VC Asset Bubble History: Why Does Every New Coin Seem Destined to Zero Out?

TechFlow Selected TechFlow Selected

VC Asset Bubble History: Why Does Every New Coin Seem Destined to Zero Out?

The misalignment between venture capital firms and founders is driving founders toward alternative funding channels.

Author: 0xLouisT

Translation: TechFlow

Altcoins are bleeding continuously—why? Is it due to high FDVs, or CEX listing strategies? Should Binance and Coinbase simply deploy capital into new altcoins via TWAP (time-weighted average price)? The real culprit isn't new—it all traces back to the 2021 crypto venture capital bubble.

In this article, I'll break down how we got here. In follow-up pieces, I’ll explore the impact of this phenomenon on projects and liquid markets, potential future trends, and offer advice for founders navigating the current environment.

The ICO Craze (2017–2018)

The crypto industry is inherently highly liquid—projects can issue tokens at any stage, representing nearly anything. Prior to 2017, most trading occurred in public markets, where anyone could directly purchase tokens through centralized exchanges.

Then came the ICO (Initial Coin Offering) bubble: an era of wild speculation quickly exploited by scammers. It ended like all bubbles do—lawsuits, fraud, and regulatory crackdowns. The U.S. Securities and Exchange Commission (SEC) stepped in, effectively making ICOs illegal. To avoid U.S. jurisdiction, founders had to seek alternative fundraising methods.

The Venture Capital Boom (2021–2022)

With retail investors sidelined, founders turned to institutional investors. From 2018 to 2020, crypto venture capital gradually expanded—some firms were pure VCs, others were hedge funds allocating a small portion of their AUM to venture bets. At the time, investing in altcoins was contrarian—many believed these tokens would eventually go to zero.

Then came 2021. The bull market sent VC portfolios soaring—on paper, at least. By April, many funds were seeing 20x to 100x returns. Crypto VC suddenly looked like a “money printer.” Limited partners (LPs) flocked in, eager to ride the next wave. VCs raised new funds 10x or even 100x larger than before, convinced they could replicate these extraordinary gains.

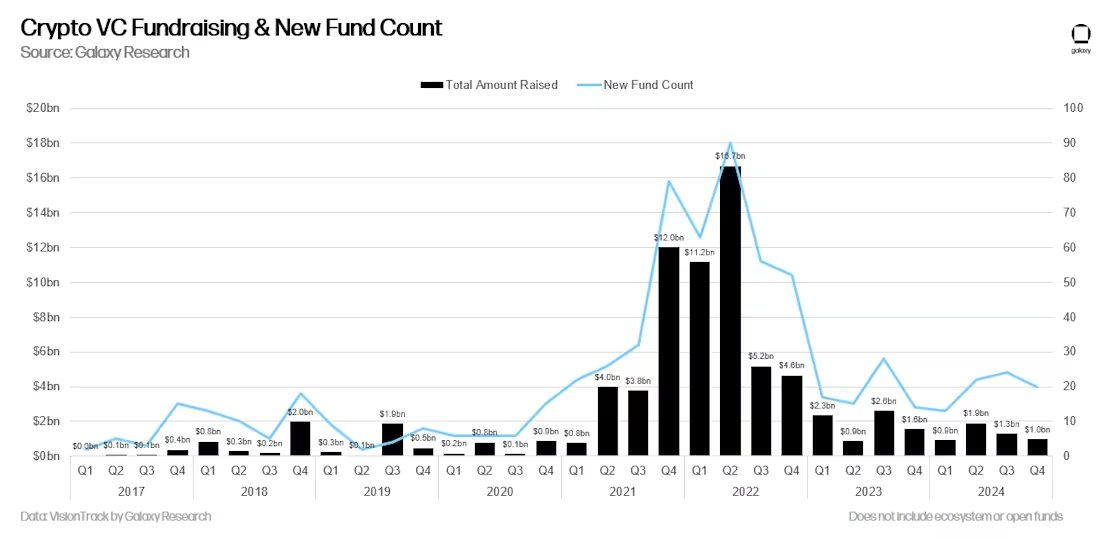

Source: Galaxy Research

There are also psychological reasons why VC became so attractive to LPs—I analyzed this in depth in a previous thread: The Real Reason There’s More Venture Capital Than Liquidity in Crypto

The Hangover (2022–2024): The Struggles and Transformation of Crypto VC

Then came 2022: Luna collapsed, 3AC went bankrupt, FTX fell—billions in paper profits vanished overnight.

Contrary to popular belief, most VCs did not exit at peak prices. They rode the downturn just like everyone else. Now, they face two major challenges:

-

Disillusioned Limited Partners (LPs): LPs who once cheered 100x returns now demand quick exits, pressuring funds to de-risk early and lock in gains.

-

Too much dry powder: There’s a massive amount of unallocated VC capital, but too few quality projects. Many funds choose to deploy into economically questionable projects just to meet investment thresholds and justify raising another fund, rather than returning capital to LPs.

Today, most crypto VCs are stuck: unable to raise new funds, holding a portfolio of low-quality projects destined to follow the "high-FDV-to-zero" script. Under pressure from LPs, VCs have shifted from long-term visionaries to short-term exit chasers. They’re frequently dumping large VC-backed tokens—alternative L1s, L2s, infrastructure tokens—whose inflated valuations they themselves helped create.

In other words, the incentives and time horizons of crypto VCs have fundamentally shifted:

-

2020: VCs were contrarians, capital-constrained, and focused on long-term building.

-

2024: VCs are crowded, overcapitalized, and increasingly short-term oriented.

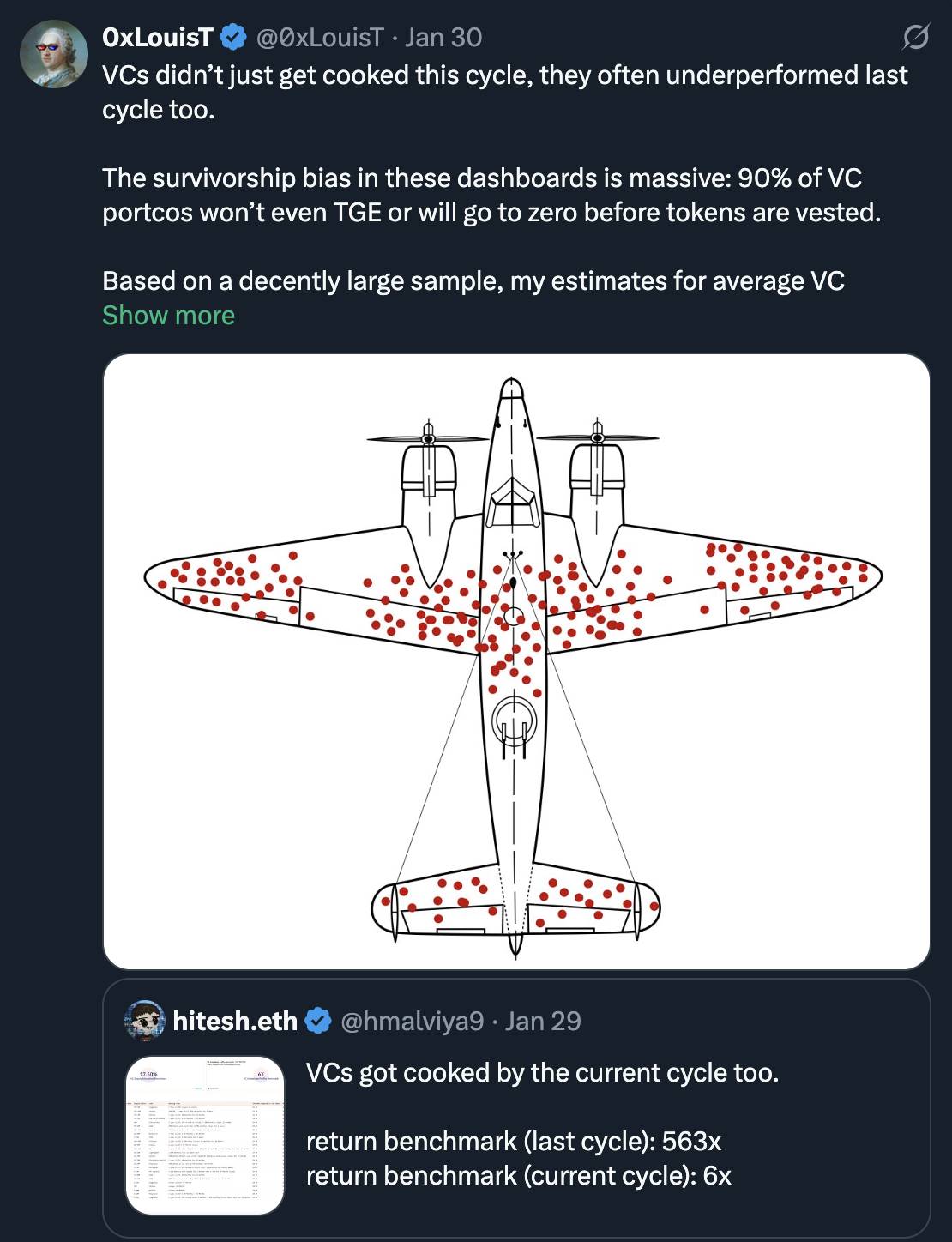

I believe most 2021–2023 vintage VC funds will underperform expectations. VC returns follow a power-law distribution, where a few winners offset many losers. But forced early exits break this model, weakening overall performance.

If you want more data on average VC returns, I wrote a thread on it previously.

It’s no surprise that more founders and communities are growing skeptical of VCs. Misaligned incentives and timeframes between VCs and founders are driving key shifts:

-

Community-driven fundraising: Projects are increasingly turning to community-based funding instead of relying on VCs.

-

Liquid capital as long-term support: Compared to VCs, liquid capital is becoming the primary source of sustained token support.

Evaluating the Liquidity / VC Cycle

Tracking capital flows between VC and liquid markets is critical. I use an indicator to assess the state of the VC market. While imperfect, it's highly informative.

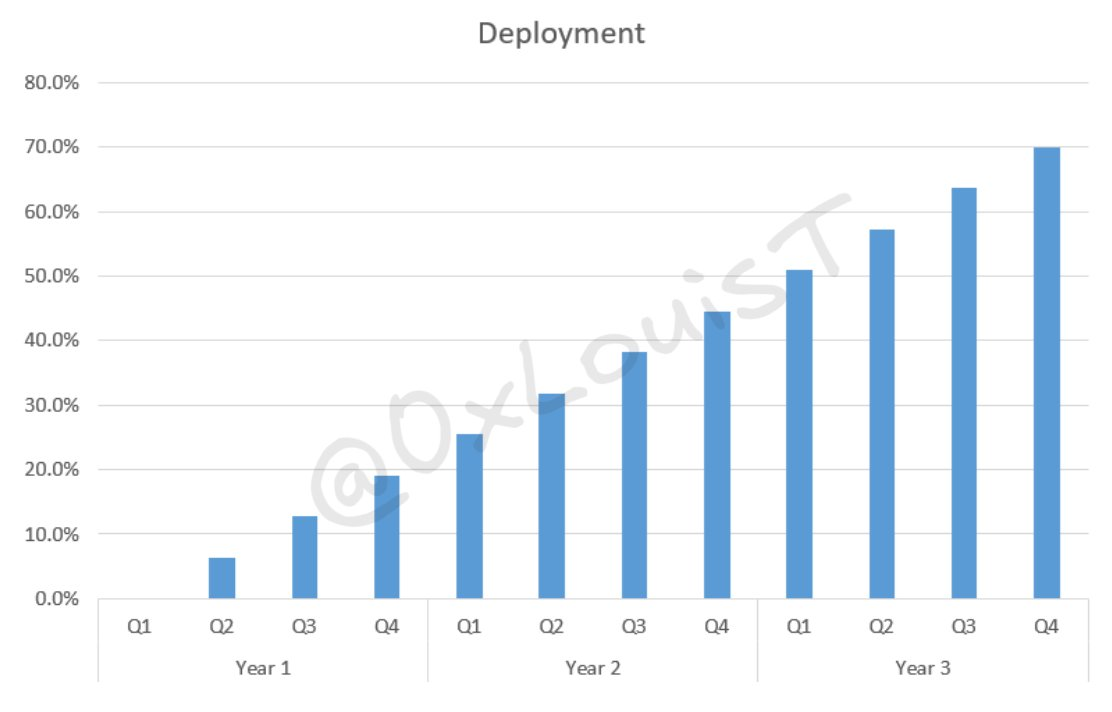

I assume VCs deploy 70% of their capital linearly over three years—this appears to be the prevailing trend among most VCs.

VC 3y Linear Deployment Visualization

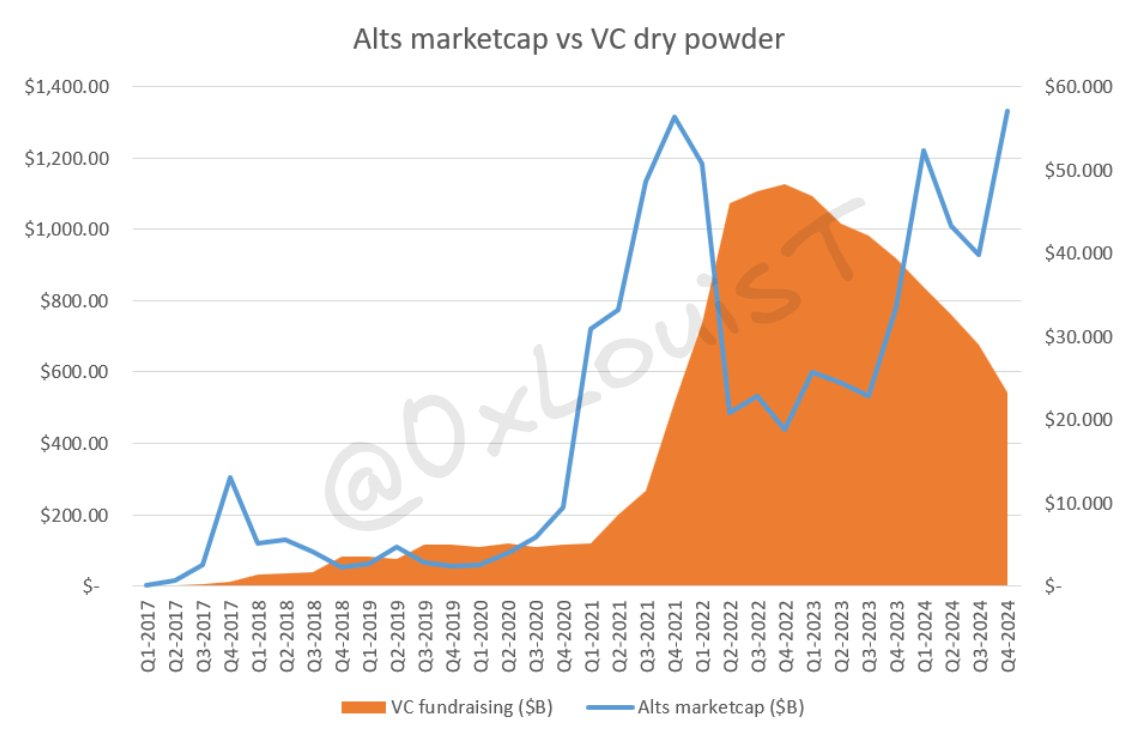

Using VC fundraising data from @glxyresearch, I apply a weighted sum model across 16 quarterly deployment rates to estimate remaining dry powder in the system. In Q4 2022, approximately $48 billion in VC capital remained undeployed. However, with fundraising stalled, this figure has since halved—and continues to decline.

VC Dry Powder Visualization Chart

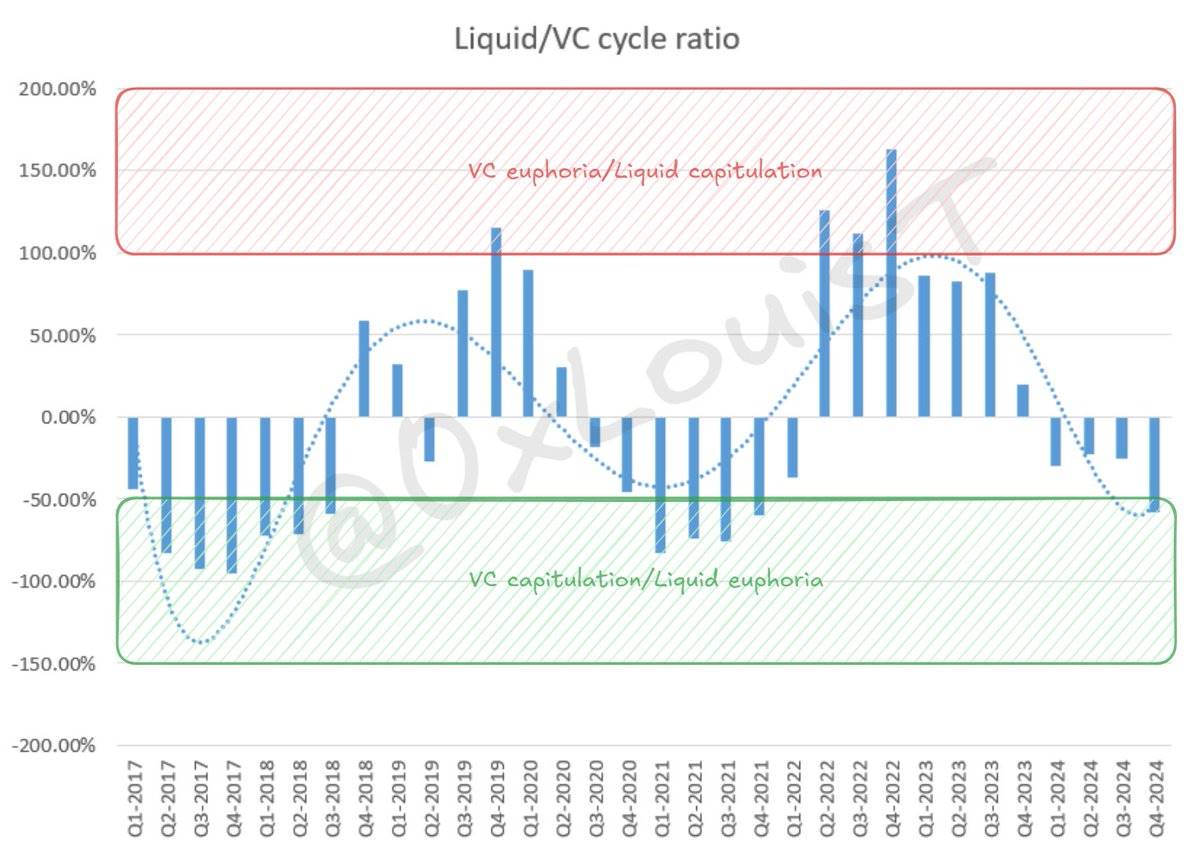

Next, I compare each quarter’s remaining VC capital against TOTAL2 (total crypto market cap excluding Bitcoin). Since VCs typically invest in altcoins, TOTAL2 serves as the best proxy. If VC capital is excessive relative to TOTAL2, the market cannot absorb future token generation events (TGEs). Normalizing this data reveals cyclical patterns in the liquidity-to-VC ratio.

Crypto VC vs. Liquid Markets: Cyclical Patterns and Future Outlook

Typically, when in a “VC euphoria” phase, risk-adjusted returns in liquid markets tend to outperform VC. The “VC capitulation” phase is more complex—it may signal VC exhaustion, or it could indicate overheating in liquid markets.

Like all markets, crypto VC and liquid markets follow cyclical dynamics. The excess capital accumulated during 2021/2022 is rapidly being depleted, making fundraising harder for founders. At the same time, cash-strapped VCs are becoming more selective in deals and terms.

I’ll stop here for now. My next piece will dive deeper into how this phenomenon impacts liquid markets.

Summary

-

Recent vintage VC funds are underperforming. VCs are shifting toward short-term selling to return capital to LPs. Many well-known crypto VC firms may not survive the next few years.

-

Misalignment between VCs and founders is pushing founders toward alternative funding routes.

-

Excess VC capital has led to irrational resource allocation—I’ll analyze this in detail in upcoming articles.

To be continued...

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News