Three-way battle among exchange wallets: Who will be the ultimate winner?

TechFlow Selected TechFlow Selected

Three-way battle among exchange wallets: Who will be the ultimate winner?

Some rely on their first-mover advantage to seize the high ground, while others break through forcefully leveraging capital and traffic.

Author: Fairy, ChainCatcher

The crypto world is in constant flux, and the battle for Web3 wallets has suddenly intensified.

Exchange wallets such as OKX, Binance, and Bitget are each fighting their own wars, leveraging product iterations, user acquisition, task mechanisms, and incentive designs in a series of ongoing offensives and defenses. Some have seized early-mover advantages to capture high ground; others are breaking through forcefully with capital and traffic.

Bybit recently announced a significant downsizing of its Web3 wallet business, while Binance Wallet has captured over 90% market share in transaction volume within just two months. OKX and Bitget haven't paused either, continuously ramping up incentives and enhancing functionality and user experience.

The outcome remains unclear, but the smoke of war has already begun to rise.

Contenders: Five Camps With Distinct Strategies

(1) OKX Wallet

Nickname: The Tech Maniac

Style: Steady progress, long-term commitment, emphasizing product refinement and cross-chain ecosystem development.

Signature Tactics: Feature integration + early ordinals move + free services at scale

Overview: One of the earliest exchanges to heavily invest in the Web3 wallet front, like a seasoned general equipped with hundreds of engineers behind the scenes.

(2) Binance Wallet

Nickname: The Traffic Warlord

Style: Late entry with surprise attack, resource prioritization, flexible and diverse gameplay

Signature Tactics: Strong entrypoint bundling + innovative mechanisms + ecosystem synergy

Overview: Started relatively late but introduced novel tactics, directing ecosystem assets across multiple channels, playing the role of a game tempo disruptor in the battlefield.

(3) Bitget Wallet

Nickname: The Night Walker in New Armor

Style: Quick response,紧跟热点 (quickly following trends)

Signature Tactics: Trend-focused breakthroughs + rapidly iterating campaigns + yield-on-hold features

Overview: Evolved from the established multi-chain wallet BitKeep, it plays flexibly and acts swiftly. Though lacking top-tier hardware or visibility, it consistently opens gaps and maintains a presence that cannot be ignored thanks to its "lightweight" and "agile" approach.

(4) Coinbase Wallet

Nickname: The Compliance Ranger

Style: Cautious moves, security-first, focused on the North American home market

Signature Tactics: Regulatory compliance + acquisition-driven enhancement

Overview: Coinbase Wallet started early. In 2018, Coinbase rebranded its self-developed wallet Toshi as Coinbase Wallet and has since expanded wallet capabilities through acquisitions such as BRD and Astro Wallet.

(5) Bybit Wallet

Nickname: The Wind-Chasing Scout

Style: Keen trial runs, imitative strategies, flexible engagement and withdrawal

Signature Tactics: Gameplay mimicry + custodial model

Overview: Bybit Wallet is not a core player. With limited early investment in wallet infrastructure, Bybit failed to build a moat.

Battlefield Chronicle: OKX Expands for Years, Binance Reaches Summit via Detour

As early as 2021, OKX launched its Web3 wallet project, recruiting talent and investing heavily, all while adhering to a "free features" strategy. Then came the sudden "ordinals craze" at the end of 2023—OKX Wallet timely launched an ordinals marketplace and successfully rode the wave.

In contrast, although Coinbase Wallet started earlier, its overall strategy has been more conservative, with slower feature updates and relatively limited market presence. At the time, Bitget and BitKeep were undergoing integration, with product rollouts and marketing efforts not yet on track, failing to establish effective competitive positioning.

The result was clear-cut: OKX Wallet pulled ahead in early battles and even squeezed the survival space of smaller independent wallets. Public data shows that OKX Web3 Wallet saw nearly a tenfold increase in users in 2024, surpassing 50% market share by early 2025—reaching a historical peak.

But three years building an empire, lost in three months.

In March 2025, the battlefield took a pivotal turn. Bybit suffered a $1.5 billion security incident, incurring massive losses and indirectly dragging OKX into turmoil. On March 17, OKX suspended its DEX aggregator service, causing its wallet market share to plummet sharply. Meanwhile, Bybit Wallet, plagued by prolonged underperformance and weak revenue, announced the shutdown of most functions.

At this moment of market turbulence, Binance Wallet seized the opportunity to break through rapidly. Despite its late start, Binance forged a detour path: directly targeting "operational strategy + wealth incentives," establishing a new paradigm via the Binance Alpha program. By focusing on traffic and asset distribution, it quickly aggregated users and ecosystem developers within months. Since May 17, Binance Wallet has steadily maintained over 90% market share, achieving a late but decisive reversal.

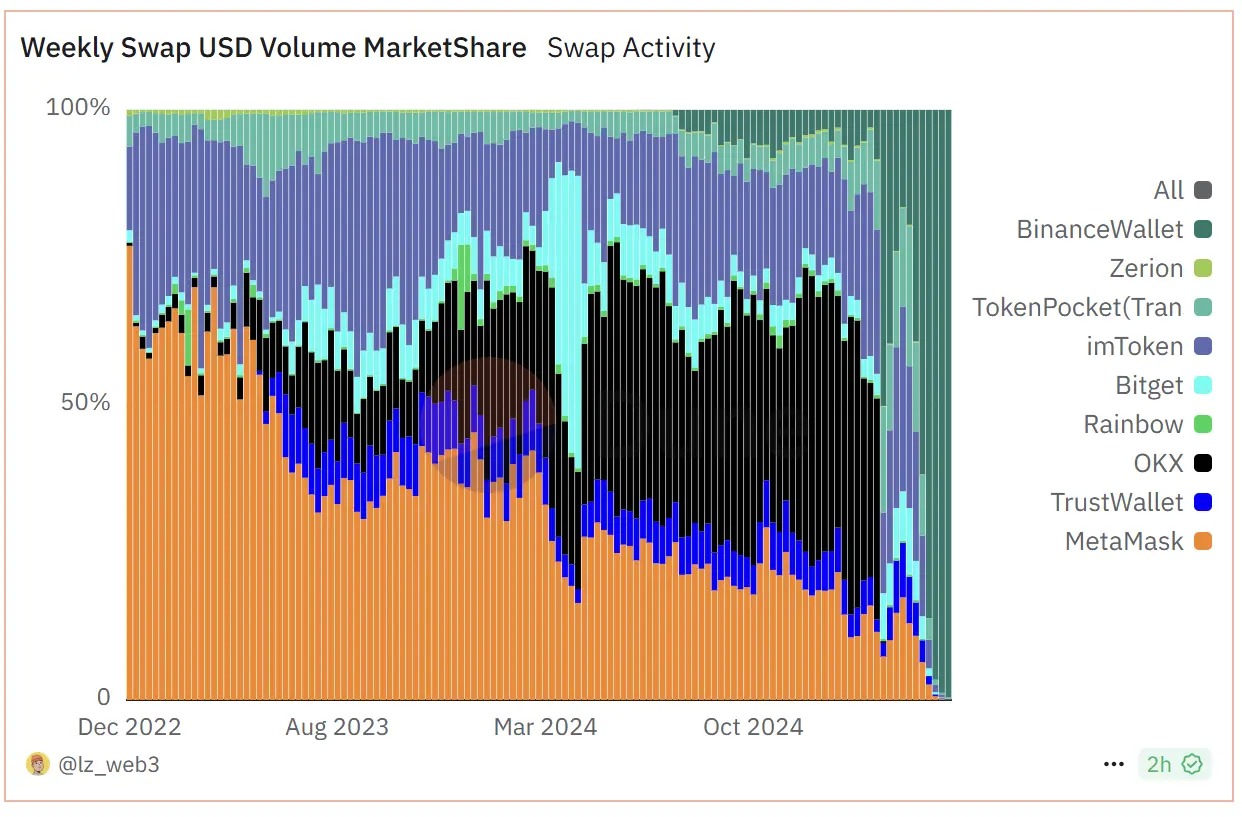

A "weekly USD trading volume market share" chart on Dune clearly illustrates the dynamic evolution of this competitive landscape.

Crypto KOL Wuwei offered an apt analogy: "OKX Wallet is like a meticulously crafted artwork, expensive to produce, killing off many small projects along the way, yet still unprofitable to this day. Binance, using industrial machinery, mass-produced replicas in two months—not only replicating features but achieving transaction volumes a hundred times that of OKX, with profitability utterly dominant."

Will the Strong Always Dominate, or Can the Weak Break Through?

In fact, facing Binance's aggressive push, OKX has also been advancing countermeasures. In response to Binance Wallet’s TGE campaign, OKX Wallet launched the Cryptopedia TGE express lane and introduced a "liquidity pool zone," catering to alpha-farming players seeking hedging opportunities. On the surface, it appears to be a "higher-dimensional strike," but most user feedback remains skeptical. While advertising APYs in the thousands of percent, these returns are only achievable within extremely narrow ranges and fluctuate violently with trading volume.

Community opinions on the ultimate winner are increasingly divided. Some believe the "strong dominate forever" scenario is now inevitable. User @0xNathanWalk stated: "OKX has superior product strength, while Binance boasts financial power and global influence—it will be hard for other wallets to break through." Others argue that differentiation and solid fundamentals remain viable paths for non-top-tier wallets.

Another school of thought re-evaluates the wallet battle from a strategic perspective. Community member @Zhouqi_2013 noted that in the current market structure, Binance rapidly attracts users via subsidies, OKX wins user trust through product excellence, and Bitget focuses on auxiliary features, compressing smaller wallets’ space through "downward pressure"—yet none of these platforms have shown clear profitability in their wallet businesses so far.

Binance achieved an extreme comeback through speed and strategy; OKX continues to hold firm on product fundamentals. Every step taken by these giants is a battle of offense and defense—early starters aren’t guaranteed victory, while latecomers can launch lightning strikes.

If we look back at every fierce battle among internet tech giants, we believe in the end, those who win the hearts of users will rule the world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News