Observations from Africa's Crypto Market: A Preference for Stablecoins, and the Desire for Success Amid Absence

TechFlow Selected TechFlow Selected

Observations from Africa's Crypto Market: A Preference for Stablecoins, and the Desire for Success Amid Absence

Africans face numerous challenges, including lack of regulatory support, inability to travel, difficulty complying with KYC/AML requirements, scarce venture capital networks, and no time to experiment with new ideas.

Written by: PATRICK MCCORRY

Compiled by: TechFlow

I joined a trip organized by Borderless Africa, forming a small team with Yoseph Ayele, Songyi Lee, Jeff Coleman, Ye Zhang, Kartik Talwar, and Jacob Willemsma.

The journey spanned Kenya and Nigeria over approximately nine days.

In each country, we conducted the following activities:

-

Q&A sessions and panel discussions;

-

Small-circle discussions hosted by locals;

-

Developer education workshops.

Beyond these events, we also had opportunities to meet founders and prominent contributors.

This article reflects my personal views and insights gained from these conversations. Key highlights include:

-

USDT and Binance P2P are extremely popular

-

Desire to earn based on ability rather than geography

-

What lies ahead?

Disclaimer: Locals were invited at every event to learn about Ethereum and Layer 2 protocols. The audience attending these events likely has strong interest in cryptocurrency. While it may not broadly represent today’s population, as crypto adoption continues to expand, it could become mainstream in the future.

USDT and Binance P2P Are Extremely Popular

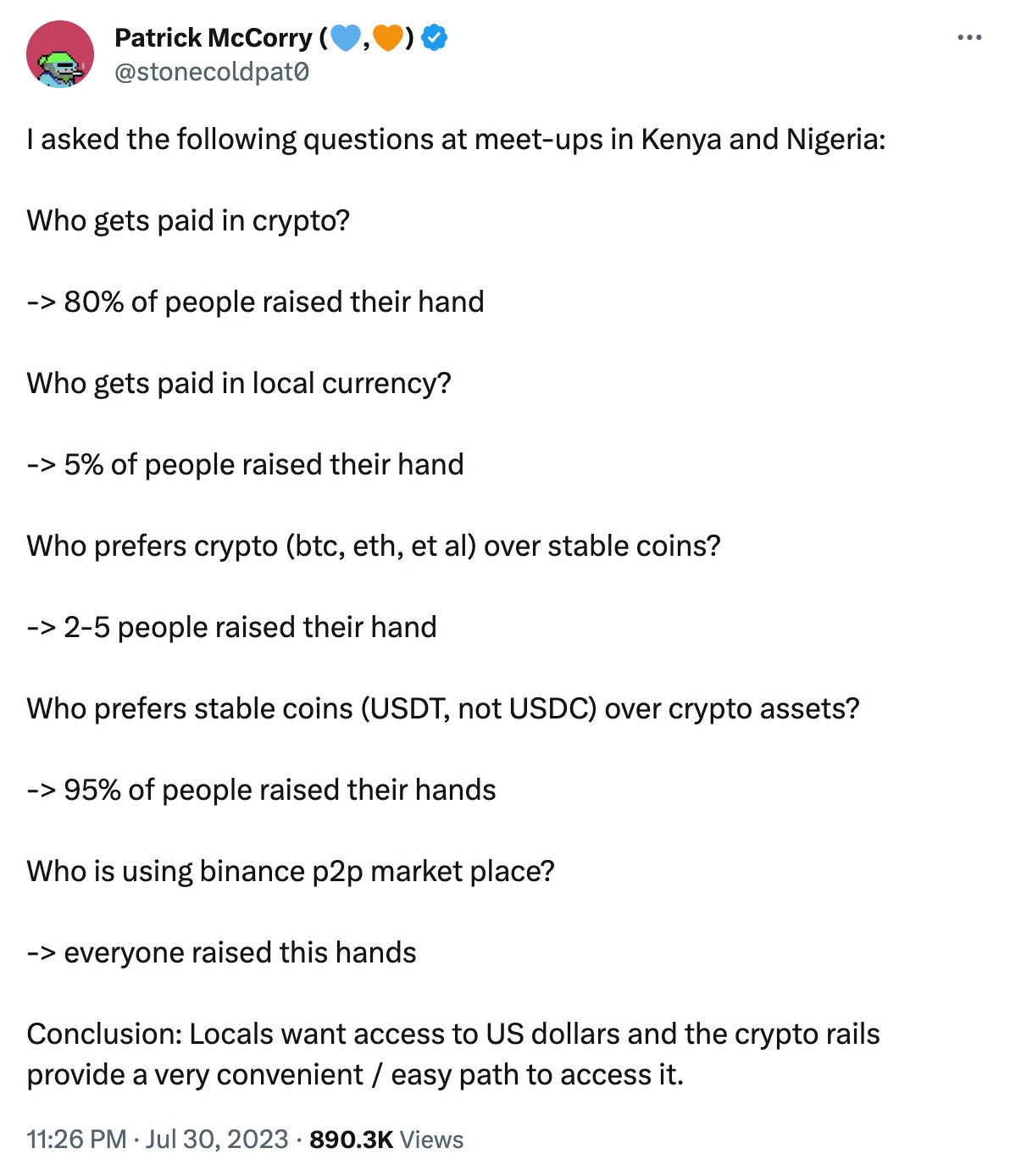

At every event, I asked the same set of questions:

-

Who receives salaries in cryptocurrency?

-

Who receives salaries in local currency?

-

Who would prefer to be paid in Bitcoin/Ethereum?

-

Who prefers stablecoins?

-

Who is actively using Binance's P2P marketplace?

Across all events, responses were remarkably consistent:

-

They have previously received salaries via cryptocurrency.

-

They prefer to be paid in stablecoins, especially USDT.

-

They use Binance’s P2P marketplace to convert stablecoins into local currencies (and vice versa).

-

Little interest in holding native crypto assets like Bitcoin or Ethereum. Furthermore, participants prefer networks such as Tron or Binance Smart Chain for transactions.

Reasons: nearly zero fees and “fast” confirmation times.

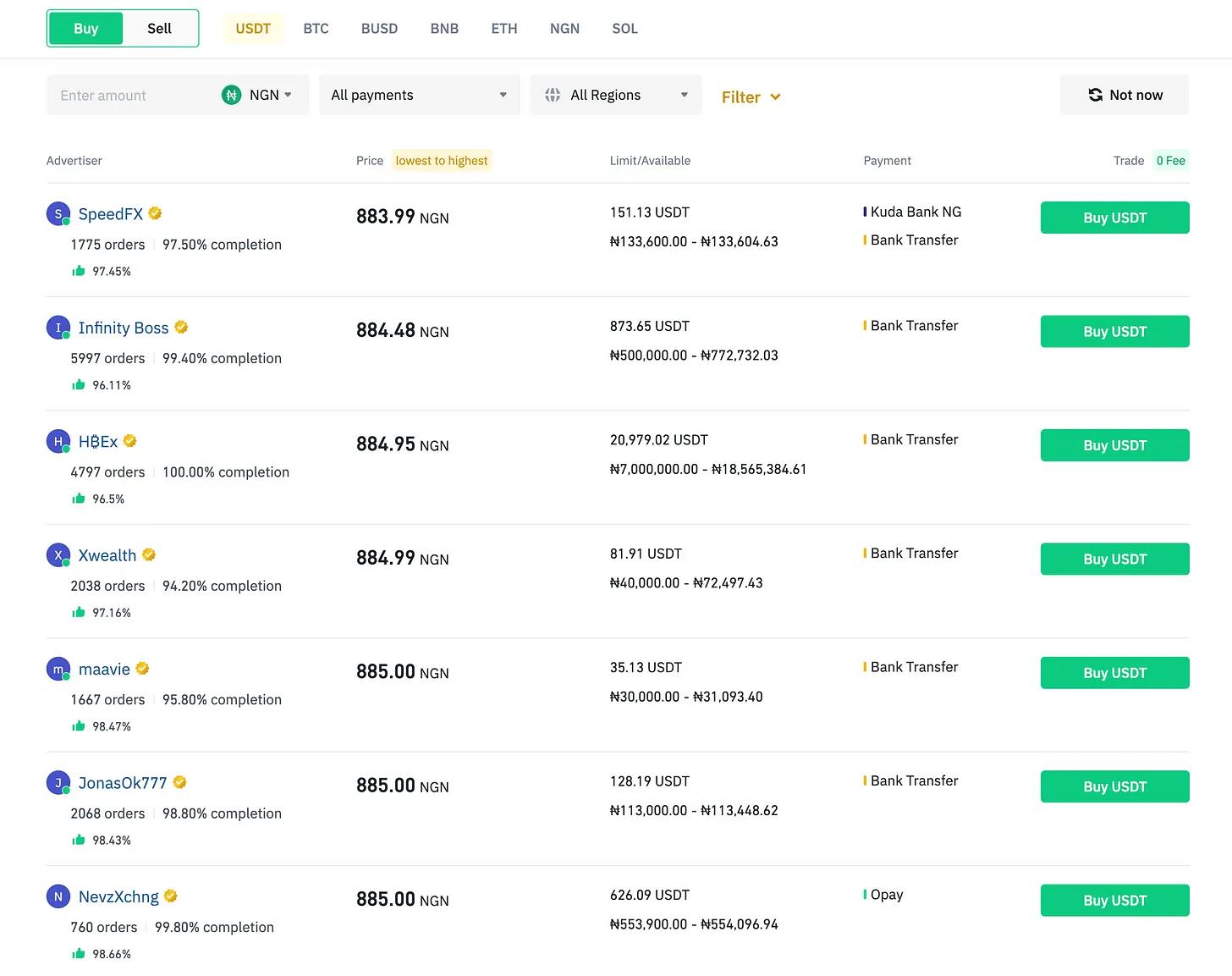

Binance Is Highly Popular

While competitors like Onboard are emerging, nearly all participants still rely on Binance as their primary trading platform.

One person explained that Binance entered Africa around 2018 and established Binance Labs. There was latent interest, but no initial expansion strategy. Over time, Binance realized Africans wanted access to stablecoins, making Africa a key market. I saw locals wearing Binance-branded clothing despite never having worked there.

To me, USDT’s rise seems coincidental. In 2018, there were no major stablecoin competitors, and Africa followed broader market trends where USDT surpassed Bitcoin as the most liquid and traded asset. I wish I had asked more about why USDT is preferred over USDC.

Cryptocurrency Represents Easy Access to Stablecoins

The rise of stablecoins cannot be underestimated. From an African perspective, stablecoins represent the most significant innovation.

They provide convenient dollar access for Africans:

-

Africans can bypass local black markets.

-

Africans avoid real-world dangers associated with black markets.

-

Africans can exchange at broader market exchange rates.

More importantly, there’s no need to hide dollars under mattresses—everything is digital. Of course, achieving widespread stablecoin adoption isn’t easy.

Some readers might think: "Well, if I can represent dollars as on-chain assets, problem solved!"

That’s step one. The broader challenge is creating an online marketplace that enables liquid exchanges between stablecoins and local currencies. This market must support large-scale conversions with minimal price slippage.

Why is this truly challenging? Africa has about 42 currencies. We need to cultivate a liquid market facilitating conversions between all local currencies and stablecoins. This requires coordinated efforts from many local participants.

Fortunately, crypto systems excel at enabling participants to collaborate and provide liquidity when needed.

So far, this works well in Kenya and Nigeria. I lack data confirming its applicability across all 42 African currencies.

Why Stablecoins Instead of Crypto Assets?

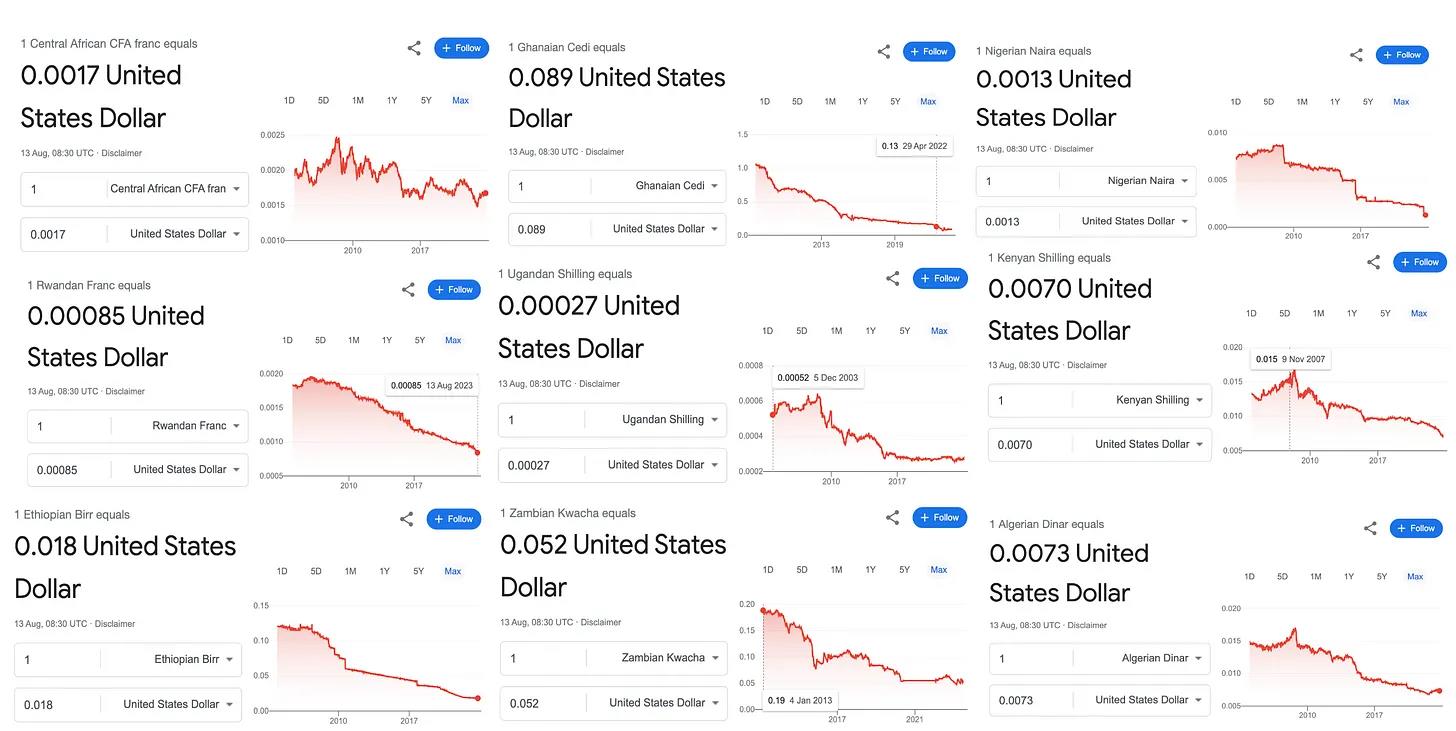

It may surprise many, but African local currencies depreciate rapidly against the dollar. Some, like Zimbabwe’s currency, have failed due to hyperinflation.

For example, since 2008:

-

Nigerian Naira has lost 7/8 of its value against the dollar.

-

Kenyan Shilling has depreciated by 50% against the dollar.

The depreciation of the Kenyan Shilling is particularly striking because Kenya’s GDP tripled during the same period from 2008 to 2023. Despite economic growth, the currency continues to weaken. Confidence in the economy grows, but confidence in the local currency does not.

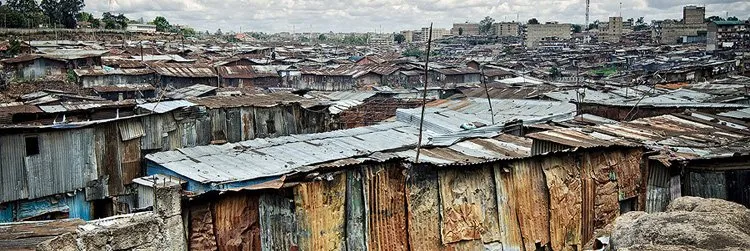

Undoubtedly, large populations in Kenya and Nigeria still live in absolute poverty.

For Westerners, especially Britons, poverty means living in government-subsidized housing. Families struggle to make ends meet, yet they have roofs over their heads and access to healthcare. Considering homelessness, the UK has about 271,000 people, or 0.4% of its population (approximately 67 million).

An estimated 60% of Nairobi’s population lives in slums. Additionally, the World Bank estimates that about 50% of Nigeria’s and Kenya’s populations live in slums.

In slums, entire families may live in a single room ("studio"). Outside their door lies a narrow corridor connecting them to main streets. As we experienced firsthand, sewage flows through these corridors like obstacle courses. Many live on less than $1 per day with almost no social welfare.

This is why the following statement feels disconnected from reality for Africans, especially those in slums:

-

“The real win is helping people understand why Bitcoin is the best long-term savings asset.”

I don’t mean to criticize the above comment, but it’s detached from real-world conditions and realities faced by locals.

I believe locals would welcome long-term savings goals, but they urgently need to address immediate expenses. For instance, if they fail to pay bills for any reason, landlords might pay $10 to a group of youths to threaten tenants into paying rent.

Surprisingly, landlords still exist within slums.

I don’t believe stablecoins help people living in slums. Solutions lie in creating better market conditions for locals to accumulate wealth, build better infrastructure, and escape slums. I understand individuals might seek online work and receive payments via crypto systems, but for many living under these conditions, this isn’t an accessible solution.

In other words, crypto systems aren’t relevant for about 50% of Nigeria’s or Kenya’s populations except in exceptional cases.

Africans using stablecoins don’t live in slums. I imagine they’ve achieved some financial stability and can cover near-term expenses.

Over time, the dollar loses purchasing power—a crypto meme suggesting we keep all savings in native crypto assets holds little meaning for them, as it’s a foreign concept.

The situation in Africa is precisely the opposite. The dollar’s purchasing power only increases relative to their own local currencies. Holding dollars is safer than holding local crypto assets.

To Africans, the dollar is very stable—that’s why stablecoins find product-market fit among them.

Demographics of attendees included:

-

Community leaders,

-

Software developers,

-

Startup founders.

Craving Success Amid Discrimination and Distrust

The following Q&A originated from a gathering in Nigeria.

Who has issues with online payment providers like PayPal?

Everyone in the audience raised their hands, laughing at each other.

In Africa (especially Nigeria), users are frequently locked out of services because their IP addresses are flagged as suspicious by online service providers. Some of us have even been locked out of our own accounts.

The end result: Africans are excluded from financial technology services taken for granted in the West.

Who has concerns about KYC?

We were told that about 70% of Nigerians lack passports.

The Nigerian government launched the National Identification Number (NIN) program for identity verification and KYC purposes, but it has been plagued by problems and delays.

On the other hand, the Central Bank of Nigeria runs a separate identity verification process called the Bank Verification Number (BVN). It serves as a unique identifier across all banking services. Only 25% of Nigeria’s population (57 million) has registered for BVN.

Identity remains a challenge in Nigeria. This affects companies’ ability to comply with regulations before sending funds to Nigerians. Whether through crypto or other means, this identity issue needs resolution within regulatory frameworks.

Who has missed opportunities due to others distrusting you?

This time, no one laughed. Everyone raised their hands—it was sobering.

If readers take away just one point, I believe this explains why blockchain technology, particularly Rollups as a tech stack, is so important to our colleagues in Africa. It reduces power imbalances between users and operators, enabling parties who want to transact but distrust each other to do so securely.

In other words, it allows users to:

-

Lock funds into an operator’s service,

-

Interact with the service,

-

Eventually withdraw funds without trusting the service operator.

We can define, measure, and reduce trust in financial interactions—that’s what makes the crypto space so special. I call it the field of trust engineering.

I hope one day the tech stack delivers scalable benefits to our colleagues.

Let us transact on their platforms, pay for their services, and most importantly, stop worrying about who they are or where they live.

What’s one thing we should tell Westerners about Nigerians?

One participant and several others offered thoughtful remarks. I summarize the key points below:

"Nigerians are exceptionally hungry for opportunity. They’re driven by incentives. Design the right incentive programs, and Nigerians will join. Nigerians have learned everything they know from the internet. Give them a Nokia 3310 phone, and they’ll use it as a tool to get somewhere.

They want to escape their local environment, work online, and join the global workforce. They see blockchain as a great equalizer—enabling rewards based on ability rather than location.

Projects require less capital to succeed in Africa. For every dollar spent in the U.S./Europe yielding one point, you get a thousand points in Africa."

And:

"If there are Nigerians in the project, there’s money to be made. If there are no Nigerians, beware." — A Kenyan local

I chuckled, but it truly illustrates their hunger for success.

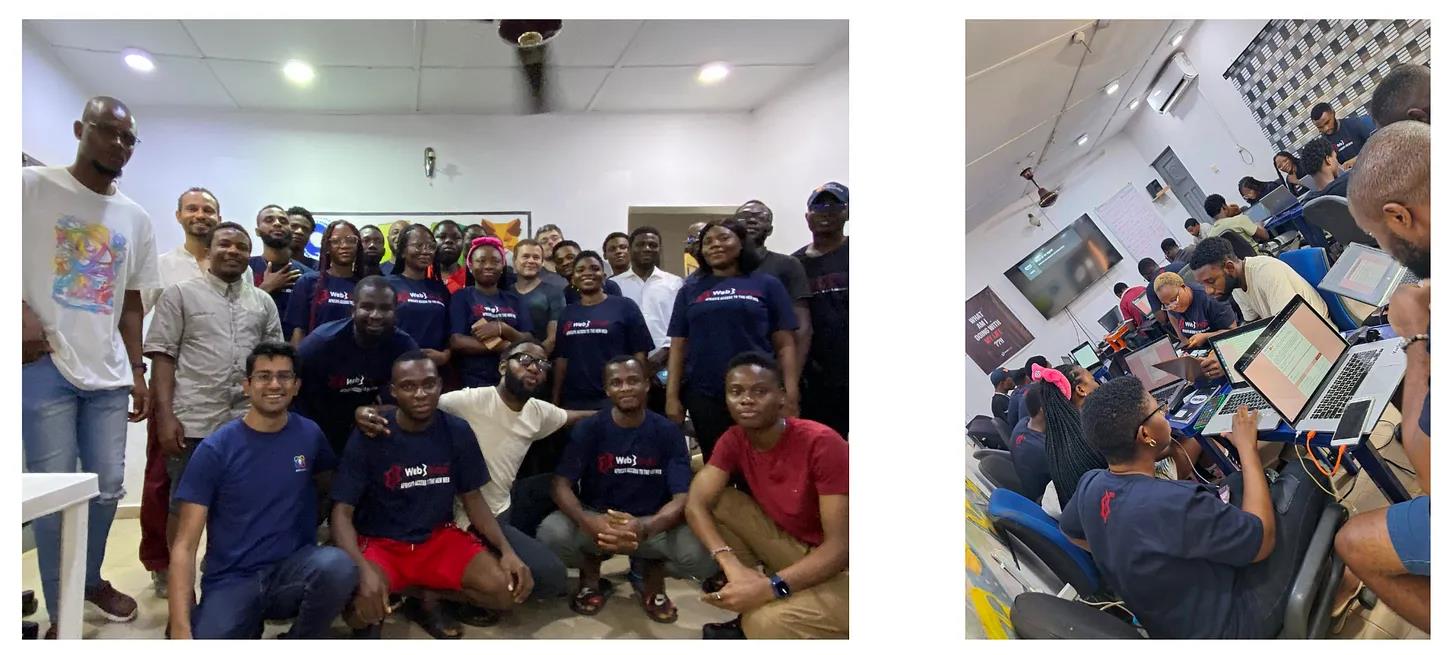

Web3 Bridge

Please take a moment to imagine:

-

Leaving your family and friends for 16 weeks, traveling thousands of kilometers, living with 40 others (bunk beds) to learn Web3.

-

Hoping for a life-changing opportunity.

-

This opportunity means working online, earning based on ability, and not being discriminated against due to your location.

That’s Web3Bridge.

Web3Bridge is an educational program that has run free of charge since 2019.

The program attracts Web2 developers and aspiring programmers who want to learn how to enter the Web3 industry.

We met a woman who left her husband and three children behind to attend. I imagine many others in that room face similar struggles—leaving loved ones for extended periods. Such courage shouldn’t be underestimated.

The curriculum and topics covered are also impressive. It starts with basics like what is blockchain, proceeds to implementing your first Solidity (or Cairo) smart contract, and advances to full-stack development of Web3 applications.

Again, the entire program is completely free, whether attended in person or online. We learned Web3Bridge’s sustainability relies on grants and personal investments (time and money) from its founders.

Currently, physical facilities include several houses, but founder Ayo shared his dream with us. He wants to purchase nearby land and open a larger campus. With more physical space, he can scale up, teaching hundreds of developers at once.

I sincerely hope his vision materializes, and the crypto community should consider how to support Web3Bridge.

What Lies Ahead?

During my nine-day visit to Kenya and Nigeria, I gained valuable insights leading to important conclusions about their workforce, crypto’s potential role, and whether we (the West) can support their growth.

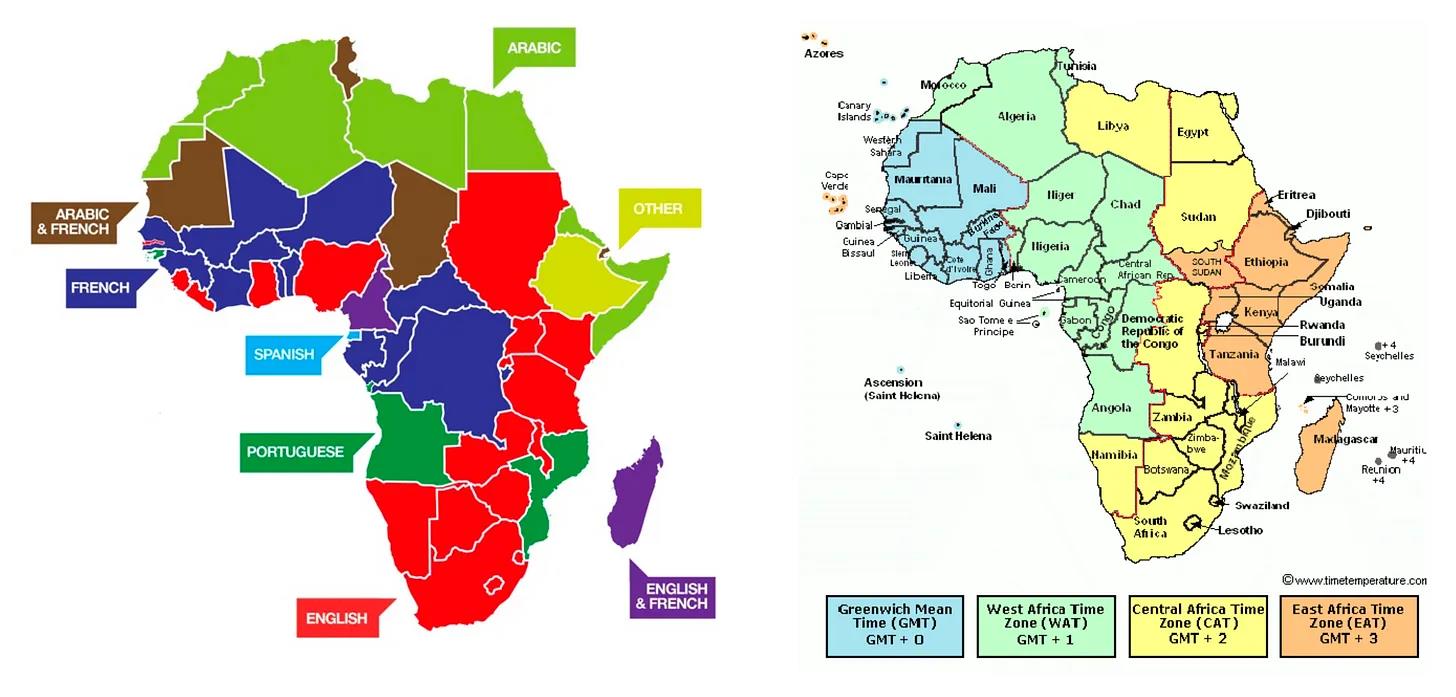

Africa Has Unique Advantages in Achieving Success

In my view:

-

Africans share time zones with Europeans,

-

They fluently speak European languages, especially English and French,

-

They possess strong ambition and desire to create wealth.

Africans are well-positioned in online competition.

In the digital realm, if a worker in a specific time zone is needed and they communicate in the same language, it may not matter whether the worker is in Europe or Africa.

To me, the overarching goal of helping Africans succeed is:

-

Providing better crypto infrastructure for reliably hiring and paying Africans,

-

Reducing key differences distinguishing Africans from Europeans in online communities,

-

Enabling African developers to leverage crypto as a software stack and eliminate reliance on trusted service operators.

Long-term: African and European communities should become indistinguishable in the digital space.

Only then can Africans primarily earn based on ability rather than geography.

Africans Understand Cryptocurrency

Thanks to the internet and online communities, Africans aren’t isolated from the Ethereum ecosystem. We encountered the following teams and individuals:

-

Teams building Arbitrum projects,

-

Participants who attended ETHGlobal hackathons and won prizes,

-

Learners studying how to implement Cairo smart contracts on StarkNet,

-

Those familiar with Optimism’s retroactive funding,

-

Eager to learn zero-knowledge proofs.

Africans don’t need us Westerners visiting to preach why they should care about Ethereum or the broader crypto ecosystem.

They already have a vibrant NFT community.

Africans are already interested in crypto, and the number of enthusiasts continues to grow steadily.

How Can We Help Africa?

Africans don’t need our help understanding how to use cryptocurrency. If anything, we need their help showcasing use cases.

As outlined in this article, how Africans conveniently use crypto to access dollars helps validate all the technologies we’re building. This provides undeniable evidence that crypto has product-market fit and many people depend on it.

On the other hand, we need better understanding of challenges Africans face before participating in the online economy and launching their own crypto projects. Challenges include:

-

Lack of government support.

Kenya lacks crypto legislation, but the government recently seized WorldCoin hardware, claiming failure to disclose true intentions. Nigeria bans banks from participation, though individuals may use crypto.

-

Almost no venture capital presence.

Angel investment is possible but very rare. Identity issues complicate legal compliance and may hinder fundraising.

-

No time for experimentation.

The drive for success makes Africans highly focused on building the next product. They lack leisure time to tinker with technology for fun, potentially affecting their ability to generate innovative new ideas.

-

Global perceptions.

Westerners misunderstand African capabilities and real needs. Africans can demonstrate their abilities and value, but they need all of us to amplify it.

Grant Programs for Africa

Repeatedly proposed as a solution is a grant program focused on Africa. Regarding grant programs, I’d like to offer several observations relevant to any program (not just Africa-focused ones):

-

Grants should go to projects and individuals needing resources to advance progress,

-

Grants should support individuals who benefit from tinkering time and better grasp research-oriented ideas,

-

Grants can de-risk pre-seed stages for venture capital firms,

-

Grants shouldn’t be seen as long-term funding sources, as it’s easy to keep funding projects that should fail,

-

Grants should only be disbursed when recipients present unambiguous proof of work,

-

Grants can nurture environments, connect developers, and build communities for knowledge sharing.

Any grant program aiming to operate in Africa—or any geographic region—needs local leaders to run it. Grant managers can be compensated to review and approve grants. This can fully become a full-time role.

Most people, even outstanding local leaders, lack experience running or participating in grant programs. Like any system, it’s best to start small and gradually scale over time. Avoid handing massive treasuries to brand-new grant programs. Grant managers should earn reputations managing funds and demonstrating impact.

Grants alone won’t solve local problems, especially in Africa. Funds are limited and easily depleted. Be cautious with fund usage. Grants should target the most promising groups and individuals advancing their projects. This is “free” money, but it shouldn’t be widely distributed.

To me, Uniswap stands as one of the most successful examples. Founder Hayden received a $50,000 grant from the Ethereum Foundation to cover audit costs. That sufficed to pay for audits, drive progress, and build today’s tech giant Uniswap.

Advancing progress doesn’t require massive funding. Less is more.

Finally, two issues hinder any grant program’s success.

-

If Africans can’t comply with KYC/AML rules, grants may not be distributable.

-

A local venture capital network must emerge to fund successful cases afterward.

Both issues are structural and infrastructural, extending beyond crypto. Especially for venture capital networks, you need former founders willing to invest and help a new generation build large, sustainable companies.

In-Person Education

One thing missing in Africa but abundant in the West is in-person education.

In the West, numerous workshops, summer and winter schools teach core crypto technologies. More importantly, many educational events are free.

Unfortunately, many Africans face limitations attending crypto-related events.

Many lack passports; even those who have them face visa requirements and potentially burdensome travel costs.

They can’t come to us in person.

As an experiment, Ye Zhang and I hosted developer workshops in both Kenya and Nigeria.

To our surprise, many software developers attended—more than expected. They asked excellent technical questions. There’s a large pool of skilled developers eager to learn Ethereum’s core infrastructure and novel topics like zero-knowledge proofs.

Until now, they’ve relied entirely on the internet for learning, but interacting face-to-face with world experts is best—not just for learning, but also for inspiration pursuing a subject, as experts often love their fields passionately, and intellectual passion is contagious.

This leads me to the next step: we don’t really need conferences marketing new Web3 projects to Africans. People crave knowledge sharing and learning.

Our greatest contribution to Africans is organizing and delivering in-person education programs—like summer schools—inviting experts to teach technical topics.

Final Conclusions

Key takeaways from the above include:

-

Crypto payments have become a convenient method for accessing dollars.

-

Due to early expansion and promotion of P2P markets, Binance is popular in Africa.

-

Africans want to earn based on ability rather than geography, and they have the perseverance to pursue it.

-

The long-term goal should be reducing differences between Europeans and Africans in the digital sphere.

-

Africans face many challenges including lack of regulatory support, inability to travel, difficulty complying with KYC/AML, almost no VC network, and no time to experiment with new ideas.

-

More importantly, nearly all Nigerians raised their hands admitting they lost opportunities due to others distrusting them.

-

Web3Bridge’s education program is doing vital work—the next step is Westerners personally assisting with summer schools.

One impact of our visit was helping communities connect. Many participants didn’t know each other, especially developers. Apparently, some local community leaders plan to continue organizing more events. With more visits, we hope to help local leaders build larger communities.

Two final topics I’d like to discuss.

Africans love life. Though we only visited Nigeria and Kenya, we also met Africans from Uganda, Ghana, and other countries. They joked lightheartedly—Nigerians are dramatic, or they go to Ghana to relax.

Locals happily taught me fun phrases like Mubaba, Alagba, m'soupa—terms of praise for men and women. I seized every chance to say them; most laughed, especially Kenyans. They even told me East Africans have round foreheads while West Africans have flat foreheads.

As a programmer, it’s easy to focus on broader systems and try to evaluate how to fix things for everyone’s benefit. Yet we must never forget that at the system’s core are people. Taking time to understand their customs, humor, and fully appreciate everything they sacrifice to sit in the same room as the rest of us—is always worthwhile.

What is Africa?

One compelling aspect of Africa is its immense cultural richness and how it shapes Africans’ perception of the continent.

In West Africa, there’s a Schengen-like agreement allowing visa-free travel among several countries. However, travel between East and West Africa (and vice versa) is uncommon and difficult—requiring visas, high economic costs, and time. For example, a flight from Lagos to Nairobi takes about five hours, with round-trip tickets potentially exceeding $600.

I noticed East and West Africans mutually recognize each other as integral parts of African identity. Conversely, they don’t consider South Africans or North Africans to belong to the same standard definition of “Africa.” South Africa is seen as more European, while North Africa is viewed as more Islamic.

This sentiment manifests in the fact that—at least among those I asked—no one had been to Algeria or expressed desire to go. This is interesting because my stepfather grew up in Algeria and strongly identifies as African. I lack deep insight here. I imagine it relates to cultural differences and Africa’s colonial history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News