The Rise and Fall of Crypto Retail Investors: The On-Chain Migration Underway

TechFlow Selected TechFlow Selected

The Rise and Fall of Crypto Retail Investors: The On-Chain Migration Underway

Wind blows · mountain corner · dark and bright again.

Author: Zuoye

-

VCs and market makers serve as the primary front-line gatekeepers of exchanges

-

Airdrops and memes have initiated a revaluation process within the on-chain value system

-

Increasingly complex tokenomics from projects obscure underlying growth stagnation

Retail investors have been frustrated lately. First came RedStone, full of twists and turns, ending with retail failing to block its listing—RedStone ultimately made it onto Binance. Then GPS unraveled a deeper scandal, prompting Binance to crack down hard on market makers, showcasing the so-called "Cosmic Exchange's" absolute power.

The narrative is far from ideal. As VC-backed tokens gradually lose momentum, so-called "value tokens" have become mere excuses for projects, VCs, and market makers to offload bags. In every market volatility cycle, they rush through a standard trilogy: foundation establishment, airdrop rollout, and exchange listing followed by dumping.

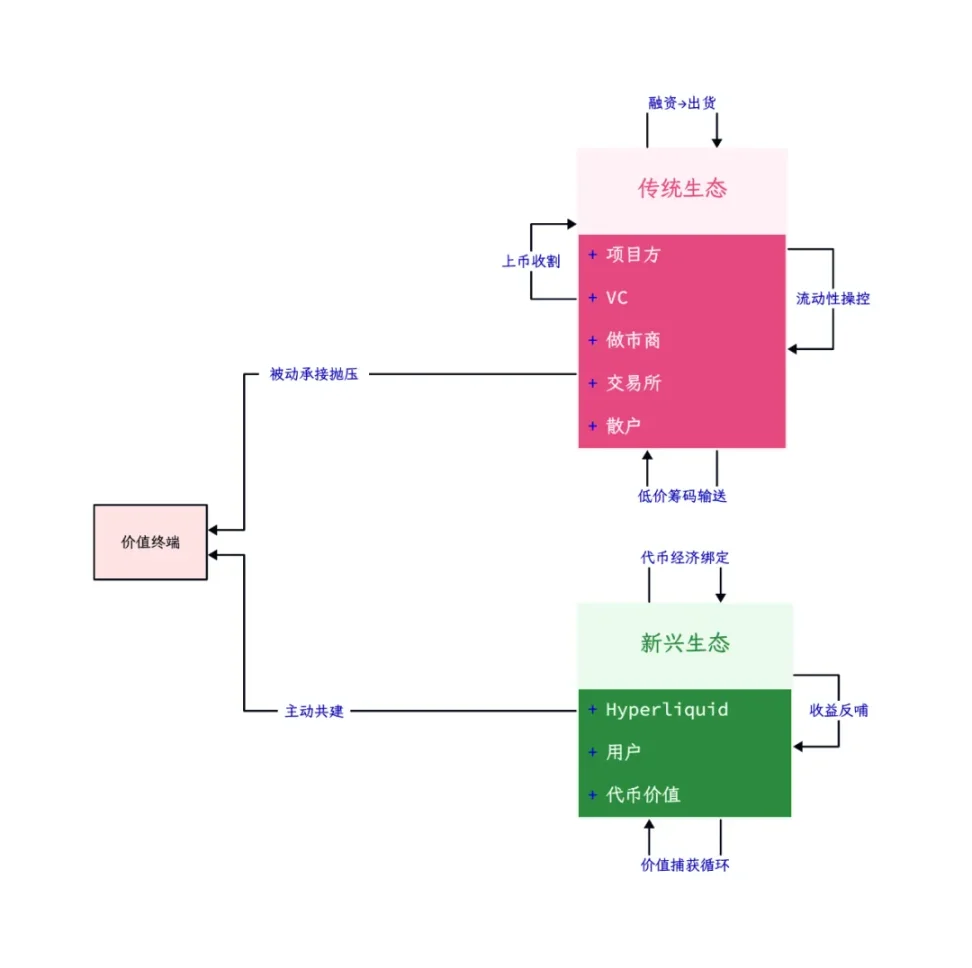

Caption: Traditional vs. emerging value flows, Image source: @zuoyeweb3

It’s foreseeable that Babylon, Bitlayer, and other BTCFi ecosystem projects will repeat this pattern. Recall how IP’s post-listing price movement had nothing to do with project fundamentals, but was directly correlated with aggressive buying from Korean traders—and we can’t rule out coordinated efforts among market makers, project teams, and exchanges.

In contrast, Hyperliquid’s approach stands out: no VC investment, no reliance on major exchanges, and no fragmented interests. It achieves balance between the project team and early users, directing all protocol revenue back to its native token, meeting the value preservation needs of later-stage buyers.

Judging from IP and Hyperliquid’s performance, strong alignment and utility commitment from project teams can suppress exchange- and VC-driven concentration and dumping behaviors.

This push and pull means that as Binance brings market makers into the spotlight, its own industry moat is rapidly eroding.

A Self-Fulfilling Prophecy: The RedStone Exposure

In Minecraft, RedStone lies buried 16 layers underground, requiring mining before it can be processed.

Throughout this gold rush, exchanges leverage their dominant traffic and liquidity to become the final destination for tokens. On the surface, it appears mutually beneficial: exchanges gain new listings to attract users, while users access novel assets for potential gains.

This model can be further reinforced by platform tokens like BNB/BGB, strengthening the exchange’s market position.

However, starting in 2021, with deep involvement from major Western crypto VCs, initial valuations across the industry became inflated. Take cross-chain bridges as an example: based on pre-listing disclosed valuations, LayerZero was valued at $3 billion, Wormhole at $2.5 billion, Across Protocol at $200 million in 2022, and Orbiter also at $200 million. Today, their respective FDVs stand at $1.8 billion, $950 million, $230 million, and $180 million.

Data source: RootData & CoinGecko, Chart: @zuoyeweb3

Every high-profile endorsement added to a project ultimately comes at the expense of retail investors.

From the VC token storm beginning mid-2024 to the “bestie coin” AMA controversy involving He Yi in early 2025, the relationship between exchanges and VCs has become unsustainable. The credibility once lent by VCs and exchange listings now seems laughable amid meme mania. The only remaining role of VCs is capital provision. Driven by returns, token investing has effectively replaced product investing.

At this point, crypto VCs are lost. Web2 VCs couldn’t invest in DeepSeek; Web3 VCs couldn’t get into Hyperliquid. An era has officially ended.

After the VC collapse, exchanges are left relying solely on market makers as safe havens for retail. Users chase memecoins on-chain, while market makers are limited to managing liquidity for a small number of listed tokens after internal pumps on PumpFun or surges on DEXs. While the relationship between on-chain activity and market makers isn't our focus here, we’ll keep the discussion centered on centralized exchanges.

For both market makers and exchanges, meme coins now carry the same inflated pricing as VC tokens. If “value tokens” lack real value, then “air tokens” clearly cannot be fairly priced based on thin air. Fast pumping and dumping becomes the universal strategy for market makers.

When this cycle endlessly repeats, quickly getting listed on Binance isn’t the market maker’s original sin—the fact that Binance can be gamed so easily is the real industry crisis. As the last line of liquidity defense, Binance can no longer identify truly long-term viable tokens. This marks the birth of an industry-wide crisis.

Binance may promote RedStone despite its flaws, or deliver righteous punishment to market makers—but what comes next? The industry won’t change its existing model. There will still be overpriced tokens waiting in the listing pipeline.

Complexity and Bloat Signal the End

Ethereum’s L2s are multiplying, and eventually, every dApp will become its own chain.

Tokenomics and airdrop designs grow increasingly complex—from BTC as gas to ve(3,3) mechanics—far exceeding the comprehension of average users.

Since Sushiswap captured market share by airdropping tokens to Uniswap users, airdrops have become a standard user acquisition tactic. But under Nansen’s anti-sybil scrutiny, airdrops have turned into a strategic battleground between professional farming groups and project teams—ordinary users are the only ones left excluded.

Farmers want tokens, projects need volume, VCs supply seed capital, and exchanges crave new listings. In the end, retail bears all the costs, left with nothing but falling prices and helpless rage.

Shifting toward memes is just the beginning. More critically, retail across the board is reassessing their cost-benefit calculations. What if one avoids Binance and instead trades futures on Bybit or Hyperliquid?

Currently, daily trading volume on on-chain perpetuals reaches about 15% of Binance’s, with Hyperliquid alone accounting for 10%. This isn’t the end—it’s the true beginning of the on-chain movement. Notably, DEXs capture around 15% of CEX volumes, while Uniswap handles roughly 6% of Binance’s volume, highlighting Solana DeFi’s rapid rise.

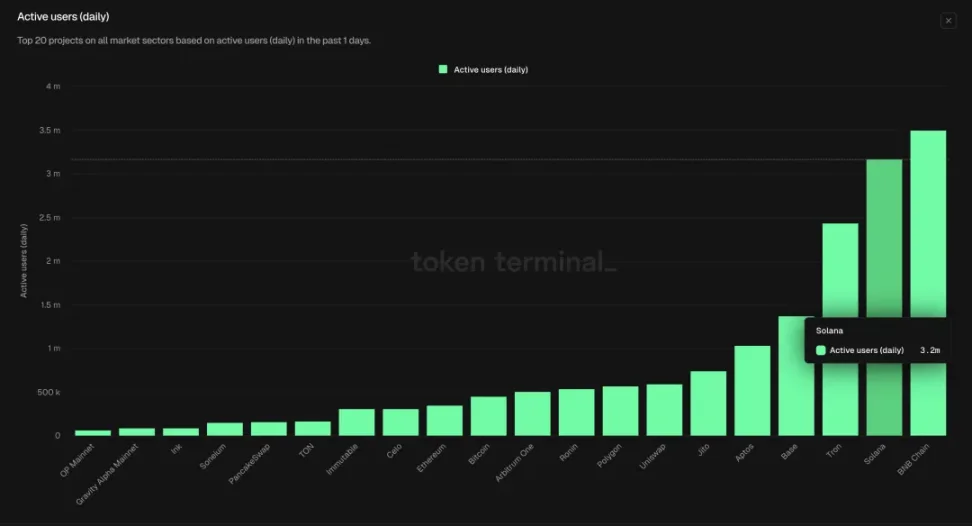

Caption: On-chain DAU, Image source: TokenTerminal

Binance boasts 250 million users, while Hyperliquid has only 400,000. Uniswap has 600,000 active users, and Solana sees 3 million daily active users. We can roughly estimate the total on-chain user base at around 1 million—still firmly in the early adopter phase.

Yet not only are L2s multiplying, but dApp tokenomics are growing more complex, reflecting project teams’ inability to balance their interests with those of retail. Without commitments from VCs and exchanges, projects can’t launch. But accepting VC and exchange terms inevitably sacrifices retail interests.

In biological evolution, whether through Darwinian theory or molecular biologists’ probability models, one fundamental truth emerges: when a species grows excessively large and intricately complex—like the Quetzalcoatlus—it typically signals entry into an extinction phase. Today, it’s the birds, not the giants, that dominate the skies.

Conclusion

Exchanges purging market makers is essentially a cannibalistic move within a saturated competitive landscape. Retail will continue facing coordinated attacks from VCs and project teams. Fundamental improvement remains unlikely. Migration to on-chain platforms continues as an ongoing historical shift. Even leaders like Hyperliquid remain unprepared for billion-scale user demand.

Fluctuations between value and price, struggles over利益 and distribution, will continue cycling through each market phase—writing yet another chapter of retail’s tragic history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News