Africa, the world's poorest continent, has become the hottest player in the global crypto scene

TechFlow Selected TechFlow Selected

Africa, the world's poorest continent, has become the hottest player in the global crypto scene

The Stablecoin Popularized by Africa's Poor: How Big Is the Pie?

Author: Cool Labs

If you were given 1 yuan RMB or virtual currency worth 1 yuan, which would you choose?

Most Chinese people might pick their national fiat currency—after all, legal tender circulates easily and holds stable value. As for cryptocurrencies, their prices swing wildly between sky-high peaks and steep crashes; the waters run too deep and feel far from secure.

But if you posed this question in Africa, Southeast Asia, South America, or the Middle East, the answer might flip entirely. People there would often prefer cryptocurrency over an equivalent amount of local fiat money.

01 The Poorest Continent Embraces Crypto

The image of Africa as poor and backward is deeply ingrained. When many think of Africans, they picture emaciated refugees holding crumpled bills while buying basic goods.

Hard to believe, but today they're using digital payments. While we cling to outdated stereotypes, Africa has become the world’s fastest-growing region for digital finance and one of the most widespread adopters of cryptocurrency.

In 2023, Africa accounted for half of all global digital payment accounts with 856 million registered users, contributing more than 70% of total global growth. In Kenya, 75.8% of adults use digital payments; in South Africa, it's 70.5%; Ghana at 63%; Gabon at 62.3%. To put that in perspective, these figures outpace many developed nations—Germany, for example, has only a 42% adoption rate.

In reality, across Africa you’ll find familiar QR codes and point-of-sale scanners everywhere.

Even more striking: despite struggling with food security, Africans have become deeply engaged in crypto trading. From July 2023 to June 2024, sub-Saharan Africa ("Black Africa") transacted $125 billion worth of on-chain cryptocurrency—Nigeria alone accounted for $59 billion. Since 2021, the number of cryptocurrency users in sub-Saharan Africa has grown 25-fold—the fastest pace globally, surpassing even the most internet-advanced regions.

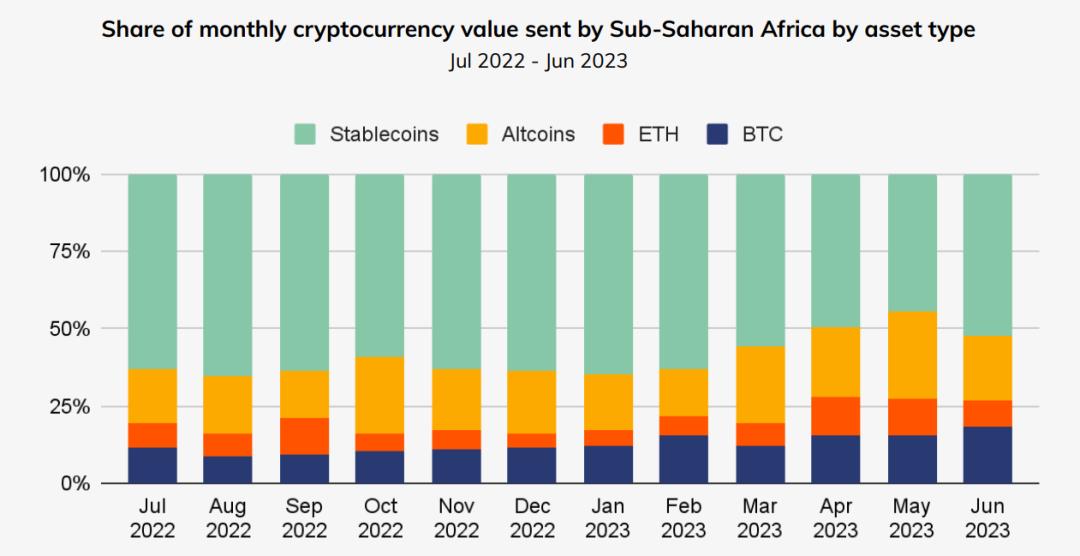

Many Chinese netizens associate cryptocurrencies primarily with Bitcoin, whose volatile price swings lead them to assume African enthusiasm stems from desperation—"betting everything hoping to get rich overnight." But this isn’t accurate. Over 50% of the cryptocurrencies traded by Africans are not speculative coins but a special type: stablecoins.

Medium

Stablecoins are cryptocurrencies pegged to real-world assets like fiat currencies. Their purpose is to bring price stability to crypto markets. One major example, USDT (Tether), is designed to maintain a 1:1 parity with the U.S. dollar—each Tether issued corresponds to one dollar held in reserve by the issuing company.

Originally created to lock in profits from volatile trades (like Bitcoin), stablecoins let traders convert gains into a stable asset without exiting the digital realm. To stretch an analogy, Bitcoin is like stock in the virtual world, while stablecoins act as cash.

This feature became a lifeline for Africans.

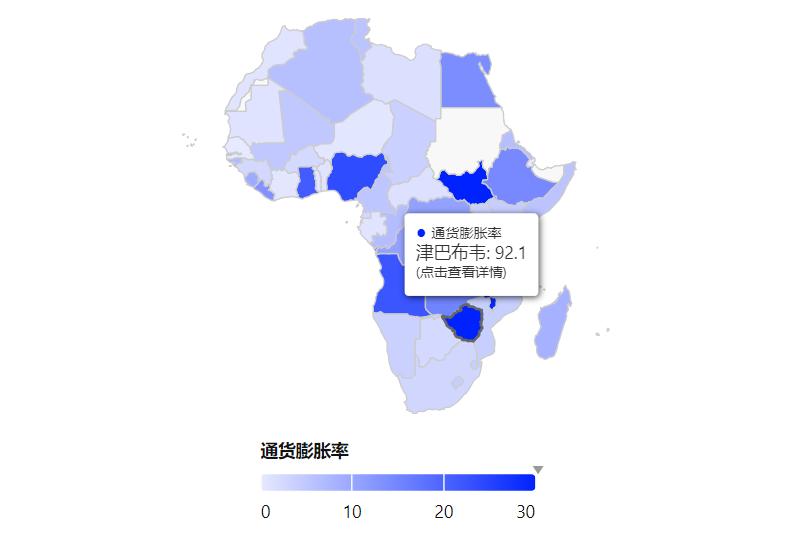

For them, high inflation is a constant psychological burden. Most sub-Saharan African countries suffer weak economies and governance, making them vulnerable to global shocks. Governments print money recklessly to cover deficits, coupled with frequent coups and civil wars—leading to rampant hyperinflation. In 2024, Africa’s average inflation hit a staggering 18.6%, far above the accepted 3% threshold. Zimbabwe reached an absurd 92%.

In short, your hard-earned savings could lose a fifth—or even half—their value within a year. If inflation spirals, your money may become worthless paper.

After years of such turmoil, Africans naturally lost trust in their national currencies and sought to exchange earnings into more stable foreign currencies. By recognition and liquidity, the obvious choice is the U.S. dollar. Yet unlike China, which generates trade surpluses as the “world factory,” African nations mainly export raw materials and fruits, earning little in dollars—most of which must be spent importing essential goods. Central banks lack sufficient forex reserves. Moreover, governments impose strict capital controls—even if dollars exist, they won’t give them to ordinary citizens.

Accessing banks is also extremely difficult due to underdeveloped infrastructure—over 350 million African adults lack access to financial services, and 55% don't have bank accounts.

Those desperate to obtain dollars resort to black markets. In Zimbabwe, the black-market exchange rate is nearly double the official rate—27 Zimbabwean dollars per USD officially, versus 50:1 unofficially. After Sudan descended into war two years ago, its official rate stayed at 560 Sudanese pounds per USD, while the black market soared to 2100:1.

With no access to dollars or banks, what do Africans have? Mobile phones. Thanks to an industrial powerhouse in the East, cheap smartphones flooded Africa, achieving over 70% penetration. Faced with crisis, Africans turned to digital finance for survival.

Their solution? Stablecoins. Platforms like Yellow Card allow users to buy stablecoins using local African currencies. Since leading stablecoins like Tether are directly pegged to the U.S. dollar, this effectively enables free foreign exchange conversion and wealth preservation.

Yellow Card offers rates slightly below official levels but far better than black markets. For instance, Nigeria’s official rate is 1590 naira per USD, while Yellow Card sells 1 USDT for 1620 naira. Both sides benefit—the platform earns a spread, users avoid being gouged.

For unbanked individuals or those unable to reach physical branches, stablecoins simplify saving. Just register an account, hand local cash to a local agent, who sends stablecoins to your wallet—conversion and deposit done instantly, minus a small fee.

Beyond inflation protection, stablecoins also solve another problem: inefficient cross-border remittances. Due to outdated systems, sending money across borders in sub-Saharan Africa incurs exceptionally high fees—up to 7.8% loss, compared to 4%-6.4% elsewhere. Migrant workers sending money home or multinational companies transferring profits face heavy deductions. With stablecoins, people now bypass traditional channels, moving funds via blockchain transfers. Some platforms charge just 0.1%—practically free.

When businesses hold stablecoins and employees want them, why go through extra steps? Many companies began paying salaries directly in stablecoins.

Blockworks

Salaries in stablecoins, savings in stablecoins—soon, people hold almost no local cash. Why bother converting back and forth? Easier to just scan and pay. Thus, stablecoins further accelerated digital payment adoption across Africa.

Unlike China’s popular digital payment apps, African platforms are deeply integrated with stablecoin exchanges. Users can seamlessly swap between stablecoins and local currency during transactions. Some platforms even allow direct spending in stablecoins, skipping conversion altogether. Major supermarket chains partner with stablecoin providers, encouraging usage—some offer up to 10% cashback for stablecoin payments.

South Africa Pick n Pay

Africa used stablecoins to fight inflation—but other countries made the same move.

Turkey, after chaotic economic policies since 2021, saw soaring inflation, turning it into the world’s fourth-largest crypto market with $170 billion in annual volume—surpassing all of sub-Saharan Africa. Two out of every five Turks now own some form of cryptocurrency. In 2022, when the Turkish lira dropped over 30% in months, citizens rushed into stablecoins for safety. At one point, lira-to-USDT trades made up 30% of all global fiat-to-Tether volume...

Another emerging stablecoin market is South America, where several nations face monetary chaos. In Argentina, public concern over the peso grew amid President Milei’s radical policy shifts. After Argentina abolished capital controls in April this year, trading volume on stablecoin exchanges surged nearly 100%.

These cases show that new technologies spread fastest not in wealthy nations, but in places facing existential crises—pressure drives change.

02 The Hidden Corners

Focusing solely on stablecoins’ role in hedging against inflation risks overlooking their core nature: they remain cryptocurrencies.

While blockchain records are transparent, real identities behind transactions are usually hidden behind wallet addresses. Even knowing a wallet address rarely reveals the actual person or entity involved. Without central bank backing, stablecoin transactions escape traditional financial oversight. This makes stablecoins ideal for illicit activities operating in shadows.

We mentioned Latin America as a growing stablecoin market—not just for inflation hedging, but also because criminals value their untraceability. Drug cartels in Mexico, Brazil, and Colombia now widely use USDT to launder drug money and transfer illicit funds. Last May, Maximilian Hoop Cartier, heir to the Cartier jewelry empire, was arrested by U.S. authorities. He was accused of collaborating with Colombian drug lords to smuggle 100 kilograms of cocaine and laundering hundreds of millions in drug proceeds—all conducted through Tether transactions.

Cases like this are countless. Frustrated U.S. law enforcement shifted focus upstream—to Tether itself. In October last year, the U.S. federal government launched a broad criminal investigation into whether Tether had been used by third parties to fund illegal activities including drug trafficking, terrorism, hacking, and money laundering.

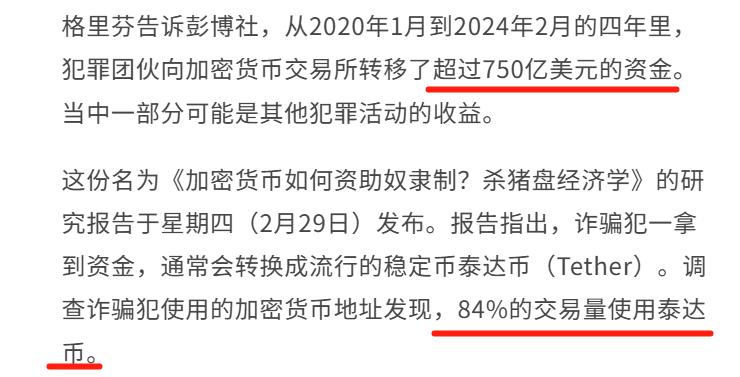

Similar trends emerged in Southeast Asia, known for online gambling, telecom fraud, and human trafficking. As crackdowns intensified, suspicious bank activity leads to immediate freezes, rendering traditional money transfer methods ineffective. Criminal networks increasingly rely on stablecoins.

How big is this? According to U.S. researchers, between January 2020 and February 2024, criminal groups moved over $75 billion into crypto exchanges—84% of which used Tether.

Tether strongly disputed the report, claiming "every asset is traceable, every criminal catchable," yet did not challenge the $75 billion figure itself.

Lianhe Zaobao

Another party treating stablecoins as treasure is Russia. Russians aren't interested in gambling or scams—but they need alternatives to existing international settlement systems.

Since the Ukraine conflict began, Russia faced sweeping sanctions, including expulsion from SWIFT—the backbone of global financial messaging connecting over 11,000 institutions across 200+ countries. Being cut off meant losing access to conventional cross-border transaction mechanisms.

Yet the world still needs Russian resources, and Russia still needs foreign goods—especially war-related supplies. To conceal these hidden trades, stablecoins serve as dollar proxies for foreign settlements.

As early as 2021, Russia officially reported zero U.S. dollar reserves—but unconfirmed amounts of stablecoins quietly flowed in. Just last April, Western agencies intercepted a single transfer of $20 billion worth of Tether into Russia.

TechFlow

03 How Profitable Are Stablecoins?

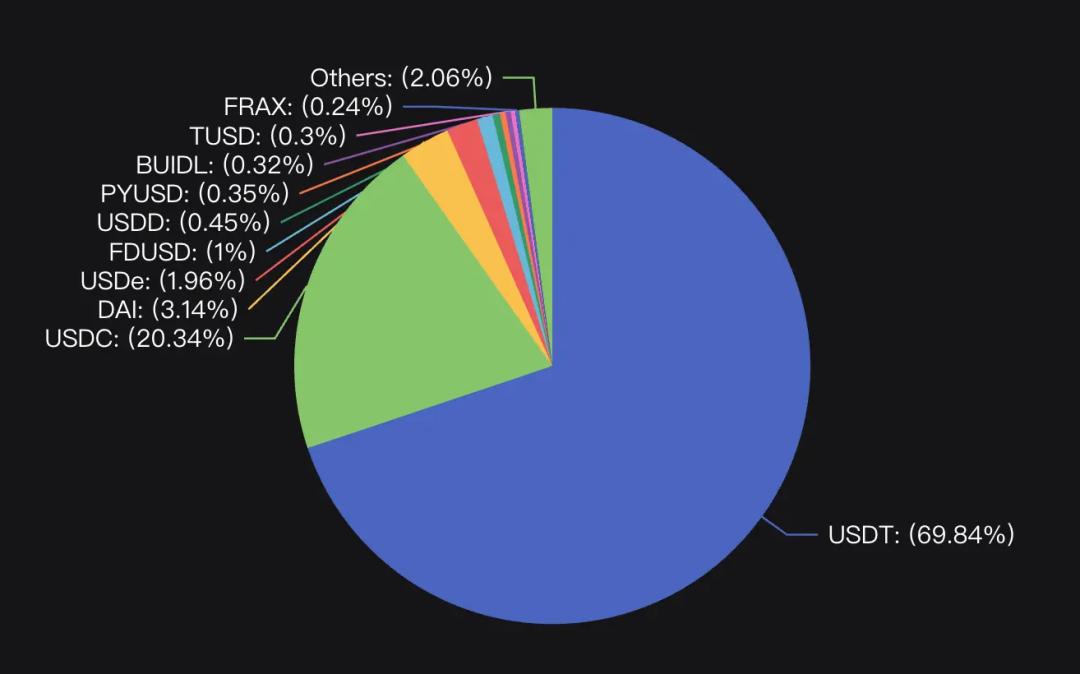

Ordinary people fleeing inflation use them. Criminals use them. Sanctioned nations use them... Driven by these new demands, stablecoin scale has exploded. In just six years, total holdings have increased about 45-fold, reaching $246 billion today. Annual trading volume exceeds $28 trillion—surpassing traditional banking giants Visa and Mastercard.

You might wonder: what benefits do stablecoin issuers gain from this boom?

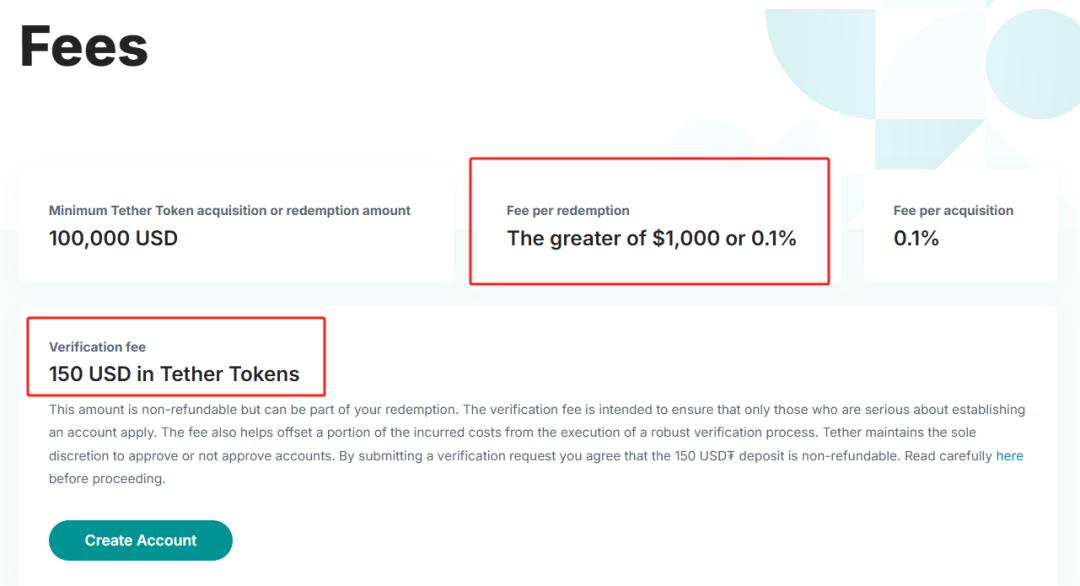

First comes transaction fees. Issuers charge users for minting or redeeming stablecoins. Tether, for example, charges 0.1%. Sounds low—but with massive scale, it adds up. Tether's USDT supply now exceeds $120 billion. There’s also a minimum fee: if the calculated cost falls below $1,000, you still pay $1,000. New users pay a $150 verification fee.

Second is income from interest earned on the vast reserves backing stablecoins. Since USDT is pegged 1:1 to the dollar, each coin represents a dollar deposited with Tether. Tether pays no interest to users—but deposits those dollars in banks earning interest. It also lends part of the cash to vetted companies, earning higher yields than bank deposits.

Moreover, Tether doesn’t hold all reserves in cash. Of its backing assets, 66% are U.S. Treasuries, 10.1% overnight reverse repurchase agreements—stable instruments yielding over 4%. On $120 billion in holdings, this generates enormous returns.

Third, companies profit from arbitrage during buybacks. Although USDT targets 1:1 parity, market supply-demand imbalances cause minor fluctuations. Small percentages translate to huge sums at scale.

During regulatory pressure or scandal allegations, media scrutiny shakes confidence, prompting mass sell-offs that push USDT below par. Tether then uses reserves to aggressively buy back and burn tokens.

For example, in 2018, when USDT dipped to 98 cents, Tether bought back 500 million units. They minted $5 billion earlier, but repurchased at $4.9 billion—netting $100 million. Plus, this bold move restored market confidence, halting panic withdrawals—a win-win.

Thanks to these three revenue streams, Tether—with only 150 employees—earned $13 billion in 2024, outperforming giants like BlackRock and Alibaba, leaving some Fortune 500 firms envious. Its per-employee profit of $93 million ranks first globally.

04 Shadow Dollars Reinforcing Hegemony?

The impact of stablecoins goes beyond creating new tech titans. More alarmingly, they’re enabling seamless migration of dollar dominance from traditional finance into the blockchain world.

Think: stablecoins require universally trusted anchor assets. Among fiat options, historical inertia leads issuers to favor the most recognized—U.S. dollars or Treasuries. From the Pacific to the Arctic, everyone loves the dollar. Today’s top stablecoins—USDT, USDC (second), FDUSD (fifth)—all peg to dollars, Treasuries, or equivalents.

The result: more circulating stablecoins mean greater global demand for dollars, forming a loop: users buy stablecoins → issuers accumulate more dollars/Treasuries. Stablecoins thus become “shadow dollars,” reinforcing dollar circulation worldwide and opening new demand channels for U.S. debt—greatly enhancing Washington’s financing power. Tether alone has become the 19th-largest buyer of U.S. Treasuries globally—larger than Germany—with funding sourced from millions of users. Effectively, the world is collectively boosting Treasury holdings.

If this trend continues, the already fragile U.S. dollar hegemony will be re-strengthened via stablecoins. Other nations may retain control over monetary policy, but widespread daily and cross-border use of shadow dollars severely undermines their monetary sovereignty.

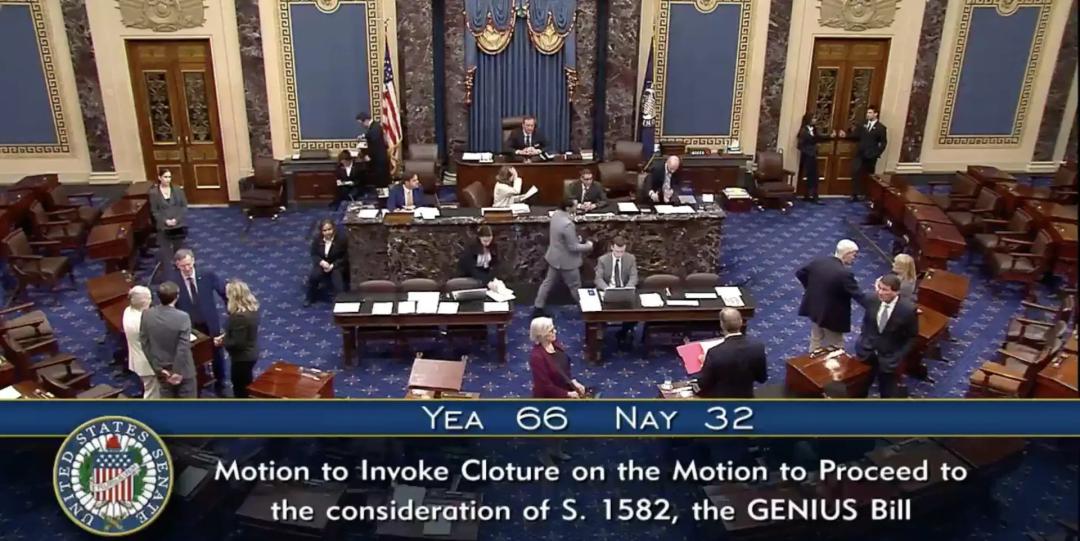

Hence, U.S. leadership sees opportunity and is doubling down. Recently, the U.S. passed the GENIUS Act, featuring key provisions:

First, every stablecoin issued must be fully backed by equivalent U.S. dollars or Treasuries;

Second, issuers must register with the federal government, disclose reserves monthly, ensure fund safety, and comply with anti-money-laundering laws;

Third, in case of issuer bankruptcy, stablecoin holders have priority redemption rights.

Simple rules, massive implications. Legally mandating dollar/Treasury backing strengthens the dollar ecosystem. Tighter regulation boosts user confidence, driving more wealth into stablecoins—and thus into dollar-denominated assets. Industry experts predict stablecoin supply will grow from $246 billion today to $2 trillion by end-2028, generating $1.6 trillion in new short-term Treasury demand—just enough to help the U.S. withstand a bond sell-off wave.

Trump himself champions this shift. USD1, a stablecoin backed by the Trump family, follows the same dollar/Treasury model. Leveraging his influence, he stakes a claim in the stablecoin gold rush. USD1 already ranks seventh among stablecoins by market share.

Other nations long seeking to dismantle dollar dominance refuse to stand idle. Hong Kong—the financial gateway of China—passed legislation on May 21 to pilot a Hong Kong dollar-pegged stablecoin. Initial trials will expand later to include banks, large internet firms, and fintech companies applying for issuance licenses. JD.com, a well-known player, has entered the space—its JD-HKD, pegged 1:1 to HKD, is currently undergoing sandbox testing.

Others follow suit. Singapore, the EU, and Russia are all considering launching stablecoins pegged to their own currencies.

The battlefield of financial warfare is shifting from sovereign currencies to cryptocurrencies.

05 The Next Financial Nuclear Bomb

An internet meme claims the Fed’s vault is Schrödinger’s box—never publicly audited for decades. Who knows if the gold is still there?

The same joke applies to stablecoins. Despite claims of full dollar/Treasury backing, information asymmetry persists between issuers and users. Audits aren’t always reliable. As stablecoin usage grows, so does vulnerability to trust crises. What if reserves are secretly misused? What if custodian banks collapse due to systemic risk?

In 2023, Silicon Valley Bank’s failure triggered the second-largest bank collapse in U.S. history. USDC, the second-largest stablecoin, had $3.3 billion in reserves parked there. Once revealed, its dollar peg broke—within hours, USDC plunged from $1 to $0.87. Falling value triggered panic redemptions, pushing USDC toward collapse. Only after the Federal Reserve stepped in with a $25 billion bailout did stability return.

In other words, stablecoins aren’t truly immune to instability—they merely turn sudden crashes into slow-motion ones.

For countries reliant on dollar transactions, SWIFT used to be the financial nuclear option: disconnect you, and you’re finished. Using crypto seems to bypass this system—but stablecoins themselves may become an even bigger weapon. Though borderless and neutral in theory, the few companies behind them are not. Your adversary only needs to target the issuer.

After reports surfaced about Russia using Tether to evade sanctions, multiple Western nations threatened Tether: fix it, or we’ll come after you. To prove loyalty, Tether froze $27 million worth of USDT belonging to Russian exchange Garantex—halting all transactions and withdrawals, taking the site offline, wiping out many users’ assets entirely.

We’ve long said cryptocurrencies promote decentralized finance.

Stablecoins suggest otherwise—they simply replace old centers of power with new ones.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News