Web3 entrepreneurs, how to seize the African blue ocean market?

TechFlow Selected TechFlow Selected

Web3 entrepreneurs, how to seize the African blue ocean market?

For people living in Africa, a Web3 wallet is not just a vessel for money, but also a possibility to move from economic marginalization to the center.

Author: Liu Honglin, Zheng Hongde

The Gap in Financial Inclusion

Living in the second decade of the 21st century, we can instantly transfer money, buy funds, and make QR code payments using our mobile phones. Bank accounts have become as essential as air, seamlessly integrated into daily life—so much so that it all seems taken for granted. High-quality financial tools mean better risk management, scalability, and wealth growth. Yet across vast regions of emerging markets—Africa, Latin America, South Asia—billions of adults have never held a bank account. These "emerging" areas often develop later, with scarce financial services, leaving a massive population unbanked—an issue rarely noticed.

In these regions, banks are sparse, fees are high, processes cumbersome, and lack of trust makes stable financial services a privilege for only a few. While mobile payment solutions like Kenya's M-Pesa meet local needs, cross-border transfers still face high fees and daily transaction limits, and many areas remain underserved.

Even more critical is the fragility of local fiat currencies in many regions: Zimbabwe has suffered from sky-high inflation, even issuing currency notes worth 100 trillion, plagued by hyperinflation; Angola’s kwanza nearly collapsed, wiping out citizens' wealth through depreciation. To preserve value, ordinary people resort to buying U.S. dollars at high prices on black markets, exposing themselves to great risks and additional costs. Stable financial services seem out of reach.

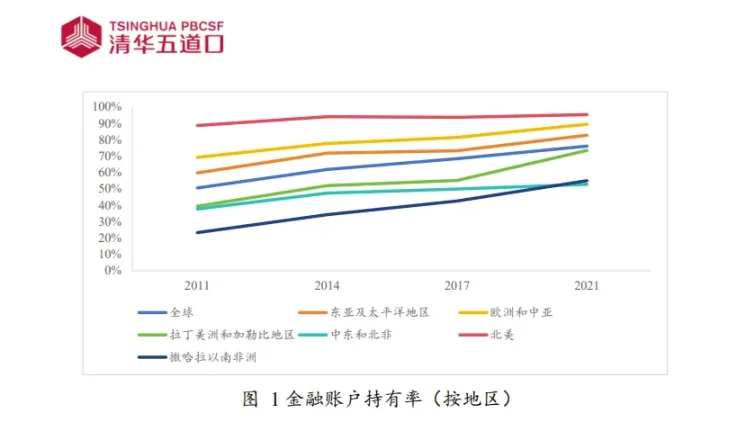

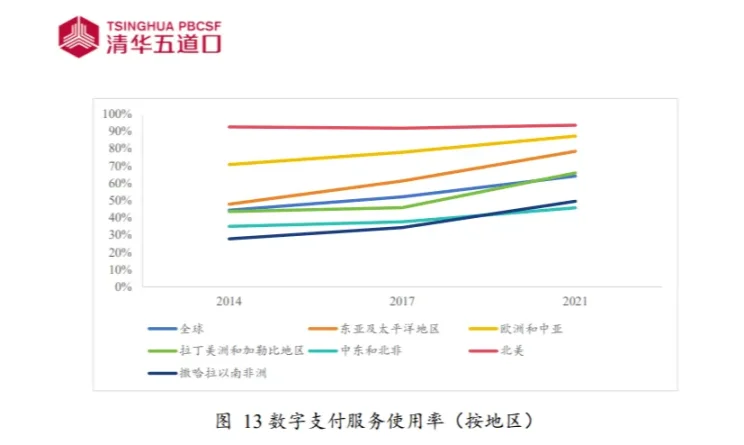

Let’s look at data from the 2023 Global Findex Report on financial inclusion trends:

Thanks to its advanced financial system, North America has nearly saturated bank account ownership. In contrast, sub-Saharan Africa lags behind at just 55%, far below the global average. Similarly, digital payment usage reaches 92% in North America, while the Middle East, North Africa, and sub-Saharan Africa show clear gaps. Many people still cannot access inclusive finance, let alone improve their lives through banking.

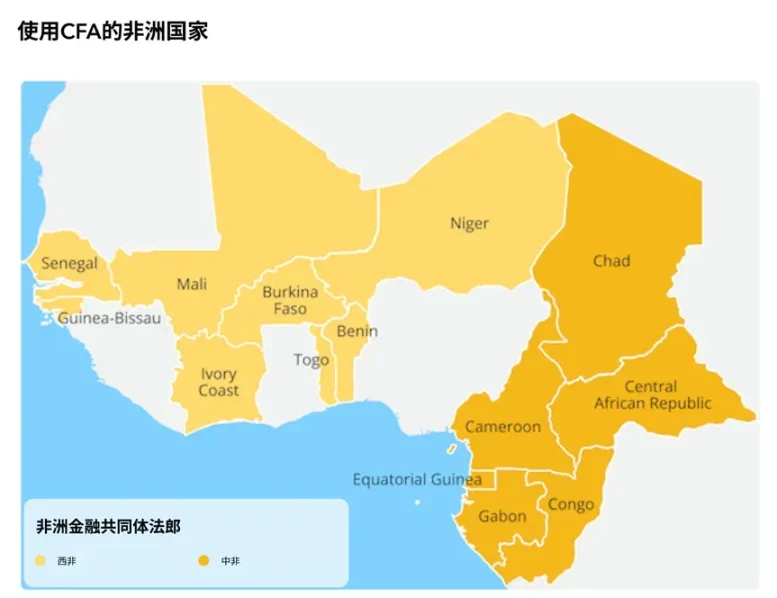

Also, did you know that many parts of Africa use the CFA franc—a currency created by France—instead of their own national currencies?

In December 1945, following France’s ratification of the Bretton Woods Agreement, General de Gaulle issued a decree establishing the CFA (West African CFA franc) monetary system, controlling exchange rates and even designing and printing banknotes used in Africa. The CFA franc became the official currency across France’s African colonies and is still used today in 14 sub-Saharan African countries, forming what is known as the “African Financial Community Franc Zone.”

Imagine a country requiring your nation to deposit half of its foreign exchange reserves into its treasury in exchange for permission to issue your own currency. Now imagine this same country controls your currency’s value and holds veto power over its exchange rate. This sounds like financial occupation—but for 14 sub-Saharan African nations, it is reality: half their foreign reserves are held in former colonial ruler France, suggesting France maintains a form of “new hegemony” through such mechanisms.

Alex Gladstein of the Human Rights Foundation once said: “Unlike conventional fiat systems, the CFA system is far more insidious. CFA is monetary colonialism.” Journalist Joseph, after field research, remarked: “From Cuba to Turkey, from South Africa to Serbia—I’ve never seen anywhere with greater demand for monetary liberation than Central or West Africa.”

Understanding these challenges naturally leads us to see blockchain and Web3 as tailor-made solutions. Decentralized trust bypasses traditional banking barriers, eliminating reliance on legacy financial institutions. Web3 wallets serve as gateways for users to interact with blockchains, protecting privacy while overcoming identity or geographic restrictions. Regardless of background, individuals need only a smartphone to control digital assets via non-custodial wallets, participating in savings, lending, and investment—breaking down financial access barriers, holding the keys to finance, and even achieving monetary liberation.

For people living in these regions, a Web3 wallet is not merely a vessel for money but a pathway from economic marginalization toward centrality. The potential of blockchain-based financial inclusion may connect billions from financial islands to the global economy. This is a revolution in financial equality—opening this door allows ordinary people to step onto the world stage.

Case Studies Show Potential: Web3 in Africa

Jambo: A Chinese Entrepreneur Raised in Africa Sells Web3 Phones

Jambo founder James Zhang is a third-generation Chinese resident of the Democratic Republic of Congo in Africa. He witnessed firsthand the inefficiencies of the local financial system: workers required daily wage settlements due to lack of trust; cross-border payments relied on church networks; corrupt intermediaries obstructed money flows. While studying computer science at New York University, he encountered Bitcoin and Ethereum, recognizing blockchain’s potential. In 2021, at age 26, James founded Jambo, aiming to solve three core problems in emerging markets using Web3: cross-border payments, remittances, and the unbanked.

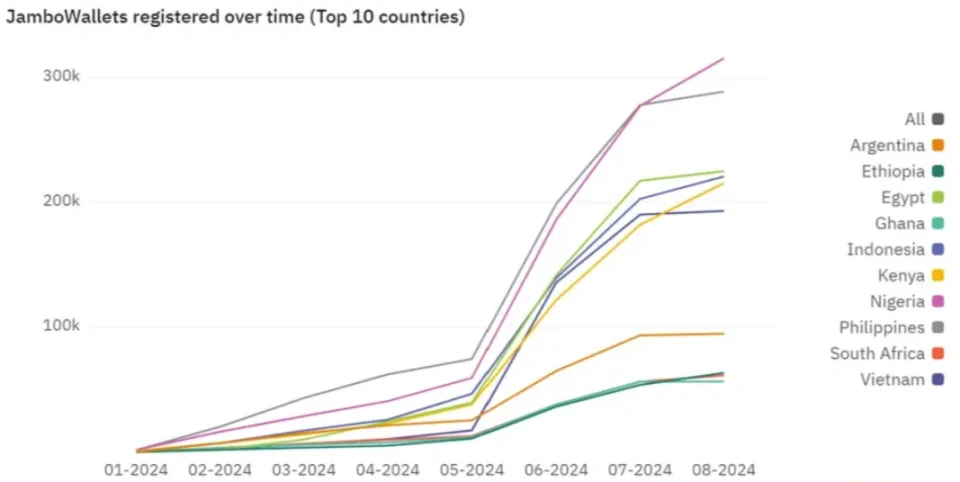

The launched JamboPhone, pre-installed with 20 Web3 apps (wallets, games, DeFi), has sold 870,000 units to date, activated nearly 10 million non-custodial wallets, and reached 128 countries, gaining popularity across emerging markets.

Founder James Zhang stated bluntly: “I believe in Africa there’s nothing to save because it’s just 1% super-rich and 99% poor. So we took a different approach—helping ordinary people earn money.” Based on this philosophy, Jambo built the Jambo Super APP, offering income opportunities through a “learn, play, earn” model, enabling young users—who may lack bank accounts and job prospects—to generate revenue within this super app.

Beyond Africa, Latin America and Southeast Asia also represent vast emerging markets eager for Web3 and cryptocurrency to bring stable currency and financial systems. After accumulating success in Africa, Jambo is now expanding into other “blue oceans,” aspiring to become a pioneer in Web3 mobile infrastructure and driving mass adoption of Web3 through emerging markets.

Yellow Card: Driving the Stablecoin Revolution in Africa

Founded in 2019 as a small team in Nigeria, Yellow Card has grown into Africa’s largest stablecoin exchange, operating in 20 African countries. As the first licensed stablecoin platform, Yellow Card integrates local banks and mobile payment systems via its payment API and “Africa-as-a-Service” suite, providing businesses and individuals with secure, low-cost stablecoin trading services. In October 2024, it secured $33 million in Series C funding, bringing total funding to $85 million.

Chris Maurice, CEO of Yellow Card Exchange, points out that in Africa, multiple national currencies are highly unstable, with about 70% of countries facing foreign exchange shortages. Many businesses cannot obtain sufficient U.S. dollars for operations. Stablecoins like USDT and USDC have become dollar substitutes, serving as tools for value storage, international supplier payments, and hedging against currency depreciation.

For example, Ethiopia, Africa’s second most populous country, saw its local currency, the birr (ETB), depreciate by 30% in July 2024 after the government relaxed currency controls to secure a $10.7 billion loan from the IMF and World Bank. This instability further fueled demand for stablecoins.

Many African businesses now access stablecoins through platforms like Yellow Card. With transaction costs as low as $0.05, Yellow Card has helped approximately 30,000 businesses optimize cross-border payments and treasury management, surpassing $3 billion in trading volume in 2024. Maurice emphasizes: “Stablecoins in Africa are not just financial tools—they are survival necessities.” Stablecoins are empowering businesses, breaking down traditional financial barriers, and advancing financial modernization in Africa.

Xend Finance: DeFi Empowering African Finance

Nigeria’s currency depreciation crisis inspired Xend Finance founder Aronu. Aronu and his mother participated in a credit union in Nigeria, attempting to weather economic hardship through regular savings and mutual aid. But they gradually realized that despite consistent saving, their money kept losing value, people grew poorer, and sometimes suffered significant financial losses.

Africa’s weak banking system and strong demand for value preservation gave rise to Xend Finance—a DeFi platform targeting credit unions. By aggregating DeFi lending protocols, Xend offers users multi-tier interest returns, enabling ordinary people to benefit from DeFi.

Beyond aggregation and lending, Xend stands out by bringing DeFi to real-world contexts where it's truly needed. Aronu says: “We provide value for people living in unstable economies whose assets are unprotected.” Xend not only offers credit union members an alternative to traditional deposits but also helps low-income individuals combat currency depreciation through optimized yields, filling gaps left by traditional finance.

Through partnerships with giants like Binance, Google, and Polygon, Xend has expanded into Ghana and Kenya. Previously inaccessible financial lending services are gradually reaching more parts of Africa, aiming to attract non-crypto users into DeFi. Targeting savings and value preservation amid currency depreciation, Xend provides credit union members with alternatives to traditional savings and brings hope to low-income Africans facing economic volatility.

Ejara: Democratizing Crypto Investment and Payments, Enabling French-Speaking Africans to “Start Investing at $1”

Ejara is a Cameroon-based Web3 platform founded in 2020, focused on providing cryptocurrency investment and payment services to French-speaking Africans. Inspired by financial exclusion and currency depreciation, the founders developed the Ejara mobile app, allowing users to invest in assets like stablecoins and Bitcoin with as little as $1, while supporting cross-border payments and local currency exchange.

In 2023, Ejara raised $8 million in Series A funding led by Dragonfly Capital and Circle Ventures, reaching a valuation of $50 million. By 2024, Ejara had surpassed 300,000 users across Cameroon, Senegal, and Côte d'Ivoire, with monthly transaction volume hitting $20 million.

Ejara distinguishes itself through low barriers to entry and localization. The platform supports French-language interfaces and integrates mobile wallets like Orange Money, reducing technical hurdles for Web3 adoption. In 2024, Ejara launched its “Ejara Earn” program, offering users 8–12% annual yield through stablecoin staking, attracting a large number of African women new to crypto (accounting for 40% of users). Ejara’s active performance and sustained growth from 2023 to 2024 have made it a benchmark in French-speaking Africa’s Web3 space. Tayim says: “We aim to use blockchain technology to democratize investment and savings products across the region, enabling ordinary Africans to participate in global financial markets.”

Africa’s Web3 Regulation: Compliance Remains Essential

We observe that the rapid development of Web3 in Africa goes hand-in-hand with regulation—business operations must always comply. Currently, Nigeria, Botswana, Mauritius, Namibia, South Africa, and Seychelles have enacted legislation regulating digital assets, while Algeria, Egypt, Morocco, and Tunisia explicitly ban them. Other African countries have neither established regulatory frameworks nor imposed bans, remaining in a “regulatory vacuum.” Let’s examine regulatory examples from several countries:

South Africa

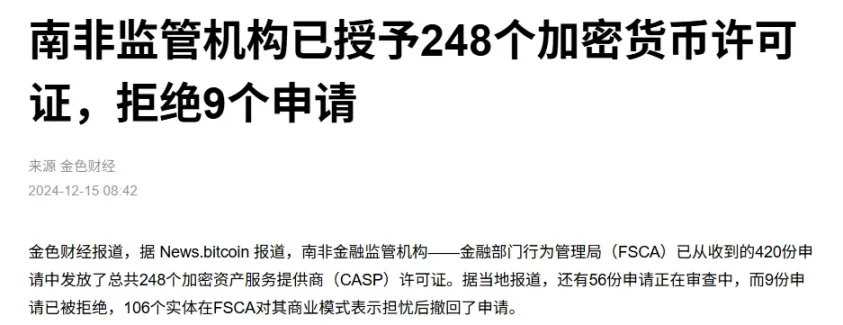

South Africa leads Africa in digital asset regulation. In 2022, the Financial Sector Conduct Authority (FSCA) released the Crypto Asset Declaration, marking a milestone in the country’s regulatory approach. The declaration defines crypto assets as “financial products,” requiring service providers to register and comply with the Financial Advisory and Intermediary Services Act (FAIS). In 2023, FSCA published a comprehensive crypto regulatory framework covering anti-money laundering (AML) and customer protection requirements. As of 2024, over 300 crypto firms have obtained licenses or are in the application process.

Mauritius

The Mauritian government continues efforts to attract investors, build a resilient economy, and position Mauritius as a hub for emerging technologies. Toward this end, it passed the Virtual Asset Act, effective February 7, 2022. Concurrently, the Financial Services Commission (FSC) issued “Guidance Notes on Anti-Money Laundering / Countering the Financing of Terrorism for Virtual Asset Service Providers (VASPs) and Initial Token Offering Issuers,” based on national risk assessments. In 2023, Mauritius further updated its AML/CFT regulations, strengthening oversight of digital assets. Thanks to progressive regulation, Mauritius is increasingly seen as one of Africa’s crypto-friendly jurisdictions.

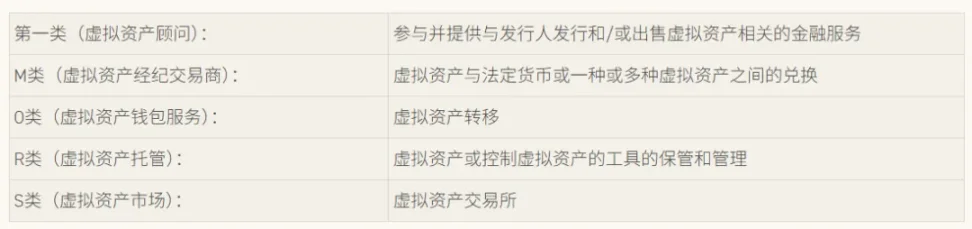

*The Virtual Asset Act establishes five license types for VASPs

Nigeria

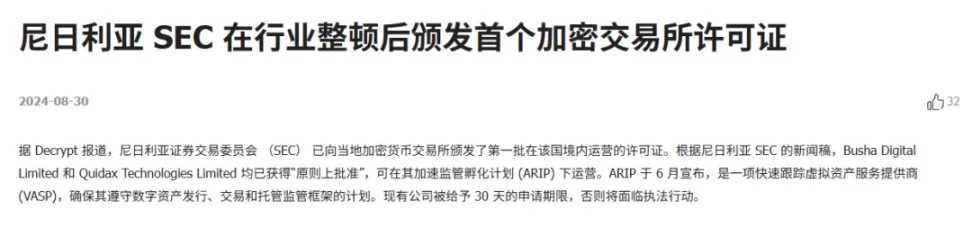

According to Chainalysis reports, Nigeria ranks second globally in cryptocurrency adoption. In 2023, the Nigerian Securities and Exchange Commission (SEC) released the Digital Assets Rules, bringing crypto assets under regulation and requiring exchanges and VASPs to register and comply with AML/CFT requirements. As reported by Decrypt in August 2024, Nigeria’s SEC has issued the first set of operational licenses to local cryptocurrency exchanges.

It’s evident that many African countries are embracing blockchain. Nigeria’s regulatory framework enables Yellow Card to operate legally; South Africa’s classification of crypto as financial products allows Ejara to stay compliant; Kenya’s sandbox model gives Jambo a green light; Botswana and Mauritius attract investment through virtual asset laws. On this fertile ground filled with financial needs and entrepreneurial opportunities, building businesses requires prioritizing compliance.

Emerging Markets: The Next Blue Ocean for Web3 Startups

Africa’s Web3 boom is just the tip of the iceberg regarding emerging market potential. Latin America, South Asia, and Southeast Asia face similar challenges of inadequate financial inclusion and exhibit strong financial demand.

In Latin America, inflation crises in Brazil and Argentina are accelerating stablecoin adoption, with platform transaction volumes rising steadily. In South Asia, India and Pakistan see rapid expansion of DeFi-powered micro-lending projects due to financial exclusion and high remittance costs. In Southeast Asia, crypto payment apps like Coins.ph in the Philippines and Vietnam serve over 20 million users, meeting cross-border remittance needs.

*Coins.ph, a cryptocurrency exchange in the Philippines

The decentralization, low cost, and high inclusivity of Web3 blockchain are precisely the remedies for financial pain points in emerging markets. From stablecoin trading and DeFi lending to crypto payments and NFT assetization, Web3 offers diverse entry points to meet savings, investment, and payment needs. In 2024, global Web3 startups raised over $12 billion in funding, with emerging markets accounting for 30%, highlighting the vast potential of this blue ocean. Whether it’s Jambo’s mobile infrastructure, Yellow Card’s stablecoin trading, Xend’s DeFi empowerment, or Ejara’s investment democratization, Web3’s multi-scenario applications are reshaping the financial landscape. This vast, underexplored market awaits more innovators, while governments progressively establish regulatory frameworks to advance financial equity legally and compliantly.

ManQin Lawyers’ Summary

Against the backdrop of a stark global gap in financial inclusion, emerging markets like Africa face challenges including lack of banking services, fragile currencies, and difficulties in cross-border payments. Web3, leveraging blockchain’s decentralized trust mechanism and the convenience of Web3 wallets, breaks down financial service barriers, offering hope for financial equality in these regions. African Web3 companies like Jambo and Yellow Card are meeting local financial needs through innovative models, achieving remarkable results in cross-border payments, stablecoin trading, and DeFi lending. Meanwhile, multiple African nations are actively exploring regulatory pathways, with countries like South Africa, Mauritius, and Nigeria enacting digital asset regulations that define compliant boundaries for Web3 development.

In fact, Africa’s Web3 boom is only the tip of the iceberg—Latin America, South Asia, and Southeast Asia also present enormous financial demands, making them undoubtedly a blue ocean for Web3 entrepreneurship, full of infinite opportunities.

Many domestic entrepreneurs are eager to seize this opportunity and launch overseas ventures. However, conducting Web3 business in emerging markets demands prioritizing compliance. Entrepreneurs must closely monitor regional regulatory developments and innovate within compliant frameworks to seize opportunities without triggering risks, successfully capturing their share of the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News