MEME ecosystem recovery in progress: leader effect helps boost funds and sentiment, liquidity still awaits breakthrough

TechFlow Selected TechFlow Selected

MEME ecosystem recovery in progress: leader effect helps boost funds and sentiment, liquidity still awaits breakthrough

The "head effect" is gradually becoming the core driver of traffic and capital, especially as the synergistic effect between platforms and tools further amplifies the market influence of the head, making it a key variable in capital flows and sentiment fluctuations.

Author: Nancy, PANews

Recently, sentiment in the MEME market has gradually warmed, especially driven by several "golden dog" projects, significantly boosting overall market activity. However, the MEME ecosystem is still in its early recovery phase, with capital confidence yet to fully return. Meanwhile, against a backdrop of insufficient liquidity and high emotional sensitivity, the leader effect has increasingly become the core driver of traffic and capital flows—particularly as the synergies between platforms and tools amplify leaders' market influence, making them key variables in fund flows and sentiment shifts.

Launchpad: Strong Leader Effect Driving Emerging Platforms

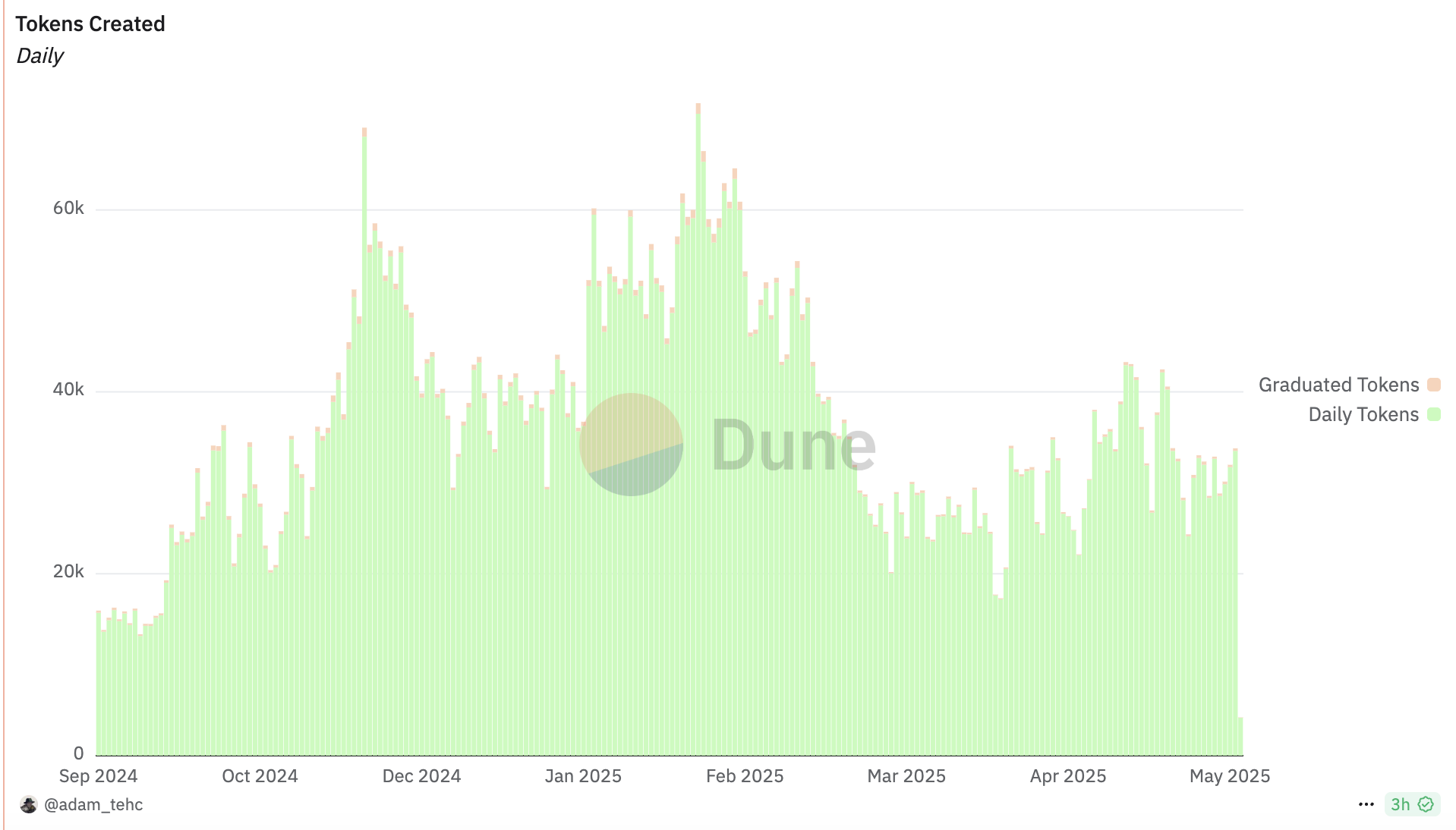

Although the MEME market has shown signs of recovery, the number of token creations and user activity levels remain far from historical highs.

Taking Pump.fun—the current main hub for launching MEME tokens—as an example, according to Dune data, daily token creation on the platform exceeded 33,000 as of May 7, up 48.6% from previous lows (around 17,000), but still only 47.5% of its historical peak. On token graduation rates, it has rebounded to 0.81%, a clear improvement from the lowest point, though still far below the historical high of 1.67%. In terms of user activity, Pump.fun currently sees 199,000 daily active wallets, a 55.1% rebound from last month’s low, yet only 46.9% of its historical peak (approximately 424,000). Notably, from a new user perspective, daily new wallet additions are around 94,000, still limited compared to the historical peak of over 216,000. This suggests that while short-term MEME enthusiasm has clearly returned, overall user participation and liquidity breadth have not yet fully recovered.

Nonetheless, some emerging token launch platforms are rapidly expanding by leveraging the leader effect. For instance, Boop, which recently gained popularity, successfully harnessed FOMO driven by KOLs, platform incentives, and precise market timing to achieve rapid user growth and market cap surges through the leader effect. However, this approach also faces challenges such as short-term user retention due to KOL airdrops and competitive pressure from rivals potentially replicating its strategy.

Notably, several recently hyped "golden dog" projects have demonstrated a significant leader effect—where influential figures like KOLs and large holders drive traffic and capital inflows, creating snowball-like propagation that further amplifies token narratives. For example, major holders collectively pushed Fartcoin's market cap past $1 billion again, while House gained sudden popularity after promotion by well-known KOLs like ansem and him. In contrast, recent MEME coins relying on event-driven or grassroots narratives, although capable of attracting short-term attention, have struggled to convert traffic into sustained capital inflows, leading to rapid declines in popularity.

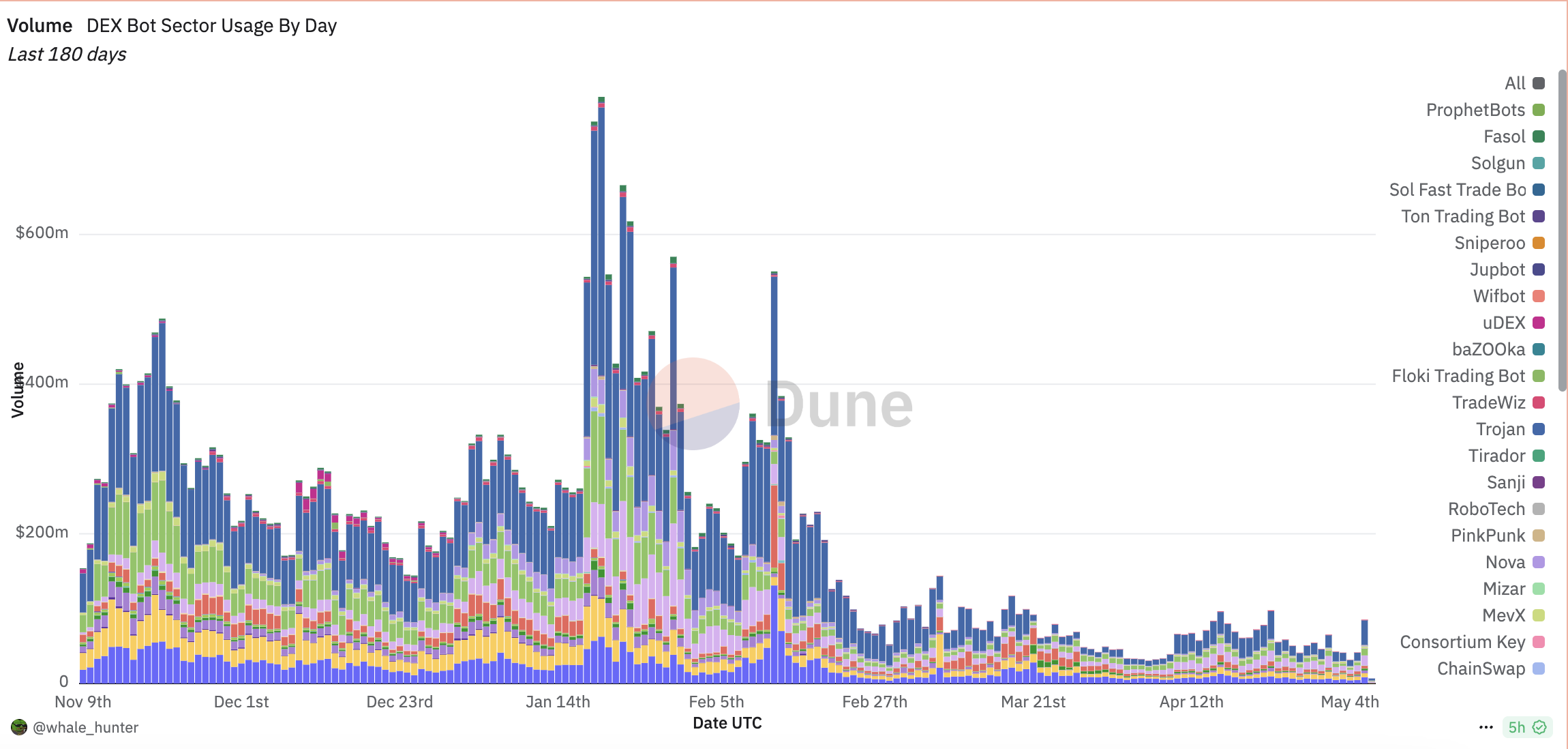

Trading Bots: Trading Volume Recovers, Still Nearly 90% Below Peak

Trading bots are becoming essential tools for on-chain users to enhance trading efficiency and have recently rebounded alongside improving market sentiment. Dune data shows that as of May 6, daily trading volume via bots reached $85.37 million, with over 57,000 daily users—up nearly 64.1% and 43.8% respectively from recent monthly lows. However, compared to January's peak, daily trading volume and user numbers remain down 89.1% and 62.5%.

For retail investors, trading bots offer features like smart money tracking, automated copy-trading, and on-chain data analysis, enabling them to monitor and quickly capture real-time moves by KOLs and large holders in information-asymmetric markets, thereby improving participation efficiency and reducing PVP risk.

Meanwhile, retail users tend to place high trust in trading bots endorsed or used by leaders, and this endorsement effect significantly boosts the market adoption and activity of such bots. Naturally, due to their capital size and market influence, leaders prefer bots that are easy to operate, fast-executing, and highly successful in trades to maximize efficiency and returns. Therefore, whether trading bots can meet demands in functionality diversity, security, and response speed is central to leaders’ willingness to adopt them. Of course, there remains the potential risk of some leaders using bots for market manipulation.

For example, Axiom, which emerged recently, quickly gained favor among MEME traders thanks to advantages like support for complex strategies, efficient execution, and user-friendly design—particularly meeting core needs of leaders (KOLs/large holders)—and rapidly rose to become the leading player in the trading bot sector.

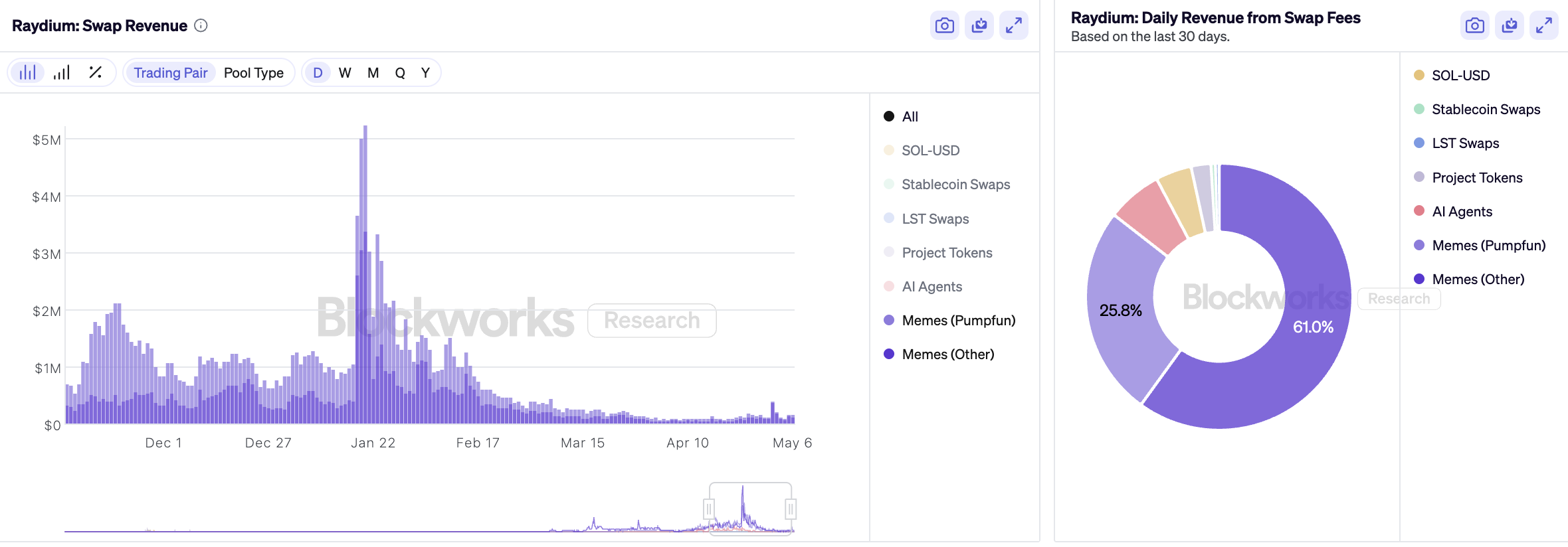

DEX: MEME Revenue Plummets, PumpSwap Shows Early Advantage

MEMEs remain one of the core revenue sources for DEXs. Take Raydium as an example: Blockworks data shows that in the past 30 days, MEME-related trading accounted for 86.8% of its daily trading revenue, while revenue from MEME token launches made up as high as 93.5%—highlighting their dominant role in shaping the platform’s overall revenue structure.

However, revenue from MEMEs is experiencing a sharp decline. Blockworks data indicates that as of May 6, Raydium’s daily revenue from MEME trading stood at just $156,000—down over 97% from its January peak of $5.244 million. Likewise, daily revenue from MEME token issuance has fallen from a high of $149,000 to merely $19,000, reflecting a rapid cooling in market enthusiasm and a clear retreat in speculative sentiment.

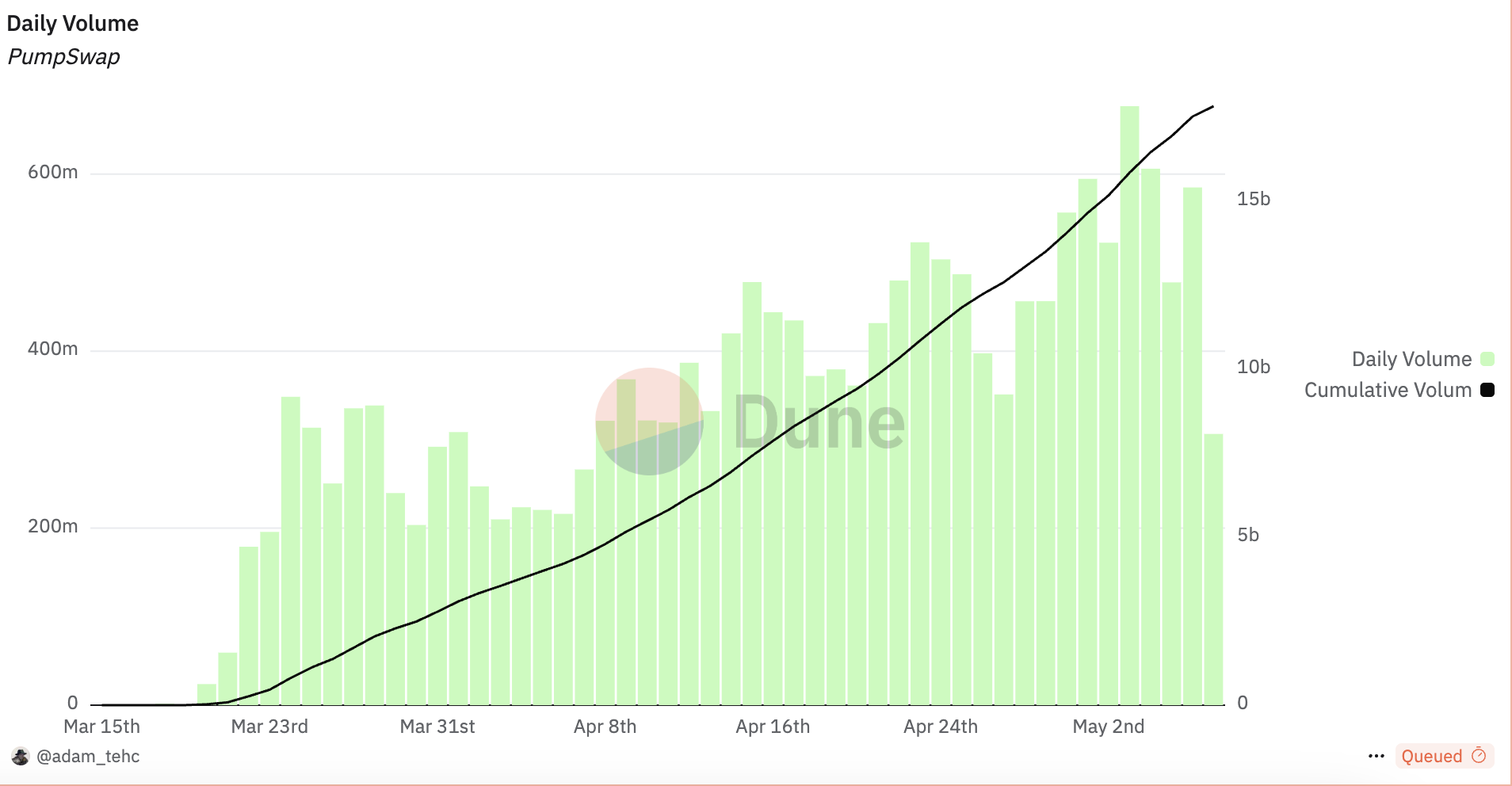

In contrast, PumpSwap has shown strong momentum. Dune data reveals that since its launch on March 20, the platform has accumulated $17.67 billion in trading volume, with a marked upward trend starting in early April and a single-day high exceeding $670 million. Platform user activity has also steadily climbed, rapidly attracting a large number of new users during its cold-start phase, followed by a gradual increase in returning users—indicating strong user retention. Particularly in early May, its daily active wallets briefly surpassed 450,000. Notably, as of May 7, PumpSwap accounted for 12.7% of Solana’s total DEX trading volume, securing an initial competitive edge within the ecosystem.

In this process, the role of large holders and KOLs cannot be overlooked—they not only drive significant increases in MEME trading volume but also accelerate liquidity pool expansion and concentrated user influx, serving as core drivers behind the platform’s short-term breakout.

Wallets: Activity Rebounds, Down Over 80% From January Peak

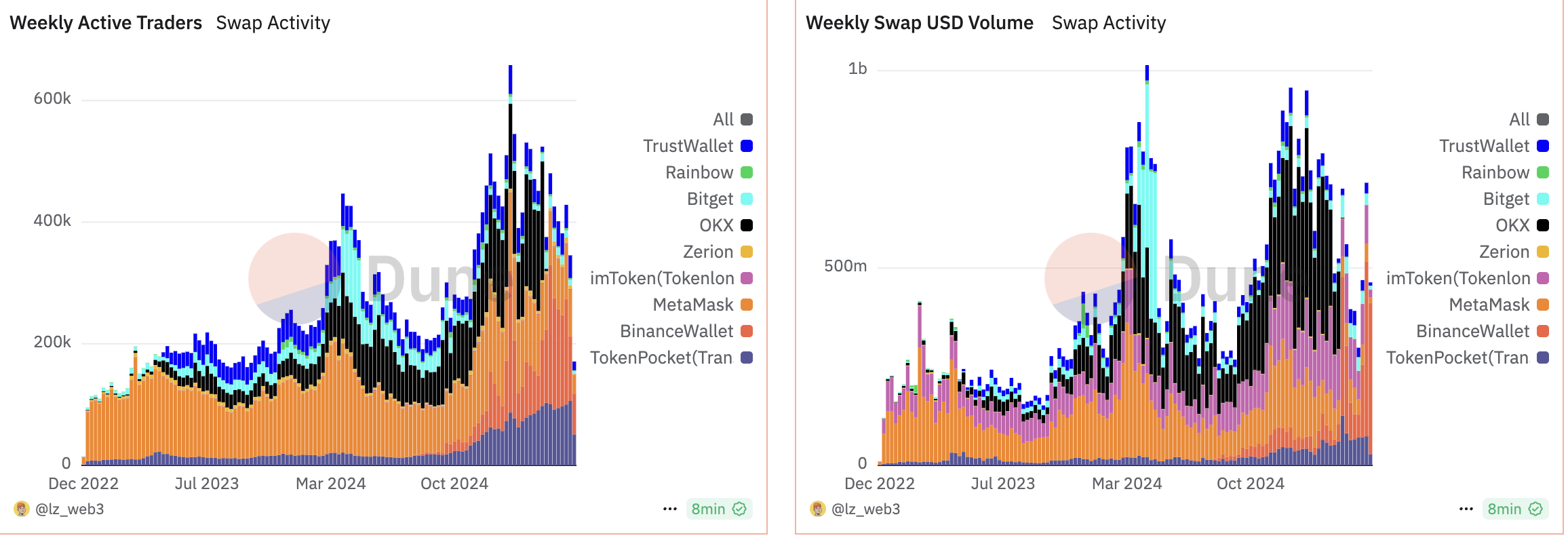

Wallet usage is another key indicator of on-chain sentiment. Dune data shows that as of May 5, weekly transaction volume across major wallets exceeded $460 million, a 35.2% rebound from recent lows, but only 51.6% of this year’s peak (approximately $950 million). At the same time, weekly active addresses reached 17,000, a drop of over 80.4% from January’s peak of 87,000. This indicates that while transaction scale has somewhat recovered, user engagement remains low, with overall on-chain activity still in the early stages of recovery and market sentiment yet to fully rebound.

Likewise, a wallet’s appeal and user stickiness depend on core factors such as functional completeness, breadth of use cases, and ecosystem integration. For example, high-market-share wallets like OKX Web3 Wallet and Binance Wallet have successfully attracted a large number of MEME traders, becoming mainstream choices in this niche. In this process, usage rates and word-of-mouth effects from large holders and KOLs have played a critical role, significantly boosting wallet visibility and enhancing trust and adoption intentions among ordinary users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News