The Rise of Cryptocurrency in Africa: How Stablecoins Are Transforming the Financial Landscape in Sub-Saharan Africa?

TechFlow Selected TechFlow Selected

The Rise of Cryptocurrency in Africa: How Stablecoins Are Transforming the Financial Landscape in Sub-Saharan Africa?

Stablecoins are gradually replacing traditional financial instruments and becoming an indispensable financial infrastructure in Africa.

Written by: CHAINALYSIS TEAM

Translated and compiled: Aiying Team

Amid global economic instability and local currency depreciation, Africa is gradually emerging as one of the global leaders in cryptocurrency adoption. Stablecoins in particular are increasingly replacing traditional financial tools, becoming essential financial infrastructure across the continent. In this article, Aiying Payment analyzes real-world use cases of cryptocurrencies in Africa and their far-reaching impacts based on Chainalysis’ latest "2024 Geography of Cryptocurrency Report," revealing the key forces driving this transformation and its future trajectory.

1. Overview of Africa’s Crypto Economy: Steady Growth and Real-World Applications

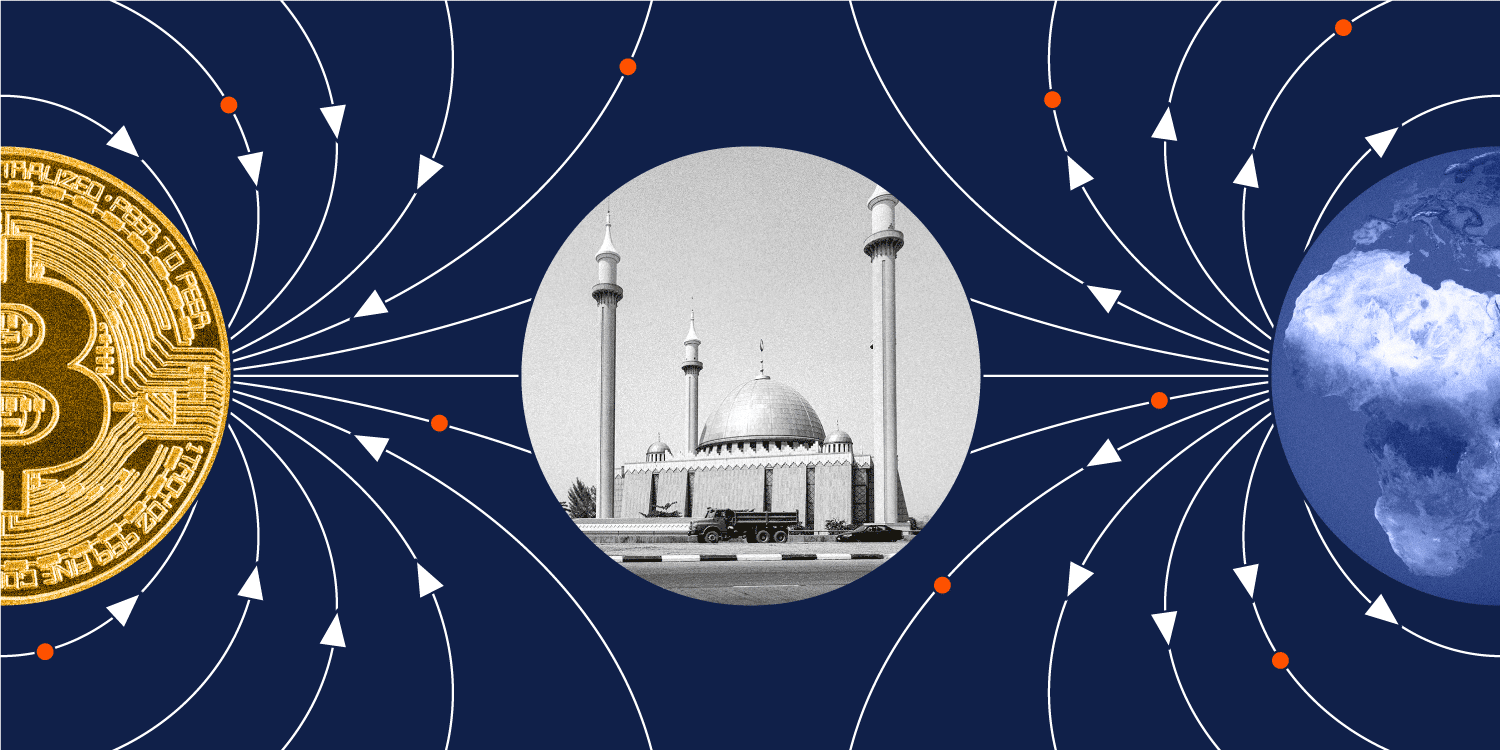

Although Sub-Saharan Africa accounts for only 2.7% of global cryptocurrency transaction volume,

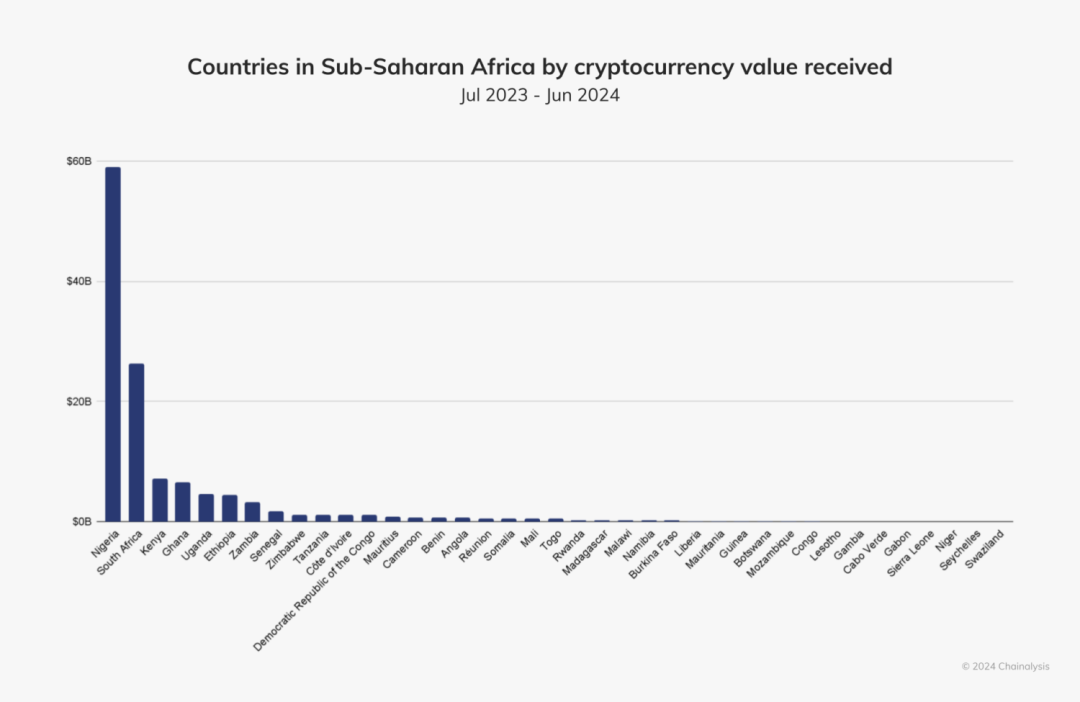

this is largely due to the region's relatively low GDP. However, from July 2023 to June 2024, blockchain transaction volume in Sub-Saharan Africa reached approximately $125 billion—$7.5 billion higher than the previous year. Africa’s crypto economy is steadily rising, particularly standing out in practical utility. People are using cryptocurrencies for commercial payments, inflation hedging, and small daily transfers.

In the Global Crypto Adoption Index, Nigeria ranks second, demonstrating strong market vitality; meanwhile, Ethiopia, Kenya, and South Africa have all entered the top 30. These countries are not only advancing cryptocurrency adoption among individual users but also catalyzing broader shifts in regional economic models.

2. Widespread Use of Stablecoins in Africa: A New Tool Against Inflation and for Cross-Border Transactions

According to World Bank data, as of 2021, only 49% of adults in Sub-Saharan Africa had bank accounts, further intensifying demand for alternative financial services such as stablecoins and cryptocurrencies. This statistic reflects the reality of many adults being excluded from traditional banking systems and explains the widespread adoption of crypto across the region.

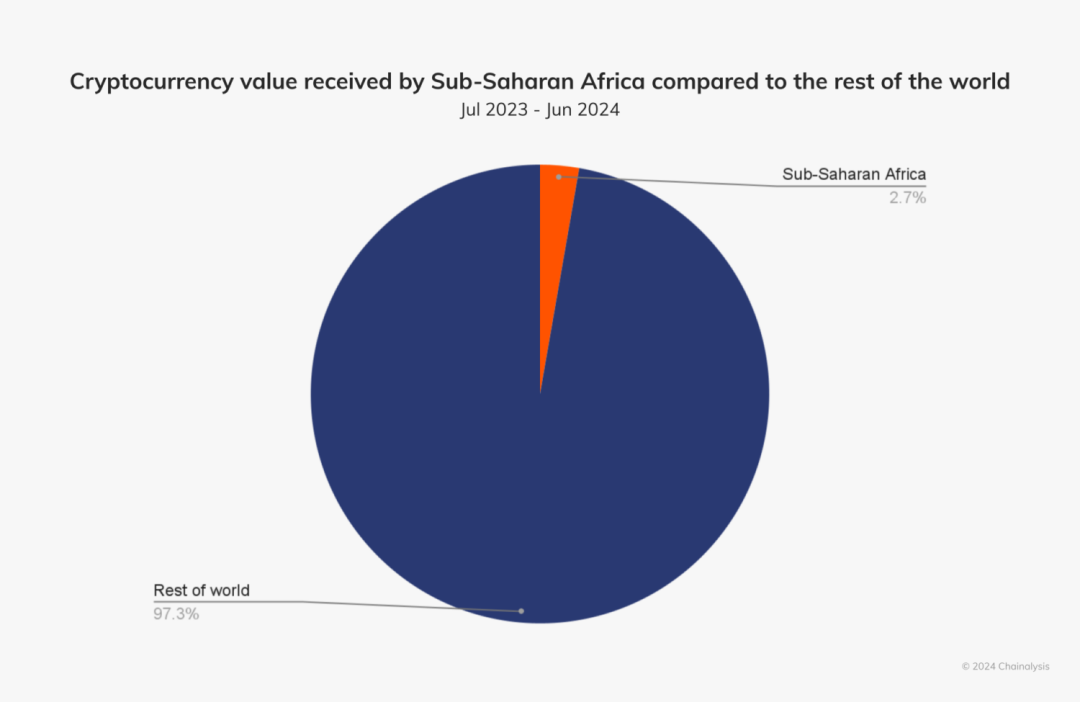

(Cryptocurrency ecosystems across different regions)

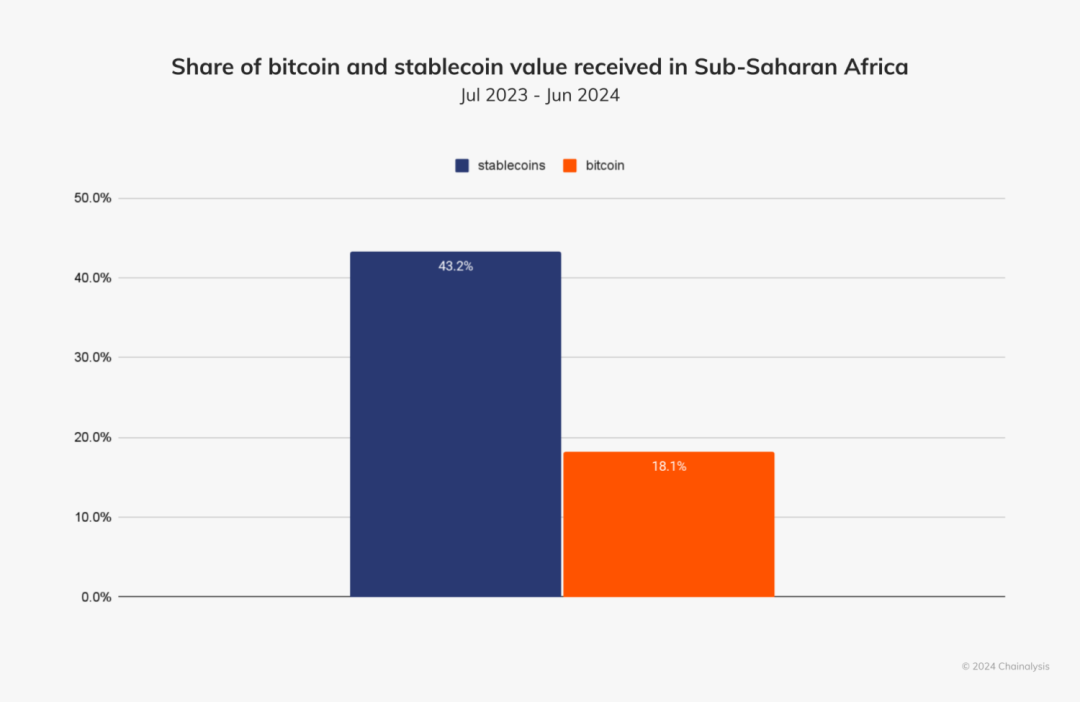

Due to extreme currency instability and limited access to U.S. dollars in many African countries, stablecoins such as USDT and USDC have become vital tools for individuals and businesses to store value, make international payments, and support cross-border trade. Currently, stablecoins account for about 43% of total crypto transaction volume in the region.

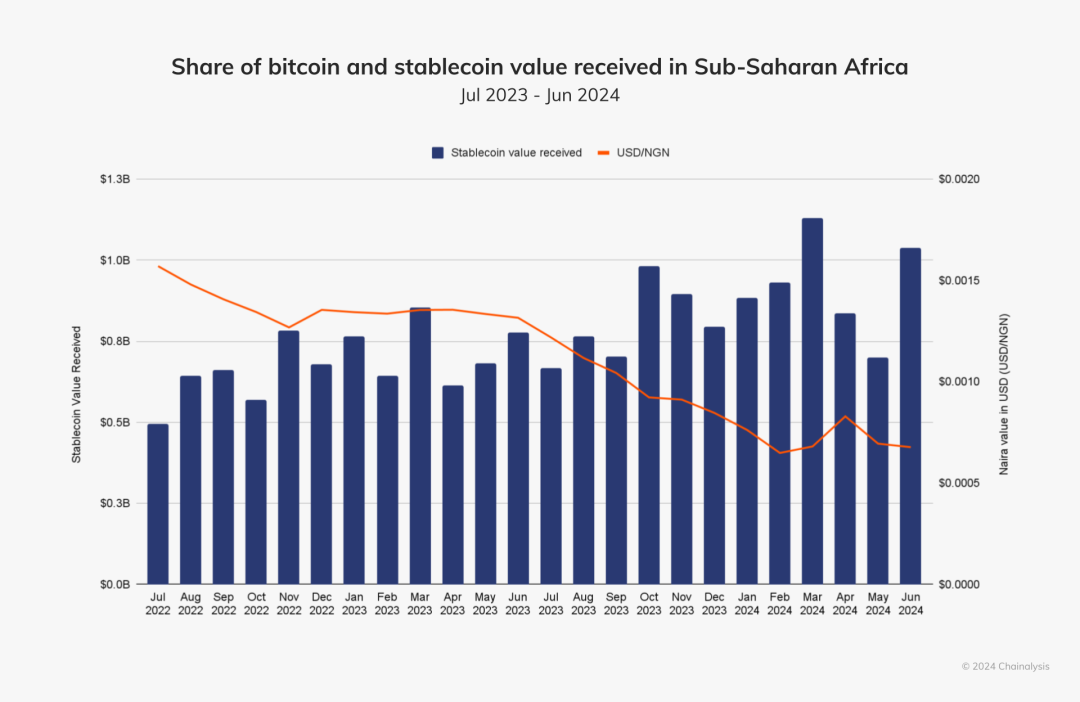

Chris Maurice, CEO of Yellow Card exchange, noted that around 70% of African countries face foreign exchange shortages, leaving many businesses unable to secure sufficient U.S. dollars for operations. In this context, stablecoins offer enterprises a viable path to sustain operations and drive economic growth. From small importers purchasing overseas goods to multinational companies importing raw materials, stablecoins effectively fill foreign exchange gaps unmet by traditional financial systems—especially during periods of local currency depreciation, when inflows of stablecoins significantly increase.

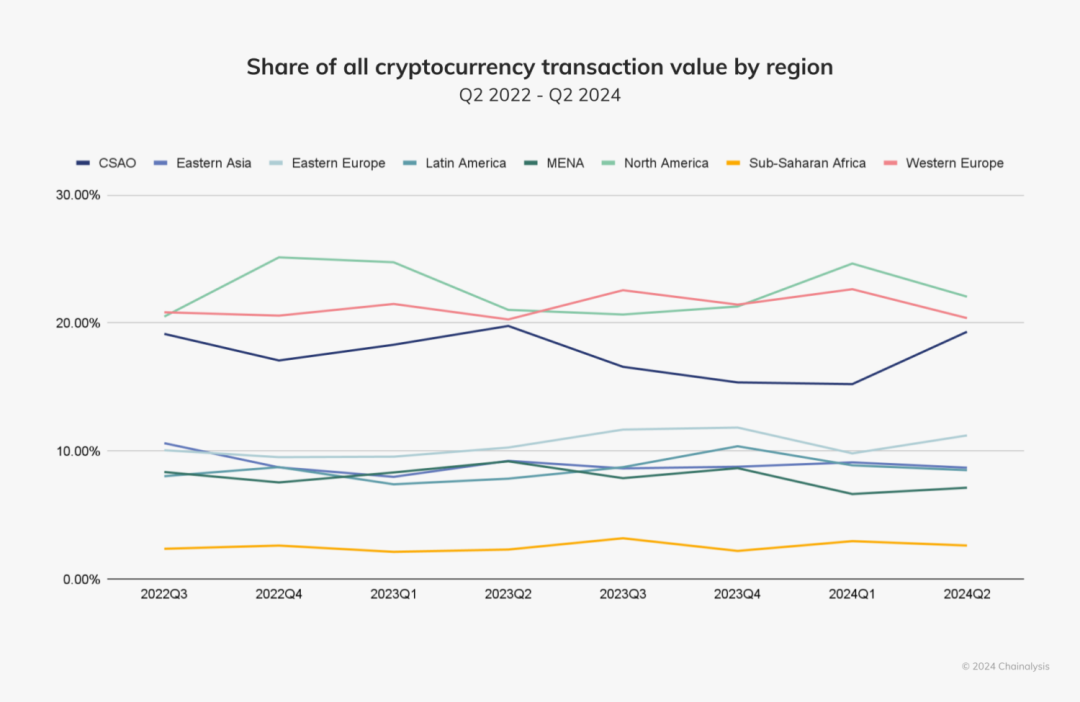

(Trends in Bitcoin and stablecoin receipts in Sub-Saharan Africa)

For example, Ethiopia—the continent’s second most populous country—saw an 180% growth rate in retail-sector stablecoin transactions. In July 2024, the Ethiopian birr (ETB) depreciated by 30% after the government relaxed currency controls to secure a $10.7 billion loan from the IMF and World Bank, further fueling demand for stablecoins.

For many African businesses, accessing stablecoins via platforms like Yellow Card provides an alternative solution where traditional financial institutions fail to meet dollar demands. “Stablecoins are essentially a substitute for the U.S. dollar,” Maurice said. “If you can get USDT or USDC, you can easily convert them into dollars elsewhere.” This reality makes stablecoins indispensable for companies engaging in international trade. From small-scale importers buying overseas products to multinationals importing raw materials from Europe, stablecoins are bridging transactions left incomplete by traditional finance due to FX shortages.

Stablecoins are also revolutionizing cross-border payments across Africa. “People don’t care about cryptocurrency itself,” emphasized Maurice, highlighting Africa’s focus on real-world applications. He cited client examples at Yellow Card, such as large food manufacturers using stablecoins to pay overseas suppliers. Additionally, many African fintech firms rely on stablecoins to manage large amounts of local currency before converting them into stablecoins for cross-border payments.

Rob Downes of Absa Group observed a similar trend among institutional clients in South Africa. “Our institutional clients are particularly interested in using stablecoins as tools to manage liquidity and reduce currency volatility risk,” Downes said. In countries with highly volatile exchange rates, stablecoins present an attractive option for businesses to hedge against currency risks.

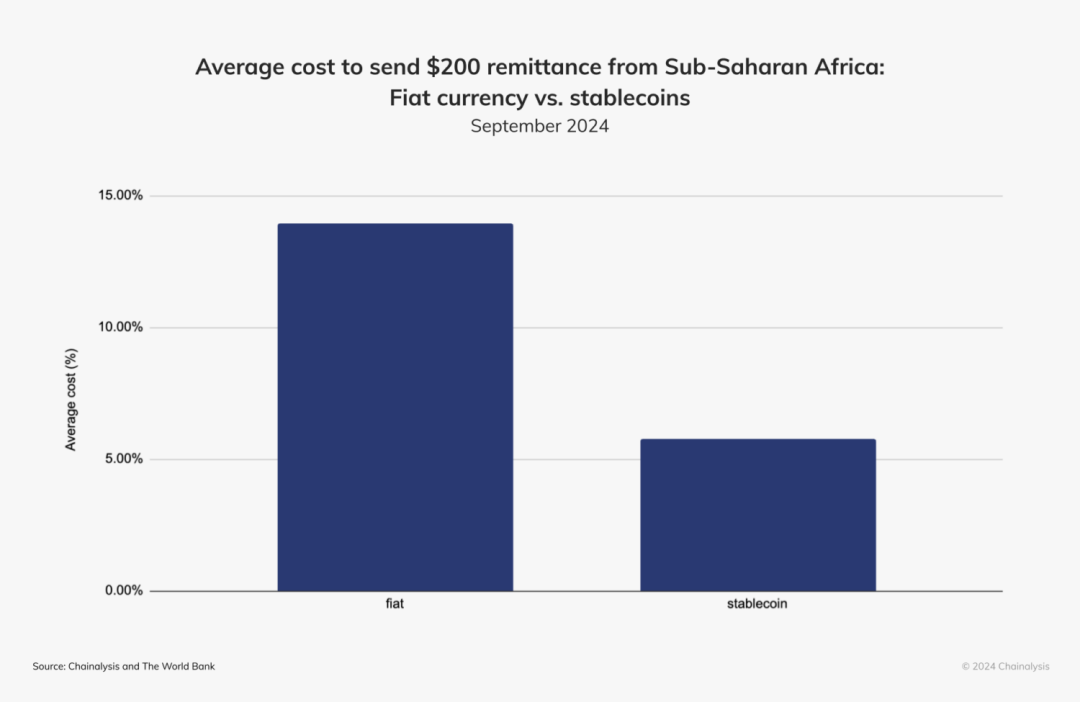

Downes also pointed out that the use of stablecoins in remittances and international payments is a ‘game-changing tool’. For individuals, stablecoins offer a faster, more cost-effective alternative for sending money home or paying overseas expenses—more efficient and cheaper than traditional remittance methods.

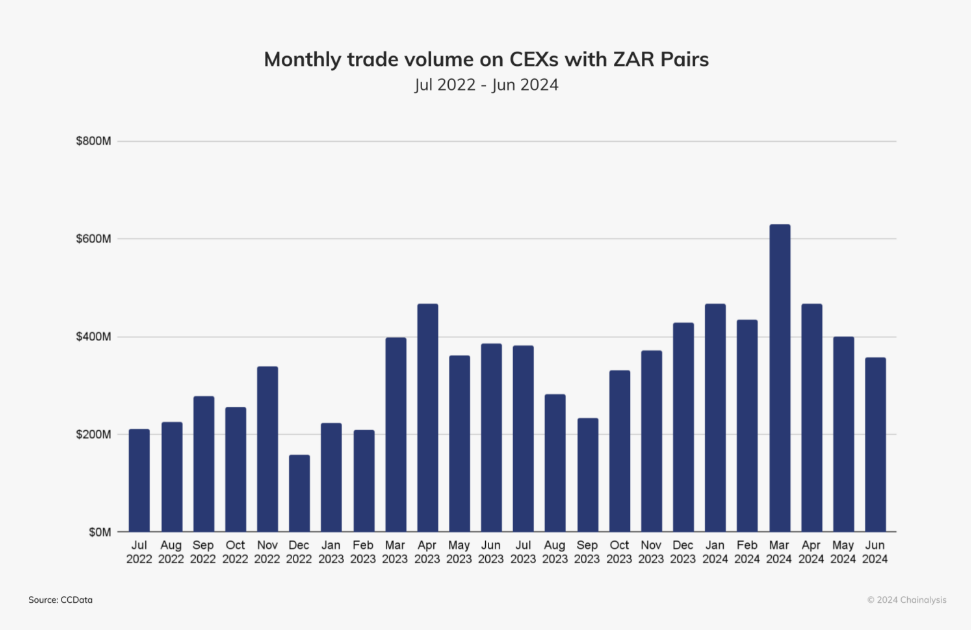

Since late 2023, stablecoin trading volumes on South African exchanges have grown strongly, with over 50% month-on-month growth recorded in October 2023. Stablecoins have overtaken Bitcoin to become the most popular cryptocurrency in recent months.

3. Nigeria’s Role as a Crypto Hub: Global Adoption and Diverse Applications

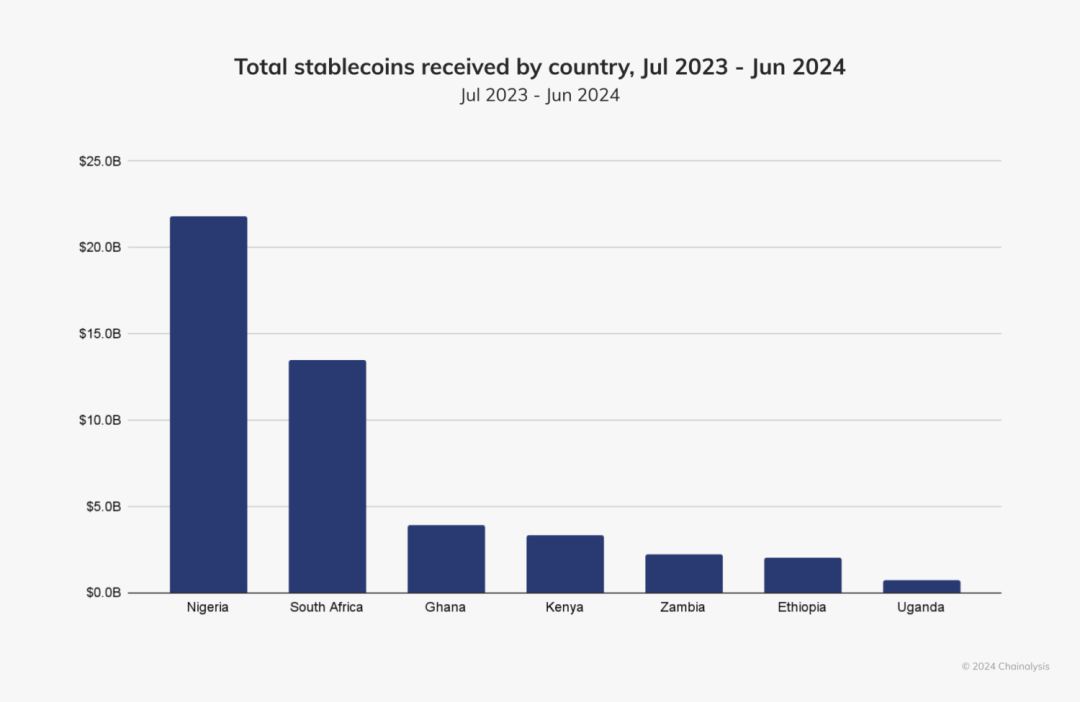

Nigeria is undoubtedly the epicenter of cryptocurrency activity in Sub-Saharan Africa. From July 2023 to June 2024, Nigeria received a total of $59 billion in cryptocurrency.

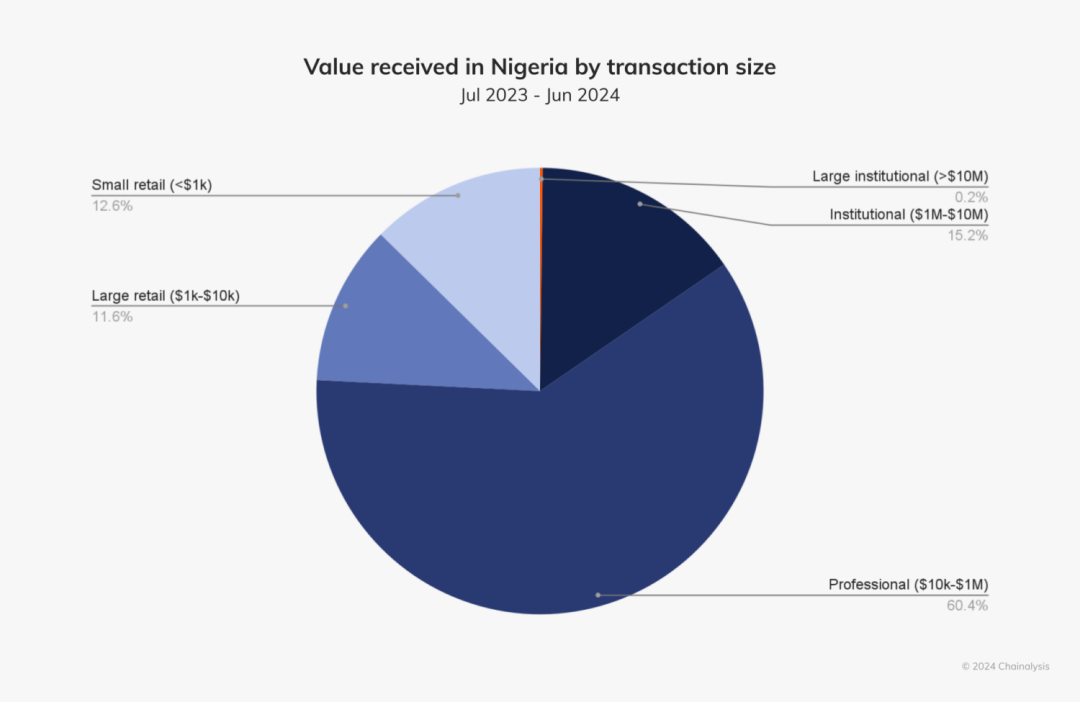

Notably, Nigeria’s crypto transactions are dominated by small retail and professional trades, with 85% of transactions valued below $1 million.

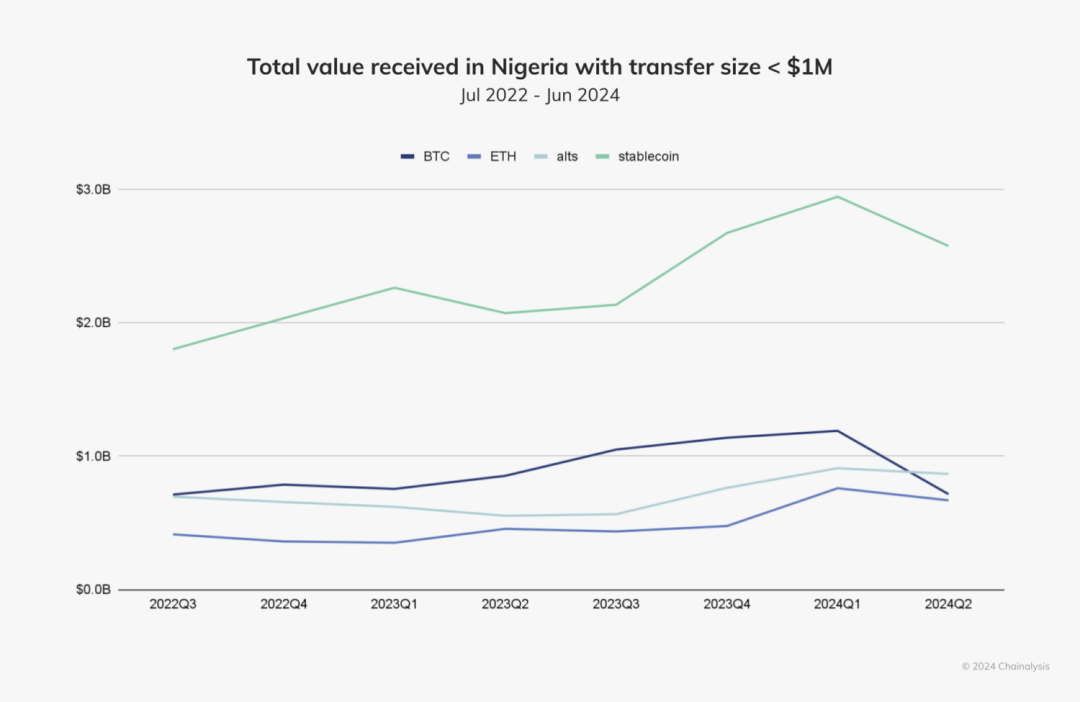

As the naira continues to depreciate, stablecoins are becoming the preferred payment method, helping Nigerians conduct cross-border remittances, cover daily expenses, and even make small purchases. Moyo Sodipo, co-founder of Busha exchange, noted that real-world use cases in Nigeria now include bill payments, mobile airtime top-ups, and everyday retail spending—marking a shift in perception from crypto as a “get-rich-quick” scheme to a practical financial tool.

In Nigeria, stablecoins are increasingly becoming a cornerstone of the crypto economy. Data shows they account for 40% of total cryptocurrency inflows—leading among all Sub-Saharan African nations. Like Ethiopia, Ghana, and South Africa, Nigeria has seen robust demand for stablecoins, especially in cross-border remittance scenarios.

Traditional remittance channels, hampered by inefficiency and high costs, are losing ground. In contrast, stablecoins offer a more convenient and affordable alternative. Sodipo explained: “Cross-border remittances are the primary use case for stablecoins in Nigeria because they’re faster and cheaper.” Data indicates that using traditional fiat channels to send $200 from Sub-Saharan Africa costs about 60% more than using stablecoins.

The rise of stablecoins also reflects economic pressures in Nigeria. As in other African countries, inflation and sharp depreciation of the naira have forced people to seek new ways to preserve value and transfer funds. In February 2024, the naira hit a record low. Against this backdrop, stablecoin usage in small-to-medium transfers has become increasingly prominent. In Q1 2024 alone, stablecoin transaction volume in Nigeria for transfers under $1 million approached $3 billion, making it the dominant payment method in this segment.

While Bitcoin and other altcoins still hold significant market share—with transaction volumes reaching tens of billions of dollars—stablecoins have clearly become the preferred choice for small and medium-sized transactions. This trend underscores the rapid and widespread expansion of stablecoin adoption, particularly in areas underserved by traditional banking.

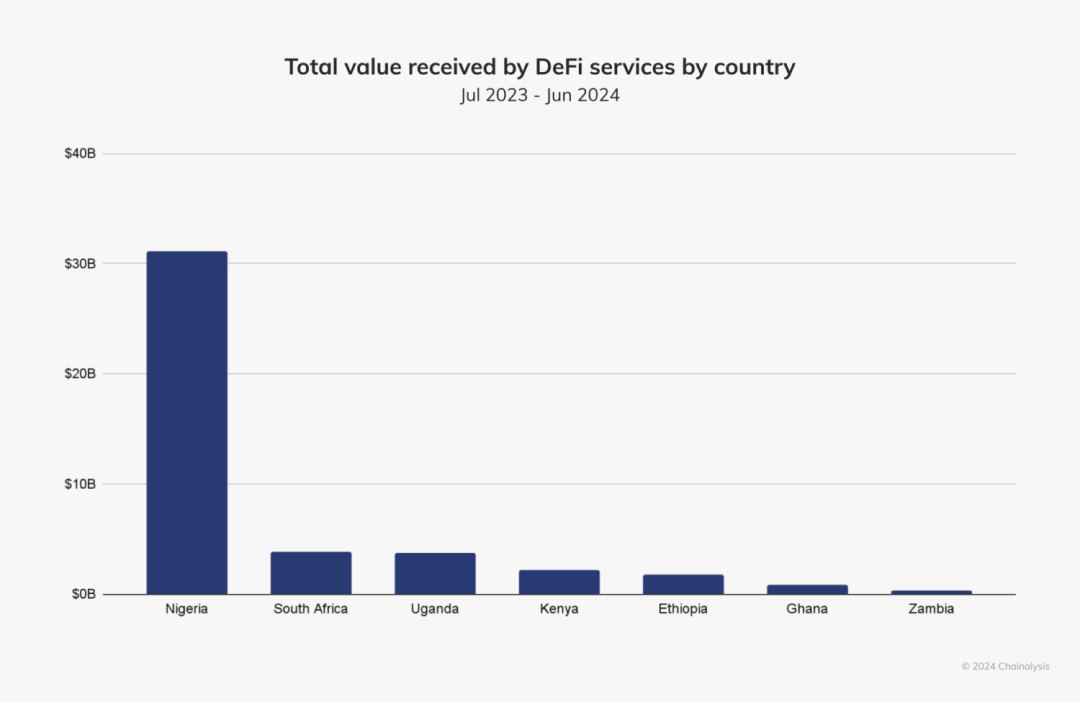

Meanwhile, DeFi (decentralized finance) is experiencing explosive growth in Nigeria, aligning with Sub-Saharan Africa’s global leadership in DeFi adoption. At the forefront of this trend, Nigeria received over $30 billion in transaction value through DeFi services in the past year.

DeFi platforms are opening new opportunities for Nigerians—earning interest, taking out loans, and participating in decentralized trading—services often inaccessible through traditional financial systems. Sodipo noted: “DeFi is a major growth area. Users are actively exploring how to maximize returns and access services unavailable in traditional finance.”

In December 2023, the Central Bank of Nigeria lifted its ban on banks providing services to crypto companies—an action that injected new momentum into the crypto economy. Since the lifting of the ban, cooperation and transactions have become smoother, unlocking numerous new opportunities. “With this policy change, the Nigerian Securities and Exchange Commission (SEC) launched the Accelerated Regulatory Incubation Program (ARIP) in June 2024, requiring all Virtual Asset Service Providers (VASPs) to register and undergo evaluation before receiving full operational approval. The industry views ARIP very positively—it reduces regulatory uncertainty and marks a positive step toward a clearer regulatory framework,” said Sodipo.

Despite regulatory progress, many financial institutions remain cautious and have not fully entered the crypto market, primarily due to lingering regulatory ambiguity. “Banks are watching and waiting for clearer signals from the central bank and SEC before fully committing,” Sodipo added. Nevertheless, Nigeria’s crypto market continues to show strong growth momentum. Looking ahead, Sodipo remains optimistic about Nigeria’s crypto outlook, especially amid ongoing regulatory reforms. He concluded: “Open dialogue with regulators is crucial. We hope that greater clarity will encourage more banks and financial institutions to join this space.”

4. Institutional Investors Driving Market Growth in South Africa

South Africa’s crypto market is undergoing dynamic transformation, fueled by growing institutional participation and integration with traditional finance (TradFi). As Africa’s economic engine, South Africa is not only one of the largest crypto markets in the region but also received approximately $26 billion in crypto assets over the past year, with the rise of licensed firms and large-scale institutional transactions serving as key drivers of rapid market expansion.

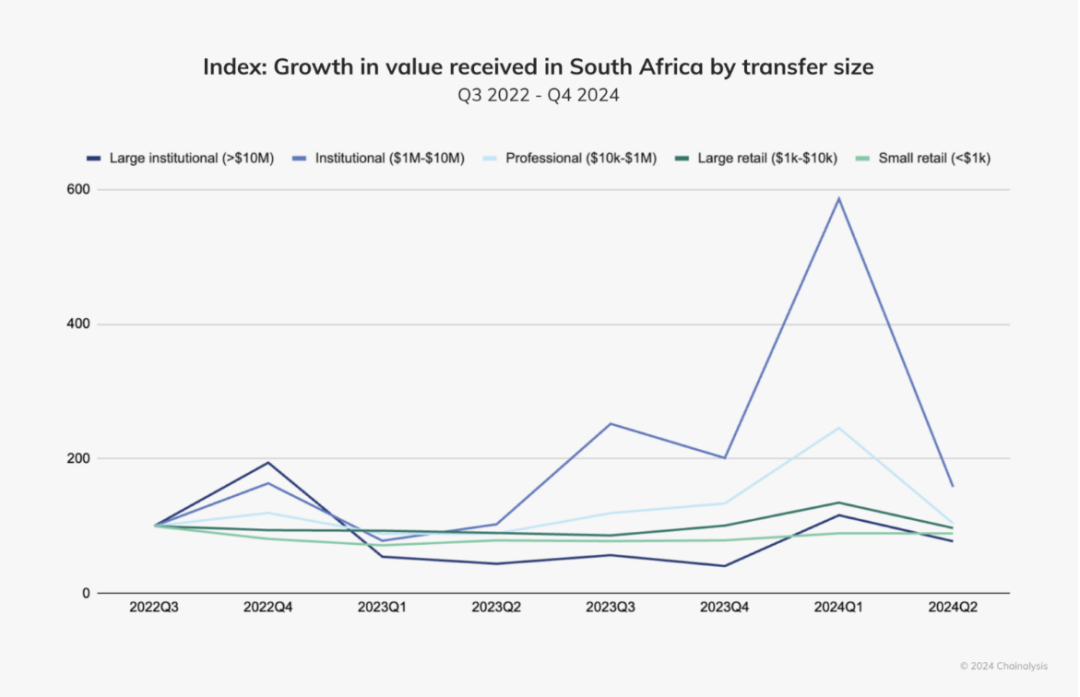

Data shows that from late 2023 to Q1 2024, institutional and professional-grade transaction volumes in South Africa expanded rapidly, becoming the main contributors to total transaction volume. Rob Downes of Absa Group believes South Africa stands at a pivotal intersection between traditional finance and digital assets: “An increasing number of institutional clients are showing interest in digital asset custody solutions, which will profoundly impact South Africa’s crypto ecosystem.”

While institutional investors lead much of the market activity, retail and professional traders maintain steady participation. Carel van Wyk, founder of MoneyBadger, noted that South Africa’s crypto market is maturing, particularly in payments. “In the past, people tried using blockchain for payments, but high on-chain transaction fees made it impractical—especially for small, fast transactions. Now, with the rise of Layer 2 technologies and payment APIs, crypto payments are becoming viable again, allowing retailers to accept crypto while settling in fiat.”

On the regulatory front, South Africa’s Financial Sector Conduct Authority (FSCA) decided to bring crypto assets under existing financial regulations—a move that has served as a key catalyst for market growth. Clearer regulatory frameworks have boosted confidence among businesses and investors, enabling licensed firms to grow sustainably in compliant environments and encouraging financial institutions to explore crypto services. “Compared to other regions, South Africa’s regulatory environment is relatively lenient, giving us confidence to develop stronger custody and payment solutions,” Downes commented.

Cryptocurrency pairs involving the South African rand (ZAR) are also growing rapidly, with monthly trading volumes reaching hundreds of millions of dollars. The performance of ZAR pairs reflects the increasing maturity of South Africa’s crypto ecosystem. Downes believes this will attract more institutional players: “We’re seeing exchanges mature, which is critical for building trust among both retail and institutional investors.”

Regulatory transparency and market growth have drawn interest from major financial institutions. Absa Group, one of South Africa’s largest banks, is actively exploring blockchain and cryptocurrency opportunities. Downes revealed that Absa’s primary goal is to offer institutional-grade crypto custody services—the biggest near-term opportunity. “What excites me most—and represents our largest revenue potential—is custody services.” Secure custody forms the foundation for institutional crypto adoption, providing security and compliance for exchanges, investment firms, and other major market participants.

Despite growing interest in crypto, South African banks still face challenges in risk management and compliance. They need to build trusted relationships with crypto exchanges and service providers to advance banking and payment services. Absa Group adopts a “learn and experiment” approach to developing its crypto business—a strategy supported by senior management. “We deliberately position these efforts as lightweight engagements focused on learning and market interaction.” Through this model, Absa participates in regulatory sandboxes and works closely with regulators to advance blockchain projects within compliance boundaries.

Demand for crypto-related services from clients continues to grow. Downes noted: “Over the past 18 months, inquiries about crypto payments, investments, and banking services for exchanges have tripled.” Particularly, family offices and asset managers are beginning to explore integrating digital assets into their portfolios. “While traditional financial institutions are still in early stages regarding crypto, client demand is pushing us to accelerate development.”

Banks like Absa Group are helping bridge the gap between traditional and crypto finance through continuous innovation and exploration of blockchain technology. “Traditional financial institutions have unique advantages in introducing blockchain-based financial services, leveraging our extensive regulatory experience and control systems,” Downes said. As these technologies gradually integrate, acceptance among both businesses and consumers will accelerate, further solidifying South Africa’s important role in the global crypto economy.

Sub-Saharan Africa stands at a critical juncture. While its share of the global crypto economy remains modest, its growth momentum cannot be overlooked. Nigeria and South Africa, as regional leaders, are driving significant on-chain activity, positioning the region as an emerging force in cryptocurrency adoption and fintech innovation.

Stablecoins have become a central part of Sub-Saharan Africa’s crypto narrative, offering an effective tool against persistent inflation and currency devaluation. They now dominate the majority of crypto transactions across the continent. At the same time, decentralized finance (DeFi) adoption in Africa leads the world, experiencing rapid growth.

While countries like South Africa, Nigeria, Ghana, Mauritius, and Seychelles have made notable progress in establishing regulatory frameworks, others are actively exploring regulatory pathways suited to their contexts amid rising transaction volumes and growing crypto demand. As banks and other financial institutions deepen their involvement, establishing clear regulatory frameworks has become more urgent than ever.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News