New Breakthrough in On-Chain Unsecured Loans? Core Highlights and Product Analysis of 3Jane

TechFlow Selected TechFlow Selected

New Breakthrough in On-Chain Unsecured Loans? Core Highlights and Product Analysis of 3Jane

3Jane bypassed the barriers hindering uncollateralized loans by leveraging existing fiat-to-crypto on-ramp infrastructure.

Author: Alea Research Daily Newsletter

Translation: TechFlow

DeFi (decentralized finance) money markets were once considered a true revolution that could disrupt key areas of traditional finance. While on-chain lending continues to thrive, its user scale and institutional penetration have not reached the levels initially envisioned by some.

The biggest obstacle hindering further growth in DeFi lending may not be user experience, smart contract risks, or other factors—but rather the inability to achieve low-collateral or unsecured loans. Whether it's salaried individuals applying for mortgages or large corporations borrowing to complete acquisitions, the ability for borrowers to access funds exceeding the value of their collateral is crucial.

Traditionally, unsecured lending in the crypto space has been almost mythical. Without access to users' credit information or guarantees from decentralized protocols, it's difficult for users to prove their creditworthiness or repayment capacity.

3Jane introduces a new approach to unsecured lending by combining elements of CeFi (centralized finance) and DeFi. In today’s article, we’ll break down the 3Jane whitepaper released yesterday, discuss how unsecured lending could transform on-chain markets, and explore related topics…

The Current State of Unsecured Lending

The unsecured credit industry is a nearly $12 trillion market. In DeFi, however, this market barely exists—especially at the retail level. Although protocols like Maple Finance and Goldfinch use DeFi smart contracts to offer loans to institutions, this segment remains small.

In the centralized crypto space, lending has yet to recover to its 2021 peak. Major players such as Celsius and Genesis OTC (over-the-counter) once provided unsecured loans to big market participants. This trend came to an abrupt halt in 2022 and has not resumed since. While this may be beneficial for ensuring relative stability and sustainability in the current cycle, it leaves a significant market gap waiting to be filled.

When it comes to mainstream assets and those with large market caps, institutional lending remains a necessary component for maximizing liquidity flow. However, if unsecured lending can be realized on-chain, it could have a transformative impact on on-chain markets. If solutions like 3Jane work as intended and gain broader adoption, they could represent a major breakthrough for DeFi lending.

Background of 3Jane

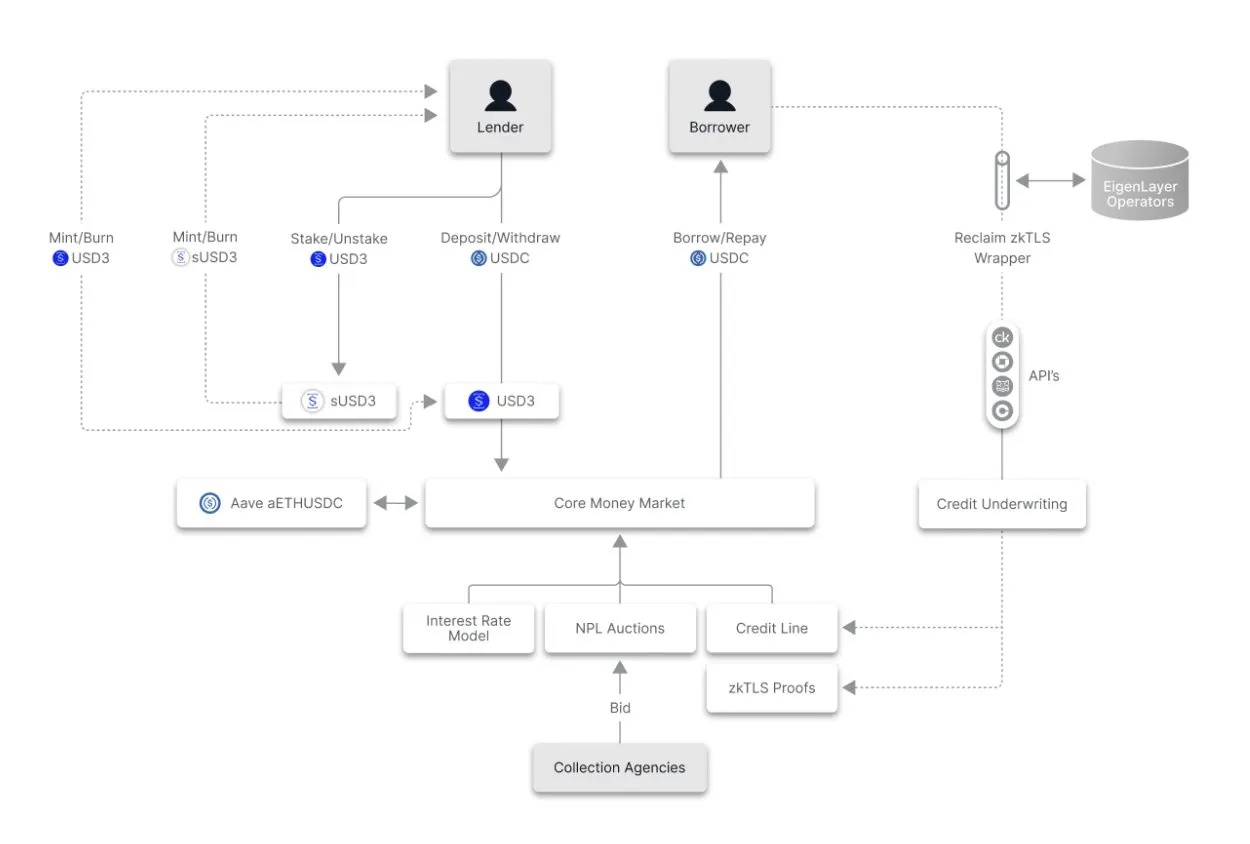

3Jane bypasses the barriers blocking unsecured lending by leveraging existing fiat-to-crypto onboarding infrastructure. Since the last cycle, there has been a quiet but significant improvement in the crypto user experience—particularly in ease of onboarding. Plaid offers API services enabling users to link their bank accounts to fintech apps like Robinhood and others.

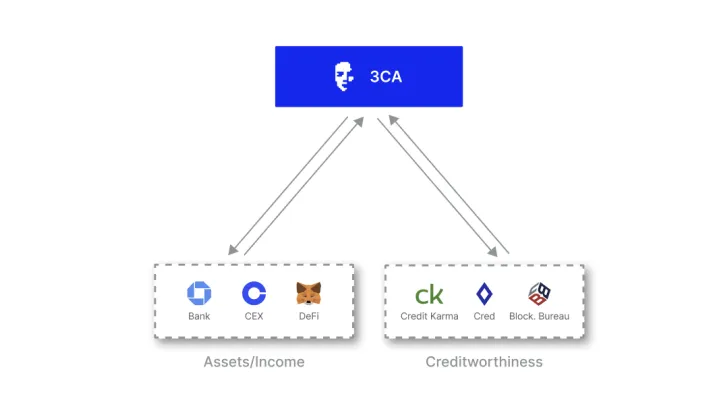

Plaid is 3Jane’s initial method for connecting off-chain reputation with on-chain Ethereum addresses. For user privacy, zkTLS is used to securely transmit off-chain data to the Jane3 protocol.

Collateralization does not occur on-chain; instead, it is managed by an off-chain algorithm that adjusts based on borrower risk before presenting loan terms. Factors influencing credit scores include the user’s wallet balance, potential DeFi activity, bank balance, expected income, and credit data associated with linked bank accounts. Plaid itself does not extract credit records—this is handled by other providers.

Once all criteria are met, loans can be issued. The mechanism works as follows: capital providers deposit USDC to mint 3Jane’s native USD3 or sUSD3, taking on risk exposure for certain credit lines. Loans on 3Jane are fully unsecured, making repayment critical—failure to manage this properly could lead to reduced or even zero participation from capital providers.

Outstanding debt on 3Jane is treated similarly to credit card debt or other forms of unsecured obligations. Failure to repay may result in a damaged credit score and exposure to debt collection efforts. In 3Jane’s case, the protocol auctions defaulted debt to U.S.-based collection agencies. These agencies receive a portion of the recovered amount, while the remainder goes back to the original capital provider.

Given the international nature of cryptocurrency, it remains unclear how effective these measures will be in deterring defaults, or whether capital providers will feel sufficiently protected. Nonetheless, this represents an interesting example of on-chain actions producing off-chain consequences—a phenomenon typically seen only in high-profile bankruptcies or exploit incidents.

3Jane’s stated target users include individual traders, miners, enterprises, and even AI agents. This suggests the service primarily serves asset-rich users, which may reassure capital providers and make collections easier in case of default.

Users can delete their personal data from the platform after repaying their loans—data that is crucial for collections if repayment fails. Subsequently, this data may be shared with specific collection agencies bidding on particular defaulted loans.

Overall, 3Jane offers a unique solution to the challenge of unsecured lending. Even if, in practice, it ultimately serves ultra-high-net-worth individuals (UHNWIs) or institutions—similar to past centralized unsecured lending models—it still presents a compelling case study for the possibilities of ZK technology and Web2 integration within the crypto space.

Key Links

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News