BIP-177 Sparks the Bitcoin Unit War by Killing "Satoshi"

TechFlow Selected TechFlow Selected

BIP-177 Sparks the Bitcoin Unit War by Killing "Satoshi"

Can Bitcoin become a global currency by rejecting "聪" as the base unit?

Original | Odaily Planet Daily (@OdailyChina)

Author|Golem (@web3_golem)

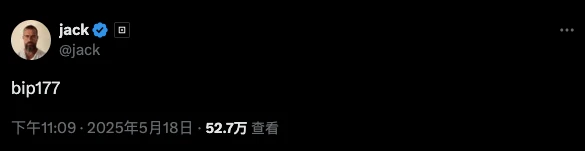

On the evening of May 18, Jack Dorsey, founder of social platform X (formerly Twitter), posted about "bip 177," a mysterious string that quickly drew widespread attention. BIP stands for "Bitcoin Improvement Proposal"; what Jack posted was not some cryptic meme symbol, but the Bitcoin Improvement Proposal numbered 177.

BIP-177: Making Bitcoin "Multiply"

BIP-177 was proposed by John Carvalho, CEO of Synonym. This proposal aims to redefine Bitcoin's base unit and representation method without modifying the core consensus protocol. Key points include:

-

Change Bitcoin’s base unit from “satoshi (sat)” to “bitcoin,” phasing out both satoshi and sat;

-

The currency code “BTC” remains unchanged and can still be used; 1 BTC = 100,000,000 bitcoins;

-

The symbol “₿” can represent the base unit bitcoin; e.g., 0.345 BTC = 34,500,000 bitcoins = ₿ 34,500,000;

-

Applications should allow users to switch between traditional BTC format and the new integer format.

In short, BIP-177 aims to make everyone's Bitcoin appear "larger" in display and formatting. The total supply would visually become 210 trillion bitcoins, though the actual supply remains unchanged.

Benefits of BIP-177

Although it only changes display and format, John believes BIP-177 offers clear benefits:

-

Reduced cognitive load

Due to Bitcoin’s rising value, using Bitcoin for daily payments or on-chain transactions often involves decimal fractions. By redefining and displaying BTC’s base unit as “one bitcoin,” user cognitive load can be reduced. Integer-only interfaces simplify mental calculations and reduce potential confusion or user errors. For example, spending 2,000 bitcoins is easier to grasp than spending 0.00002 BTC.

-

Eliminating unit intimidation

Currently, one Bitcoin costs around $104,000, which easily triggers unit intimidation—people perceive it as too expensive. Yet saying you can only afford 0.1 BTC might feel embarrassing. For newcomers, the high nominal price creates a “ceiling anxiety,” making them believe further price increases are unlikely.

With the new format, one bitcoin appears to cost just $0.00104. Compared to $100,000, this feels much more affordable and suggests greater upside potential, eliminating unit intimidation.

-

Simplified user experience

Phasing out the base unit satoshi simplifies user experience. Removing artificial decimal formats helps users understand Bitcoin’s protocol is fundamentally about counting discrete units. Satoshi is a secondary monetary unit relative to Bitcoin, adding complexity. Understanding both bitcoin and satoshi becomes two separate issues, hindering broader adoption.

Opposing Views

Of course, there are also opposing voices within the community regarding BIP-177.

-

Destroying “Satoshi culture”

The strongest opposition stems from replacing satoshi—the base unit named after Bitcoin’s creator, Satoshi Nakamoto—which poses cultural resistance.

-

Potential confusion

Users accustomed to BTC as the unit may become confused, especially during verbal communication. For Chinese translations, it presents a challenge—if both BTC and the base unit bitcoin are translated as “比特币,” serious confusion arises, affecting consensus.

-

Impact on Bitcoin’s brand perception

This is a major conflict point. Bitcoin gains attention and goes mainstream largely because its price keeps rising. But with the new format, Bitcoin’s price appears “cheap,” potentially altering newcomers’ perception of Bitcoin’s brand value.

“Prestige Work” During a Bull Market?

During bull markets, as Bitcoin’s price and purchasing power rise, discussions about its base unit naturally resurface.

In December 2017, when Bitcoin surpassed $10,000, a community member proposed BIP-176, introducing a new unit called bits, where 1 bit = 100 satoshis = 0.000001 BTC. The reasoning behind this proposal was nearly identical to BIP-177—reducing cognitive load and facilitating daily use (no wonder these two proposals are numbered consecutively)—but it ultimately wasn’t adopted.

Today, Bitcoin has crossed $100,000, ten times higher than eight years ago, with its purchasing power significantly increased. In the U.S., one Bitcoin can buy a Tesla Model S Plaid; in China, it can easily cover a Xiaomi SU7 Ultra; in El Salvador, it can purchase an entire villa.

These purchases are already considered luxuries for ordinary people, so renewed focus on Bitcoin’s base unit and representation is understandable. But fundamentally, such upgrades have no real impact on the Bitcoin network—they resemble “prestige work” done during bull markets. If the market falls into a bear phase and Bitcoin’s value drops, interest in this issue may fade again.

According to BIP-177’s proposed timeline, even if approved, moving from the first stage—introducing the concept—to the second stage—mainstream services and media defaulting to integer-only display—and finally reaching the third stage—integer format becoming standard—is expected to take two years. However, enthusiasm for implementing this proposal may fluctuate with market conditions.

Interestingly, Bitcoin Pizza Day is approaching. Fifteen years ago, someone bought two pizzas with 10,000 BTC, worth only $41 at the time. Today, those 10,000 BTC are worth over $1 billion. Now, if BIP-177 passes, people would still spend 35,000 bitcoins to buy those same two pizzas—how’s that not another cycle?

If you can't improve my life, change the unit of measurement instead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News