CZ's implied confrontation with dingaling, netizens take sides online

TechFlow Selected TechFlow Selected

CZ's implied confrontation with dingaling, netizens take sides online

Blur's CRO, real NFT diamond hands.

Author: TechFlow

Welcome back to the first day after the May Day holiday—crypto markets still have no shortage of drama and hot topics.

During the holiday, $BOOP, the native token of the new token launchpad Boop.fun, was clearly one of the top performers, briefly surpassing a $500 million market cap. And with Binance Alpha listing $BOOP yesterday, community attention on the token has intensified.

Yet amid the excitement around the new token launch, a cryptic post from CZ quickly sparked widespread discussion in the community about Boop.fun founder dingaling.

On May 5, CZ replied to a post on X implying that a former employee had been fired for insider trading ("rat trading"), and that this person falsely claimed to have been Binance's CXO—a position that doesn't even exist at Binance.

Although CZ emphasized not to take it personally, the original post he replied to described "a founder recently launching a platform project on Solana claiming to revolutionize meme token mechanics"—a description that is quite explicit.

If you've been following market trends, it doesn't take much to realize this refers directly to Boop.fun and dingaling.

The most interesting part? On dingaling’s public profile (with 250k followers), in addition to identifying himself as the founder of Pancakeswap, he does list a former title as Binance "CRO." Combined with CZ’s statement that Binance never had any CXO role, the implication becomes unmistakable.

When facts align closely, saying “not to take it personally” sounds more like camouflage or self-protection. Though neither party has engaged in direct confrontation, the veiled jabs have already set the community ablaze.

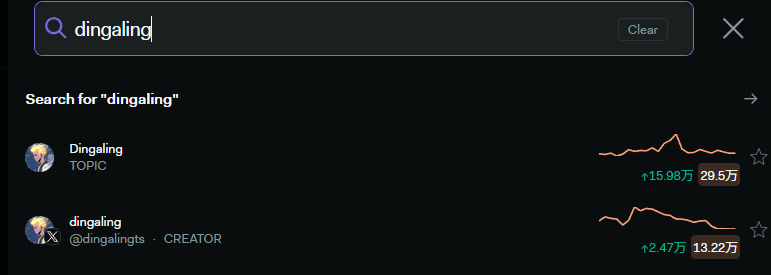

If you search for "dingaling" on crypto social sentiment platforms, you’ll find discussions about him spiking sharply in a short time, with many in the community passionately debating the matter.

Beyond defensive arguments driven by personal $BOOP holdings, more valuable discussions focus on dingaling’s past and Boop’s future trajectory.

Fuzzy CRO, Real NFT Diamond Hands

Who exactly is dingaling?

The title "CRO" is ambiguous—some guess Chief Risk Officer, others Chief Revenue Officer, or Chief Research Officer.

Dingaling himself hasn’t clarified what CRO stands for. Following CZ’s cryptic post, some netizens jokingly suggested it stands for Chief Rat Officer (implying he was fired for rat trading).

Jokes aside, beneath the vague title lie traces of his past.

Crypto blogger NFT Ethics revealed that dingaling’s early Twitter handle was @DinghuaXiao, seemingly matching his full name. Although most of his links to Binance have since been scrubbed from the web, screenshots from community members show that users could previously message him directly on Telegram for help with Binance-related issues.

This suggests a customer support or client relations role.

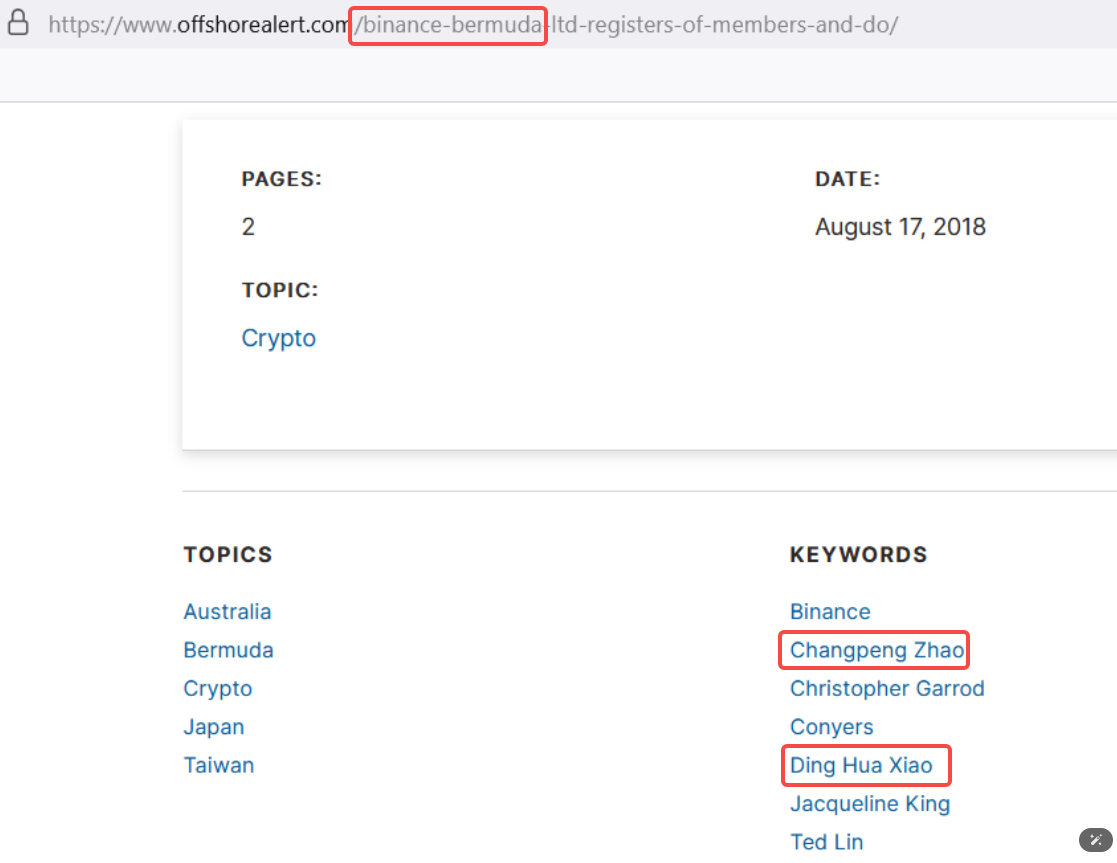

Beyond this public-facing role, NFT Ethics pointed out a lesser-known connection: dingaling was once one of the key figures in Binance’s offshore entity in Bermuda. Screenshots (now possibly taken down) showed both CZ and Ding Hua Xiao listed on the company’s website.

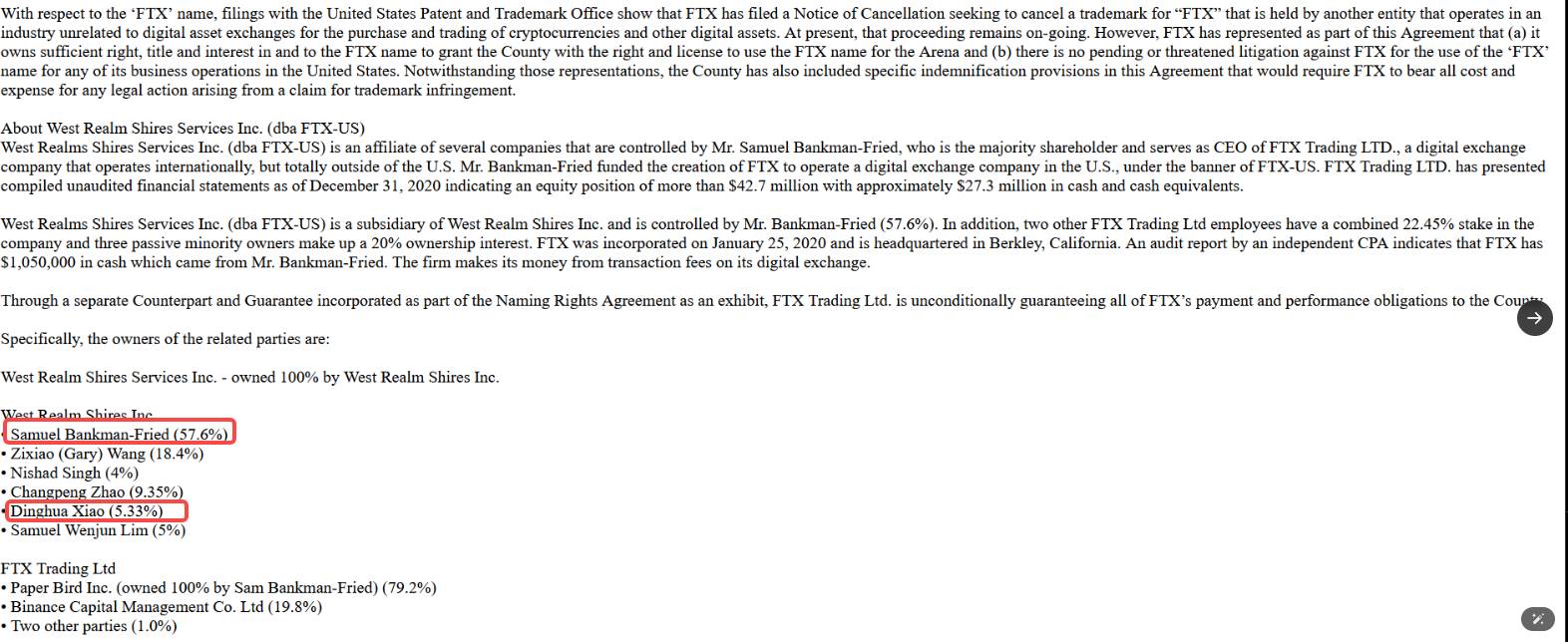

Further details indicate Ding Hua Xiao was also a member of West Realm Shires Inc, the joint venture between Binance and FTX. This entity controlled FTX’s U.S. operations (FTX-US).

Documents show shareholding proportions among SBF, CZ, and Ding, with Ding holding 5.33%. While not a majority stake, it confirms his close ties to both FTX’s core team and CZ.

Most of NFT Ethics's revelations were made in 2022, so their current validity is uncertain. We can’t definitively determine dingaling’s exact role at Binance, but piecing together these clues offers a glimpse.

One thing is clear: dingaling was certainly no ordinary employee.

While his titles remain vague, his actions in the crypto space are well-documented—which explains why the community is so invested in discussing him:

An OG player and renowned diamond hands in the NFT world.

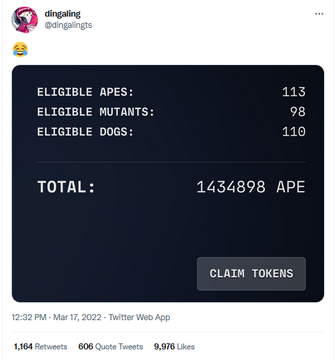

He’s considered one of the most successful "NFT investors," having earlier held 113 Bored Ape Yacht Club (BAYC) NFTs and over 70 Azukis, accumulating more than 1.4 million Ape airdrops worth tens of millions of dollars at their peak.

He was also an early investor in CryptoKitties and one of the largest investors in NBA Top Shots.

The community calls him an "NFT OG" and "diamond hands" because he rarely engages in short-term pump-and-dump schemes. Instead, he’s known for buying large volumes of floor-price NFTs and holding them long-term.

At the height of the NFT boom, many players treated dingaling’s purchase of an NFT as a signal of its blue-chip quality. His floor-sweeping strategy often boosted prices, benefiting other holders of the same NFTs, thus earning broad community trust.

LooksRare’s Failure—Can Boop Succeed?

As an NFT trader, dingaling has undoubtedly been successful—arguably a legend. But when it comes to investing in or building products, his track record is less impressive.

In 2022, dingaling joined LooksRare as an advisor and investor. At the time, OpenSea dominated the NFT marketplace space, and LooksRare aimed to challenge its leadership and capture significant market share.

Initially, LooksRare launched a $LOOKS rewards program to incentivize trading, and trading volume briefly approached OpenSea’s levels. But the momentum didn’t last. As overall market conditions weakened and rampant wash trading emerged, the NFT market collapsed—and LooksRare failed to gain lasting traction.

In terms of price, $LOOKS peaked around $7 but now trades around $0.01—effectively zeroed out, a relic of a bygone era.

History seems to repeat itself. In this cycle, Pump.fun has risen to prominence, and a wave of challengers and innovators have emerged to dethrone it—Boop.fun being one of them.

With a similar launch mechanism and slightly different reward structures, will Boop repeat LooksRare’s failed attempt to unseat a dominant player?

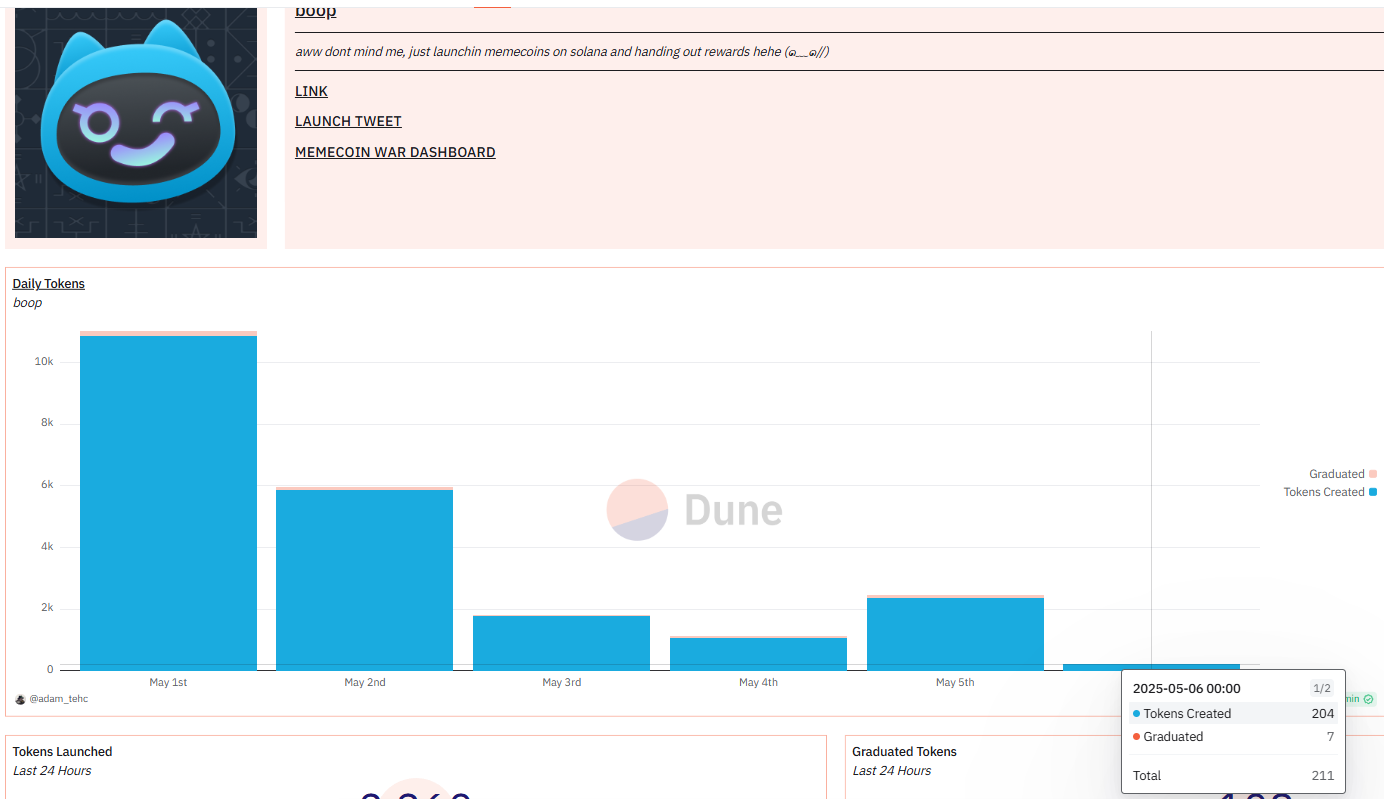

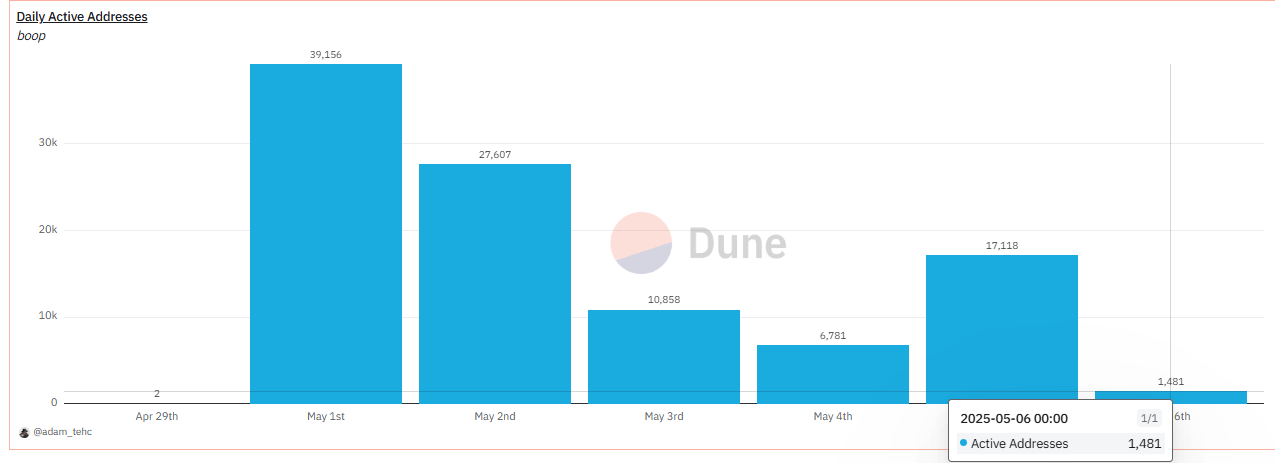

Data from Dune’s dashboard on Boop.fun shows that within five days of launch, daily token launches declined noticeably. By the day before publication, daily launches had dropped from an initial 10,000 to just 1,000–2,000 tokens, with active addresses also decreasing daily.

In a market environment plagued by insufficient liquidity and intense PVP (player-versus-player) dynamics, Boop.fun’s viability remains uncertain.

Community Fallout: Can Ants Shake a Tree?

No one knows Boop.fun’s future—but already, some are defending dingaling and turning criticism toward CZ.

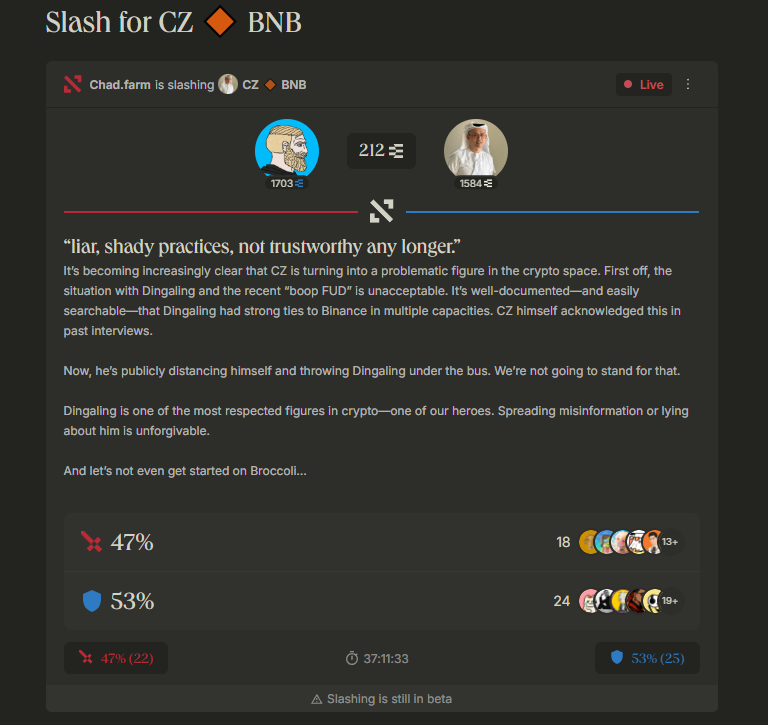

On Ethos Network, a small user @chadstrdaumus0 with only 215 followers initiated a “slash” proposal attempting to use decentralized governance to penalize CZ for spreading FUD about Boop.

The mechanism works like this: Ethos Network is a decentralized social platform aiming to build a reputation system for the crypto economy. Users stake ETH to generate reputation scores, allowing them to review others (positively or negatively) or initiate “slash” proposals to punish bad behavior such as spreading FUD or fraud. Slashes require community voting; if passed, the target’s staked assets may be confiscated and their reputation score damaged.

@chadstrdaumus0’s proposal directly targets CZ, arguing his cryptic post made unfounded accusations against Boop and dingaling, harming the project’s prospects.

This is very Web3—anyone can challenge another’s言论 based on their own logic, even if that person is CZ.

However, participation in this discussion remains limited. Some point out that such accusations require solid evidence to succeed—clear, detailed proof such as whether the CRO title ever existed, or whether dingaling actually held such a role. Right now, it’s too easy to accuse CZ of a "guilt by suggestion" without concrete backing.

Still, for the proposer, the truth might not be the priority—position size is.

Corporate Brand vs. Crypto OG Reputation

Looking back, CZ’s indirect jab was barely veiled, while dingaling hasn’t removed his “ex-Binance CRO” title. What motivates each side?

CZ’s cryptic post may seem casual, but on closer inspection, it could reflect strategic distancing.

If dingaling continues claiming to be “ex-Binance CRO,” especially with Boop now listed on Binance Alpha, any price crash or negative incident could damage Binance’s credibility—raising suspicions of利益 transfer or insider dealings.

As the world’s largest exchange, Binance has faced regulatory scrutiny (e.g., the 2022 U.S. investigation). CZ’s sensitivity to brand image is understandable.

Unless dingaling is unaware of CZ’s comments and the surrounding buzz, his decision to keep the title unchanged likely signals a deliberate stance.

He may not have actively used the “CXO” title to promote Boop, but all publicly available information—including his NFT OG status and even the ambiguous CRO title—can serve as reputational capital. Quietly leveraging that reputation to give Boop a stronger launch is, in itself, a smart move.

We don’t know the private grievances behind this clash, but one thing is certain:

No statement in crypto is made without motive. Every voice speaks in defense of what they believe is worth fighting for.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News