Where Did the Stablecoins Go?

TechFlow Selected TechFlow Selected

Where Did the Stablecoins Go?

Stablecoins are independently permeating every crevice of the global economy, decoupled from the crypto market.

By TechFlow

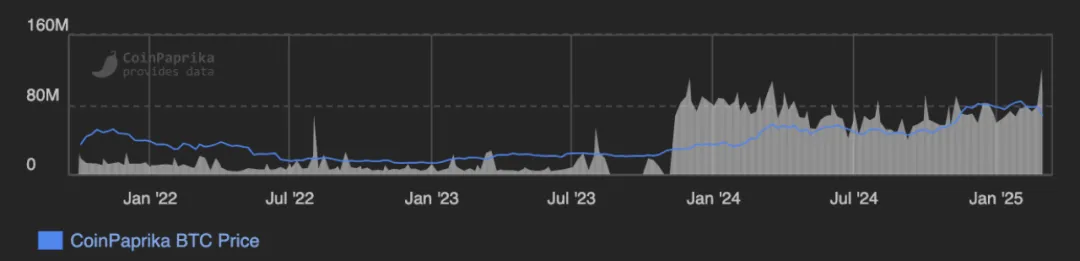

In spring 2025, the crypto market remains icy. Bitcoin's price has fallen from its January high of $109,000 to a low of $75,000.

Trading volumes have slumped alongside market volatility. Sector-wide rallies have gone silent, replaced only by sporadic coin movements capturing short-term market attention.

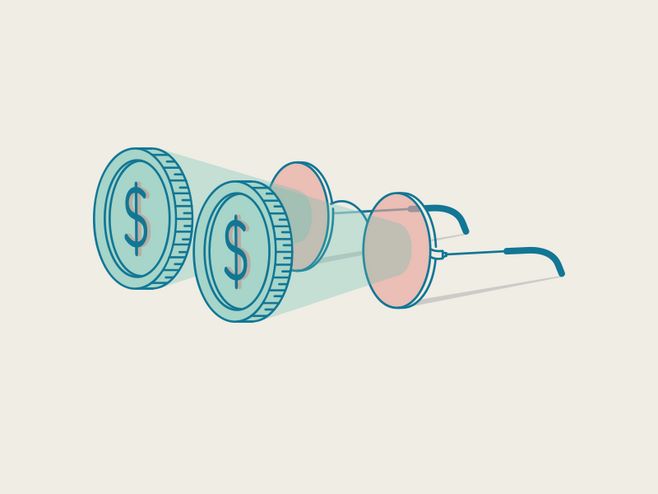

Yet amid this downturn, the stablecoin market tells a different story: According to Artemis, stablecoin total market capitalization reached $231.6 billion by April 2025—up 51% from $152.6 billion in the same period of 2024.

As the broader crypto asset market weakens, stablecoins continue expanding. So here arises the question: If newly issued stablecoins are not flowing into crypto investments, where exactly are they going?

Beyond Crypto: Stablecoins Rapidly Taking Root in the Real World

As foundational infrastructure in the blockchain ecosystem, stablecoins dominate on-chain transactions and serve as essential tools for token swaps, DeFi operations, and transfers among crypto users.

Yet their influence has long transcended the boundaries of crypto, taking root and growing steadily in the real world.

In terms of market cap, stablecoins directly account for 5% of the total cryptocurrency market value. When including stablecoin-issuing companies and blockchains primarily focused on stablecoins (such as Tron), this proportion rises to 8%.

Notably, major stablecoin issuers operate similarly to MasterCard, reaching end-users through intermediaries like exchanges and payment service providers.

Take Argentina as an example. Although local crypto exchanges such as LemonCash, Bitso, and Rippio are relatively unknown globally, they collectively serve a staggering 20 million users—half the size of Coinbase’s user base—despite Argentina’s population being just one-seventh that of the United States. Lemon Cash alone generated around $5 billion in transaction volume last year, mostly concentrated in stablecoin-related trading.

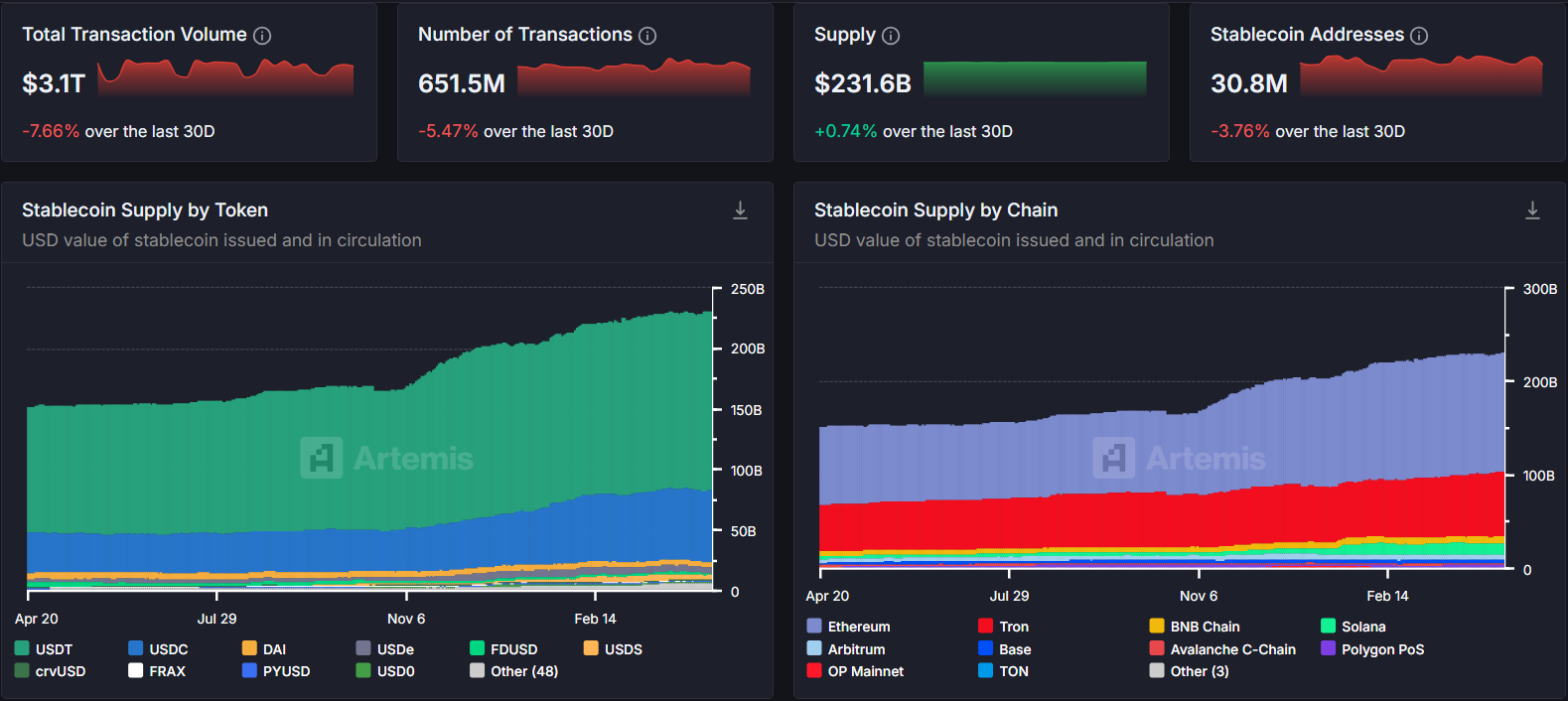

More strikingly, according to Artemis data, of the $206.78 billion in circulating stablecoins as of March 2025, traditional crypto use cases such as CEXs and DeFi accounted for only a small share. A massive 67% ($138.6 billion) flowed into "unclassified applications."

The majority of stablecoin flows move through untracked data blind spots—their secrets locked within black boxes outside the crypto sphere.

In Illicit Trade, Stablecoins Are Circulating “Stably”

On the darker side of societal norms, stablecoins are weaving a vast network across gray and black industries.

Liu Ping (a pseudonym), who works in cross-border e-commerce, explains that while正规 dollar settlement platforms like Airwallex, Payoneer, and PingPong require strict qualification reviews and verified order data, “there’s always demand for alternative solutions,” especially among merchants selling counterfeit goods, infringing products, or illegal weapons. These illicit vendors either pay premium prices to access “gray-market backdoors” on platforms or directly use USDT for payments.

As Liu Ping notes, a corresponding underground industry has emerged: after receiving funds via platform backdoors, illegal merchants quickly funnel money through underground banks to convert it into USDT and withdraw it—“essentially making those who open backdoors profit at the expense of their own company’s losses.”

She also highlights more covert practices in digital advertising: “Certain gray-market accounts specifically run illegal ads on platforms like Facebook—for instance, promoting firearms. The funding often comes from stolen credit cards. There are people专门 buying up these stolen card limits, topping up ad accounts, then reselling the balances at a discount in USDT. A $2,000 ad credit might be sold for just $1,500–$1,700 worth of USDT.”

“Cross-border merchants actually want to settle in USDT—it’s flexible, has no exchange rate spread, and helps mitigate some asset risks. But正规 platforms hold licenses, collect USD, and must comply with foreign exchange regulations,” Liu Ping admits.

“But licensed platforms must follow rules. Gray-market backdoors essentially give scammers a window to exit via USDT. Small amounts get withdrawn directly, causing losses to the platform; sometimes fraudsters collude with platform employees—say, a scammer collects $3 million but can withdraw $2 million, with the remaining $1 million split between the platform and the insider who opened the door.”

This pattern extends domestically. In Shenzhen’s Waterbeach Market—the largest jewelry and gold trading hub in China—tens of thousands of gold merchants cluster within one square kilometer, accounting for 75% of China’s market share. Here, stablecoins have become a covert tool for gray-market currency exchange.

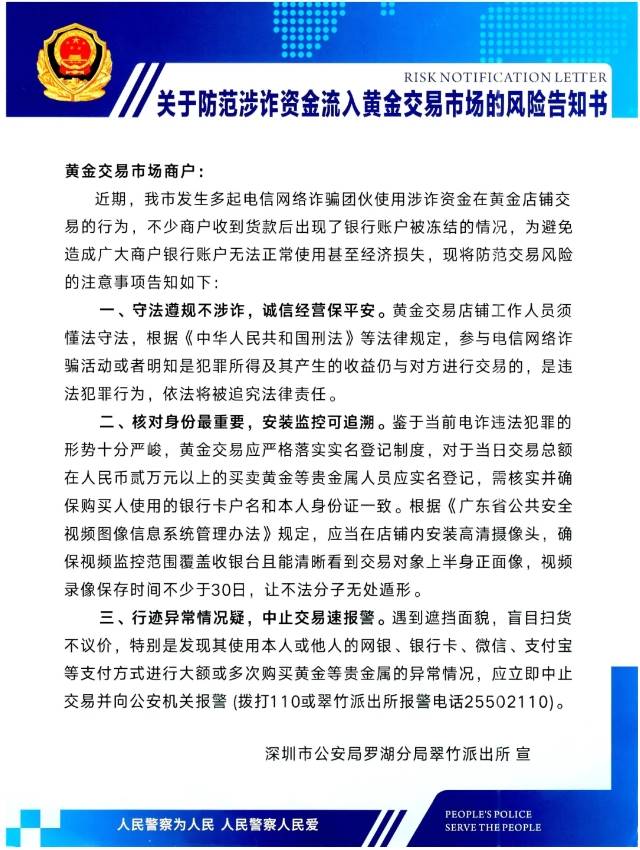

In 2024, Luohu Branch of Shenzhen Public Security Bureau issued a risk advisory requiring real-name registration for any gold transactions exceeding 20,000 RMB in a single day, targeting underground trades in Waterbeach.

Industry insiders reveal that currency exchange in Waterbeach is “mature and convenient.” Clients contact “exchange agents” through referrals, who then manage the entire process.

Some inconspicuous stalls see massive daily cash flows. “Regular customers” pay in cash or card for gold bars, and staff deliver physical gold instantly based on real-time prices.

To reduce risk, exchange agents typically delegate smaller transactions (under 10 million RMB) to subordinates. Larger deals go through members’ seats at gold exchanges. Compared to physical stalls, using exchanges suits rapid, high-volume transfers—though fees are higher.

Through this buy-sell cycle, clients’ RMB is transformed into anonymized physical gold.

The most critical step, however, is converting the gold into USDT or other stablecoins. Agents help clients install cold wallets (e.g., imToken), depositing USDT after the conversion. Alternatively, if clients prefer immediate fiat withdrawal, the agent can directly exchange for USD or EUR. The entire process can be completed within a day, with commissions usually under 6% of the transaction amount.

This method isn’t foolproof. While the real-name rule hasn’t been strictly enforced, regulators are monitoring large transactions.

Insiders note that “black-on-black robbery” risks persist in gold-for-currency exchanges—unscrupulous dealers may forge documents and abscond. As gold prices surge, so does the incentive to default.

Local “currency exchange agents” leverage complex gold trading networks to convert RMB into anonymous physical gold, then into USDT or foreign currencies—all within a day, with fees under 6%. Despite inherent fraud risks, this remains a typical case of how stablecoins facilitate illicit capital flows, reflecting a much larger global underground money laundering network in operation.

A Billions-Dollar Stablecoin Money Laundering Chain

Underground banks are an indispensable link in the stablecoin money laundering chain.

Also known as “underground banks,” these illegal financial institutions primarily conduct cross-border remittances and fund transfers through unofficial channels. Predominantly located in East and Southeast Asia, they play a central role in global money laundering networks. Often collaborating with casinos, online gambling platforms, and transnational crime syndicates, they rapidly launder illicit funds into the shadows of the global economy.

USDT, pegged to the U.S. dollar, has become the launderers’ preferred instrument—in 2023 alone, illegal crypto transactions involving USDT in Southeast Asia exceeded $5 billion.

Criminals typically convert illicit proceeds into USDT via over-the-counter (OTC) markets, then withdraw as cash or store in cold wallets, achieving anonymity and cross-border movement.

This is especially prevalent in Southeast Asia’s gambling industry. According to SlowMist’s UNODC report, the region hosts over 340 licensed and unlicensed casinos, mainly along the lower Mekong River border areas.

The relationship between casinos and underground banks is best described as “mutually symbiotic.”

Southeast Asian casinos obscure fund origins through “custody” arrangements and sham “investments,” forming intricate money laundering chains. The anonymity and non-face-to-face nature of online gambling further complicate fund tracing.

Gambling intermediaries sit at the core of this laundering pipeline. The founders of Asia’s two largest gambling intermediaries—Suncity and D'Amico—were sentenced to 18 and 14 years respectively for money laundering and organized crime. Through casinos, online gambling platforms, and underground banks, they processed over $100 billion in funds. These intermediaries used stablecoins to transfer money, evade capital controls, and relied on unregulated payment firms to complete transactions.

Huione Group, a Cambodian financial entity, provides fund transfer services for Southeast Asian online gambling and fraud operations through its guarantee business. Its payment platform, Huione Pay, is deeply involved in money laundering activities.

In July 2024, Tether froze TRON wallets linked to Huione, involving 29.62 million USDT. Yet despite the freeze, Huione continued operating through new addresses.

Due to weak regional regulation and a surge in unauthorized virtual asset service providers (VASPs), underground banks continue to expand their operational space. In 2023, economic losses from cyber fraud in East and Southeast Asia were estimated at $18–37 billion.

Stablecoins Amid Geopolitical Tensions

In geopolitical conflicts, stablecoins are playing an increasingly significant role.

Since Western sanctions cut Russia off from SWIFT in 2022, cryptocurrencies—especially stablecoins—have become vital alternatives for cross-border settlements. Russian businesses now convert rubles into USDT to pay overseas suppliers, bypassing the dollar-based system.

To adapt, the Russian government has taken proactive steps: starting September 1, 2024, it permitted digital currencies in cross-border transactions. By November, crypto mining was legalized, allowing legal entities and individual entrepreneurs registered with the Ministry of Digital Development to legally mine crypto.

Meanwhile, many Russian oligarchs have transferred assets to the UAE—a jurisdiction not aligned with Western sanctions—using cryptocurrencies to liquidate holdings or directly purchase property in Dubai.

However, the U.S. has responded accordingly. Garantex, a Russian crypto exchange, exemplifies this: despite being sanctioned by the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) in April 2022, its daily trading volume rose sharply—from about $11 million in March 2022 to $121.6 million in March 2025, a more than 1,000% increase.

But the good times didn’t last. With increased regulatory pressure, the EU added Garantex to its sanctions list in its 16th round of Russia sanctions in February 2025.

On March 6, Tether froze approximately $28 million in USDT linked to multiple Garantex-associated wallets, forcing the exchange to suspend all trading and withdrawals and issue asset risk warnings to Russian users.

Stablecoins have now stepped onto the stage of international geopolitical confrontation.

A Safe Haven Against Hyperinflation in Latin America

In Latin America, stablecoins are becoming crucial safe havens against hyperinflation and currency devaluation.

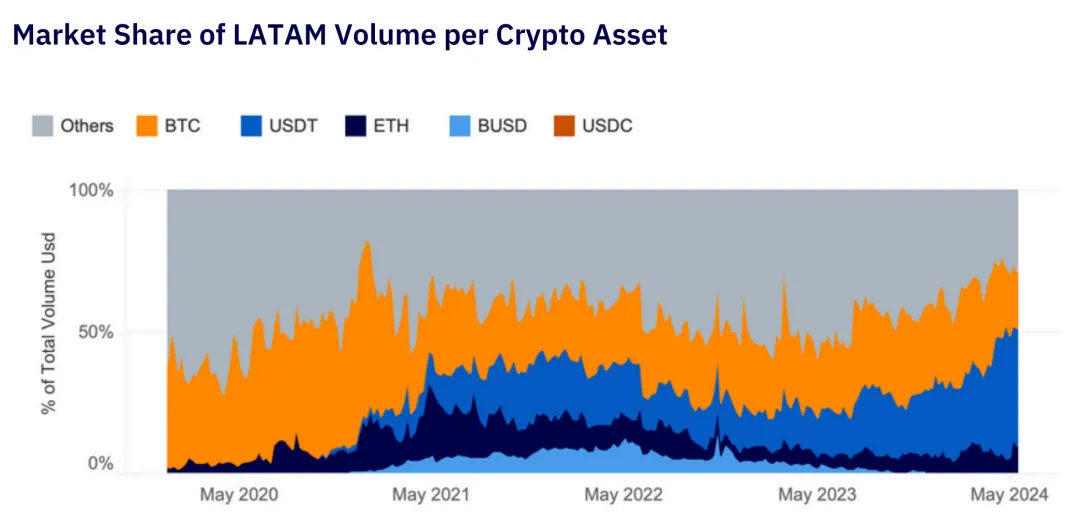

According to Aiying Compliance’s “LATAM Market Report,” political instability and economic crises have driven cryptocurrency adoption, particularly in Argentina, Venezuela, and Brazil. In 2024, LATAM’s total crypto transaction volume reached $16.2 billion, with USDT-related transactions accounting for over 40%.

Crypto transaction volumes in Latin America continue to grow, with stablecoins seeing the strongest gains

Source: “LATAM Market Report” by Aiying Compliance

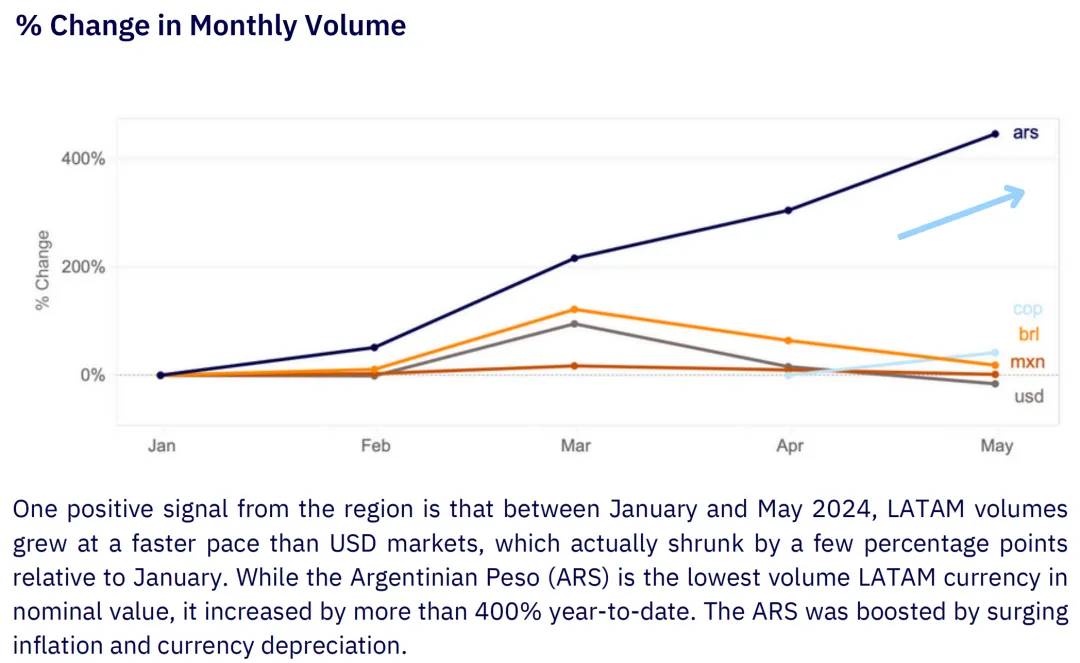

In Argentina, inflation soared past 200% in 2024, with the peso depreciating rapidly. “Yesterday’s peso can’t buy today’s goods”—this has become everyday reality for Argentinians amid economic crisis.

A Chainalysis report indicates that to cope, many Argentinians turn to black markets to buy foreign currency, most commonly USD.

This so-called “blue dollar” trades at informal parallel exchange rates, typically accessed through nationwide underground exchange points known as “cuevas.”

Besides, dollar-pegged stablecoins have also become a popular choice for Argentinians seeking to preserve wealth and fight inflation.

Argentina leads Latin America in stablecoin adoption, with stablecoin transactions making up 61.8% of its crypto volume—slightly above Brazil’s 59.8%, and far exceeding the global average of 44.7%. From January to May 2024, Argentina’s crypto transaction volume surged over 400%.

Argentina’s crypto transaction volume grew over 400% from Jan to May 2024

Source: “LATAM Market Report” by Aiying Compliance

The rise of stablecoins not only offers a solution to inflation but also opens new economic pathways for tens of millions of unbanked individuals across Latin America.

Across the region, millions lacking bank access rely on smartphones and USDT wallets for transactions. Mexico’s largest exchange, Bitso, holds 99.5% of the country’s crypto market share. For everyday savings and remittances, USDT usage continues to grow steadily.

The Future: Interwoven Light and Shadow

Expanding stablecoins flow into both the light and dark sides of the global financial system.

On the surface, they shoulder the role of facilitating crypto transactions and circulation, offering users stability amid volatile assets. In the shadows, they enable covert profit channels for gray and black industries.

Stablecoins are moving independently of the crypto market, seeping into every crack of the global economy.

In 2025, stablecoin market cap approaches $250 billion. Behind this number lies a multi-layered struggle between crypto and reality, order and violation, freedom and regulation.

Perhaps stablecoins haven’t delivered the same visible impact as Bitcoin, but they are undoubtedly reshaping the rules of capital flow in a subtler, more pervasive way—becoming an unavoidable component of the global financial system.

On one hand, they provide a stable value anchor for the digital economy, serving vast user groups including millions of unbanked individuals in developing countries. On the other, their anonymity enables more concealed channels for cross-border capital movement, drawing sustained scrutiny from global regulators.

While offering price stability to users, “stablecoins” are quietly undermining the foundations of the traditional financial system. This seemingly contradictory yet unified trait may well be the key to understanding the new landscape of the future financial world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News