USDT0: A New Node in the Expansion of Tether's Stablecoin Empire

TechFlow Selected TechFlow Selected

USDT0: A New Node in the Expansion of Tether's Stablecoin Empire

USDT has become the dominant stablecoin, but its market dominance has declined from 70% to 61%.

Author: xparadigms, Four Pillars

Translation: Block unicorn

Key Takeaways

-

USDT has become the dominant stablecoin, growing its market cap from $80 billion to $144 billion over the past year, yet its market dominance declined from 70% to 61% as other stablecoins also expanded.

-

Tether USDT is natively supported on approximately 12 blockchains, while bridged versions of USDT exist across over 80 blockchains, introducing additional risks and management challenges due to reliance on third-party bridges without direct oversight from Tether.

-

To address scaling challenges, Tether is pursuing a horizontal strategy (e.g., the multi-chain token USDT0 using LayerZero OFT for cross-chain transfers) and a vertical strategy (e.g., supporting Arbitrum’s Legacy Mesh and the Bitcoin sidechain Plasma), aiming to unify liquidity and build dedicated ecosystems.

-

As stablecoin issuers expand, interoperability has become the first step in scaling. LayerZero, offering customizable infrastructure and broad blockchain support, has emerged as the primary gateway for this cross-chain growth strategy.

Preface

USDT brought the U.S. dollar on-chain, transforming it into a global digital asset. It has become the largest stablecoin, with a market capitalization exceeding $140 billion. Despite facing numerous rumors about under-collateralization in the past, it has maintained its position as the leading stablecoin. As the stablecoin market expands, Tether USDT's market cap has grown from $80 billion to $144 billion—a 80% increase over the past year.

While USDT continues to grow, other stablecoins are also expanding, causing USDT’s market dominance to decline from 70% to 61% over the past year. To sustain growth, USDT has adopted an aggressive approach to expand its cross-chain capabilities—from implementing the multi-chain token USDT0 powered by LayerZero OFT, to building hubs centered around Legacy Hub and Plasma. Through these strategies, they are addressing previous challenges.

Let us first examine the problems they face.

1. Challenges in Tether USDT’s Expansion Plan

1.1 Tether USDT Only Supports 12 Chains

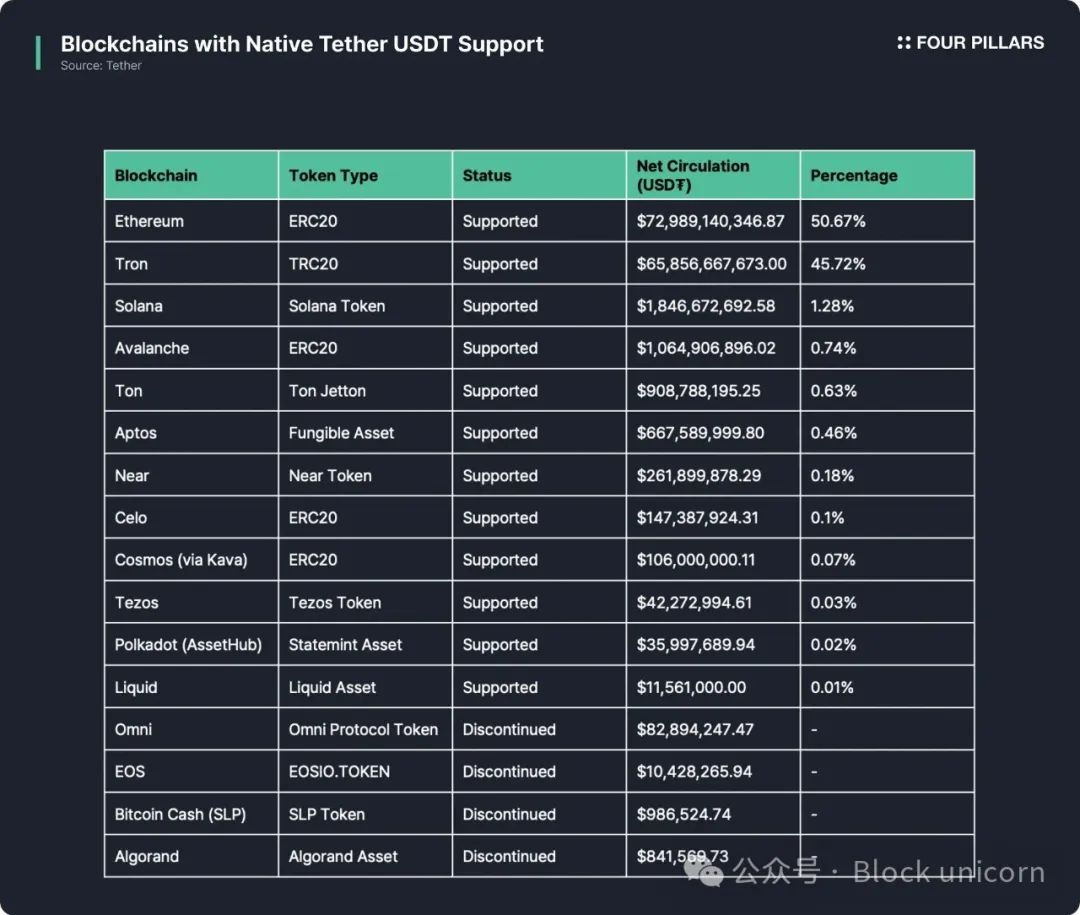

Source: Tether Official Knowledge Base | Supported Protocols and Integration Guide

In 2014, Tether launched its stablecoin USDT initially on the Omni Layer protocol of the Bitcoin blockchain. Over the years, Tether expanded USDT issuance to other major blockchains, including Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Solana (SPL), among others. As of early 2025, Tether natively supports USDT on approximately 12 blockchains. Nevertheless, data from DeFiLlama shows that USDT exists on over 80 blockchains. Notably, more than 50 of these chains host over $1 million worth of USDT, and among the top 30 blockchains by USDT transaction volume, 17 rely on bridged versions rather than native support.

When USDT is not natively supported on a blockchain, it means Tether does not directly issue or redeem USDT on that chain. Instead, third-party bridges lock native USDT on supported chains and mint corresponding “wrapped” or “bridged” versions on new blockchains. For users, this introduces compatibility issues and an additional layer of risk. The security and reliability of bridged USDT depend entirely on the third-party bridge operators, not Tether itself. If a bridge is hacked or fails, users may lose their bridged USDT, and Tether bears no responsibility for such losses. Only USDT on natively supported blockchains is directly backed and redeemable by Tether; thus, holding bridged USDT means relying on the solvency and security of the bridge.

Moreover, Tether has ceased minting USDT on several blockchains due to low usage or security concerns. These include Omni Layer on Bitcoin, Kusama’s AssetHub, Bitcoin Cash’s Simple Ledger Protocol (SLP), EOSIO.TOKEN on EOS, and Algorand. While redemptions may still be possible for a limited time, no new USDT tokens are being issued on these networks.

Although USDT appears widely available across many blockchains, only a few are natively supported by Tether. On all other chains, users interact with bridged versions of USDT, which carry additional risks not applicable to native tokens.

1.2 Bridged USDT Is Increasing

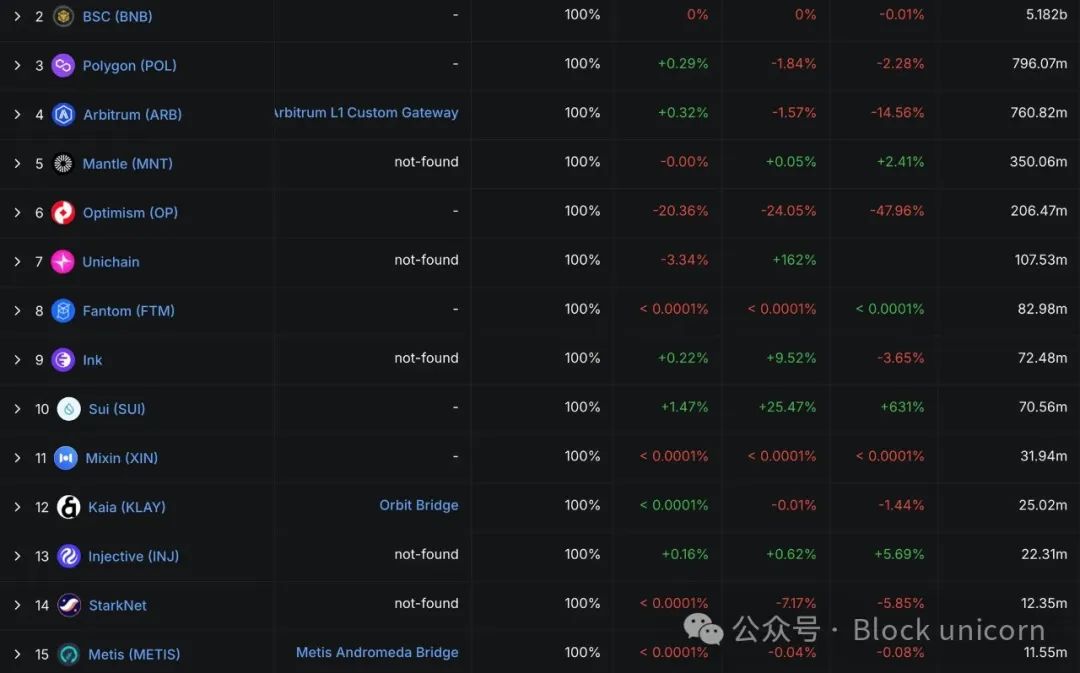

Source: Tether: Circulating Supply and Statistics - DefiLlama

Currently, the circulating supply of USDT on Ethereum is approximately $64.94 billion, with about $8 billion of USDT bridged to other blockchains. For example, around $5.2 billion of USDT has been minted on Binance Smart Chain (BSC) via the BSC Bridge. Additionally, several major Layer 2 networks—such as Arbitrum, Polygon, Optimism, and Mantle—operate their own native bridges for USDT transfers. Other Layer 1 blockchains, including Fantom, Kaia, and Sui, rely on third-party bridges to facilitate USDT movement across chains.

From Tether’s perspective, the growth of bridged USDT presents significant management challenges. Tether can only directly monitor and control USDT issued on natively supported networks. Once USDT is bridged to other chains via third-party bridges, Tether loses direct oversight of those tokens. This fragmentation makes it increasingly difficult for Tether to track total supply, ensure compliance, and manage risks arising from the expanding number of blockchains and bridge protocols.

Ultimately, while the rise of bridged USDT enhances liquidity and interoperability within the crypto ecosystem, it also introduces new complexities for Tether as the issuer.

1.3 Tether Is Leaking Value to Tron

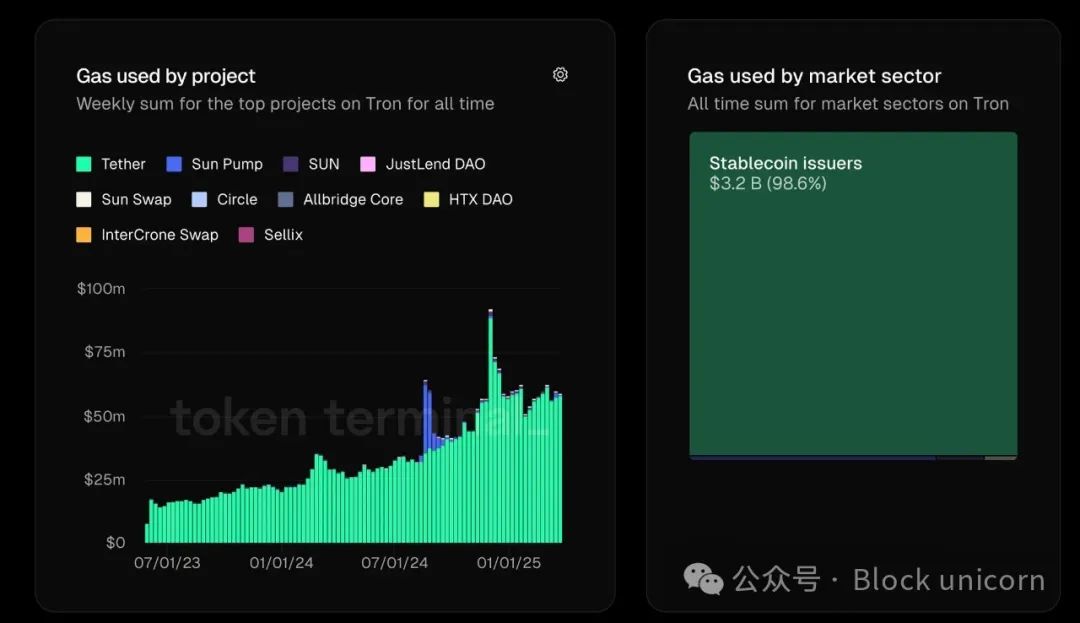

Source: Tron Gas Usage | Token Terminal

Stablecoins are the backbone of on-chain finance, serving as the primary medium for settlement, trading, and lending. This phenomenon is particularly evident on Tron, where stablecoin-related transactions dominate on-chain activity—USDT alone accounts for over 98% of Tron’s stablecoin supply and nearly all transaction volume.

Currently, the total market cap of stablecoins on Tron is $71.5 billion, with USDT dominating at over $70.9 billion in circulation, far surpassing other stablecoins like USDD, TUSD, and USDC, which collectively represent only a small fraction of the market. This dominance is so complete that Tron could be called a “USDT chain,” with 98% of transaction fees and 99% of transactions driven by USDT transfers. As a result, Tron captures over $2.5 billion in annual fee revenue from these activities.

But this raises a critical question: What if Tether, the issuer of USDT, launched its own blockchain—not only capturing transaction fees but also reclaiming the ecosystem value currently flowing to Tron? Tether has demonstrated the ability to rapidly mint and move billions of USDT to meet market demand, frequently adjusting supply across blockchains to optimize cost and efficiency. If Tether incentivized major centralized exchanges (which currently hold about 30% of USDT on Tron) to migrate their USDT holdings to a Tether-operated chain, it could redirect network activity and fee revenue back into its own ecosystem.

Such a move could fundamentally reshape the economic model of stablecoin infrastructure. For exchanges and users, migrating to a Tether-native chain might mean lower fees, faster settlements, and potential rewards for early adopters. For Tether, it would unlock new revenue streams and strengthen control over its stablecoin environment.

In the long run, this could create a win-win scenario: users and exchanges benefit from a layer optimized for efficient settlement, while Tether captures value currently leaking to third-party blockchains. Given USDT’s dominance on Tron and across the broader crypto ecosystem, the opportunity for Tether to internalize this value is both significant and increasingly feasible.

2. Tether’s Strategy—Horizontal and Vertical Scaling

To address the challenges faced by Tether USDT, two potential solutions exist. The first is horizontal scaling—expanding across the existing 300+ blockchains through improved cross-chain strategies while continuing to grow. The second is vertical scaling—owning the infrastructure stack to capture more value and offer additional services.

2.1 USDT0—Horizontal Scaling Using LayerZero OFT

Source: LayerZero Scan

Tether has launched its multi-chain version of USDT, known as USDT0. This token now leverages LayerZero’s OFT token framework to easily expand to other blockchains or rollups. Since launching a month ago, its total value locked (TVL) and circulating supply have reached $971 million, with cross-chain transaction volume exceeding $3 billion. Now, sending USDT across different blockchains is cheaper than ever before.

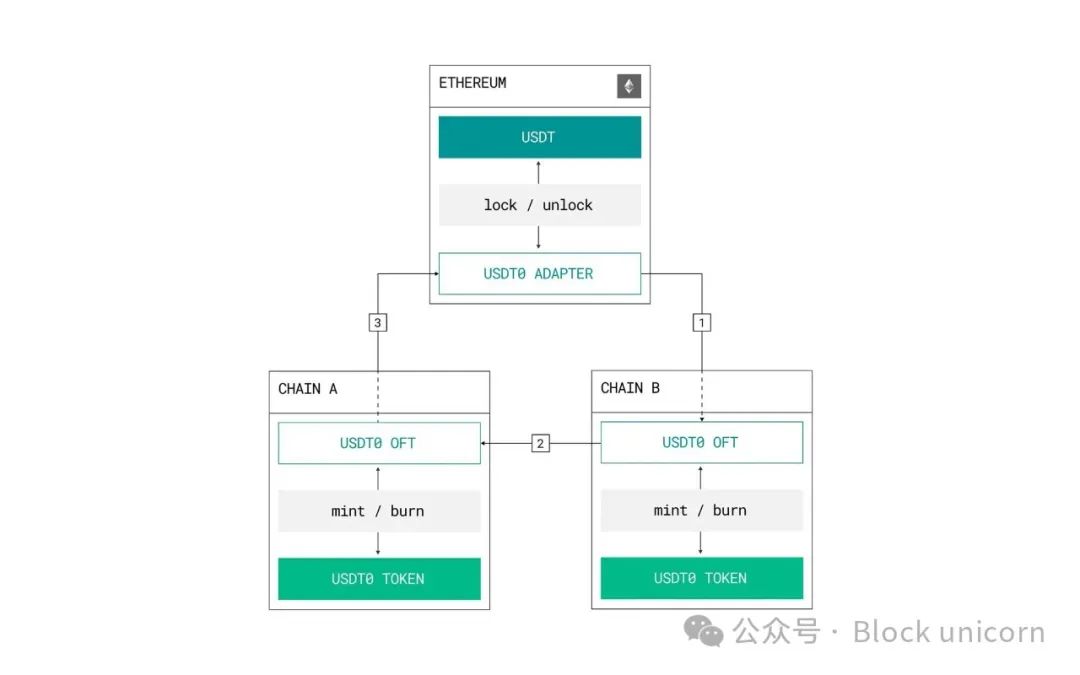

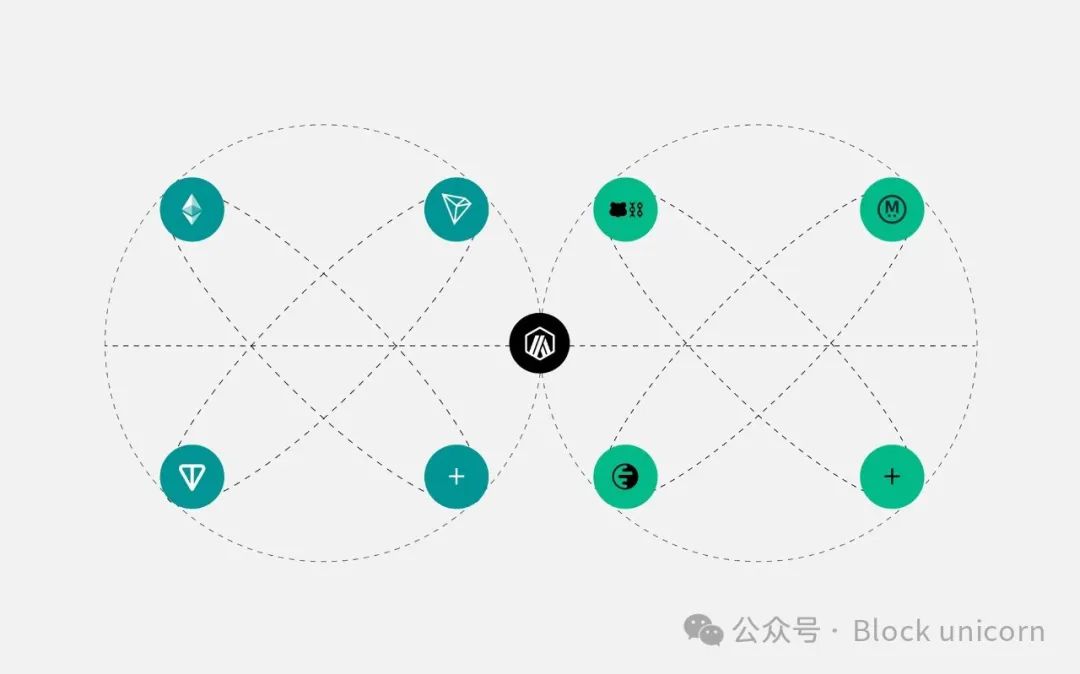

This is enabled by LayerZero’s OFT standard, which allows tokens to be locked or burned on the source chain and minted on another chain. USDT can be locked on natively supported chains like Ethereum, Tron, and TON, then minted as USDT0 on unsupported chains like Arbitrum, Optimism, and Berachain. For transfers between unsupported chains, the system uses a burn-and-mint mechanism. This approach simplifies supply management across different networks while reducing the need for native support.

Source: "USD₮0 Mechanism Design Review" | Chaos Labs

LayerZero enables “issuer-aligned interoperability,” where cross-chain operations of USDT0 are validated by two entities: the USDT0 DVN and the LayerZero DVN. This means cross-chain transfers only occur when approved by infrastructure operated by the issuer, USDT0.

For USDT0 to support a new chain, two conditions must be met: LayerZero must support the chain, and the team must either find or begin supporting a DVN route for that chain. Currently, LayerZero supports around 131 mainnets, including most major networks, so the expansion of USDT0 is more a strategic decision than a technical barrier.

2.2 Legacy Mesh and Plasma—Building Hubs for USDT

Tether achieves vertical scaling by supporting two key initiatives: building the Legacy Mesh for USDT0 and the Bitcoin sidechain Plasma. Legacy Mesh acts as a central network connecting existing USDT deployments with USDT0 (the multi-chain version for chains lacking native USDT support). Arbitrum serves as the central hub, aggregating liquidity pools and using LayerZero’s communication protocol to facilitate cross-chain transfers. This allows users to seamlessly move assets between Ethereum, Tron, and TON and networks supported by USDT0, such as Arbitrum, Ink, and Berachain. With Arbitrum connected to Ethereum, Tron, and TON, it unifies 98% of USDT supply, while Legacy Mesh creates a tightly integrated ecosystem for stablecoins across mature and emerging blockchains.

The second initiative, Plasma, takes a bolder approach by building a Bitcoin sidechain focused on payment efficiency. From day one, USDT0 will be supported on Plasma and directly linked to USDT on Ethereum, Tron, and TON.

Legacy Mesh and Plasma together create a comprehensive liquidity and ecosystem hub for USDT. Arbitrum serves as the liquidity backbone, while Plasma optimizes transaction throughput and develops its own dapp ecosystem. This synergy enables USDT to expand its influence in both liquidity and applications.

Source: "Introducing Legacy Mesh: Your USDT Anywhere, Now Everywhere" — USD₮0

3. Interoperability Is the “First Step” in Stablecoin Expansion Strategy

Stablecoins make fiat currency semi-global, while interoperability makes them truly global. As the blockchain ecosystem expands to over 300 networks, stablecoin use cases and user bases are becoming increasingly fragmented. For stablecoin issuers, focusing on a single chain may work initially, but long-term growth and adoption depend on cross-chain strategies that allow their tokens to move seamlessly across multiple blockchains.

A notable example is the Wyoming Stablecoin (WYST), the first fully reserved, state-issued stablecoin in the U.S. By partnering with LayerZero and adopting its OFT standard, WYST can be issued and used across multiple major blockchains, including Ethereum, Avalanche, and Solana. This interoperability not only expands WYST’s user base but also reduces operational costs and improves the experience for institutions and individuals needing to transact or settle across different networks.

The case of WYST highlights a broader industry trend: interoperability strategies must go hand-in-hand with issuance strategies. As stablecoins seek wider adoption, LayerZero—with its customizable infrastructure and extensive chain support—is becoming the gateway for cross-chain expansion, enabling issuers to efficiently enter new markets and use cases.

Source: "Accelerating Asian Stablecoin Development Through Interoperability" | Four Pillars

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News