Binance Alpha points competition intensifies, but the truth isn't so sweet

TechFlow Selected TechFlow Selected

Binance Alpha points competition intensifies, but the truth isn't so sweet

This points-driven frenzy is ruthlessly pushing ordinary users out of the game.

Author: Frank, PANews

Binance Alpha's points game is pushing "involution" to unprecedented extremes. As the points threshold once surpassed 200, while airdrop yields plummeted to around $25, the declining return on user investment has sparked widespread community discussion.

Beneath this seemingly winner-takes-all feast, some argue that its massive traffic is "spilling over" into other ecosystems like Sui and Solana, injecting vitality into them. But how real is this spillover effect? And what long-term impact will this Binance Alpha-driven farming frenzy ultimately have on the industry?

The Reality Behind Traffic "Spillover": Observing Sui's Alpha Effect

The mechanics of Binance Alpha’s points game have been detailed previously and won't be repeated here. Overall, however, as more users join, the payout per airdrop clearly hits an upper limit, while the points threshold keeps rising. In this scenario, users must further compress costs to preserve profit margins.

Recently, Binance Alpha began listing tokens from the Sui ecosystem and subsequently announced several Sui-based Alpha projects. The inclusion of Sui provided volume farmers with a new low-cost opportunity. On May 14, multiple KOLs including @lianyanshe pointed out that projects like NAVX on Sui offer lower gas fees during volume farming and are less vulnerable to sandwich bot attacks, resulting in lower overall wear and tear. Thus, several Sui projects were expected to become the new "kings of involution" for Binance Alpha farming.

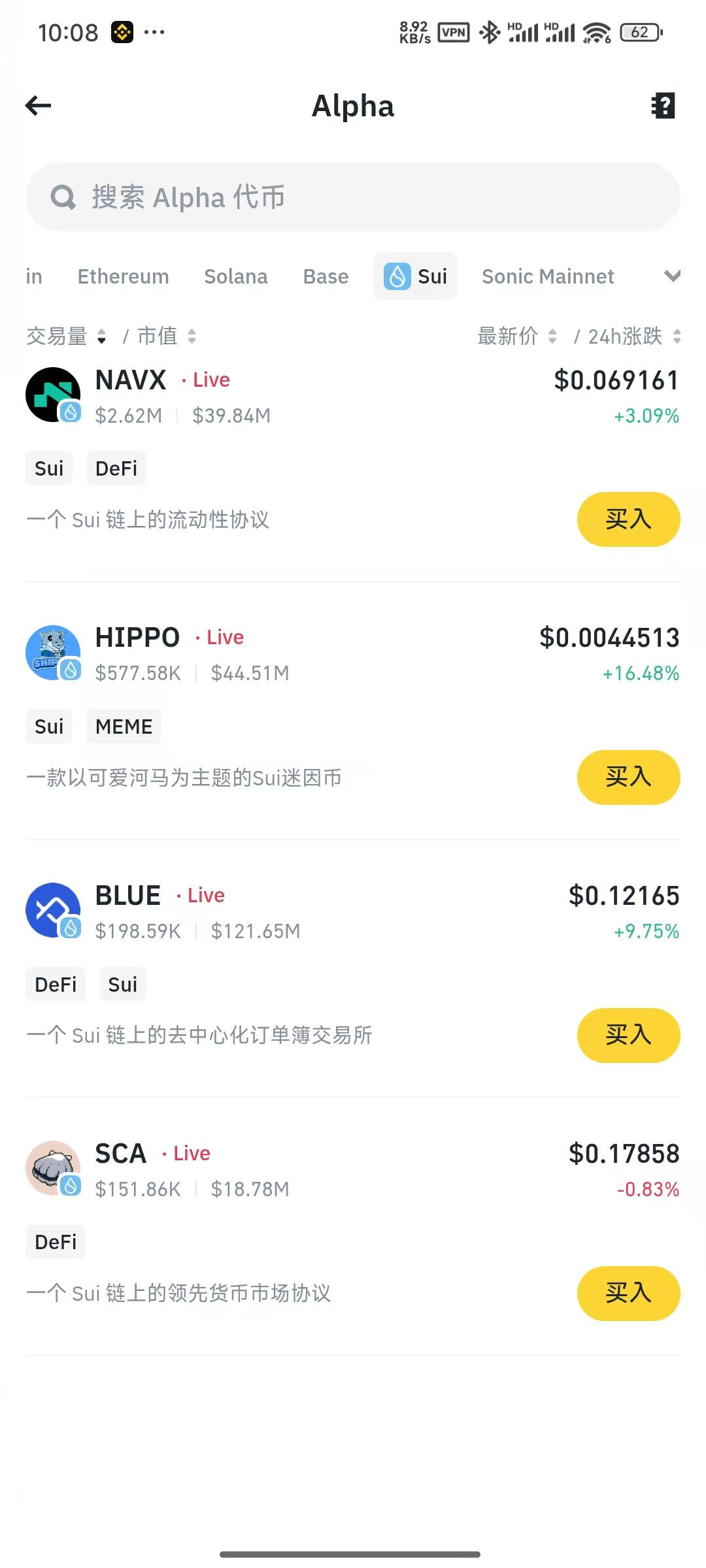

If most users adopt this approach, it could indeed bring significant trading volume and token热度 to the Sui ecosystem. However, such effects have not materialized in reality. According to PANews' investigation, trading volumes for Sui ecosystem tokens on Alpha are not high. NAVX, the highest among them, recorded only $3.34 million in 24-hour trading volume, while others like HIPPO, BLUE, and SCA saw volumes ranging from tens of thousands to just hundreds of thousands of dollars. By comparison, several projects on Solana consistently exceed $10 million in daily trading volume, and top BSC projects reach over $200 million. That said, being listed on Binance Alpha did boost NAVX’s volume—on May 13, its main pool volume hit $1.6 million, up from just a few thousand dollars the previous day.

In actual trading operations, it can be observed that Binance Wallet’s official cross-chain bridge currently does not support direct asset swaps between the Sui ecosystem and BSC. Users cannot directly convert assets like BNB into USDC on Sui. To save on this cost, they would instead incur expenses using alternative cross-chain bridges.

Solana's Top MEMEs Unexpectedly Gain Capital Inflows

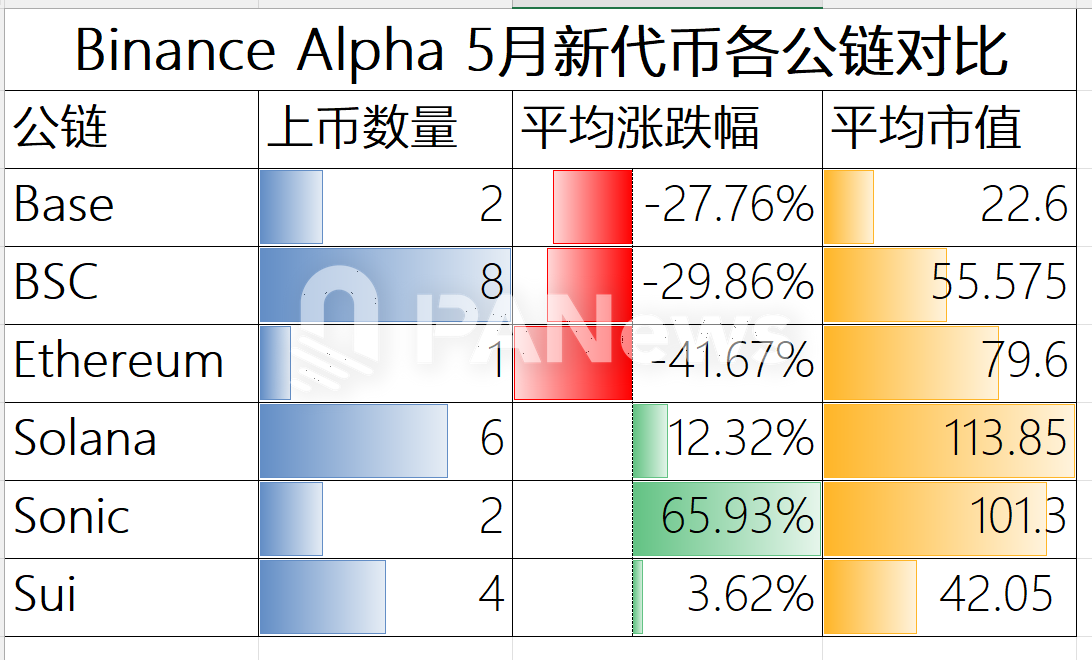

Solana is one of the ecosystems with the most projects listed on Binance Alpha after BSC. Starting in May, Solana’s overall DEX trading volume has clearly increased. On May 4, Solana’s DEX volume was $2.2 billion; by May 15, it had risen to $4.59 billion—a more than twofold increase. Indeed, leading tokens listed on Binance Alpha such as MOODENG and jellyjelly saw substantial increases in trading volume and experienced noticeable price surges. MOODENG rose 140% from launch to May 14, and the six Solana tokens launched on Binance Alpha in May averaged a 12.32% gain—among the few ecosystems showing positive performance across major chains.

Besides Sui and Solana, Sonic may be another ecosystem that recently benefited most visibly from this spillover effect. As Fantom’s new brand, Sonic urgently needs breakout exposure and capital inflow. Although Binance Alpha has so far listed only three Sonic ecosystem projects, two tokens launched in May achieved an average gain of 65.93% (as of May 14), ranking highest among all ecosystems. However, given the small number of listed tokens, this doesn’t necessarily indicate higher potential for Sonic ecosystem tokens.

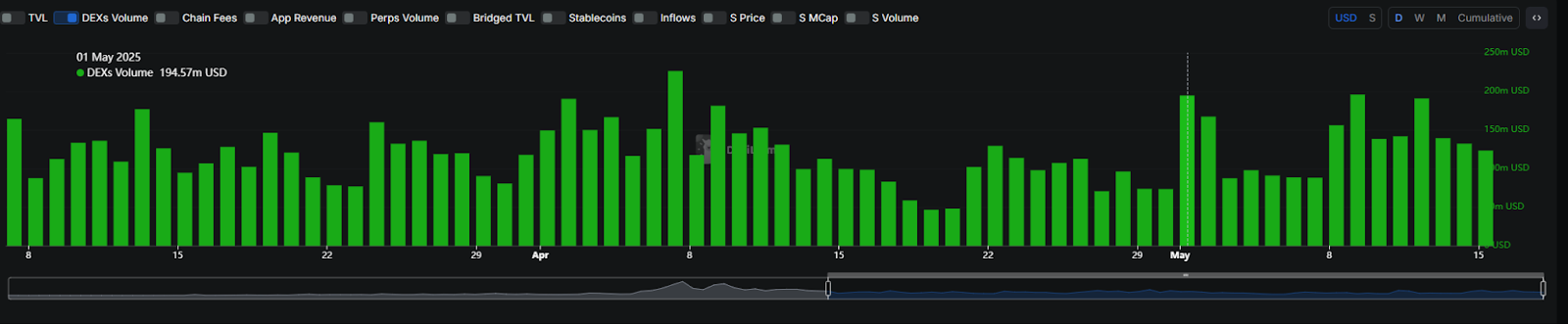

Notably, on May 1—the day Binance Alpha announced two Sonic projects—Sonic’s DEX trading volume surged significantly, jumping from the previous day’s $73.4 million to $194 million.

Project Paradox: Peak at Launch or Value Discovery?

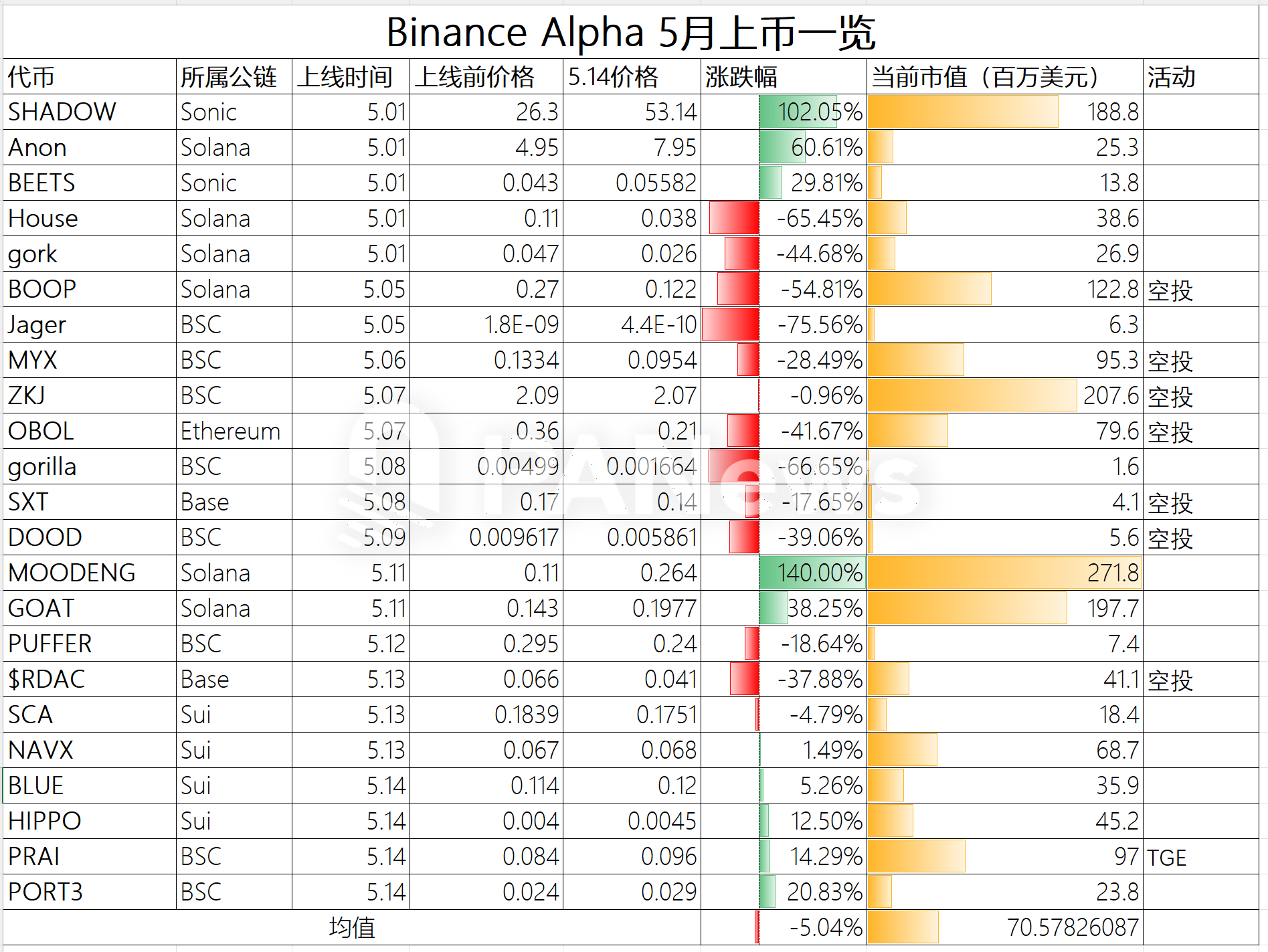

Beyond ecosystem impacts, do projects see their prices skyrocket after listing on Binance Alpha? Data shows that the 23 tokens launched in May posted an average price change of -5.04%, with the worst performer dropping 75%. While these projects all experienced short-term price pumps upon listing, they generally saw significant pullbacks and declines afterward. Therefore, listing on Binance Alpha does not guarantee a "golden dog" breakout—it merely adds another trading venue.

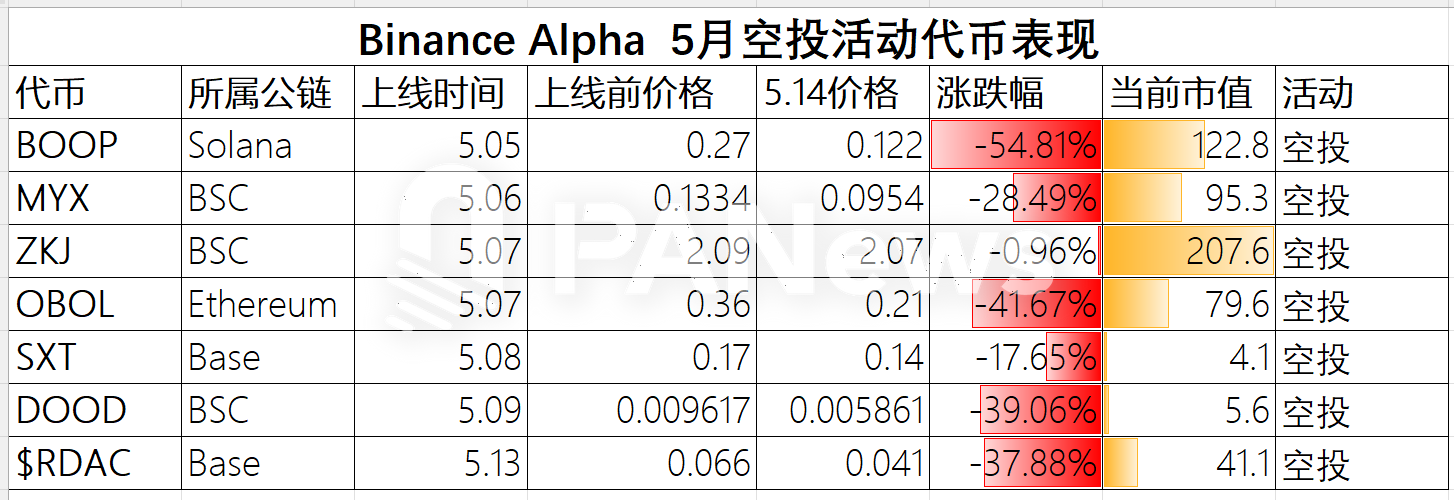

Moreover, even projects launching with airdrops haven’t gained market favor. The seven airdrop projects launched in May averaged a 31.5% decline, all remaining in negative territory as of May 14. This suggests that for projects, airdrops and farming campaigns do not drive sustained price appreciation.

Overall, the average market cap of projects listed on Binance Alpha reached $70 million, with the lowest at around $1.6 million and the highest, MOODENG, reaching $271 million. Notably, newly listed Solana ecosystem tokens averaged over $100 million in market cap, indicating higher expectations for the Solana ecosystem.

The Endgame of Involution: A Battleground for Pros, Exit for Ordinary Users

For ecosystems and projects, Binance Alpha means exposure and traffic concentration. For users, however, intensifying involution is eliminating ordinary participants, turning it into a battleground for professional studios and large holders. With the points threshold reaching 205, users now need to earn at least 15 points daily to keep up. Assuming $1,000 principal earns 2 points, users must additionally generate $8,000 in daily trading volume to meet the requirement. Daily slippage and gas fees for this volume could exceed $10. Failing to meet the next threshold or receiving minimal airdrops results in losses and wasted effort. The latest RDAC token airdrop yielded only about $25 upon sale—hardly covering the cost of achieving 205 points.

Looking ahead, the points threshold is likely to keep rising. Under current rules, higher daily point requirements lead to exponentially increasing trading volume demands. Either Binance Alpha must raise per-address airdrop amounts, or a large number of users will exit the rat race, causing the threshold to fall back to a reasonable level. Either way, this game of involution appears close to its end. DEX trading volume on BSC has already started to decline recently, falling 16.4% from $3.16 billion on May 12 to $2.64 billion on May 15.

In summary, Binance Alpha’s "traffic spillover" effect varies significantly across ecosystems. The Sui ecosystem failed to absorb large-scale farming activity as expected, whereas Solana demonstrated stronger positive interaction and growth. For project teams, the short-term spotlight from Alpha often fails to translate into lasting value support—price peaks at launch followed by declines have become the norm, and airdrops have not served as saviors. Instead, various airdrop-providing projects have effectively become the ones paying for Binance’s wallet promotion.

The deeper issue is that this points-driven frenzy is ruthlessly pushing ordinary users off the playing field. Ever-rising points thresholds, exponentially growing volume demands, and shrinking airdrop returns are transforming Binance Alpha into a zero-sum arena for professional studios and whales. The recent drop in DEX trading volume on BSC suggests that this model, built on intense "involution," is approaching its sustainability limits.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News