U.S. banking regulators release blueprint allowing lenders greater flexibility in engaging with crypto assets

TechFlow Selected TechFlow Selected

U.S. banking regulators release blueprint allowing lenders greater flexibility in engaging with crypto assets

U.S. banking regulators have provided a new roadmap for traditional banks to enter the cryptocurrency asset sector.

By Bobo Yilong, TechFlow

U.S. banking regulators have released a blueprint regarding lenders' holdings of cryptocurrency, providing a new roadmap for traditional banks to enter the digital asset space.

On July 14, media reported that U.S. regulatory agencies issued new guidelines outlining how banks can offer cryptocurrency custody services to customers without violating regulations. This move is seen as another significant development since the "Trump 2.0 era" in terms of how regulators guide traditional finance into the digital asset arena.

According to reports, the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency jointly stated that banks planning to provide crypto asset custody services must take into account the evolving nature of the crypto market and its underlying technologies, and establish governance frameworks capable of adapting to associated risks.

The release of this new guidance follows the regulators’ withdrawal in April of previously issued risk advisories related to the crypto industry. At that time, the Federal Reserve also rescinded a 2022 directive that had required banks to seek prior approval before engaging in crypto-related activities.

Now, banks' crypto-related operations will be supervised under standard regulatory procedures. The market has interpreted this as a signal of regulatory easing, granting banks greater autonomy in offering digital asset products and services to customers—a clear shift from earlier, more cautious oversight.

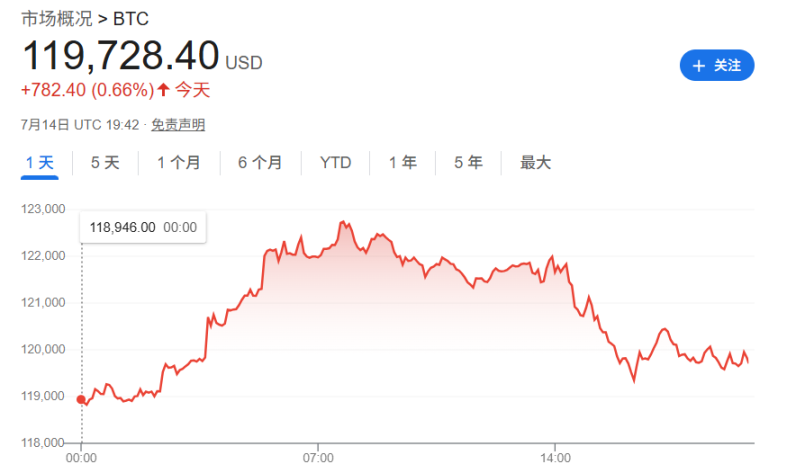

TechFlow previously noted that investor sentiment surged following news that the U.S. Congress would hold a "Crypto Week," during which three key bills would be reviewed. Bitcoin briefly broke through $123,000 during Monday trading—hitting a new all-time high—before quickly retreating below $120,000.

This dual boost from regulation and legislation is reshaping market expectations for the crypto ecosystem. On one hand, industry participants believe clear rules will bring long-term stability to the market.

On the other hand, some analysts warn that the current rally heavily relies on policy prospects, and any legislative setbacks could trigger sharp market corrections.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News