Backed by YZi Labs, a deep dive into USD.AI's new stablecoin model

TechFlow Selected TechFlow Selected

Backed by YZi Labs, a deep dive into USD.AI's new stablecoin model

USD.AI generates returns through AI hardware collateral, filling the gap in financing for computing resources.

By San, TechFlow

On August 26, YZi Labs announced a strategic investment in USD.AI, a stablecoin protocol providing hardware-backed financing for AI infrastructure.

According to CoinGecko data, the global stablecoin market cap has surpassed $285 billion. Giants like Circle and Kraken are also stepping into the stablecoin payment chain race.

However, most current stablecoin projects still rely on traditional models pegged to the U.S. dollar or Treasury bonds, showing limited innovation and generally "lacking imagination." Against this backdrop, a unique challenger is entering the market with a fresh approach.

Recently, a distinctive stablecoin project—USD.AI—that integrates DePIN, RWA, and AI, has sparked heated discussions in the market. It doesn't simply peg to the dollar but generates yield through AI hardware collateralization, filling a gap in computing resource financing.

Recently, USD.AI officially launched its deposit channel, rapidly gaining traction. This could bring new opportunities for the convergence of AI and stablecoins.

Project Background

According to Rootdata, the project was founded in 2024. On the team front, David Choi—one of USD.AI’s core founders—is the co-founder and CEO of MetaStreer, a well-known NFT lending platform, and previously worked as an investment banking analyst at Deutsche Bank.

What truly thrust USD.AI into the spotlight is its impressive funding background.

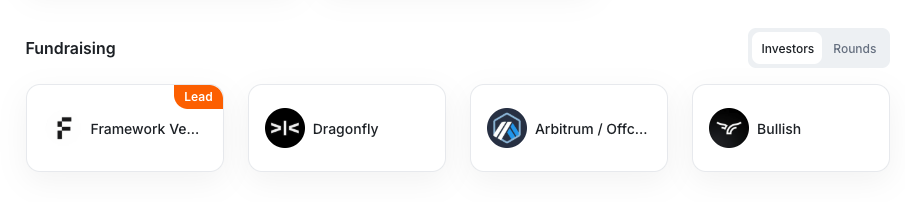

On the 14th of this month, USD.AI announced it had raised $13.4 million in Series A funding led by Framework Ventures.

As a firm focused on DeFi and infrastructure investments, Framework Ventures has backed star projects such as Uniswap and ChainLink. Its lead investment in USD.AI reflects institutional recognition of the project’s innovative value. The list of other investors is equally strong, including top crypto VC Dragonfly, Layer2 giant Arbitrum, and recently IPO-listed exchange Bullish.

This high-profile funding round not only injected substantial resources into USD.AI but also validated the appeal of a DePIN-AI-stablecoin hybrid to top-tier capital, significantly raising market expectations. Following the announcement, USD.AI capitalized on the momentum and officially launched on the 19th, sparking widespread discussion.

Operating Principles and Core Mechanisms

Against the backdrop of growing AI compute demand, USD.AI was designed to combine stablecoin protocols with AI infrastructure financing, addressing a gap overlooked by existing market players:

Small and mid-sized AI companies own valuable GPU hardware but struggle to secure operational funding through traditional channels.

The project’s core goal is to use on-chain capital to support AI firms in hardware procurement and operations, bridging the financing gap left by traditional finance in the emerging AI economy, while maintaining the low-risk nature of stablecoins.

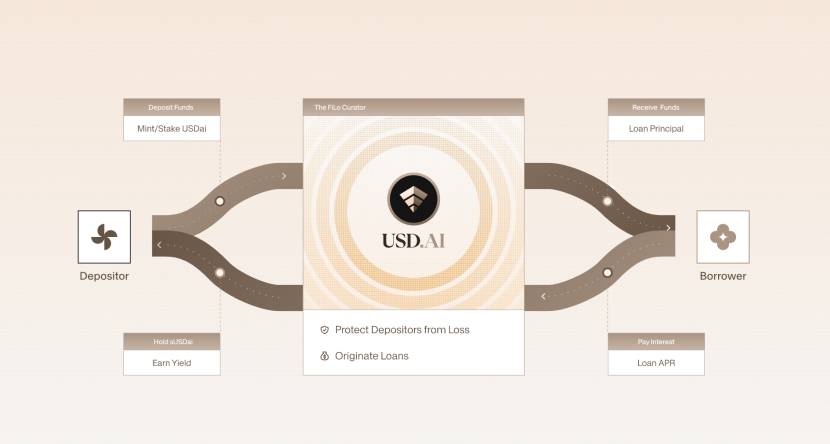

Centered around a closed-loop system of “collateralize-mint-invest-yield,” USD.AI integrates trending concepts of RWA and AI, showcasing unique innovation advantages in this latest wave of stablecoin development.

USD.AI’s mechanism begins with users depositing stablecoins such as USDT or USDC as collateral to mint USDai at a 1:1 ratio. USDai is backed by U.S. Treasuries and major stablecoins, ensuring price stability, instant redeemability, and liquidity—making it suitable for trading or liquidity provision within DeFi ecosystems. Users can further choose to stake USDai to receive sUSDai tokens and participate in other DeFi protocols to earn additional yields, achieving a “multi-layered return” effect.

USD.AI allocates user deposits into two types of assets: first, lending to AI companies for purchasing GPUs and other hardware, generating high-interest returns—currently showing an annualized yield of 6.96% on the official website; second, idle funds are invested in U.S. Treasuries to provide a stable base yield. sUSDai holders can amplify returns via DeFi protocols, with the project targeting an annualized return of 15%-25%, while USDai holders enjoy low-risk, stable yields.

USD.AI’s core mechanisms include several key components to ensure both innovation and stability:

1. Dual-token system: USDai serves as a low-risk stablecoin ideal for conservative users; sUSDai targets yield-seeking investors, offering flexibility and higher risk exposure. This design caters to different risk appetites while maintaining compatibility with the DeFi ecosystem.

2. Asset tokenization and Caliber framework: Through the CALIBER framework, USD.AI tokenizes physical assets such as AI hardware into on-chain assets, combining legal and technical measures to ensure transparent ownership and legal enforceability. An on-chain insurance mechanism further reduces default risk.

3. QEV redemption mechanism: To address the long-term and illiquid nature of AI infrastructure assets, USD.AI introduced the QEV mechanism, which manages sUSDai redemption requests through market-driven pricing—avoiding inefficiencies of first-come-first-served models while ensuring fairness and protocol stability.

4. FiLo Curator expansion mechanism: This allows the protocol to onboard large-scale new borrowers, expanding the AI infrastructure investment portfolio, while structural safeguards and risk-alignment mechanisms protect user interests and ensure diversified, sustainable revenue streams.

In summary, user funds deposited into USD.AI are lent to AI companies needing GPU and other hardware computing power to generate interest—all fully transparent. Idle funds are used to purchase U.S. Treasuries for guaranteed baseline returns.

USD.AI’s innovative mechanisms give it distinct competitive advantages: compared to traditional stablecoin projects, it achieves higher yields through AI infrastructure investments; compared to high-risk DeFi protocols, its risk isolation and insurance mechanisms significantly reduce systemic risk.

USD.AI not only injects fresh energy into the stablecoin market but also offers a scalable solution for capital needs in the AI economy, potentially becoming a pioneer in merging stablecoins with AI infrastructure.

How to Participate

USD.AI is now open for user deposits and inviting others to earn Allo points from the USD.AI rewards system.

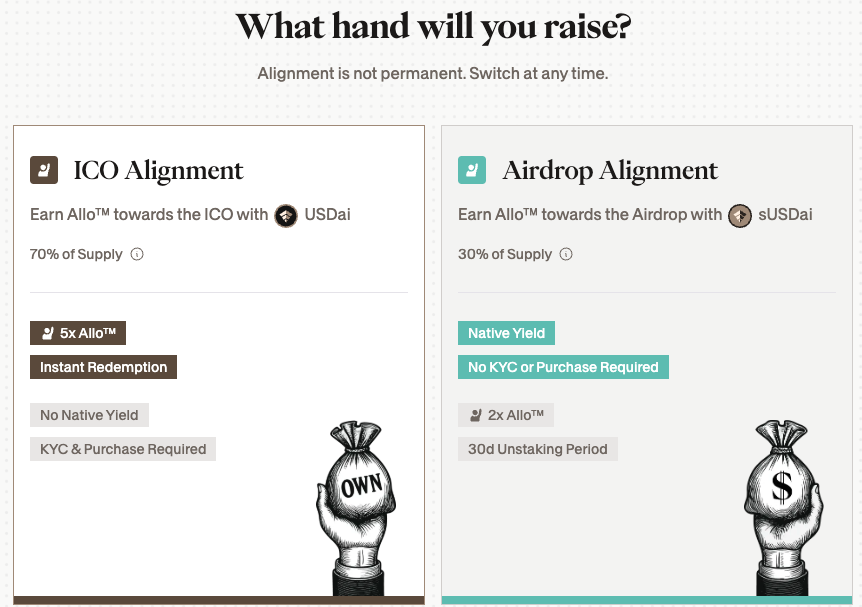

Users can obtain final token rewards through either an ICO or airdrop. All participants will enter at a project valuation of $30 million circulating supply (10% of total FDV of $300 million).

According to official tweets, minting or staking USDai will continuously generate points daily. Users can choose different strategies to determine whether they receive ICO allocations or airdrop rewards.

The Allo points campaign will end when YPO (cumulative yield paid out) reaches $20 million. Users opting for ICO allocations must complete KYC, while those choosing airdrops do not need KYC.

Advanced strategies for earning Allo points can be found in the introduction video shared on the official tweet.

In short, holding USDai qualifies users for the ICO; to qualify for the airdrop, users must stake USDai to obtain sUSDai.

Purchasing USDai or sUSDai now grants qUSDai, a deposit queue token that automatically converts into the corresponding token within 24 hours.

USD.AI currently has a total deposit cap of $100 million. Since all incoming funds are in qUSDai status, the current TVL only reflects the $52 million deposited during the private testing phase.

Market Discussion

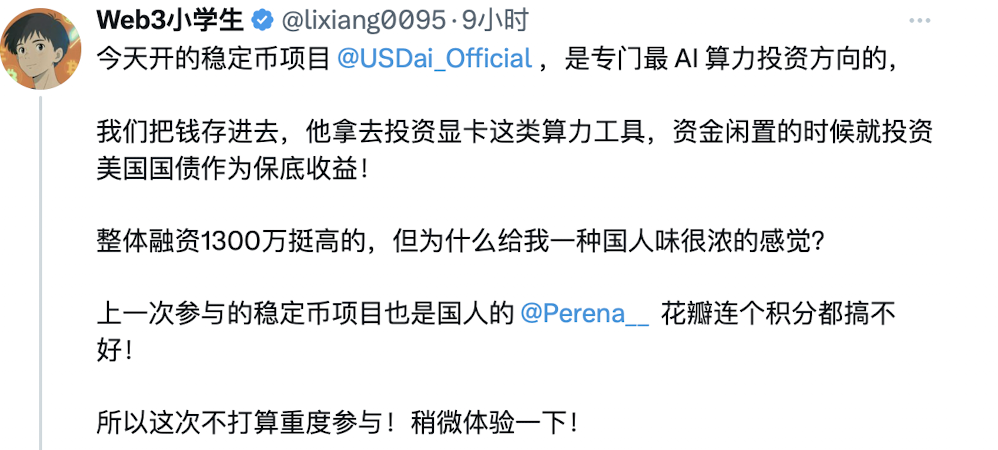

Current market sentiment toward USD.AI is polarized.

Supporters generally view USD.AI as a uniquely innovative stablecoin project that combines the popular AI narrative, allowing users to benefit from AI growth while securing stable returns. Offering multiple participation strategies enables different user types to find suitable approaches, balancing the stability of stablecoins with high-risk, high-reward options.

Critics argue that disclosed information suggests the team may be primarily Chinese-speaking and that the project merely stacks trending buzzwords without substantive innovation.

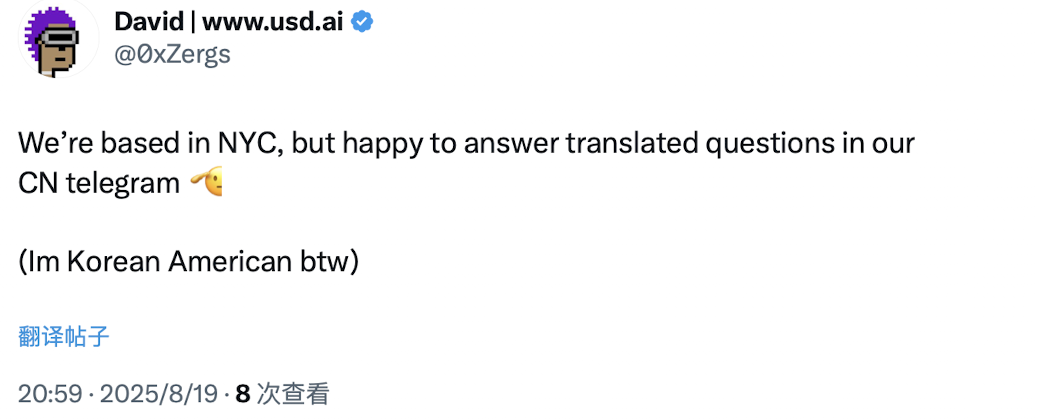

Interestingly, USD.AI’s core founder David recently replied to this FUD tweet, clarifying he is a Korean-American and that the project is headquartered in New York, while expressing willingness to engage with Chinese-speaking users.

In my view, USD.AI indeed presents a different answer in the crowded stablecoin space. But whether it gains market favor and recognition depends on whether users are willing to “vote with their feet” and quickly fill up the $100 million TVL cap.

Its success or failure will serve as a litmus test for market acceptance of the emerging “AI infrastructure + stablecoin” narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News