Hardware Wallet Mass Hunt: Beyond the Blind Spot, A Complete Security Guide from Purchase to Activation

TechFlow Selected TechFlow Selected

Hardware Wallet Mass Hunt: Beyond the Blind Spot, A Complete Security Guide from Purchase to Activation

A mature "hunting chain" has quietly taken shape, and manufacturers' verification mechanisms along with users' security awareness urgently need to be closed-loop.

Author: Web3 Farmer Frank

Imagine you're a patient holder who has endured a long bear market, finally withdrawing your hard-earned BTC from a CEX into a newly purchased hardware wallet, feeling the peace of mind that comes with full control over your assets.

Two hours later, you open the app—your wallet is empty.

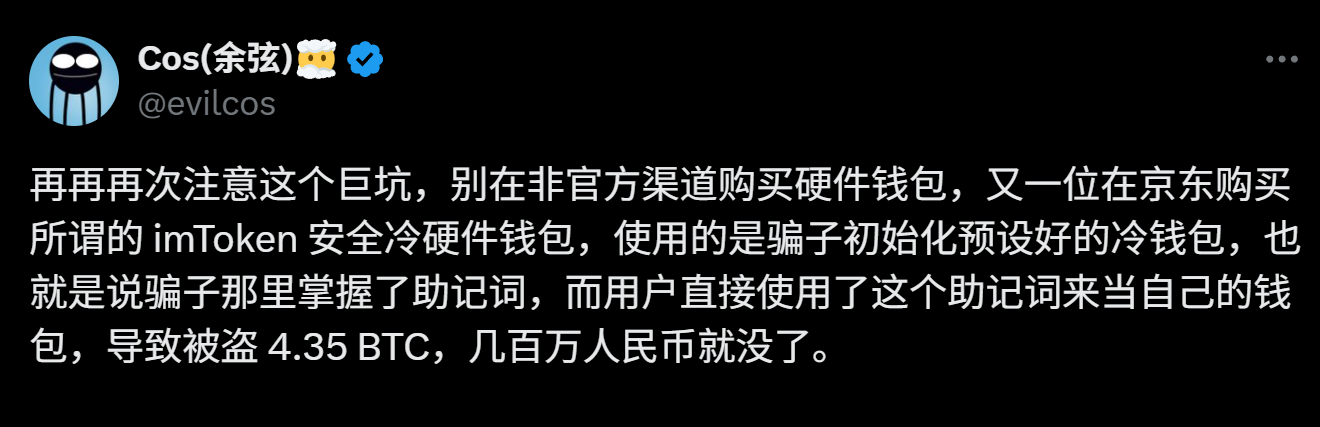

This isn't hypothetical. It's a real incident that just occurred: an investor bought a hardware wallet on JD.com and deposited 4.35 BTC into it, unaware that the device had already been pre-initialized by scammers, complete with generated recovery phrases and fake instructions guiding users through a trap setup process to link the device to a mobile app.

In other words, the moment the user activated the wallet, it already belonged to hackers.

Unfortunately, this is not an isolated case. Recently, multiple incidents have emerged where investors purchasing hardware wallets on e-commerce platforms such as Douyin, JD.com, and Amazon ended up being defrauded or even completely drained of their assets. Upon close examination of these recent security breaches, a mature "hunting chain" targeting the hardware wallet sales process is quietly taking shape.

1. The Gray "Secondhand" Chain Preying on Beginners

Hardware wallets are devices designed to generate private keys in a fully offline environment. In theory, as long as the recovery phrase is properly backed up, their daily usage offers near-top-tier security—this is the standard safety message most Web3 users receive.

However, real-world risks often don't lie in the device itself, but in the purchase and activation stages.

Due to long-term promotion, many investors easily adopt a simplistic belief: "hardware wallet = absolute security." This psychological bias causes many to overlook several critical prerequisites upon receiving the device:

Is the packaging intact? Are the seals tampered with? Must the recovery phrase be self-generated? Is the activation status confirmed as "first use"? As a result, many users rush to transfer assets into their new hardware wallet immediately upon receipt, unknowingly falling into scammers' traps.

Whether it's the earlier case of losing 50 million worth of crypto assets after purchasing a hardware wallet on Douyin, or the recent incident of BTC being wiped out after buying an imKey on JD.com, all issues trace back to the purchase and activation phases.

A mature gray industry chain around hardware wallet sales has now surfaced on domestic e-commerce platforms.

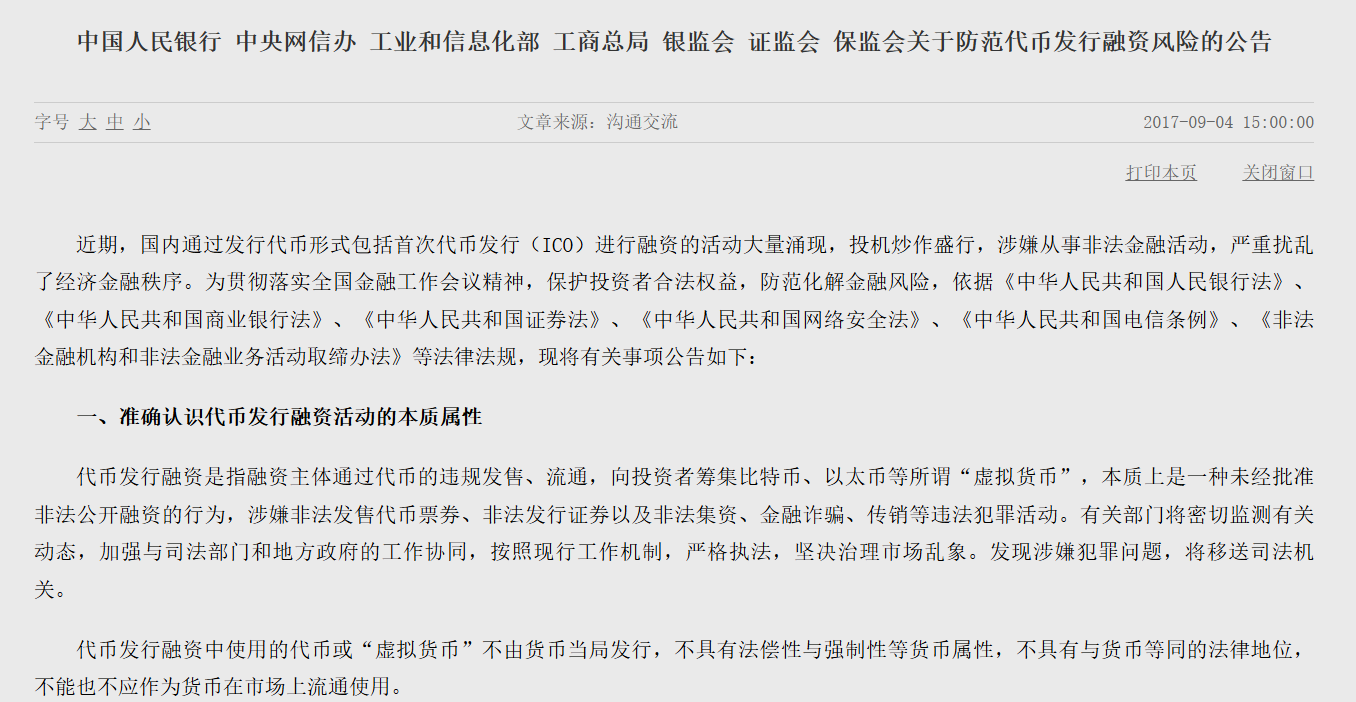

Theoretically, China has maintained strict controls over cryptocurrency for years. As early as 2014, e-commerce platforms banned direct sales of crypto-related items. Furthermore, the September 4, 2017 joint announcement by the People's Bank of China and six other ministries, "On Preventing Risks of Token Issuance Financing," explicitly prohibited domestic platforms from offering services involving cryptocurrency trading, exchange, pricing, or brokerage.

On the surface, terms like "brokerage and other services" are broad enough that hardware wallets—the tools used to store private keys—fall into a gray zone and should technically be banned. Consequently, platforms like Taobao, JD.com, and Pinduoduo have long blocked keyword searches related to cryptocurrency.

In reality, however, things are quite different.

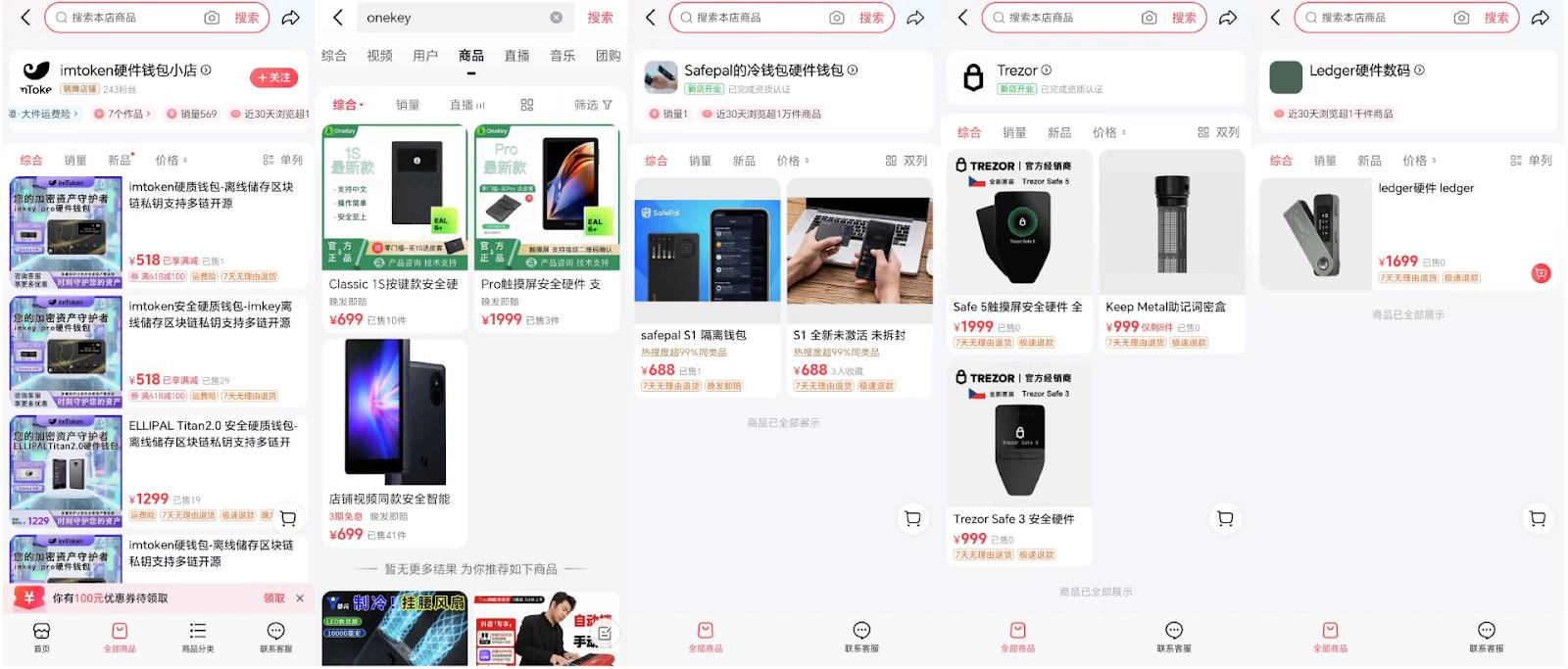

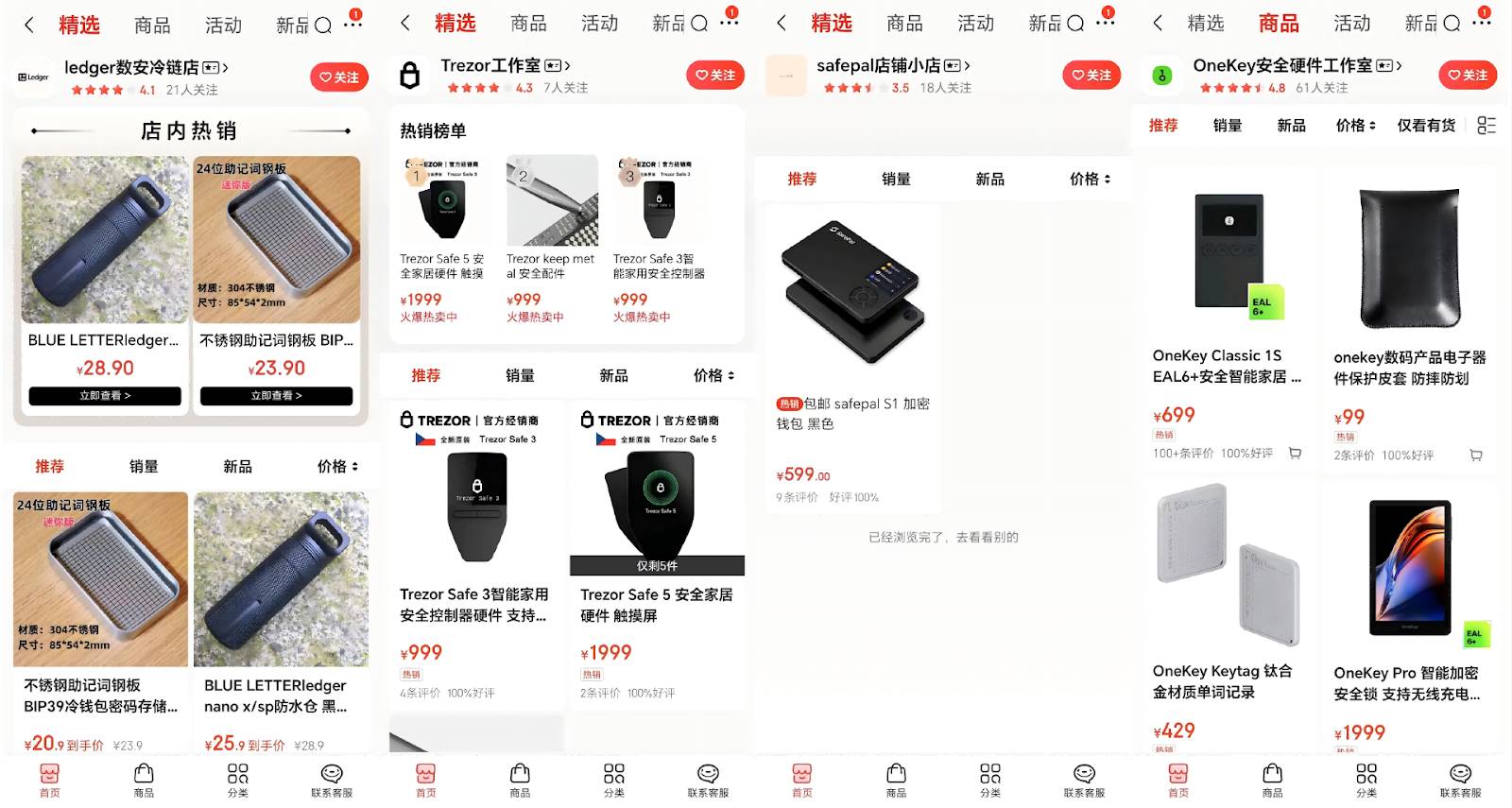

As of July 29, the author conducted direct keyword searches for five hardware wallet products—Ledger, Trezor, SafePal, OneKey, and imKey (imToken)—on Taobao, JD.com, Pinduoduo, and Douyin. The results showed surprisingly smooth buying channels.

Douyin had the most comprehensive offerings, with stores selling Ledger, Trezor, SafePal, OneKey, and imKey.

JD.com followed closely, listing hardware wallets for Ledger, Trezor, SafePal, and OneKey. Stores selling imKey appear to have been taken down following recent security incidents.

Taobao was relatively stricter, showing only one store selling imKey. While Xiaohongshu lacks direct shop search functionality, secondhand private sales and proxy purchase posts are everywhere.

Undoubtedly, apart from a few rare authorized agents, the vast majority of these stores are small retailers operating through unofficial channels—neither officially authorized nor able to guarantee the security of the device supply chain.

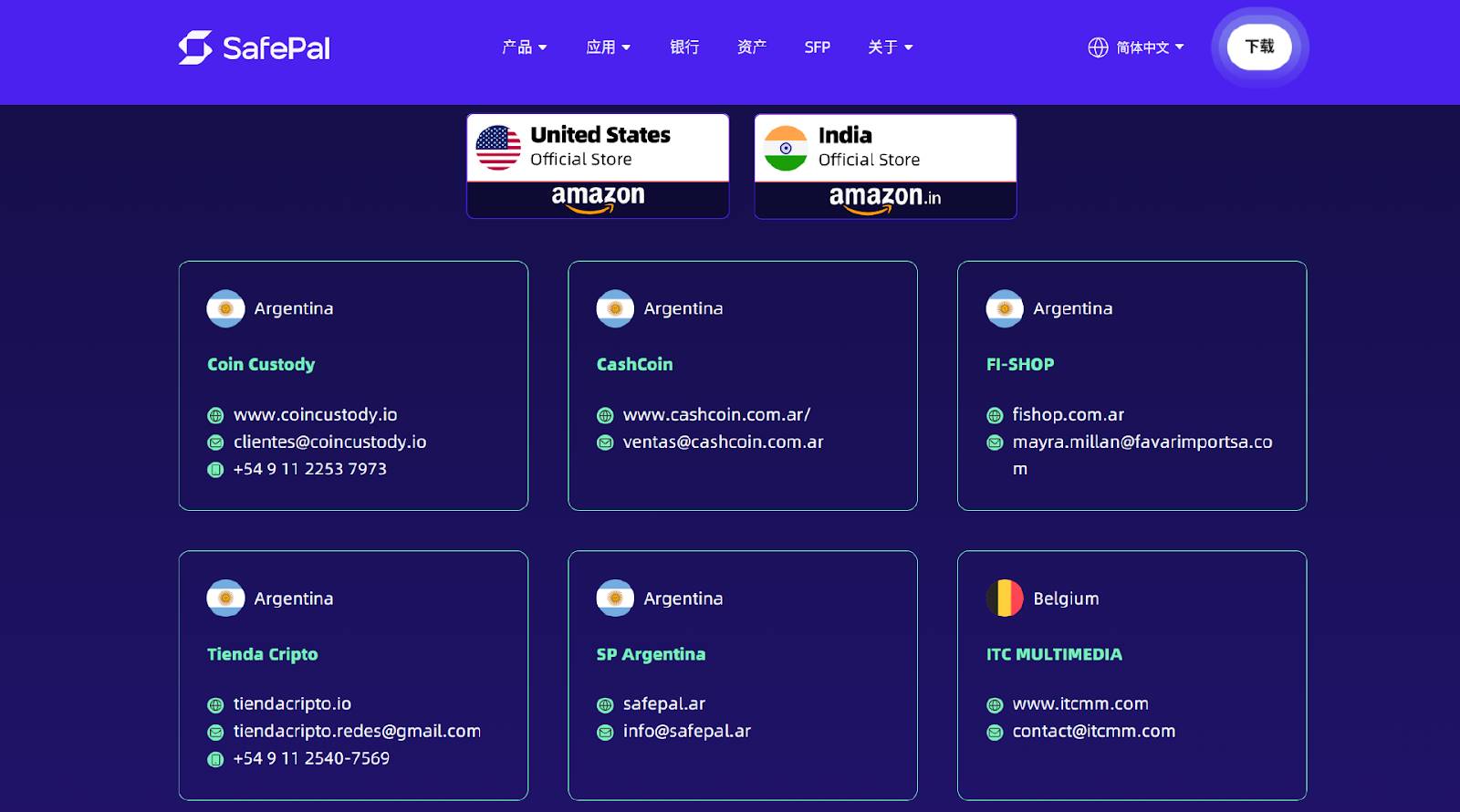

Objectively speaking, official agent/distributor systems for hardware wallets do exist globally. Brands popular in Chinese-speaking regions such as SafePal, OneKey, and imKey generally follow similar distribution models:

-

Direct purchase from official website: users can order various hardware wallet models directly online;

-

E-commerce channels: domestically via Youzan micro-stores, internationally through official platforms like Amazon;

-

Regional distributors: authorized agents in various countries/regions provide localized purchasing options, with authenticity verifiable on the official website—for example, SafePal offers a global agent lookup page.

Yet within China’s e-commerce ecosystem, most users still buy through unofficial, untraceable channels—creating fertile ground for gray-market operations to plant recovery phrase traps.

Many of these devices may be "secondhand/thirdhand" or even counterfeit, with no guarantee that some weren’t opened, initialized, and pre-loaded with recovery phrases during resale. Once users activate such devices, their assets flow directly into scammer-controlled wallets.

So the key question becomes: beyond the sales channel, can end users independently verify and protect themselves against risks when using a newly acquired hardware device?

2. User-Side Vulnerabilities and "Self-Verification" Mechanisms

Ultimately, the reason these hardware wallet scams succeed repeatedly isn’t due to technical flaws in the devices themselves, but because multiple vulnerabilities exist across the distribution and usage process.

Looking at China’s e-commerce and distributor networks, main risks center on two points:

-

Secondhand or multi-hand circulated devices: gray-market operators may open, initialize, and pre-load recovery phrases onto used devices; once users activate them, funds go straight to scammer wallets.

-

Fake or tampered devices: unofficial channels may distribute counterfeit units, possibly embedded with backdoors, putting users’ entire balances at risk of theft upon deposit.

For experienced Degen users familiar with hardware wallets, these traps pose little threat—they naturally perform security checks during purchase, initialization, and pairing. But for first-time buyers or inexperienced users, the likelihood of falling victim rises sharply.

In the latest incident mentioned above, scammers had pre-created the wallet and inserted fake paper instructions, guiding buyers to activate the secondhand imKey using a fraudulent setup flow, thereby transferring assets directly. According to discussions with industry insiders, cases involving opened products sold with fake manuals are increasingly appearing in multiple locations.

Many new users tend to ignore product integrity—whether packaging has been opened or anti-tamper stickers damaged—and often skip comparing included items against official checklists. They also may not realize they can verify whether a device is new or previously initialized directly within the official app. Proper verification of these details would expose most traps immediately.

Therefore, whether a hardware wallet’s design comprehensively supports and actively enables user-side self-verification is the most crucial gate to breaking the gray-market attack chain.

Take SafePal’s Bluetooth-enabled X1 hardware wallet as an example—it offers a relatively complete path for user-initiated self-verification:

-

First-time binding alert: when activating and pairing the hardware wallet with the app, a prompt appears asking “This device has already been activated. Was this action performed by you?”

-

Historical activation info display: reportedly, the SafePal interface will also show the device’s initial activation time and whether it’s the first time this phone is binding, helping users instantly determine if the device is brand new or has been previously initialized.

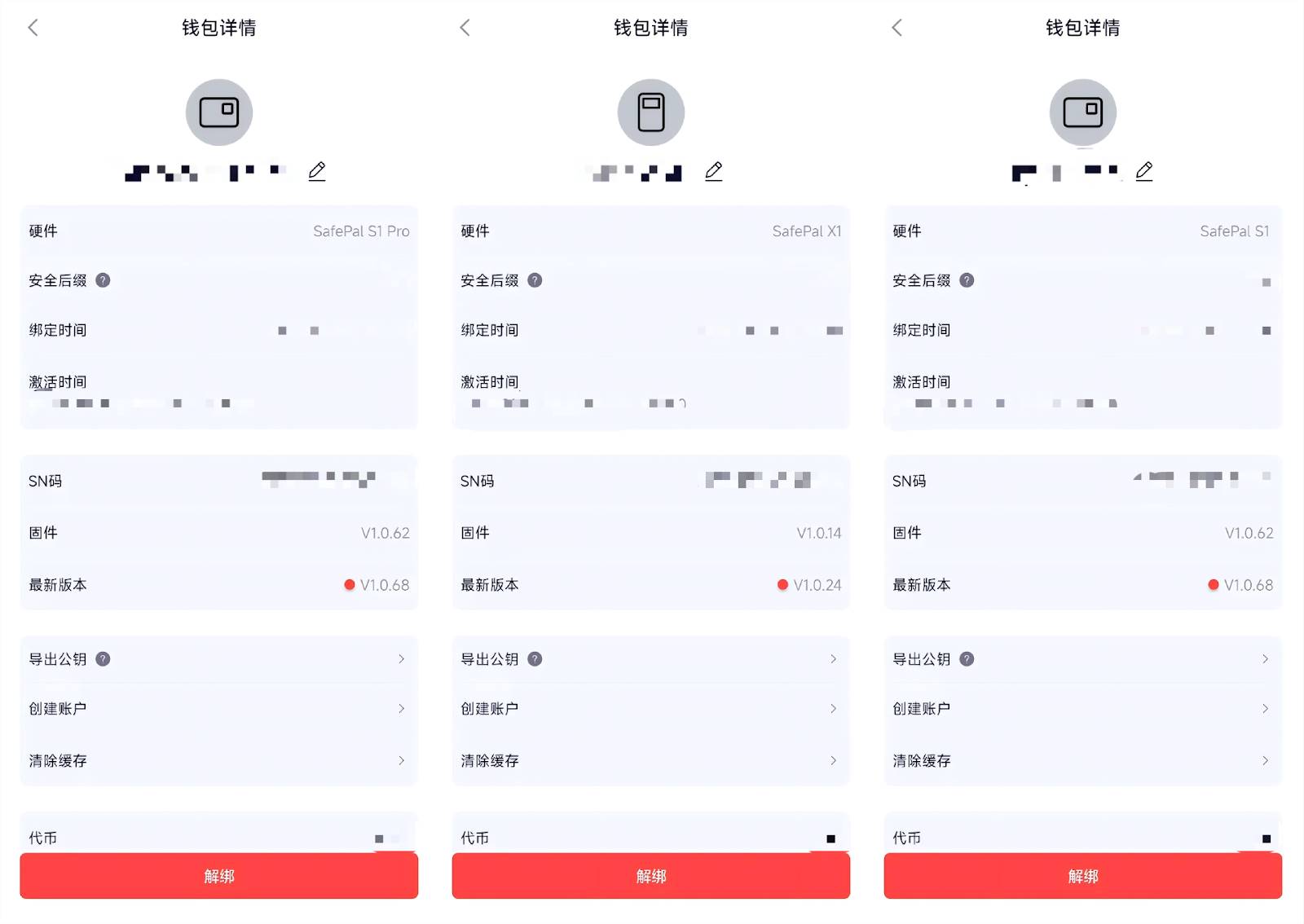

Beyond this, based on actual user experience, both QR-code-based models like the SafePal S1 and S1 Pro, and Bluetooth-connected models like the X1, allow users to view the hardware wallet’s SN code and historical activation time within the SafePal app after pairing (as shown below), further confirming device origin and usage status.

This is possible because each SafePal hardware wallet is assigned a unique SN code at factory, which is bound together with the device’s hardware fingerprint and stored in SafePal’s backend system to confirm provenance and usage state.

This means that when a user first uses the hardware wallet, they must activate it before creating a wallet. During activation, the app sends both the connected device’s SN and fingerprint information back to SafePal’s backend for verification. Only upon successful match does the system allow continued use and records the activation time.

When another phone attempts to bind to this same hardware wallet later, the app warns the user that the device has already been activated—not its first use—and prompts for secondary confirmation.

Through these verification steps, users can almost instantly detect secondhand or counterfeit devices, cutting off the first step commonly exploited by gray-market attackers.

For novice users, SafePal’s visual, traceable verification mechanism is far easier to understand and act upon than simple instruction manuals or text warnings, better meeting real-world fraud prevention needs.

3. A Full-Process Security Guide for Hardware Wallets

Overall, for beginners, simply owning a hardware wallet doesn’t mean their assets are automatically secure.

On the contrary, hardware wallet security isn’t achieved through a one-time purchase, but built collectively through awareness during three stages: purchase, activation, and usage. A lapse at any stage could become an opening for attackers.

1. Purchase Stage: Stick to Official Channels Only

The hardware wallet security chain begins at the point of purchase. Therefore, everyone is advised to buy directly from the official website.

Once you choose to order via e-commerce platforms or live streams, or buy secondhand, such as through Taobao, JD.com, or Douyin via unofficial routes, you’re exposed to extremely high risk—no cold wallet brand sells products through Douyin livestreams or Kuaishou links. These avenues are nearly always dominated by gray-market operations.

Upon receiving the product, the first step is to inspect the packaging and anti-counterfeit labels. If the package has been opened, the seal is broken, or internal packaging appears abnormal, raise immediate suspicion. Ideally, cross-check all included items against the official checklist to quickly rule out certain risks.

The more thorough you are at this stage, the lower your future security costs will be.

2. Activation Stage: Not Initializing Equals "Giving Money Away"

Activation is the core of hardware wallet security and the phase most vulnerable to hidden traps.

The common tactic involves gray-market actors pre-opening the device, setting up a wallet, writing down the recovery phrase, and inserting forged instructions to guide users into using this ready-made wallet—ultimately capturing all subsequently deposited assets. That’s exactly what happened in the recent JD.com imKey fraud case.

Thus, the primary principle during activation is to self-initialize and generate a completely new recovery phrase. Products that support device status self-inspection and historical activation verification significantly reduce passive exposure risk. For instance, as mentioned earlier, SafePal alerts users during first pairing if the device was previously activated, displaying past activation times and binding information, allowing immediate identification of suspicious devices and breaking the attack chain.

3. Usage Stage: Guard Your Recovery Phrase and Maintain Physical Isolation

During regular use, hardware wallet security centers on recovery phrase management and physical isolation.

The recovery phrase must be written down manually—never photographed, screenshotted, or stored via WeChat, email, or cloud services, as any internet-connected storage equals voluntarily exposing your attack surface.

When signing transactions, Bluetooth or USB connections should be short-lived and used only as needed. Prioritize QR code signing or offline data transfer methods, avoiding prolonged physical connection to networked environments.

In essence, hardware wallet security is never "buy and forget"—it’s a defense jointly constructed by users across three stages:

-

Purchase: avoid secondhand and unofficial channels;

-

Activation: self-initialize and verify device status;

-

Usage: safeguard the recovery phrase and avoid prolonged network exposure.

From this perspective, hardware wallet manufacturers urgently need to follow SafePal’s lead—by providing first-activation alerts, activation date displays, and binding history—to offer users verifiable, full-process mechanisms. Only then will the hunting chains relied upon by gray-market operators truly fail.

Final Thoughts

A hardware wallet is a good tool, but never a foolproof ultimate safeguard.

On one hand, hardware wallet manufacturers must stay alert to market changes, especially designing intuitive, easy-to-use verification mechanisms within product interfaces and setup flows specifically tailored to prevent beginner-targeted "hunting chains," enabling every user to easily assess their device’s authenticity and security status.

On the other hand, users themselves must cultivate strong security habits—from purchasing through official channels, proper initialization and activation, to daily recovery phrase management—leaving no step skipped and maintaining security awareness throughout the entire lifecycle.

Only when device verification mechanisms and user security awareness form a closed loop can hardware wallets move closer to the goal of "absolute security."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News