After James Wynn's hundreds of millions in liquidations, why is CZ supporting Web3 dark pool trading?

TechFlow Selected TechFlow Selected

After James Wynn's hundreds of millions in liquidations, why is CZ supporting Web3 dark pool trading?

Dark pools are private trading venues that have long existed in traditional financial markets. Their advantage lies in enabling institutions to execute large orders without triggering market volatility, but they have frequently faced controversy due to their centralized operating model being prone to abuse.

Author: c4lvin : : FP, Researcher at Four Pillars

Translation: Tim, PANews

Key Takeaways:

-

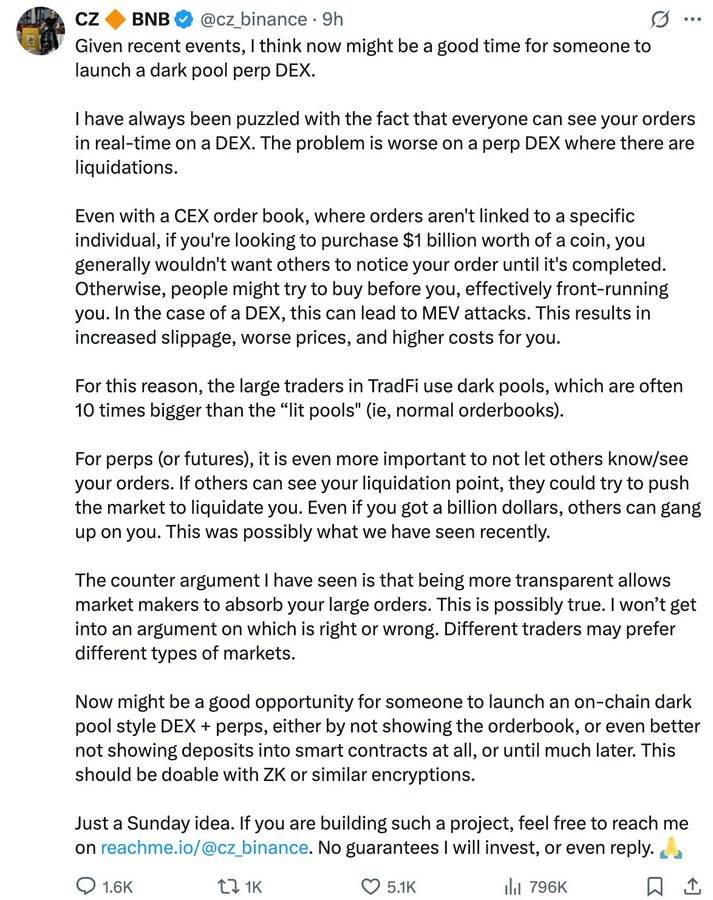

Former Binance CEO Changpeng Zhao (CZ) has proposed building a dark pool-style perpetual contract DEX to address MEV attacks and large position exposure caused by DEX transparency, sparking market-wide interest in the dark pool sector.

-

Dark pools are private trading venues long established in traditional finance, allowing institutions to execute large trades without triggering market volatility. However, they have repeatedly faced controversy due to centralized operation models prone to abuse.

-

Web3-native dark pools can resolve critical flaws in both existing financial systems and Web3, positioning them as pivotal innovations expected to play a major role in the future Web3 privacy market.

Source: "Darker than Black"

On June 1, 2025, a tweet from former Binance CEO Changpeng Zhao (CZ) stirred significant discussion within the crypto community. He highlighted the need for a "dark pool-style perpetual DEX," arguing that real-time public order visibility on current DEXs disadvantages traders. This sparked debate around privacy and efficiency in cryptocurrency trading, bringing renewed attention to the concept of dark pools. This article aims to explain what dark pools are and what they mean in the context of Web3.

Source: CZ’s Twitter

1. What Is a Dark Pool?

1.1 Traditional Finance Dark Pools

Source: b2broker

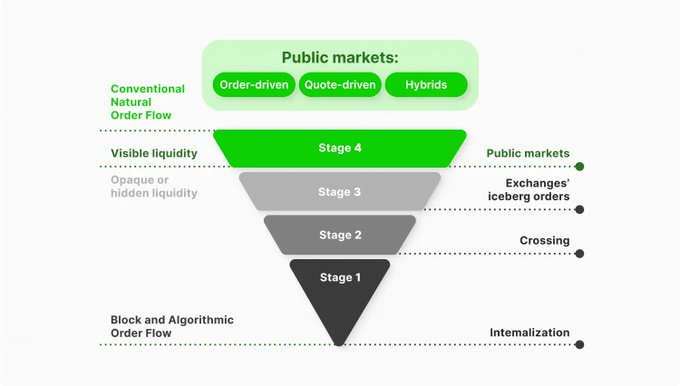

Although CZ’s comments might suggest dark pool trading is a novel innovation unique to Web3, this financial instrument has existed in traditional markets for decades. The history of dark pools dates back to 1979 when the U.S. Securities and Exchange Commission (SEC) passed Rule 19c-3, allowing securities listed on specific exchanges to be traded on alternative platforms. With the rise of electronic high-frequency trading in the 1980s, order book transparency increased dramatically, prompting institutional investors seeking to hide large trade intentions to demand private trading venues.

Most people interact with public exchanges like the New York Stock Exchange or NASDAQ. However, placing large buy/sell orders on these platforms can significantly move prices and potentially harm retail traders. Dark pools refer to independent trading systems that allow institutions or major investment banks to execute large-scale transactions privately.

In traditional exchanges, all buy and sell orders are publicly displayed on the order book for all participants to see. In contrast, dark pool platforms do not disclose order prices or quantities before execution. Due to this feature, large institutional investors can conceal their trading intentions while minimizing market impact. As of 2025, up to 51.8% of U.S. stock trading volume occurs through dark pools, indicating they have evolved beyond alternative mechanisms into mainstream trading infrastructure.

Dark pool trading differs somewhat from over-the-counter (OTC) crypto trading. Dark pool operators accumulate shares by shorting stocks to provide liquidity to buyers. Because they must report short-selling details to financial regulators such as FINRA, dark pool transaction data and volumes are actually transparent. The key difference lies in the anonymity of the initiating institution—its identity remains undisclosed. Currently, dark pool volume is publicly tracked via the DIX index, which traders often use to infer institutional capital flows.

1.2 Criticisms of Traditional Dark Pools

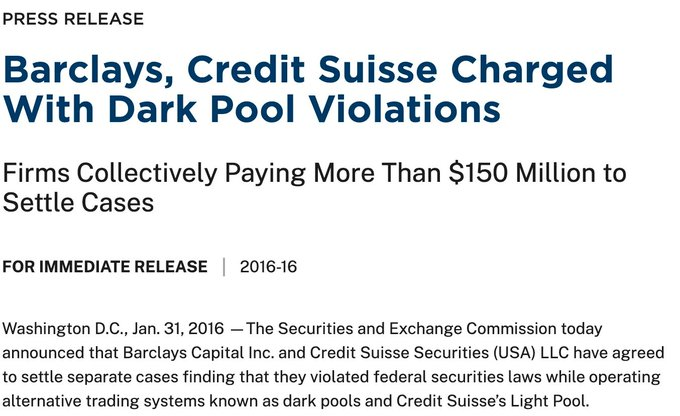

Nevertheless, traditional financial dark pools have drawn widespread criticism. Since they are operated by centralized entities, when potential profits from corruption exceed penalty costs, abuse becomes highly likely—leading to numerous real-world legal cases.

Source: SEC

In 2016, several major financial institutions were fined over $150 million for violating federal laws related to dark pool operations. Barclays and Credit Suisse faced lawsuits from the SEC for breaching dark pool regulations. They were accused of providing false information about participant composition and failing to disclose preferential treatment given to high-frequency trading firms.

In 2018, the SEC fined Citigroup $12 million for misleading investors in its dark pool business. Citigroup leaked confidential client order information to high-frequency trading companies, enabling them to execute over $9 billion in trades opposite its clients’ positions and profit easily.

These issues stem from reliance on trusted central operators and inherent conflicts of interest—pain points that decentralized Web3 dark pool solutions aim to resolve.

1.3 Web3 Dark Pools

The concept of Web3 dark pools is gaining traction, with implementations more complex and transparent than those in traditional finance. While all blockchain transactions are publicly recorded—seemingly conflicting with privacy needs—Web3 dark pools leverage advanced cryptographic techniques like zero-knowledge proofs and multi-party computation (MPC) to effectively protect transaction privacy. Ironically, blockchain’s inherent transparency becomes a technical advantage enabling higher levels of privacy protection.

The core advantage of Web3 dark pools is their ability to eliminate operational risks present in traditional Web2-style dark pools. Transactions are automatically executed via smart contracts without intermediaries, allowing users to retain full control over their assets. Unlike traditional models, there is no risk of operator misuse of user data, and every step of the process can be cryptographically verified.

Web3 dark pools also introduce a new concept called “programmable privacy.” This allows developers to flexibly define which parts of an application should remain private and which should be public. For example, trading instructions can stay fully confidential during execution, while final trade outcomes may only be revealed to specific counterparties—all while complying with regulatory requirements. While similar functionality isn't impossible in traditional software, Web3 offers superior flexibility and verifiability at the protocol level.

2. Demand for Dark Pool Perpetual Contract DEXs

CZ advocated for a dark pool model for perpetual contract DEXs, citing problems arising from current DEX transparency. His main arguments are outlined below:

2.1 Avoiding MEV Attacks

DEX transparency is one of the primary causes of MEV (Maximal Extractable Value) attacks. As previously mentioned, when DEX orders are visible in the blockchain mempool, MEV bots detect these transactions and perform front-running, back-running, or sandwich attacks. This results in worse-than-expected execution prices for traders, especially with large orders where slippage increases significantly. CZ once stated: "If you want to execute a $1 billion order, you naturally want to complete it before others notice." He argues that dark pool mechanisms are needed to solve this issue.

2.2 Significant Latent Demand

CZ noted that dark pools are already widely used in traditional finance and suggested that the liquidity provided by dark pools could be up to ten times greater than that of public exchanges. He believes the crypto market similarly needs such solutions, particularly emphasizing the importance of trader privacy in high-risk products like perpetual contracts.

Beyond CZ’s views, demand for dark pools is increasingly recognized not only in Web2 but also in Web3 markets. According to Blocknative research, private mempool transactions on Ethereum accounted for just 4.5% of total volume in 2022, but now represent over 50% of total gas fees. Although Solana lacks a traditional mempool environment, various trading bots and wallet solutions now include MEV prevention as a standard feature—indicating rising user awareness of MEV. This clearly demonstrates that the Web3 community now fully recognizes manipulative behaviors affecting trade outcomes and has strong incentives to avoid them.

2.3 Harm Caused by DEX Transparency

CZ pointed out that "all orders on DEXs are real-time and public," stressing that this creates serious risks in perpetual contract trading. On perpetual DEXs, traders’ positions and liquidation levels are directly exposed on-chain, enabling malicious actors to manipulate markets. For instance, if other traders discover the liquidation price of a large position, they can deliberately push prices to trigger forced liquidations. CZ referenced “recent events,” seemingly alluding to the HLP fund liquidation incident on Hyperliquid or James Wynn’s massive liquidation.

Source: @simonkim_nft

A more detailed explanation of CZ’s tweet can be found in an article recently written by Hashed founder Simon Kim. The article argues that despite Web3 enabling decentralization and privacy, it has paradoxically created the most transparent surveillance system ever—a reality where all transactions are permanently recorded, visible to anyone, and analyzed by AI.

The article highlights the case of MicroStrategy, proving even corporations cannot escape tracking. Despite Michael Saylor repeatedly warning about the risks of exposing wallet addresses, blockchain analytics platform Arkham Intelligence successfully traced the company’s Bitcoin holdings, identifying 87.5% of its total position.

The article also examines James Wynn’s $100 million liquidation event on Hyperliquid, underscoring the necessity of dark pool trading. Wynn had opened a $1.25 billion long position in Bitcoin with 40x leverage. Because his liquidation price was publicly visible, market participants exploited this vulnerability—some traders actively took opposing positions and profited $17 million within a week. This incident reveals the drawbacks of transparent position data on perpetual DEXs and confirms real demand for opaque, private trading environments.

3. Different Ways to Implement Dark Pools On-Chain

While many may have first encountered the concept of dark pools through CZ’s tweet, numerous projects have been actively developing such systems. To achieve the core goal of “trader privacy,” different teams have adopted varied technical approaches using distinct cryptographic methods. Below are the mainstream implementation strategies and representative projects:

3.1 Renegade

Source: Renegade

Renegade is one of the most prominent on-chain dark pool projects currently live on Arbitrum, an Ethereum Layer 2 network. The project combines multi-party computation (MPC) with zero-knowledge proofs to build its privacy solution.

In the Renegade protocol, all state data (balances, order books, etc.) are managed locally by traders, eliminating dependence on centralized or distributed servers. When executing a trade, users must know both old and new wallet states and submit three key pieces of information to the smart contract: commitment, nullifier, and validity proof. This structure is common in zero-knowledge proof-based systems like Zcash.

Renegade’s defining feature is end-to-end privacy—before and after transactions. Prior to execution, order details (price, size, direction) remain completely hidden. After completion, only the counterparty learns what assets were exchanged. All trades are pegged to Binance’s real-time mid-price, ensuring zero slippage and no price impact, making it highly attractive as a Web2-like experience.

A key architectural aspect of Renegade is that whenever a new order enters the system, multiple independent relay nodes continuously perform MPC via peer-to-peer communication. During this process, Renegade proves a special NP statement called “VALID MATCH MPC,” demonstrating that, given public commitments to order information and matching tuples, both counterparties genuinely possess valid input orders. Through this collaborative zero-knowledge proof framework, Renegade delivers full anonymity, privacy, and security.

3.2 Arcium

Arcium is a privacy-focused project built on the Solana ecosystem, leveraging additive secret sharing in MPC to enable encrypted shared state. This approach allows developers to store encrypted data on-chain and perform computations while keeping raw data confidential throughout. Notably, Arcium’s architecture supports non-interactive local addition and single-round multiplication, achieving strong security while greatly improving computational efficiency.

Additionally, Arcium implements “programmable privacy,” enabling developers to specify which states should be stored in encrypted form and which functions should operate on those encrypted states within Solana programs. Multi-party computation tasks are managed by a virtual execution environment known as the Multi-Party eXecution Environment (MXE). MXE defines task parameters such as involved data, executable programs, and participating nodes. With this framework, Arcium supports large-scale, parallel transaction processing akin to native Solana performance.

Source: Arcium

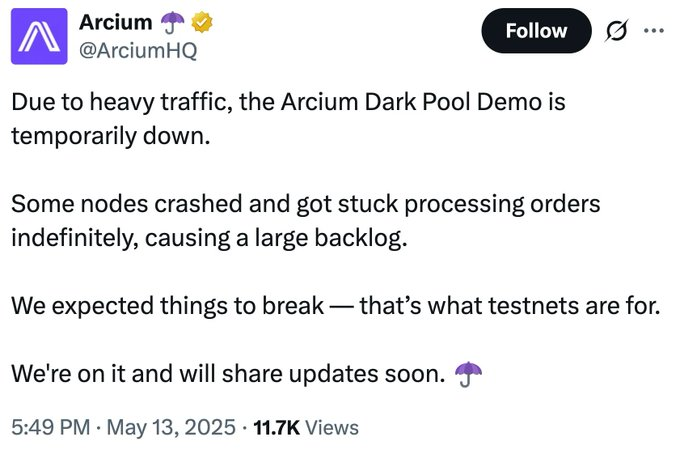

Recently, Arcium launched a demo version of its dark pool on Solana’s public testnet, creating the first on-chain confidential trading venue on Solana. Any existing Solana DeFi project can integrate with Arcium to deploy dark pool functionality and offer private trading services to users.

3.3 Aztec

Aztec is a privacy-centric zero-knowledge rollup solution. In 2022, it completed a $100 million Series B funding round led by a16z crypto—one of the largest investments in the privacy tech space.

Similar to Arcium, Aztec allows developers to mark certain functions as private. These private functions execute and verify locally on users’ devices, while only public functions run on the Aztec network. Private function state values are stored as UTXOs decryptable only by the user, inaccessible to anyone else.

Source: Aztec

Aztec previously partnered with Ren Protocol to jointly develop a privacy-preserving trading protocol based on dark pool technology. Aztec’s system enables users to trade using zero-knowledge tokens called “Aztec Notes,” with neither transaction details nor amounts disclosed on any public order book. When users deposit funds into Aztec, the system generates cash-like encrypted credentials using an off-chain UTXO state mechanism. As transactions are submitted and executed, the state tree continuously updates encrypted information, viewable only by credential holders—fully protecting user identity and account balance confidentiality.

4. If the Technology Works, the Dark Pool Will Thrive

The biggest technical challenge facing Web3 dark pools is scalability and performance. Current secure multi-party computation and zero-knowledge proof technologies require immense computational power and still face limitations when handling high-volume transaction loads. For example, Renegade’s peer-to-peer network structure leads to exponential growth in system complexity as the number of participants increases.

There exists a trade-off between privacy and scalability in dark pools. Zac Williamson, co-founder of Aztec, noted: “Fully private transactions require transmitting more data because everything is encrypted, consuming more resources and reducing scalability.” Overcoming these fundamental constraints will require developing more efficient cryptographic libraries.

Source: Arcium

Network stability is another critical challenge. Recently, Arcium tested a dark pool demo application on Solana’s Devnet using its test infrastructure. During testing, some nodes crashed under high traffic, causing order queue backlogs. The purpose of this test was to validate infrastructure resilience and address potential issues before mainnet launch—an issue that was quickly resolved. This shows that deploying dark pools requires cutting-edge technology and rigorous testing to handle demanding workloads.

In the long term, dark pools are poised to become integral components of the cryptocurrency trading ecosystem. As Binance founder CZ pointed out, dark pools already account for over 50% of trading volume in traditional finance—a model likely to achieve similar dominance in crypto markets. As institutional participation in crypto grows, this trend will accelerate further.

However, this does not mean existing DEXs will be entirely replaced. Instead, the two models are more likely to coexist and complement each other, serving different needs. The market is expected to bifurcate: small trades prioritizing price discovery will continue on traditional DEXs, while large, privacy-sensitive trades will shift to dark pools.

Dark pool development will extend beyond privacy trading into broader applications. As demonstrated by Arcium’s ongoing efforts, sectors such as AI, DePIN, and supply chain management are seeing growing demand for privacy-preserving technologies. As a foundational step in privacy infrastructure, dark pools could evolve into a cornerstone of the broader Web3 privacy ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News