YZi Labs makes a move, investing twice in seven years—Is the hardware wallet still a good business?

TechFlow Selected TechFlow Selected

YZi Labs makes a move, investing twice in seven years—Is the hardware wallet still a good business?

Binance-affiliated investment after a 7-year gap: From SafePal to OneKey, is the hardware wallet business a good deal?

By Web3 Farmer Frank

On June 5, YZi Labs tweeted that it had invested in OneKey, an open-source hardware wallet company.

This marks the first time in seven years since Binance-affiliated entities have backed a hardware wallet project, following their 2018 investment in SafePal. The move stands out for its restraint and thus draws significant attention, reigniting industry debate over whether "hardware wallets remain a good business."

Viewed chronologically, the importance of self-custody has been repeatedly validated since the 2022 FTX collapse. These two (publicly known) investments by Binance-linked resources over a seven-year span are clearly not random but reflect a deliberate and strategic bet.

So here arises the question: Is the hardware wallet still a viable business? Or, beyond bull and bear cycles, regulatory crackdowns, and security incidents, has it transcended mere profitability to become a foundational layer of trust within Web3 infrastructure?

Is a Hardware Wallet a Good Business?

The hardware wallet space has always been one where “newcomers struggle to enter, while established players find growth difficult.”

High barriers to entry, substantial user education costs, thin hardware margins, and long conversion cycles represent inherent structural challenges. Thus, despite being regarded as the “ultimate solution” for asset security throughout Web3’s decade-plus evolution, hardware wallets remain distant from mass adoption due to psychological and usability thresholds.

Reviewing the development history of major hardware wallet products on the market reveals that the industry's origins trace back as early as 2014—a remarkably long timeline:

-

2014: Trezor launched the world’s first hardware wallet; Ledger also released its classic Nano series the same year, marking the beginning of cold wallet security technology;

-

2018: SafePal became the first hardware wallet project selected into the Binance Labs Incubator and later received strategic investment from Binance. It launched its iconic S1 model the following year;

-

2019: OneKey was officially founded with a positioning of “open-source × minimalist,” gaining traction during the on-chain summer via strong sales of the OneKey Classic, becoming one of the most representative hardware wallet brands among Chinese-speaking users;

Notably, although these companies either formed or launched mature products before 2020, those key milestones did not directly catalyze the transition of hardware wallets from “geek tools” to “mainstream user gateways.”

Rather, two unexpected industry events were what truly brought hardware wallets back into the spotlight:

-

First, the explosive rise of the 2020 on-chain summer, which prompted a wave of DeFi degens to adopt hardware wallets for secure signing and contract interactions—marking a pivotal step in user education from zero to one;

-

Second, the 2022 FTX collapse, whose CEX implosion triggered a crisis of trust, forcing many users to reevaluate private key management. The slogan “Not your keys, not your coins” evolved from idealistic rhetoric into a tangible pain point, sharply increasing interest in hardware wallets;

Since then, hardware wallets—once relegated to niche corners—have formally entered the core narrative of Web3 security.

To be fair, Trezor and Ledger’s Hardware Wallet 1.0 era was indeed unsuitable for average users—complex setup and backup processes, high operational barriers, clunky companion software, and prices often exceeding 1,000 RMB deterred most before they could even experience the value.

The emergence of brands like SafePal and OneKey significantly lowered entry barriers by reducing prices and redesigning user experiences. This strategy of “removing price walls and prioritizing UX” served as a crucial catalyst in moving hardware wallets from geek circles toward mainstream markets.

If a product is affordable enough and offers a friendly experience, users are more willing to take the first step into self-custody—even just to “try it out.” Once they experience improved security and satisfaction, trial users may become long-term adopters.

Demand for security has always been rigid. Especially as the Web3 user base continues expanding, security should not be an advanced feature but a basic public service.

This is why we say security isn’t an add-on to Web3—it’s the foundation. Every successful scam risks driving a user away from Web3 entirely. Without new users, the ecosystem goes nowhere.

From this perspective, regardless of whether hardware wallets constitute a “good business,” they are increasingly becoming an indispensable one.

A Review of Mainstream Hardware Wallets on the Market

If hardware wallets were once exclusive gear for tech-savvy enthusiasts, today they are evolving into broader crypto infrastructure serving wider audiences.

I’ve personally used multiple hardware wallets including Cobo, imKey, OneKey, and SafePal. Beyond differences in experience, I’ve clearly observed rapid industry evolution—especially among Chinese-speaking users, where alongside overseas veterans Trezor and Ledger, OneKey and SafePal stand out for highest recognition and most active product iteration.

1. OneKey: Rapid Brand Building Through Open-Source Philosophy

Among mainstream hardware wallet makers, OneKey—spun off from BTCC—didn't start early, but quickly built strong (especially among Chinese-speaking) user awareness by capitalizing on the on-chain summer narrative, establishing a clear brand identity: minimalist, secure, open-source.

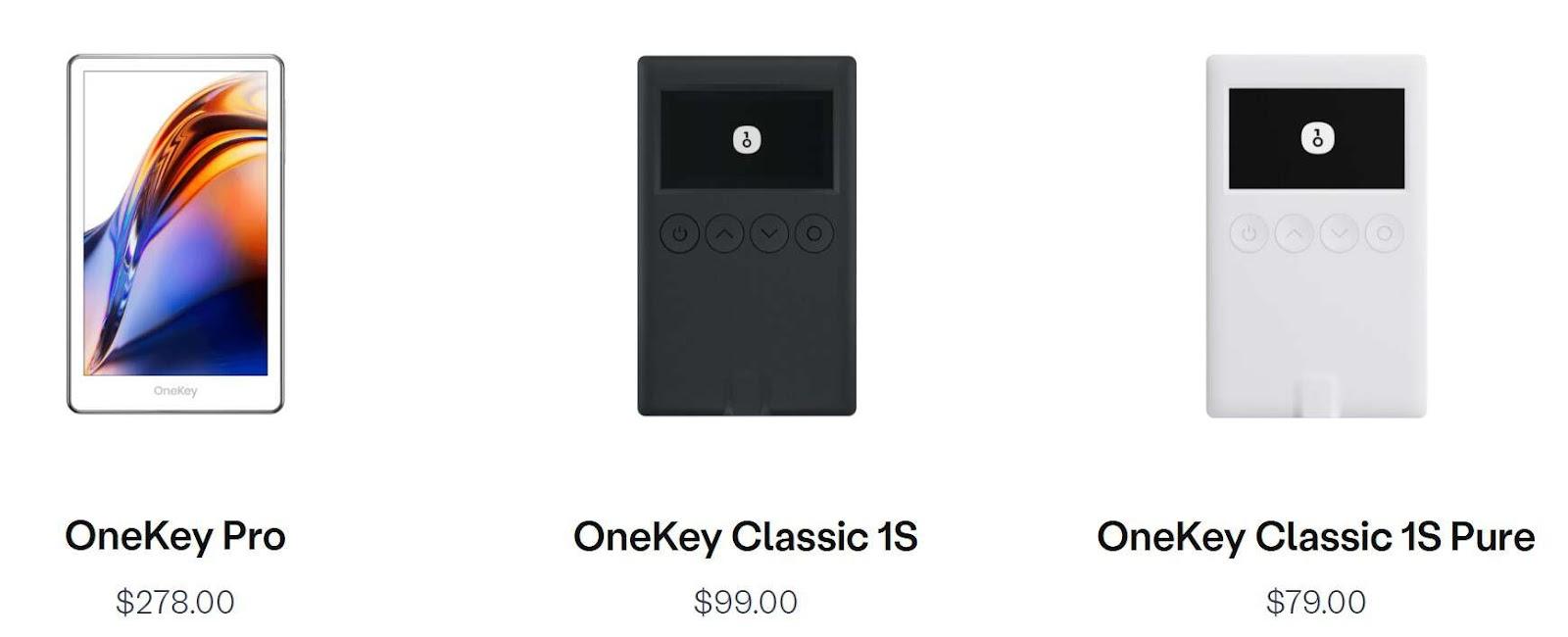

In recent years, OneKey’s product lineup has earned widespread goodwill in Chinese-speaking markets. Key offerings include:

-

OneKey Classic 1S / 1S Pure: Credit-card-sized lightweight cold wallets designed for first-time cold wallet users;

-

OneKey Pro: Features air-gapped offline signing, fingerprint-encrypted verification, and wireless charging, balancing security and convenience for advanced users;

Its flagship OneKey Classic, launched in 2020, rode the wave of the on-chain summer to become a favorite among DeFi degens. However, the model is now sold out.

More recently, OneKey has attempted to “break out of the niche,” such as launching a USDC yield module that attracted over $62 million in subscriptions—reflecting its active user base and community stickiness.

2. SafePal: From Hardware to Full-Stack – Binance’s Homegrown “Wallet OG”

Compared to OneKey, which just received investment from YZi Labs, SafePal is actually Binance’s earliest supported hardware wallet project, with a growth path more aligned with Binance’s incubation model:

In September 2018, SafePal became the only wallet brand selected into the inaugural Binance Labs Incubator program, undergoing a 10-week incubation in San Francisco. By year-end, it secured funding from Binance and officially launched its first hardware wallet, the S1, in the first half of 2019.

Following a “move fast and iterate quickly” product strategy, SafePal expanded its lineup to cover various market segments, building a tiered product matrix for different user levels:

-

Entry-level S1 (2019), Bluetooth-enabled X1 (2023), and upgraded S1 Pro (2024)—all open-sourced;

-

Companion mobile app (2020) and browser extension wallet (2022);

-

Telegram mini-program wallet (2024), on-chain banking accounts, and Mastercard services (2024);

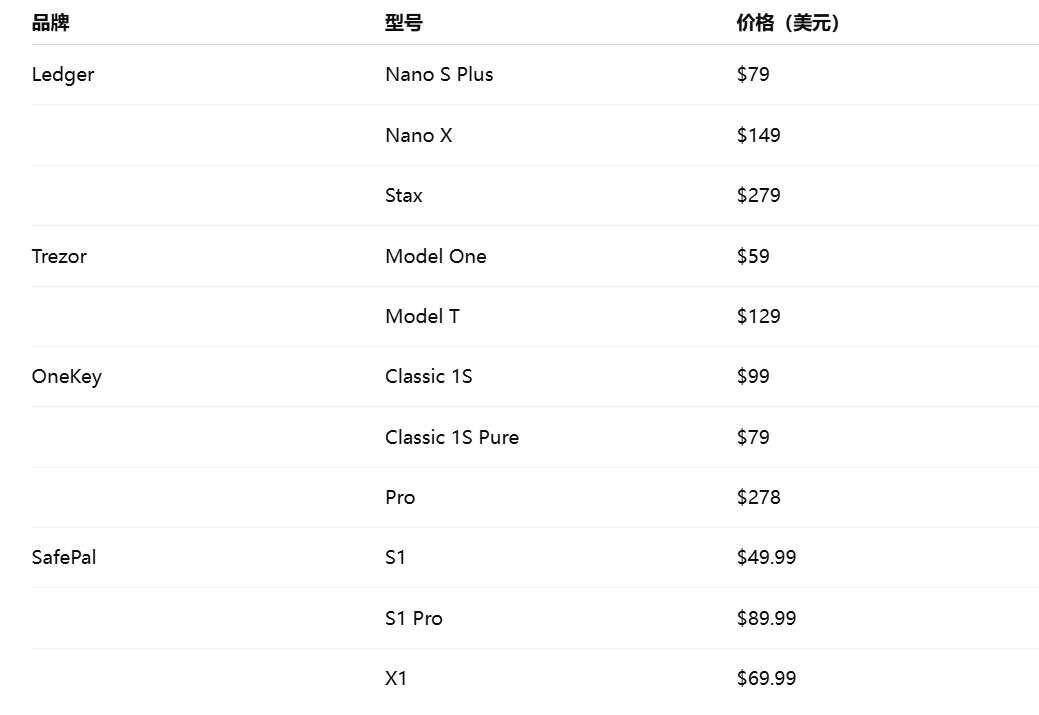

Despite producing multiple hardware models, SafePal maintains an accessible pricing strategy—its current top-tier S1 Pro retails at just $89.99, the X1 Bluetooth version at $69.90, and the S1 as low as $49.99.

Notably, SafePal is one of the few hardware wallet projects with its own token—SFP, launched via Binance IEO Launchpad in 2021—making it widely recognized among Chinese-speaking users. Because of this, SafePal is known for deep integration with Binance’s ecosystem:

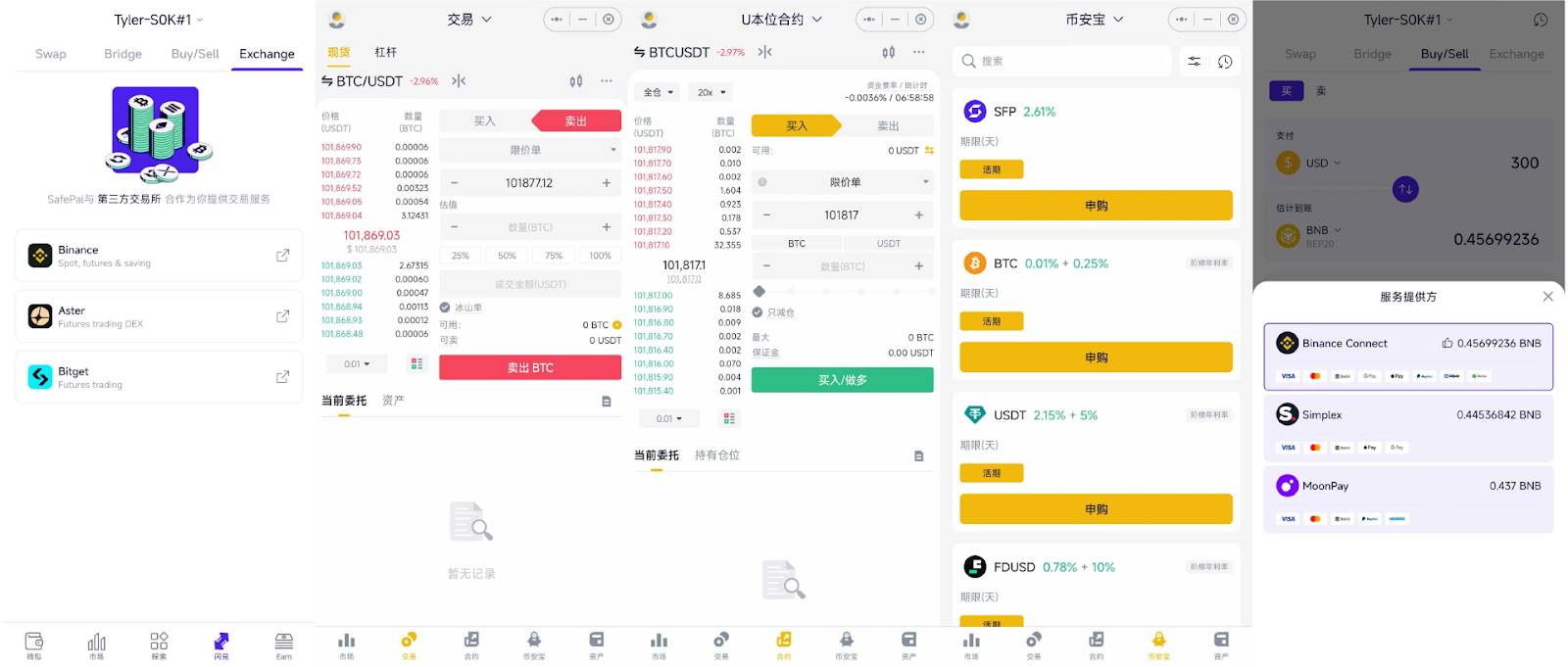

It remains the only wallet deeply integrated with Binance—offering direct access within the app to Binance’s spot trading, margin trading, futures, and wealth management features (via sub-accounts), along with light integration of Binance’s fiat deposit/withdrawal channels. This enables users to leverage Binance’s liquidity and fiat gateways all within the SafePal wallet, meeting most daily trading needs.

Beyond that, SafePal enjoys a first-mover advantage in supporting BNB Chain activities and ecosystem collaborations—for example, enabling gas-free transfers of stablecoins on BNB Chain (I personally use the SafePal app regularly to transfer USDT/USDC and save on gas fees).

Worth noting: In April, SafePal co-founder Veronica became a mentor for the latest cohort of the YZi Labs Incubator—an indication of her team’s sustained relationship with Binance-affiliated VCs and growing industry influence.

3. Ledger and Trezor

As mentioned above, Ledger and Trezor are the longest-standing overseas hardware wallet manufacturers, though both have long faced criticism for being “hard to use” and “too expensive.”

Ledger currently leads the world in cumulative hardware wallet sales, with over 6 million units shipped for its Nano S and Nano X series. It holds strong brand credibility and regulatory compliance credentials in Western markets, appealing particularly to institutions and high-net-worth individuals with strict requirements for hardware-isolated private keys and security certifications.

Trezor is widely recognized as the “pioneer of hardware wallets,” having launched the world’s first model in 2014. Its Trezor One and Model T devices enjoy strong reputations within BTC communities, among tech enthusiasts, and libertarian circles, with an operation logic tailored to power users.

4. Keystone: QR-Based Offline Solution Focused on Maximum Security

Keystone is a fully open-source air-gapped security device based on embedded systems (no Bluetooth, USB, or Wi-Fi). It uses a camera to scan QR codes for address generation and transaction signing, ensuring private keys never touch the internet. It is also the official hardware wallet partner of MetaMask and supports linking with MetaMask.

The flagship Keystone Pro features a 4-inch touchscreen, fingerprint recognition, and multiple security chips (three independent CC EAL5+ certified chips). It supports up to three sets of recovery phrases and can interact via QR code with popular wallets like MetaMask and Solflare.

Overall, while current players differ in product positioning, all aim to build next-generation encrypted entry points combining “security × usability × interoperability.”

More Than Cold Storage: From Single Device to Full-Stack Services

The starting point of hardware wallets is security—but their ultimate destination extends far beyond.

This reflects a shared trend across nearly all major wallet providers: while cold storage remains a core competency, relying solely on one or more hardware devices is no longer sufficient to maintain competitive differentiation.

From a commercial standpoint, the typical user profile for hardware wallets includes “on-chain degens,” “diamond-handed holders,” and “high-net-worth crypto users”—niche groups with extreme demands for security. For them, the primary value lies in offline storage and isolation of private keys.

However, as the crypto user base shifts from tech-savvy early adopters to everyday users, “secure storage” is merely the first step. More and more users now expect wallets not just to serve as vaults for hoarding assets, but as seamless platforms for actively using those assets—covering transactions, interactions, financial management, and even off-chain payments.

In other words, competition in hardware wallets is expanding from “security capability” to “service capability.”

This explains why wallet makers are shifting toward full-stack solutions. Brands like SafePal and OneKey have already extended functionality into DeFi and TradFi use cases, going well beyond simple coin storage:

-

Enhanced on-chain experience: Support for one-click swap, multi-chain asset display, and contract permission analysis lowers the barrier to on-chain interaction;

-

Integration into payment scenarios: Incorporating Lightning Network, cross-chain bridges, and stablecoin protocols enables fast on-chain payments and inter-chain asset movement;

-

Ecosystem tool integration: Offering contract permission analyzers/removal tools, Gas stations, built-in DApp browsers, extension wallets, Telegram mini-programs, and other modules to bridge the “last mile” of on-chain activity;

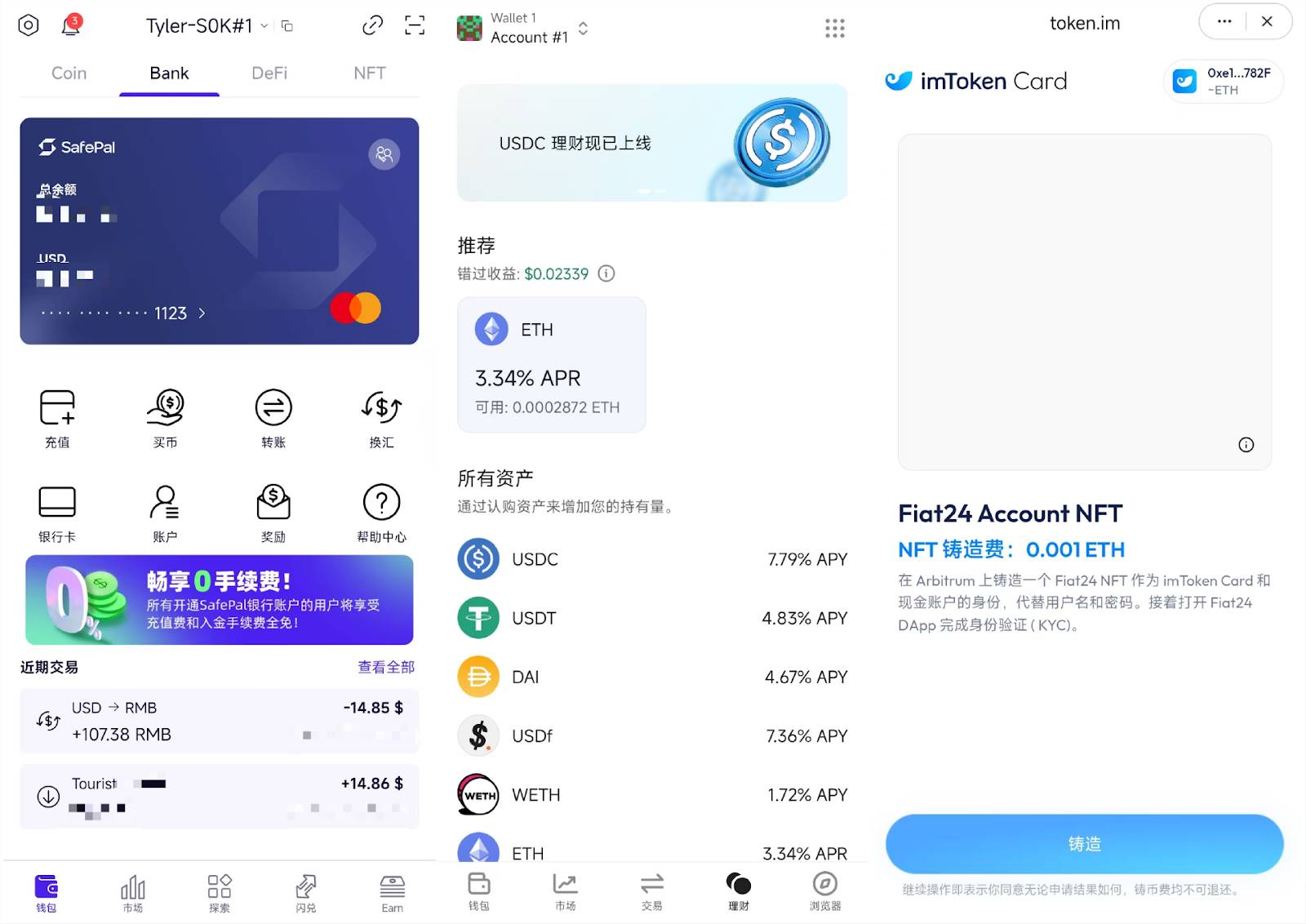

Some, like SafePal, even attempt to embed exchanges (e.g., Binance, Bitget) directly into the wallet interface. Others—including imToken, SafePal, and TokenPocket—integrate banking services like Fiat24 to enable bank account or Mastercard-based spending, creating consumer-level innovations that further connect fiat channels with real-world spending.

From left to right: SafePal’s "Bank" page, OneKey’s wealth management page, imToken Card page

The “full-stack approach” is best exemplified by SafePal—the first hardware wallet project funded by Binance. Starting from a hardware wallet, it has progressively built a suite of products including mobile apps, browser extensions, off-chain payment accounts, and card services, forming a complete asset management loop covering “cold storage → on-chain interaction → off-chain usage.”

In this context, the hardware wallet ceases to be an isolated device and instead becomes the physical security foundation of a multi-platform product ecosystem—one that combines “hardware-based holding + app/extension-based interaction + off-chain payment usage.” This shift represents a defining trend.

Across the industry, this convergence signals a growing consensus: when evaluating hardware wallet competitiveness today, we’re moving from “can it protect assets?” to “is it affordable?” and further to “is it enjoyable to use?” Their role is continuously expanding—from cold storage to multi-chain interaction, from on-chain asset management to off-chain deposits and withdrawals.

This may also explain why Binance has re-entered the hardware wallet space after seven years. Regardless of which path ultimately prevails, the second act of hardware wallets has clearly just begun.

Final Thoughts

Wallets have long been seen as battlegrounds for Web3 access—the intersection of on-chain identity and off-chain payment channels.

For this reason, despite apparent fragmentation, all players are converging toward the same goal: whether legacy international brands like Ledger and Trezor, or rising stars like SafePal, OneKey, and Keystone, they are all heading in the same direction—building comprehensive crypto wallet systems that unify private key security, on-chain interaction, and off-chain payments.

So—is the hardware wallet still a good business?

Current signs, especially YZi Labs’ renewed investment, suggest a positive answer. But it’s no longer simply about selling devices to a niche group of tech enthusiasts. Instead, it is evolving into foundational infrastructure for self-custody, secure interaction, and real-world crypto adoption.

Truly great businesses aren’t just profitable—they embed themselves into the core logic of an industry, becoming indispensable components.

The next chapter of hardware wallets may very well occupy exactly that position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News