Top 10 Cryptocurrency Exchanges of 2025 (So Far): Calm Before the Institutional Storm

TechFlow Selected TechFlow Selected

Top 10 Cryptocurrency Exchanges of 2025 (So Far): Calm Before the Institutional Storm

Behind the scenes, these exchanges are preparing for the next big wave.

Even without retail frenzy or bull market tailwinds, leading cryptocurrency exchanges are thriving through trading volume growth, innovation, and strategic shifts. Below are the top-performing exchanges so far in 2025 and why they're poised to ride the next wave.

Cryptocurrency Exchanges Leading 2025

Crypto market activity during the first half of 2025 has been relatively calm. Despite a brief rally at the beginning of the year, major digital assets continue to trade within ranges, and retail investor enthusiasm has cooled. However, behind the scenes—particularly in regulatory and institutional arenas—momentum is building.

The United States is moving closer to establishing a clear legislative framework for digital assets, a shift expected to unlock new levels of capital inflows and institutional participation. Meanwhile, an increasing number of tech companies and financial institutions are exploring Bitcoin not only as an asset but also as a strategic treasury reserve—a practice championed by Strategic firms.

With many anticipating a rebound in trading volumes during the second half of 2025, centralized exchanges are positioning themselves to become central hubs for the next wave of crypto activity. Here are the top 10 cryptocurrency exchanges so far in 2025, ranked based on a combination of trading volume, user growth, product innovation, global influence, and overall market relevance.

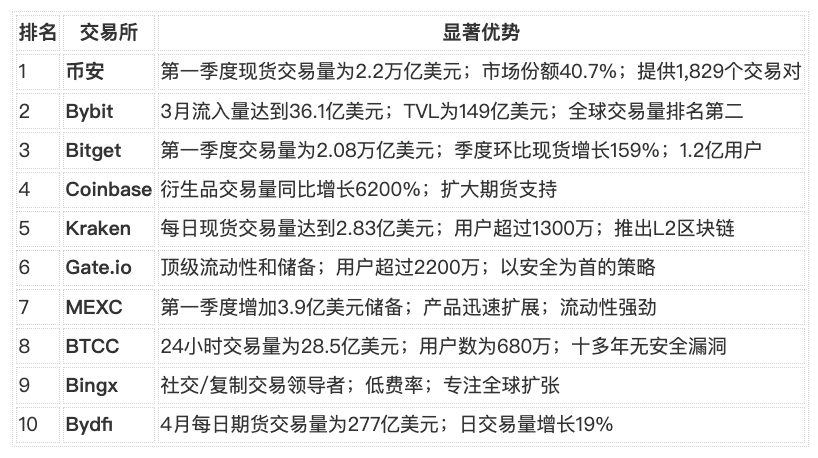

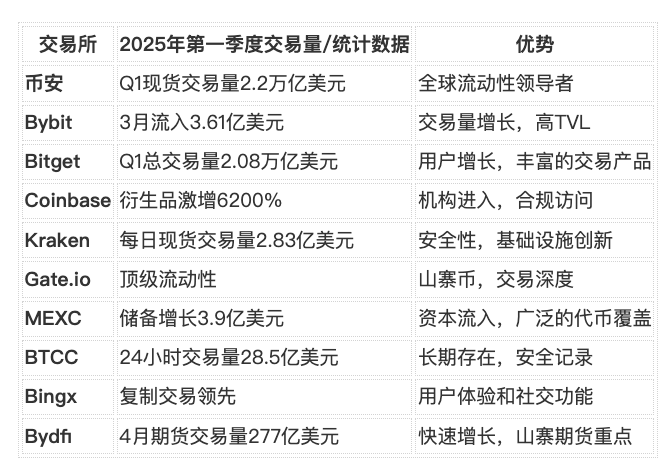

Top 10 Cryptocurrency Exchanges of 2025 (Year-to-Date)

Exchange-by-Exchange Breakdown

Binance — Dominance Through Depth

As market leader, Binance processed $2.2 trillion in spot trading volume during Q1 2025, increasing its market share from 38% to 40.7%. With over 1,800 trading pairs covering decentralized tokens, meme coins, and perpetual contracts, it remains the go-to platform for high-liquidity traders worldwide. Binance is actively collaborating with multiple governments to shape digital asset regulations and establish national Bitcoin reserves.

Bybit — Derivatives Powerhouse With Social Edge

Bybit has reestablished itself as a volume giant, reporting $3.61 billion in inflows and $14.9 billion in TVL in March. Focused on perpetual contracts and advanced derivatives, it became the second-largest exchange globally by trading volume in Q2. Bybit earned praise for its swift and transparent handling of the February 2025 hack, ensuring no customer funds were lost and processing over 350,000 withdrawals without interruption. Its active bounty program has helped recover part of the stolen assets, reinforcing platform trust.

Bitget — Where Social Trading Meets Massive Volume

Emerging as a standout performer this year, Bitget recorded a total trading volume of $2.08 trillion in Q1 2025, with spot market volumes up 159% quarter-over-quarter. The platform attracted nearly 5 million new CEX users in the first quarter, bringing its global user base beyond 120 million. Bitget announced an updated BGB token burn model, completing its first quarterly burn of over 30 million tokens, aiming to enhance scarcity and long-term value.

Coinbase — The Institutional Gateway to America

Coinbase remains the entry point for millions of U.S. users and institutions, boasting over 110 million verified users. Its perpetual futures offerings expanded from 15 to 106 in 2024, recording a 6,200% year-on-year increase in daily derivatives trading volume. With new regulations on the horizon, Coinbase is uniquely positioned to capture inflows from traditional finance.

Kraken — Security and Innovation

One of the longest-standing exchanges, Kraken is regarded by many institutions and advanced users as a trusted name. With over 13 million users and $283 million in daily spot trading volume, it continues to innovate—especially through the launch of its Ink Layer secondary blockchain to support scalable on-chain products. In March, Kraken completed the acquisition of Ninjatrader, reporting a 19% revenue increase.

Gate.io — The Silent Giant With Deep Reserves

Gate.io has quietly amassed 22 million users and over $10 billion in reserves. With a reserve ratio of 128.58%, it ranks among the most solvent exchanges globally. First-quarter contract trading volume grew by 31%, signaling rising engagement. Gate.io is focused on enhancing user experience, boosting liquidity, and strengthening its presence in key markets.

MEXC — At the Forefront of Altcoins

MEXC has been quietly building strength. Between February and April 2025, the platform added $390 million in on-chain deposits, reflecting renewed user confidence and capital inflows. Known for its wide range of asset listings and low fees, MEXC is gaining popularity among altcoin and futures traders. Recently, MEXC launched a $300 million ecosystem growth fund during its 7th anniversary celebration.

BTCC’s longevity speaks volumes. As one of the oldest cryptocurrency exchanges founded in 2011, it offers reliable trading infrastructure, futures contracts, and robust security that have evolved with the market. With a 24-hour trading volume of $2.85 billion in April, its selective KYC process, global accessibility, and extensive experience make it a solid choice for users seeking performance and trust. Its security, European compliance, and stability are widely praised. Recently, BTCC upgraded its VIP program to support high-volume traders worldwide.

Bingx — Scaling Copy Trading and Community

Bingx has carved out a niche in regulated social trading. Its copy trading feature is well-designed, supporting low-fee spot and derivatives trading. Particularly popular in Asia and Latin America, Bingx continues expanding with strong compliance and innovative features. Recently, Bingx launched its global internship program to cultivate the next generation of crypto leaders.

Bydfi — Scalable User Experience

Bydfi (formerly Bityard) is growing rapidly by offering an easy-to-use interface, competitive fees, and a broad altcoin catalog. In April, Bydfi reached $27.7 billion in average daily futures trading volume, with a daily growth rate of 19%. Built for new traders with a low learning curve, it's particularly useful for users in Southeast Asia, India, and Latin America. Bydfi was an official sponsor of the recent TOKEN2049 Dubai event.

Exchange Snapshot Summary (May 2025)

Outlook for H2 2025

-

Regulatory breakthroughs in the U.S., EU, and APAC regions could significantly expand compliant trading volume pipelines.

-

Bitcoin-centric treasury strategies may drive corporate demand. Derivatives and perpetual contracts will likely remain dominant as user demand shifts toward leveraged exposure.

-

With new legislation, macro tailwinds, and institutional moves converging, rankings are expected to shift rapidly in Q3.

Final Thoughts

Surface calm masks a louder story told by exchange data. Behind the scenes, these platforms are preparing for the next big wave. Whether driven by regulation, macro trends, or institutional demand, these top ten exchanges are leading the charge.

2025 Cryptocurrency Exchange FAQ

Which exchange has the lowest fees?

Binance, Bitget, and Bingx offer some of the most competitive trading fees in both spot and futures markets, often providing discounts for high-volume traders or native token holders.

Can I trade cryptocurrency without KYC in 2025?

Yes. Depending on your region, platforms like BTCC, MEXC, Bydfi, and Gate.io allow limited trading without full identity verification. However, higher withdrawal limits and premium services typically require verification.

Which cryptocurrency exchange is currently the most secure?

Kraken, Binance, and Coinbase are consistently rated among the most secure exchanges due to their strong regulatory compliance, insurance programs, and multi-layered security protocols. Still, best practices include using two-factor authentication (2FA) and storing long-held crypto in private wallets.

Which cryptocurrency exchange is best for beginners?

Coinbase, Crypto.com, and Bitget are considered beginner-friendly in 2025 due to their simple user interfaces, straightforward fiat on-ramps, and strong customer support.

Which exchange is best for trading altcoins?

MEXC, Gate.io, and Bingx offer some of the largest selections of altcoins, including meme coins, small-cap tokens, and early trading pairs not yet listed on larger platforms like Coinbase or Binance.

Which exchange is best for futures trading?

Bybit, Bitget, and Binance Futures dominate futures trading in 2025, offering deep liquidity, a wide range of perpetual contracts, and advanced risk management tools designed for professional traders.

How important is Proof of Reserves when choosing an exchange?

Since 2022, Proof of Reserves has become a critical trust metric. Exchanges like Gate.io and Kraken regularly publish independent reserve audits, helping users verify full backing of customer funds rather than relying solely on internal claims.

What fees should I watch for when using an exchange?

In addition to trading fees, users should check for hidden costs such as withdrawal fees, deposit fees (especially for fiat), and maker/taker fee structures. Always review the exchange’s fee schedule before funding your account.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News