Crypto OTC: The "Invisible Engine" of Stablecoin Payments in Africa

TechFlow Selected TechFlow Selected

Crypto OTC: The "Invisible Engine" of Stablecoin Payments in Africa

Over-the-counter (OTC) cryptocurrency trading is rapidly becoming a key force enabling global businesses to "seamlessly participate" in Africa's digital financial ecosystem.

Translation: Will A Wang

"Small currencies, hard-to-transfer nations" has become a synonym for African countries. For enterprises planning to enter African markets, the complexity of the local financial environment—banking system limitations, exchange rate volatility, and regulatory uncertainty—can be daunting. These barriers not only hinder daily operations but also deter potential investors. As a result, finding alternative solutions has become essential; in recent years, blockchain-based crypto funding channels are being adopted by more and more companies.

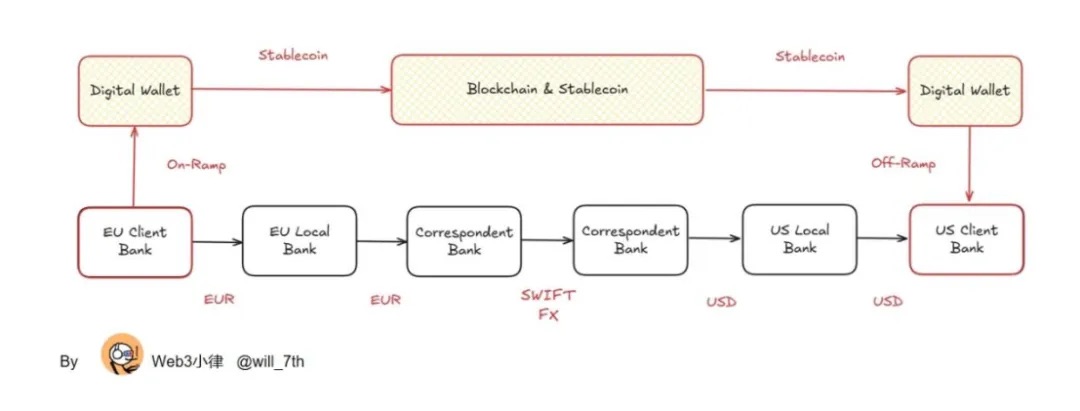

As discussed in our previous article "Stablecoin Payments and Global Capital Flow Patterns," while stablecoins fully embody blockchain's core capability of "instant transfer of funds and value," payment goes far beyond just "peer-to-peer transfers." Just like a stablecoin sandwich, even though blockchain replaces traditional payment rails for horizontal value/funds transmission, both ends still rely on outdated financial systems and must ultimately return to bank accounts within the target country’s market.

This is where crypto over-the-counter (OTC) trading becomes a core component for stablecoin payment companies, especially for these African "small currencies, hard-to-transfer nations." The lack of local financial infrastructure and failure of traditional channels have forced the rapid growth of the crypto OTC market. Its efficient on-ramp/off-ramp services enable secure and fast conversion between fiat and stablecoins for corporate capital flows.

As Africa and the world accelerate their embrace of digital innovation, crypto/stablecoin payment channels offer businesses opportunities to expand in rapidly changing markets.

Hence, we have compiled a report from Quidax, an African stablecoin payment company (also known as a local African OTC service provider), titled The Rise of OTC and Stablecoins: Africa's Quiet FX Revolution. This report reveals how global businesses can leverage crypto OTC trading to simplify settlements, access liquidity, and confidently expand into African markets, offering a strategic overview. Based on regional insights, market trends, and operational realities, this report targets decision-makers, finance executives, and treasury teams, helping them navigate Africa’s evolving cryptocurrency landscape under compliant and transparent conditions. The interviews with several African crypto industry leaders are particularly insightful.

Executive Summary

Over-the-counter (OTC) cryptocurrency trading is rapidly becoming a key enabler for global businesses to seamlessly participate in Africa’s digital financial ecosystem. By conducting large-scale peer-to-peer crypto transactions outside traditional exchanges, OTC models bridge structural gaps in conventional banking systems, providing secure and compliant pathways for institutional settlement. In 2024, global OTC crypto trading volume surged 106% year-on-year, with stablecoin activity growing as much as 147%, driving African platforms like Quidax and Busha to achieve high-efficiency, large-scale transactions via this model. These services help enterprises meet liquidity needs with minimal market impact, enable real-time fiat settlements, and streamline compliance entry into high-growth markets such as Nigeria, South Africa, and Ethiopia.

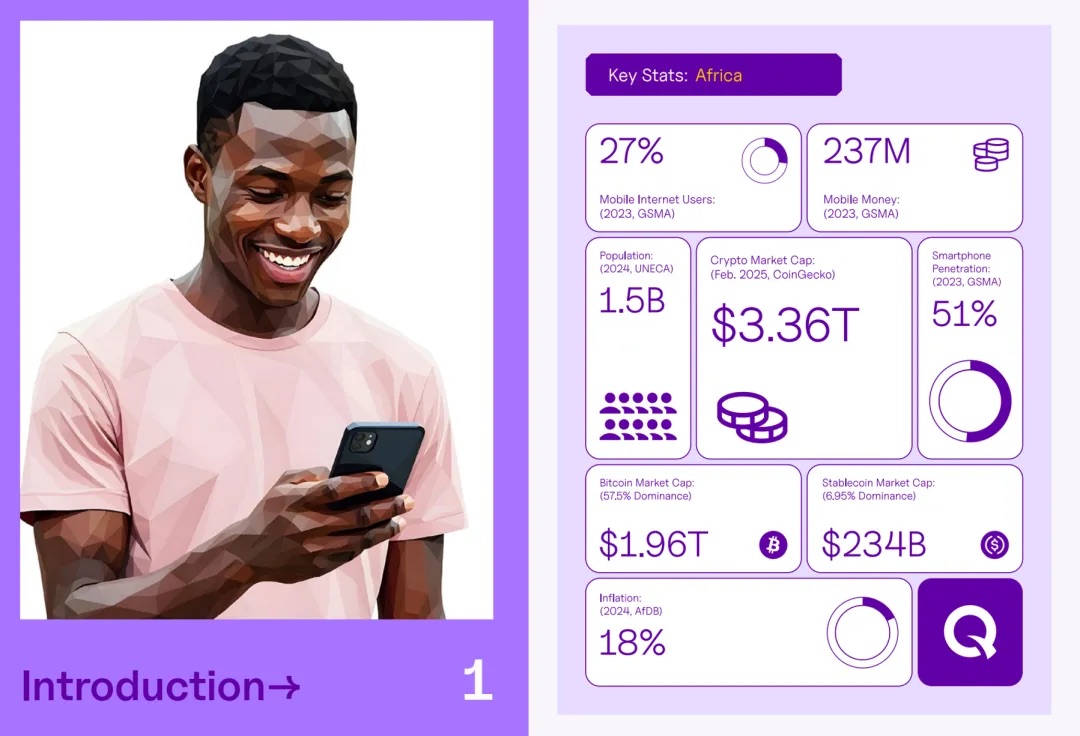

Africa’s overall crypto landscape is undergoing rapid transformation: with a median age of just 19.2 and over 60% of the population unbanked, it presents a unique dual driver of “demographics + economy” for digital financial solutions. Cryptocurrencies have evolved from retail speculation to practical applications, particularly excelling in cross-border payments and inflation hedging. Last year, Nigeria processed approximately $59 billion in crypto value, ranking second globally behind India; South Africa and Kenya are also showing strong momentum through mobile wallet integration and relatively friendly crypto policies.

Stablecoins have become the dominant asset for settlements, accounting for 43% of all crypto transactions in sub-Saharan Africa (SSA), favored for their price stability, real-time settlement, and transparent auditing. Nigeria alone absorbed over 40% of SSA’s stablecoin inflows, while Ethiopia and Zambia saw annual growth exceeding 100%. Enterprises are using stablecoins like USDT and USDC to hedge foreign exchange fluctuations, simplify import processes, and accelerate cross-border settlements, with stablecoin transaction volumes surpassing Bitcoin in most African regions.

Although regulation remains cautious, many African governments are shifting from “prohibition” to “engagement.” Nigeria’s issuance of crypto licenses in 2024 is seen as a turning point, sparking renewed commercial interest; Ghana, South Africa, and Kenya have also launched central bank digital currencies (CBDCs) and regulatory sandboxes, providing clearer paths to compliance. Executives from firms like Busha and Xago call for a hybrid model that balances “innovation + governance + risk control” in their report interviews.

OTC trading has achieved product-market fit across multiple industries: banks and payment providers embed stablecoin channels into cash flows; manufacturers and importers use OTC swaps to avoid slippage and bank fees; digital enterprises leverage crypto channels for fast user onboarding and real-time settlements. Quidax’s expansion into South African Rand (ZAR) and Ethiopian Birr (ETB) channels demonstrates industry momentum; infrastructure provider Kotani Pay integrates API-driven stablecoin-fiat exchange directly into mobile wallet ecosystems.

Regulatory attitudes are shifting from “outright bans” to “licensing + sandbox” approaches. In 2024, Nigeria’s SEC issued operating licenses to multiple virtual asset service providers; South Africa’s FSCA has also granted dozens of crypto asset licenses. However, over 15 African countries have varying regulatory frameworks, creating compliance complexities for cross-border players. Despite caution, many governments are moving from “ban” to “regulation.” Nigeria’s 2024 licensing regime marks a watershed moment, reigniting business enthusiasm. CBDC initiatives and sandbox programs in Ghana, South Africa, and Kenya are paving the way for compliance. Industry leaders like Busha and Xago advocate for a hybrid model emphasizing “innovation + governance + risk control” in the report.

Looking ahead, programmable stablecoin channels and API-driven OTC platforms will recede into the background as “invisible infrastructure” integrated into enterprise ERP and fintech applications, working alongside frameworks like the African Continental Free Trade Area (AfCFTA) to support intra-African trade. Institutional-grade crypto asset reserves and multi-country CBDC pilots in West and East Africa will further blur the boundaries between fiat and crypto settlements, ushering in a new era of “24x7, USD-equivalent” liquidity in Africa.

1. Overview of Africa’s Crypto Market

The rise of cryptocurrencies in Africa mirrors the global evolution of fintech and digital currencies, closely tied to the mobile phone revolution that swept across the continent in the early 2000s. Over the past three decades, the rapid adoption of mobile and internet technologies has laid the foundation for digital transformation across industries. This shift, driven by a young and tech-savvy population, has provided fertile ground for blockchain—the underlying technology of cryptocurrencies—to take root.

In Africa, over 60% of the population remains unbanked, making blockchain a popular solution in finance by offering fast, low-barrier solutions for cross-border payments and digital asset transactions.

Initially, people embraced crypto assets to hedge against inflation and circumvent capital controls, making them tools for personal savings and business payments. Today, this trend deepens: over-the-counter (OTC) crypto trading is enabling seamless capital flows for global businesses, bypassing the numerous obstacles posed by traditional banking systems—foreign exchange volatility, delayed settlements, and complex cross-border compliance. With the growing popularity of Bitcoin, Ethereum, Tether, and other stablecoins, African enterprises now view crypto not just as a tool, but as a reliable, fast, and transparent financial infrastructure capable of replacing outdated traditional systems.

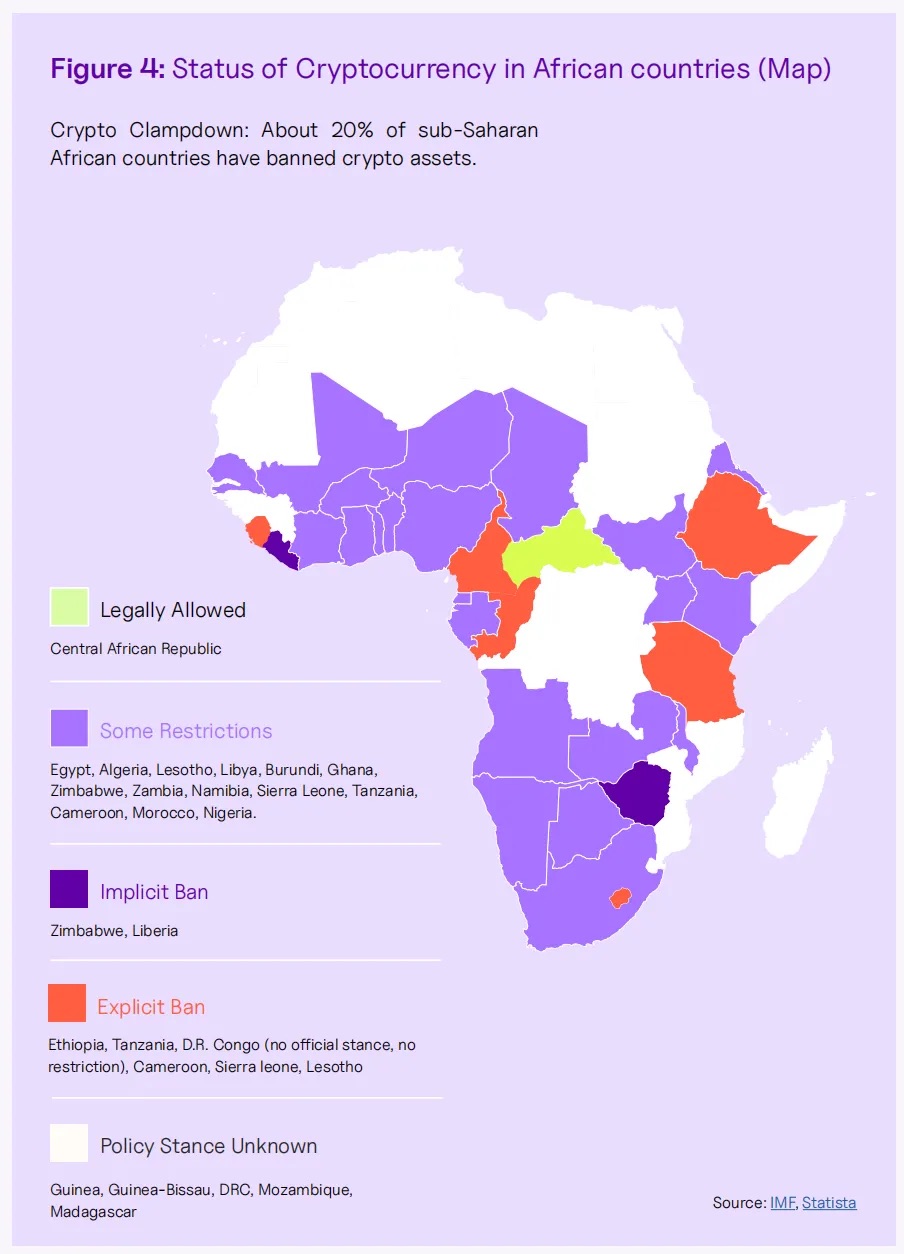

1.1 Evolution of Cryptocurrency in Africa

The decentralized and unregulated nature of cryptocurrencies is seen as potentially threatening the status of fiat currency and weakening monetary authorities’ functions. Governments also worry about digital assets being used for unregulated illegal transactions. In many African countries, central banks and financial regulators initially responded cautiously. Thus, countries including Nigeria, Tunisia, Egypt, Lesotho, and Algeria successively banned the use of cryptocurrencies in formal transactions. However, due to the decentralized nature of crypto, no single government can completely shut it down, leaving underground trading active.

As major global economies (such as the UK, US, Canada) gradually legislate and accept cryptocurrencies and digital assets, more multinational corporations—Microsoft, Tesla, PayPal, KFC, etc.—have begun accepting crypto, notably Bitcoin, as payment.

Consequently, global acceptance of crypto has gradually permeated Africa, strengthening local users’ belief that “cryptocurrency is the future of money.” As transaction volumes continue to grow, some African countries have started relaxing bans—Nigeria, Tunisia, Senegal, Sierra Leone, Ghana—and others are researching central bank digital currencies (CBDCs) as regulated alternatives, including Nigeria, Egypt, Morocco, Algeria, and Kenya. In April 2022, the Central African Republic (CAR) went further, passing legislation to recognize Bitcoin as legal tender alongside the CFA Franc; however, implementation was paused pending approval from the Bank of Central African States (BEAC). In February 2025, CAR launched a meme coin.

1.2 Cryptocurrency in Africa’s Business Landscape

Today, as more governments begin to tap into the immense potential of cryptocurrency—value creation, smart transactions, tax revenue—the African crypto ecosystem continues to evolve. Yet, like elsewhere, African businesses are taking bold steps forward.

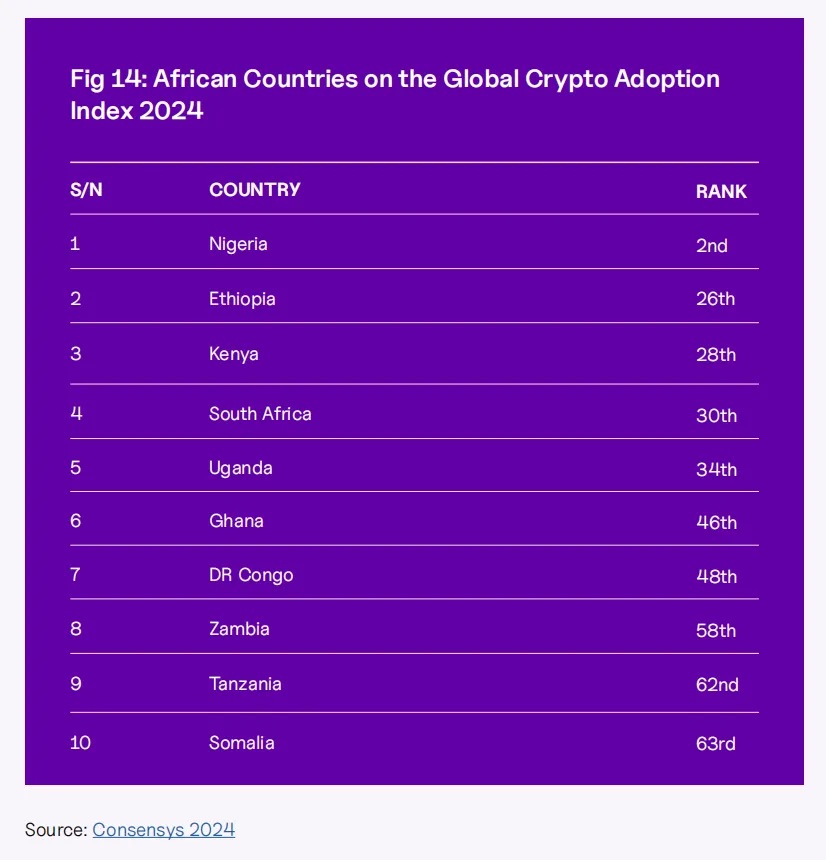

While sub-Saharan Africa (SSA) accounts for only $4.8 trillion in crypto transactions—2.7% of the global total (compared to MENA’s 7.5%)—local enterprises already use crypto for daily payments, inflation hedging, and increasingly frequent, smaller (retail-level) transfers. According to Chainanalytics’ "2024 Global Crypto Geography Report," stablecoins now account for 43% of SSA’s transaction volume, with Nigeria ranking second globally in crypto adoption (after India), and Ethiopia (26th), Kenya (28th), and South Africa (30th) all in the top 30.

The report also shows SSA leading globally in DeFi adoption, partly due to urgent demand for accessible financial services: World Bank data indicates only 49% of adults had bank accounts in SSA as of 2021. Businesses also use stablecoins to hedge FX risk.

In response to this trend, African central banks remain generally cautious but maintain a “policy observation window,” preserving possible compliant space for crypto assets.

Key turning points for crypto adoption in Africa include the 2020 pandemic, the 2021 Russia-Ukraine conflict, and ongoing efforts toward regional integration. The African Union’s High-Level Expert Group on Emerging Technologies (APET) encourages the development of alternative payment methods like blockchain and crypto to promote cross-border transactions, enhance financial inclusion, and reduce transaction costs.

2. Crypto OTC Trading in Africa

Over-the-counter (OTC) trading is rapidly becoming an alternative channel for accessing crypto in Africa.

Financial markets typically operate in two forms: exchanges and over-the-counter (OTC). Exchanges (such as stock or crypto exchanges) publicly match buyers and sellers, with all trades executed “on-exchange” and visible to all participants regardless of involvement.

In contrast, OTC trading occurs directly between two parties, one of which is often a “trading desk.” A trading desk is a commercial entity specializing in buying and selling specific assets. In OTC trades, both parties agree on a price beforehand, then execute the trade; only the two parties know the quantity and price.

In crypto, unlike exchange-based trading, OTC refers to private, direct large-volume crypto asset trades conducted between buyers and sellers outside regular exchanges, avoiding market price impacts. However, compared to exchanges, OTC trading usually carries higher counterparty risk.

As transaction sizes grow, OTC is rapidly becoming a key alternative method for acquiring crypto in Africa.

OTC desks fall into two types: Principal Desks and Agency Desks.

-

Principal Desk: Uses its own capital to buy/sell crypto assets for clients, bearing price fluctuation risks during the transaction window. For example, if a client requests to buy 500 BTC, the principal desk first purchases it with its own funds and delivers it at the pre-agreed price—even if market prices rise in the meantime, the desk absorbs the difference.

-

Agency Desk: Acts solely as a broker between buyer and seller, without using its own capital. If prices move unfavorably before completion, the client must adjust bids and bear market risk. The agency desk charges a brokerage fee.

2.1 Global Crypto OTC Trading

Finery Markets data shows: driven by institutional inflows and macro tailwinds, the global crypto OTC market expanded significantly in 2024, primarily fueled by surging stablecoin demand and increased crypto-to-crypto transactions. Bitcoin accounted for 22% of total OTC trading volume, with overall OTC volume up 106% YoY and stablecoin volume up 147% YoY, marking a highly active year for institutional and large-scale digital asset transactions.

Key drivers behind this growth include:

-

Spot ETF Launch: Approval of spot BTC and ETH ETFs provided institutional investors with a compliant and convenient entry path.

-

Regulatory Tailwinds: The pro-crypto stance of the Trump administration significantly boosted spot trading volumes in Q4 2024 and improved regulatory certainty, further fueling institutional participation.

-

High Prices & Stablecoin Adoption: In December, Bitcoin surpassed $100,000, setting a new record; simultaneously, stablecoins solidified their role as the primary bridge between traditional and digital finance.

-

Regional Distribution: Europe led institutional spot OTC demand with 38.5%, followed by North America, Asia, and the Middle East each at 15.4%.

2.2 Advantages of OTC Trading

OTC crypto settlement has become a vital complement to exchange markets, especially suitable for enterprises requiring large, fast, and compliant digital asset settlements. Below are five core advantages global businesses should note:

-

Deep Liquidity

OTC desks aggregate large buy/sell orders off-exchange, allowing enterprises to complete bulk crypto or stablecoin trades in one go, without splitting order books. Trades settle fully at negotiated prices, avoiding partial fills or slippage common on public exchanges.

-

Compliance and Transparency

Prominent OTC platforms (e.g., Quidax) enforce full KYC/AML procedures, whitelist counterparties and wallet addresses, provide auditable transaction trails, and hold local licenses (e.g., Nigeria SEC, South Africa FSCA), offering robust assurance for finance and compliance teams.

-

Instant Settlement

Unlike traditional bank channels that may take days to clear, OTC crypto settlements—especially stablecoins—are typically completed within minutes, greatly reducing settlement risk and accelerating working capital turnover.

-

Effortless Large Transactions

OTC desks specialize in six- or even seven-figure USD trades, executing them in a single order to avoid market shocks and price volatility from large public orders, ensuring price stability.

-

Personalized Service and Negotiation Room

OTC desks offer customized quotes, flexible settlement options (fiat or stablecoins like USDT/USDC), and direct negotiation, allowing enterprises to tailor transaction structures based on cash flow needs, hedging strategies, and treasury policies. OTC trades occur privately off-exchange, ideal for large transactions where confidentiality is critical.

2.3 How OTC Trading Solves Global Enterprises’ Africa Pain Points

Thanks to their unique positioning, OTC crypto desks precisely address long-standing challenges faced by multinational enterprises in Africa. Below we map pain points to OTC solutions, supported by mini-case scenarios.

-

Foreign Exchange Volatility

Pain Point: Rapid local currency fluctuations erode profits when converting large sums via banks.

OTC Solution: Settle in USD-pegged stablecoins (USDT/USDC) or major cryptos, locking in exchange rates and instantly hedging intraday FX risk.

Scenario: A Nigerian importer signs a 30-day USDT contract with an OTC desk to pay an East Asian supplier, successfully avoiding mid-month NGN/USD depreciation.

-

Complex Cross-Border Payments

Pain Point: Multi-tier correspondent banking leads to delays, fees, and operational complexity.

OTC Solution: Convert local currency to stablecoins, transfer instantly on-chain, then convert directly to recipient’s fiat—closing the loop in one transaction.

Scenario: A Ghanaian NGO uses Quidax’s OTC desk to disburse grants in USDT to a Kenyan partner, who converts to KES within minutes.

-

Exchange Slippage

Pain Point: Large limit orders shock the market, causing slippage and hidden costs.

OTC Solution: Desks use proprietary liquidity or bilateral matching to execute bulk trades at pre-agreed prices, minimizing market impact.

Scenario: An African fintech firm buys 5 BTC for reserves via OTC at a fixed price, avoiding 2% slippage loss.

-

Compliance with Local Currency Regulations

Pain Point: Differing currency controls and AML/KYC rules across countries complicate local operations.

OTC Solution: Licensed OTC providers (e.g., Quidax) offer one-stop KYC/AML onboarding and customize settlement routes per local fiat channels and legal frameworks.

Scenario: A European exporter completes SEC-VASP compliance, local beneficiary reporting, and full EUR→NGN stablecoin→partner bank account flow via Quidax Nigeria OTC desk—all auditable.

-

Optimizing Supplier/Partner Payment Processes

Pain Point: Manual FX purchases and multiple bank transfers tie up working capital and involve lengthy approval chains.

OTC Solution: Dedicated account managers negotiate payment terms, issue settlement instructions, and automate recurring payments via API or scheduled calls.

Scenario: A pan-African agribusiness sets weekly OTC swaps, converting USD holdings to NGN stablecoins to pay multiple Lagos suppliers—no repeated bank approvals needed.

-

Batch Payouts to Platform Users

Pain Point: High-frequency payouts in gig economy or gaming platforms face slow bank batches and high fees.

OTC Solution: Desks batch-distribute stablecoins or conduct direct crypto transfers, reaching end-users in areas with weak banking infrastructure.

Scenario: A Nigerian digital platform uses OTC to instantly and cheaply pay USDT prizes to contest winners, who can withdraw immediately to personal wallets.

2.4 African OTC Firm Quidax

Quidax is a licensed, compliant crypto exchange founded by an African team, enabling anyone to easily buy, sell, store, and transfer crypto assets. Its core expertise lies in over-the-counter (OTC) trading, seamlessly integrating high-volume, compliant settlements into existing platforms via dedicated crypto APIs for enterprises and fintech companies.

Quidax operates under dual licenses from Canada’s MSB and Nigeria’s Securities and Exchange Commission (SEC) as a VASP. Since launching in 2018, Quidax has served users in over 70 countries and maintains localized teams in key African markets. The platform connects directly to fiat channels, supporting multiple African currencies including Nigerian Naira (NGN), South African Rand (ZAR), and Ethiopian Birr (ETB). Quidax’s OTC desk handles single trades above $100,000 and supports instant settlement in fiat or USDT, delivering a seamless enterprise payment experience.

2.5 How Key African Industries Leverage OTC Trading

OTC Use Cases Overview:

Use Case 1: Cross-Border Trade and Commerce

Pain Point: International brands and distributors face high costs and long settlement cycles when paying local partners across multiple African markets.

Solution: Through OTC stablecoin trading, enterprises can purchase digital dollars (USDC, USDT, etc.) at favorable rates and instantly convert them to local fiat via Quidax OTC for fast, compliant settlements.

Impact: Settlement time reduced from “days” to “hours”; FX costs significantly lowered; cash flow and supplier relationships improve.

Use Case 2: Digital Platforms and Consumer Applications

Pain Point: Large global digital platforms serving African users need to quickly pay local partners and service providers while tightly controlling operating costs.

Solution: Platforms bulk-purchase stablecoins via Quidax OTC desk and instantly convert to local fiat for efficient, reliable revenue sharing.

Impact: Partner payout times drastically reduced; transaction and FX fees lowered; OTC process embedded into automated treasury workflows.

Use Case 3: Institutions and Treasury Operations

Pain Point: Financial institutions, corporate groups, and investment entities urgently need reliable, compliant, and scalable solutions to transfer large-value funds into and across African countries.

Solution: Quidax OTC trading supports large single transactions with guaranteed execution, provides local fiat channels, and meets regulatory requirements.

Impact: Enhanced treasury management; greater confidence in regulatory compliance; frictionless expansion of cross-border business.

Case Study I: Simplifying Cross-Border E-Commerce Settlements in Africa

NevaCommerce is a European-headquartered global digital commerce services firm connecting international brands with distributors and end customers in Nigeria, South Africa, and Kenya through its emerging market network.

Challenges

-

High fees and slow settlement when using traditional bank channels to make large local-currency payments to partners.

-

Profit erosion due to exchange rate volatility and high FX conversion costs.

-

Regulatory complexity in cross-border transactions creates operational hurdles.

Solution

-

Partnered with Quidax OTC desk to use stablecoins for cross-border settlements.

-

Leveraged OTC trading to access competitive large-volume liquidity and exchange rates.

-

Used Quidax OTC to seamlessly convert stablecoins to local fiat for fast, compliant partner payments.

Results

-

Settlement time reduced from up to 5 days to under 1 hour.

-

Up to 2% savings on FX spreads and fees per transaction.

-

Faster, more reliable payments strengthened local partner relationships.

Key Differentiators from OTC

-

Customized pricing and ability to handle large single transactions.

-

Private, secure, and compliant trade execution.

-

Support for local currencies and adherence to regulations, eliminating compliance concerns.

“For the first time, our finance and operations teams can settle in Africa quickly and cost-effectively—OTC has completely transformed our business.” — NevaCommerce CFO

Case Study II: Streamlining Local Partner Settlements in Africa

Global Platform Co. is a fast-growing international digital platform with millions of users and partners in African markets including Nigeria, South Africa, and Ghana.

Challenges

-

Slow and costly processes when settling with local partners and service providers.

-

Market pressure demands shorter payout cycles to improve user experience and partner satisfaction.

-

Traditional payment methods lack flexibility and incur high transaction fees.

Solution

-

Integrated Quidax OTC desk for batch settlements using stablecoins.

-

Accessed deep liquidity and optimal exchange rates via OTC trading.

-

Instantly converted stablecoins to local fiat for fast, compliant payments to African partners.

Results

-

Partner settlement time reduced from 48 hours to under 4 hours.

-

Operating costs lowered, capital efficiency improved.

-

OTC trading embedded into daily global settlement workflows.

Key Differentiators from OTC

-

Stable, locked pricing for high-volume transactions.

-

Seamless API integration enabling automated settlements.

-

Compliance coverage ensured via Quidax’s licenses and local expertise.

“With Quidax OTC, our treasury team now has the flexibility, speed, and compliance assurance needed to serve the African market seamlessly.” — Global Platform Co. CFO

3. Stablecoin Payment Trends in Africa

Like other global regions, Africa’s stablecoin market has matured, surpassing Bitcoin as the preferred asset in daily transactions. Except in North America (where stablecoin trading slightly exceeds Bitcoin), stablecoin volumes exceed Bitcoin by more than double elsewhere.

In Africa, high inflation and currency depreciation erode wealth, making stablecoins a popular hedge against local currency instability, offering a more reliable means for transactions and value preservation.

FX volatility drove retail and small-scale stablecoin transfers to account for 43% of total crypto transactions last year.

Currently, stablecoin growth in Africa is primarily driven by transfers under $1 million—i.e., retail and non-institutional transfers. Sub-Saharan Africa (SSA) is the fastest-growing region for retail and professional stablecoin transfers, with annual growth exceeding 40% in both segments. Last year, stablecoins accounted for 43% of all crypto transaction volume in SSA.

3.1 Rising Stablecoin Adoption in Africa

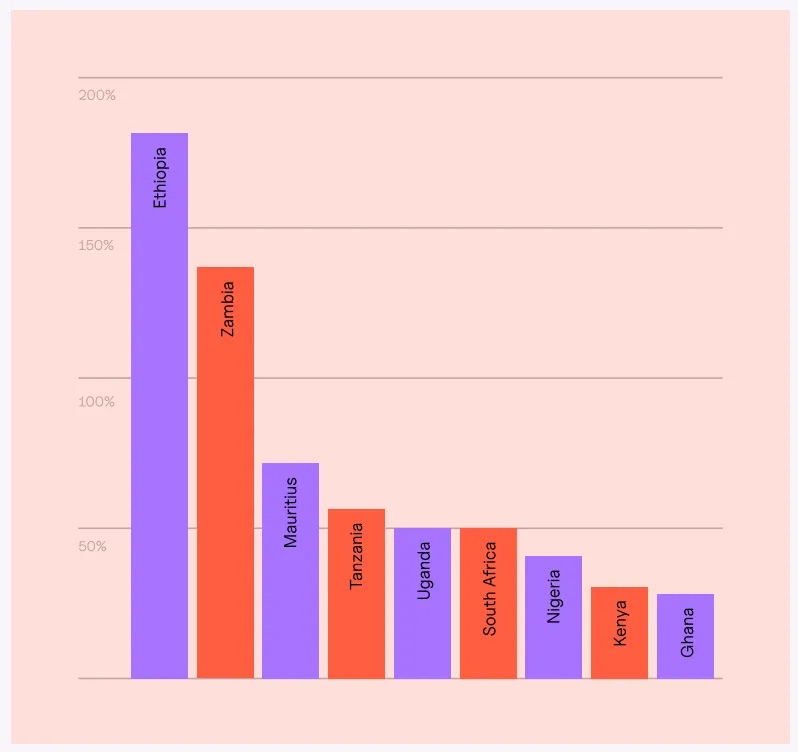

While Nigeria and South Africa lead in stablecoin adoption, usage is rapidly increasing in Ethiopia, Zambia, Mauritius, Kenya, and Ghana. The chart below shows year-over-year growth in retail-level (single transaction under $10,000) stablecoin transaction volume in SSA (comparison period: July 2022–June 2023 vs. July 2023–June 2024).

Ethiopia and Zambia both recorded stablecoin annual growth exceeding 100% over the past year. Ethiopia emerged as the fastest-growing retail stablecoin transfer market, with 180% year-over-year growth. The Ethiopian Birr (ETB) depreciated 30% in July after the government relaxed currency controls to qualify for a $10.7 billion IMF and World Bank loan. This devaluation is expected to further boost demand for stablecoins. Nigeria’s crypto activity is largely driven by small retail and professional transactions, with about 85% of receipts under $1 million. Nigeria received over $20 billion in stablecoin inflows in SSA, accounting for more than 40%.

Meanwhile, beyond stablecoins' rising prominence, decentralized finance (DeFi) is also having a pivotal moment in Nigeria, reflecting SSA’s broader lead in global DeFi adoption.

3.2 Role of Stablecoins in Mitigating Crypto Price Volatility

Stablecoins play a crucial role in the entire crypto ecosystem by solving its most persistent problem—price volatility. Cryptocurrencies like Bitcoin and Ethereum can experience sharp swings in short periods, making them impractical as mediums of daily exchange or reliable stores of value.

According to S&P Global Ratings, in OTC settlement processes, stablecoins enable minute-level, near-instant final settlement, versus days required by traditional methods; slippage is minimal (typically under 1%, a stark contrast to 5–10% FX fees); and immutable records on blockchain enhance KYC/AML transparency and compliance. As a programmable, 24x7 “dollar rail,” stablecoins allow African enterprises, fintech firms, and telecom-finance ecosystem partners to expand cross-border payment corridors without building new banking infrastructure.

3.3 Relevant Data

Although sub-Saharan Africa (SSA) accounts for a small share of global crypto transaction volume, multiple indicators suggest promising prospects for the region in the crypto space.

YouGov 2024 Survey Data:

-

93% of global respondents reported having heard of cryptocurrency, with 51% saying they “know something about it.”

-

Sub-Saharan Africa (SSA) accounts for only 2.7% of global transaction volume.

-

Nigeria received approximately $59 billion in crypto value in 2024, ranking second globally in crypto adoption index (after India).

-

Future crypto investment intent among African respondents reached 87%, higher than other global regions.

-

In terms of “understanding level,” Nigeria (77%), South Africa (65%), South Korea (61%), and India (60%) ranked highest.

-

In “current or past ownership of crypto assets,” Nigeria (73%), South Africa (68%), Philippines (54%), Vietnam (54%), and India (52%) all exceeded 50%.

Chainalysis "2024 Global Crypto Geography Report"

-

Sub-Saharan Africa (SSA) still has the smallest share of global transaction volume at 2.7%.

-

Stablecoins now account for approximately 43% of total volume in the region.

-

Nigeria received around $59 billion in crypto value in 2024, ranking second in global adoption index.

3.4 Interview with Buchi Okoro, CEO of Quidax

Q: What key consumer behavior changes in crypto application have you observed in Africa over the past two years?

A: The most noticeable shift is from “speculation” to “practical use.” Initially, most users treated crypto assets as investment vehicles; today, we see significantly increased usage in daily transactions—more consumers are using crypto for cross-border payments and even e-commerce purchases.

Q: What structural or fundamental barriers are currently hindering widespread crypto adoption in African commercial transactions? Can these barriers be changed or improved?

A: Regulatory absence is one of the biggest barriers, making many African market enterprises hesitant to adopt crypto. But this can change. We’re seeing positive signals: countries like Nigeria have introduced regulatory frameworks such as digital asset exchange licenses, greatly boosting market confidence and consumer security. If this model spreads to more African nations, it could create a frictionless environment for businesses to embrace crypto. What we need is “balanced regulation”—regulators and compliant crypto firms working together to encourage innovation and protect users while maintaining appropriate oversight.

Q: Looking ahead 2–3 years, how do you foresee the evolution of Africa’s crypto market? What changes might occur in the short and long term?

A: In the short term, more African countries will roll out regulatory frameworks, leading to a “regulatory wave.” This will bring structural order, legalize crypto in various countries, and protect consumers. Long term, collaboration between traditional financial institutions and crypto firms will deepen; some central banks will launch CBDCs in response to the growing crypto ecosystem.

Q: Which key markets deserve attention? What are the core drivers behind crypto adoption in these African markets?

A: Nigeria, Ghana, Kenya, Rwanda, Tanzania, and South Africa. A large, young consumer base, relatively sound financial infrastructure, and forward-looking tech policies will be the three main engines driving growth in these markets.

Q: How will African OTC desks evolve? Given fraud cases and corporate governance issues, is “fully decentralized” realistic?

A: In the coming years, as regulatory frameworks mature, the OTC sector will see stronger “institutionalization.” Desks will adopt more standardized operating procedures, focusing on rigorous risk management and compliance practices. Technologically, upgrades will follow—more automated systems, stronger custody and escrow features will emerge.

Q: How are African enterprises currently exploring OTC platforms? What interesting use cases, key players, industries, or sectors exist? Where is growth fastest and opportunity greatest?

A: Use cases are abundant: cross-border trade settlements for import/export firms, payment channels for dealings with international suppliers, and corporate treasury hedging against local currency fluctuations via OTC. The import/export, tech, and e-commerce sectors are actively leveraging OTC opportunities.

Q: How can regulators effectively collaborate with industry players to promote crypto industry growth? Is it possible to emulate the African Continental Free Trade Area (AfCFTA) model for pan-African crypto regulatory cooperation?

A: Regulatory sandboxes are excellent—they allow industry players to test innovations in controlled environments. Regular public-private dialogues are also crucial, enabling regulators and practitioners to understand each other and co-create rules. The interaction between Nigeria’s SEC and crypto stakeholders is a model example. As for pan-African cooperation, it’s entirely feasible: we could push for unified consumer protection policies and mutual recognition of licensed entities.

Q: Looking ahead 2–3 years, how do you anticipate the evolution of Africa’s crypto regulatory landscape?

A: I believe regulation will become more granular, clearly differentiating between types of crypto activities—trading, payments, asset tokenization, fundraising—and tailoring rules accordingly.

3.5 Interview with Moyo Sodipo, Co-founder of Busha

Busha is a licensed cryptocurrency exchange and payment platform headquartered in Nigeria, serving African markets. Founded in 2018, it received one of Nigeria’s first provisional digital asset licenses from the SEC in 2023, becoming one of Nigeria’s first compliant crypto exchanges.

Q: What structural or fundamental barriers are currently hindering widespread crypto adoption in African commercial transactions? Can these be changed or improved?

A: Regulatory ambiguity has been a major stumbling block. Until August 2024, Nigeria lacked a clear crypto regulatory framework, meaning many individuals and businesses interested in crypto and digital assets took a wait-and-see approach. Consequently, we’ve had to spend significant effort convincing and explaining before people actually start using crypto. Fortunately, under the leadership of the new SEC director-general, the Nigerian government has decided to regulate crypto, bringing a glimmer of hope.

Q: What key consumer behavior shifts in crypto application have you observed in Africa over the past two years?

A: The biggest change I’ve seen is growing awareness of “crypto settlement.” Looking back at Nigeria, crypto first gained widespread attention during the 2017 bull run; prior to that, MMM Ponzi schemes were rampant, and many conflated Bitcoin with MMM. That was my memory of the first mass attempt to engage with crypto. The second wave came when forex trading became popular—due to limited FX access in Nigeria, people used crypto to fund trading accounts, a trend continuing today. Overall, crypto has evolved from a mere “get-rich-quick” tool to a payment method integrated into daily life. Now, we see increasing discussions around stablecoin adoption in various contexts.

While crypto isn’t fully recognized in Nigeria yet, globally, people are expanding stablecoin use cases, demonstrating how they can transform intercontinental remittances. With Nigeria’s licensing regime in place, in the coming years we’ll see more businesses not only accepting crypto but stablecoins as payment. Imagine checking out to buy an airline ticket and seeing “Pay with Stablecoin” as an option—that world holds infinite possibilities. I believe we’re transitioning from the “get-rich-quick” narrative to the “practical payment tool” narrative.

Q: Looking ahead two to three years, how do you see the evolution of crypto settlement in Africa? What short- and long-term changes might we see?

A: Crypto acceptance and adoption will inevitably rise. I believe within two to three years, we’ll see crypto used in everyday consumption. Once African countries launch stablecoins pegged to their local currencies, cross-border transactions will become simpler: imagine “Kenyan Shilling Stablecoin (CKS)” and “Nigerian Naira Stablecoin (CNGN)”—I wouldn’t need a Kenyan bank account to conduct trade between Nigeria and Kenya. That’s the future I envision—digital versions of national currencies running on blockchain, enabling intra-African trade without physical dollar movement. In the coming years, stablecoins of different currencies will be widely traded, promoting intra-African trade without reliance on physical dollars.

Q: What’s the overall outlook for crypto and OTC trading in Africa in 2025?

A: The outlook is very positive. Especially this year: when we look at different jurisdictions and market participants across Africa, we see more people finally willing to use stablecoins in various scenarios—whether for savings, cross-border remittances, or direct supplier payments. Discussions are far more intense than last year. Clearly, people are “ignited” and ready to truly explore this technology to ensure faster, smoother, and more efficient business operations.

3.6 Interview with Jurgen Kuhnel, CEO of Xago

Xago Technologies (Pty) Ltd is a fintech company founded in 2016 and headquartered in South Africa. Leveraging the high speed and scalability of the XRP Ledger (Ripple), it provides efficient, secure digital payment and crypto asset trading services.

Q: As a frontline practitioner, what key changes in consumer crypto application have you observed in Africa over the past two years?

A: It’s hard to speak for the entire African consumer market because our business is so focused. But we’ve definitely seen explosive growth of stablecoins in Africa—“explosion” doesn’t even do it justice. Usage of USDT and USDC has surged, with USDT being the most widely accepted. I often say that a few years ago everyone talked about M-Pesa in Kenya: mobile money emerged, backed by some government support, and now controls about 55% of Kenya’s GDP. USDT is like the “undeclared M-Pesa,” sweeping across Africa.

My point is, when you talk to ordinary Africans, they don’t care whether USDT is 100% USD-backed, whether it runs on Tron or Ethereum, or whether it trades at premium or discount—they know exactly how to use it. I think this viral spread will catch many off guard.

Q: Looking ahead two to three years, how do you see the evolution of Africa’s crypto market? What short- and long-term changes might occur?

A: From our perspective, the trend is very clear. As regulatory frameworks roll out, more “big players” are entering. Look at the US: giants like BlackRock brought Bitcoin ETFs to stock exchanges; governments are starting to treat Bitcoin as a hedge against domestic or foreign reserves. Even a Trump tweet can move the market. Over a dozen US states have proposed legislation, and Trump recently signed an executive order. Once the US takes this step, other countries will quickly follow.

Major US companies have already accumulated large amounts of Bitcoin. Some say “crypto is still in infancy” or “will explode,” but it’s already exploded—it’s everywhere. Personally, I haven’t met anyone who hasn’t heard of Bitcoin—maybe one or two living off-grid.

Look at my kids, aged 16 and 17—they’ll be the main consumers in ten years, with zero psychological barrier to crypto. In ten years, crypto will be as mundane as mobile payments today. Going back to the beginning: we got into crypto because we needed alternatives. For example, sending money to the UK traditionally requires SWIFT; now I can buy crypto and send it cross-border instantly. For big global banks and payment giants, switching to this new paradigm takes time, but eventually crypto will become another parallel clearing rail.

Q: Which key African markets deserve attention? What specific factors will drive crypto adoption there?

A: In South Africa, some ATMs already allow direct crypto buying or cash-out; some exchanges integrate with retailers to enable crypto shopping. The South African market is already quite mature.

Key markets will always be those with the largest populations and economies: Nigeria, South Africa. They also have the highest adoption. Namibia is actively introducing licensed exchanges; countries like Mozambique with tight liquidity can benefit greatly from crypto. Overall, African users prefer stablecoins over Bitcoin or XRP—they simply want to convert their local currency into stable assets like USD. For Americans, the dollar is depreciating; for Africans, the dollar is the anchor—the “hard currency.”

Q: You mentioned OTC crypto trading earlier—can you elaborate on how enterprises are practically using OTC today?

A: OTC is usually not for individuals but for enterprises with real needs. For example, a company holding lots of Angolan currency may struggle to convert it to USD via local banks—most African countries need USD to import goods or services, so they turn to OTC. Or a company headquartered in South Africa with operations in Angola needs to repatriate funds, but traditional channels fail, so they use crypto OTC.

Of course, this doesn’t mean crypto is “more reliable”—it’s just another option. If traditional FX channels work smoothly, with full bank backing and clear CFO sign-off, enterprises will still prefer the old way. Only when traditional channels jam, especially during liquidity crunches, do they try crypto.

Q: Looking ahead, do you think African cross-border payments will be widely driven by crypto platforms and OTC desks, similar to how AfCFTA integrates trade?

A: Personally, I’m optimistic about this scenario, but end users may not realize crypto is running in the background. As regulatory and reporting frameworks mature, South African cross-border settlement firms could legally use crypto. Obstacles remain, so crypto is currently just a backup. In the future, crypto settlement will run alongside traditional methods like SWIFT and Western Union, embedded into existing networks. Open your bank app and see: “Do I use SWIFT or crypto channel for this transaction?”

The more USDT/USDC is used, the smoother adoption becomes. We already have a partner doing integration: users pay via mobile wallet, and the recipient gets USDC or USDT. There’s an excellent company in Kenya operating such a mobile payment system.

4. Africa’s Crypto Regulatory Framework

For international enterprises entering Africa’s emerging commercial frontier, the maze of differing national regulations, licensing regimes, and compliance requirements often poses a challenge; any misstep risks frozen funds, heavy fines, or brand damage. African regulators impose increasingly strict KYC/AML requirements for large transactions. Cooperating with unlicensed counterparties or anonymous P2P platforms exposes enterprises to enforcement actions and fund reversals. Quidax’s crypto OTC onboarding process includes:

-

Automated global sanctions list screening;

-

Ongoing transaction monitoring;

-

Full customer due diligence.

This ultimately forms an institutional-grade compliance framework aligned with global best standards, ensuring every dollar or stablecoin transfer has an immutable, auditable on-chain trail available for internal and external review.

Many African countries enforce strict foreign exchange controls and fund repatriation rules, often trapping cross-border settlements in regulatory gridlock. Quidax circumvents this through direct fiat channels and stablecoin pairs pegged to local currencies—Nigerian Naira (NGN), South African Rand (ZAR), Ethiopian Birr (ETB)—fully complying with guidance from central banks and securities commissions. This pan-African licensing model ensures enterprise settlements won’t be disrupted by unexpected freezes or holds.

4.1 Treating Cryptocurrency as Regulated Digital Assets

The overall regulatory trend treats crypto as “virtual or digital assets” (similar to property) and taxes them accordingly. The US, UK, and Canada do this: the IRS has declared that general tax principles applicable to property also apply to crypto assets. South Africa and Nigeria have introduced similar frameworks under their Virtual Asset Service Provider (VASP) regulations.

However, facing a highly volatile and decentralized system, most governments are seeking balance between “risk control” and “innovation promotion.” Data shows only one-quarter of sub-Saharan African countries formally regulate crypto.

Despite slow progress, African nations’ hardline stances on crypto are shifting. Currently, about 70% of African countries maintain “neutral” or “uncertain” policy positions toward crypto.

Nigeria

As one of Africa’s largest holders of crypto assets, Nigeria’s regulatory environment has long been unclear. In 2017 and 2021, Nigeria’s Central Bank (CBN) banned formal financial institutions from participating in crypto trading (spurring P2P trading). Meanwhile, Nigeria’s Securities and Exchange Commission (SEC) continued studying the market, launching its “Regulatory Incubation Program” (SRIP) in 2021 and issuing “Digital Asset Rules” in 2022. In 2023, CBN released “Virtual Asset Service Provider (VASP) Guidelines,” allowing financial institutions to provide settlement channels for crypto transactions while banning direct trading. In 2024, SEC launched the “Accelerated Regulatory Incubation Program” (ARIP) framework and granted “Approval-in-Principle” to Quidax and Busha.

South Africa

On October 19, 2022, South Africa’s Financial Sector Conduct Authority (FSCA) officially classified “crypto assets” as financial products, regulating them under Section 1(h) of the Financial Advisory and Intermediary Services Act (FAIS Act). This classification builds on FSCA’s 2020 proposal, requiring firms offering crypto-related services to obtain licenses and report crypto transactions. Since June 2023, FSCA has issued licenses to 59 crypto service providers.

Kenya

Like others, Kenya’s stance on crypto is evolving. In December 2024, Kenya’s National Treasury released draft “National Policy on Virtual Assets and Virtual Asset Service Providers” and “Virtual Asset Service Providers Bill.” The draft states: “This policy aims to create a fair, competitive, and stable market for virtual assets (VAs) and virtual asset service providers (VASPs) in Kenya.” It comprehensively outlines licensing for VA activities and VASPs, consumer protection, and cybersecurity regulatory frameworks. The government has opened these draft regulations for public comment, with a deadline of January 2025.

Egypt

In 2018, Egypt’s highest Islamic legislative body issued a religious edict declaring commercial transactions involving Bitcoin as “haram” (forbidden under Islamic law). This position was reaffirmed in January 2021—no protection offered for losses from crypto transactions.

The “Central Bank and Banking System Law” (Law No. 194 of 2020) explicitly prohibits the issuance, trading, or promotion of cryptocurrencies without prior approval from the Central Bank of Egypt (CBE). Article 206 imposes severe penalties, including fines and imprisonment, for unauthorized crypto-related activities.

Central African Republic

On April 22, 2022, the Central African Republic’s parliament passed a law establishing cryptocurrency as legal tender in the country. The law proposes coexistence of crypto with the existing legal tender of the Economic and Monetary Community of Central Africa (CEMAC)—the Central African CFA franc (FCFA).

However, CAR is a CEMAC member, and monetary issuance authority belongs to the Bank of Central African States (BEAC). BEAC’s governor subsequently declared CAR’s new crypto law “invalid,” citing violation of regional group terms. In February 2025, CAR launched a meme coin in defiance.

Other Countries

Although Ethiopia’s government is gradually opening its economy to competition and digital technologies, it remains cautious toward crypto assets. High mining activity and rising usage are forcing the state to reconsider its hardline stance. Tunisia, Senegal, and Sierra Leone remain silent or neutral, having not enacted crypto-related legislation. In Tunisia, the finance minister has stated the need to re-evaluate the current criminalization of crypto traders. North Africa’s bans are stricter: Egypt, Algeria, and Libya have outright banned cryptocurrency use. In 2024, Morocco and Ghana released draft crypto regulatory guidelines.

4.2 Regulatory Challenges and Opportunities in Africa’s Crypto Ecosystem

Challenges

-

Regulatory Uncertainty: Many African countries lack regulations permitting crypto. Although Nigeria, Kenya, and South Africa are developing VASP strategies, the ultimate direction remains unclear. Crypto assets are still seen as potential threats to monetary policy institutions.

-

Decentralized and Unregulated Nature: This characteristic makes effective regulation difficult for governments. Attempts at central bank digital currencies (CBDCs) have not seen significant success, but regulated blockchains still hold potential.

-

Illicit Fund Flows: As noted, crypto enables illicit financing; this is particularly acute in Africa, where fraud and terrorist financing are increasingly prevalent.

-

Price Volatility: Cryptocurrencies like Bitcoin are prone to extreme market swings, potentially causing destructive impacts on household and corporate finances.

Opportunities:

-

Enhanced Financial Inclusion: If regulators approve crypto, collaboration between VASPs and traditional financial institutions could enrich financial services and products.

-

Promoting Intra-African Cross-Border Trade: Through continental regulatory coordination, crypto could facilitate intra-African trade development.

-

Improved Payment Efficiency: Cryptocurrencies, especially stablecoins, have great potential to reduce transfer and settlement costs in Africa.

-

Inflation Hedging: Stablecoins are increasingly viewed as safe-haven tools against inflation and currency depreciation, aiding household wealth preservation.

4.3 Interview with Michael Kioneki, Founder of Blockchain Association of Kenya

Q: Please introduce the background, core mission, and role of the Blockchain Association of Kenya within Kenya’s blockchain ecosystem.

A: I am the founder and chair of the Blockchain Association of Kenya, established in 2015. I entered this industry in 2014, when the ecosystem was vastly different from today—I’ve witnessed its transformation firsthand. Until recently, I served as Head of Growth and Business Development at Fonbnk, a startup. Since 2014, I’ve collaborated with numerous crypto and fintech startups, among the early thought leaders advocating blockchain/crypto as fintech infrastructure. For nearly a decade, I’ve focused on public education and community building; in 2023, we co-drafted the “Virtual Asset Service Provider Bill” (VASP Bill) with the association and stakeholders, submitting it to Parliament. My core goal has always been promoting ethical blockchain adoption in Kenya, the region, and across Africa, influencing organizations beyond Kenya and foreign investors eyeing this market.

Over the past decade, different stages presented different key barriers; overcoming them has pushed the ecosystem to new heights.

Q: Looking ahead two years, how do you see the evolution of Africa’s crypto market? What short- and long-term changes might occur?

A: Overall, I believe the industry will move toward “formalization.” Kenya, South Africa, and others have passed or are advancing relevant bills; Nigeria’s government is taxing giants like Binance and demanding compliance. Kenya is similarly collecting back taxes. So the core trend is “formalization”: companies obtaining licenses, opening bank accounts, paying taxes properly, acquiring customers transparently—no longer operating in a “gray zone.” Crypto firms will need government “birth certificates” like fintech companies.

The biggest question is which services will be permitted. For example, once Binance obtains licenses in various countries, users can legally speculate on exchanges; blockchain-powered fintech will use the technology to improve cross-border payments (Yellowcard, Binance Pay are already doing this). Online payments will emerge—users paying merchants in local currency via crypto channels, with stablecoins as key enablers. Also, capital markets will see “tokenization”—firms raising funds through security tokens.

All of this hinges on “formalization”: regulators must be able to manage systemic and consumer risks from technology and enterprises.

Q: How are African enterprises currently engaging in OTC crypto settlements?

A: Actually, it’s already happening. Firms like Quidax and Yellowcard are doing it—connecting with different bank partners across markets to complete cross-border settlements, just not advertising it. Some pure B2B companies, not consumer-facing, provide backend settlement support for fintech or crypto firms. Nigerian firms excel

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News