shallow market depth on new chains, further reducing capital efficiency for users and protocols. In contrast, Skate AMM’s global Bitmap liquidity model integrates liquidity pools across different VMs into a unified view, using a primary chain (e.g., Ethereum L1) as an anchor point to synchronize price states. This structure ensures all trades inherit a consistent pricing curve, drastically reducing cross-chain slippage and arbitrage costs.

Skate AMM also features automatic rebalancing capabilities. By integrating fast cross-chain messaging protocols like Hyperlane, it enables real-time inter-chain liquidity scheduling, dynamically optimizing asset distribution based on market demand. This mechanism enhances capital utilization and generates sustainable fee revenue for the protocol.

At the application level, Skate AMM offers ideal liquidity support for the cross-chain expansion of stablecoins and real-world assets (RWA). For instance, Plume Network’s native stablecoin pUSD leverages Skate AMM to achieve seamless liquidity coverage across multiple chain ecosystems—avoiding redundant liquidity pool deployments while achieving higher pricing efficiency and arbitrage stability.

With its plug-and-play deployment model and unified arbitrage execution path, Skate AMM is gradually becoming the “liquidity operating system” for emerging asset protocols expanding across chains, and serves as a trusted cross-chain market access layer for DeFi protocols.

Currently, ahead of the Skate TGE, the platform has launched an engagement points campaign on its AMM DEX—users can earn points by trading on https://amm.skatechain.org/swap , with points redeemable for airdrops at TGE.

RWA as the Market Entry Point

Today, the RWA sector is experiencing unprecedented growth momentum. By 2025, total stablecoin supply has surpassed $240 billion, and the total value locked (TVL) in RWA protocols exceeds $25 billion. Behind this surge lies not only sustained user demand but also active participation from traditional financial institutions such as BlackRock and Franklin Templeton. This emerging trend signifies a shift in the on-chain asset market—from “crypto-native” toward “structured and institutionalized.”

Meanwhile, next-generation stablecoins are increasingly exhibiting characteristics of “yield-bearing” and “cross-chain native” design. More protocols are issuing stablecoins linked to off-chain yields and seeking broader use cases through multi-chain deployment. However, most asset protocols today still face challenges including fragmented cross-chain liquidity, severe price divergence, and high deployment costs, hindering sustainable growth.

Skate AMM directly addresses these pain points by unifying pricing systems and sharing liquidity pools across virtual machines, offering a structured solution. It significantly improves the efficiency and credibility of new assets entering multi-chain markets, ensures price consistency, strengthens arbitrage stability, and generates native fee income for protocols.

Take Plume Network’s pUSD as an example—a stablecoin originally issued for a specific ecosystem, struggling to scale efficiently without inter-chain liquidity coordination. With Skate AMM, pUSD can rapidly connect to a unified cross-chain liquidity system, avoiding redundant deployments and price slippage, enhancing liquidity depth, and granting Plume sustainable MEV revenue and pricing control.

From an application perspective, Skate is progressively becoming the default liquidity infrastructure layer for stablecoins and RWA protocols entering the multi-chain market—facilitating cross-chain growth in asset markets and accelerating the formation of an “inter-chain capital network.” This new architecture lays a more robust and scalable financial foundation for the Web3 world.

Skate AVS: The First System in the EigenLayer Ecosystem to Generate and Redistribute Protocol Revenue Based on Actual Usage

A key differentiator between Skate and other infrastructure projects is that it not only boasts a clear technical architecture and application roadmap but has already demonstrated strong product-market fit and sustainable revenue generation in live operations.

To date, Skate has been successfully deployed across major virtual machine environments—including EVM chains such as Ethereum, Base, and BNB Chain, as well as non-EVM SVM-based networks like Solana and Eclipse. These deployments validate Skate’s portability and operational efficiency in multi-chain systems and reflect its responsiveness to real user needs.

Notably, within just two months of launch, Skate AMM has achieved over $100 million in cumulative trading volume and completed its first round of protocol fee distribution. This revenue model is not built on pre-mining or token subsidies but stems directly from transaction fees generated by on-chain activity—marking Skate as the first AVS on EigenLayer capable of generating real, usage-driven protocol revenue.

More importantly, these protocol revenues are periodically distributed to AVS restakers based on actual usage, rather than accumulating statically—creating a sustainable, usage-driven incentive mechanism. This model boosts participation incentives for Skate node operators and sets a reference paradigm for EigenLayer: verification services centered on genuine demand.

At a time when AVS models generally face the challenge of “high valuation, low revenue,” Skate offers a replicable blueprint—demonstrating how sustainable, verifiable protocol revenue can be built through cross-chain liquidity and high-frequency trading structures. As more DeFi protocols, RWA applications, and on-chain assets integrate with Skate, protocol revenue is expected to grow steadily, further strengthening the network effect.

Skate is pioneering a new infrastructure paradigm—an on-chain transaction flow-driven protocol economy—setting measurable growth trajectories and replicable incentive structures for AVS and modular validation services.

Conclusion

Skate is building truly meaningful cross-chain application infrastructure for the multi-chain world. Through its stateless architecture, AVS-backed security, unified liquidity engine, and native compatibility with all major virtual machine environments, Skate not only redefines the technical pathways of cross-chain interaction but also delivers an efficient, composable, and sustainable foundation for stablecoins, RWA assets, and next-generation on-chain financial protocols.

At this pivotal stage as Web3 advances toward multi-chain collaboration and asset interconnectivity, Skate’s technical framework and product mechanisms have completed the closed-loop validation from concept to real-world implementation. With increasing ecosystem partners and core protocol integrations onboarding, Skate will continue driving the unification of inter-chain logic and consolidation of liquidity—introducing an unprecedented infrastructure standard for cross-chain finance and potentially transforming Web3 scalability and user experience at a fundamental level.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News