Hotcoin Research | Ethereum's New Engine for Takeoff or Just Empty Hype? Analysis of the Spectra Upgrade and Its Impact on the Crypto Market

TechFlow Selected TechFlow Selected

Hotcoin Research | Ethereum's New Engine for Takeoff or Just Empty Hype? Analysis of the Spectra Upgrade and Its Impact on the Crypto Market

In summary, the Spectra upgrade marks a significant step forward for Ethereum in terms of scalability and user experience, creating opportunities for DeFi/NFTs, large-scale applications, and institutional-grade use cases.

1. Introduction

Looking back at over a decade of blockchain's technological evolution, Ethereum has consistently played the dual role of leader and pioneer. From its genesis block in 2015, to The Merge in 2022 that slashed energy consumption by 99.95%, and EIP-4844 in 2024 that dramatically reduced Layer2 fees, each upgrade has profoundly reshaped the boundaries of what decentralized applications can achieve. Today, facing fierce competition from emerging high-performance public chains like Solana and Sui, as well as growing market demand for low fees, high speed, and ease of use, Ethereum stands at a new crossroads—the Spectra upgrade. Against a backdrop of低迷 ETH prices and capital rapidly shifting toward faster Layer1s, the success or failure of Spectra will not only determine Ethereum’s performance and user experience but also reshape the flow of capital, developers, and users across the crypto market.

This article uses accessible language to systematically outline Ethereum’s upgrade roadmap, break down the content and significance of the Spectra upgrade, and analyze its potential impact on the crypto market. We hope this piece helps readers understand why Spectra could be Ethereum’s next catalyst—and why it still faces serious challenges.

2. Background and Content of the Spectra Upgrade

Ethereum’s development can be divided into multiple phases: early proof-of-work (PoW) consensus, followed by “The Merge” in 2022, which transitioned the network to proof-of-stake (PoS), reducing energy consumption by approximately 99.95% and laying the foundation for future scalability. After The Merge, the official Ethereum roadmap outlined "Ethereum's Six Visions": The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge. Each phase targets different goals, all aimed at improving scalability, lowering costs, and maintaining network security and decentralization.

- The Merge: In 2022, Ethereum Mainnet merged with the Beacon Chain, completing the transition from PoW to PoS, cutting network energy use by nearly 99.95%, and enabling future scaling technologies such as proposer-block builder separation.

- The Surge: Aims to significantly increase network throughput via Rollups and data availability sharding (e.g., Blob data introduced by EIP-4844), targeting over 100,000 TPS across L1+L2. This phase will also advance Data Availability Sampling (DAS), enabling sampling-based verification.

- The Scourge: Designed to enhance censorship resistance and decentralization by reducing risks from large validators and single points of control, including mitigating MEV (Maximal Extractable Value) through mechanisms like ePBS (execution Payload Builder Separation).

- The Verge: Originally planned to replace state root Patricia trees with Verkle trees, allowing validators to verify blocks using minimal "witnesses" without storing full state—enabling stateless clients. The Verge also envisions using zero-knowledge proofs (SNARK/STARK) for efficient execution validation, potentially enabling any device, even smartphones, to run full nodes.

- The Purge: Aims to drastically reduce node storage burden for historical data by expiring old data, simplifying the protocol (e.g., keeping execution data for limited periods), and removing outdated functions. For example, EIP-4444 proposes retaining historical blocks and transactions for only one year, combined with future distributed storage, so nodes no longer need permanent storage of all history.

- The Splurge: Includes various miscellaneous optimizations such as stabilizing the EVM (e.g., adopting the new EVM Object Format EOF), deepening native account abstraction (allowing all accounts advanced smart features), fee model refinements, and introducing advanced cryptography (verifiable delay functions, blinding signatures, etc.).

Source:https://ethroadmap.com/

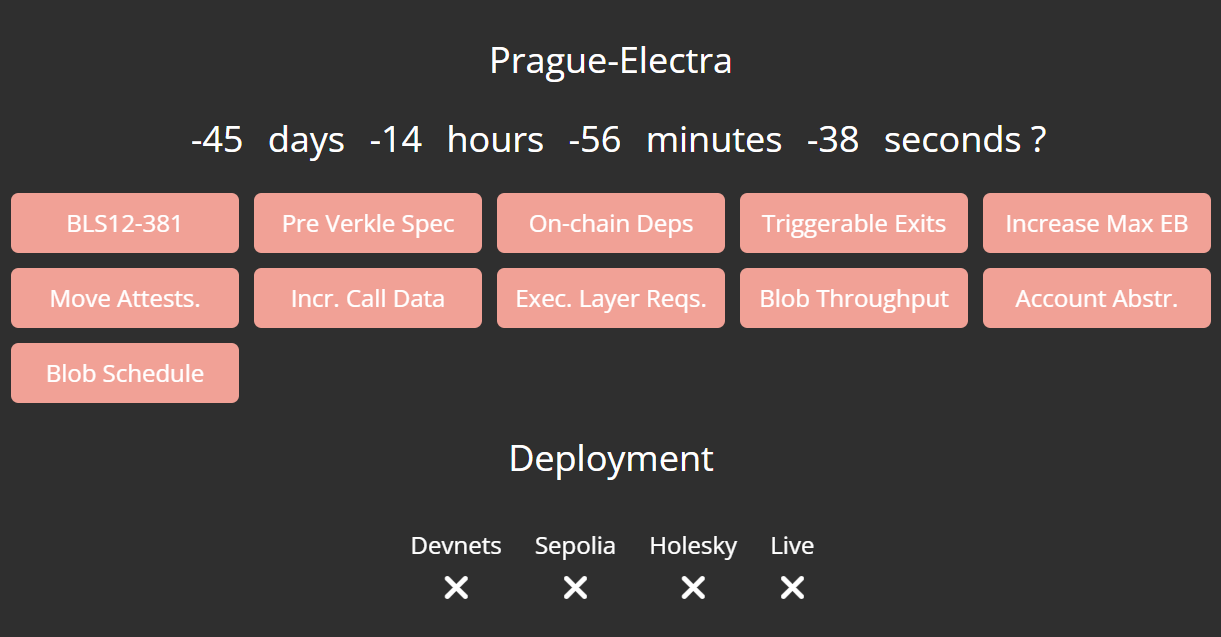

The Spectra upgrade (also known as Pectra, derived from Prague + Electra) is scheduled to go live on May 7, 2025, marking the most significant network upgrade since The Merge. Focused on enhancing scalability, user experience, and validator operations, its core goals include smart account support, increased data throughput, and smoother staking/unstaking processes. Spectra includes around 11 core EIPs, spanning changes to both the execution and consensus layers. Key components are:

- Account Abstraction: EIP-7702 allows regular externally owned accounts (EOAs) to temporarily act as smart contracts, enabling wallets to bundle transactions, set conditions, and allow third-party gas payment. This means users won’t need ETH to pay gas—they can use stablecoins like USDC or DAI—greatly lowering the barrier to entry for new users.

- Validator Flexibility: EIP-7251 increases the maximum stake per validator from 32 ETH to 2048 ETH, allowing large stakers to consolidate multiple validators into a single node, reducing operational overhead. Meanwhile, EIP-7002 introduces an execution-layer trigger for voluntary exits, letting validators exit via contract calls without needing their original private key—further simplifying the exit process. These changes reduce operational complexity and improve network reliability.

- Scaling and Data Availability: EIP-7691 doubles the blob data capacity per block (average from 3 to 6, peak from 6 to 9), effectively boosting Layer2 (Rollup) throughput and alleviating congestion. To prevent excessive hardware demands on nodes, PeerDAS (EIP-7594)—a peer-to-peer data availability sampling protocol—is introduced. PeerDAS enables the network to confirm L2 data availability via random sampling, without requiring every node to download all data, thus maintaining decentralization while increasing throughput.

- State Optimization: EIP-2935 introduces a new system contract at the execution layer to query the last 8192 block hashes, preparing for future technologies like Verkle trees. This allows light nodes to access recent historical block hashes without storing full history, supporting decentralized state verification. Additionally, EIP-7549 removes committee indices from the signature scope in attestation messages, simplifying consensus node validation and improving zero-knowledge proof circuit efficiency.

- Other Improvements: Spectra also includes integrating validator deposits into the execution layer (EIP-6110), enabling ETH deposits to directly enter the Beacon Chain upon block proposal, simplifying deposit data verification. EIP-7840 fixes blob configuration parameters in clients, standardizing execution-consensus parameters. EIP-7623 adjusts traditional calldata pricing to encourage developers to adopt more efficient blob storage. Furthermore, BLS12-381 curve precompiles (EIP-2537) are added to support future zero-knowledge protocols and multi-signature applications.

In simple terms, the Spectra upgrade allows the Ethereum network to operate faster and more reliably without sacrificing decentralization. Future Ethereum nodes will handle larger data volumes without requiring exponentially higher hardware specs, thanks to the new PeerDAS mechanism that reduces individual node load. Higher throughput and more flexible validation will bring users lower transaction fees and faster confirmation times, while developers gain the foundation to build more complex and interactive applications.

3. Analysis of Spectra’s Impact on the Crypto Market

1. Capital Outflows and Persistent ETH Weakness

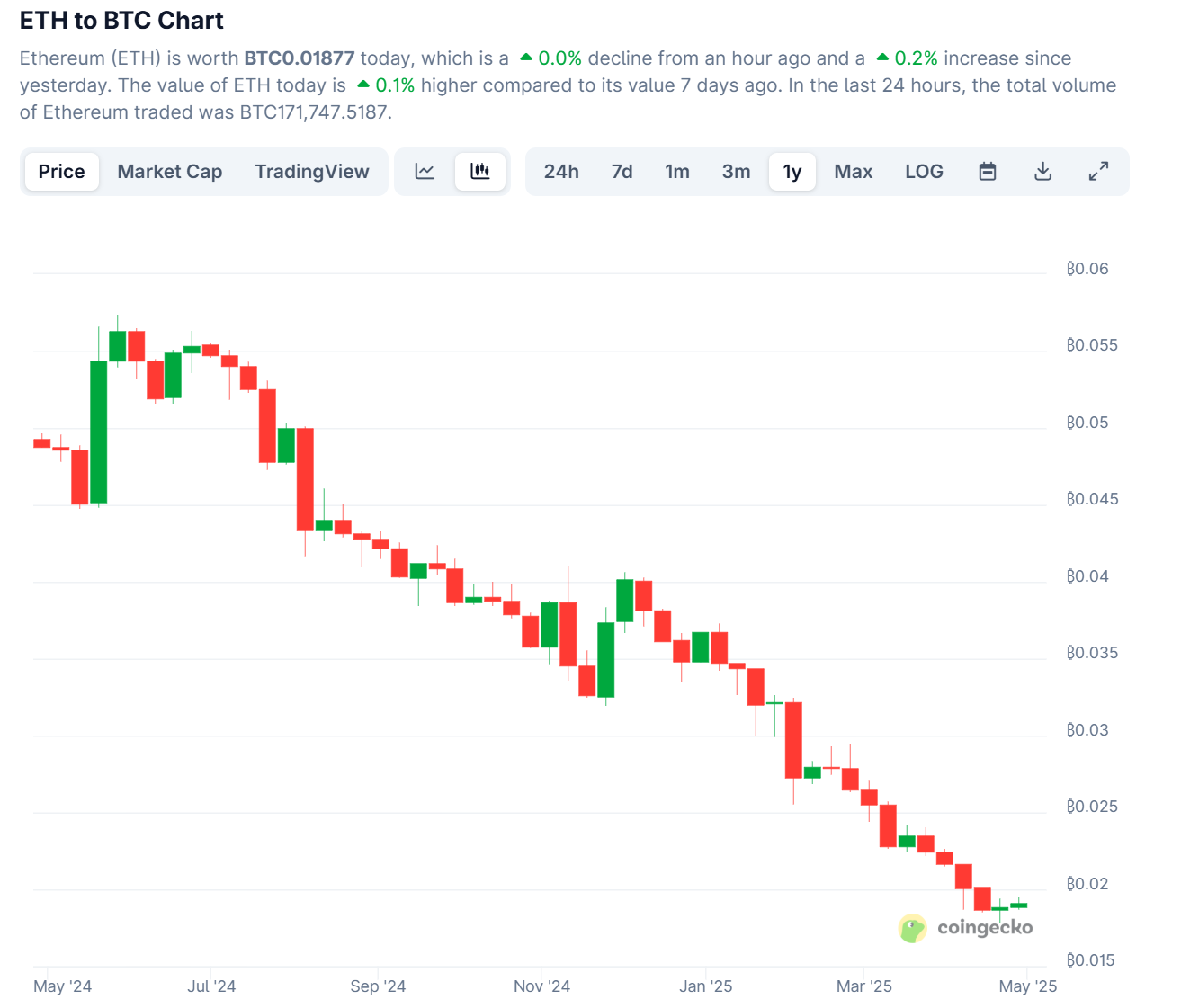

So far this year, spot Ethereum ETFs have seen net outflows exceeding $110 million, adding selling pressure. Institutional减持 has driven the ETH/BTC ratio to a five-year low of 0.019, while the SOLETH ratio has risen 24%. Since Q1, average L1 gas fees on Ethereum have been 20–30 times higher than on Solana. During the same period, Ethereum processed about 1.5 TPS, while Solana peaked above 2,000 TPS. Due to the high 32 ETH staking threshold, Ethereum’s staking rate stands at only 28%, compared to Solana’s 65%.

Source:https://www.coingecko.com/en/coins/ethereum/btc

Source:https://www.coingecko.com/en/coins/solana/eth

2. Reshaping ETH’s Supply-Demand Dynamics via the Spectra Upgrade

- Smart Accounts (EIP-7702) will allow direct gas payments in USDC/DAI, eliminating the “buy ETH first” barrier. Industry estimates suggest this could boost daily active users by 15–25%.

- Doubled blob capacity + PeerDAS could reduce average L2 fees by another 40%, with Rollup transaction volume expected to grow 2–3x within six months.

- EIP-7251 raises the per-validator cap to 2,048 ETH, enabling consolidation of large nodes and reducing loss from reinvested staking rewards; if 20% of stakers consolidate, annual new sell pressure could theoretically drop by 3–4%.

- EIP-7002 allows execution-layer-initiated exits, improving liquidity. Combined with ETF rules prohibiting staking, Spectra may drive more long-term capital to stake directly on-chain for yield, reducing circulating supply in secondary markets.

3. Ripple Effects on L1 and L2

- Solana still occasionally halts under high load and lacks natively abstracted smart accounts. If Spectra significantly improves ETH’s user experience, it may divert some high-frequency trading and DeFi capital, dampening expectations for SOL’s comeback.

- Sui differentiates itself through gaming and social use cases. After Spectra’s fee reductions, L2 gaming platforms (e.g., Immutable, Xai) will see enhanced cost advantages, potentially competing with Sui.

- Layer2 projects will benefit directly from the upgrade. Increased blob capacity and improved data availability will make transactions on Arbitrum, Optimism, and others more efficient and cheaper, boosting the appeal of these scaling solutions. As the upgrade rolls out, market participants expect increased capital and user inflows into the broader crypto ecosystem, especially Rollup tokens and DeFi platforms.

4. Opportunities and Challenges Brought by the Spectra Upgrade

The Spectra upgrade brings numerous opportunities for Ethereum and the broader industry:

1. Strengthening Ethereum’s Competitive Edge: By significantly enhancing scalability and user-friendliness, Spectra enables Ethereum to better compete with rivals like Solana, Avalanche, and BNB Chain. For instance, as Ethereum improves processing power and lowers fees, investors and developers are more likely to stay within its ecosystem rather than migrate elsewhere.

2. Increasing Appeal to Institutions: Greater scalability and stability, combined with upcoming enterprise-grade features (such as native privacy and contract accounts), could attract fintech and traditional financial institutions deeper into Web3. This aligns with Ethereum’s long-term vision of becoming a “truly global, secure infrastructure.”

3. Enhanced Accessibility for Regular Users: User-friendly payment options and lower entry barriers could drive mass adoption, contributing to overall growth in the crypto market.

However, Spectra also faces challenges:

1. Technical Complexity and Implementation Risks: This upgrade integrates several cutting-edge technologies (PeerDAS, Verkle, etc.), and unexpected issues arose during testing: two testnet activations resulted in validator errors and chain forks, forcing developers to conduct a third test to fix the problems. This highlights the complexity of large-scale protocol upgrades, requiring extreme caution for future changes.

2. Fragmentation in the Layer2 Ecosystem: With multiple L2 solutions currently on Ethereum, achieving seamless cross-chain interoperability and shared liquidity still requires further standards and infrastructure development.

3. Competitive Pressure: Other public chains are not idle, actively advancing their own scalability and UX improvements. While Spectra extends Ethereum’s lead, ongoing technical iterations from competitors remain inevitable. Strategically, Ethereum must continue strengthening decentralization and security alongside performance gains to maintain its edge.

5. Outlook on Future Ethereum Upgrades and Conclusion

Looking ahead, Ethereum’s roadmap continues to evolve. After Spectra, the focus will shift to further refining the protocol and introducing next-generation technologies. The Ethereum Foundation has proposed incorporating two new upgrade targets beyond 2025: Fusaka and Glamsterdam. Fusaka will introduce more complete data availability sampling schemes like PeerDAS, enabling extremely high throughput without requiring nodes to store the entire network data load. Glamsterdam will focus on optimizing gas costs and protocol efficiency, maintaining high performance under complex workloads and providing stronger support for deeply integrated Layer2 Rollups and ZK technologies. Together, these upgrades aim to position Ethereum as a truly global, high-throughput settlement layer.

In summary, the Spectra upgrade marks a major step forward for Ethereum in scalability and user experience, opening doors for DeFi/NFTs, large-scale applications, and institutional use cases. Yet, high technical complexity, intensifying external competition, uncertain regulatory landscapes, and the challenge of multi-layer ecosystem interoperability place greater demands on Ethereum. Whether the ecosystem can fully leverage these opportunities and effectively address the challenges will ultimately determine Ethereum’s standing in the global crypto market.

About Us

Hotcoin Research, the core research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We offer a three-pillar service framework of "trend analysis + value discovery + real-time tracking," delivering precise market interpretations and practical strategies through deep dives into crypto industry trends, multidimensional evaluations of promising projects, and round-the-clock market monitoring. Our weekly《Hotcoin Selection》strategy livestreams and daily《Blockchain Today》news briefings cater to investors at all levels. Leveraging advanced data analytics models and industry networks, we empower novice investors to build foundational knowledge and help professional institutions capture alpha, jointly seizing value-growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and invest only within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News