From Meme Coins to CSGO Skins: Speculation Never Sleeps

TechFlow Selected TechFlow Selected

From Meme Coins to CSGO Skins: Speculation Never Sleeps

Financial freedom is always out of reach, and there's always someone at the top ready to take the fall.

Written by: TechFlow

You might not have played CS:GO, but you surely know someone who made money from it—and recently, perhaps lost some too.

As the Meme coin frenzy gradually fades, speculators who once rode the volatile waves of Meme coins are now turning their attention to CS skins, discussing CS:GO item price charts in various cryptocurrency trading groups. Former "Meme hunters" in the crypto space have transformed into "skin scalpers," with CS:GO skins becoming their new wealth playbook.

CS:GO (Counter-Strike: Global Offensive) was officially released on August 21, 2012. In 2013, weapon cases and cosmetic skins were introduced, along with Steam Market trading, laying the foundation for the CS:GO skin economy. Through free-to-play transitions and multiple updates, the game has enjoyed a thriving skin market spanning over twelve years.

In May 2025, the CS skin market suddenly collapsed. The skin index plummeted 20% within three days, with prices of numerous popular trading items nearly halved, sparking heated discussions among users across platforms. This sense of market collapse is all too familiar to crypto traders—except this time, what's in their hands are "virtual gun skins."

Players who had long enjoyed steady gains from skin appreciation suddenly found themselves unable to "be happy anymore."

Hyped-up markets are fragile. How did these NFT-like skins, which crash as hard as Meme coins, attract their believers—and what will they leave behind?

Making money? Just a side gig

In April 2025, while Meme coin activity remained lukewarm, the CS:GO skin market was booming, capturing the interest of many crypto players.

It all started with the 2013 Arms Deal update, which introduced skins (also known as "items"—essentially graphical overlays that change weapon appearances in CS), obtainable only through random in-game drops.

This ushered in the era of "crates as lottery tickets." To acquire rare skins they couldn't get otherwise, players began trading organically. The rise of skin trading websites further fueled market growth, giving birth to a vast ecosystem—including players, trading platforms, streamers, scalpers, black markets, and data tools.

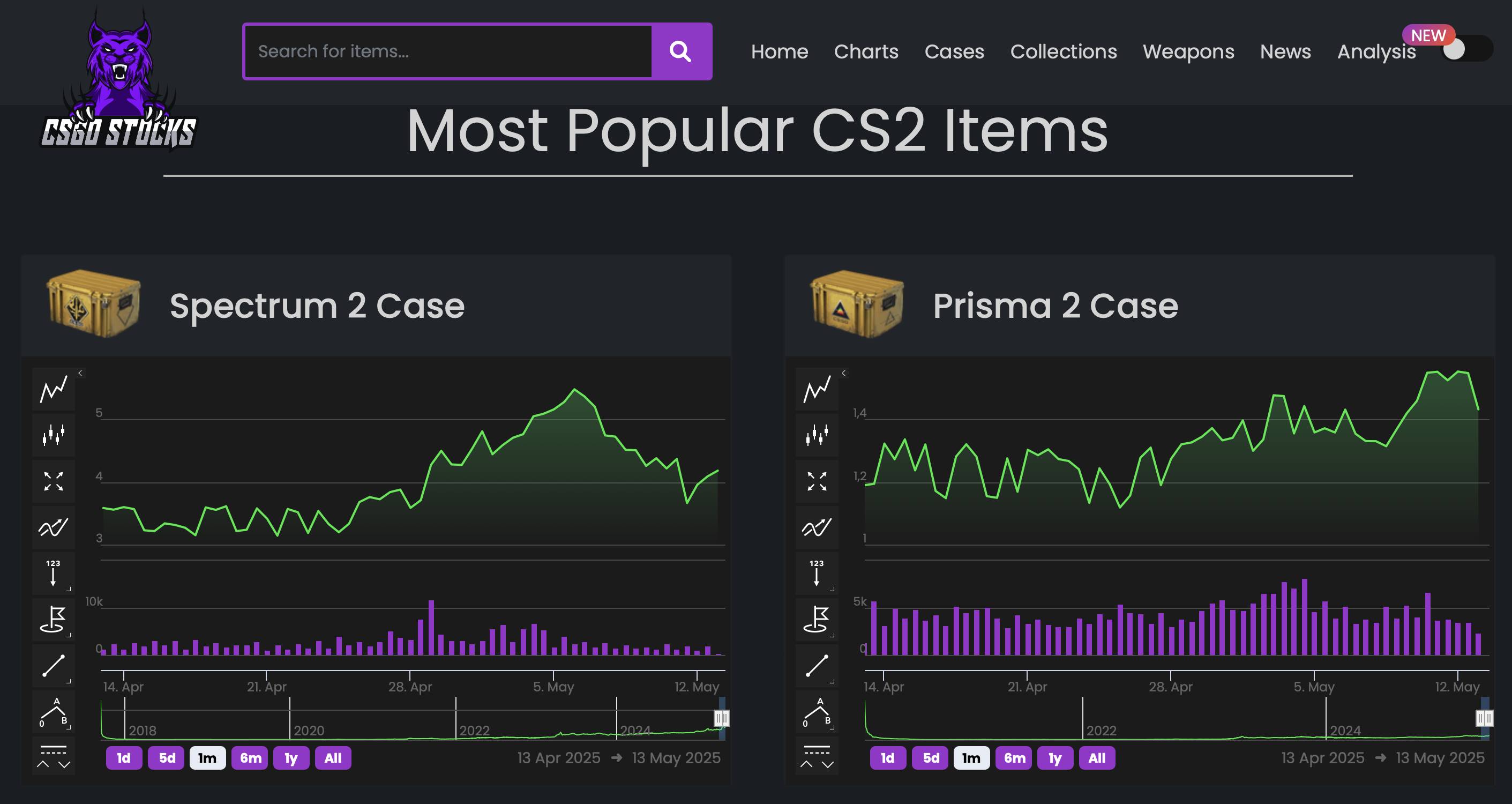

Even historical price K-line charts emerged

Source: CSGO STOCKS

Yet, most people experiencing the ups and downs of the CS:GO skin market initially just wanted to play.

In 2019, Mantou was still in college. At first, gaming was purely for fun. As he put it: "After playing for a while, I wanted to buy some skins"—a completely normal desire for any player.

For CS:GO players, skins are more than just decoration; they function like social currency. High-quality or rare skins signal status within the community and satisfy vanity. This naturally creates demand for skin circulation, spawning an entire market around it.

As Mantou learned more about the market, seeing how much skins appreciated in value—and being a cash-strapped student—he developed the urge to "trade skins."

His first profit wasn't huge—"I made a few hundred yuan at first, felt happy for a few days."

Compared to those solely focused on profiting from skins, for Mantou, buying skins and playing the game go hand-in-hand. He didn't think much about trading strategies—"I'd just buy them when I felt like playing"—but market fluctuations would draw him back to CS:GO. For instance, he returned in April after hearing that "skins are heating up."

In reality, CS:GO and its spawned skin economy truly complement each other.

Famous KOL Huajiao once studied this self-generated market economy out of curiosity. In his view, the lasting wealth effect of the CS:GO skin market is inseparable from the game’s inherent attributes.

"As a shooter, CS:GO's gameplay is extremely simple and hasn't changed much since launch," he said. Combined with Valve's frequent event-driven incentives, the game can quickly bring back veteran players due to nostalgia or other factors.

While effectively attracting and retaining veterans, promotion by esports streamers lowers entry barriers, continuously drawing in new generations—mostly students—who form the market's incremental base.

Vanity drives skin trading, while profit potential hooks both new and old players. "Play-to-earn" perfectly captures the synergy between CS:GO and its skin economy.

Making skin prices soar

The price range in the CS:GO skin market is staggering—from common skins costing a few yuan to rare collectibles worth tens or even hundreds of thousands. Together, they form this unique ecosystem. Much like tiering in crypto—common skins resemble "shitcoins," while top-tier items like Dragon Lore sniper rifles or Butterfly Knives rival NFT blue-chips such as BAYC and CryptoPunks. Their prices keep breaking records due to scarcity and consensus-driven premiums.

At the lower end of the price spectrum are abundant weapon cases and common-quality skins. For example, the Snakebite Case sells for about $0.36 (RMB 2.5), affordable due to easy acquisition and high supply, meeting basic personalization needs for most players.

In the mid-tier range, prices typically span from dozens to hundreds of RMB. These skins usually feature superior designs, moderate rarity, or apply to more popular weapons.

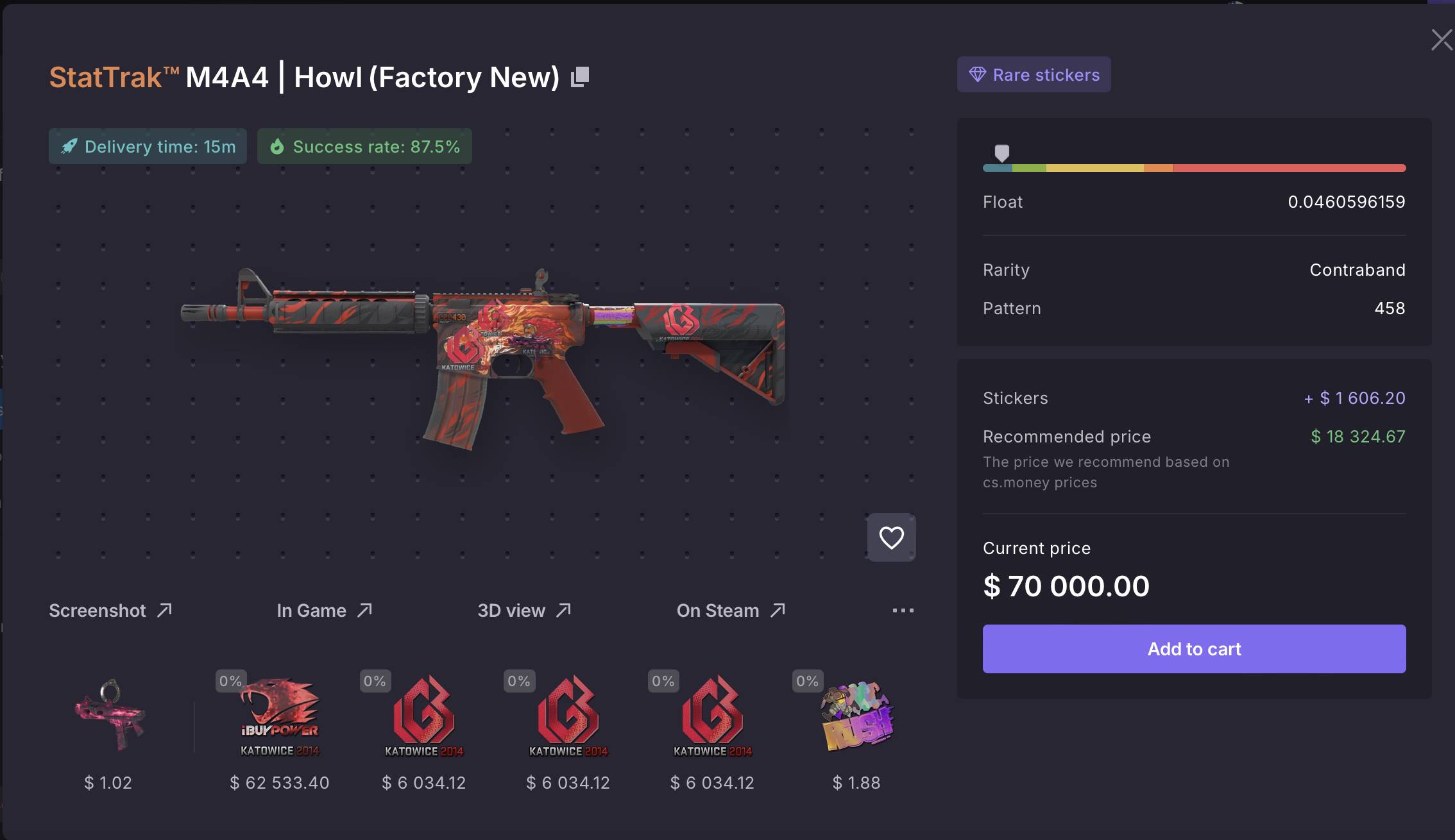

Source: CSMoney

In the high-end market, prices grow exponentially, with items routinely priced in the thousands or even tens of thousands of RMB. These are typically ultra-rare knives, gloves, or legendary-grade firearm skins. A brand-new, kill-count-tracked M4A4 | Howl with rare stickers lists at $18,324 (about 130,000 RMB) on secondary markets.

Source: ShadowPay article

These high-value skins transcend their role as in-game items, functioning instead as collectibles and investment assets.

Overall, skin prices are influenced by aesthetics, wear condition, rarity, design, scalper behavior, student holidays, new drops, streamer effects, and more. Platforms like Steam Market and third-party trading sites also play crucial roles in shaping the CS:GO skin market.

Even when factors seem logically traceable, unpredictable price surges still occur. Such volatility is common to both the CS:GO skin market and the crypto world.

When CS:GO announced its upgrade to CS2 in 2023, many high-end skins and rare stickers rose in price. But just months later, upon CS2’s official release, several skins dropped sharply due to altered visual rendering or adjusted drop rates, leaving many buyers stuck holding depreciated assets. Similarly, the $TRUMP coin surged before Trump took office but crashed instantly afterward, leaving chaos in its wake.

Despite appearing as random and free as Meme coins, skin price movements and trades are ultimately under Valve's control. The entire economic ecosystem built around skins must adapt to the studio’s rules, with Valve maintaining absolute authority.

Huajiao noted, "They (Valve) control all probabilities and the rarity of every skin drop, and even dictate where you can get them." Even in-game appearance of skins can change with updates. "Why did CS2 affect prices so much? Because Valve changed how some skins look in-game—some better, some worse," said Mantou.

CS:GO skins may fly like financial products, but if you look down, the kite string remains firmly in Valve’s hands.

In extreme scenarios, there's always the risk that "Valve could update the game tomorrow and disable free skin trading." As Mantou put it: "You can't predict policy changes from Valve. NFTs are easier to handle in that regard."

Crypto stories, replayed in the skin market

The investment nature and price dynamics of skins have led many in the crypto space to exclaim: "This is basically NFTs!"

That's no exaggeration. The unintentional realization of "play-to-earn" aligns closely with the core principle of GameFi—earning while playing.

Although CS:GO skins can be used in-game—setting them apart from NFTs in functionality—Mantou admitted, "Some expensive ones really are beautiful," though in truth, functionality plays only a minor role.

"Skins don’t do anything—not even +3 attack power." For the broad youth demographic, skins fulfill complex psychological and social needs. They represent aesthetic desires, face culture, and identity symbols—mirroring the roles NFTs play in certain communities.

Professional skin trading sites like Jbskins.com describe a max-stickered golden decal from the 2022 Antwerp Championship as "not just a simple sticker, but a symbol of status," adding, "It won’t improve your skill, but it will definitely enhance your gaming experience and your face."

Beyond social symbolism, both skins and NFTs share similarities in price drivers.

Huajiao pointed out that specific CS:GO skin prices often rise due to celebrity effects from streamers or pro players using them, similar to how NFTs rely on influencer endorsements for value.

Celebrity purchases can boost NFT floor prices, causing values to surge tenfold or even thousandfold in short periods. Yet, once market sentiment shifts, liquidity tightens, or negative news emerges, NFT prices can crash dramatically, devastating late buyers.

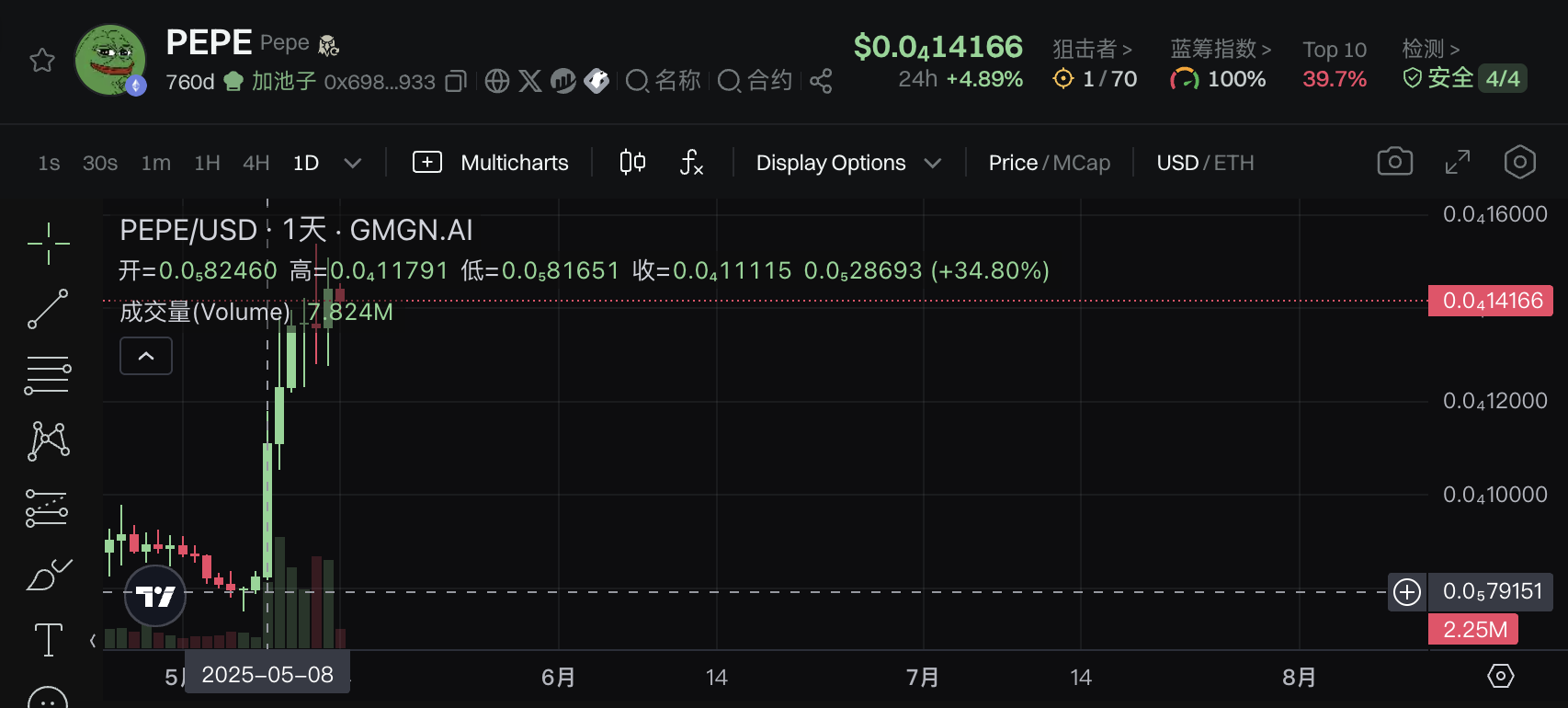

More coincidentally, right after the CS skin market collapse, crypto and Meme coin markets quietly warmed up again. Ethereum, long dormant, saw a 7-day gain nearing 40%, breaking above $2,500, with older tokens like $PEPE, $PNUT, and $moodeng rebounding one after another. Some speculate capital is rotating across virtual assets, creating an alternative "vampire effect." While unprovable, this curious capital flow has become casual chatter in crypto circles.

Risk and opportunity always coexist. Before May, CS:GO players enjoyed a period of stable happiness—until this unprecedented price plunge hit.

Mantou previously earned 50,000 RMB from skin appreciation, but overnight, it vanished—and turned into a 70,000 RMB loss. Regarding this crash, he remained calm, saying his experience in crypto helped. Compared to previous slow, low-volume "death by a thousand cuts," this sharp drop with relatively healthy volume might actually be positive—if the market attracts renewed attention and slowly recovers.

After all, from Meme coins to CS:GO skins, cyber speculation never ends. Markets, emotions, greed, and fear continue their endless cycle across different arenas.

The only constant? Financial freedom remains elusive, and someone always gets left holding the bag at the top.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News