Binance Alpha: New Growth Strategies in the Latest War for Attention, Liquidity, and User Traffic

TechFlow Selected TechFlow Selected

Binance Alpha: New Growth Strategies in the Latest War for Attention, Liquidity, and User Traffic

Binance Alpha has provided numerous community-driven, meme-based, and small-to-medium-sized crypto projects with a pathway to reach a broader investor base and strive for listing on Binance.

Author: Black Mario

Actually, in previous rounds of competition, Binance's moves were somewhat slow. For example, during the inscriptions period, OKX Wallet took an early lead (Binance Wallet only launched its inscriptions market in April 2024, and within months, inscriptions cooled down). During the last Meme season and AI season, Solana’s ecosystem clearly became the hub of liquidity and momentum—platforms like PumpFun continuously turned into massive pumps—while BNB Chain, backed by the giant Binance, remained lukewarm, lacking standout tokens or notable trading markets.

On another front, the rise of on-chain derivatives markets is also impacting Binance, with platforms such as HyperliquidX attracting a wave of users and capital onto-chain. Thus, under multiple pressures, Binance has been in a tough spot. The launch of Binance Alpha in December last year clearly reflects its strategic intent:

Hence, I believe its strategic significance can be summarized into several points:

1) Activate transaction activity and liquidity among the platform's vast user base

Binance CEX itself doesn’t lack users (250 million registered) or funds, but it lacks the catalyst to fully activate user trading activity and capital liquidity—especially in driving these token-holding users into its own on-chain ecosystem. Therefore, Alpha 2.0 introduced a points mechanism, using events such as TGEs, Alpha airdrops, and IDOs as catalysts, aiming to encourage more token holders to participate in trading within the Alpha zone, particularly boosting liquidity in the Alpha zone.

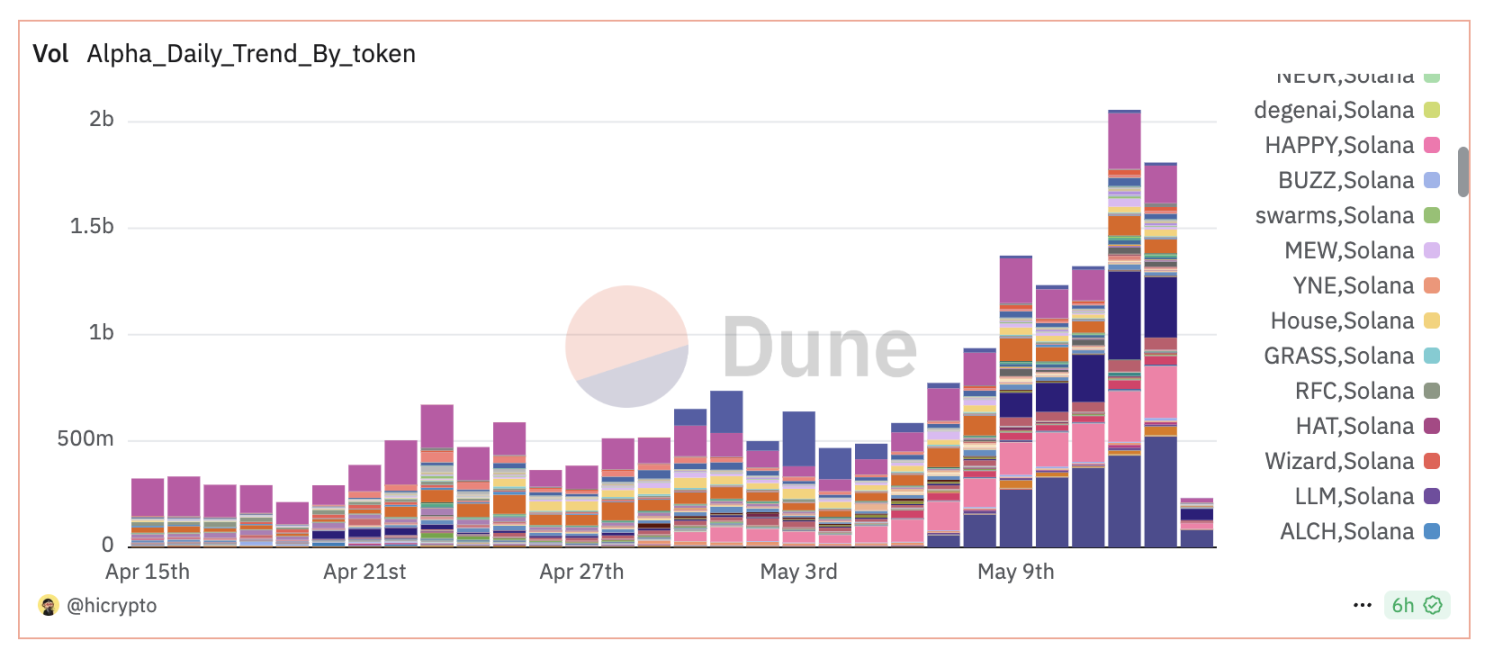

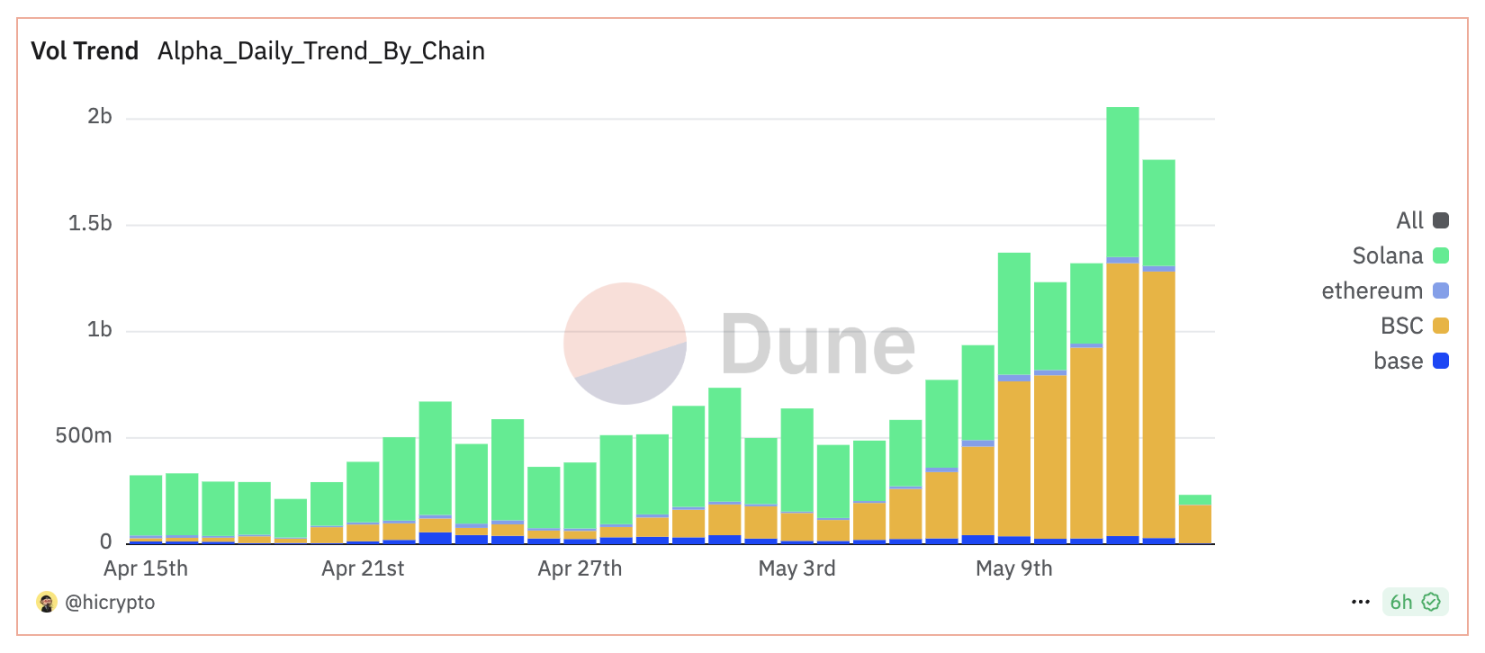

We’ve seen that after version 2.0, especially following the introduction of the points system, the trading impact on the Binance Alpha section has been extremely evident. Since the first TGE event on the 25th requiring a points threshold, trading volume has surged dramatically—the more intense the competition, the better the trading volume performance.

2) Drive traffic to BNB Chain, revitalize the ecosystem, and support more native projects

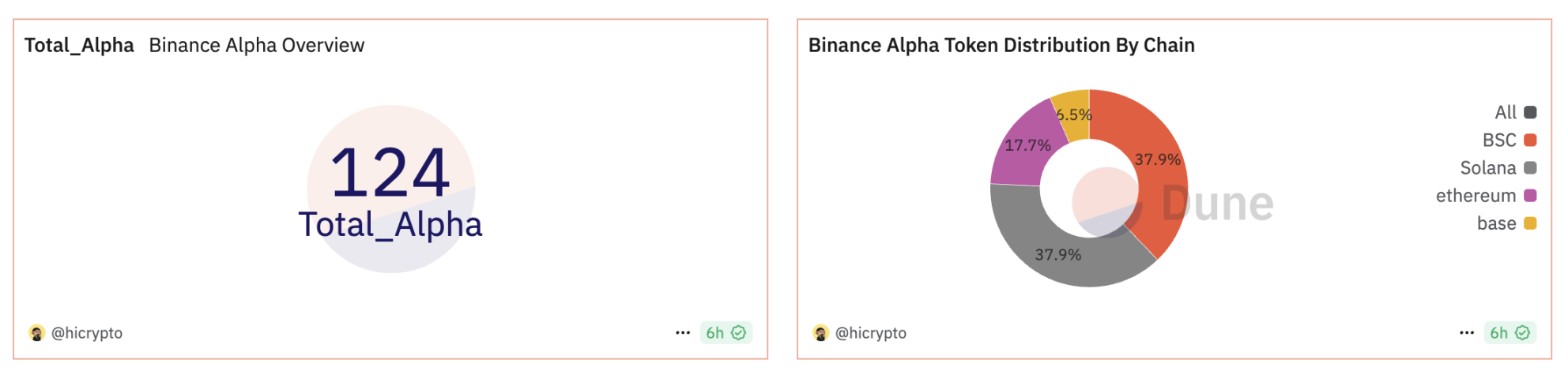

The goal of Binance Alpha to drive traffic, revitalize the ecosystem, and support more native projects on BNB Chain is quite clear. Even during the initial 1.0 phase, it was evident that a high proportion of tokens listed on Alpha were from BNB Chain. Currently, among the 124 projects listed on Alpha, over 70% are BNB Chain-based tokens, with 38% being native BNB Chain projects in popular sectors such as AI, Meme, and DeFi.

Leading in trading volume: BSC tokens account for approximately 40% of Alpha’s total trading volume, with weekly trading volume surging by 122.5% and weekly turnover increasing by 78%, highlighting strong ecosystem momentum.

In addition, many policies favor BNB Chain—for instance, the double-points policy launched on May 1st directly encourages users to trade on BNB Chain, aiming to further bring liquidity and users to BNB Chain. Looking at data from lookonchain on May 9th:

Moreover, the growth in on-chain Alpha asset trading data on BNB Chain also illustrates this trend.

3) Capture user traffic, liquidity, and attention from other chains

Alpha also aims to capture user traffic, liquidity, and attention from other chains—particularly its "longtime rival" Solana. A significant portion of tokens listed on Alpha are from the Solana chain, including popular Solana tokens such as ai16z. Besides Solana, Ethereum and Base also host many high-quality assets in sectors like Meme and AI, so the Alpha platform is well-positioned to attract active users, attention, and liquidity from other chains—especially in the current environment where overall market narratives are weak and FOMO opportunities scarce.

4) Bring in new users

The Alpha points farming mechanism has also brought in many new users. On one hand, the rules and thresholds for farming points aren’t overly complex or costly, unlike Layer 2-era on-chain volume farming which was difficult and expensive. Many farming users bring along friends and family, providing a key entry point for new users to access the Binance platform and become crypto investors. Although there’s no definitive data yet on how much trading volume this has generated, clues can already be found in the number of newly registered addresses on BNB Chain.

5) Redefine the listing mechanism

Another point relates to reshaping Binance’s token listing mechanism. After the highly publicized controversy around Binance listings (the so-called "girlfriend group" manipulating the listing process), the CEO personally stepped in to debunk rumors and pledged to enhance transparency and fairness in listings. In this context, Alpha now serves as a positive example, offering community-driven, Meme-type, and mid-to-small-sized crypto projects a pathway to reach broader investors and qualify for Binance listings.

Of course, after Alpha 2.0 integrated the Alpha zone into the app, trading Alpha-zone tokens has become even more convenient. I even think that from the user’s perspective, the difference between being listed on the main site and on Alpha is no longer that significant. As such, the previous Alpha zone performed quite well, bringing substantial exposure to projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News