Binance Alpha Points "Battle Royale": A Web3 Wallet War Where One Player Ate 90% of the Market Share

TechFlow Selected TechFlow Selected

Binance Alpha Points "Battle Royale": A Web3 Wallet War Where One Player Ate 90% of the Market Share

Binance Web3 wallet's market share surged dramatically, capturing 90% of the market.

By: Frank, PANews

Recently, Binance Web3 Wallet has made waves in the Web3 wallet market with its innovative "Alpha" model, rapidly capturing market share to dominate 90% of the sector. This phenomenon stems from its clever points-based airdrop mechanism, strategic shifts by competitors, and the resulting ripple effects and notable recovery within the BNB Chain ecosystem.

How did Binance Alpha skillfully leverage market gaps and user psychology to achieve such rapid expansion? Beneath the surface of this gold rush, what is the real pressure of intensifying competition ("neijuan") users face, and what are their actual returns? Is this merely a fleeting traffic frenzy, or a groundbreaking innovation capable of reshaping the industry?

Exploiting Competitor Gaps and Points Mechanism to Dominate the Wallet Market

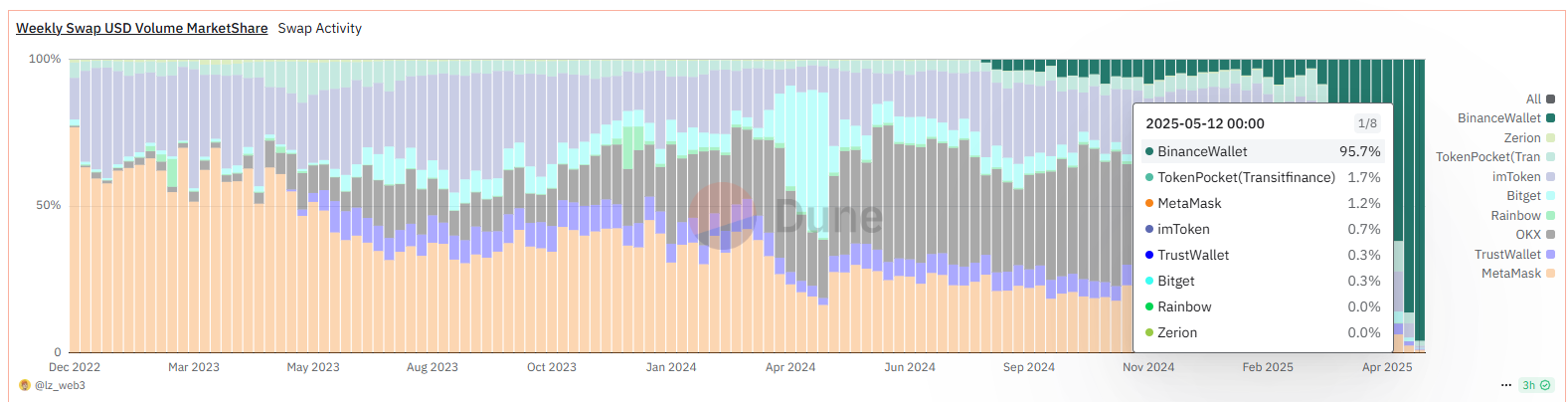

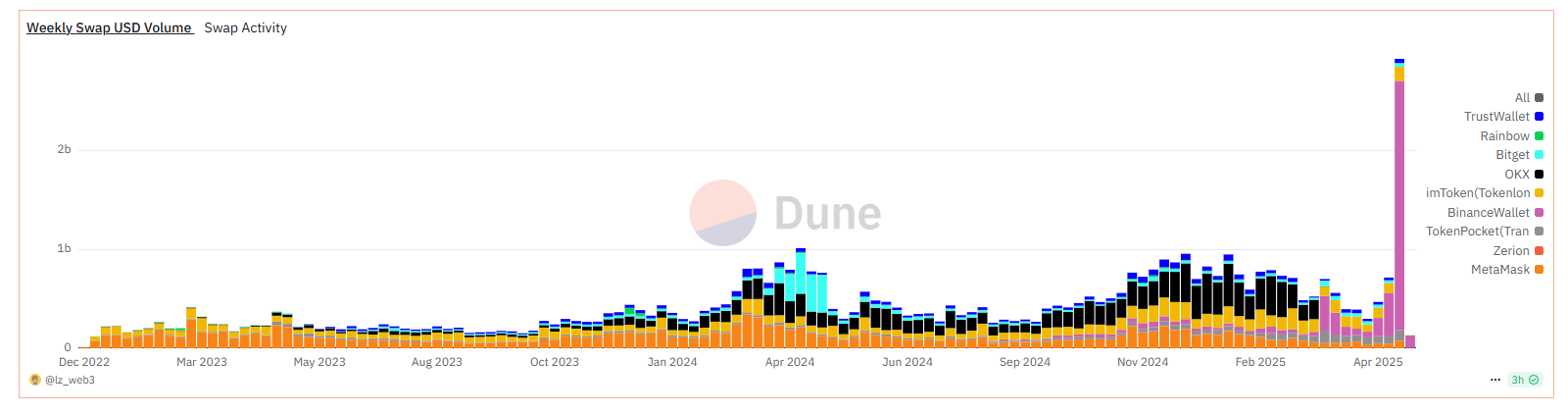

Since its launch, Binance Web3 Wallet's market share has grown explosively. According to Dune data, by May 12, 2025, Binance Web3 Wallet accounted for 95.7% of total transaction volume across all tracked Web3 wallets, ranking first—up significantly from 54.1% in March 2025. On May 10, 2025, Binance Wallet reached a daily peak transaction volume exceeding $930 million, compared to just $76 million on April 22.

The Alpha initiative has also boosted activity in the BNB Chain ecosystem. BNB Chain’s TVL increased by over $6 billion from early 2024 to May 2025—a rise closely tied to Binance Alpha. Official data shows that half of the top 20 Alpha tokens by trading volume are native BSC projects. Among the top 10 Alpha tokens by new active users, 90% are BSC tokens, with six projects seeing over 20% of new users. On-chain BSC metrics have surged as well: approximately 4.3 million new users were added in the past week, daily new addresses exceeded 1 million for two consecutive days, and active addresses surpassed 2 million. The total number of unique BSC addresses has reached 552 million. These figures indicate that Binance Alpha is becoming a key driver of activity and capital inflow on BNB Chain.

Notably, the sharp rise in Binance Web3 Wallet's market share coincides closely with OKX’s suspension of its DEX aggregator service. On March 17 this year, OKX announced it would pause trading services on its DEX product aggregator, after which OKX Wallet’s market share plummeted from around 50% to 3.6%. Almost simultaneously, on March 18, Binance announced the release of the Binance Alpha 2.0 test version, integrating Alpha trading directly into the Binance exchange.

Data clearly reflects this shift: during the week from March 10 to March 17, Binance Wallet held only 8.3% of transaction volume market share; by March 24, that figure had risen to 50.2%, making it the leading wallet application by market share.

On April 17, BinanceAlpha announced the upcoming launch of the GM token and initiation of an airdrop program. Search interest for BinanceAlpha began rising sharply, accompanied by a significant increase in trading volume. From April 17 to April 24, transaction volume reached $184 million—more than triple the previous week’s $57.94 million. As the points-based gameplay gained traction on social media, weekly transaction volume hit $1.574 billion by the week ending May 5, a 27-fold increase from before the airdrop launch. This surge pushed total wallet transaction volume across the chain to a record-breaking $1.876 billion.

The "Sweetness" and "Burden" for Alpha Users

This explosive growth originates fundamentally from Binance Alpha’s points-based airdrop mechanics. The Binance Alpha points system is a complex mechanism designed by Binance to incentivize participation, identify active users, and allocate airdrops or TGE eligibility. It primarily allocates points based on user metrics such as trading volume and balance within Binance Alpha, then sets point thresholds for each airdrop event to determine participant eligibility.

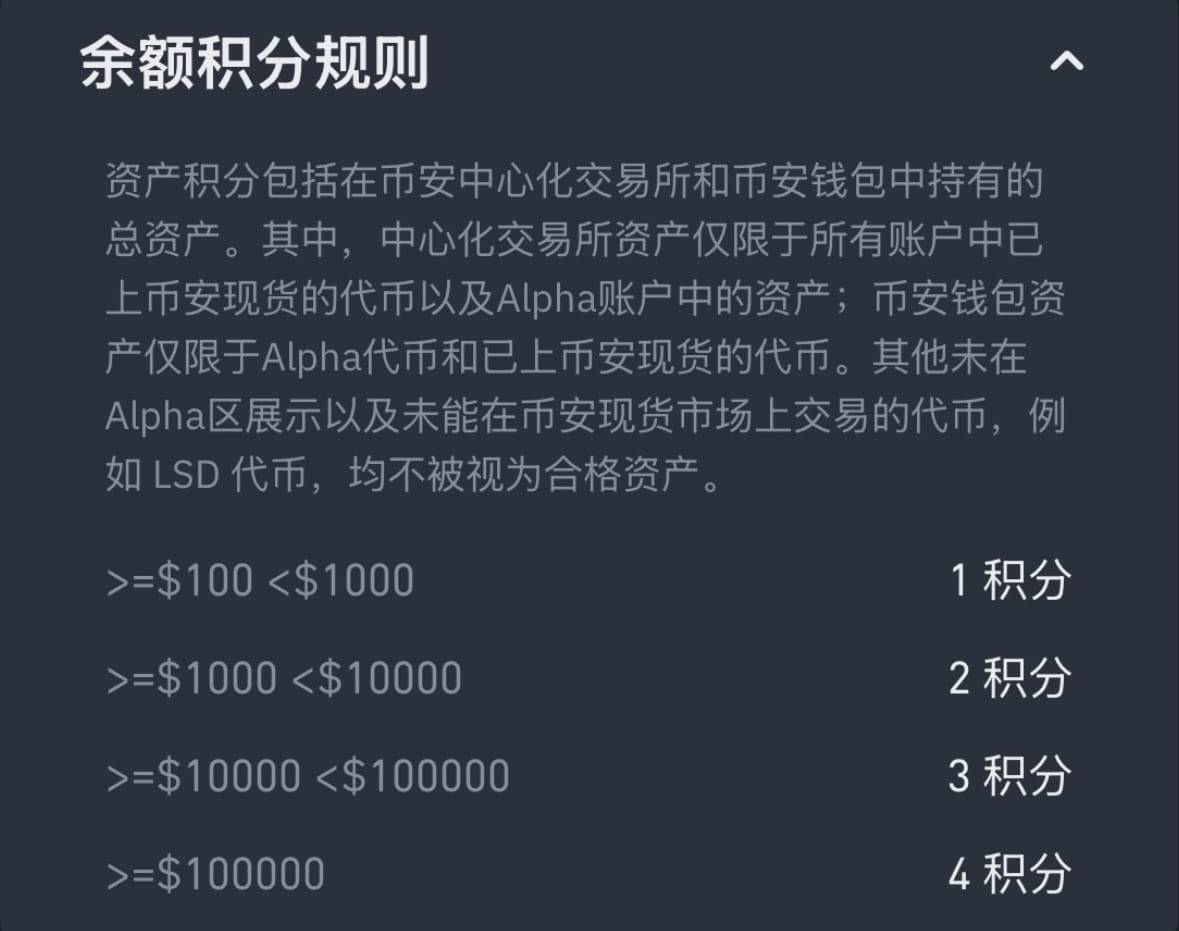

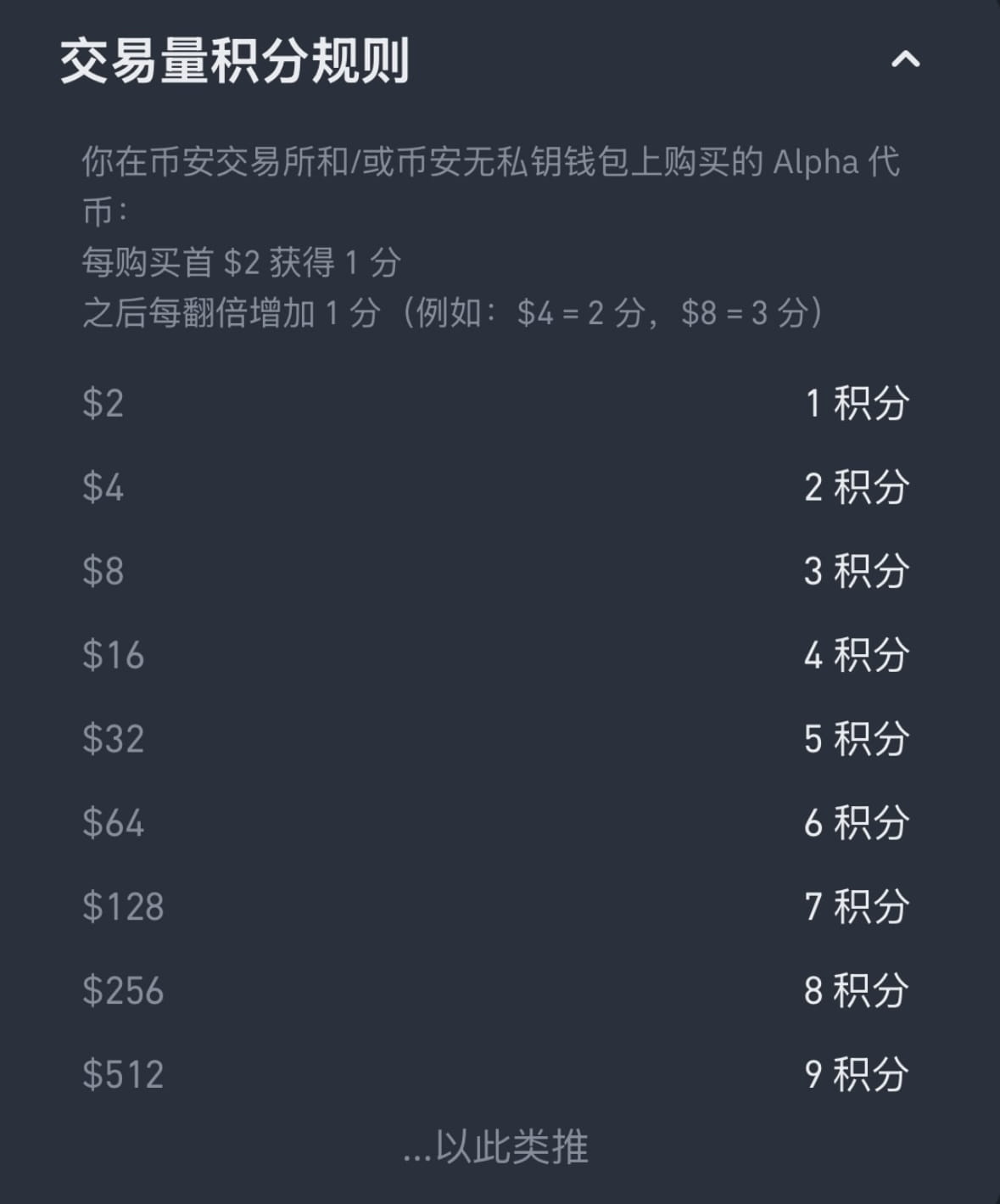

However, as user numbers surge, this points system is turning into a fierce arena of intensified competition ("neijuan"). The system hinges on two main evaluation metrics: asset balance and daily trading volume.

Asset balances are divided into four tiers: $100 ≤ total assets < $1,000: 1 point per day; $1,000 ≤ total assets < $10,000: 2 points per day; $10,000 ≤ total assets < $100,000: 3 points per day; $100,000 and above: 4 points per day.

For trading volume: buying $2 worth of tokens earns 1 point; $4 earns 2 points; $8 earns 3 points; $16 earns 4 points; $32 earns 5 points. For every doubling of transaction value beyond that, an additional 1 point is awarded (e.g., $64 earns 6 points, $128 earns 7 points, etc.). Generally, trading $32 daily to earn 5 points is considered a relatively cost-effective strategy.

Moreover, these points are calculated on a rolling 15-day basis, meaning users cannot rest on past achievements but must continuously farm points to maintain their standing.

This points system offers several clear attractions to users. First, the rules are transparent, allowing users to accurately predict how many points they can accumulate and whether they can meet airdrop thresholds. Second, there is little first-mover advantage—latecomers can still catch up and achieve similar point levels as early participants.

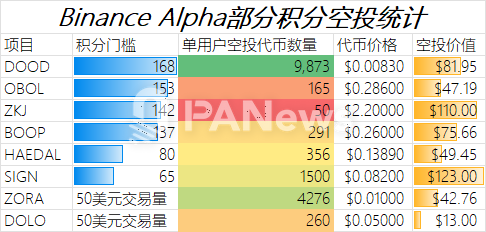

Yet, as competition intensifies, the required point thresholds keep rising. From initial requirements like $50 in trading volume or $100 in asset balance, newer projects like DOOD now require 168 points. Based on this standard, a new user must maintain a daily average of over 11.2 points to qualify for the airdrop. Calculations suggest users need at least $1,000 in holdings and over $1,024 in daily trading volume to accumulate enough points. Factoring in blockchain fees and slippage costs, total expenses could exceed $60. Compared to the final airdrop value of $81, this yields roughly a 35% return. However, considering the opportunity cost of the $1,000 principal, the 15-day return rate is only about 2%. While this may underperform a single successful token trade, the relative stability makes it attractive to many farming studios, who often deploy multiple accounts at scale.

Traffic Frenzy or Paradigm Shift?

In reality, is Binance Alpha truly a novel form of large-scale airdrop?

The DOOD airdrop announcement revealed the eligibility criteria: 30,271 accounts qualified. With each account receiving approximately $81, the total airdrop amounted to roughly $2.48 million. Other token airdrops have not disclosed specific address counts, so exact figures are unavailable, but estimated scales appear similar. In terms of project airdrops, a few million dollars isn't particularly high—especially when compared to hundreds-of-millions-or-even-billions dollar airdrops like Hyperliquid or Movement—even falling short of the allocation given to a single major holder.

Yet, judging by promotional impact and the transaction data generated for the ecosystem, Binance Alpha’s return on investment is undeniably impressive. At its core, this mechanism resembles the once-popular "transaction mining" trend from years ago. Given Binance’s visible success, other exchanges are now launching similar initiatives.

On May 7, Bybit announced its WEB3 Points Program, where users can earn WEB3 points by holding crypto assets, conducting trades, inviting friends, and completing other tasks.

On May 5, OKX Exchange announced a major upgrade to the DEX aggregator built into its self-custody wallet, OKX Wallet. New features include on-chain market analytics, smart fund tracking, and Meme mode. As of May 11, OKX Wallet’s market share had rebounded to 8.5%.

Amid this competitive scramble for wallet market dominance, some traditional wallet applications have become unintended casualties. In June 2023, MetaMask commanded over 60% of transaction volume market share. By May 2025, that share had dwindled to just 2.9%. Binance-affiliated Trust Wallet faces a similar predicament.

Overall, Binance Alpha has ignited a new wave of farming enthusiasm through its points system—akin to early exchange liquidity mining—using potential incentives to stimulate trading activity. On one hand, it serves as an effective tool for Binance Wallet, BSC, and related ecosystem products to gain market share and boost user engagement. Through carefully designed points and airdrop mechanisms, it has successfully attracted massive user traffic and capital, even cannibalizing competitor market share. The revival of BNB Chain is clearly correlated with the momentum from Alpha, creating what might be called an “Alpha-BNB Chain flywheel effect.”

On the other hand, the 15-day rolling points window, point decay mechanisms, and ever-rising airdrop thresholds force users into a treadmill-like cycle of sustained high-intensity trading. Their net gains are often difficult to calculate precisely and come with hidden costs such as slippage and gas fees. For many ordinary users, the “gold rush” may gradually morph into a “sweatshop.” This intensifying competition could spread not only among users but also among exchanges. If the cost-to-reward ratio of such airdrops falls below profitability, today’s bustling scene could cool down rapidly.

Nonetheless, from an industry perspective, Binance Alpha’s design offers valuable lessons—especially for projects planning future airdrops. Binance Alpha stands as a classic example of achieving big results with minimal spending.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News