Why Was BSC Able to Successfully Replicate Solana's Meme Ecosystem Miracle?

TechFlow Selected TechFlow Selected

Why Was BSC Able to Successfully Replicate Solana's Meme Ecosystem Miracle?

Can BSC, which evolves through "learning by doing" and advancing through learning, make it to the other shore this time?

By: BUBBLE

With the boost of three meme waves, BSC has evolved from CZ retweeting "Happy Trading" to support a single-point attack by novice investors, into an experienced player who now orchestrates coordinated upgrades with multiple components, connects exchange liquidity as its outer armor, and skillfully manipulates market sentiment. What exactly has BSC done? Why is it considered the most likely chain to replicate Solana's success?

Testing Starts with "Test Coins"

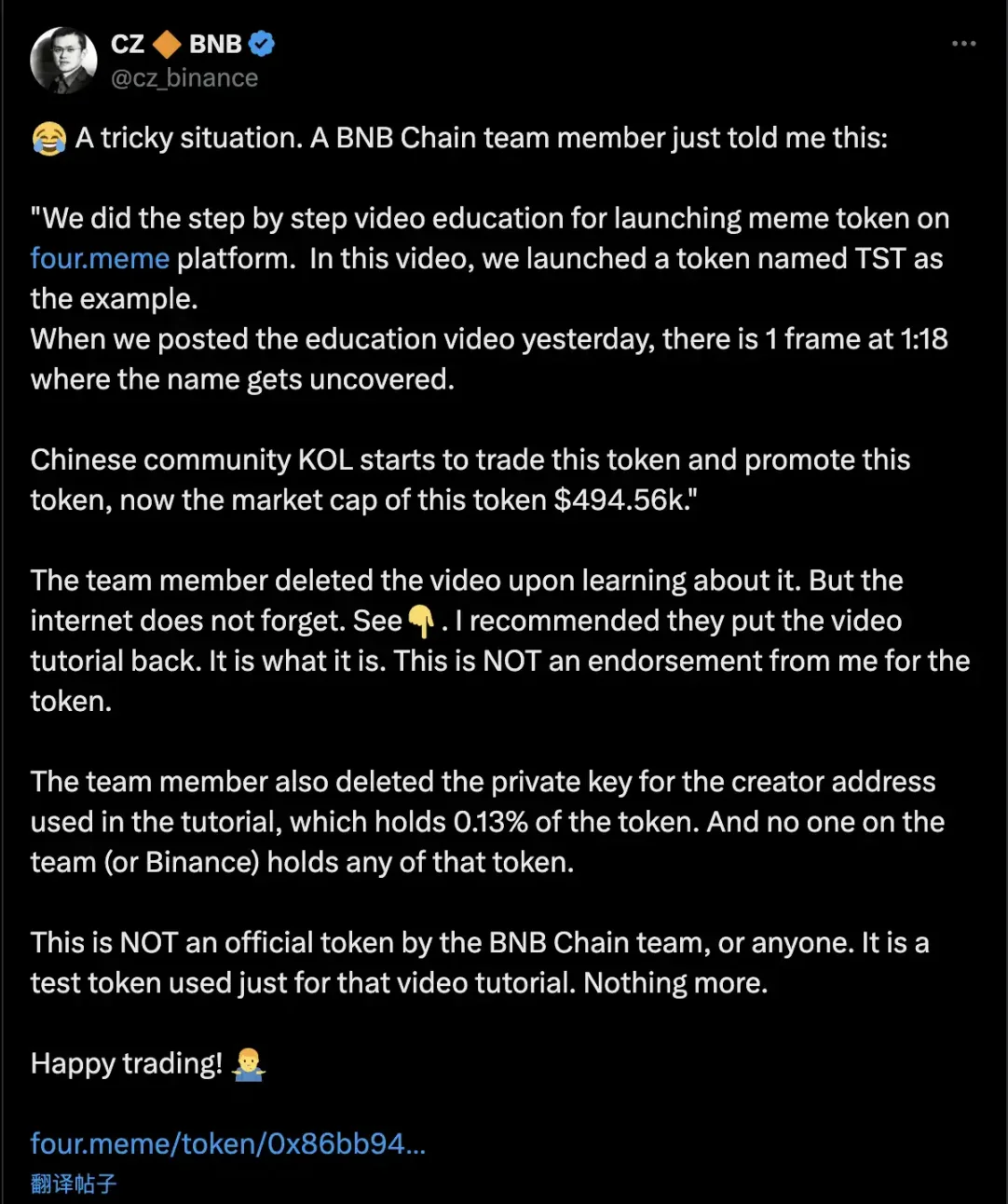

BSC’s rise in meme expertise can be divided into three phases. On February 5, the BNB Chain team released a promotional video for Four.meme featuring a test token. It's not uncommon for such demo tokens to gain market attention—previous examples include pumpfun or demonstration videos from various DEXs. The unusual part was CZ’s attitude, someone who had never engaged in memes before. The next day, CZ retweeted the video and commented on the situation, summarizing his solution in one phrase: “Happy Trading.”

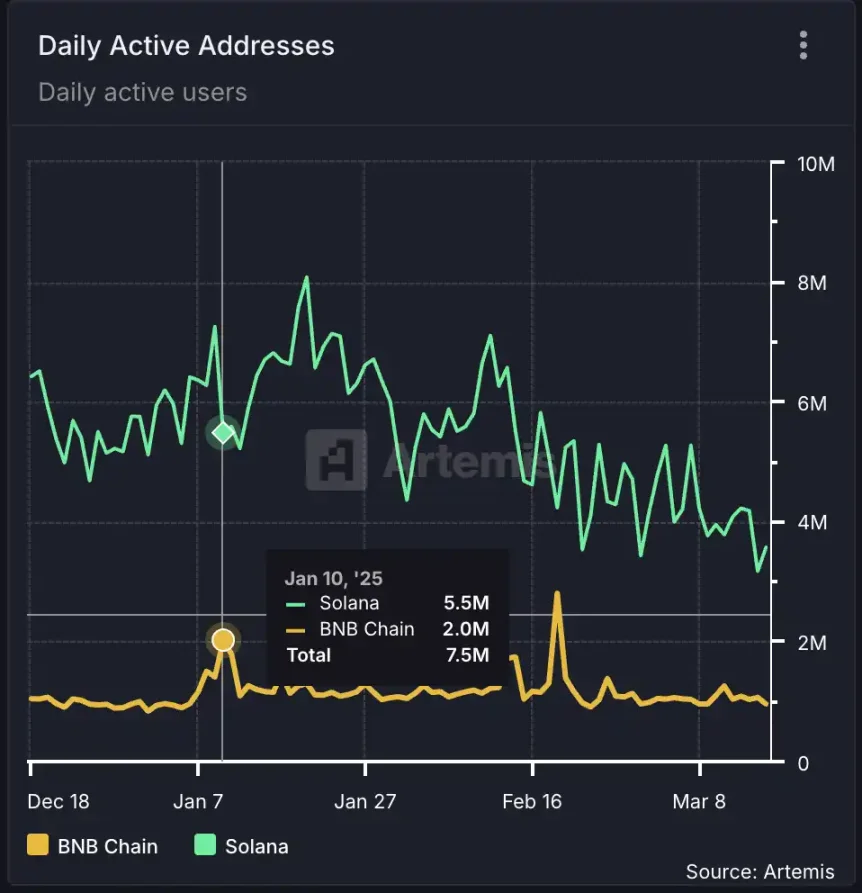

That moment marked the turning point. The market responded immediately to this first-ever endorsement of a meme coin by the industry’s most influential figure, pushing the token’s market cap to $50 million that day. Three days later, when $TST was listed on Binance, its price surged to a peak of $600 million. This wealth effect caused BSC’s DEX trading volume to grow more than threefold—though this wave didn’t last long.

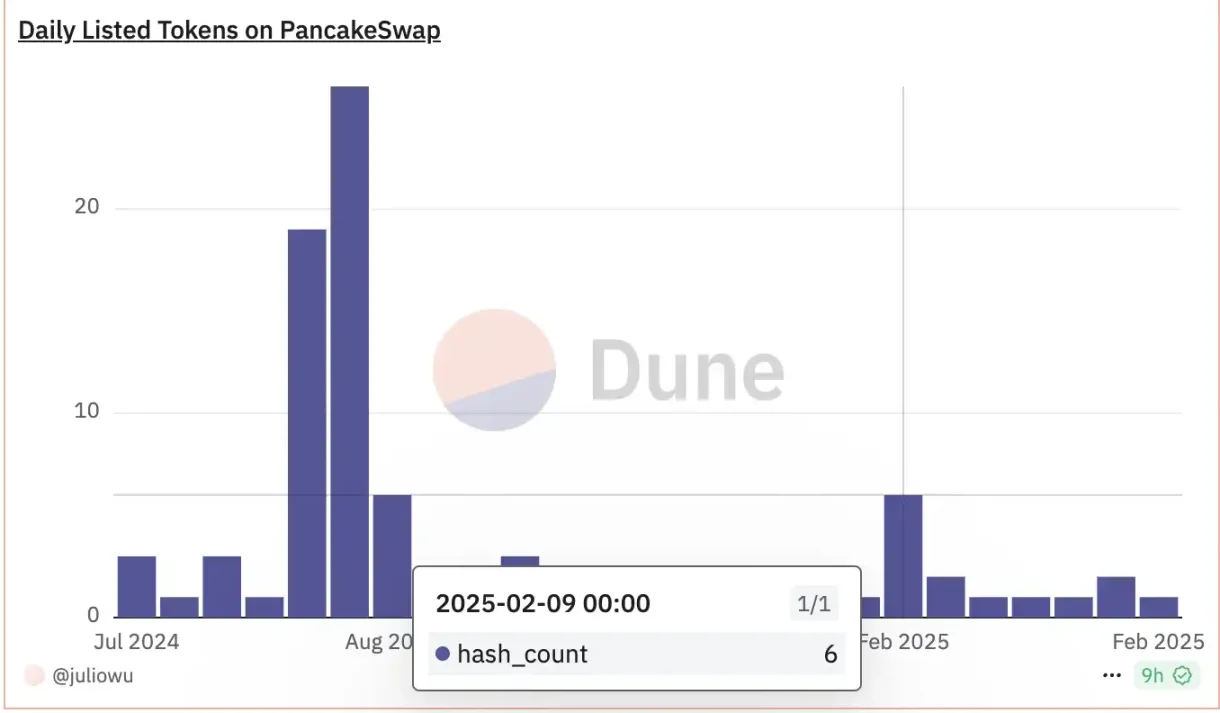

However, at this stage, CZ’s meme tactics were still immature. He underestimated the power of his words, trying to downplay the situation with a casual “Happy Trading,” but failed to contain the spreading FOMO. After $TST’s listing, liquidity did not sustainably increase; instead, it was seen as a brief spectacle of attention economics. With only 10 tokens successfully launched on Four.meme that week, CZ’s initial “test” failed to inject lasting vitality into BSC’s ecosystem. This indicated that his understanding of community-driven dynamics and market rhythm was still in its early stages.

What truly sparked speculation, however, was Binance’s shifting attitude toward memes. Compared to their previous cautious avoidance of BSC-related memes, this move raised a critical question: “If Binance can list a test token, what about other memecoins?” This planted a seed in the community’s mind—just how much liquidity could a top CEX bring to a meme? The answer came just days later.

Dogs Are Mandatory

On the morning of February 13, CZ tweeted expressing curiosity about how meme coins work, asking whether simply sharing a pet’s name and photo would prompt someone to create a token, and questioning how one could distinguish an “official” version. After learning the mechanics, he remarked, “The way things work is quite interesting. As with major decisions, I need about a day to think. Should I respect my dog’s privacy, or reveal the details for everyone? Well, I might interact with a few meme coins on BNB Chain.”

When someone suggested using a random dog photo, CZ replied, “No, that would be deceptive. If we do it, we do it right—just share a real photo and name.”

Soon after, the entire internet began guessing the name of CZ’s dog, with users preemptively launching related meme coins in hopes of securing early positions. A few tokens even saw their market caps rise by hundreds of millions, even over a billion dollars. Later that evening, CZ teased that he would reveal the dog’s photo in three hours (around 8 PM Dubai time), building intense anticipation among meme traders.

After several hours of suspense, CZ finally revealed the photo of his dog Broccoli and shared their story in the early hours of February 14. He clarified, “I’ve only shared my dog’s photo and name. I won’t personally launch a meme coin. That decision lies with the community. The BNB Foundation may reward top meme projects on BNB Chain with LP support or other incentives. Details are still being discussed. More updates coming soon.”

Then came chaos on BNB Chain. Tens of thousands of Broccoli-named meme coins flooded the network, leading Binance Web3 Wallet to even add a dedicated “CZ’s Dog” section. Investors were overwhelmed. What followed was an intense on-chain PVP battle and a RugPull carnival themed around “Broccoli.” BNB Chain underwent a massive stress test—and the results were poor. The network choked under congestion, front-ends froze, sandwich attacks ran rampant. Meme traders used to Solana’s smooth experience were left frustrated by the subpar performance.

As AC Brother commented, because CZ did not release the official contract address (CA), the intended organic community growth instead led to heavy retail losses. Among all Broccoli coins, the highest market cap barely reached hundreds of millions. Despite high participation, capital was extremely fragmented, preventing any strong consensus leader from emerging. Instead, liquidity drained into the pockets of devs and insiders, with numerous貔貅 (Píxiū) schemes and insider-controlled tokens dominating the scene, leaving investors as exit liquidity. According to on-chain analyst Yujin, one Broccoli creator on BNB Chain made $6.72 million in profit from just 1 BNB, achieving a 9,517x return in 24 minutes.

In this phase, “Intern” CZ showed limited progress in meme manipulation on BSC. He began to grasp the cultural nature of memes, using teasers and narrative tweets to stir community emotions—a step up from the $TST era. Yet, he still lacked the ability to guide market consensus. Listing multiple same-name tickers on Binance Alpha led to severe token fragmentation. Infrastructure shortcomings caused network congestion during high-concurrency transactions and exacerbated MEV issues, preventing BSC from forming a seamless meme ecosystem like Solana’s.

In hindsight, CZ reflected on this as an unexpected “stress test,” acknowledging BSC’s shortcomings in scalability and community guidance. This experience taught him that memes require not just hype, but also infrastructure support and clear direction. This social experiment prompted deeper thinking within BSC about promoting on-chain culture—highlighting the importance of foundational infrastructure, cultural education, community leadership, and the impact of leaders’ public statements.

Culture, Characters, and Infrastructure—All Three Together

In the following month, amid a bearish macro market, BSC took the opportunity to fix issues exposed during the previous “stress test.” By the time “Mubarak” emerged, everything was ready.

BSC completed the distribution of $4.4 million in liquidity incentives to top meme projects and, three days later on March 10, announced a second round of liquidity support. Prior to this, CZ personally tested on-chain products—his first hands-on use of native tools. As a “newbie,” CZ discovered firsthand the pain points after using Binance’s own DEX. In March, BSC launched the Pascal hard fork testnet, introducing gas abstraction, smart contract wallets, bundled transactions, and repeatedly stated his determination to eliminate malicious MEV.

With these upgrades in place, the next “stress test” arrived. When CZ retweeted with the caption “Mubarak,” it officially kicked off the third wave—the “Middle East narrative”—following the earlier “test concept” and “Broccoli concept.” For details on the Mubarak event, refer to Dao’s prior coverage; we won’t repeat it here.

Further reading: Mubarak Soars 1300x Over Weekend, CZ Creates Several New A8 Players on BSC | 100x Post-Mortem

This time, market sentiment toward CZ’s handling of the meme cycle was largely positive. His timing and execution were night and day compared to previous attempts. First, news of MGX investing in Binance captured broad attention. Then, leveraging Binance’s Chinese-language Twitter account, CZ conjured the dominant “Middle East” narrative around Mubarak, with He Yi engaging the simple, relatable character IP “Palu.” Soon after, CZ quickly interacted with one specific Mubarak community member, avoiding the chaotic free-for-all seen during the Broccoli episode. At key moments, he subtly dropped well-timed positive signals, steadily elevating Mubarak’s momentum. This triggered a broader meme season. After Mubarak was listed on Binance Futures, Binance launched Alpha 2.0 and introduced the “BNB Goodwill Alliance” to combat MEV exploitation.

More independently developed infrastructure also began to emerge—Flap stepped in when Four.meme crashed during the He Yi “DDDD” hype, and new token launch models like FairMint appeared. A growing number of foundational tools surfaced during this cycle.

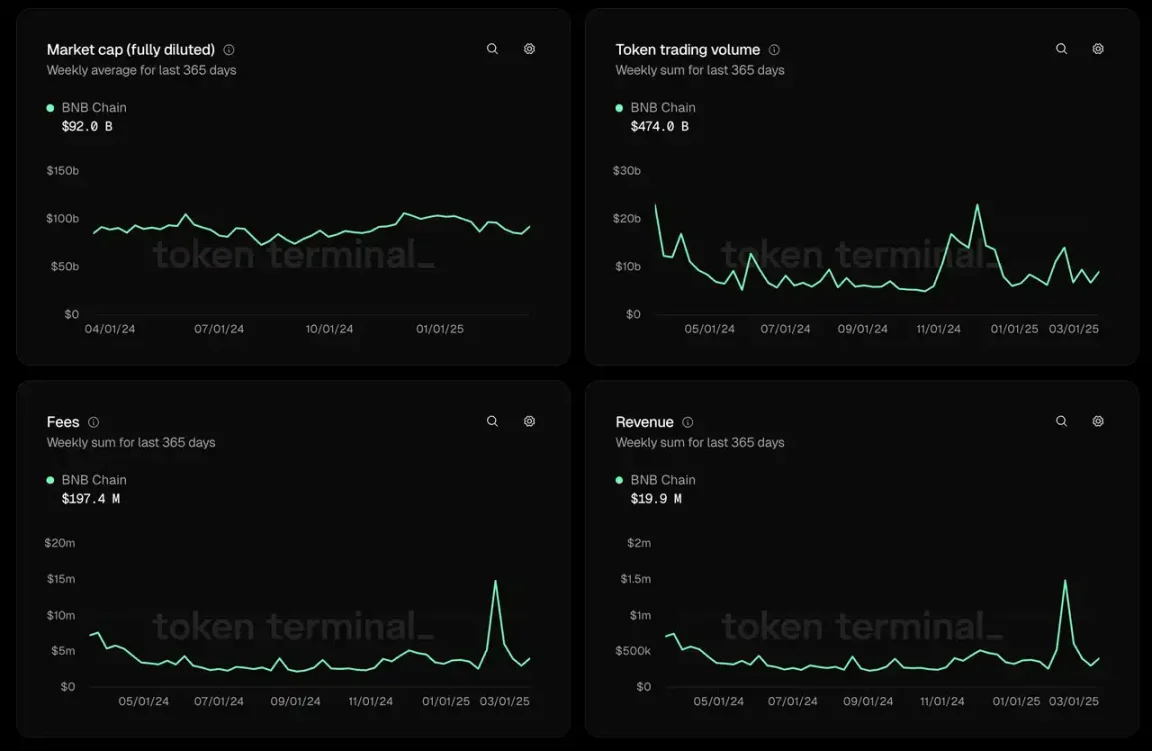

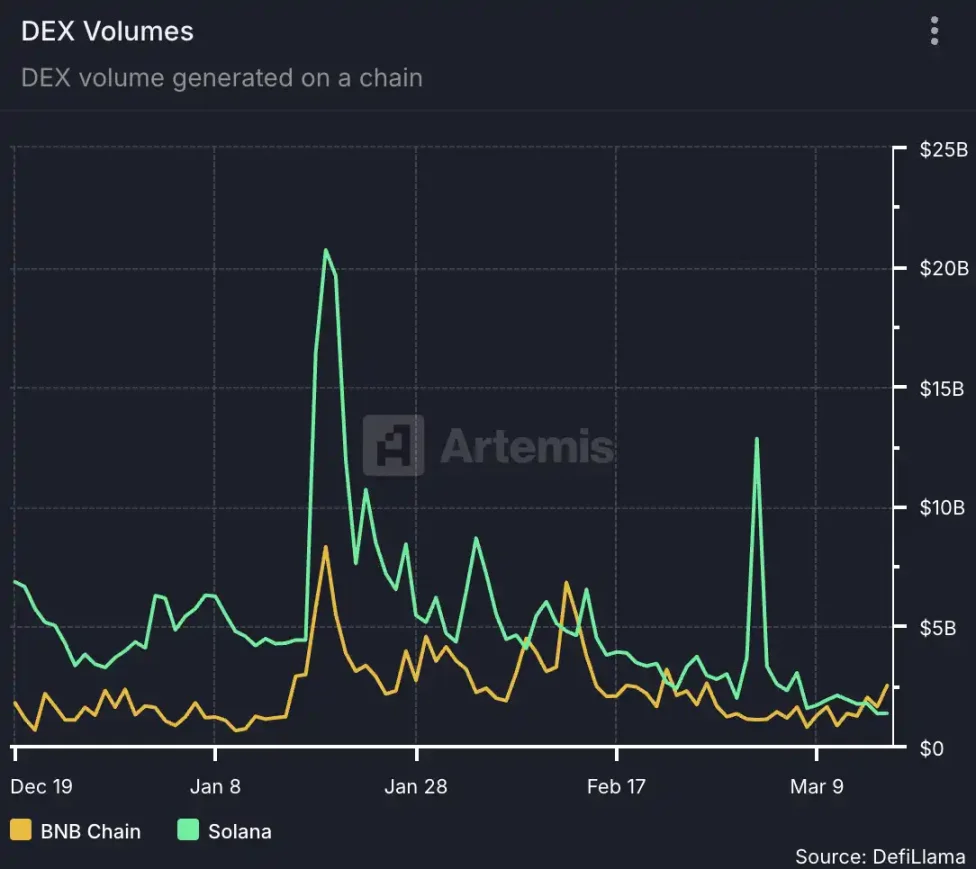

The data outcomes of this meme season were highly beneficial for Binance. Most notably, DEX trading volume briefly reached twice that of Solana.

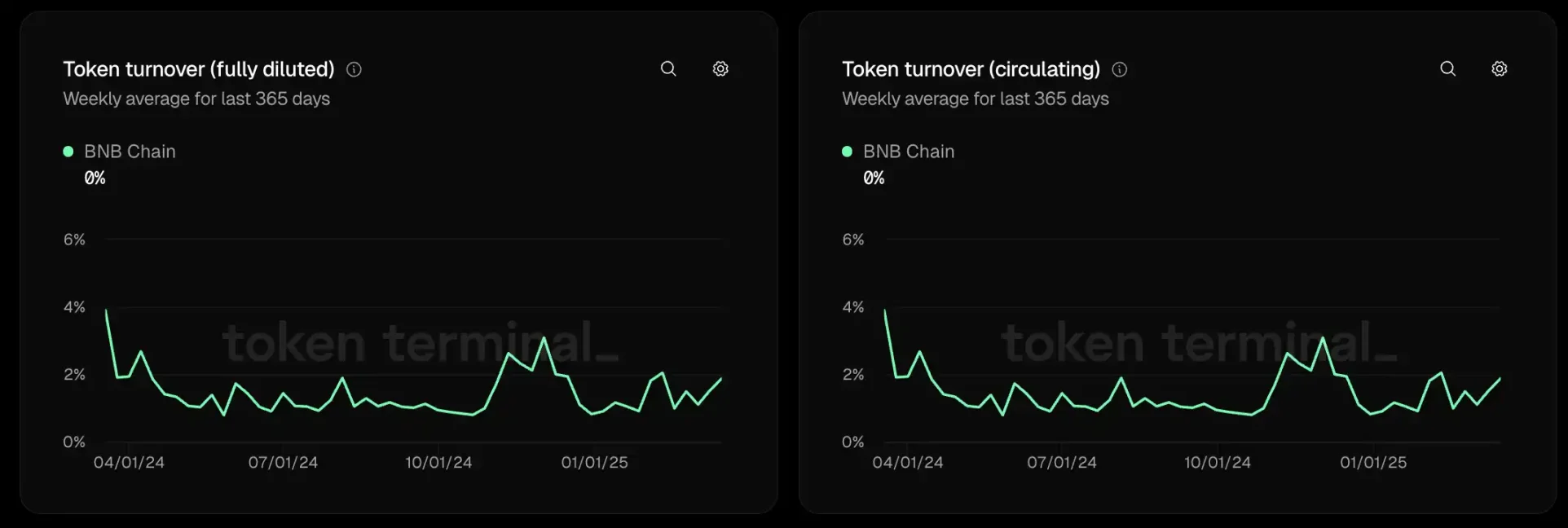

Token turnover spiked multiple times, yet there was no significant inflow of capital from external chains, indicating that liquidity stemmed from genuine on-chain buy/sell orders—and continued to trend upward.

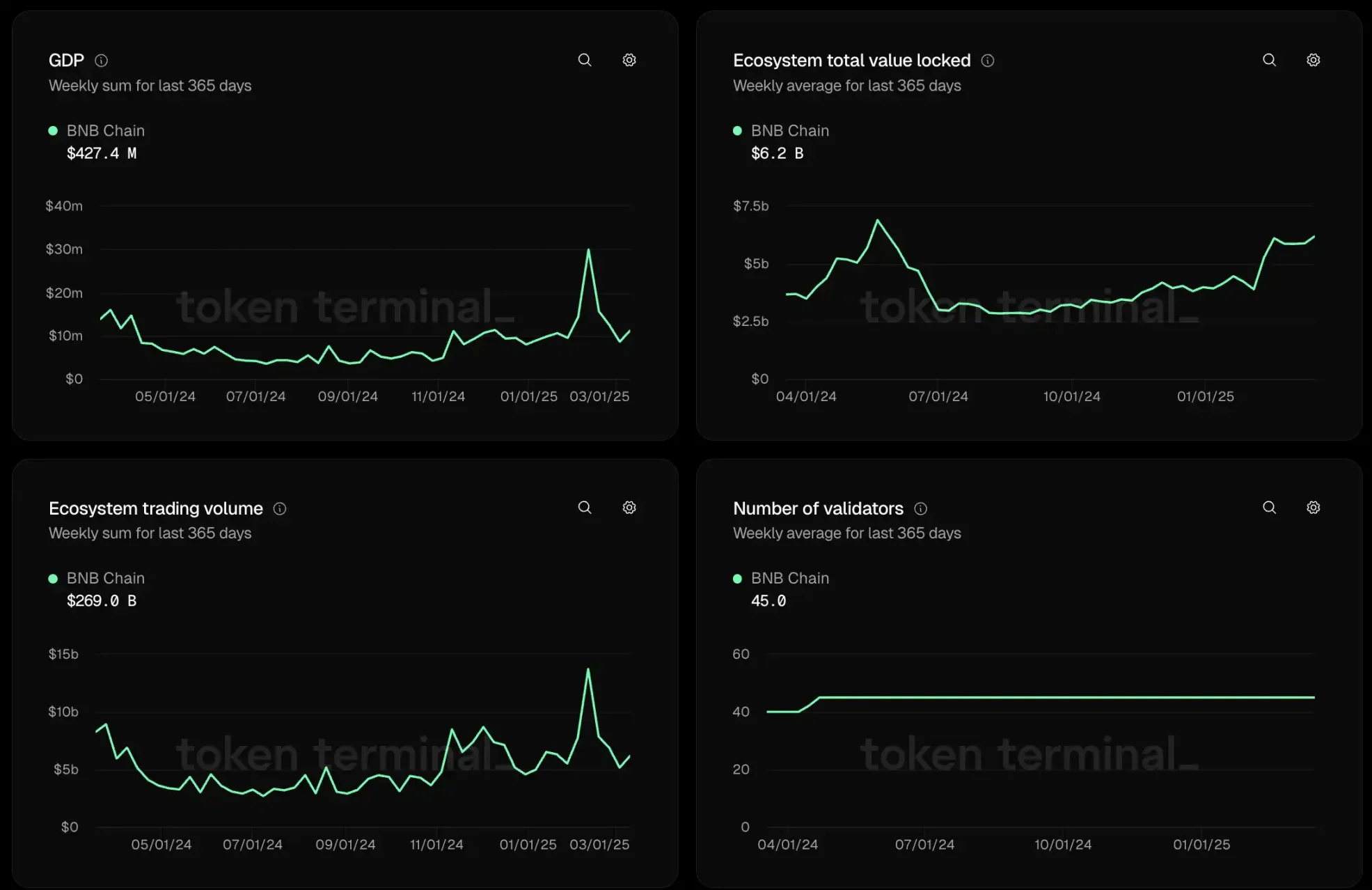

GDP—which represents the proportion of fees earned by applications within the ecosystem—remained stable relative to overall transaction volume, while ecosystem TVL doubled. On-chain liquidity, relative to participant count, remains under-saturated.

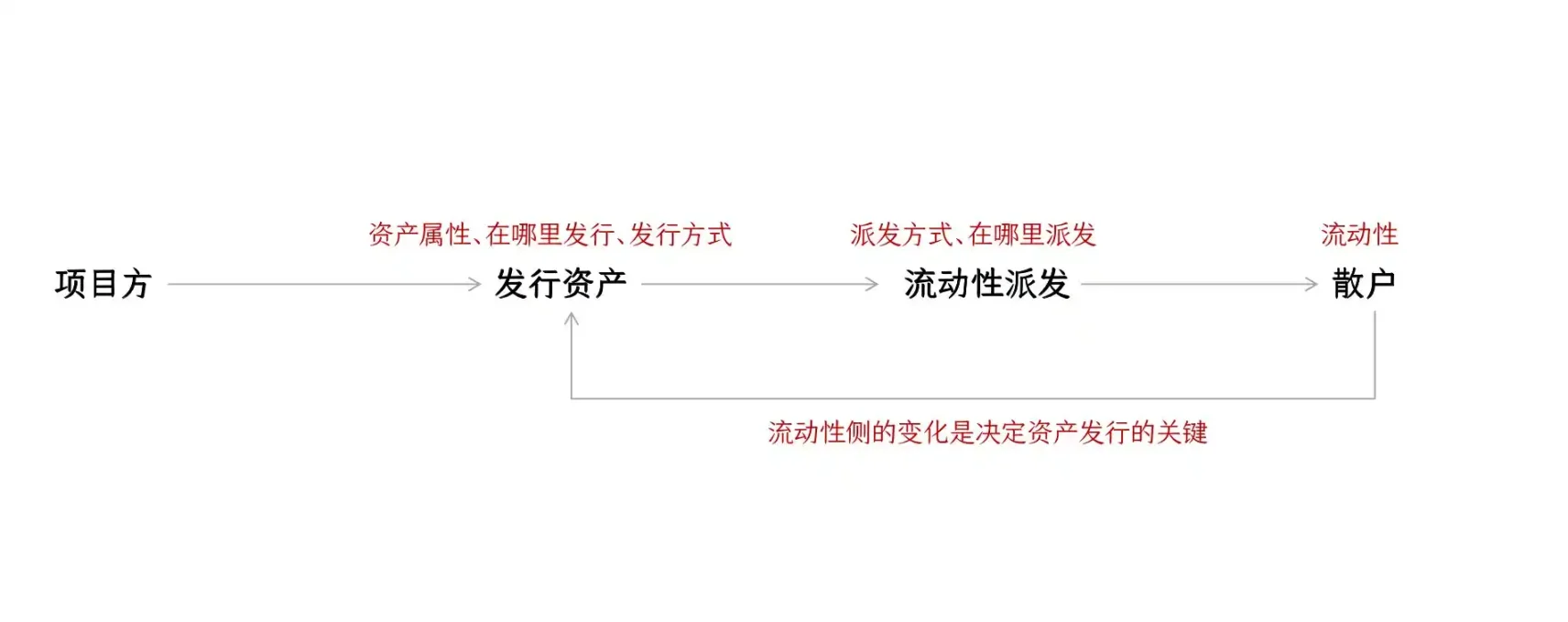

Community influencer and researcher Timo (@timotimo007) noted that Binance directly deployed heavy firepower on the liquidity side—the demand side—to reverse-engineer asset issuance. Simply put, the massive liquidity on Binance’s centralized platform influences how new assets are launched. Unexpectedly, Binance didn’t approach this from the supply side, but instead unleashed a major play on the liquidity front, which in turn reshapes the supply side.

The BNB Card incident, which sparked KOL backlash, prompted reflection on BSC’s meme development. The market seems to carry post-traumatic stress from perceived “cartel-like” behavior. Borrowing meme expert Neso’s framework, most current BSC meme coins still fall under *Forced Memes*—artificially promoted attempts to manufacture virality, rather than organically spreading through genuine user engagement. These memes lack external extensibility and fail to cultivate self-sustaining communities on-chain. This will be the key challenge for BSC in replicating Solana’s success.

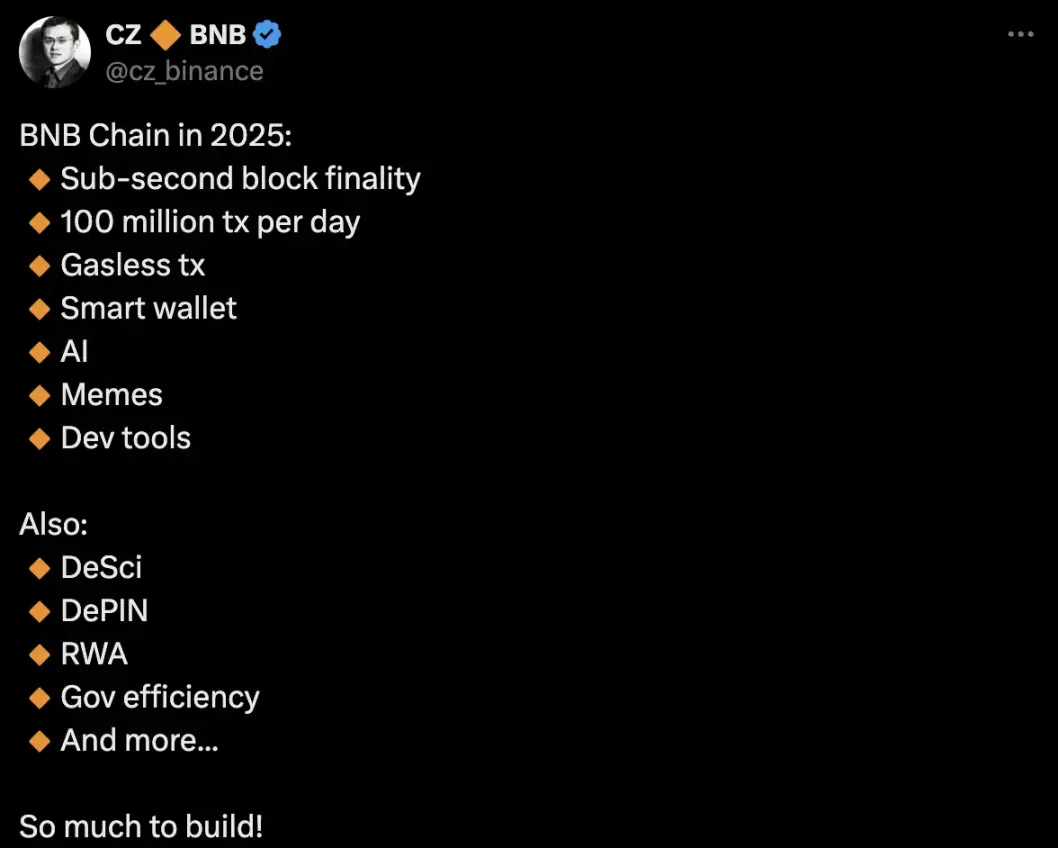

Whether BSC can sustain this momentum depends on future market reactions. If attention and liquidity can maintain inertia, further growth is possible. According to “Chief Intern” CZ’s outlined 2025 BNB Chain roadmap, AI is expected to receive a larger share of resources, and the previously popular DeSci trend may also return to BSC. BlockBeats will continue to monitor BSC’s next moves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News