Hyperliquid Airdrop Guide 2.0: Earning Strategy for High-Potential Early-Stage Projects

TechFlow Selected TechFlow Selected

Hyperliquid Airdrop Guide 2.0: Earning Strategy for High-Potential Early-Stage Projects

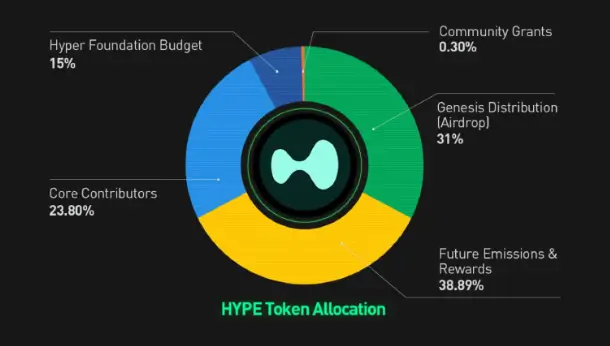

Please remember, 38.8% of HYPE is still reserved for future distribution and rewards.

Author: Hixon

Translation: TechFlow

They say Faze Banks is always one step ahead. Wrong, Blocmates are (usually) the earliest.

In fact, to be honest, when it comes to Hyperliquid, we were the first.

Some joined us in mining, some didn't, but that's okay. Maybe the second big opportunity is right in front of us.

The current market condition is that unless you were born on the trading floor or are one of those "magicians" who always perfectly go long or short on a certain X platform, you're likely experiencing losses (me too).

Don't worry, those who endure will eventually thrive. My plan is simple: during this bear market, I’ll focus on the Hyper EVM ecosystem and aim for a third-season HYPE airdrop.

Besides, all protocols mentioned here will airdrop their native tokens—a win-win strategy.

Remember, 38.8% of HYPE is still reserved for future distribution and rewards:

Before diving in, note that these protocols are at an early stage. Do not invest more than you can afford to lose.

Also, I'll only mention the most important ones widely supported by the Hyperliquid core community.

Current State of Hyper EVM

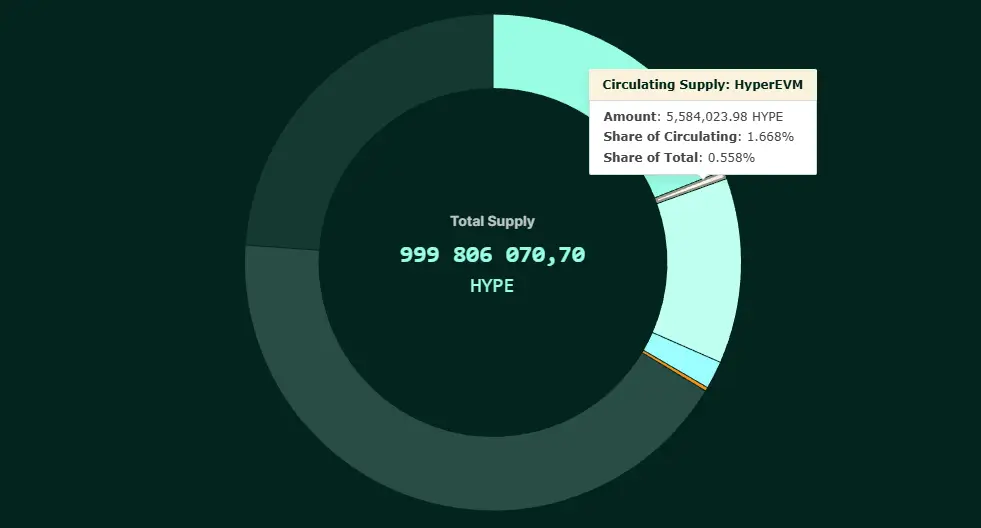

At the time of writing, only about 1.6% of the total circulating supply of HYPE has been deployed on Hyper EVM. This means you can now consider yourself an early participant, similar to starting mining in the first or second month of Season One.

Source: HypeBurn

However, note that this percentage has doubled in the past week. Attention is growing, and once Season Three is announced (currently speculative, but highly likely), capital inflows will surge.

Looking at the top seven applications on DefiLlama, we can clearly see the current protocol leaders. We’ll focus on these and more.

Source: DefiLlama

How to Transfer HYPE to Hyper EVM

The easiest first step is to bridge USDC to Arbitrum, then deposit into Hyperliquid. Then, use the "Spot" feature to buy HYPE (you can find the "Spot" option in the token search bar). Once you hold HYPE, simply click the "Transfer to EVM" button to bridge it to Hyper EVM.

You can also directly use HyBridge for bridging.

Now that you're ready, let’s dive into the specific applications.

KittenSwap

Starting with decentralized exchanges (DEX). KittenSwap is currently the main 3,3 DEX on Hyperliquid EVM. Remember Shadow on Sonic? This is a similar story.

The best way to mine on KittenSwap is to pick your favorite liquidity pool. The lower the total value locked (TVL), the more points you earn. For example, I chose the HYPE/PURR pool because I noticed PURR’s price movement closely follows HYPE, meaning I won’t suffer much impermanent loss.

If you want a 1.28x points boost, you can buy a MechaCat on Drip.Trade. Also, MechaCat NFTs themselves will receive 3% of the total airdrop.

In the spirit of Hyperliquid, points miners will get 30% of the total supply and are considered earliest participants.

Join KittenSwap: Click here

HyperSwap

HyperSwap is currently the second-largest DEX on Hyper EVM.

Lower TVL means less competition, potentially offering good opportunities for users with smaller capital. Similar to KittenSwap, just pick your preferred liquidity pool and start mining. Points are distributed every Sunday.

HypurrFi

HypurrFi is a place where you can boost HYPE by depositing and borrowing the USDXL stablecoin. Watch your health factor and liquidation level, visible on the homepage.

Then, you can use USDXL in liquidity pools on KittenSwap or HyperSwap above. This way, you earn double points and increase your Hyper EVM activity.

Looped Hype

This is another leveraged opportunity, ideal for those wanting to boost HYPE staking yields or use LHYPE in DEX pools. Again, this helps you gain more points and boost Hyper EVM activity. That’s the strategy.

Stake Your HYPE

You can choose to stake your HYPE on the official Hyperliquid staking page or use the following LST (liquid staking token) providers:

If Season Three happens, all of these will boost your points.

Drip Trade

Drip Trade is the main NFT hub on Hyper EVM and has already attracted significant activity.

Hypers is the official collection from Drip Trade, and may receive token allocations when DRIP launches.

I personally also bought some Hypios (these Hypio mining points series is leading and received many whitelists), MechaCats, and Tiny Hyper Cats.

HyperLend

HyperLend positions itself as the Aave of Hyperliquid and has seen significant adoption.

For this project, you might need to wait for limits to increase, as many users have already claimed points here.

Hyper Unit

Hyper Unit enables depositing native BTC and ETH into Hyper EVM. Over 1,000 ETH have already been deposited, and I believe this number will grow rapidly by the time this article publishes.

Just use its deposit page. The official Hyperliquid account actively promotes this project on X, so I believe the points bonus is worthwhile.

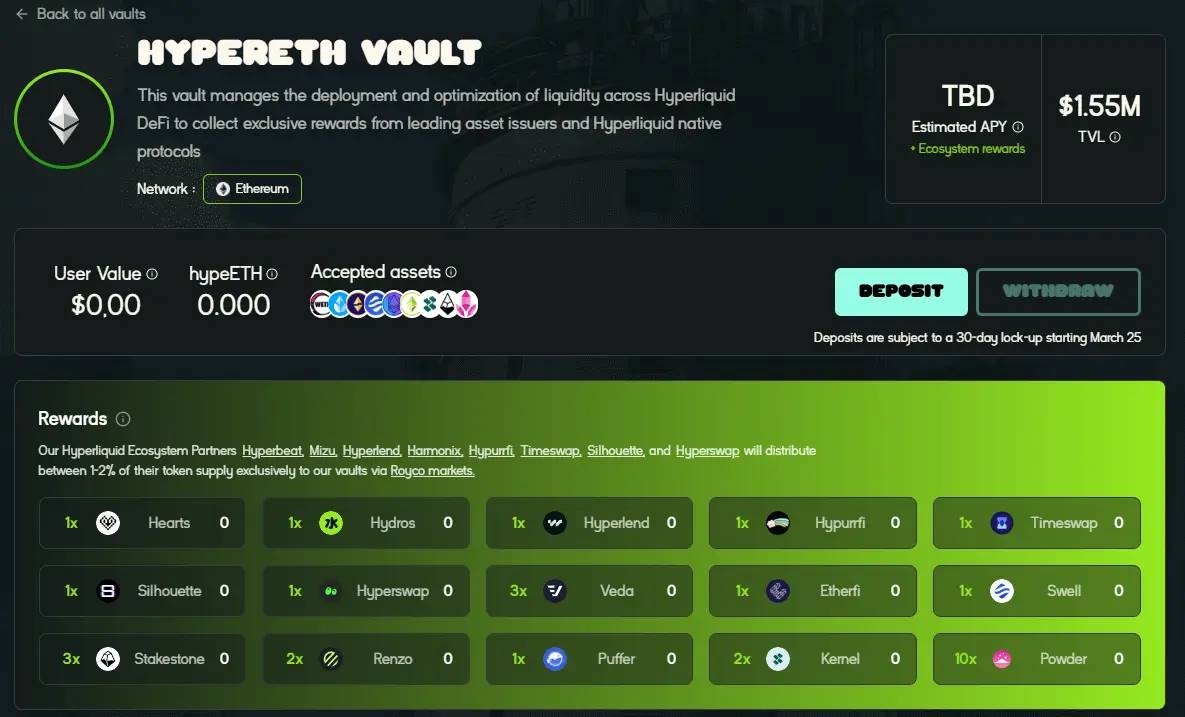

Mizu Labs

This project is very interesting. Mizu Labs aims to become the unified liquidity layer for Hyper EVM.

Currently, they offer hypeETH and hypeBTC vaults. These vaults automatically deploy your tokens across key protocols both inside and outside Hyperliquid.

These vaults not only earn you points but also boost your Hyper EVM activity. To get hypeETH on HyperEVM, refer to the guide.

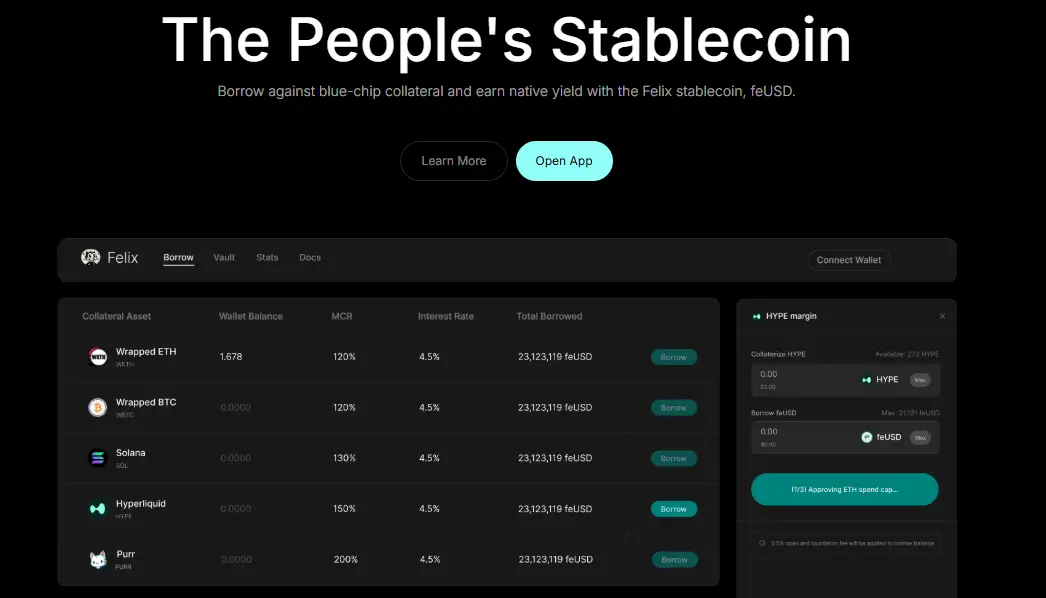

Felix Protocol

Felix provides critical infrastructure still missing and needing improvement in the Hyper EVM ecosystem: stablecoins.

Once Felix fully launches, you can deposit HYPE and mint feUSD. Again, you can use feUSD in various liquidity pools to double your points and EVM activity.

Additionally, you can join the HYPE stability pool and earn HYPE rewards through Felix’s liquidations.

Projects to Watch

You can game the above ten protocols weekly—swapping, providing liquidity, lending, looping—but if you really want to dig deep into this airdrop, there are more projects to explore.

Here are some to watch. Important: some are even earlier-stage and less known than the previous ten. Be mindful of risks.

Summary

Despite the current market slump, opportunities like this are hard to ignore. Personally, I’ll keep some funds aside and stay active on HyperEVM weekly while scouting for new projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News