How Ethena Grew into a DeFi Cornerstone in Just One and a Half Years?

TechFlow Selected TechFlow Selected

How Ethena Grew into a DeFi Cornerstone in Just One and a Half Years?

Ethena's USDe has become the fastest dollar-pegged asset to reach a $5 billion supply.

Author: ParaFi Capital

Translation: Felix, PANews

In less than 18 months, Ethena has become a cornerstone of DeFi and CeFi infrastructure.

Ethena’s USDe has become the fastest dollar-denominated asset to reach a $5 billion supply. As Ethena continues its rapid growth, this article dives into the protocol's mechanics, focusing on three key areas:

-

Anchor resilience: To what extent has Ethena maintained its peg during significant market downturns?

-

Yield profile and system support: How have the protocol’s asset composition and yield drivers changed year-to-date?

-

Capacity limits: Is Ethena approaching DeFi TVL or open interest caps?

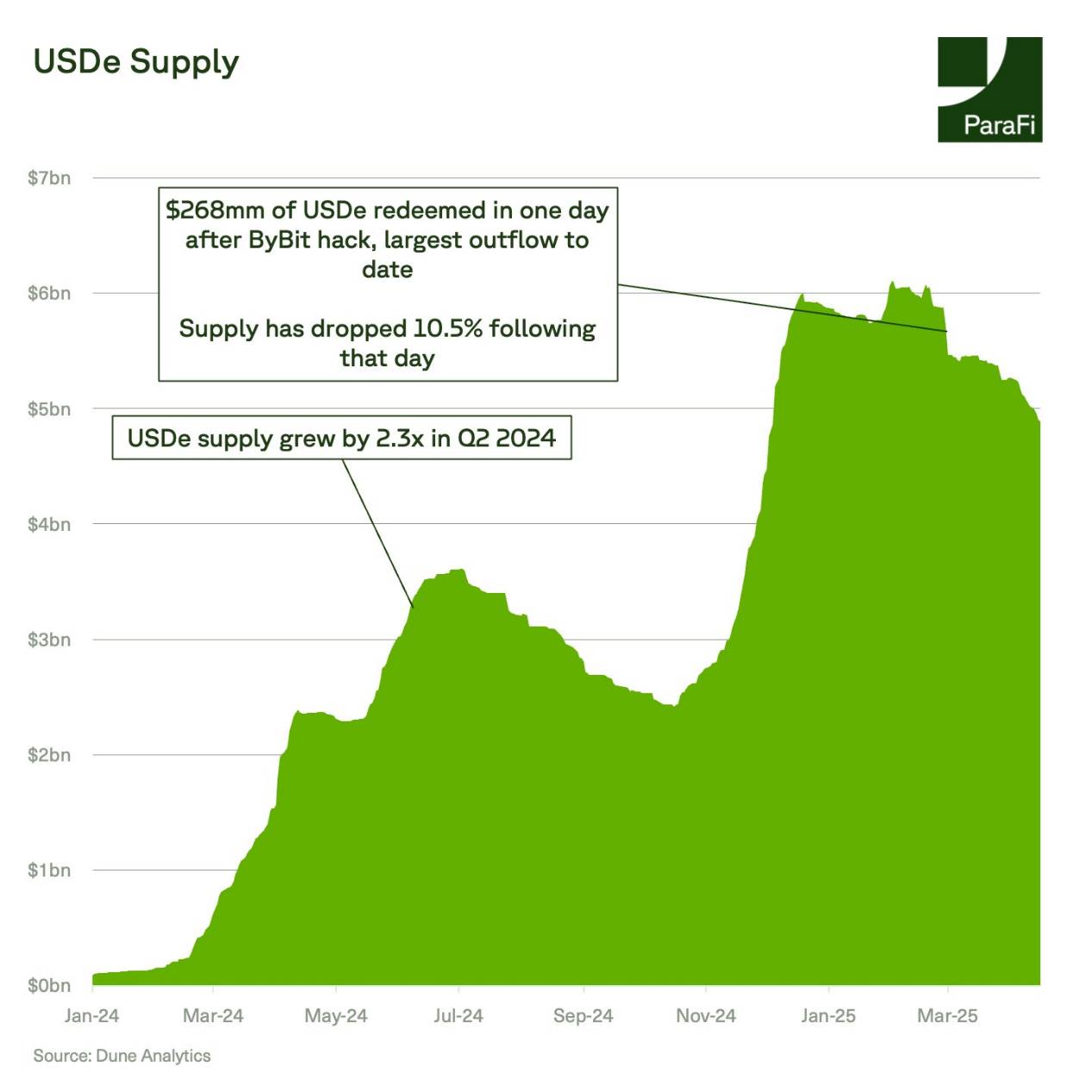

USDe has weathered extreme market volatility, including eight Bitcoin drops exceeding 10%, as well as the largest crypto hack in history. Since launch, the protocol has processed $3.3 billion in redemptions, yet USDe has never deviated more than 0.5% from its dollar peg over the past year. Following “Liberation Day” (PANews note: Trump referred to April 2 as “Liberation Day,” unveiling a global tariff plan), the protocol experienced $409 million in redemptions.

sUSDe has emerged as the yield benchmark in DeFi—a metric that traditional finance (TradFi) institutional investors may increasingly monitor to assess risk appetite and market sentiment.

Ethena’s yield mechanism is rooted in structural advantages.

A significant portion of sUSDe APY comes from funding rates earned through basis trades used to hedge spot exposure. Historically, these funding rates have been positive—positive on 93% of days over the past year.

The yields offered by sUSDe tend to exceed those of BTC funding rates due to two key factors:

-

Not all USDe is staked, meaning yields are concentrated among a smaller supply base;

-

Ethena’s custodial framework supports cross-margin accounts, optimizing capital efficiency. Currently, only 43% of USDe is staked—the lowest level since August.

Over the past six months, sUSDe has delivered an average yield of 12.3%, significantly outperforming Maker/Sky savings rate at 8.8% and BTC funding rates at 9.2%.

Notably, Ethena operates exclusively in high-interest-rate environments where the federal funds rate exceeds 4%. Given that sUSDe yields should be negatively correlated with real interest rates, declining real rates could increase demand for leverage in crypto assets, pushing up funding rates—and thereby boosting sUSDe yields.

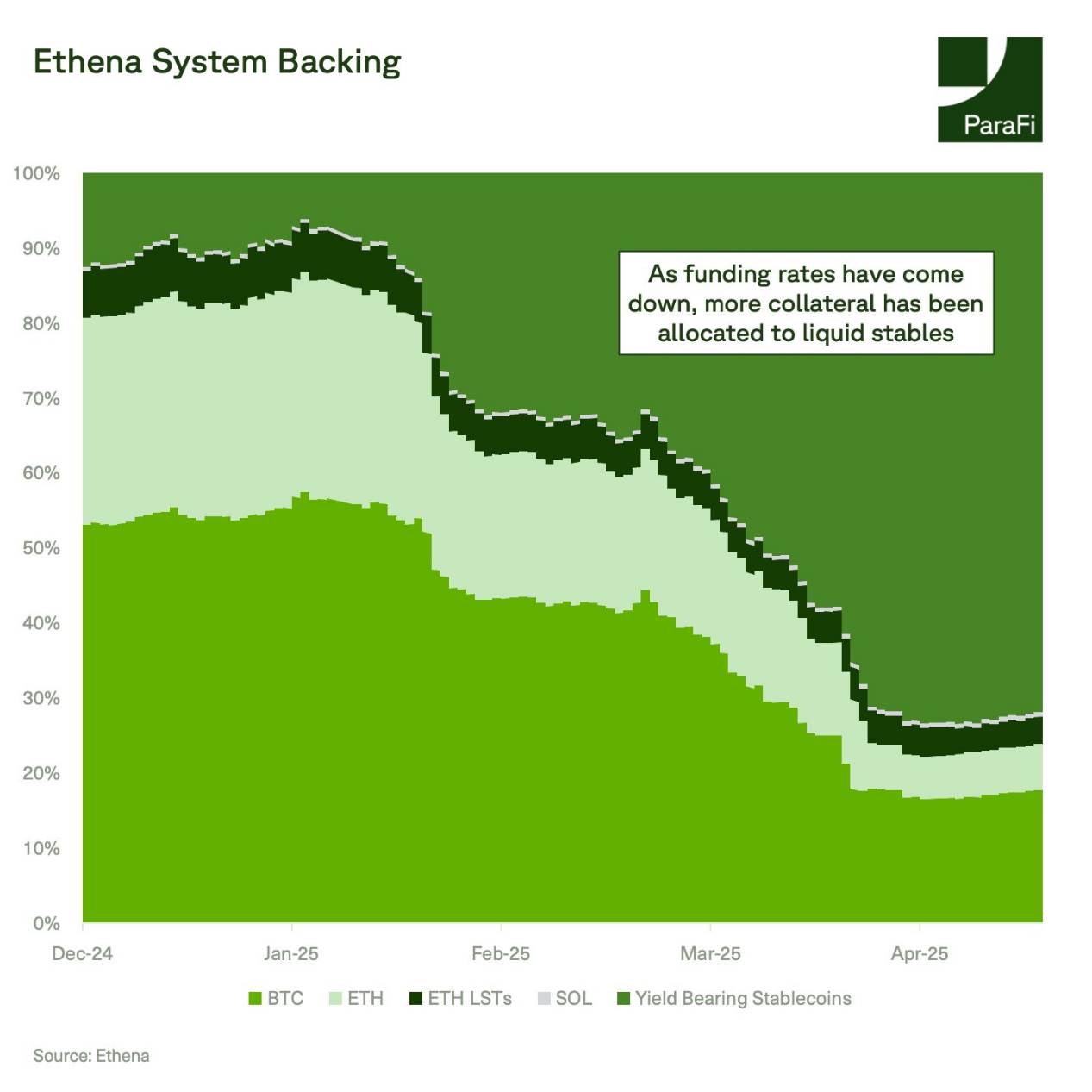

Ethena achieves its yield targets through dynamic collateral management. Depending on yield conditions, Ethena strategically shifts between funding rate arbitrage, stablecoins, and Treasury yields.

In December 2024, Ethena launched USDtb, a stablecoin backed by BlackRock’s BUIDL product, which has grown to over $1.4 billion in supply.

Currently, 72% of Ethena’s collateral is allocated to liquid stable assets—a stark shift from the end of 2024, when 53% was in BTC and 28% in ETH. This transition reflects declining funding rates relative to Sky and Treasury yields.

Capacity constraints were a major concern early on.

Today, with a supply of approximately $5 billion, Ethena’s total TVL represents just 12% of the open interest in Bitcoin, Ethereum, and Solana futures—an inherently conservative measure, as not all of Ethena’s collateral is linked to perpetual contracts.

During periods of explosive open interest growth—such as late 2024—even with a $6 billion supply, Ethena would still account for only 14% of the market share.

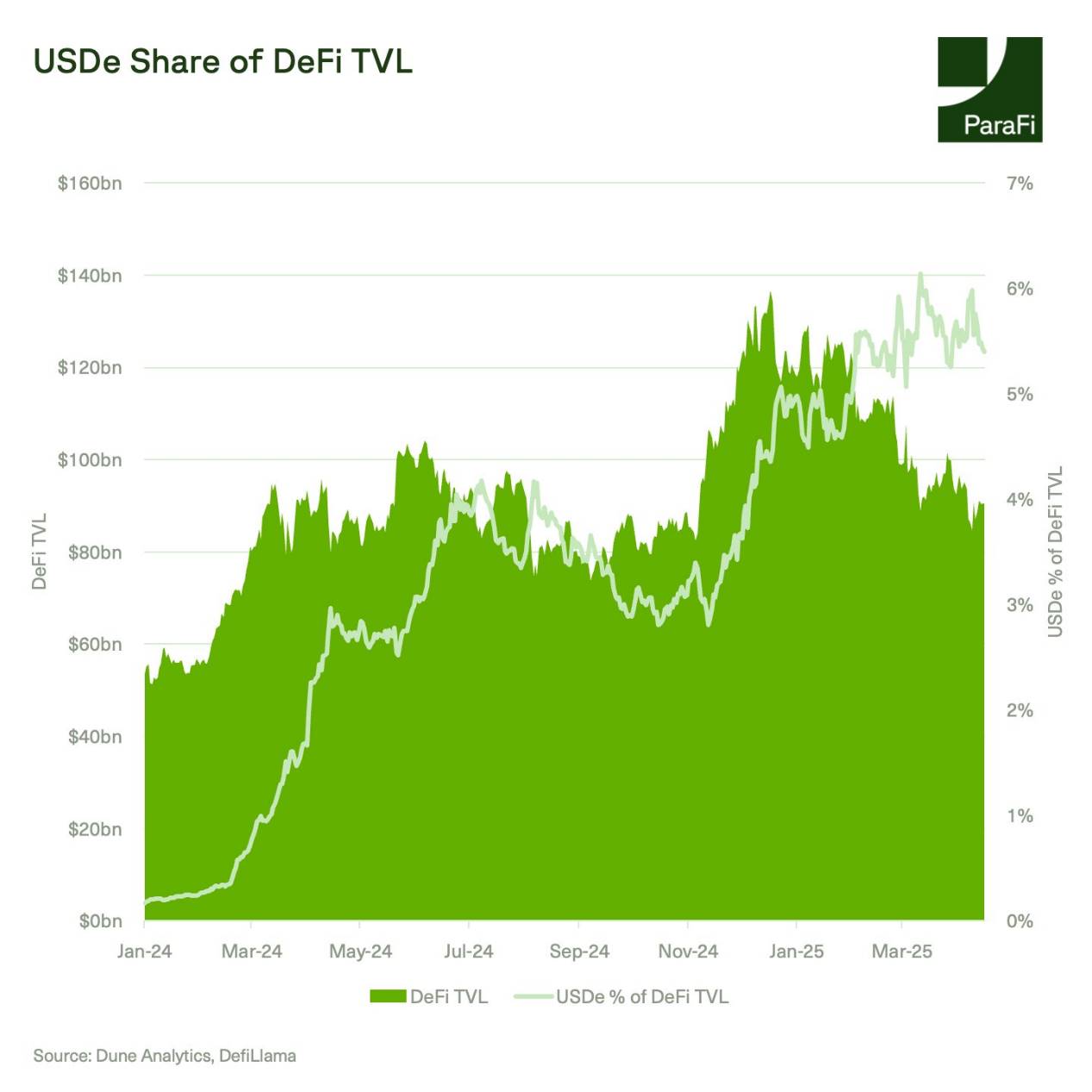

Ethena has solidified its position as a DeFi cornerstone, with deep integration of USDe and sUSDe across the ecosystem.

USDe alone contributes approximately 60% of Pendle’s TVL and about 12% of Morpho’s TVL. Since launch, Ethena’s share of DeFi TVL has steadily increased, reaching around 6% in March this year.

While DeFi TVL has declined 23% year-to-date, in line with recent price trends—and despite ByBit’s February hack—USDe’s TVL dropped only 17%.

What opportunities and risks should be watched ahead?

-

USDe supply under negative funding rate environments

-

Exchange operational risks

-

USDtb supply growth and integrations

-

Institutional adoption of iUSDe

-

Launch of Ethena’s Converge

-

USDe payment use cases

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News